Market news

-

22:30

Commodities. Daily history for Oct 18’2016:

(raw materials / closing price /% change)

Oil 50.77 +0.95%

Gold 1,263.30 +0.03%

-

22:29

Stocks. Daily history for Oct 18’2016:

(index / closing price / change items /% change)

Nikkei 225 16,963.61 0.00 0.00%

Shanghai Composite 3,083.09 +41.92 +1.38%

S&P/ASX 200 5,410.75 0.00 0.00%

FTSE 100 7,000.06 +52.51 +0.76%

CAC 40 4,508.91 +58.68 +1.32%

Xetra DAX 10,631.55 +127.98 +1.22%

S&P 500 2,139.60 +13.10 +0.62%

Dow Jones Industrial Average 18,161.94 +75.54 +0.42%

S&P/TSX Composite 14,752.25 +155.73 +1.07%

-

22:28

Currencies. Daily history for Oct 18’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0977 -0,19%

GBP/USD $1,2300 +0,95%

USD/CHF Chf0,9898 +0,08%

USD/JPY Y103,86 -0,04%

EUR/JPY Y114,02 -0,22%

GBP/JPY Y127,75 +0,92%

AUD/USD $0,7671 +0,52%

NZD/USD $0,7193 +0,32%

USD/CAD C$1,3107 -0,14%

-

22:00

Schedule for today, Wednesday, Oct 19’2016

02:00 China Retail Sales y/y September 10.6% 10.6%

02:00 China Fixed Asset Investment August 8.1% 8.2%

02:00 China Industrial Production y/y September 6.3% 6.4%

02:00 China GDP y/y Quarter III 6.7% 6.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August 2.1% 2.1%

08:30 United Kingdom Average Earnings, 3m/y August 2.3% 2.3%

08:30 United Kingdom ILO Unemployment Rate August 4.9% 4.9%

08:30 United Kingdom Claimant count September 2.4 3

12:30 U.S. Housing Starts September 1142 1175

12:30 U.S. Building Permits September 1152 1165

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 Australia Conference Board Australia Leading Index August 0.4%

14:30 U.S. Crude Oil Inventories October 4.9

15:15 Canada BOC Press Conference

17:00 United Kingdom MPC Member Andy Haldane Speaks

18:00 U.S. Fed's Beige Book

20:15 Canada BOC Gov Stephen Poloz Speaks

23:45 U.S. FOMC Member Dudley Speak

-

20:01

U.S.: Total Net TIC Flows, August 73.8

-

20:00

U.S.: Net Long-term TIC Flows , August 48.3

-

19:00

FTSE 7000.06 52.51 0.76%, DAX 10631.55 127.98 1.22%, CAC 4508.91 58.68 1.32%

-

16:01

European stocks closed: FTSE 7000.06 52.51 0.76%, DAX 10631.55 127.98 1.22%, CAC 4508.91 58.68 1.32%

-

15:50

No major change for oil prices today

The dollar regained some of the previously lost ground after the release of new data on inflation, which showed moderate growth. These data seem to be taken into account at the Fed's decision on interest rates.

Since the end of September, when it was announced the preliminary agreement of OPEC, oil prices are in the range of 48-53 dollars per barrel.

"Prices are no longer rising," - said John Saucer, vice president of Mobius Risk Group in Houston. "They quickly rebounded, and now they are consolidating", - he added.

Meanwhile, investors are increasingly skeptical that OPEC will be able to agree on a reduction of total oil production by 1-2%. Especially it is not clear which countries will reduce the production.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 49.76 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 51.25 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:32

WSE: Session Results

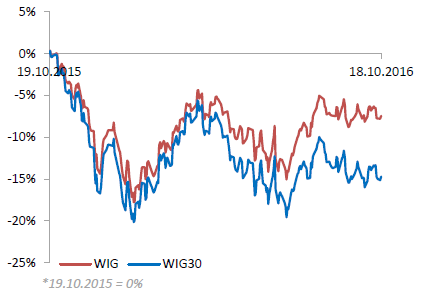

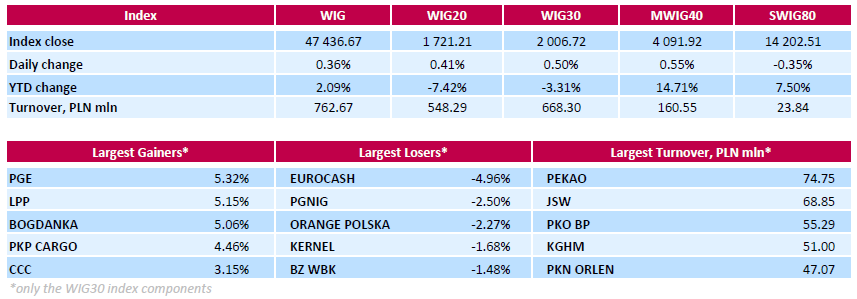

Polish equity market closed higher on Tuesday. The broad market benchmark, the WIG Index, surged by 0.36%. Within the WIG index performance was mixed, with utilities (+2.99%) outperforming and telecoms (-1.43%) lagging.

