Market news

-

22:31

Commodities. Daily history for Oct 20’2016:

(raw materials / closing price /% change)

Oil 50.61 -0.04%

Gold 1,266.20 -0.10%

-

22:29

Stocks. Daily history for Oct 20’2016:

(index / closing price / change items /% change)

Nikkei 225 17,235.50 +236.59 +1.39%

Shanghai Composite 3,084.76 +0.0366 0.00%

S&P/ASX 200 5,442.14 +6.78 +0.12%

FTSE 100 7,026.90 +4.98 +0.07%

CAC 40 4,540.12 +19.82 +0.44%

Xetra DAX 10,701.39 +55.71 +0.52%

S&P 500 2,141.34 -2.95 -0.14%

Dow Jones Industrial Average 18,162.35 -40.27 -0.22%

S&P/TSX Composite 14,847.92 +7.43 +0.05%

-

22:28

Currencies. Daily history for Oct 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0924 -0,45%

GBP/USD $1,2250 -0,29%

USD/CHF Chf0,9928 +0,40%

USD/JPY Y103,96 +0,56%

EUR/JPY Y113,57 +0,11%

GBP/JPY Y127,34 +0,27%

AUD/USD $0,7624 -1,22%

NZD/USD $0,7188 -0,54%

USD/CAD C$1,323 +0,82%

-

22:00

Schedule for today, Friday, Oct 21’2016

08:30 United Kingdom PSNB, bln September -10.05 -8.5

12:30 Canada Retail Sales, m/m August -0.1% 0.2%

12:30 Canada Retail Sales YoY August 2.3%

12:30 Canada Retail Sales ex Autos, m/m August -0.1% 0.3%

12:30 Canada Consumer Price Index m / m September -0.2% 0.2%

12:30 Canada Consumer price index, y/y September 1.1% 1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y September 1.8% 1.8%

14:00 Eurozone Consumer Confidence (Preliminary) October -8.2 -8

-

21:45

New Zealand: Visitor Arrivals, September 13%

-

19:00

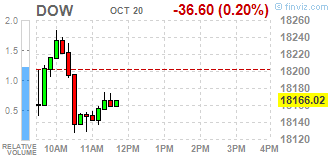

DJIA 18189.16 -13.46 -0.07%, NASDAQ 5244.99 -1.42 -0.03%, S&P 500 2142.74 -1.55 -0.07%

-

16:00

European stocks closed: FTSE 7026.90 4.98 0.07%, DAX 10701.39 55.71 0.52%, CAC 4540.12 19.82 0.44%

-

15:45

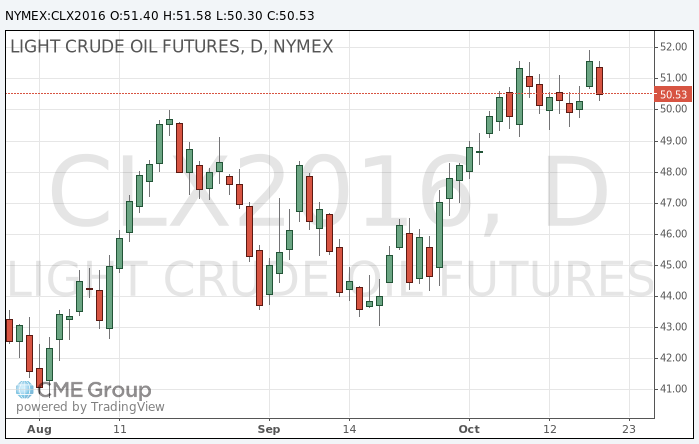

Oil fell from 2016 highs

Oil prices fell and could not hold the positions conquered the day before. Investors took profits after data on Wednesday showed a larger than expected drop in crude inventories in the United States.

On Wednesday, the Energy Information Administration reported a drop of commercial oil reserves by 5.2 million barrels in the week of October 8-14, mainly due to the decrease in imports, after which oil prices have risen to new hig.hs

"We are seeing profit-taking," - said Bart Melek of TD Securities. However, he believes that the situation in the oil market as a whole has improved and investors are waiting for the reduction of oil production by OPEC.

However, commercial US crude inventories still remain at the level of 468.7 million barrels, which is 5.4% higher than a year ago and 31.5% higher than the average of similar date for the last five years.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 50.30 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 51.27 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:45

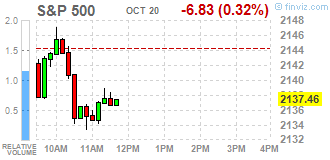

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes slightly fell on Thursday as weak earnings from index heavyweights such as Verizon dented optimism about the earnings season and as a drop in oil prices weighed on energy stocks.

