Market news

-

22:29

Stocks. Daily history for Oct 18’2016:

(index / closing price / change items /% change)

Nikkei 225 16,963.61 0.00 0.00%

Shanghai Composite 3,083.09 +41.92 +1.38%

S&P/ASX 200 5,410.75 0.00 0.00%

FTSE 100 7,000.06 +52.51 +0.76%

CAC 40 4,508.91 +58.68 +1.32%

Xetra DAX 10,631.55 +127.98 +1.22%

S&P 500 2,139.60 +13.10 +0.62%

Dow Jones Industrial Average 18,161.94 +75.54 +0.42%

S&P/TSX Composite 14,752.25 +155.73 +1.07%

-

19:00

FTSE 7000.06 52.51 0.76%, DAX 10631.55 127.98 1.22%, CAC 4508.91 58.68 1.32%

-

16:01

European stocks closed: FTSE 7000.06 52.51 0.76%, DAX 10631.55 127.98 1.22%, CAC 4508.91 58.68 1.32%

-

15:32

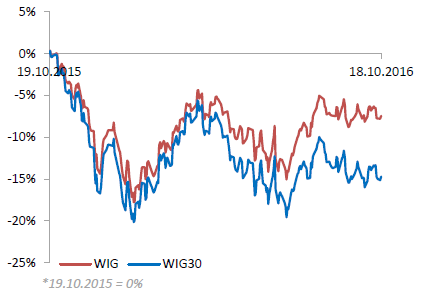

WSE: Session Results

Polish equity market closed higher on Tuesday. The broad market benchmark, the WIG Index, surged by 0.36%. Within the WIG index performance was mixed, with utilities (+2.99%) outperforming and telecoms (-1.43%) lagging.

The large-cap stocks grew by 0.5%, as measured by the WIG30 Index. Within the index components, genco PGE (WSE: PGE) and clothing retailer LPP (WSE: LPP) recorded the biggest gains, up 5.32% and 5.15% respectively. Other major advancers were railway freight transport operator PKP CARGO (WSE: PKP), footwear retailer CCC (WSE: CCC) and two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), adding between 3.03% and 5.06%. On the other side of the ledger, FMCG-wholesaler EUROCASH (WSE: EUR) led the decliners, tumbling by 4.96%, following the announcement the company faced objections from Poland's antimonopoly office UOKiK over its takeover of alcoholic beverages distributor PDA as the deal might infringe on competition on two local markets. It was followed by oil and gas producer PGNIG (WSE: PGN) and telecommunication services provider ORANGE POLSKA (WSE: OPL), losing 2.5% and 2.27% respectively.

-

15:02

Wall Street. Major U.S. stock-indexes rose

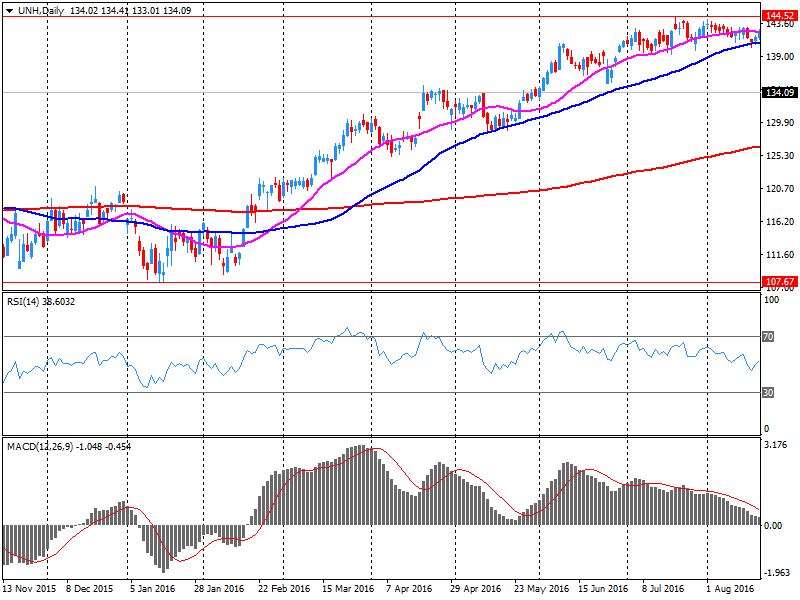

Major U.S. stock-indexes rose on Tuesday, as a slew of better-than-expected quarterly reports, including those from Netflix and UnitedHealth, buoyed investor sentiment.