The large-cap stocks grew by 0.5%, as measured by the WIG30 Index. Within the index components, genco PGE (WSE: PGE) and clothing retailer LPP (WSE: LPP) recorded the biggest gains, up 5.32% and 5.15% respectively. Other major advancers were railway freight transport operator PKP CARGO (WSE: PKP), footwear retailer CCC (WSE: CCC) and two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), adding between 3.03% and 5.06%. On the other side of the ledger, FMCG-wholesaler EUROCASH (WSE: EUR) led the decliners, tumbling by 4.96%, following the announcement the company faced objections from Poland's antimonopoly office UOKiK over its takeover of alcoholic beverages distributor PDA as the deal might infringe on competition on two local markets. It was followed by oil and gas producer PGNIG (WSE: PGN) and telecommunication services provider ORANGE POLSKA (WSE: OPL), losing 2.5% and 2.27% respectively.

-

15:26

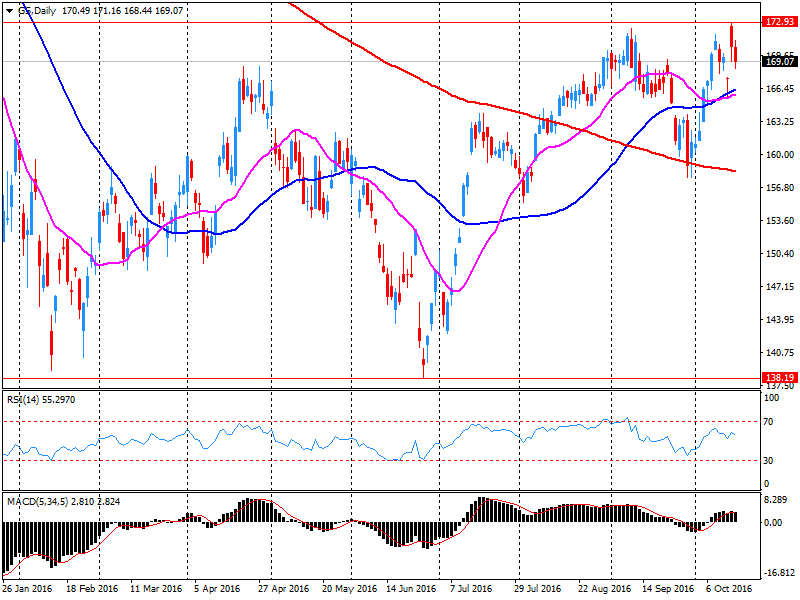

Gold in the accumulation range

Gold prices rose, as disappointing data on US inflation eased reasons for the tightening of monetary policy of the Fed, putting pressure on the US dollar.

The US Commerce Department reported that the Consumer Price Index rose by 0.3% in September compared with the previous month, in line with expectations, after rising in the previous month by 0.2%. In annual terms, the consumer price index increased by 1.5% last month, in line with expectations, after rising 1.1% in August. The value was the highest since October 2014.

The consumer price index (excluding food and energy) rose a seasonally adjusted 0.1% last month, lower than the forecasts of +0.2%. In the 12 months to September core consumer price index rose by 2.2%.

USD index, which measures the value of the US currency against a basket of six major currencies, fell 0.2% to 97.66 on Tuesday morning after falling from a seven-month high the previous session.

The cost of December futures for gold on COMEX rose to $ 1265.0 per ounce.