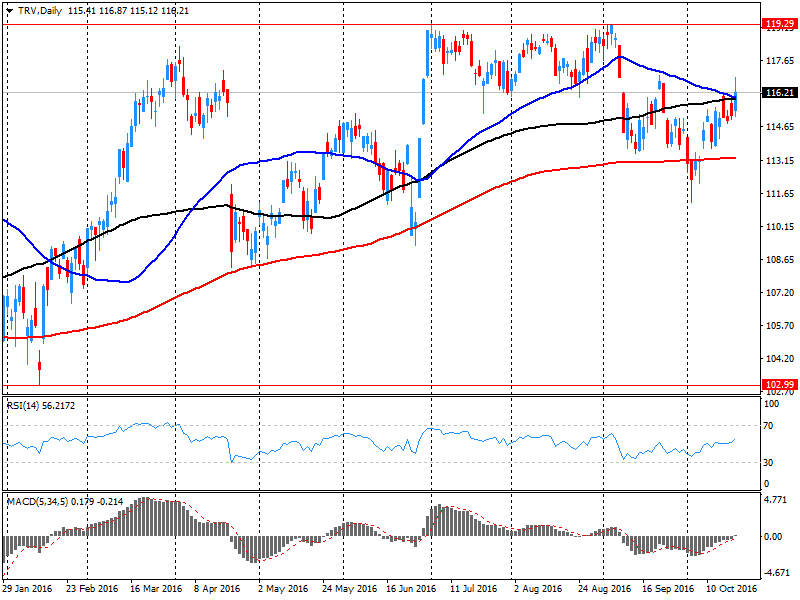

Most of Dow stocks in negative area (21 of 30). Top gainer - American Express Company (AXP, +8.96%). Top loser - The Travelers Companies, Inc. (TRV, -4.87%).

Almost all S&P sectors also in negative area. Top gainer - Healthcare (+0.4%). Top loser - Technology (-0.5%).

At the moment:

Dow 18088.00 -37.00 -0.20%

S&P 500 2131.50 -6.50 -0.30%

Nasdaq 100 4813.75 -16.50 -0.34%

Oil 50.80 -1.02 -1.97%

Gold 1266.50 -3.40 -0.27%

U.S. 10yr 1.74 -0.01

-

15:36

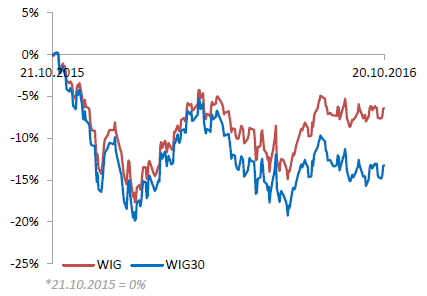

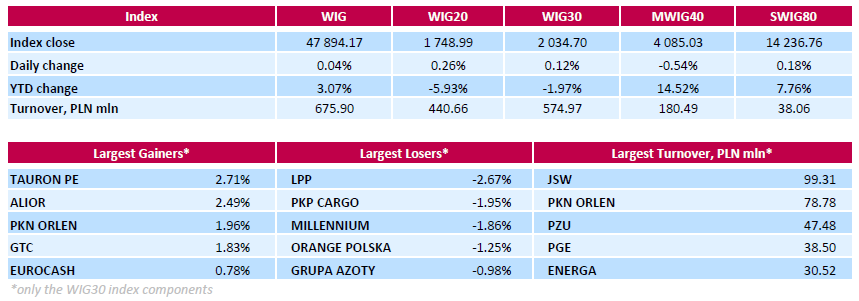

WSE: Session Results

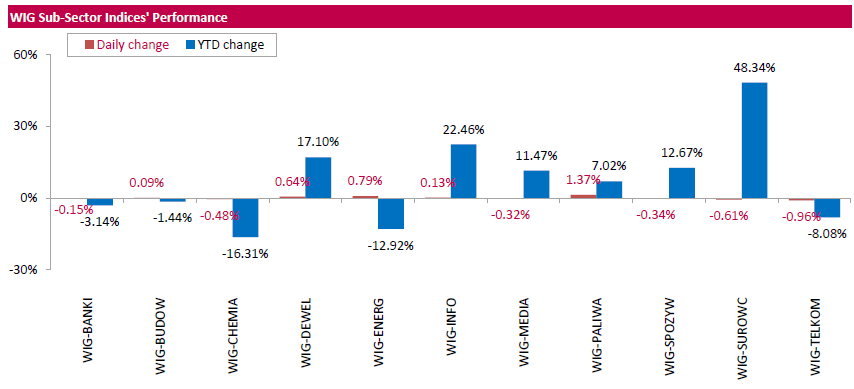

Polish equity market closed flat on Thursday. The broad market benchmark, the WIG Index, edged up 0.04%. Sector performance in the WIG Index was mixed. Oil and gas sector (+1.37%) recorded the biggest gains, while telecoms (-0.96%) lagged behind.

The large-cap stocks measure, the WIG30 Index, rose by 0.12%. In the index basket, genco TAURON (WSE: TPE) and bank ALIOR (WSE: ALR) were the best-performing names, advancing by 2.71% and 2.49% respectively. They were followed by oil refiner PKN ORLEN (WSE: PKN) and property developer GTC (WSE: GTC), gaining 1.96% and 1.83% respectively. On the other side of the ledge, clothing retailer LPP (WSE: LPP) demonstrated the worst performance, tumbling by 2.67%. Other major decliners were railway freight transport operator PKP CARGO (WSE: PKP), bank MILLENNIUM (WSE: MIL) and telecommunication services provider ORANGE POLSKA (WSE: OPL), which lost between 1.25% and 1.95%.

