Market news

-

19:34

DJIA 18162.49 0.14 0%, NASDAQ 5257.36 15.53 0.30%, S&P 500 2142.16 0.82 0.04%

-

16:06

European stocks closed: FTSE 100 7,022.10 -4.80 -0.07%, DAX 10,710.73 +9.34 +0.09%, CAC 40 4,536.07 -4.05 -0.09%

-

15:47

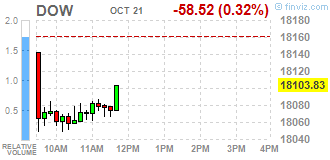

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. S&P and Dow lower as GE's shares were off 1,9%, weighing the most on the S&P 500, after the conglomerate lowered its full-year revenue growth target and narrowed its profit forecast. Nasdaq slightly rose due to Microsoft surging to an all-time high.

Most of Dow stocks in negative area (27 of 30). Top gainer - Microsoft Corporation (MSFT, +4.69%). Top loser - The Travelers Companies, Inc. (TRV, -4.87%).

Almost all S&P sectors also in negative area. Top gainer - Services (+0.1%). Top loser - Healthcare (-0.8%).

At the moment:

Dow 17986.00 -122.00 -0.67%

S&P 500 2129.50 -7.50 -0.35%

Nasdaq 100 4836.50 -7.25 -0.15%

Oil 50.58 -0.05 -0.10%

Gold 1267.20 -0.30 -0.02%

U.S. 10yr 1.74 -0.01

-

15:40

WSE: Session Results

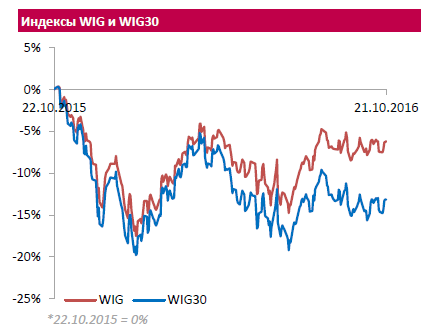

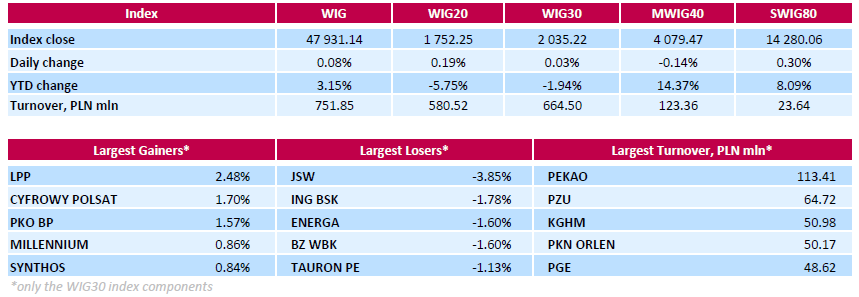

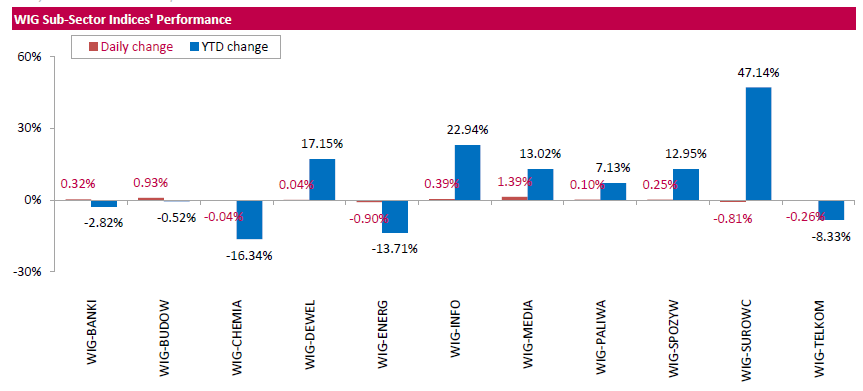

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, edged up 0.08%. Sector performance within the WIG Index was mixed. Media (+1.39%) sector outperformed, while utilities (-0.90%) lagged behind.

The large-cap WIG30 Index inched up 0.03%. Within the index components, clothing retailer LPP (WSE: LPP) was the best-performing name, climbing by 2.48% and almost fully erasing its yesterday's losses. It was followed by media group CYFROWY POLSAT (WSE: CPS) and bank PKO BP (WSE: PKO), advancing 1.7% and 1.57% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) fell the most, down 3.85%, correcting after significant growth, observed in the second decade of October. Among other biggest decliners were two banking sector names ING BSK (WSE: ING) and BZ WBK (WSE: BZW) as well as three gencos ENERGA (WSE: ENG), TAURON (WSE: TPE) and PGE (WSE: PGE), which retreated by 0.93%-1.78%.

