Market news

-

19:34

DJIA 18162.49 0.14 0%, NASDAQ 5257.36 15.53 0.30%, S&P 500 2142.16 0.82 0.04%

-

16:06

European stocks closed: FTSE 100 7,022.10 -4.80 -0.07%, DAX 10,710.73 +9.34 +0.09%, CAC 40 4,536.07 -4.05 -0.09%

-

15:47

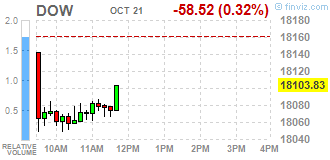

Wall Street. Major U.S. stock-indexes mixed

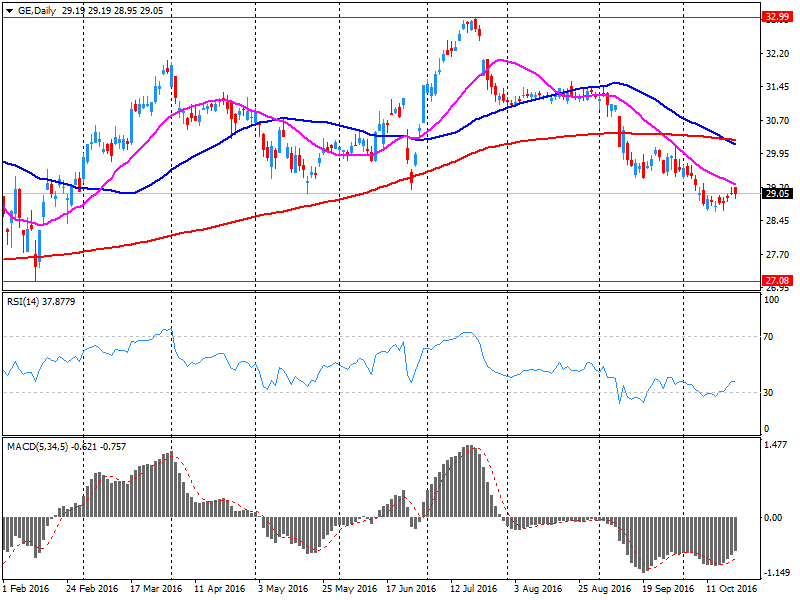

Major U.S. stock-indexes mixed. S&P and Dow lower as GE's shares were off 1,9%, weighing the most on the S&P 500, after the conglomerate lowered its full-year revenue growth target and narrowed its profit forecast. Nasdaq slightly rose due to Microsoft surging to an all-time high.

Most of Dow stocks in negative area (27 of 30). Top gainer - Microsoft Corporation (MSFT, +4.69%). Top loser - The Travelers Companies, Inc. (TRV, -4.87%).

Almost all S&P sectors also in negative area. Top gainer - Services (+0.1%). Top loser - Healthcare (-0.8%).

At the moment:

Dow 17986.00 -122.00 -0.67%

S&P 500 2129.50 -7.50 -0.35%

Nasdaq 100 4836.50 -7.25 -0.15%

Oil 50.58 -0.05 -0.10%

Gold 1267.20 -0.30 -0.02%

U.S. 10yr 1.74 -0.01

-

15:40

WSE: Session Results

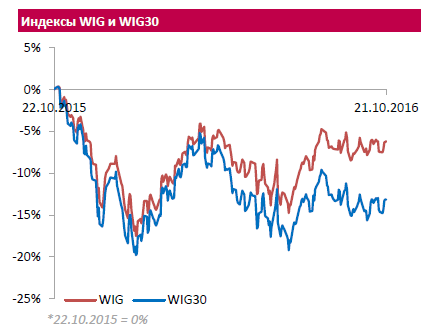

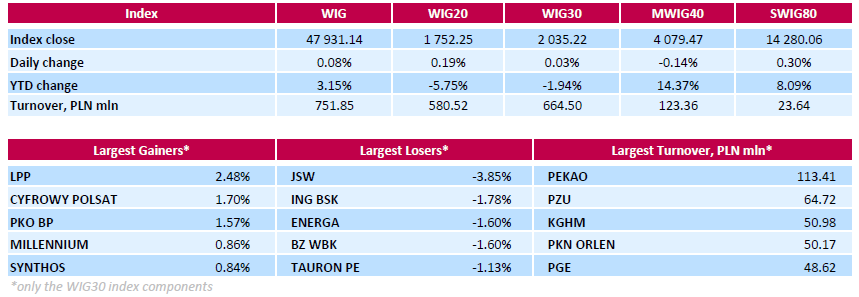

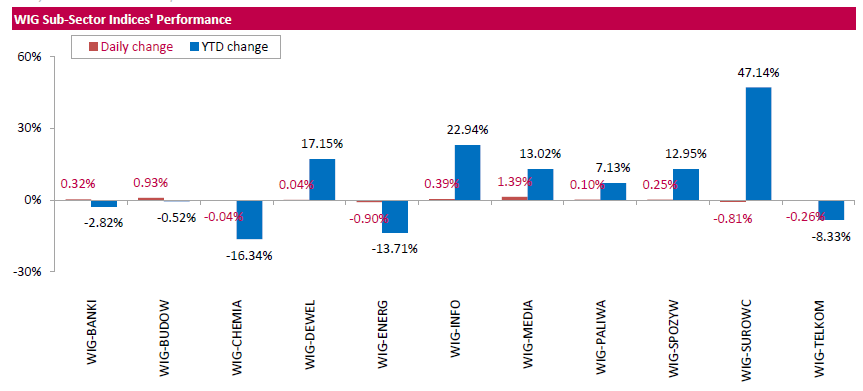

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, edged up 0.08%. Sector performance within the WIG Index was mixed. Media (+1.39%) sector outperformed, while utilities (-0.90%) lagged behind.

The large-cap WIG30 Index inched up 0.03%. Within the index components, clothing retailer LPP (WSE: LPP) was the best-performing name, climbing by 2.48% and almost fully erasing its yesterday's losses. It was followed by media group CYFROWY POLSAT (WSE: CPS) and bank PKO BP (WSE: PKO), advancing 1.7% and 1.57% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) fell the most, down 3.85%, correcting after significant growth, observed in the second decade of October. Among other biggest decliners were two banking sector names ING BSK (WSE: ING) and BZ WBK (WSE: BZW) as well as three gencos ENERGA (WSE: ENG), TAURON (WSE: TPE) and PGE (WSE: PGE), which retreated by 0.93%-1.78%.

-

15:24

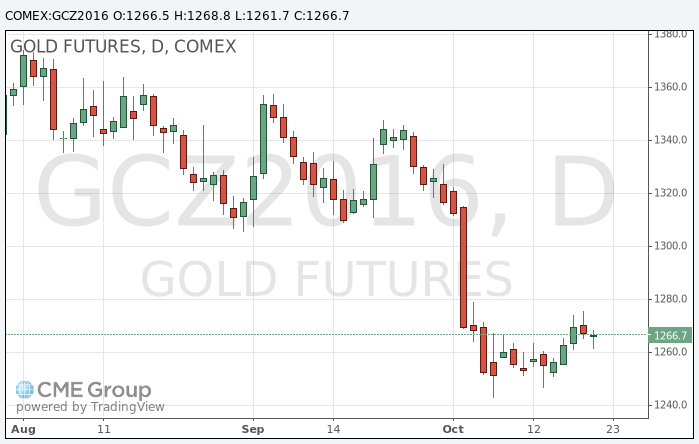

Gold price flat for the day

Gold price was littIe changed as investors consider the strengthening of the dollar and the alleged rise in demand for the metal from India.

The dollar index, which tracks the greenback against a basket of currencies, was up 0.3%, to 88.60. A stronger dollar usually exerts pressure on the gold price. Gold prices are denominated in dollars, so that the metal becomes less attractive.