-

15:02

Wall Street. Major U.S. stock-indexes rose

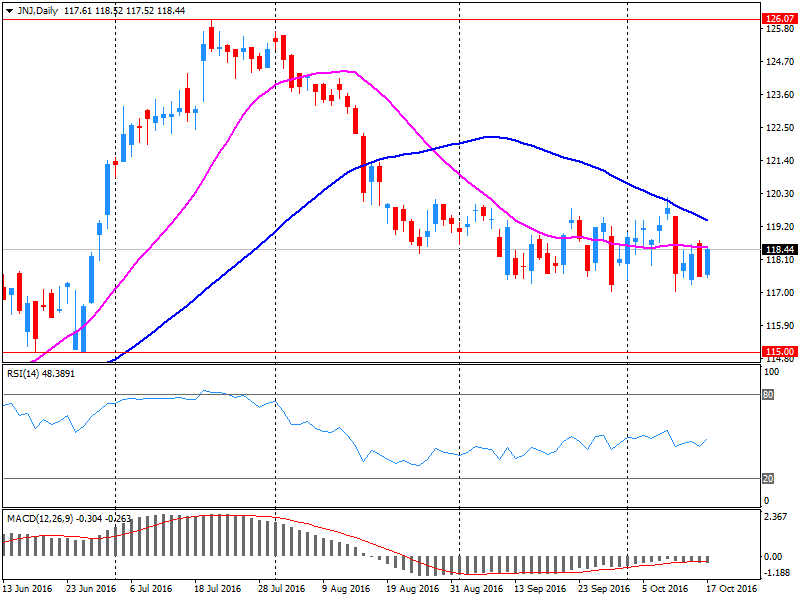

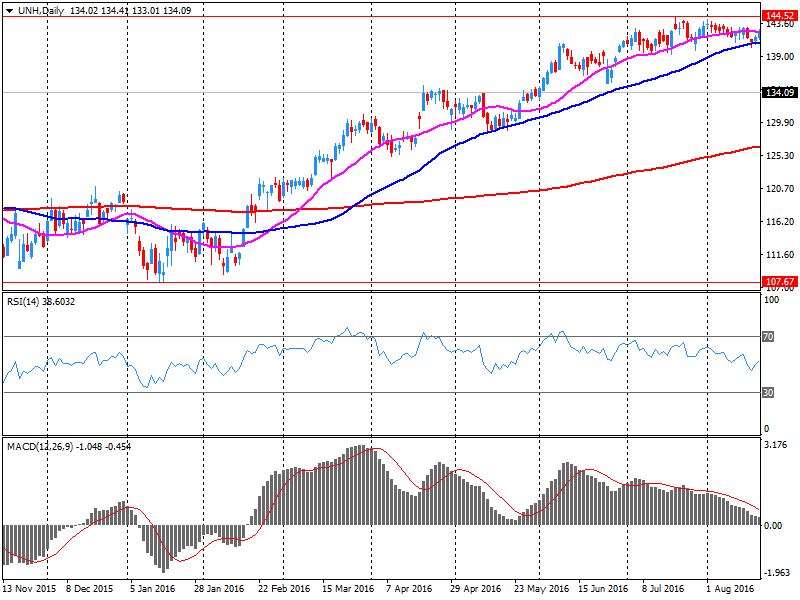

Major U.S. stock-indexes rose on Tuesday, as a slew of better-than-expected quarterly reports, including those from Netflix and UnitedHealth, buoyed investor sentiment.

UnitedHealth (UNH) rose 6,7% after the health insurer said it expect the strong growth seen in 2016 to continue into 2017. Other health insurers also gained on the news. Johnson & Johnson (JNJ) was down 2,3%, while Pfizer (PFE) gained 0,8% on after it announced plans to ship a cheaper biosimilar to Remicade, JNJ's top selling product. The news overshadowed J&J's slight earnings beat. Goldman Sachs (GS) rose 2,2%, lifting shares of other banks, after the company's results blew past Wall Street estimates, mirroring results at its Wall Street peers.

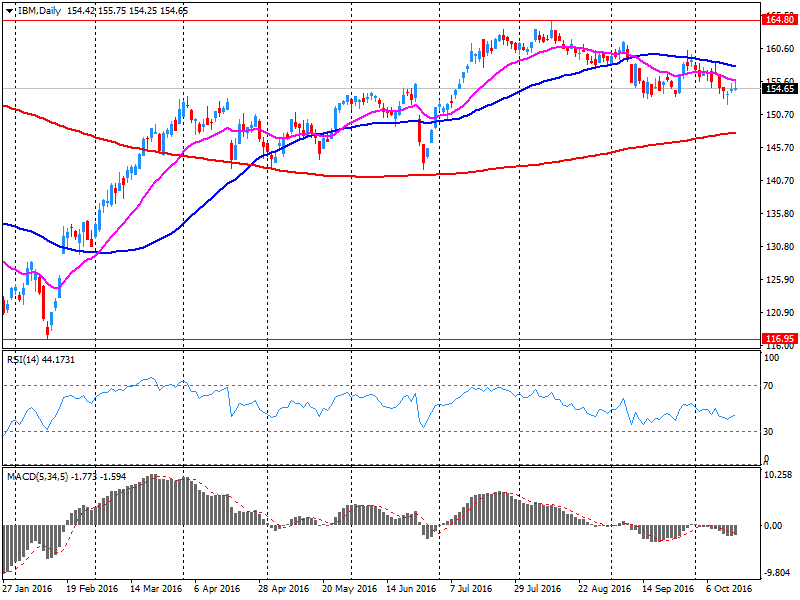

Most of Dow stocks in positive area (23 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +6.66%). Top lsoer - International Business Machines Corporation (IBM, -3.35%).

Almost all S&P sectors also in positive area. Top gainer - Healthcare (+1.1%). Top loser - Conglomerates (-0.2%).

At the moment:

Dow 18073.00 +60.00 +0.33%

S&P 500 2132.75 +9.75 +0.46%

Nasdaq 100 4842.25 +39.00 +0.81%

Oil 50.27 -0.10 -0.20%

Gold 1260.50 +3.90 +0.31%

U.S. 10yr 1.77 -0.00

-

14:24

US Builder Confidence remained on firm ground in October

Builder confidence in the market for newly constructed single-family homes remained on firm ground in October, down two points to a level of 63 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

"Even with this month's drop, builder confidence stands at its second-highest level in 2016, a sign that the housing recovery continues to make solid progress," said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill. "However, builders in many markets continue to express concerns about shortages of lots and labor."

"The October reading represents a mild pullback from a jump in September, and indicates that the housing market continues to make slow and steady gains," said NAHB Chief Economist Robert Dietz. "Moreover, mortgage rates remain low and the HMI index measuring future sales expectations has been over 70 for the past two months. These factors will sustain continued growth in the single-family market in the months ahead."