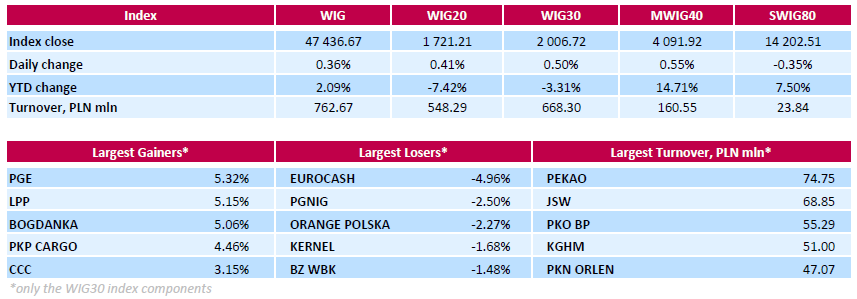

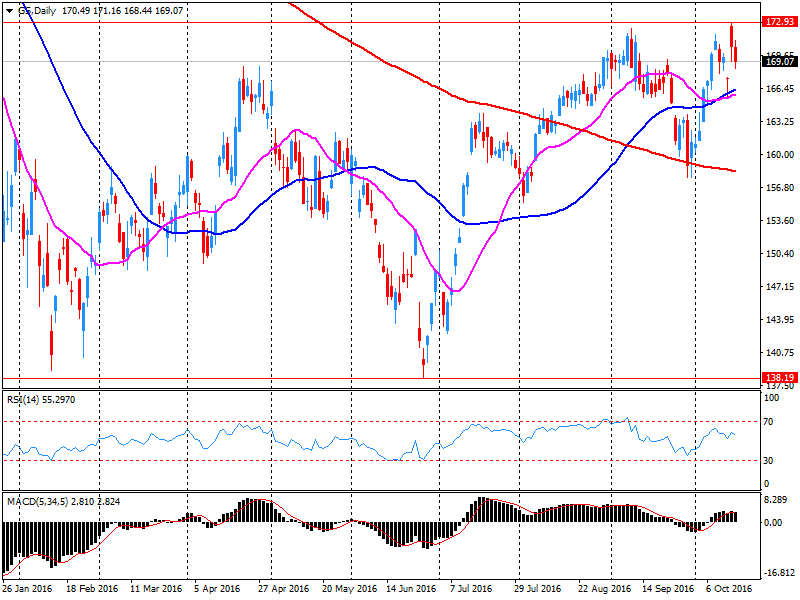

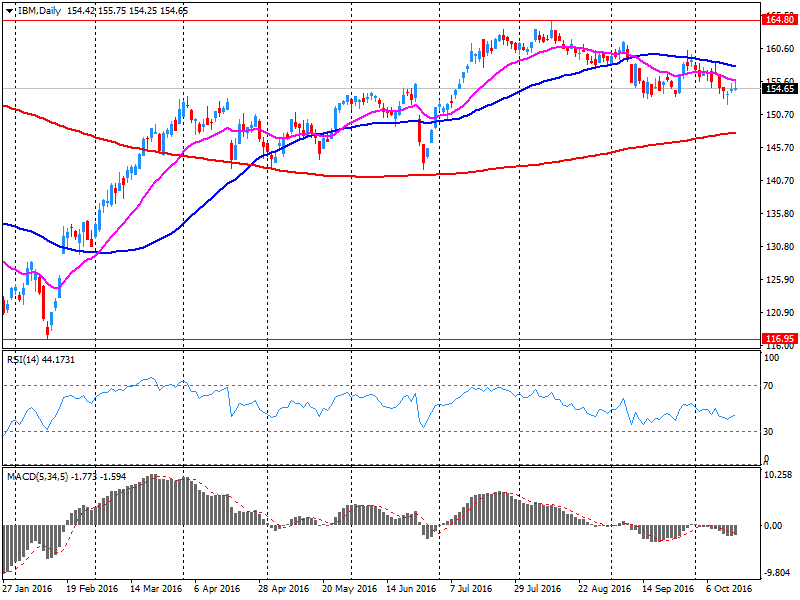

UnitedHealth (UNH) rose 6,7% after the health insurer said it expect the strong growth seen in 2016 to continue into 2017. Other health insurers also gained on the news. Johnson & Johnson (JNJ) was down 2,3%, while Pfizer (PFE) gained 0,8% on after it announced plans to ship a cheaper biosimilar to Remicade, JNJ's top selling product. The news overshadowed J&J's slight earnings beat. Goldman Sachs (GS) rose 2,2%, lifting shares of other banks, after the company's results blew past Wall Street estimates, mirroring results at its Wall Street peers.

Most of Dow stocks in positive area (23 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +6.66%). Top lsoer - International Business Machines Corporation (IBM, -3.35%).

Almost all S&P sectors also in positive area. Top gainer - Healthcare (+1.1%). Top loser - Conglomerates (-0.2%).

At the moment:

Dow 18073.00 +60.00 +0.33%

S&P 500 2132.75 +9.75 +0.46%

Nasdaq 100 4842.25 +39.00 +0.81%

Oil 50.27 -0.10 -0.20%

Gold 1260.50 +3.90 +0.31%

U.S. 10yr 1.77 -0.00

-

13:31

U.S. Stocks open: Dow +0.26%, Nasdaq +1.04%, S&P +0.63%

-

13:22

Before the bell: S&P futures +0.74%, NASDAQ futures +0.74%

U.S. stock-index futures rose amid solid corporate earnings and as investors speculated that the economy is strong enough to cope with the gradual pace of monetary tightening indicated by policymakers.