-

15:25

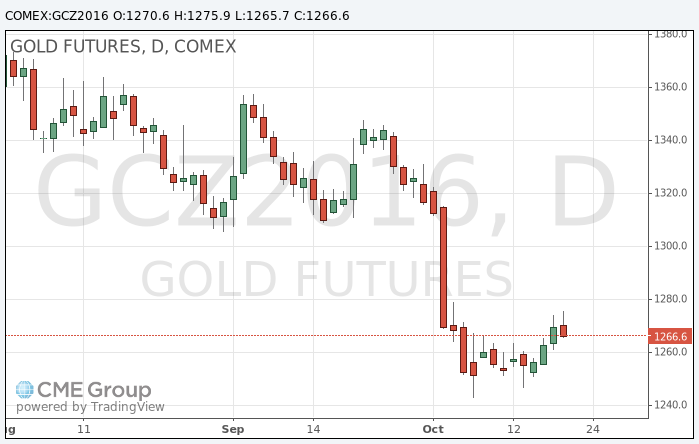

Gold price under preasure

Gold price decline fallowing the dynamics of the euro after ECB meeting and Mario Draghi's comments.

European Central Bank President Mario Draghi but did not make specific promises about QE extension or taper.

The key interest rate has been maintained at a record-low of 0%, where it had been since March of this year. In addition, the ECB's management has decided to leave the rate on deposits at the level of -0.4 meaning that commercial banks pay the central bank for the storage of their excess reserves.

Draghi said that the "sharp end" of asset the purchase program "unlikely". The relevant decision on this issue will be taken within the framework of the ECB meeting on 8 December.

At the same time, the US dollar rose on stronger expectations about further increases in interest rates by the Federal Reserve.

The cost of December futures for gold on the COMEX fell to $ 1265.6 per ounce.

-

14:29

US leading economic index resumed its increase in September

The index of leading economic indicators from the Conference Board increased by 0.2 percent in September to 124.4 (2010 = 100), after falling 0.2 percent in August, as well as increasing by 0.5 percent in July. Last change coincided with forecasts.

-

14:05

US Existing-home sales rebounded strongly in September

Existing-home sales rebounded strongly in September and were propelled by sales from first-time buyers reaching a 34 percent share, which is a high not seen in over four years, according to the National Association of Realtors. All major regions saw an increase in closings last month, and distressed sales fell to a new low of 4 percent of the market.

Total existing-home sales 1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, hiked 3.2 percent to a seasonally adjusted annual rate of 5.47 million in September from a downwardly revised 5.30 million in August. After last month's gain, sales are at their highest pace since June (5.57 million) and are 0.6 percent above a year ago (5.44 million).

-

14:00

U.S.: Existing Home Sales , September 5.47 (forecast 5.35)

-

14:00

U.S.: Leading Indicators , September 0.2% (forecast 0.2%)

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0900 (EUR 1.46bln) 1.0948-50 (438m) 1.0955 (476m) 1.1000 (1.21bln) 1.1050-53 (1.-6bln) 1.1155-60 (1.08bln)

GBPUSD 1.2235 (GBP 245m)

USDJPY 101.68-69 (USD 1.27bln) 103.00 (1.26bln) 103.50-55 (630m) 104.00 (930m)104.50 (1.13bln)

EURJPY: 113.45 ( EUR 235m)

EURGBP 0.8850 (EUR 201m)

EURCHF 1.0800 (EUR 370m)

AUDUSD 0.7400 (AUD 595m) 0.7500 (1.37bln) 0.7600 (429m) 0.7675 (347m) 0.7700 (457m)

USDCAD: 1.3100 (305m) 1.3150 (335m) 1.3200 (242m)

NZDUSD 0.7305-10 (NZD 565m)

EURAUD 1.4200 (EUR 345m) 1.4500 (245m)

-

13:32

U.S. Stocks open: Dow -0.24%, Nasdaq -0.21%, S&P -0.23%

-

13:28

-

13:28

Before the bell: S&P futures -0.20%, NASDAQ futures -0.15%

U.S. stock-index futures slipped on concern that European Central Bank stimulus won't jump-start growth in the region's economy, while mixed earnings reports from American companies provided little direction.

Global Stocks:

Nikkei 17,235.50 +236.59 +1.39%

Hang Seng 23,374.40 +69.43 +0.30%

Shanghai 3,084.76 +0.0366 0.00%

FTSE 7,000.04 -21.88 -0.31%

CAC 4,501.15 -19.15 -0.42%

DAX 10,598.52 -47.16 -0.44%

Crude $51.08 (-1.43%)

Gold $1272.80 (+0.23%)

-

12:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.9

-0.14(-0.5178%)

13337

Amazon.com Inc., NASDAQ

AMZN

814.5

-3.19(-0.3901%)

15909

American Express Co

AXP

65.25

4.00(6.5306%)

310959

Apple Inc.

AAPL

116.91

-0.21(-0.1793%)

60447

AT&T Inc

T

38.94

-0.44(-1.1173%)

183346

Boeing Co

BA

136.1

-0.08(-0.0587%)

6763

Caterpillar Inc

CAT

87

-0.23(-0.2637%)

9175

Cisco Systems Inc

CSCO

30.4

0.05(0.1647%)

211

Citigroup Inc., NYSE

C

49.4

-0.08(-0.1617%)

11792

Exxon Mobil Corp

XOM

86.9

-0.27(-0.3097%)

4308

Facebook, Inc.

FB

129.99

-0.12(-0.0922%)

126330

Ford Motor Co.

F

12

-0.01(-0.0833%)

29783

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.95

-0.07(-0.6986%)

12688

General Electric Co

GE

29.11

0.05(0.1721%)

11235

General Motors Company, NYSE

GM

32

0.15(0.471%)

1500

Goldman Sachs

GS

173.8

-0.71(-0.4069%)

2995

Google Inc.

GOOG

800.89

-0.67(-0.0836%)

4791

Home Depot Inc

HD

126.5

0.61(0.4845%)

115

Intel Corp

INTC

35.44

-0.07(-0.1971%)

76726

International Business Machines Co...

