Market news

-

22:30

Commodities. Daily history for Oct 19’2016:

(raw materials / closing price /% change)

Oil 51.43 -0.33%

Gold 1,270.00 +0.01%

-

22:29

Stocks. Daily history for Oct 19’2016:

(index / closing price / change items /% change)

Nikkei 225 16,998.91 +35.30 +0.21%

Shanghai Composite 3,085.32 +1.45 +0.05%

S&P/ASX 200 5,435.36 +24.61 +0.45%

FTSE 100 7,021.92 +21.86 +0.31%

CAC 40 4,520.30 +11.39 +0.25%

Xetra DAX 10,645.68 +14.13 +0.13%

S&P 500 2,144.29 +4.69 +0.22%

Dow Jones Industrial Average 18,202.62 +40.68 +0.22%

S&P/TSX Composite 14,840.49 +88.24 +0.60%

-

22:28

Currencies. Daily history for Oct 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0973 -0,04%

GBP/USD $1,2285 -0,12%

USD/CHF Chf0,9888 -0,10%

USD/JPY Y103,38 -0,46%

EUR/JPY Y113,45 -0,50%

GBP/JPY Y127 -0,59%

AUD/USD $0,7717 +0,60%

NZD/USD $0,7227 +0,47%

USD/CAD C$1,3121 + 0,11%

-

22:00

Schedule for today, Thursday, Oct 20’2016

00:30 Australia NAB Quarterly Business Confidence Quarter III 2

00:30 Australia Unemployment rate September 5.6% 5.7%

00:30 Australia Changing the number of employed September -3.9 15

06:00 Germany Producer Price Index (MoM) September -0.1% 0.2%

06:00 Germany Producer Price Index (YoY) September -1.6% -1.2%

06:00 Switzerland Trade Balance September 3.02

08:00 Eurozone Current account, unadjusted, bln August 31.5

08:30 United Kingdom Retail Sales (MoM) September -0.2% 0.4%

08:30 United Kingdom Retail Sales (YoY) September 6.2% 4.8%

11:45 Eurozone ECB Interest Rate Decision 0.0% 0.0%

12:00 United Kingdom MPC Member Shafik Speaks

12:30 Eurozone ECB Press Conference

12:30 U.S. Continuing Jobless Claims 2046 2050

12:30 U.S. Initial Jobless Claims 246 250

12:30 U.S. Philadelphia Fed Manufacturing Survey October 12.8 5.3

14:00 U.S. Leading Indicators September -0.2% 0.2%

14:00 U.S. Existing Home Sales September 5.33 5.35

21:45 New Zealand Visitor Arrivals September 9%

-

19:02

DJIA 18232.71 70.77 0.39%, NASDAQ 5250.65 6.81 0.13%, S&P 500 2146.90 7.30 0.34%

-

16:01

European stocks closed: FTSE 7021.92 21.86 0.31%, DAX 10645.68 14.13 0.13%, CAC 4520.30 11.39 0.25%