Global Stocks:

Nikkei 16,963.61 +63.49 +0.38%

Hang Seng 23,394.39 +356.85 +1.55%

Shanghai 3,083.09 +41.92 +1.38%

FTSE 7,029.07 +81.52 +1.17%

CAC 4,512.06 +61.83 +1.39%

DAX 10,641.60 +138.03 +1.31%

Crude $50.20 (+0.52%)

Gold $1262.80 (+0.49%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.68

0.33(1.2524%)

44097

ALTRIA GROUP INC.

MO

62.75

0.32(0.5126%)

2000

Amazon.com Inc., NASDAQ

AMZN

822

9.05(1.1132%)

28503

AMERICAN INTERNATIONAL GROUP

AIG

60.7

0.41(0.68%)

632

Apple Inc.

AAPL

118.35

0.80(0.6806%)

191787

AT&T Inc

T

39.5

0.23(0.5857%)

6746

Barrick Gold Corporation, NYSE

ABX

16.3

0.40(2.5157%)

302685

Boeing Co

BA

135

1.00(0.7463%)

300

Caterpillar Inc

CAT

88

0.71(0.8134%)

425

Chevron Corp

CVX

101.92

0.56(0.5525%)

56663

Cisco Systems Inc

CSCO

30.35

0.13(0.4302%)

1444

Citigroup Inc., NYSE

C

49.05

0.45(0.9259%)

16678

Exxon Mobil Corp

XOM

87.22

0.68(0.7858%)

8459

Facebook, Inc.

FB

128.67

1.13(0.886%)

117506

Ford Motor Co.

F

11.91

0.03(0.2525%)

71744

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.74

0.22(2.3109%)

44721

General Electric Co

GE

29.05

0.20(0.6932%)

34503

General Motors Company, NYSE

GM

32

0.44(1.3942%)

100

Goldman Sachs

GS

171.4

2.40(1.4201%)

87524

Google Inc.

GOOG

786.4

6.44(0.8257%)

2638

Home Depot Inc

HD

125.45

0.31(0.2477%)

100

Intel Corp

INTC

37.8

0.51(1.3677%)

69993

International Business Machines Co...