Meanwhile, the seasonal demand for gold in India since the beginning of the season of festivals is growing, according to Commerzbank AG.

"At the end of this month will be the feast of Diwali and Dhanteras. Both are important in the Hindu tradition, and at that time people used to give gold".

India and China are two of the world's largest gold-consuming countries.

The cost of December futures for gold on COMEX is trading in the range of $ 1261.7 - $ 1268.8 per ounce.

-

14:45

Tarullo: Still Concerned About Rapid Funding Runs, Investor Redemptions

-

14:04

EU consumer confidence little changed in October

In October 2016, the DG ECFIN flash estimate of the consumer confidence indicator remained broadly unchanged in both the EU (-0.1 points to -6.5) and the euro area (+0.2 points to -8.0) compared to September.

-

14:00

Eurozone: Consumer Confidence, October -8 (forecast -8)

-

13:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0800 (EUR 711m) 1.0900 (1.55bln) 1.0920-25 (1.14bln) 1.0950 (624m) 1.0975 (364m) 1.1000 (2.25bln) 1.1050 (357m) 1.1075 (1.05bln)

GBPUSD 1.2245 (GBP 644m)

USDJPY 103.55 (USD 280m) 103.70 (487m) 104.00 (376m) 104.20 (380m)

105.00 (366m) 105.25-30 (1.93bn) 105.50 (770m)

USDCHF 1.0131 (USD 500m)

EURJPY: 115.00 (EUR 997m)

EURGBP 0.8850 (EUR 201m)

EURCHF 1.0800 (EUR 370m)

USDCAD: 1.3000-10 (USD 970m) 1.3075 (200mn) 1.3100 (390m) 1.3200 (470m) 1.3250-55 (430m) 1.3300 (638m) 1.3325 (271m) 1.3350 (250m)

NZDUSD 0.7260 (NZD 225m)

USDSGD 1.3850 (1.54bln) 1.3925 (600m) 1.3950 (400m) 1.4125 (2.15bln)

-

13:33

U.S. Stocks open: Dow -0.59%, Nasdaq -0.13%, S&P -0.44%

-

13:26

Before the bell: S&P futures -0.46%, NASDAQ futures -0.20%

U.S. stock-index futures declined as investors assessed mixed earnings reports and guidances from American companies.

Global Stocks:

Nikkei 17,184.59 -50.91 -0.30%

Hang Seng - Closed

Shanghai 3,091.29 +6.83 +0.22%

FTSE 7,037.35 +10.45 +0.15%

CAC 4,527.22 -12.90 -0.28%

DAX 10,694.97 -6.42 -0.06%

Crude $50.48 (-0.30%)

Gold $1266.80 (-0.06%)

-

13:08

Germany should correct its excessive trade surplus, does not respect EU rules – Italy’s PM Renzi

-

13:00

Belgium: Business Climate, October -1.8 (forecast -1.5)

-

12:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.06

-0.80(-0.471%)

4656

ALCOA INC.

AA

26.67

-0.02(-0.0749%)

6503

ALTRIA GROUP INC.

MO

64.26

2.41(3.8965%)

217201

Amazon.com Inc., NASDAQ

AMZN

809.15

-1.17(-0.1444%)

12866

American Express Co

AXP

66.63

-0.15(-0.2246%)

17306

Apple Inc.

AAPL

117.05

-0.01(-0.0085%)

72686

AT&T Inc

T

38.6

-0.05(-0.1294%)

42953

Boeing Co

BA

135.25

-0.59(-0.4343%)

5345

Caterpillar Inc

CAT

86.19

-0.44(-0.5079%)

3936

Cisco Systems Inc

CSCO

30.13

-0.03(-0.0995%)

29638

E. I. du Pont de Nemours and Co

DD

69.03

-0.43(-0.6191%)

4885

Exxon Mobil Corp

XOM

86.8

-0.41(-0.4701%)

22664

Facebook, Inc.