-

15:52

WSE: Session Results

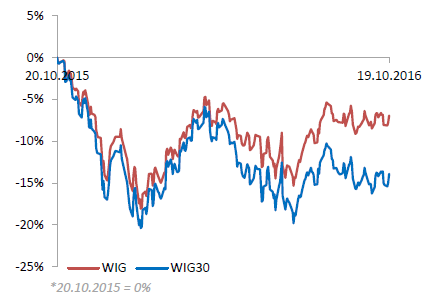

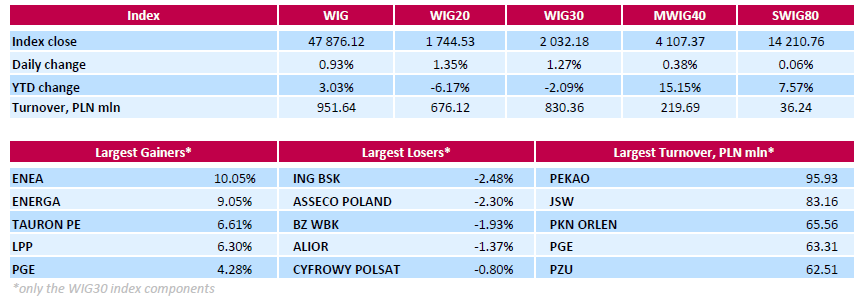

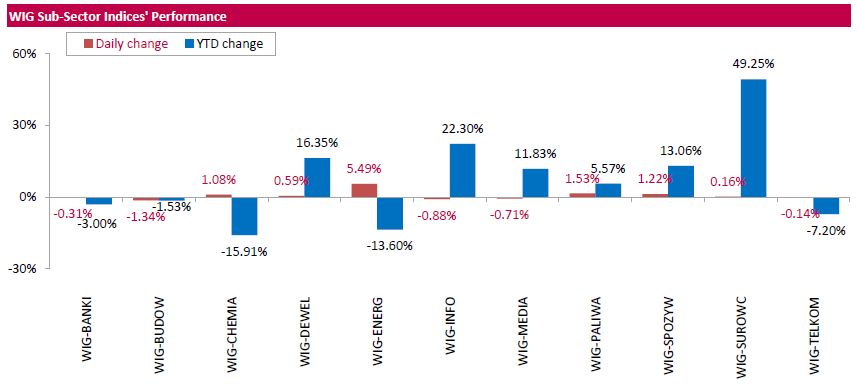

Polish equity market closed higher on Wednesday. The broad market measure, the WIG index, added 0.93%. Sector performance within the WIG Index was mixed. Utilities stocks (+5.49%) were the strongest group, while construction sector names (-1.34%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, surged by 1.27%. A majority of the index components rose. All four energy generating sector's names ENEA (WSE: ENA), ENERGA (WSE: ENG), TAURON (WSE: TPE) and PGE (WSE: PGE) delivered solid advances, climbing by 4.28%-10.05%, helped by the announcement the Energy Minister Krzysztof Tchorzewski stated he did not see a need of raising capital in state-run utilities this year to get extra taxes from them. Recall, Poland's government plan, which was announced in September, implied raising capital in utilities by increasing the nominal value of their shares, which triggers the need of paying of flat-rate income tax of 19 percent on the increased nominal value. Thermal coal miner BOGDANKA (WSE: LWB) as well as two retailers LPP (WSE: LPP) and CCC (WSE: CCC) also recorded significant gains, up 4.06%, 6.3% and 3.45% respectively. On the other side of the ledger, IT-company ASSECO POLAND (WSE: ACP) and three banking names ING BSK (WSE: ING), BZ WBK (WSE: BZW) and ALIOR (WSE: ALR) bank were the major laggards, losing 1.37%-2.48%.

-

15:44

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes little changed on Wednesday as gains in energy and financial stocks were offset by a drop in technology shares, led by Intel. Intel (INTC) fell 4,7%, the biggest drag on all three indexes, after the chipmaker's disappointing current-quarter revenue forecast.

Most of Dow stocks in positive area (20 of 30). Top gainer - Chevron Corporation (CVX, +1.44%). Top loser - Intel Corporation (INTC, -5.60%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+1.2%). Top loser - Healthcare (-0.3%).

At the moment:

Dow 18136.00 +72.00 +0.40%

S&P 500 2138.75 +6.75 +0.32%

Nasdaq 100 4831.00 +4.00 +0.08%

Oil 52.05 +1.43 +2.82%

Gold 1272.90 +10.00 +0.79%

U.S. 10yr 1.74 -0.01

-

14:35

US crude oil inventories decreased by 5.2 million barrels from the previous week

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.2 million barrels from the previous week. At 468.7 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 2.5 million barrels last week, and are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories increased last week. Distillate fuel inventories decreased by 1.2 million barrels last week but are above the upper limit of the average range for this time of year.

Propane/propylene inventories fell 1.2 million barrels last week but are above the upper limit of the average range. Total commercial petroleum inventories decreased by 3.6 million barrels last week.

-

14:31

Australia: Conference Board Australia Leading Index, August 0.0%

-

14:30

U.S.: Crude Oil Inventories, October -5.2 (forecast 2.75)

-

14:21

-

14:02

Bank of Canada maintains overnight rate target at 1/2 per cent

"The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

The global economy is expected to regain momentum in the second half of this year and through 2017 and 2018. After a weak first half, the US economy in particular is strengthening: solid consumption is being underpinned by strong employment growth and robust consumer confidence. However, because of elevated uncertainty, US business investment is on a lower track than expected.

Looking through the choppiness of recent data, the profile for growth in Canada is now lower than projected in July's Monetary Policy Report (MPR). This is due in large part to slower near-term housing resale activity and a lower trajectory for exports. The federal government's new measures to promote stability in Canada's housing market are likely to restrain residential investment while dampening household vulnerabilities. Recent export data are improving but are not strong enough to make up for ground lost during the first half of 2016, despite the effects of the Canadian dollar's past depreciation. Growth in exports over 2017 and 2018 are projected to be slower than previously forecast, due to lower estimates of global demand, a composition of US growth that appears less favourable to Canadian exports, and ongoing competitiveness challenges for Canadian firms".

-

14:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

13:49

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0850 (EUR 249m) 1.0925 (488m) 1.0940 (497m) 1.0950 (648m) 1.0995-1.1000 (403m) 1.1025 (624m) 1.1050 (787m) 1.1065-70 (716m)

GBPUSD 1.2265 (GBP 278m) 1.2348 (202m)

USDJPY 102.00 (USD 340m) 103.00 (1.1bln) 103.40 (250m) 103.60 (381m) 103.70(377m) 105.00 (425m)

EURJPY: 114.00 ( EUR 283m)

AUDUSD 0.7600 (AUD368m) 0.7630-35 (365m) 0.7670 (404m) 0.7700 (342m)

USDCAD: 1.2900 (200m)

EURSEK 9.7000 (EUR 854m)

-

13:31

U.S. Stocks open: Dow +0.10%, Nasdaq -0.06%, S&P +0.06%

-

13:17

Before the bell: S&P futures +0.20%, NASDAQ futures +0.07%

U.S. stock-index futures edged higher amid corporate earnings and as crude oil rose for a second day.