IBM

151.35

0.09(0.0595%)

965

International Paper Company

IP

47.83

-0.45(-0.9321%)

1000

Johnson & Johnson

JNJ

114.64

0.05(0.0436%)

2893

JPMorgan Chase and Co

JPM

68.2

-0.15(-0.2195%)

6055

McDonald's Corp

MCD

111.22

-0.04(-0.036%)

295

Microsoft Corp

MSFT

57.6

0.07(0.1217%)

24245

Nike

NKE

51.99

0.19(0.3668%)

750

Pfizer Inc

PFE

32.55

-0.05(-0.1534%)

602

Procter & Gamble Co

PG

85.48

-0.06(-0.0701%)

2515

Starbucks Corporation, NASDAQ

SBUX

53.39

0.24(0.4516%)

1106

Tesla Motors, Inc., NASDAQ

TSLA

201.1

-2.46(-1.2085%)

60340

The Coca-Cola Co

KO

41.95

-0.10(-0.2378%)

7721

Travelers Companies Inc

TRV

113.13

-3.10(-2.6671%)

1175

Twitter, Inc., NYSE

TWTR

17.05

-0.02(-0.1172%)

22951

Verizon Communications Inc

VZ

49.25

-1.13(-2.243%)

478649

Visa

V

83.03

0.22(0.2657%)

14988

Wal-Mart Stores Inc

WMT

69

0.11(0.1597%)

765

Walt Disney Co

DIS

91.75

-0.18(-0.1958%)

2662

Yahoo! Inc., NASDAQ

YHOO

42.78

0.05(0.117%)

2614

Yandex N.V., NASDAQ

YNDX

19.86

0.01(0.0504%)

1000

-

12:52

-

12:51

Draghi: December Decisions Will Define Policy Environment for Coming Months

-

12:45

Draghi: No Discussion of Extending QE. EUR/USD moves higher

-

12:43

Upgrades and downgrades before the market open

Upgrades:

American Express (AXP) upgraded to Neutral from Underperform at BofA/Merrill

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Guggenheim

Other:

American Express (AXP) target lowered to $52 from $57 at RBC Capital

-

12:41

US unemployment claims below 300K but above expectations

In the week ending October 15, the advance figure for seasonally adjusted initial claims was 260,000, an increase of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 246,000 to 247,000. The 4-week moving average was 251,750, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 249,250 to 249,500.

There were no special factors impacting this week's initial claims. This marks 85 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

12:38

Draghi: Inflation to Pick Up Over Next Couple of Months

-

12:36

Company News: Travelers (TRV) Q3 results beat analysts’ forecasts

Travelers reported Q3 FY 2016 earnings of $2.40 per share (versus $2.93 in Q3 FY 2015), beating analysts' consensus estimate of $2.36.

The company's quarterly revenues amounted to $6.389 bln (+3.2% y/y), beating analysts' consensus estimate of $6.210 bln.

TRV fell to $114.00 (-1.92%) in pre-market trading.

-

12:34

Draghi: Economy Has Shown Resilience

-

Data Point to Continued Growth

-

Low Oil Prices Provide Additional Support for Households

-

Domestic Demand Should be Supported by Policy

-

In Dec ECB will have new staff projections through to 2019

-

Council will review the committees work on QE in Dec

-

Data suggests Q3 will be similar to Q3

-

Investment should be supported by favourable financing conditions

-

EZ economy expected to be dampened by export demand

-

-

12:33

US regional manufacturing conditions continued to improve

Results from the October Manufacturing Business Outlook Survey suggest that regional manufacturing conditions continued to improve. Indexes for general activity, new orders, and shipments were all positive this month. But firms reported continued weakness in overall labor market conditions. Firms expect continued growth for manufacturing over the next six months and are becoming more optimistic about employment expansion.

The index for current manufacturing activity in the region edged down, from a reading of 12.8 in September to 9.7 this month. The index has now been positive for three consecutive months (see Chart 1). Other broad indicators showed notable improvement. The new orders index improved markedly this month, increasing from 1.4 in September to 16.3 in October. The percentage of firms reporting increases in new orders this month rose to 40 percent from 30 percent last month. The current shipments index also improved, rising 24 points to 15.3. The delivery times, unfilled orders, and inventories indexes remained weak, however, with all registering negative readings, although they were less negative than in September.

-

12:31

U.S.: Philadelphia Fed Manufacturing Survey, October 9.7 (forecast 5.3)