-

13:33

U.S. Stocks open: Dow -0.59%, Nasdaq -0.13%, S&P -0.44%

-

13:26

Before the bell: S&P futures -0.46%, NASDAQ futures -0.20%

U.S. stock-index futures declined as investors assessed mixed earnings reports and guidances from American companies.

Global Stocks:

Nikkei 17,184.59 -50.91 -0.30%

Hang Seng - Closed

Shanghai 3,091.29 +6.83 +0.22%

FTSE 7,037.35 +10.45 +0.15%

CAC 4,527.22 -12.90 -0.28%

DAX 10,694.97 -6.42 -0.06%

Crude $50.48 (-0.30%)

Gold $1266.80 (-0.06%)

-

12:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.06

-0.80(-0.471%)

4656

ALCOA INC.

AA

26.67

-0.02(-0.0749%)

6503

ALTRIA GROUP INC.

MO

64.26

2.41(3.8965%)

217201

Amazon.com Inc., NASDAQ

AMZN

809.15

-1.17(-0.1444%)

12866

American Express Co

AXP

66.63

-0.15(-0.2246%)

17306

Apple Inc.

AAPL

117.05

-0.01(-0.0085%)

72686

AT&T Inc

T

38.6

-0.05(-0.1294%)

42953

Boeing Co

BA

135.25

-0.59(-0.4343%)

5345

Caterpillar Inc

CAT

86.19

-0.44(-0.5079%)

3936

Cisco Systems Inc

CSCO

30.13

-0.03(-0.0995%)

29638

E. I. du Pont de Nemours and Co

DD

69.03

-0.43(-0.6191%)

4885

Exxon Mobil Corp

XOM

86.8

-0.41(-0.4701%)

22664

Facebook, Inc.

FB

129.85

-0.15(-0.1154%)

73943

Ford Motor Co.

F

11.95

-0.02(-0.1671%)

26468

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.12

-0.09(-0.8815%)

15519

General Electric Co

GE

28.75

-0.32(-1.1008%)

463547

Goldman Sachs

GS

173.81

-0.70(-0.4011%)

3691

Home Depot Inc

HD

125.72

-0.53(-0.4198%)

9840

HONEYWELL INTERNATIONAL INC.

HON

109

0.86(0.7953%)

4392

Intel Corp

INTC

35.32

-0.11(-0.3105%)

38134

International Business Machines Co...

IBM

151.08

-0.44(-0.2904%)

6268

Johnson & Johnson

JNJ

114.45

-0.42(-0.3656%)

16707

JPMorgan Chase and Co

JPM

67.94

-0.32(-0.4688%)

22979

McDonald's Corp

MCD

114.54

3.97(3.5905%)

576332

Merck & Co Inc

MRK

62.1

0.18(0.2907%)

18624

Microsoft Corp

MSFT

60.78

3.53(6.1659%)

1582401

Nike

NKE

51.69

-0.20(-0.3854%)

10107

Pfizer Inc

PFE

32.58

0.04(0.1229%)

35612

Procter & Gamble Co

PG

84.52

-0.41(-0.4828%)

4071

Starbucks Corporation, NASDAQ

SBUX

53.5

-0.09(-0.1679%)

9835

Tesla Motors, Inc., NASDAQ

TSLA

199.59

0.49(0.2461%)

5400

The Coca-Cola Co

KO

42

0.07(0.1669%)

33426

Travelers Companies Inc

TRV

109.21

-0.31(-0.2831%)

2565

Twitter, Inc., NYSE

TWTR

16.92

0.02(0.1183%)

23226

UnitedHealth Group Inc

UNH

144.64

-0.43(-0.2964%)

5168

Verizon Communications Inc

VZ

49.03

-0.11(-0.2239%)

25528

Visa

V

82.55

0.05(0.0606%)

12634

Wal-Mart Stores Inc

WMT

68.55

-0.18(-0.2619%)

8776

Walt Disney Co

DIS

91.64

-0.39(-0.4238%)

9605

Yahoo! Inc., NASDAQ

YHOO

42.24

-0.14(-0.3303%)