Global Stocks:

Nikkei 16,998.91 +35.30 +0.21%

Hang Seng 23,304.97 -89.42 -0.38%

Shanghai 3,085.32 +1.45 +0.05%

FTSE 7,000.60 +0.54 +0.01%

CAC 4,512.91 +4.00 +0.09%

DAX 10,644.37 +12.82 +0.12%

Crude $51.00 (+1.41%)

Gold $1272.40 (+0.75%)

-

12:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.54

0.03(0.1132%)

967

ALTRIA GROUP INC.

MO

62.65

-0.01(-0.016%)

505

Amazon.com Inc., NASDAQ

AMZN

821

3.35(0.4097%)

8609

American Express Co

AXP

60.45

0.37(0.6158%)

1407

Apple Inc.

AAPL

117.41

-0.06(-0.0511%)

135776

AT&T Inc

T

39.37

0.01(0.0254%)

665

Barrick Gold Corporation, NYSE

ABX

16.64

0.27(1.6494%)

64432

Chevron Corp

CVX

102.3

0.51(0.501%)

948

Citigroup Inc., NYSE

C

49.13

0.14(0.2858%)

1310

Facebook, Inc.

FB

128.71

0.14(0.1089%)

33032

Ford Motor Co.

F

11.9

0.01(0.0841%)

8248

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.85

0.13(1.3375%)

38358

General Electric Co

GE

29

0.02(0.069%)

2922

Goldman Sachs

GS

172.78

0.15(0.0869%)

4830

Google Inc.

GOOG

797.94

2.68(0.337%)

2023

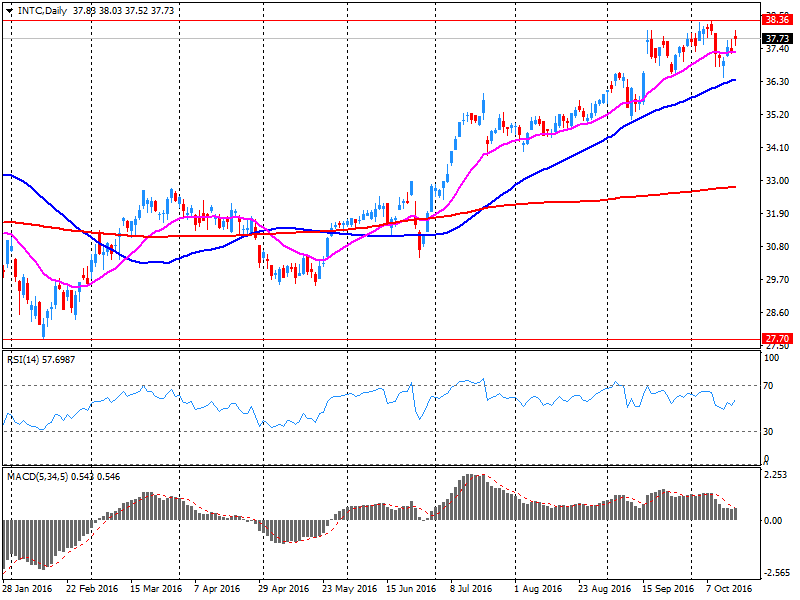

Intel Corp

INTC

36

-1.75(-4.6358%)

1468938

International Business Machines Co...

IBM

151

0.28(0.1858%)

1852

Johnson & Johnson

JNJ

115.5

0.09(0.078%)

4961

JPMorgan Chase and Co

JPM

67.85

0.15(0.2216%)

3800

McDonald's Corp

MCD

112.04

0.79(0.7101%)

701

Microsoft Corp

MSFT

57.5

-0.16(-0.2775%)

19746

Nike

NKE

51.31

0.09(0.1757%)

120

Pfizer Inc

PFE

32.99

0.30(0.9177%)

4444

Procter & Gamble Co

PG

87

0.2195(0.2529%)

1276

Starbucks Corporation, NASDAQ

SBUX

52.9

0.29(0.5512%)

7287

Tesla Motors, Inc., NASDAQ

TSLA

199.5

0.40(0.2009%)

14337

The Coca-Cola Co

KO

42.05

0.08(0.1906%)

1200

Twitter, Inc., NYSE

TWTR

16.9

0.07(0.4159%)

84153

UnitedHealth Group Inc

UNH

143.35

-0.04(-0.0279%)

157

Verizon Communications Inc

VZ

50.11

-0.16(-0.3183%)

1191

Visa

V

81.6

0.02(0.0245%)

1578

Walt Disney Co

DIS

91

-0.17(-0.1865%)

810

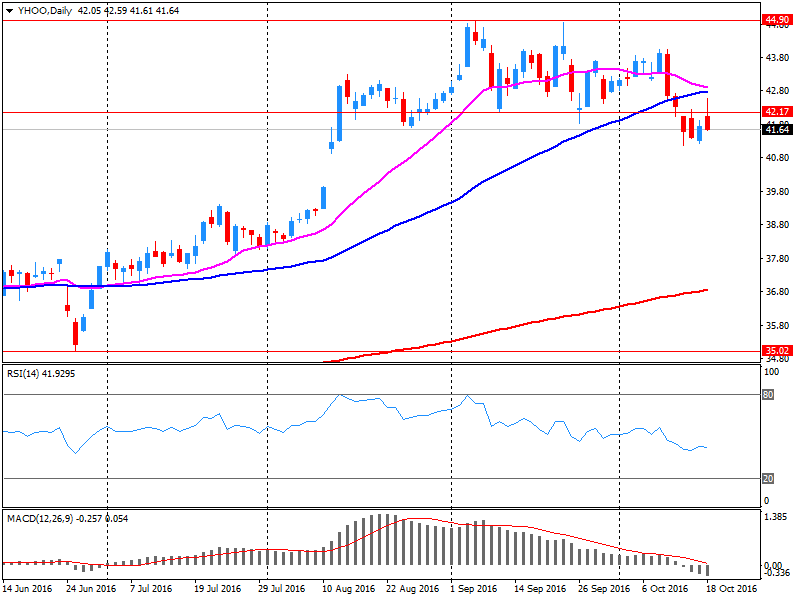

Yahoo! Inc., NASDAQ

YHOO

42.11

0.43(1.0317%)