IBM

150.25

-4.52(-2.9205%)

45027

International Paper Company

IP

46.51

-0.69(-1.4619%)

256

Johnson & Johnson

JNJ

118.2

-0.29(-0.2447%)

27238

JPMorgan Chase and Co

JPM

67.72

0.55(0.8188%)

65054

McDonald's Corp

MCD

113.05

0.64(0.5693%)

835

Microsoft Corp

MSFT

57.64

0.42(0.734%)

111873

Nike

NKE

51.32

0.29(0.5683%)

4191

Pfizer Inc

PFE

32.81

0.31(0.9539%)

5040

Starbucks Corporation, NASDAQ

SBUX

53.13

0.37(0.7013%)

4076

Tesla Motors, Inc., NASDAQ

TSLA

196.62

2.66(1.3714%)

15112

The Coca-Cola Co

KO

41.8

0.20(0.4808%)

1165

Twitter, Inc., NYSE

TWTR

16.84

0.11(0.6575%)

82095

UnitedHealth Group Inc

UNH

137.25

3.12(2.3261%)

5057

Visa

V

81.68

-0.47(-0.5721%)

10926

Walt Disney Co

DIS

91.4

0.57(0.6275%)

16023

Yahoo! Inc., NASDAQ

YHOO

42.02

0.23(0.5504%)

37210

-

12:45

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Intl Paper (IP) downgraded to Underperform at Macquarie

Yahoo! (YHOO) downgraded to Hold from Buy at Needham

Other:

Apple (AAPL) target raised to $130 from $120 at Stifel

Apple (AAPL) target raised to $108 from $105 at Deutsche Bank

-

12:03

Company News: Goldman Sachs (GS) Q3 results beat analysts’ estimates

Goldman Sachs reported Q3 FY 2016 earnings of $4.88 per share (versus $2.90 in Q3 FY 2015), beating analysts' consensus estimate of $3.83.

The company's quarterly revenues amounted to $8.168 bln (+19% y/y), beating analysts' consensus estimate of $7.407 bln.

GS rose to $171.60 (+1.54%) in pre-market trading.

-

11:24

Company News: Johnson & Johnson (JNJ) Q3 EPS beat analysts’ estimate

Johnson & Johnson reported Q3 FY 2016 earnings of $1.68 per share (versus $1.49 in Q3 FY 2015), beating analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $17.820 bln (+4.2% y/y), slightly beating analysts' consensus estimate of $17.745 bln.

The company issued raised guidance for FY2016, projecting EPS of $6.68-6.73, up from $6.63-6.73, versus analysts' consensus of $6.69; revenues are forecasted to amount to $71.5-72.2 bln versus analysts' consensus of $72.14 bln.

JNJ rose to $ 118.80 (+0.26%) in pre-market trading.

-

11:08

Company News: UnitedHealth (UNH) Q3 EPS beat analysts’ estimate

UnitedHealth reported Q3 FY 2016 earnings of $2.17 per share (versus $1.65 in Q3 FY 2015), beating analysts' consensus estimate of $2.08.

The company's quarterly revenues amounted to $46.293 bln (+11.6% y/y), slightly beating analysts' consensus estimate of $46.061 bln.

The company issued raised guidance for FY2016, projecting EPS of ~$8.00, up from $7.80-7.95, versus analysts' consensus of $7.92.

UNH rose to 135.41 (+0.95%) in pre-market trading.

-

10:52

Major stock indices in Europe show a positive trend

European stocks resumed their rally against the backdrop of better than forecasted corporate earnings reports. Support for indices also had an appreciation of the mining and energy sectors in response to the increase in oil prices and a number of precious metals.

Gradually, the focus shifts to ECB's meeting, which will be held tomorrow. It is expected that the base rate will remain at the zero level, and the amount of monthly asset purchases - at the level of 80 billion euros. Most economists also expect that the Central Bank will extend the QE which should be completed in March 2017, but this decision is unlikely to be taken before December. Meanwhile, ECB President Draghi may announce changes in the structure of the program, aimed at preventing possible shortages of acquired assets.

