Market news

-

22:29

Stocks. Daily history for Oct 17’2016:

(index / closing price / change items /% change)

Nikkei 225 16,900.12 0.00 0.00%

Shanghai Composite 3,041.24 -22.56 -0.74%

S&P/ASX 200 5,388.68 0.00 0.00%

FTSE 100 6,947.55 -66.00 -0.94%

CAC 40 4,450.23 -20.69 -0.46%

Xetra DAX 10,503.57 -76.81 -0.73%

S&P 500 2,126.50 -6.48 -0.30%

Dow Jones Industrial Average 18,086.40 -51.98 -0.29%

S&P/TSX Composite 14,596.52 +11.53 +0.08%

-

19:01

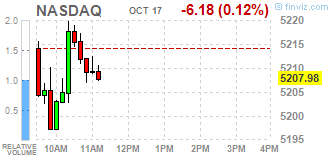

DJIA 18093.66 -44.72 -0.25%, NASDAQ 5204.29 -9.87 -0.19%, S&P 500 2128.49 -4.49 -0.21%

-

16:02

European stocks closed: FTSE 6947.55 -66.00 -0.94%, DAX 10503.57 -76.81 -0.73%, CAC 4450.23 -20.69 -0.46%

-

15:32

WSE: Session Results

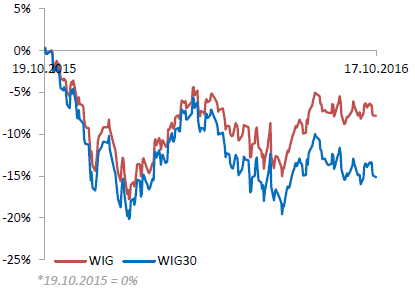

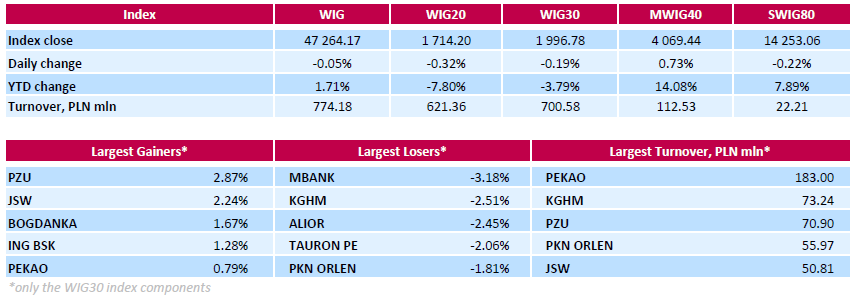

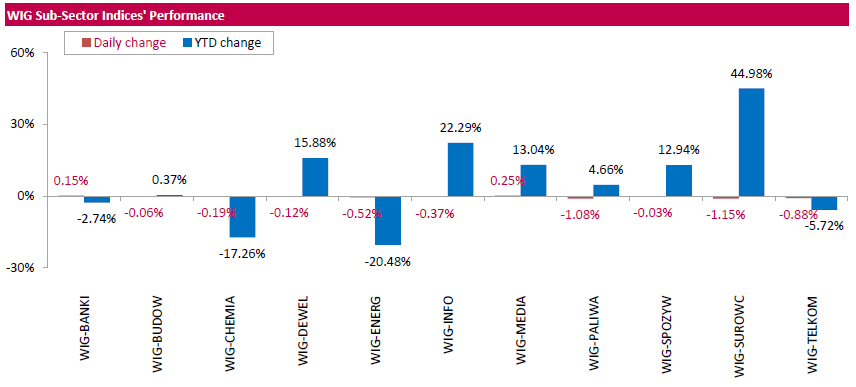

Polish equity market closed flat on Monday. The broad market measure, the WIG Index, edged down 0.05%. The WIG sub-sector indices were mainly lower with materials measure (-1.15%) underperforming.

The large-cap stocks' measure, the WIG30 Index, fell by 0.19%. In the index basket, banking sector name MBANK (WSE: MBK) topped the decliners' list, tumbling by 3.18%. Among other major laggards were copper producer KGHM (WSE: KGH), bank ALIOR (WSE: ALR) and genco TAURON PE (WSE: TPE), plunging by 2.51%, 2.45% and 2.06% respectively. On the other side of the ledger, insurer PZU (WSE: PZU) led the gainers, jumping by 2.87%, helped by the announcement the company is in talks to buy a 30-percent stake in bank PEKAO (WSE: PEO; +0.79%) from Italy's banking group Unicredit. It was followed by two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), climbing by 2.24% and 1.67% respectively.