6901

-

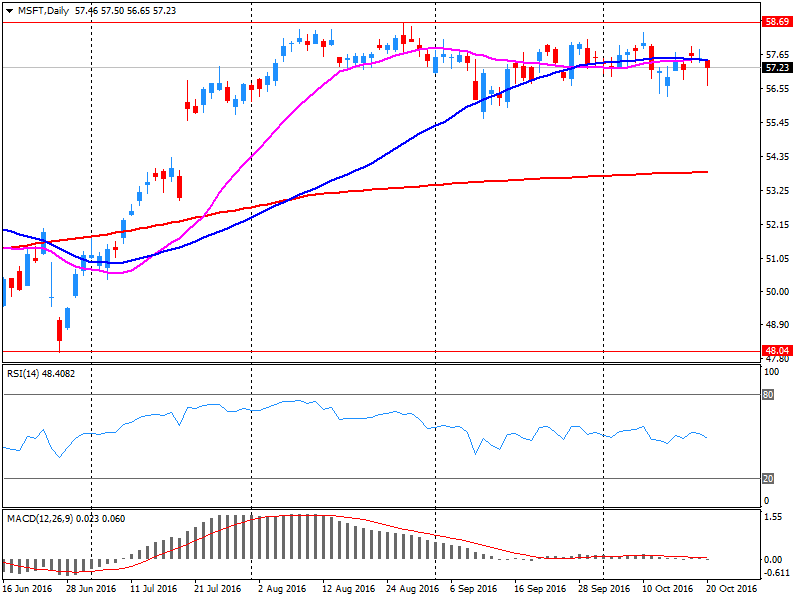

12:45

Upgrades and downgrades before the market open

Upgrades:

Microsoft (MSFT) upgraded to Outperform from Market Perform at William Blair

Microsoft (MSFT) upgraded to Buy at Wunderlich; target raised to $70

Downgrades:

Yahoo! (YHOO) downgraded to Hold from Buy at Jefferies

Other:

Apple (AAPL) target raised to $135 from $125 at Cowen

Microsoft (MSFT) target raised to $69 from $62 at BMO Capital Markets

Wal-Mart (WMT) initiated with a Neutral at Piper Jaffray; target $73

-

12:26

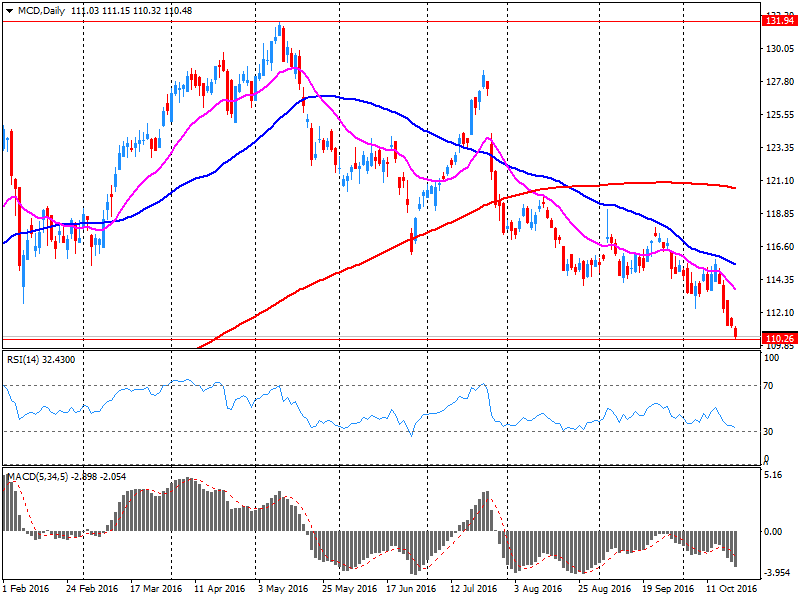

Company News: McDonald's (MCD) Q3 financials beat analysts’ forecasts

McDonald's reported Q3 FY 2016 earnings of $1.62 per share (versus $1.40 in Q3 FY 2015), beating analysts' consensus estimate of $1.48.

The company's quarterly revenues amounted to $6.424 bln (-2.9% y/y), beating analysts' consensus estimate of $6.280 bln.

MCD rose to $114.52 (+3.57%) in pre-market trading.

