Market news

-

15:24

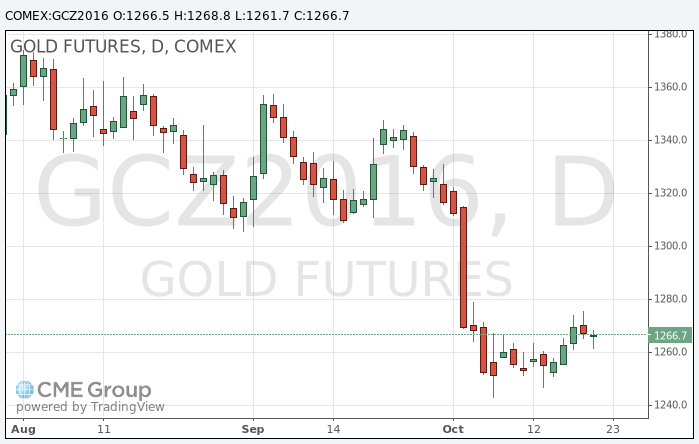

Gold price flat for the day

Gold price was littIe changed as investors consider the strengthening of the dollar and the alleged rise in demand for the metal from India.

The dollar index, which tracks the greenback against a basket of currencies, was up 0.3%, to 88.60. A stronger dollar usually exerts pressure on the gold price. Gold prices are denominated in dollars, so that the metal becomes less attractive.

Meanwhile, the seasonal demand for gold in India since the beginning of the season of festivals is growing, according to Commerzbank AG.

"At the end of this month will be the feast of Diwali and Dhanteras. Both are important in the Hindu tradition, and at that time people used to give gold".

India and China are two of the world's largest gold-consuming countries.

The cost of December futures for gold on COMEX is trading in the range of $ 1261.7 - $ 1268.8 per ounce.

-

08:22

Oil little changed

This morning, New York futures for Brent have fallen in price 0.14% to $ 50.56 and WTI trading flat at $ 51.38 per barrel. Thus, the black gold's rally stops for now, move caused by a strengthening dollar. The dollar rose to the highest level since March against major currencies, potentially limiting the oil demand, because the fuel has risen in price in countries with other currencies. But despite the decline, the oil market was optimistic, as financial investors are still keen to invest more in oil futures.

-