8385

Yandex N.V., NASDAQ

YNDX

20

0.26(1.3171%)

1100

-

12:54

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Hold from Sell at Loop Capital

Downgrades:

Other:

Intel (INTC) target lowered to $37 from $38 at RBC Capital

Intel (INTC) target lowered to $42 from $43 at Needham

Yahoo! (YHOO) target raised to $48 from $44 at Susquehanna

Yahoo! (YHOO) target raised to $42 from $38 at Mizuho

Yahoo! (YHOO) target raised to $45 from $39 at RBC Capital

Goldman Sachs (GS) target raised to $170 from $160 at RBC Capital

Hewlett Packard Enterprise (HPE) target raised to $26 at Needham

Starbucks (SBUX) target lowered to $64 at RBC Capital Mkts

UnitedHealth (UNH) target raised to $169 at Mizuho

DuPont (DD) initiated with a Buy at Nomura

-

12:40

Unexpected drop for US housing starts

BUILDING PERMITS

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,225,000. This is 6.3 percent (±1.9%) above the revised August rate of 1,152,000 and is 8.5 percent (±2.4%) above the September 2015 estimate of 1,129,000. Single-family authorizations in September were at a rate of 739,000; this is 0.4 percent (±1.6%)* above the revised August figure of 736,000. Authorizations of units in buildings with five units or more were at a rate of 449,000 in September.

HOUSING STARTS

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,047,000. This is 9.0 percent (±9.2%)* below the revised August estimate of 1,150,000 and is 11.9 percent (±11.9%) below the September 2015 rate of 1,189,000. Single-family housing starts in September were at a rate of 783,000; this is 8.1 percent (±7.4%) above the revised August figure of 724,000. The September rate for units in buildings with five units or more was 250,000.

HOUSING COMPLETIONS

Privately-owned housing completions in September were at a seasonally adjusted annual rate of 951,000. This is 8.4 percent (±10.3%)* below the revised August estimate of 1,038,000 and is 5.8 percent (±13.4%)* below the September 2015 rate of 1,010,000.

-

12:30

U.S.: Building Permits, September 1225 (forecast 1165)

-

12:30

U.S.: Housing Starts, September 1047 (forecast 1175)

-

12:11

Company News: Yahoo! (YHOO) Q3 EPS beat analysts’ estimates

Yahoo! reported Q3 FY 2016 earnings of $0.20 per share (versus $0.15 in Q3 FY 2015), beating analysts' consensus estimate of $0.14.

The company's quarterly revenues amounted to $0.857 bln (-14.6% y/y), slightly missing analysts' consensus estimate of $0.861 bln.

The company issued downside guidance for Q4, projecting Q4 revenues of $0.88-0.92 bln versus analysts' consensus estimate of $0.939 bln.

YHOO rose to $42.20 (+1.25%) in pre-market trading.

-

12:00

Company News: Intel (INTC) Q3 results beat analysts’ estimates

Intel reported Q3 FY 2016 earnings of $0.80 per share (versus $0.64 in Q3 FY 2015), beating analysts' consensus estimate of $0.72.

The company's quarterly revenues amounted to $15.778 bln (+9.1% y/y), beating analysts' consensus estimate of $15.605 bln.

The company also issued in-line guidance for Q4, projecting Q4 revenues of $15.2-16.2 bln versus analysts' consensus estimate of $15.88 bln; gross margin 63% +/- a couple percent. This revenue forecast is lower than the average seasonal increase for the fourth quarter.

INTC fell to $36.10 (-4.34%) in pre-market trading.