-

12:31

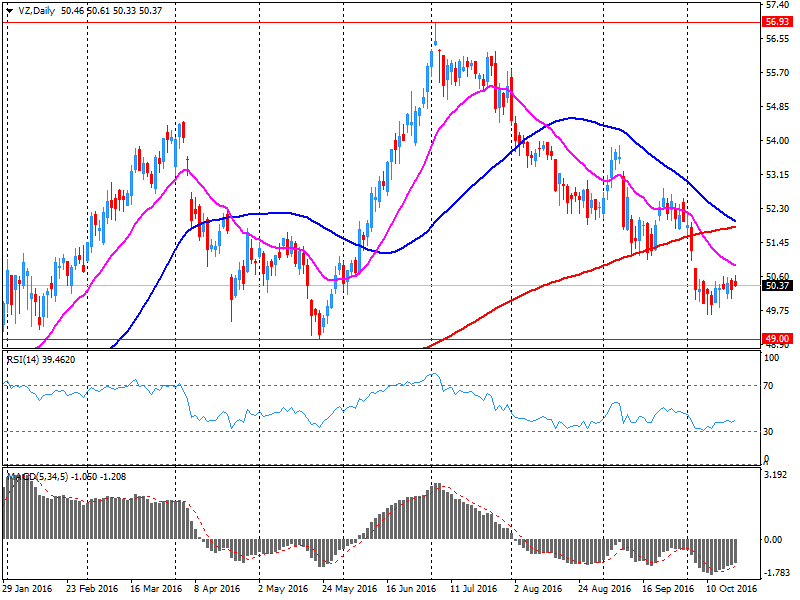

Company News: Verizon (VZ) Q3 EPS beat analysts’ estimate

Verizon reported Q3 FY 2016 earnings of $1.01 per share (versus $1.04 in Q3 FY 2015), beating analysts' consensus estimate of $0.99.

The company's quarterly revenues amounted to $30.937 bln (-6.7% y/y), missing analysts' consensus estimate of $31.066 bln.

VZ fell to $49.12 (-2.50%) in pre-market trading.

-

12:30

U.S.: Initial Jobless Claims, 260 (forecast 250)

-

12:30

U.S.: Continuing Jobless Claims, 2057 (forecast 2050)

-

12:02

Orders

EUR/USD

Offers 1.0980 1.1000 1.1025-30 1.1055 1.1070 1.1085 1.1100-05 1.1130 1.1150

Bids 1.0950 1.0920 1.0900 1.0880 1.0850 1.0830 1.0800

GBP/USD

Offers 1.2300 1.2325-30 1.2350 1.2380 1.2400 1.2430 1.2450

Bids 1.2250 1.2220 1.2200 1.2185 1.2165 1.2145-50 1.2130 1.2100

EUR/GBP

Offers 0.8955 0.8975-80 0.9000 0.9030-35 0.9050

Bids 0.8920 0.8900-05 0.8870 0.8850-55 0.8830 0.8800

EUR/JPY

Offers 114.00 114.20 114.70-75 115.00 115.50 115.80 116.00

Bids 113.50 113.00 112.60 112.00 111.85 111.50 111.00

USD/JPY

Offers 103.85 104.00 104.25-30 104.50 104.80 105.00

Bids 103.50 103.20-25 103.00 102.85 102.50 102.30 102.00

AUD/USD

Offers 0.7685 0.7700 0.7730-35 0.7755-60 0.7800

Bids 0.7650 0.7625-30 0.7600 0.7580 0.7550 0.7500

-

12:02

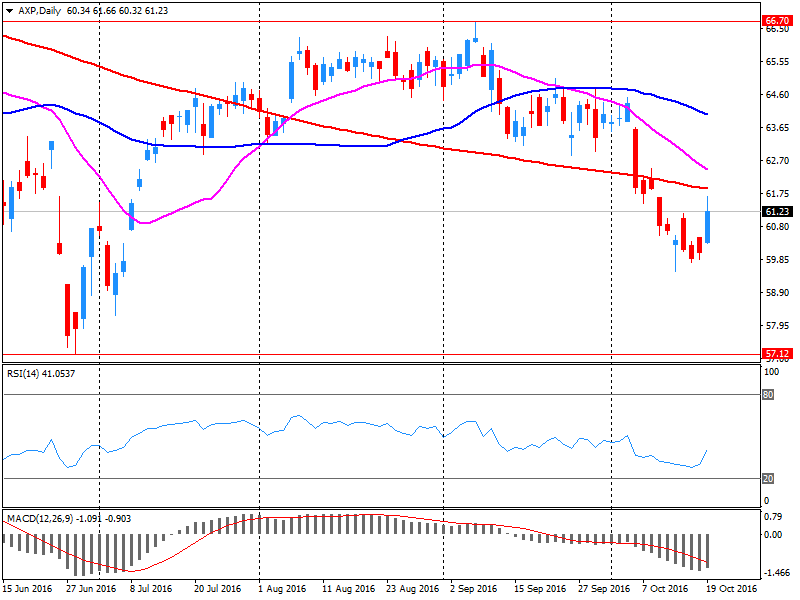

Company News: American Express (AXP) Q3 financials beat analysts’ forecasts

American Express reported Q3 FY 2016 earnings of $1.24 per share (versus $1.24 in Q3 FY 2015), beating analysts' consensus estimate of $0.96.

The company's quarterly revenues amounted to $7.774 bln (-5.1% y/y), slightly beating analysts' consensus estimate of $7.713 bln.

The company also raised its FY2016 EPS forecast to $5.90-6.00 from $5.40-5.70 versus analysts' consensus estimate of $5.60. It reaffirmed guidance for FY2017, projecting EPS of at least $5.60 versus analysts' consensus estimate of $5.55.

AXP rose to $65.05 (+6.20%) in pre-market trading.

-

11:47

No change for ECB interest rates

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases.

Regarding non-standard monetary policy measures, the Governing Council confirms that the monthly asset purchases of €80 billion are intended to run until the end of March 2017, or beyond, if necessary, and in any case until it sees a sustained adjustment in the path of inflation consistent with its inflation aim.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:30 CET today".

-

11:45

Eurozone: ECB Interest Rate Decision, 0.0% (forecast 0.0%)

-

10:37

Major stock indices in Europe trading mixed

European stocks remain near the opening level, move associated with the ECB meeting. In addition, investors continue to closely monitor the corporate reporting.