-

15:19

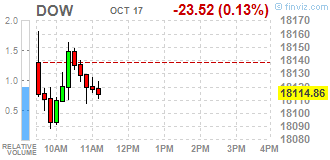

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes lower on Monday morning as a dip in energy and healthcare stocks more than offset the boost to financials from Bank of America (BAC) strong results.

Most of Dow stocks in negative area (20 of 30). Top gainer - International Business Machines Corporation (IBM, +0.66%). Top loser - Merck & Co., Inc. (MRK, -1.14%).

Almost all S&P sectors also in negative area. Top gainer - Utilities (+0.3%). Top loser - Conglomerates (-0.5%).

At the moment:

Dow 18036.00 -23.00 -0.13%

S&P 500 2124.50 -2.50 -0.12%

Nasdaq 100 4803.25 -1.00 -0.02%

Oil 49.59 -0.76 -1.51%

Gold 1257.20 +1.70 +0.14%

U.S. 10yr 1.78 -0.02

-

13:32

U.S. Stocks open: Dow +0.06%, Nasdaq -0.01%, S&P +0.04%

-

13:19

Before the bell: S&P futures -0.04%, NASDAQ futures -0.08%

U.S. stock-index futures were little changed after paring an earlier drop, amid earnings reports from Bank of America (BAC) и Hasbro (HAS) .

Global Stocks:

Nikkei 16,900.12 +43.75 +0.26%

Hang Seng 23,037.54 -195.77 -0.84%

Shanghai 3,041.24 -22.56 -0.74%

FTSE 6,962.73 -50.82 -0.72%

CAC 4,454.99 -15.93 -0.36%

DAX 10,530.95 -49.43 -0.47%

Crude $50.40 (+0.10%)

Gold $1254.60 (-0.07%)

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.41

-0.03(-0.1135%)

2440

Amazon.com Inc., NASDAQ

AMZN

820.16

-2.80(-0.3402%)

9355

Apple Inc.

AAPL

117.76

0.13(0.1105%)

65136

Barrick Gold Corporation, NYSE

ABX

15.74

0.05(0.3187%)

17587

Citigroup Inc., NYSE

C

48.4

-0.21(-0.432%)

6889

Facebook, Inc.

FB

128.04

0.16(0.1251%)

42243

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.55

-0.11(-1.1387%)

34084

General Electric Co

GE

28.82

-0.07(-0.2423%)

8064

Goldman Sachs

GS

170.57

0.05(0.0293%)

2260

Google Inc.

GOOG

778.4

-0.13(-0.0167%)

460

HONEYWELL INTERNATIONAL INC.

HON

108.01

-0.99(-0.9083%)

340

Intel Corp

INTC

37.5

0.05(0.1335%)

9600

Johnson & Johnson

JNJ

116.99

-0.57(-0.4849%)

1633

JPMorgan Chase and Co

JPM

67.25

-0.27(-0.3999%)

18347

McDonald's Corp

MCD

113.8

-0.29(-0.2542%)

4000

Microsoft Corp

MSFT

57.35

-0.07(-0.1219%)

3987

Nike

NKE

51.24

-0.38(-0.7361%)

4309

Pfizer Inc

PFE

32.77

0.11(0.3368%)

100

Tesla Motors, Inc., NASDAQ

TSLA

197.3

0.79(0.402%)

18252

The Coca-Cola Co

KO

41.65

-0.02(-0.048%)

3846

Travelers Companies Inc

TRV

114.5

-0.58(-0.504%)

213

Twitter, Inc., NYSE

TWTR

16.94

0.06(0.3555%)

242367

Verizon Communications Inc

VZ

50.33

0.05(0.0994%)

275

Yahoo! Inc., NASDAQ

YHOO

41.3

-0.14(-0.3378%)

1810

Yandex N.V., NASDAQ

YNDX

18.99

0.06(0.317%)