-

12:00

Orders

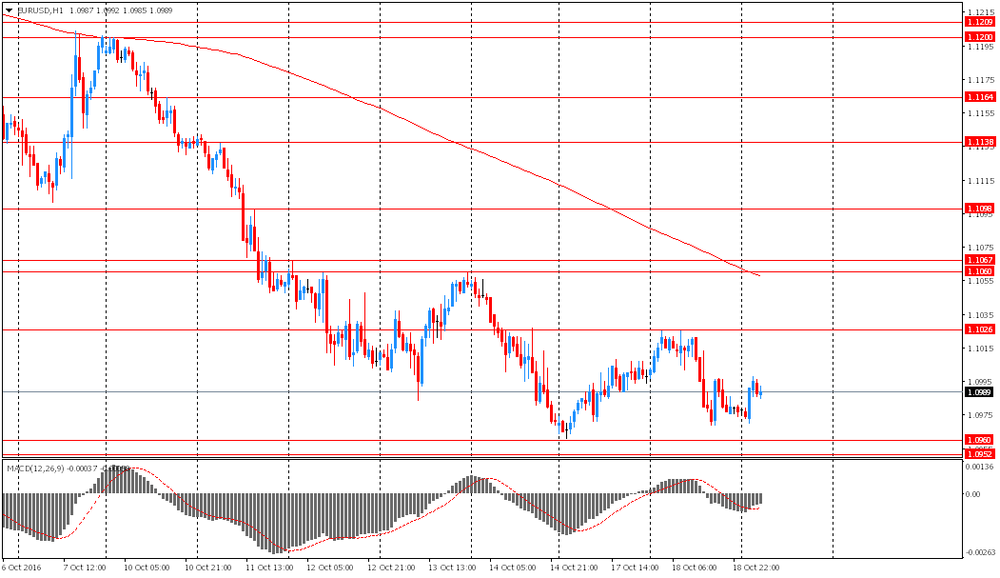

EUR/USD

Offers 1.1000 1.1025-30 1.1055 1.1070 1.1085 1.1100-05 1.1130 1.1150

Bids 1.0970 1.0950 1.0920 1.0900 1.0880 1.0850 1.0830 1.0800

GBP/USD

Offers 1.2300 1.2325-30 1.2350 1.2380 1.2400 1.2430 1.2450

Bids 1.2250 1.2220 1.2200 1.2185 1.2165 1.2145-50 1.2130 1.2100

EUR/GBP

Offers 0.8955 0.8975-80 0.9000 0.9030-35 0.9050

Bids 0.8920 0.8900 0.8850-55 0.8830 0.8800

EUR/JPY

Offers 114.20 114.50 114.80 115.00 115.50 115.80 116.00

Bids 113.75-80 113.50 113.00 112.60 112.00

USD/JPY

Offers 103.85 104.00 104.25-30 104.50 104.80 105.00

Bids 103.50 103.35 103.20 103.00 102.85 102.50

AUD/USD

Offers 0.7685 0.7700-10 0.7720 0.7755-60 0.7800

Bids 0.7650 0.7625-30 0.7600 0.7580 0.7550

-

10:49

Major European stock indices trading lower

European stock indices show a negative trend, as investors assessed mixed Chinese statistical data, as well as preparing for the ECB meeting. However, some support had moderate increase in oil prices.

As expected, China's GDP grew by 6.7% in the 3rd quarter. A similar increase was observed in the 2nd quarter. However, although the pace of growth was in line with expectations, the signs of the weakness of exports and investments was recorded together with the growth in sales of new homes. These promote the growth of fears of further slowdown. Early next year pressure on the economy will increase, since the real estate market cycle will go on the decline.

The composite index of the largest companies in the region Stoxx Europe 600 trading lower by 0.2 percent. Yesterday the index recorded the maximum increase in nearly a month on optimism that monetary policy will remain favorable for growth.

Shares of Reckitt Benckiser Group fell 2.7 percent after the company reported disappointing figures in terms of sales in the third quarter.

Quotes of Travis Perkins Plc fell 5.1 percent as adjusted annual earnings forecast was slightly below consensus.

The cost of ASML Holding NV shares rose 3.9 percent after Europe's biggest maker of semiconductor equipment announced the updated projections of profitability in the 4th quarter, which exceeded analysts' expectations.

Carrefour share rose 1.6 percent as France's largest retailer reported higher earnings in the third quarter, than experts predicted.

At the moment:

FTSE 100 -7.81 -0.11% 6992.25

DAX -19.49 10612.06 -0.18%

CAC 40 -4.86 4504.05 -0.11%

-

10:19

Nomura: BoC On Hold With A Dovish Tone.

"We expect the BoC to leave its policy rate unchanged at this week's meeting. We also believe that it will reiterate that risks on inflation remain tilted to the downside and that it will lower its growth forecast in its Monetary Policy Report. We continue to believe that the BoC will leave its policy rate at 0.50% for the rest of the year. We think there are two key questions to consider: 1) is the recent rebound in export performance sustainable, given continued underperformance is non-energy, and 2) what will be the impact of the fiscal stimulus? Until we get more concrete answers on these points, we expect the Bank to retain its wait-and-see approach. However, if further stimulus is judged necessary, we believe it is more likely to come from fiscal policy than from monetary policy".

-

09:57

Germany said to close the door to back channel Brexit negotiations - Forexlive. GBP/USD down 40 pips instantly

-

09:52

Morgan Stanley: Bearish CAD Into BoC; Sell CAD Vs AUD & NZD

"We remain bearish on CAD ahead of this week's BoC meeting where we expect a dovish outcome. In its previous meeting, the BoC stated that inflation risks have tilted somewhat to the downside and growth may be somewhat lower than anticipated in July, softening the hawkish tone that it had been adopting so far despite weak economic data. Deputy Gov. Wilkins reiterated these themes in her speech last week. This increases the possibility of the BoC cutting rates over the next few months, particularly in light of weakening inflation data. 3Q growth expectations have improved somewhat in recent weeks due to better July GDP and a narrower trade deficit but we are still skeptical the BoC's forecasts will be reached. Given the markets are pricing only a few bps of rate cuts for this year, and CAD has the largest long positioning in G10, we think further data weakness could weaken CAD significantly. We like selling CAD against other commodity currencies".