According to the forecast, ECB will leave the benchmark interest rate at zero and the deposit rate will remain at around -0.4%, while the marginal rate will remain at 0.25%. Most economists also expect that the Central Bank will hint at the possibility of extending the QE program, but a decision is unlikely to take place before December. "The tone of the ECB's statements probably signals a tendency to soft policy. We believe that the Central Bank refutes information about folding QE program until December and will not disclose details of the extension of the program. Perhaps in December, the ECB will extend the QE program until September 2017 and will adjust its structure ", - stated Bank of America Merrill Lynch.

The composite index of the largest companies in the region Stoxx Europe 600 trading lower by 0.05 percent. VStoxx Index, which measures the predicted volatility is dropping the third day in a row, and is now trading near a month low.

Capitalization of Publicis Groupe SA fell 6 percent after a report showed that the income of the French advertising company has not justified forecasts of experts in the 3rd quarter.

GEA Group has collapsed by 19 per cent, as the German engineering group said it expects a decrease in sales by the end of 2016.

Shares of Nestle SA fell 0.8 percent as the world's largest food company lowered its annual sales forecast.

The price Actelion shares It fell 3.1 percent after an improved outlook for the Swiss drugmaker earnings did not meet estimates.

Deutsche Lufthansa AG rose 7.8 percent after raising its forecast for airline profits.

At the moment:

FTSE 100 -4.46 7017.46 -0.06

DAX +28.73 10674.41 + 0.27%

CAC 40 +12.40 4532.70 + 0.27%

-

09:54

Bundesbank, Dombret: EU should not take a stance of punishing the UK in Brexit negotiations

-

09:29

Bundesbank Official Rebukes U.K. Government Over Central-Bank Meddling

-

09:05

Oil is trading lower

This morning, the New York futures for Brent have fallen in price 0.49% to $ 52.41 and crude oil futures for WTI decreased 0.56% to $ 51.53 per barrel. Thus, the black gold is correcting after recent gains. Market participants took profits on the background of lower US oil stocks by 5.2 million barrels. However, in general, the mood of investors remains positive. In addition, support for black gold had optimism about a possible OPEC production cut.

-

08:32

UK retail sales flat in September

In September 2016, the quantity bought (volume) of retail sales is estimated to have increased by 4.1% compared with September 2015; all store types except textile, clothing and footwear stores showed growth with the largest contribution coming from non-store retailing.

There was no change in the quantity bought compared with August 2016; decreases in food stores, other stores and textile, clothing and footwear stores were offset by increases in department stores, household goods stores and non-store retailers.

The underlying pattern in the retail sector continues to show relatively strong growth with the 3 month on 3 month movement in the quantity bought increasing by 1.8%.

-

08:30

United Kingdom: Retail Sales (MoM), September 0% (forecast 0.4%)

-

08:30

United Kingdom: Retail Sales (YoY) , September 4.1% (forecast 4.8%)

-

08:22

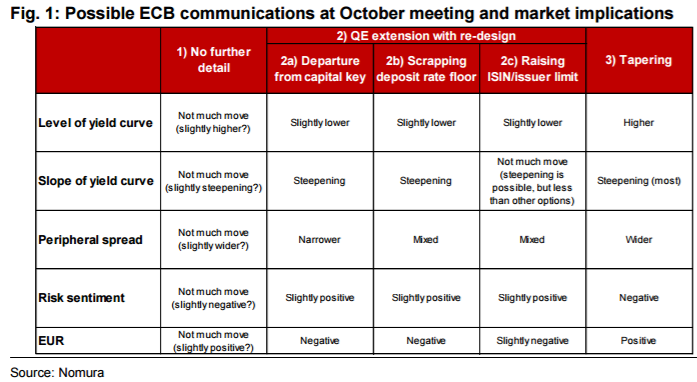

How Will EUR React at ECB? - Nomura

"Market expectations for an immediate policy change by the ECB are muted as we approach the meeting this week. Recent euro area economic data show the resilience of the economy, and a rate cut looks unlikely for now. Expectations of a rate cut into the meeting this week are fairly muted in the rates market.

The October meeting can be still important for the FX market, as markets are waiting for clarification on the future of the QE programme. We do not expect the ECB to make any final decisions on the QE programme this week, but any suggestions as to the likely path of the QE at the press conference could influence the euro area yield curve. FX market interest in the possibility of further bond sell-offs is rising, and the ECB's policy stance can influence the broader FX market, not only EUR.

Five possibilities: This week the ECB may communicate: 1) no details as to the future path of QE, 2) indications about extending QE further, or 3) indications of approaching tapering.

Then, if the ECB is inclined to extend the QE further, we see three likely options for the Bank to enable the extension: 2a)departure from the capital key, 2b) removal of the deposit rate floor, and 2c) increase in ISIN/issuer limits.

Conclusion: We believe the ECB's next step will be to extend its QE programme, not to taper it, and stronger indications of a QE extension would keep EUR/USD depreciating at its current pace.

Curve steepening is possible, but steepening owing to a QE extension would probably not cause a negative reaction in risk sentiment, which would enable USD/JPY to maintain its recent appreciation trend too. If ECB communication further increases market concerns about near-term tapering, the curve could steepen and risk sentiment deteriorate. This would challenge the recent trend of EUR/USD depreciation and USD/JPY appreciation. It is possible that the ECB does not offer any further details as to the future of QE, which would lead to muted reactions in the FX market. Under that scenario, comments by ECB officials and possible media leaks regarding the future of the QE programme, beyond the meeting next week, could increase EUR volatility into the December meeting.