100

-

12:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

JPMorgan Chase (JPM) downgraded to Mkt Perform from Outperform at BMO Capital

JPMorgan Chase (JPM) downgraded to Neutral from Buy at Buckingham Research; target $74

Other:

Alphabet (GOOG) target raised to $1070 from $940 at Credit Suisse

McDonald's (MCD) target lowered to $122 from $129 at Nomura

Freeport-McMoRan (FCX) resumed with a Underperform at BofA/Merrill

Amazon (AMZN) target raised to $1050 from $920 at Credit Suisse

-

11:31

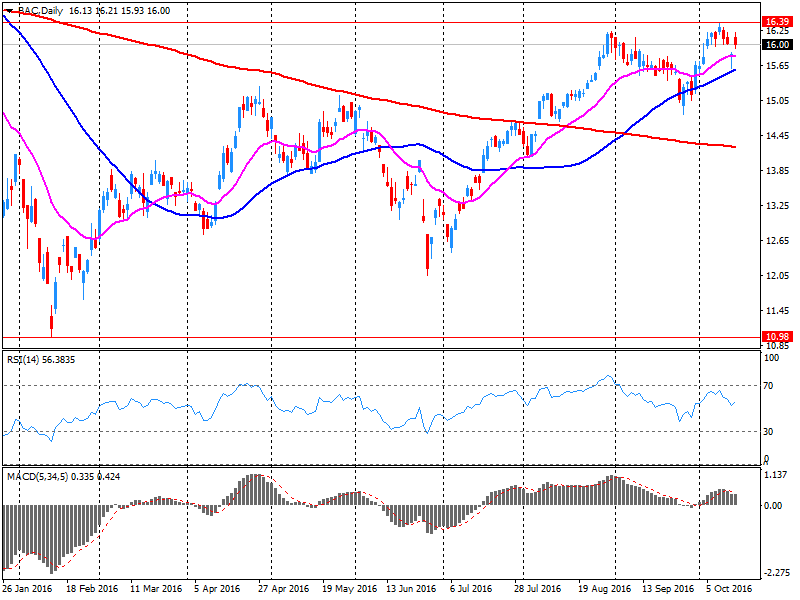

Company News: Bank of America (BAC) Q3 results beat analysts’ expectations

Bank of America reported Q3 FY 2016 earnings of $0.41 per share (versus $0.37 in Q3 FY 2015), beating analysts' consensus estimate of $0.34.

The company's quarterly revenues amounted to $21.635 bln (+3.1% y/y), beating analysts' consensus estimate of $21.039 bln.

BAC rose to $16.14 (+0.88%) in pre-market trading.

-

11:20

Earnings Season in U.S.: Major Reports of the Week

October 17

Before the Open:

Bank of America (BAC). Consensus EPS $0.34, Consensus Revenue $21038.91 mln.

After the Close:

IBM (IBM). Consensus EPS $3.23, Consensus Revenue $19011.02 mln.

October 18

Before the Open:

Goldman Sachs (GS). Consensus EPS $3.83, Consensus Revenue $7406.94 mln.

Johnson & Johnson (JNJ). Consensus EPS $1.65, Consensus Revenue $17735.15 mln.

UnitedHealth (UNH). Consensus EPS $2.08, Consensus Revenue $46061.01 mln.

After the Close:

Intel (INTC). Consensus EPS $0.72, Consensus Revenue $15605.45 mln.

Yahoo! (YHOO). Consensus EPS $0.14, Consensus Revenue $861.32 mln.

October 19

After the Close:

American Express (AXP). Consensus EPS $0.96, Consensus Revenue $7712.31 mln.

October 20

Before the Open:

Travelers (TRV). Consensus EPS $2.35, Consensus Revenue $6236.80 mln.

Verizon (VZ). Consensus EPS $0.99, Consensus Revenue $31112.02 mln.

After the Close:

Microsoft (MSFT). Consensus EPS $0.68, Consensus Revenue $21714.09 mln.

October 21

Before the Open:

General Electric (GE). Consensus EPS $0.30, Consensus Revenue $29680.03 mln.

Honeywell (HON). Consensus EPS $1.62, Consensus Revenue $9776.42 mln.

McDonald's (MCD). Consensus EPS $1.49, Consensus Revenue $6287.79 mln.