-

14:00

U.S.: NAHB Housing Market Index, October 63 (forecast 63)

-

13:55

Change in GDT Price Index from previous event +1.4%. Average price (USD/MT, FAS) 2,965$. NZD/USD moderately bid

-

13:44

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0900 (EUR 505m) 1.1000 (2.19bln) 1.1065 (249m) 1.1050 (285m) 1.1100(545m) 1.1199 (339m)

GBPUSD 1.2170 (GBP 237m)

USDJPY 102.00-05 (USD 930m) 103.60 (301m) 104.00 (326m) 105.00 (879m)

EURJPY: 112.00 (EUR 200m) 114.00 (200m)

AUDUSD 0.7500 (AUD 771m) 0.7750-55 (595m) 0.7600 (670m)

USDCAD: 1.2985 (252m) 1.3100 (USD 490m) 1.3150-55 (277m) 1.3200-05 (680m)

AUDNZD: 1.0600 (AUD 226m)

-

13:31

U.S. Stocks open: Dow +0.26%, Nasdaq +1.04%, S&P +0.63%

-

13:22

Before the bell: S&P futures +0.74%, NASDAQ futures +0.74%

U.S. stock-index futures rose amid solid corporate earnings and as investors speculated that the economy is strong enough to cope with the gradual pace of monetary tightening indicated by policymakers.

Global Stocks:

Nikkei 16,963.61 +63.49 +0.38%

Hang Seng 23,394.39 +356.85 +1.55%

Shanghai 3,083.09 +41.92 +1.38%

FTSE 7,029.07 +81.52 +1.17%

CAC 4,512.06 +61.83 +1.39%

DAX 10,641.60 +138.03 +1.31%

Crude $50.20 (+0.52%)

Gold $1262.80 (+0.49%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.68

0.33(1.2524%)

44097

ALTRIA GROUP INC.

MO

62.75

0.32(0.5126%)

2000

Amazon.com Inc., NASDAQ

AMZN

822

9.05(1.1132%)

28503

AMERICAN INTERNATIONAL GROUP

AIG

60.7

0.41(0.68%)

632

Apple Inc.

AAPL

118.35

0.80(0.6806%)

191787

AT&T Inc

T

39.5

0.23(0.5857%)

6746

Barrick Gold Corporation, NYSE

ABX

16.3

0.40(2.5157%)

302685

Boeing Co

BA

135

1.00(0.7463%)

300

Caterpillar Inc

CAT

88

0.71(0.8134%)

425

Chevron Corp

CVX

101.92

0.56(0.5525%)

56663

Cisco Systems Inc

CSCO

30.35

0.13(0.4302%)

1444

Citigroup Inc., NYSE

C

49.05

0.45(0.9259%)

16678

Exxon Mobil Corp

XOM

87.22

0.68(0.7858%)

8459

Facebook, Inc.

FB

128.67

1.13(0.886%)

117506

Ford Motor Co.

F

11.91

0.03(0.2525%)

71744

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.74

0.22(2.3109%)

44721

General Electric Co

GE

29.05

0.20(0.6932%)

34503

General Motors Company, NYSE

GM

32

0.44(1.3942%)

100

Goldman Sachs

GS

171.4

2.40(1.4201%)

87524

Google Inc.

GOOG

786.4

6.44(0.8257%)

2638

Home Depot Inc

HD

125.45

0.31(0.2477%)

100

Intel Corp

INTC

37.8

0.51(1.3677%)

69993

International Business Machines Co...

IBM

150.25

-4.52(-2.9205%)

45027

International Paper Company

IP

46.51

-0.69(-1.4619%)

256

Johnson & Johnson

JNJ

118.2

-0.29(-0.2447%)

27238

JPMorgan Chase and Co

JPM

67.72

0.55(0.8188%)

65054

McDonald's Corp

MCD

113.05

0.64(0.5693%)

835

Microsoft Corp

MSFT

57.64

0.42(0.734%)

111873

Nike

NKE

51.32

0.29(0.5683%)

4191

Pfizer Inc

PFE

32.81

0.31(0.9539%)

5040

Starbucks Corporation, NASDAQ

SBUX

53.13

0.37(0.7013%)

4076

Tesla Motors, Inc., NASDAQ

TSLA

196.62

2.66(1.3714%)

15112

The Coca-Cola Co

KO

41.8

0.20(0.4808%)

1165

Twitter, Inc., NYSE

TWTR

16.84

0.11(0.6575%)

82095

UnitedHealth Group Inc

UNH

137.25

3.12(2.3261%)

5057

Visa

V

81.68

-0.47(-0.5721%)

10926

Walt Disney Co

DIS

91.4

0.57(0.6275%)

16023

Yahoo! Inc., NASDAQ

YHOO

42.02

0.23(0.5504%)

37210

-

12:45

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Intl Paper (IP) downgraded to Underperform at Macquarie

Yahoo! (YHOO) downgraded to Hold from Buy at Needham

Other:

Apple (AAPL) target raised to $130 from $120 at Stifel

Apple (AAPL) target raised to $108 from $105 at Deutsche Bank

-

12:34

Canadian Manufacturing Sales increased 0.9% to $51.1 billion in August

Manufacturing sales increased 0.9% to $51.1 billion in August, reflecting higher sales of food, primary metal, and petroleum and coal products.

Sales were up in 15 of 21 industries, representing 69% of the total Canadian manufacturing sector. The increase reflected a higher volume of goods sold, as constant dollar sales rose 1.2%.

-

12:33

US Core CPI up 0.3% in September

The Consumer Price Index increased 0.3 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.5 percent before seasonal adjustment.

Increases in the shelter and gasoline indexes were the main causes of the rise in the all items index. The gasoline index rose 5.8 percent in September and accounted for more than half of the all items increase. The shelter index increased 0.4 percent, its largest increase since May.