As we expect the ECB to choose to extend the QE programme in the end, we judge EUR/USD downside risk is higher into the December ECB/Fed meetings".

Copyright © 2016 Nomura, eFXnews™

-

08:03

Euro Area current account improves in August

The current account of the euro area recorded a surplus of €29.7 billion in August 2016. This reflected surpluses for goods (€30.9 billion), services (€4.8 billion) and primary income (€6.6 billion), which were partly offset by a deficit in secondary income (€12.6 billion).

The 12-month cumulated current account for the period ending in August 2016 recorded a surplus of €350.0 billion (3.3% of euro area GDP), compared with one of €317.0 billion (3.1% of euro area GDP) for the 12 months to August 2015. This development was mostly due to an increase in the surplus for goods (from €327.7 billion to €372.7 billion), as well as a decrease in the deficit for secondary income (from €134.4 billion to €123.6 billion). These were partly offset by decreases in the surpluses for services (from €65.4 billion to €56.5 billion) and primary income (from €58.3 billion to €44.4 billion).

-

08:00

Eurozone: Current account, unadjusted, bln , August 23.6

-

07:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 1.46bln) 1.0948-50 (438m) 1.0955 (476m) 1.1000 (1.21bln) 1.1050-53 (1.-6bln) 1.1155-60 (1.08bln)

GBP/USD 1.2235 (GBP 245m)

USD/JPY 101.68-69 (USD 1.27bln) 103.00 (1.26bln) 103.50-55 (630m) 104.00 (930m) 104.50 (1.13bln)

EUR/JPY: 113.45 ( EUR 235m)

EUR/GBP 0.8850 (EUR 201m)

EUR/CHF 1.0800 (EUR 370m)

AUD/USD 0.7400 (AUD 595m) 0.7500 (1.37bln) 0.7600 (429m) 0.7675 (347m) 0.7700 (457m)

USD/CAD: 1.3100 (305m) 1.3150 (335m) 1.3200 (242m)

NZD/USD 0.7305-10 (NZD 565m)

EUR/AUD 1.4200 (EUR 345m) 1.4500 (245m)

-

07:28

Major stock markets trading in the green zone: FTSE -0.1%, DAX + 0.2%, CAC40 + 0.1%, FTMIB + 0.2%, IBEX + 0.3%

-

07:16

Today’s events

-

At 08:30 GMT Spain will hold an auction of 10-year bonds

-

At 11:45 GMT ECB's decision on interest rate

-

At 12:00 GMT Deputy Governor of the Bank of England Nemat Shafik will deliver a speech

- Day 1 of the EU Economic summit

-

-

06:52

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.4%, CAC 40 + 0.3%, FTSE + 0.3%

-

06:45

Retail sales to continue better-than-expected UK data? Will it be enough to support the pound?

-

06:43

Asian Shares Rise as Clinton, Trump Largely Ignore Asia

-

06:28

Options levels on thursday, October 20, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1170 (2474)

$1.1131 (1648)

$1.1070 (915)

Price at time of writing this review: $1.0961

Support levels (open interest**, contracts):

$1.0924 (7365)

$1.0896 (5200)

$1.0863 (2461)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 36344 contracts, with the maximum number of contracts with strike price $1,1300 (3790);

- Overall open interest on the PUT options with the expiration date November, 4 is 43655 contracts, with the maximum number of contracts with strike price $1,1000 (7365);

- The ratio of PUT/CALL was 1.20 versus 1.22 from the previous trading day according to data from October, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.2504 (1077)

$1.2407 (859)

$1.2312 (1360)

Price at time of writing this review: $1.2273

Support levels (open interest**, contracts):

$1.2191 (912)

$1.2094 (1433)

$1.1996 (684)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 29563 contracts, with the maximum number of contracts with strike price $1,2800 (2101);

- Overall open interest on the PUT options with the expiration date November, 4 is 29737 contracts, with the maximum number of contracts with strike price $1,2300 (1706);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from October, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:26

Swiss trade balance surplus above expectations

Between July and September 2016, the exports grew corrected for working days by 8.1% (real terms: + 2.8%) and imports by 7.9% (real terms: + 4.7%). In both approaches, the chemical-pharmaceutical products dominated the development. So these were responsible export side for about 80% of the total additional revenue. The surplus in the trade balance exceeded the first time in a quarter the 10 billion-franc stamp.

-

06:07

Confidence in the business environment of Australia increased in the third quarter

Confidence in the business community of Australia, published by the National Bank of Australia, increased to a value of 5 from 2, after rising in the second quarter. NAB's business confidence report shows the dynamics of the Australian economy as a whole, in the short term. Positive economic growth is positive for the Australian currency.

-

06:03

German producer prices for industrial products fell by 1.4%

In September 2016 the index of producer prices for industrial products fell by 1.4% compared with the corresponding month of the preceding year. In August 2016 the annual rate of change all over had been -1.6%.

Compared with the preceding month August 2016 the overall index fell by 0.2% in September 2016 (-0.1% in August and +0.2% in July).

In September 2016 energy prices decreased by 5.2 % compared with September 2015, prices of intermediate goods fell by 1.2%. In contrast prices of non-durable consumer goods rose by 0.7%, prices of capital goods by 0.6% and prices of durable consumer goods by 1.2%.

The overall index disregarding energy decreased by 0.1% compared with September 2015 and rose by 0.1% compared with August 2016.