Certain influence on the dynamics of trade had inflation data in Britain. The ONS reported that the annual consumer price inflation rose in September to 1.0 percent from 0.6 percent in August, reaching the highest level since November 2014 and showing the biggest monthly gain since June 2014. It was expected that inflation will rise to 0.9 percent, ueled by nearly 20 percent drop in the pound.

Nevertheless, official statistics are waiting for clear signs of the impact from the weakened currency. Much of the growth of inflation in September was associated with the highest monthly rise in prices for clothing, as well as the increased cost of fuel. The data also showed that over the past three months (till September) prices rose by 0.7 per cent. The calculation of basic consumer price inflation - which excludes prices for energy, food, alcohol and tobacco - rose in September to 1.5 percent from 1.3 percent, which was also slightly above economists' expectations of 1.4 percent. Producer prices increased by 1.2 percent, recording the biggest growth in the past three years.

The composite index of the largest comapnies in the regio Stoxx Europe 600 rose by 1.2 percent. Shares of mining companies led the growth among the 19 industry groups, aided by a general weakening of the US currency. Now the US dollar index, showing the relationship of the US dollar against a basket of six major currencies, was trading lower by 0.2 percent.

Capitalization of Remy Cointreau rose 2.9 percent after the company said that the rate of increase in sales exceeded the estimates of experts.

Bellway shares increased by 1.2 percent amid reports that the amount of annual profits exceeded forecasts. In addition, the company announced a dividend increase.

Shares of Ryanair Holdings rose 2.7 percent, leveling before falling 3.2 per cent. While the airline worsened the forecast of net profit for the fiscal year 2016-2017 due to Brexit, analysts say that the current effect is reflected in the share price, which is still 12 per cent below the day of the referendum.

Quotes of Burberry Group Plc fell 7.4 percent, as wholesale revenues in the first half of the year fell more than expected.

Continental AG fell 3.3 percent after the company worsened its annual forecast profitability.

Danone SA rose 0.3 percent, as the company slightly lowered the growth forecast for annual revenue, but improved assessment of the growth of profitability on the operating profit.

At the moment:

FTSE 100 +59.05 7006.60 + 0.85%

DAX +128.41 10631.98 + 1.22%

CAC 40 +49.39 4499.62 + 1.11%

-

10:48

Company News: IBM (IBM) Q3 results beat analysts’ expectations

IBM reported Q3 FY 2016 earnings of $3.29 per share (versus $3.34 in Q3 FY 2015), beating analysts' consensus estimate of $3.23.

The company's quarterly revenues amounted to $19.226 bln (-0.3% y/y), beating analysts' consensus estimate of $19.011 bln.

The company reaffirmed guidance for FY2016, projecting EPS of at least $13.50, versus analysts' consensus of $13.51.

IBM fell to $150.80 (-2.57%) in pre-market trading.

-

08:21

Major stock markets trading in the green zone: FTSE 100 7,004.01 +56.46 + 0.81%, DAX 10,578.10 +74.53 + 0.71%

-

06:41

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.8%, CAC40 + 0.6%, FTSE + 0.5%

-

04:40

Global Stocks

European stocks slumped Monday, led by a pullback in oil shares, as investors entered the trading week with the dollar sitting at a seven-month high while they waited to hear what's next for monetary policy at the European Central Bank.

U.S. stocks finished lower Monday as warnings about accelerating inflation coupled with crude-oil trading below $50 a barrel overshadowed strong earnings from Bank of America Corp. In an interview with CNBC, Jeffrey Gundlach reiterated his short positions on stocks and bonds and predicted that policy makers will have to resort to fiscal policies to support the economy.

Asian stocks crept up on Tuesday thanks to a rebound in oil prices and the dollar consolidated recent gains although underlying risk appetite was cautious on concerns over capital outflows and weak data, especially from China. Special focus will be on China's B Share market .SSEB, which was trading up around 0.8 percent on Tuesday after tumbling more than 6 percent on Monday on concerns of extended yuan weakness.

-