Market news

-

22:31

Commodities. Daily history for Oct 20’2016:

(raw materials / closing price /% change)

Oil 50.61 -0.04%

Gold 1,266.20 -0.10%

-

15:45

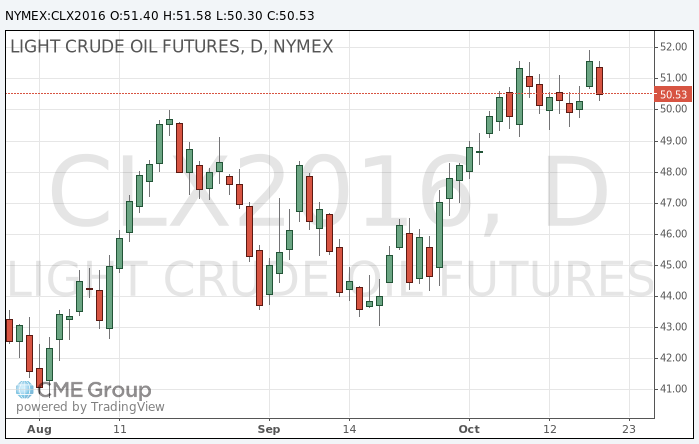

Oil fell from 2016 highs

Oil prices fell and could not hold the positions conquered the day before. Investors took profits after data on Wednesday showed a larger than expected drop in crude inventories in the United States.

On Wednesday, the Energy Information Administration reported a drop of commercial oil reserves by 5.2 million barrels in the week of October 8-14, mainly due to the decrease in imports, after which oil prices have risen to new hig.hs

"We are seeing profit-taking," - said Bart Melek of TD Securities. However, he believes that the situation in the oil market as a whole has improved and investors are waiting for the reduction of oil production by OPEC.

However, commercial US crude inventories still remain at the level of 468.7 million barrels, which is 5.4% higher than a year ago and 31.5% higher than the average of similar date for the last five years.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 50.30 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 51.27 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:25

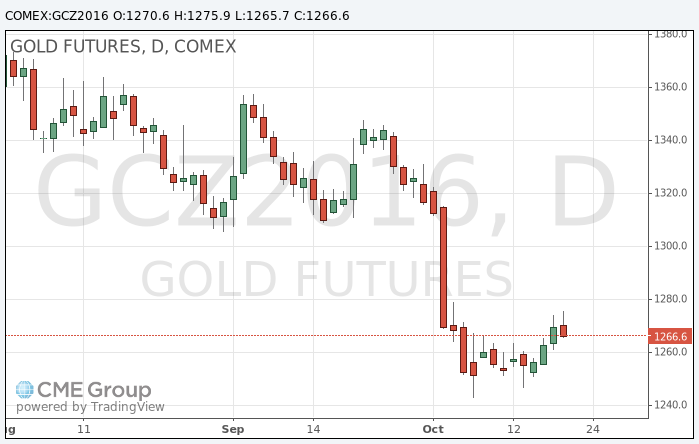

Gold price under preasure

Gold price decline fallowing the dynamics of the euro after ECB meeting and Mario Draghi's comments.

European Central Bank President Mario Draghi but did not make specific promises about QE extension or taper.

The key interest rate has been maintained at a record-low of 0%, where it had been since March of this year. In addition, the ECB's management has decided to leave the rate on deposits at the level of -0.4 meaning that commercial banks pay the central bank for the storage of their excess reserves.

Draghi said that the "sharp end" of asset the purchase program "unlikely". The relevant decision on this issue will be taken within the framework of the ECB meeting on 8 December.

At the same time, the US dollar rose on stronger expectations about further increases in interest rates by the Federal Reserve.

The cost of December futures for gold on the COMEX fell to $ 1265.6 per ounce.

-

09:05

Oil is trading lower

This morning, the New York futures for Brent have fallen in price 0.49% to $ 52.41 and crude oil futures for WTI decreased 0.56% to $ 51.53 per barrel. Thus, the black gold is correcting after recent gains. Market participants took profits on the background of lower US oil stocks by 5.2 million barrels. However, in general, the mood of investors remains positive. In addition, support for black gold had optimism about a possible OPEC production cut.

-