FB

129.85

-0.15(-0.1154%)

73943

Ford Motor Co.

F

11.95

-0.02(-0.1671%)

26468

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.12

-0.09(-0.8815%)

15519

General Electric Co

GE

28.75

-0.32(-1.1008%)

463547

Goldman Sachs

GS

173.81

-0.70(-0.4011%)

3691

Home Depot Inc

HD

125.72

-0.53(-0.4198%)

9840

HONEYWELL INTERNATIONAL INC.

HON

109

0.86(0.7953%)

4392

Intel Corp

INTC

35.32

-0.11(-0.3105%)

38134

International Business Machines Co...

IBM

151.08

-0.44(-0.2904%)

6268

Johnson & Johnson

JNJ

114.45

-0.42(-0.3656%)

16707

JPMorgan Chase and Co

JPM

67.94

-0.32(-0.4688%)

22979

McDonald's Corp

MCD

114.54

3.97(3.5905%)

576332

Merck & Co Inc

MRK

62.1

0.18(0.2907%)

18624

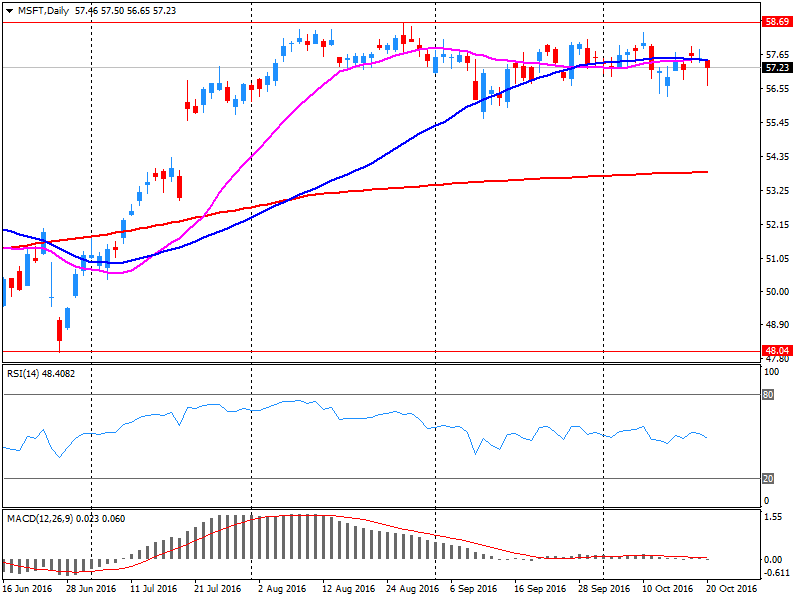

Microsoft Corp

MSFT

60.78

3.53(6.1659%)

1582401

Nike

NKE

51.69

-0.20(-0.3854%)

10107

Pfizer Inc

PFE

32.58

0.04(0.1229%)

35612

Procter & Gamble Co

PG

84.52

-0.41(-0.4828%)

4071

Starbucks Corporation, NASDAQ

SBUX

53.5

-0.09(-0.1679%)

9835

Tesla Motors, Inc., NASDAQ

TSLA

199.59

0.49(0.2461%)

5400

The Coca-Cola Co

KO

42

0.07(0.1669%)

33426

Travelers Companies Inc

TRV

109.21

-0.31(-0.2831%)

2565

Twitter, Inc., NYSE

TWTR

16.92

0.02(0.1183%)

23226

UnitedHealth Group Inc

UNH

144.64

-0.43(-0.2964%)

5168

Verizon Communications Inc

VZ

49.03

-0.11(-0.2239%)

25528

Visa

V

82.55

0.05(0.0606%)

12634

Wal-Mart Stores Inc

WMT

68.55

-0.18(-0.2619%)

8776

Walt Disney Co

DIS

91.64

-0.39(-0.4238%)