-

06:01

Dudley: Government Bailouts of Banks Are No Longer Appropriate

-

There Is Huge Political Support to End Too Big to Fail

-

European, Japanese Banks Can Use Dollar Auctions, Swap Lines

-

European Banks Have Taken Down Their Dollar Books of Business

-

Squeeze on European, Japanese Banks in Dollar Funding Markets 'Not a Problem at This Juncture'

-

We're Making Progress on Insulating Banking System From Large Firm Failures

-

Probability of Big Bank Failure Is Much Lower Today Than It Was a Decade Ago

-

'I Don't Think We Have Any Problems Here in the U.S. in Terms of Monetary Policy Being Politicized'

-

Debate Over Central Bank Policy Being Politicized Is 'Non-Issue' in U.S.

-

Put More Weight On Fed Chair's Speeches Than Other Fed Speakers

-

Some Fed Speakers 'Are More Important Than Others,' Namely The Chair

-

Market Participants Need the Ability to 'Think Along With the Fed'

-

Monetary Policy Transparency Today Is a Lot Better Than it Used to Be

-

Wells Fargo Issues Underscore 'We Have a Lot More Work to Do'

-

-

06:01

Switzerland: Trade Balance, September 437 (forecast 3.27)

-

06:00

Germany: Producer Price Index (MoM), September -0.2% (forecast 0.2%)

-

06:00

Germany: Producer Price Index (YoY), September -1.4% (forecast -1.2%)

-

05:57

EUR/USD Into ECB: Targets For 3 Scenarios - Credit Suisse

"We see three scenarios for the ECB meeting as follows:

1. The ECB is clear and impressively decisive about its easing intentions: we suspect this would be enough to allow for a push towards EURUSD technical support levels around 1.09. If these do break then the natural extension would be to push on towards one-year lows around 1.06 in the weeks ahead, especially if the market is also prepared to price in a resumed Fed tightening cycle with more confidence.

2. The ECB is vague about its likely next actions - this would argue against a near-term range breakout lower for EURUSD, especially if there is any form of squeeze higher in euro area rates. We would expect a move back above 1.10 towards 1.12 in this scenario.

3. The ECB validates the recent speculation in the press about tapering by pointing towards this course of action for 2017: this would likely take EURUSD back towards 1.15 over coming weeks, especially if the market is unsure about the probability of a Fed hike in December. It could also create a virtuous cycle for the currency in that the market may suspect that the ECB anticipates better growth and inflation outcomes and would provide a boost to the many market participants who are looking at the glass as half full for euro area macro performance going into 2017. With oil prices and euro area marketbased inflation expectations on the rise anyway, all it would take would be a relatively positive reaction from European equity markets to more market participants that the worst may be over for the economy and that the need for still-looser monetary policy is much diminished".

Copyright © 2016 Credit Suisse, eFXnews™

-

05:54

Monthly trend employment in Australia increased slightly in September

Monthly trend employment in Australia increased slightly in September 2016, according to figures released by the Australian Bureau of Statistics (ABS) today.

In September 2016, trend employment increased by 3,900 persons to 11,959,500 persons - a monthly growth rate of 0.03 per cent. This is down from the monthly employment growth peak of 0.28 per cent in September 2015. Trend part-time employment growth continued, with an increase of 11,800 persons, while full-time employment decreased by 7,900 persons.

"The latest Labour Force release shows further increases in part-time employment. There are now 130,000 more persons working part-time than in December 2015, while the number working full-time has decreased by 54,100 persons," said the Program Manager of ABS' Labour and Income Branch, Jacqui Jones.

The trend monthly hours worked increased by 2.2 million hours (0.1 per cent), though it is still below the high in December 2015.

The trend unemployment rate decreased slightly (by less than 0.1 percentage points) to 5.6 per cent, and the participation rate decreased 0.1 percentage points but remained steady at 64.7 per cent in rounded terms.

Trend series smooth the more volatile seasonally adjusted estimates and provide the best measure of the underlying behaviour of the labour market.

-

05:52

Fed's Dudley: 25bps hike later this year 'not that big a deal' --Reuters

-

05:16

Global Stocks

U.K. stocks reversed course to finish higher Wednesday, supported by a rally in oil prices, but Travis Perkins PLC shares were hammered as the building products supplier flagged rough conditions stemming from the Brexit referendum. Oil extended its rally after the U.S. Energy Information Administration unexpectedly reported that weekly domestic crude supplies dropped by 5.2 million barrels. Analysts polled by S&P Global Platts expected a climb of 2.5 million barrel climb.

U.S. stocks closed higher for a second session Wednesday, boosted by a rally in the energy sector and stronger-than-expected quarterly results from Morgan Stanley. The Federal Reserve's Beige Book, an anecdotal economic survey, also indicated that the U.S. economy continues its modest, albeit steady, expansion.

Asian stocks advanced on Thursday, propelled by strong U.S. earnings and oil prices near a 15-month high, as the third and final U.S. presidential debate before the Nov. 8 election ended. In the final debate between Republican presidential candidate Donald Trump and Democrat Hillary Clinton, Trump tried to reverse the momentum in an election that polls show is tilting away from him.

-

00:35

Australia: NAB Quarterly Business Confidence, Quarter III 5

-

00:30

Australia: Unemployment rate, September 5.6% (forecast 5.7%)

-

00:30

Australia: Changing the number of employed, September -9.8 (forecast 15)

-