-

09:16

Saudi Oil Minister warned of the risk of inadequate supply, if the investment in the sector will continue to decline and the oil market conditions continue to improve

-

the drop in oil prices comes to an end

-

an agreement on the reduction of oil production will support the rebalance

-

world oil demand is growing against the background of improved economic situation

-

the global oil and gas industry needed capital investments in the amount of 24 trillion dollars

-

many oil-producing countries want to cut production by "healthy level"

-

the meeting in Istanbul will bring closer the positions of the OPEC countries and countries outside the cartel

-

OPEC's agreement will allow to investment in the oil sector, which is not sufficient

-

many oil-producing countries want to seriously reduce production

-

-

08:33

UK labor market improves again in September - ONS

Between March to May 2016 and June to August 2016, the number of people in work and the number of unemployed people increased. The number of people not working and not seeking or available to work (economically inactive) fell.

There were 31.81 million people in work, 106,000 more than for March to May 2016 and 560,000 more than for a year earlier.

There were 1.66 million unemployed people (people not in work but seeking and available to work), 10,000 more than for March to May 2016 but 118,000 fewer than for a year earlier.

The unemployment rate was 4.9%, unchanged compared with March to May 2016 but down from 5.4% for a year earlier. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.3% both including and excluding bonuses compared with a year earlier.

-

08:30

United Kingdom: ILO Unemployment Rate, August 4.9% (forecast 4.9%)

-

08:30

United Kingdom: Average Earnings, 3m/y , August 2.3% (forecast 2.3%)

-

08:30

United Kingdom: Claimant count , September 0.7 (forecast 3)

-

08:30

United Kingdom: Average earnings ex bonuses, 3 m/y, August 2.3% (forecast 2.1%)

-

08:23

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0850 (EUR 249m) 1.0925 (488m) 1.0940 (497m) 1.0950 (648m) 1.0995-1.1000 (403m) 1.1025 (624m) 1.1050 (787m) 1.1065-70 (716m)

GBP/USD 1.2265 (GBP 278m) 1.2348 (202m)

USD/JPY 102.00 (USD 340m) 103.00 (1.1bln) 103.40 (250m) 103.60 (381m) 103.70(377m) 105.00 (425m)

EUR/JPY: 114.00 ( EUR 283m)

AUD/USD 0.7600 (AUD368m) 0.7630-35 (365m) 0.7670 (404m) 0.7700 (342m)

USD/CAD: 1.2900 (200m)

EUR/SEK 9.7000 (EUR 854m)

-

07:46

Oil rose in early trading

This morning, the New York futures for Brent rose by 1.15% to $ 50.87 and crude oil futures for WTI rose 1.08% to $ 52.24 per barrel. Thus, the black gold is trading in the green zone on the background of lower oil reserves in China. The markets are also supported by the planned OPEC production cuts.

Also, oil prices rose due to a slight weakening of the dollar, as it contributed to lower cost of fuel for buyers outside US.

According to API US crude stocks fell by 3.8 million barrels in the week to 467.1 million barrels.

Today, the US Energy Information Administration will publish data on stocks of crude oil and gasoline.

China processed 43.8 million tons of oil in September, exceeding the same period of last year by 2.4%. During the same month, oil production in China fell by 9.8% to 15.98 million tons, which was the most significant drop in 19 months.

-

07:43

Major stock markets trading in the green zone: FTSE flat, DAX -0.1%, CAC40 + 0.1%, FTMIB flat, IBEX + 0.3%

-

07:19

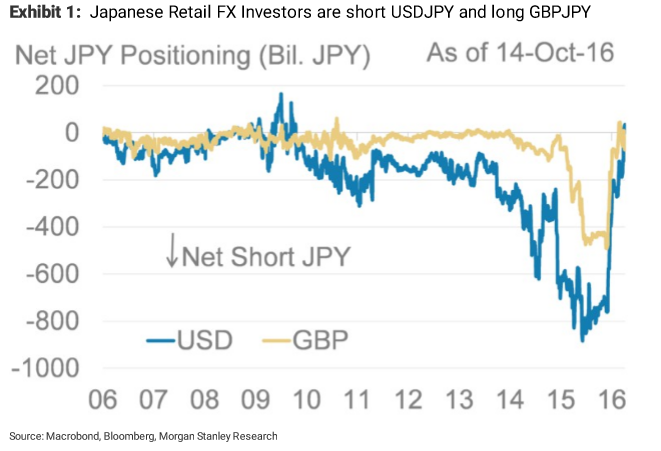

Japanese Retail Traders Bought GBP Dips And Back To Long GBP/JPY - Morgan Stanley

"The weekend after the GBP flash crash, it seems that Japanese retail FX traders bought the dip and are now back to being long GBPJPY. Our tracker also shows they are now short USDJPY for the first time since 2010.

So far, GBPJPY has remained flat since they started buying last week but we think short JPY positioning could increase if the momentum for the pair starts to turn higher. The level of gilt yields relative to JGBs was previously an indicator for Japanese investor flows into gilts, with a bit of a lag. Over recent months however, these investors have been buying gilts no matter what the level of yields.