9605

Yahoo! Inc., NASDAQ

YHOO

42.24

-0.14(-0.3303%)

6901

-

12:45

Upgrades and downgrades before the market open

Upgrades:

Microsoft (MSFT) upgraded to Outperform from Market Perform at William Blair

Microsoft (MSFT) upgraded to Buy at Wunderlich; target raised to $70

Downgrades:

Yahoo! (YHOO) downgraded to Hold from Buy at Jefferies

Other:

Apple (AAPL) target raised to $135 from $125 at Cowen

Microsoft (MSFT) target raised to $69 from $62 at BMO Capital Markets

Wal-Mart (WMT) initiated with a Neutral at Piper Jaffray; target $73

-

12:36

-

12:35

Retail sales in Canada edged down in August

Retail sales edged down 0.1% to $44.0 billion in August. Lower sales at motor vehicle and parts dealers, and general merchandise stores were the main contributors to the decline. Excluding these two subsectors, retail sales were up 0.2%.

Sales were down in 7 of 11 subsectors, representing 57% of retail trade.

After removing the effects of price changes, retail sales in volume terms decreased 0.3%.

-

12:33

Canadian inflation increases slower than expected. USD/CAD up 70 pips so far

-

The Consumer Price Index (CPI) rose 1.3% on a year-over-year basis in September, following a 1.1% gain in August.

-

Excluding gasoline, the CPI was up 1.5% year over year in September, after posting a 1.7% increase in August.

Prices were up in all eight major components in the 12 months to September, with the shelter and transportation indexes contributing the most to the year-over-year rise in the CPI. The food index posted its smallest year-over-year gain since February 2000.

The transportation index rose 2.3% in the 12 months to September, following a 0.3% gain in August. Gasoline prices posted a smaller year-over-year decrease in September (-3.2%) than in August (-11.5%). On a monthly basis, gasoline prices were up 0.8% in September, while they fell 7.9% in the same month in 2015. On a year-over-year basis, the purchase of passenger vehicles index increased 5.8% in September, after posting a 5.2% gain in August.

The clothing and footwear index rose 0.1% on a year-over-year basis in September, following a 0.4% decline in August. This turnaround was partly attributable to increases in the men's clothing index and the women's clothing index in the 12 months to September. Both indexes had declined in the previous month. For the fifth consecutive month, shoppers paid less for children's clothing on a year-over-year basis.

Food prices were up 0.1% year over year in September, after rising 1.1% in August. Prices for food purchased from stores recorded their first year-over-year decline since March 2008, down 0.9% in the 12 months to September. As a result of the decrease in September, food prices in stores returned to a level last recorded in January 2015.

-

-

12:30

Canada: Retail Sales, m/m, August -0.1% (forecast 0.2%)

-

12:30

Canada: Consumer Price Index m / m, September 0.1% (forecast 0.2%)

-

12:30

Canada: Retail Sales YoY, August 1.6%

-

12:30

Canada: Bank of Canada Consumer Price Index Core, y/y, September 1.8% (forecast 1.8%)

-

12:30

Canada: Retail Sales ex Autos, m/m, August 0.0% (forecast 0.3%)

-

12:30

Canada: Consumer price index, y/y, September 1.3% (forecast 1.5%)