The energy index increased 2.9 percent, its largest advance since April. Along with the gasoline index, other energy component indexes also rose. The index for food, in contrast, was unchanged for the third consecutive month, as the food at home index continued to decline.

The index for all items less food and energy rose 0.1 percent in September after a 0.3-percent increase in August. Along with the shelter index, the indexes for medical care, motor vehicle insurance, and personal care all increased in September

-

12:30

U.S.: CPI excluding food and energy, Y/Y, September 2.2% (forecast 2.3%)

-

12:30

Canada: Manufacturing Shipments (MoM), August 0.9% (forecast 0.3%)

-

12:30

U.S.: CPI excluding food and energy, m/m, September 0.1% (forecast 0.2%)

-

12:30

U.S.: CPI, m/m , September 0.3% (forecast 0.3%)

-

12:30

U.S.: CPI, Y/Y, September 1.5% (forecast 1.5%)

-

12:22

European session review: the US Dollar trading lower vs British Pound

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK Producer Price Index (m / m) September 0.1% 0.2% 0.2%

8:30 UK producers selling prices index, y / y in September 0.9% 1.1% 1.2%

8:30 UK producers purchase prices index m / m in September 0.2% 0.4% 0.0%

8:30 UK purchasing producer prices index, y / y in September 7.8% 7.4% 7.2%

8:30 UK Retail Price Index m / m in September 0.4% 0.1% 0.2%

8:30 UK Retail Price Index y / y in September to 1.8% 2% 2%

8:30 UK Consumer Price Index m / m in September 0.3% 0.1% 0.2%

8:30 UK Consumer Price Index y / y in September to 0.6% 0.9% 1%

8:30 UK consumer price index base value, y / y in September 1.3% 1.4% 1.5%

The pound rose against the US dollar, approaching 12 October high. Certain influence on the dynamics of trade had inflation data in Britain. The ONS reported that the annual consumer price inflation rose in September to 1.0 percent from 0.6 percent in August, reaching the highest level since November 2014 and showing the biggest monthly gain since June 2014. It was expected that inflation will rise to 0.9 percent, ueled by nearly 20 percent drop in the pound.

Nevertheless, official statistics are waiting for clear signs of the impact from the weakened currency. Much of the growth of inflation in September was associated with the highest monthly rise in prices for clothing, as well as the increased cost of fuel. The data also showed that over the past three months (till September) prices rose by 0.7 per cent. The calculation of basic consumer price inflation - which excludes prices for energy, food, alcohol and tobacco - rose in September to 1.5 percent from 1.3 percent, which was also slightly above economists' expectations of 1.4 percent. Producer prices increased by 1.2 percent, recording the biggest growth in the past three years.

The euro fell slightly against the US dollar due to investors' caution on the eve of ECB's meeting, which will be held tomorrow. In addition, market participants expect the publication of US inflation data. It is expected that in September, the CPI rose by 0.3% after rising 0.2% in August.

EUR / USD: during the European session, the pair fell to $ 1.0988

GBP / USD: during the European session, the pair rose to $ 1.2303

USD / JPY: during the European session, the pair was trading at Y103.80-Y104.10 range

-

12:03

Company News: Goldman Sachs (GS) Q3 results beat analysts’ estimates

Goldman Sachs reported Q3 FY 2016 earnings of $4.88 per share (versus $2.90 in Q3 FY 2015), beating analysts' consensus estimate of $3.83.

The company's quarterly revenues amounted to $8.168 bln (+19% y/y), beating analysts' consensus estimate of $7.407 bln.

GS rose to $171.60 (+1.54%) in pre-market trading.

-

12:00

Orders

EUR/USD

Offers 1.1025-30 1.1055 1.1070 1.1085 1.1100-05 1.1130 1.1150

Bids 1.1000 1.0985 1.0970 1.0950 1.0920 1.0900 1.0880 1.0850

GBP/USD

Offers 1.2250 1.2275-80 1.2300 1.2325-30 1.2350 1.2380 1.2400

Bids 1.2220 1.2200 1.2185 1.2165 1.2145-50 1.2130 1.2100

EUR/GBP

Offers 0.9010 0.9030-35 0.9050 0.9070-75 0.9100

Bids 0.8975-80 0.8960 0.8930 0.8900 0.8850-55

EUR/JPY

Offers 114.80 115.00 115.50 115.80 116.00 116.25-30 116.50

Bids 114.20 114.00 113.70 113.50 113.00 112.60 112.00

USD/JPY

Offers 104.25-30 104.50 104.80 105.00

Bids 103.70 103.50 103.35 103.20 103.00 102.85 102.50

AUD/USD

Offers 0.7685 0.7700-10 0.7720 0.7755-60 0.7800

Bids 0.7660 0.7625-30 0.7600 0.7580 0.7550

-

11:24

Company News: Johnson & Johnson (JNJ) Q3 EPS beat analysts’ estimate

Johnson & Johnson reported Q3 FY 2016 earnings of $1.68 per share (versus $1.49 in Q3 FY 2015), beating analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $17.820 bln (+4.2% y/y), slightly beating analysts' consensus estimate of $17.745 bln.

The company issued raised guidance for FY2016, projecting EPS of $6.68-6.73, up from $6.63-6.73, versus analysts' consensus of $6.69; revenues are forecasted to amount to $71.5-72.2 bln versus analysts' consensus of $72.14 bln.