For now our rates strategists are short gilts but we note that the recent sell-off could eventually support some foreign flows into the gilt market, as even with an FX hedge, gilts have the second highest yield in the G10 after Sweden.

Morgan Stanley keeps targeting current GBP rebound at 1.2650".

Copyright © 2016 Morgan Stanley, eFXnews

-

07:07

Today’s events

-

At 12:30 GMT, Britain will hold an auction of 10-year bonds and Germany will hold an auction of 30-year bonds

-

At 15:45 GMT FOMC members John Williams will deliver a speech

-

At 17:00 GMT Bank of Canada report on monetary policy, the Bank of Canada's decision on the basic interest rate and the accompanying statement of the Bank of Canada

-

At 18:15 GMT Press conference of the Bank of Canada

-

At 20:00 GMT Andy Haldane of the Bank of England will make a speech

-

At 21:00 GMT Economic Review of the Federal Reserve "Beige Book"

-

At 23:15 GMT Bank of Canada Governor Stephen Poloz will deliver a speech

-

-

06:44

Positive start of trading expected on the major stock exchanges in Europe: DAX futures flat, CAC40 + 0.1%, FTSE + 0.2%

-

06:43

Asian session review: The New Zealand dollar rose

The New Zealand dollar rose against the background of a rise in price of milk powder. At the end of the GlobalDairyTrade auction prices for dairy products rose by 1.4% compared with the auction two weeks ago. These price increases have not lived up to expectations, but due to the limited supply of dry milk demand will continue to be enhanced, according to the market. Milk is the largest section of New Zealand's exports. For the current year milk powder prices rose by 25% and is projected to continue to grow, said Elias Haddad of the Commonwealth Bank of Australia. Also, the New Zealand dollar was supported by the inflation data for the 3rd quarter, which turned out to be stronger than expected, which reduced the probability of a rate cut.

The euro rose slightly against the US dollar. Experts attribute this to the recent disappointing US data and the Fed's controversial comments regarding the rates. Futures on interest rates pointed to 69.1% probability of a rate hike in December, against a 50% probability in the middle of last month.

The Australian dollar has risen since the beginning of the session, but then lost positions on the background of ambiguous Chinese economic data. Gross domestic product, published by the National Bureau of Statistics of China, rose 1.8% in the third quarter, while in annual terms by 6.7%, in line with economists' forecast and the previous value. According to the report, the economy remained at the level of the previous quarter, indicating that the ongoing efforts to stimulate the economy by the government contribute to stabilization. "China's economy continues to grow steadily, we are optimistic about its prospects", - the official representative of the State Statistical Office said today.

EUR / USD: during the Asian session, the pair rose to $ 1.0995

GBP / USD: during the Asian session the pair fell to $ 1.2270

USD / JPY: fell to Y103.65

-

06:28

Options levels on wednesday, October 19, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1173 (2337)

$1.1135 (1747)

$1.1077 (736)

Price at time of writing this review: $1.0976

Support levels (open interest**, contracts):

$1.0928 (7664)

$1.0899 (5029)

$1.0865 (2665)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 35829 contracts, with the maximum number of contracts with strike price $1,1300 (3764);

- Overall open interest on the PUT options with the expiration date November, 4 is 43688 contracts, with the maximum number of contracts with strike price $1,1000 (7664);

- The ratio of PUT/CALL was 1.22 versus 1.25 from the previous trading day according to data from October, 18

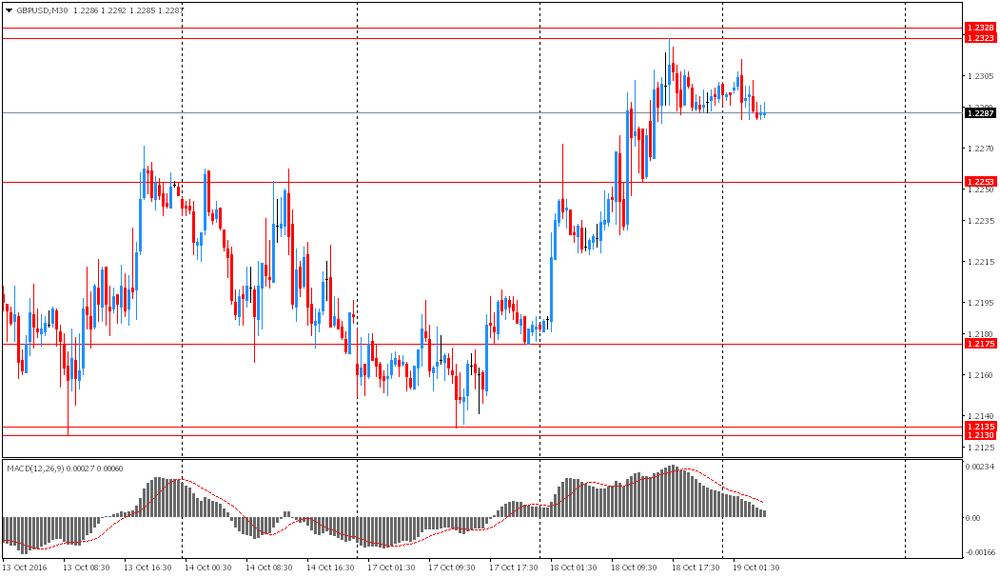

GBP/USD

Resistance levels (open interest**, contracts)

$1.2506 (1048)

$1.2409 (859)

$1.2314 (1107)

Price at time of writing this review: $1.2261

Support levels (open interest**, contracts):

$1.2190 (922)

$1.2094 (1466)

$1.1996 (694)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 29054 contracts, with the maximum number of contracts with strike price $1,2800 (2111);

- Overall open interest on the PUT options with the expiration date November, 4 is 29463 contracts, with the maximum number of contracts with strike price $1,2250 (1511);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from October, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:26

Japan's all industry activity expanded for the third straight month

Rttnews says that Japan's all industry activity expanded for the third straight month in August, the Ministry of Economy, Trade and Industry showed Wednesday.