-

12:26

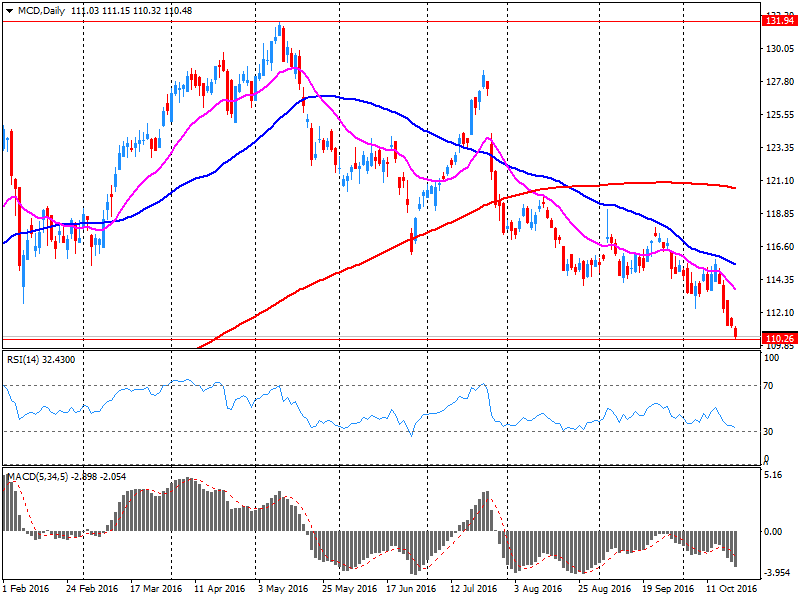

Company News: McDonald's (MCD) Q3 financials beat analysts’ forecasts

McDonald's reported Q3 FY 2016 earnings of $1.62 per share (versus $1.40 in Q3 FY 2015), beating analysts' consensus estimate of $1.48.

The company's quarterly revenues amounted to $6.424 bln (-2.9% y/y), beating analysts' consensus estimate of $6.280 bln.

MCD rose to $114.52 (+3.57%) in pre-market trading.

-

12:24

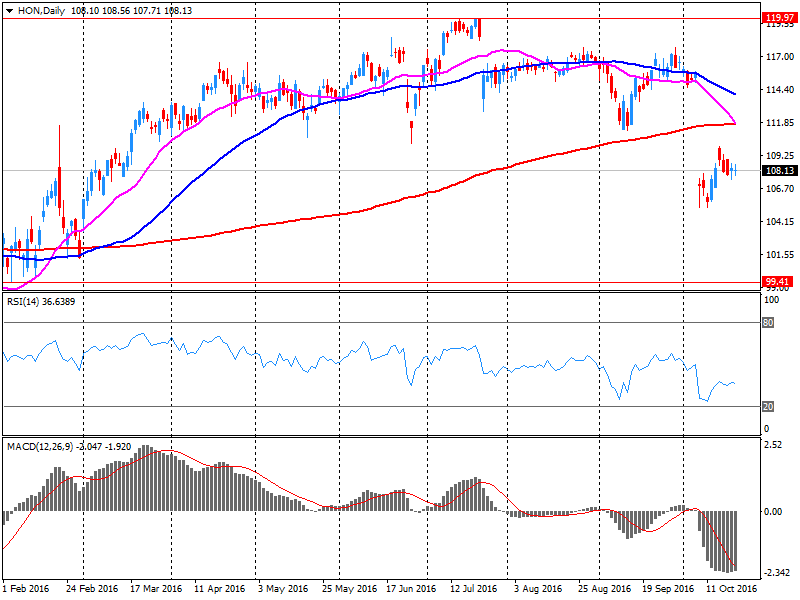

Company News: Honeywell (HON) Q3 EPS miss analysts’ estimate

Honeywell reported Q3 FY 2016 earnings of $1.67 per share (versus $1.57 in Q3 FY 2015), missing analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $9.800 bln (+2% y/y), generally in-line analysts' consensus estimate of $9.786 bln .

HON rose to $109 (+0.80%) in pre-market trading.

-

12:23

Company News: General Electric (GE) Q3 results beat analysts’ forecasts

General Electric reported Q3 FY 2016 earnings of $0.32 per share (versus $0.32 in Q3 FY 2015), beating analysts' consensus estimate of $0.30.

The company's quarterly revenues amounted to $30.021 bln (+3.8% y/y), beating analysts' consensus estimate of $29.680 bln.

GE fell to $28.95 (-0.41%) in pre-market trading.