JNJ rose to $ 118.80 (+0.26%) in pre-market trading.

-

11:08

Company News: UnitedHealth (UNH) Q3 EPS beat analysts’ estimate

UnitedHealth reported Q3 FY 2016 earnings of $2.17 per share (versus $1.65 in Q3 FY 2015), beating analysts' consensus estimate of $2.08.

The company's quarterly revenues amounted to $46.293 bln (+11.6% y/y), slightly beating analysts' consensus estimate of $46.061 bln.

The company issued raised guidance for FY2016, projecting EPS of ~$8.00, up from $7.80-7.95, versus analysts' consensus of $7.92.

UNH rose to 135.41 (+0.95%) in pre-market trading.

-

10:52

Major stock indices in Europe show a positive trend

European stocks resumed their rally against the backdrop of better than forecasted corporate earnings reports. Support for indices also had an appreciation of the mining and energy sectors in response to the increase in oil prices and a number of precious metals.

Gradually, the focus shifts to ECB's meeting, which will be held tomorrow. It is expected that the base rate will remain at the zero level, and the amount of monthly asset purchases - at the level of 80 billion euros. Most economists also expect that the Central Bank will extend the QE which should be completed in March 2017, but this decision is unlikely to be taken before December. Meanwhile, ECB President Draghi may announce changes in the structure of the program, aimed at preventing possible shortages of acquired assets.

Certain influence on the dynamics of trade had inflation data in Britain. The ONS reported that the annual consumer price inflation rose in September to 1.0 percent from 0.6 percent in August, reaching the highest level since November 2014 and showing the biggest monthly gain since June 2014. It was expected that inflation will rise to 0.9 percent, ueled by nearly 20 percent drop in the pound.

Nevertheless, official statistics are waiting for clear signs of the impact from the weakened currency. Much of the growth of inflation in September was associated with the highest monthly rise in prices for clothing, as well as the increased cost of fuel. The data also showed that over the past three months (till September) prices rose by 0.7 per cent. The calculation of basic consumer price inflation - which excludes prices for energy, food, alcohol and tobacco - rose in September to 1.5 percent from 1.3 percent, which was also slightly above economists' expectations of 1.4 percent. Producer prices increased by 1.2 percent, recording the biggest growth in the past three years.

The composite index of the largest comapnies in the regio Stoxx Europe 600 rose by 1.2 percent. Shares of mining companies led the growth among the 19 industry groups, aided by a general weakening of the US currency. Now the US dollar index, showing the relationship of the US dollar against a basket of six major currencies, was trading lower by 0.2 percent.

Capitalization of Remy Cointreau rose 2.9 percent after the company said that the rate of increase in sales exceeded the estimates of experts.

Bellway shares increased by 1.2 percent amid reports that the amount of annual profits exceeded forecasts. In addition, the company announced a dividend increase.

Shares of Ryanair Holdings rose 2.7 percent, leveling before falling 3.2 per cent. While the airline worsened the forecast of net profit for the fiscal year 2016-2017 due to Brexit, analysts say that the current effect is reflected in the share price, which is still 12 per cent below the day of the referendum.

Quotes of Burberry Group Plc fell 7.4 percent, as wholesale revenues in the first half of the year fell more than expected.

Continental AG fell 3.3 percent after the company worsened its annual forecast profitability.

Danone SA rose 0.3 percent, as the company slightly lowered the growth forecast for annual revenue, but improved assessment of the growth of profitability on the operating profit.

At the moment:

FTSE 100 +59.05 7006.60 + 0.85%

DAX +128.41 10631.98 + 1.22%

CAC 40 +49.39 4499.62 + 1.11%

-

10:48

Company News: IBM (IBM) Q3 results beat analysts’ expectations

IBM reported Q3 FY 2016 earnings of $3.29 per share (versus $3.34 in Q3 FY 2015), beating analysts' consensus estimate of $3.23.

The company's quarterly revenues amounted to $19.226 bln (-0.3% y/y), beating analysts' consensus estimate of $19.011 bln.

The company reaffirmed guidance for FY2016, projecting EPS of at least $13.50, versus analysts' consensus of $13.51.

IBM fell to $150.80 (-2.57%) in pre-market trading.

-

09:57

It's very likely that Brexit needs ratification by MP's - Government attorney

-

New Brexit treaty likely to be voted on by both houses

-

Parliament will have a central role in changing domestic laws

*forexlive -

-

09:11

GBP/USD: A Rebound From Current Levels To Target 1.2650 - Morgan Stanley

"GBP should rebound from current levels with GBPUSD projected to reach 1.2650 as reports suggest the government is considering alternatives to hard Brexit.

The FT reports that the UK may be prepared to keep paying billions to maintain single market access for the City, and reported over the weekend that a foreign car producer in the UK was assured by Mrs May that its export competitiveness would not be hit by the result of Brexit negotiations.

The market is short GBP suggesting that the chance of the UK's government negotiation stance may provide GBP with a temporary rebound. BoE's Carney suggesting that the exchange rate will have an impact on how the BoE's conducts its policy may limit the downside for GBP, for now".