-

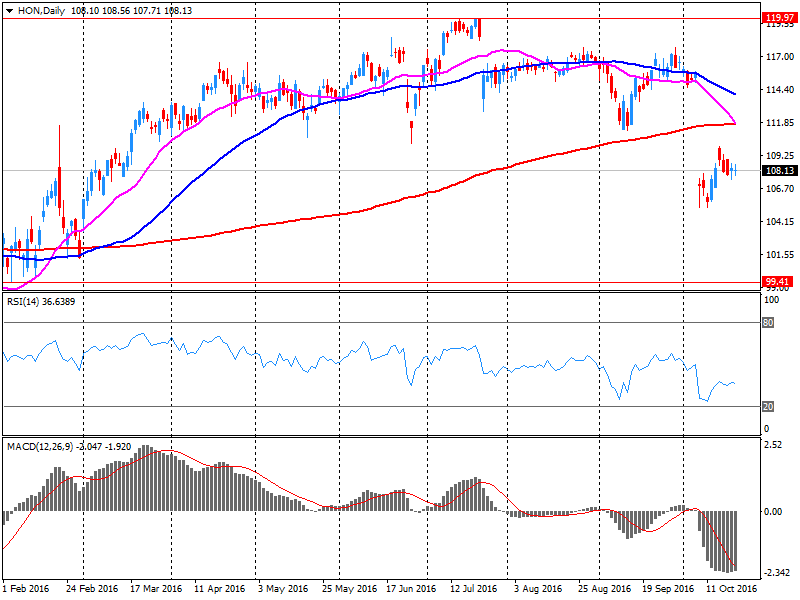

12:24

Company News: Honeywell (HON) Q3 EPS miss analysts’ estimate

Honeywell reported Q3 FY 2016 earnings of $1.67 per share (versus $1.57 in Q3 FY 2015), missing analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $9.800 bln (+2% y/y), generally in-line analysts' consensus estimate of $9.786 bln .

HON rose to $109 (+0.80%) in pre-market trading.

-

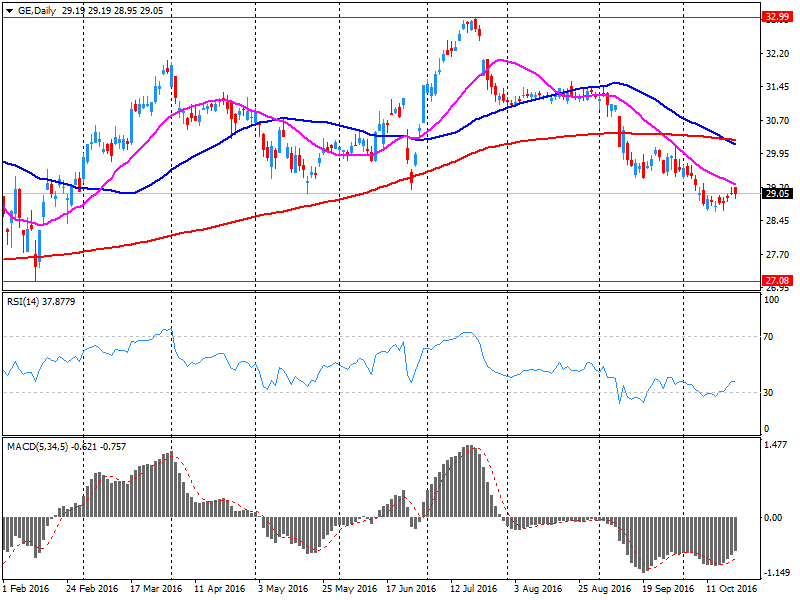

12:23

Company News: General Electric (GE) Q3 results beat analysts’ forecasts

General Electric reported Q3 FY 2016 earnings of $0.32 per share (versus $0.32 in Q3 FY 2015), beating analysts' consensus estimate of $0.30.

The company's quarterly revenues amounted to $30.021 bln (+3.8% y/y), beating analysts' consensus estimate of $29.680 bln.

GE fell to $28.95 (-0.41%) in pre-market trading.

-

12:21

Company News: Microsoft (MSFT) Q3 results beat analysts’ forecasts

Microsoft reported Q3 FY 2016 earnings of $0.76 per share (versus $0.67 in Q3 FY 2015), beating analysts' consensus estimate of $0.68.

The company's quarterly revenues amounted to 22.334 bln (+3.1% y/y), beating analysts' consensus estimate of $21.695 bln.

MSFT rose to $60.56 (+5.78%) in pre-market trading.

-

06:44

Negative start expected on the major stock exchanges in Europe: DAX futures -0.1%, CAC40 -0.1%, FTSE flat

-

04:49

Global Stocks

European stock markets erased losses and closed higher on Thursday after European Central Bank President Mario Draghi hinted the December policy meeting will be key to deciding on further easing measures.

U.S. stocks closed lower Thursday, but off session lows, as a sharp drop in oil and telecommunications shares weighed on investors' sentiment. Investors also grappled with a mixed bag of economic data, earnings results, a steep drop in crude-oil prices, the prospect of a rate increase by the Federal Reserve and tumult wrought by the U.S. presidential election.

Asian stocks were mostly lower on Friday as the dollar climbed to seven-month highs against a basket of currencies and dragged down crude oil prices, cooling investor risk appetite. The greenback was boosted by a fall in the euro after the European Central Bank shot down talk it was contemplating tapering its monetary easing - sending the common currency to its lowest since March.

-