The all industry activity index grew 0.2 percent on a monthly basis in August, the same rate as registered in July and matched economists' expectations.

Industrial production rose 1.3 percent, in contrast to a 0.4 percent drop in July. At the same time, tertiary industry activity remained flat in August.

On the other hand, construction activity contracted 0.8 percent, reversing a 1.3 percent rise in July.

Year-on-year, all industry activity grew 1.7 percent after posting a 0.8 percent drop a month ago.

-

06:25

Aussie leading index from Westpac rose 0.06% m / m

According to data released today by Westpac, Australia's index of leading economic indicators, which reflects the dynamics of the economy in the next 3-9 months, rose by only + 0.06% in September, compared with flat last month. In annual terms, this index increased 0.58% versus + 0.15% prior. Experts note that the September value of the index for the second consecutive time goes above trend and is the strongestvalue recorded from December of 2013.

All components of the index showed an improvement:

-

nearly two-thirds of the increase of the indicator due to the increase in commodity prices to +0.51 p .;

-

moderate recovery in industrial production amounted to + 0.40%

-

global financial conditions improved + 0.20%.

-

stabilization of the labor market

-

there is support from consumer sentiment and construction permits to +0.15 p. p.

-

-

06:21

Japan Finance Minister, Taro Aso: need to raise wages in order to avoid deflation in the economy

During his speech today,Aso said that in order to avoid deflation processes in the economy is necessary to raise the level of wages. With regard to external factors he expressed the view that the global economy continues to recover gradually, and Brexit may affect the global economy only in the medium term.

-

06:19

China's retail sales above expectations. Industrial productions slows down

In September, China's retail sales, year on year, increased by 10.7%, which is higher than the previous value, and analysts' forecast of 10.6%. This was reported today by the National Bureau of Statistics. This indicator measures the total amount of cash proceeds from the sale of consumer goods to end consumers. The index takes into account the total of all consumer goods delivered by various industries for households and social groups through a variety of channels in the retail trade. This is an important indicator that allows to study the changes in the retail market in China and reflects the level of economic well-being.

According to the report, retail sales increased due to growth in sales of cars and building materials, sanitary ware and furniture, amid a slight improvement in the housing market.

Also, was reported that industrial production in September, year on year increased by 6.1%, slightly lower than the previous value of 6.3% and economists' forecast of 6.4%.

-

06:10

China's gross domestic product expanded 6.7%

According to rttnews, China's gross domestic product expanded 6.7 percent on year in the third quarter of 2016, the national Bureau of Statistics said on Wednesday - in line with expectations and unchanged from the Q2 reading.

On a seasonally adjusted quarterly basis, GDP climbed 1.8 percent - also unchanged and matching forecasts.

The NBS also said that industrial production gained an annual 6.1 percent in September - shy of forecasts for 6.4 percent and down from 6.3 percent in August.

Retail sales climbed 10.7 percent on year, matching forecasts and up from 10.6 percent in the previous month.

Fixed asset investment gained 8.2 percent, in line with forecasts and up from 8.1 percent a month earlier.

-

05:30

Global Stocks

European stocks slumped Monday, led by a pullback in oil shares, as investors entered the trading week with the dollar sitting at a seven-month high while they waited to hear what's next for monetary policy at the European Central Bank.

U.S. stocks on Tuesday gained as the latest round of corporate earnings came in ahead of Wall Street's estimates, helping to buoy market sentiment. The S&P 500 SPX, +0.62% rose 13 points, or 0.6%, to finish at 2,139 while the Dow Jones Industrial Average DJIA, +0.42% climbed 75 points, or 0.4%, to close at 18,161. The Nasdaq Composite COMP, +0.85% advanced 44 points, or 0.9%, to finish at 5,243. Closely watched companies like Goldman Sachs Group Inc. GS, +2.15% Netflix Inc.

Asian shares were broadly higher early Wednesday, tracking overnight gains on Wall Street, while key data out of China met market expectations. The world's second-biggest economy expanded 6.7% in the third quarter from a year earlier, matching growth in the previous quarter, official data showed Wednesday. The figure was also in line with a forecast by economists polled by The Wall Street Journal.

-

02:01

China: Retail Sales y/y, September 10.7% (forecast 10.6%)

-

02:01

China: Industrial Production y/y, September 6.1% (forecast 6.4%)

-

02:00

China: GDP y/y, Quarter III 6.7% (forecast 6.7%)

-

02:00

China: Fixed Asset Investment, August 8.2% (forecast 8.2%)

-