Copyright © 2016 Morgan Stanley, eFXnews

-

08:36

UK Housing market indicators suggested a period of relative stability

For August 2016:

• the average price of a property in the UK was £218,964

• the annual price change for a property in the UK was 8.4% • the monthly price change for a property in the UK was 1.3%

• the monthly index figure for the UK was 114.8 (January 2015 = 100)

Housing market indicators for August suggested a period of relative stability during the month. House prices grew by 8.4% in the year to August, up slightly from 8.0% in July

-

08:35

UK CPI inflation rose above expectations. GBP/USD little changed so far

The Consumer Prices Index (CPI) rose by 1.0% in the year to September 2016, compared with a 0.6% rise in the year to August.

The rate in September 2016 was the highest since November 2014, when it was also 1.0%.

The main upward contributors to change in the rate were rising prices for clothing, overnight hotel stays and motor fuels, and prices for gas, which were unchanged, having fallen a year ago.

These upward pressures were partially offset by a fall in air fares and food prices.

CPIH (not a National Statistic) rose by 1.2% in the year to September 2016, up from 0.9% in August.

-

08:33

UK Producer Price Index rose again in the year to September 2016

The price of goods bought and sold by UK manufacturers, as estimated by the Producer Price Index, rose again in the year to September 2016. This is the third consecutive increase following 2 years of falls and the largest increase since September 2013.

Factory gate prices (output prices) for goods produced by UK manufacturers rose 1.2% in the year to September 2016, compared with a rise of 0.9% in the year to August 2016.

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum products, rose 1.4% in the year to September 2016, unchanged from last month.

The overall price of materials and fuels bought by UK manufacturers for processing (total input prices) rose 7.2% in the year to September 2016, compared with a rise of 7.8% in the year to August 2016.

-

08:30

United Kingdom: HICP, m/m, September 0.2% (forecast 0.1%)

-

08:30

United Kingdom: Producer Price Index - Input (MoM), September 0.0% (forecast 0.4%)

-

08:30

United Kingdom: Producer Price Index - Output (YoY) , September 1.2% (forecast 1.1%)

-

08:30

United Kingdom: Producer Price Index - Input (YoY) , September 7.2% (forecast 7.4%)

-

08:30

United Kingdom: Producer Price Index - Output (MoM), September 0.2% (forecast 0.2%)

-

08:30

United Kingdom: Retail Price Index, m/m, September 0.2% (forecast 0.1%)

-

08:30

United Kingdom: Retail prices, Y/Y, September 2% (forecast 2%)

-

08:30

United Kingdom: HICP ex EFAT, Y/Y, September 1.5% (forecast 1.4%)

-

08:30

United Kingdom: HICP, Y/Y, September 1% (forecast 0.9%)

-

08:23

Results of the October 2016 euro area bank lending survey

-

Loan demand continued to increase across all loan categories, while credit supply conditions remained unchanged for enterprises and improved for households

-

The general low level of interest rates played an important role in contributing to demand for loans to enterprises and households

-

Continued compression of lending rates on all loan categories

-

Banks used the liquidity obtained from the ECB's expanded asset purchase programme (APP) for granting loans, for refinancing purposes and to a lesser extent for purchasing assets

-

The ECB's negative deposit facility rate continued to have a positive impact on lending volumes, while having a negative impact on loan margins and banks' net interest income

-

-

08:21

Major stock markets trading in the green zone: FTSE 100 7,004.01 +56.46 + 0.81%, DAX 10,578.10 +74.53 + 0.71%

-

08:20

Option expiries for today's 10:00 ET NY cut

-

07:30

Oil is gaining in early trading

This morning, the New York futures for Brent rose 0.78% to $ 50.33 and crude oil futures for WTI rose 0.76% to $ 51.91 per barrel. Thus, the black gold is trading in the green zone on the background of market rebalancing expectations. Global inventories increased less than expected in the run-up to the high-demand winter heating season in the northern hemisphere.

Also another reason for the increase in the price of black gold was the dollar's decline, which moved away from the seven-month high.

According Bernstein Energy, global oil reserves increased by 17 million barrels to 5.618 billion barrels in the third quarter of 2016. This is a slight increase from the fourth quarter of 2014, confirming the slowdown in stocks, while market returns to equilibrium. "

-

07:05

Today’s events

-

At 15:30 GMT the United States will hold an auction on of 4-week bills

-

At 20:30 GMT the American Petroleum Institute report on oil stocks

-

Also today, Spain will hold an auction for on 3- and 9-month-old debt

-

-

06:41

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.8%, CAC40 + 0.6%, FTSE + 0.5%

-

06:34

Will the pound’s masive drop be enough to stimulate inflation? Expected +0.9% (y/y), up 0.3% from the previous reading. GBP volatility set to continue

-

06:31

CAD: Boc Unlikely To Hurt CAD; Our Quant Model Is Short USD/CAD - BNPP

"We see a dovish surprise from the Bank of Canada (BoC) meeting this week (Wednesday) as unlikely; Canadian economic data and oil prices are holding up relatively well so the market is unlikely to price in more BoC easing soon.

Canadian inflation data for September will be released at the end of the week

Our BNP Paribas STEER model continues to run a short USDCAD recommendation, targeting a move down to 1.3013".