-

10:46

Major stock indices in Europe show a negative trend

European stocks traded in the red zone for the fourth time in the last five sessions. The pressure on the shares put fears for the global economy, weak accountability of several European companies, as well as the negative dynamics of the oil market.

Investors are also watching for CB leaders in an attempt to get hints about changes in monetary policy. On Friday, Fed Chairman Yellen noted that he supports the idea of continuing low interest rates, as this may allow the economy to gain momentum and mitigate the effects of a prolonged period of weak growth. Meanwhile, today the Federal Reserve Bank of Boston President Rosengren said that the low level of unemployment in the US in the near future will lead to full employment and it will make the voting members of the FOMC more confident about the growth of interest rates. "I think that in November the Fed will still be inactive, however, in December, it would be reasonable to raise interest rates", - said Rosengren. Also he noted Rosengren predicted 2% inflation target by the end of 2017.

In addition, attention gradually shifted to the ECB meeting. Most likely, the base rate will be left at the zero level, and the amount of monthly asset purchases - at the level of 80 billion euros. Most economists also expect that the Central Bank will extend the QE program, which should be completed in March 2017, but this decision is unlikely to be taken before December. Meanwhile, ECB President Draghi may announce changes in the structure of the program, aimed at preventing possible shortages of acquired assets.

The statistical agency Eurostat reported that consumer prices in the eurozone rose by 0.4% after rising 0.2% in September, Annual inflation was -0.1%. Meanwhile, the growth rate of annual inflation accelerated in September to 0.4% from 0.2% in the previous month. Last Change (MoM and YoY) in line with expectations and preliminary estimate. The base index, which excludes energy and food prices, rose 0.8% year on year, confirming the forecasts and coincided with the previous estimate. In August, the index also increased by 0.8%. The maximum rise in prices in the euro area (in annual terms) was seen in restaurants and cafes (+ 0.08%). Expenses for the rent increased by 0.05%. The cost of tobacco products also increased by 0.05%. Most of the decrease in prices for fuel for transport (-0.12%), gas (-0.11%) and heating oil (-0.10%).

The composite index of the largest companies in the region Stoxx Europe Index 600 lost 0.7 percent.

Pearson Plc's capitalization declined by 10.6 per cent after the company, which publishes the influential newspaper "Financial Times, reported a reduction in quarterly earnings and warned of difficult trading conditions.

Cost of Marine Harvest has fallen to 3.6 percent, as the company lowered its production target figures for 2016.

Shares of Banco Popolare and Banca Popolare di Milano fell by 1.3 per cent and 5.6 per cent after its shareholders have approved their merger, clearing the way for the formation of the third-largest lender in Italy.

Quotes of retailer Hennes & Mauritz fell 1.5 percent. The company reported that comparable sales rose in September by 1%, as the unusually warm weather negatively affected the sales of winter clothes.

At the moment:

FTSE 100 6953.91 -59.64 -0.85%

DAX -68.67 10511.71 -0.65%

CAC 40 4445.60 -25.32 -0.57%

-

07:46

Major stock markets trading in the red zone: FTSE -0.1%, DAX -0.4%, CAC40 -0.4%, FTMIB -0.2%, IBEX -0.5%

-

06:48

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0.4%, CAC40 -0.4%, FTSE -0.3%

-

04:43

Global Stocks

European stocks stepped higher Friday, as bank shares rose and mining stocks got a lift from upbeat inflation news out of China. Economic data out of China on Friday were more upbeat. Consumer price inflation rose more strongly than expected to 1.9%, while producer prices edged up 0.1% in September. That marks the first time the factory-price gauge has been positive in more than four years.

U.S. stocks on Friday finished barely higher as an early rise, buoyed by gains in bank shares, faded into the close. The three main equity benchmarks finished the week with a second-straight weekly loss. Comments from Federal Reserve Chairwoman Janet Yellen midday Friday, where she suggested the fed could overshoot its 2% inflation target, and a strengthening dollar DXY, -0.05% up 0.6%, helped to limit gains for U.S. equities.

Asian shares were broadly lower Monday morning, with the Nikkei giving up early gains, driven by a sharp decline in electric utilities stocks after a nuclear-power skeptic's weekend win in a Japanese gubernatorial race.

-