Copyright © 2016 BNP Paribas™, eFXnews™

-

06:29

Moody's: negative interest rates worsen the profitability of Japanese banks

During today's briefing, Moody's analysts said that the negative interest rates worsen the profitability of Japanese banks. Moreover, the build-up of negative interest rates would harm the banking sector. However, Moody's stressed that banking institutions still earn on deposit taking and for this reason there is room for growth of negative interest by the Central Bank.

-

06:26

Options levels on tuesday, October 18, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1180 (2360)

$1.1145 (1569)

$1.1092 (782)

Price at time of writing this review: $1.1016

Support levels (open interest**, contracts):

$1.0959 (4422)

$1.0933 (7717)

$1.0902 (5141)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 35746 contracts, with the maximum number of contracts with strike price $1,1300 (3765);

- Overall open interest on the PUT options with the expiration date November, 4 is 44570 contracts, with the maximum number of contracts with strike price $1,1000 (7717);

- The ratio of PUT/CALL was 1.25 versus 1.26 from the previous trading day according to data from October, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.2504 (1077)

$1.2406 (831)

$1.2310 (1117)

Price at time of writing this review: $1.2229

Support levels (open interest**, contracts):

$1.2186 (835)

$1.2090 (1465)

$1.1993 (661)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 29101 contracts, with the maximum number of contracts with strike price $1,2800 (2164);

- Overall open interest on the PUT options with the expiration date November, 4 is 29325 contracts, with the maximum number of contracts with strike price $1,2300 (1502);

- The ratio of PUT/CALL was 1.01 versus 1.00 from the previous trading day according to data from October, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:18

RBA meeting minutes: growth had moderated in the June quarter, as expected

Members commenced their discussion of the Australian economy by noting that growth had moderated in the June quarter, as expected, following the very strong growth recorded in the March quarter. GDP growth over the year was higher than had been forecast a year earlier and above estimates of potential growth. Overall, growth in output in the September quarter was expected to have continued at a moderate pace similar to that seen in the June quarter.

Mining activity had grown over the year to the June quarter by more than had been expected a year earlier due to a larger-than-expected increase in resource export volumes, which looked to have increased further in July.

Household consumption growth had moderated in the June quarter. This was driven by a decline in the consumption of goods, consistent with low growth in retail sales volumes, while growth in the consumption of services had remained around average.

Indicators of labour market conditions had been mixed. The unemployment rate had declined to 5.6 per cent in August and had fallen by around ½ percentage point over the past year. However, the underemployment rate, which captures workers who would like to work more hours, had increased over the past year.

Growth in China appeared to have stabilised in recent months, supported by fiscal stimulus and accommodative financial conditions. Growth in private investment had shown some signs of stabilising, after declining since late 2011, and consumer spending appeared to be holding up, consistent with stable labour market conditions.

-

06:16

New motor vehicle sales in Australia was up 2.5% m/m

According to rttnews, the total number of new motor vehicle sales in Australia was up a seasonally adjusted 2.5 percent on month in September, the Australian Bureau of Statistics said on Tuesday - coming in at 100,640.

That follows the downwardly revised flat reading in August (originally up 0.1 percent).

Sales for sports utility vehicles jumped 1.6 percent on month and other vehicles gained 0.1 percent, while passenger vehicle sales fell 0.4 percent.

By region, the largest downward movement across all states and territories was in the Australian Capital Territory (-1.0 percent).

On a yearly basis, sales added 0.8 percent - slowing from the downwardly revised 2.8 percent gain in the previous month (originally 2.9 percent).

-

06:15

New Zeeland CPI inflation rose above expectations in September

The consumers price index (CPI) inflation rate was 0.2 percent in the September 2016 quarter, Statistics New Zealand said today. This follows inflation of 0.4 percent in the June 2016 quarter.

"Higher housing-related prices were countered by lower transportation prices," consumer prices manager Matt Haigh said.

Housing and household utilities prices rose 1.1 percent in the September 2016 quarter. This rise was influenced by higher prices for purchase of new housing, excluding land (up 2.0 percent), and local authority rates (up 3.0 percent).

Transport prices (down 3.0 percent) made the largest downward contribution for the latest quarter. Other private transport services fell 28 percent, reflecting cheaper vehicle relicensing fees implemented from 1 July. Petrol prices fell 1.7 percent, with the average price of a litre of 91 octane petrol at $1.75. Prices for new and used cars also fell.

-

04:40

Global Stocks

European stocks slumped Monday, led by a pullback in oil shares, as investors entered the trading week with the dollar sitting at a seven-month high while they waited to hear what's next for monetary policy at the European Central Bank.

U.S. stocks finished lower Monday as warnings about accelerating inflation coupled with crude-oil trading below $50 a barrel overshadowed strong earnings from Bank of America Corp. In an interview with CNBC, Jeffrey Gundlach reiterated his short positions on stocks and bonds and predicted that policy makers will have to resort to fiscal policies to support the economy.

Asian stocks crept up on Tuesday thanks to a rebound in oil prices and the dollar consolidated recent gains although underlying risk appetite was cautious on concerns over capital outflows and weak data, especially from China. Special focus will be on China's B Share market .SSEB, which was trading up around 0.8 percent on Tuesday after tumbling more than 6 percent on Monday on concerns of extended yuan weakness.

-

00:32

Australia: New Motor Vehicle Sales (YoY) , September 0.8%

-

00:31

Australia: New Motor Vehicle Sales (MoM) , September 2.5%

-