-

12:21

Company News: Microsoft (MSFT) Q3 results beat analysts’ forecasts

Microsoft reported Q3 FY 2016 earnings of $0.76 per share (versus $0.67 in Q3 FY 2015), beating analysts' consensus estimate of $0.68.

The company's quarterly revenues amounted to 22.334 bln (+3.1% y/y), beating analysts' consensus estimate of $21.695 bln.

MSFT rose to $60.56 (+5.78%) in pre-market trading.

-

12:18

Canadian CPI expected to create some volatility after a quiet european session

-

12:01

Orders

EUR/USD

Offers 1.0920 1.0950 1.0980 1.1000 1.1025-30 1.1055 1.1070 1.1085 1.1100-05

Bids 1.0880 1.0850 1.0830 1.0800 1.0785 1.0750 1.0700

GBP/USD

Offers 1.2260 1.2280 1.2300 1.2325-301.2350 1.2380 1.2400 1.2430 1.2450

Bids 1.2220 1.2200 1.2185 1.2165 1.2145-50 1.2130 1.2100

EUR/GBP

Offers 0.8920-25 0.8955 0.8975-80 0.9000

Bids 0.8885 0.8870 0.8850-55 0.8830 0.8800

EUR/JPY

Offers 113.30 113.50 113.80-85 114.00 114.20 114.70-75 115.00

Bids 113.00-112.90 112.60 112.00 111.85 111.50 111.00

USD/JPY

Offers 104.00 104.25-30 104.50 104.80 105.00

Bids 103.50 103.20-25 103.00 102.85 102.50 102.30 102.00

AUD/USD

Offers 0.7650 0.7665 0.7685 0.7700 0.7730-35 0.7755-60 0.7800

Bids 0.7620 0.7600 0.7580 0.7555-60 0.7500

-

10:54

Major stock indices in Europe show little change

European stocks are trading near the opening level, but at the same time preparing to record the largest weekly gain in a month. Better than expected financial results of the companies pushed up the Stoxx Europe 600.

Currently, the composite index of the largest companies in the region trading with an increase of 0.1 percent. Since the beginning of the week the index gained 1.3 percent, helped by yesterday's statements by ECB President Draghi, which reduced investor concern over the fact that the quantitative easing program ends too early, "Economic recovery in the euro area is expected to be suppressed by weak foreign demand. We will continue to act, if necessary, using all available tools "- said Draghi.

Certain influence on trading had data from Britain. The Office for National Statistics said that the level of public sector debt (excluding state-owned banks) amounted to 10.6 billion pounds in September, up 1.3 bln pounds, or 14.5 percent higher than the same period of 2015. In addition, the deficit has exceeded all forecasts - the average rate expected at 8.5 billion pounds. The report also showed that for the first six months of the current year the deficit amounted to 45.5 billion pounds, which is almost 5 per cent lower compared with the same period last year, but close to 55.5 billion pounds, which is projected for 2016/17.

The capitalization of SAP rose 3.2 percent after the company reported an improvement in their forecasts for earnings and sales.

Cost of Ericsson shares fell 4.6 percent amid reports that the company has completed the third quarter with a net loss (for the first time in nearly 4 years).

Shares of Daimler AG fell by 3 per cent, as the German automaker lowered its forecast for revenue.

Quotes of British American Tobacco Plc rose 2.9 percent after it made a bid for the remaining 57.8 percent of the US company Reynolds American Inc for $ 47 billion. Reynolds American Inc's value increased by 1.9 percent.

Shares of Yara International ASA and Valeo SA rose at least 3.1 percent after their financial results exceeded the forecasts of experts.

Intercontinental Hotels Group shares fell 1.5 percent, as the volume of hotel network revenue grew at a slower pace than analysts expected.

At the moment:

FTSE 100 +16.05 7042.95 + 0.23%

DAX +9.78 10711.17 + 0.09%

CAC 40 -5.43 4534.69 -0.12%

-

10:30

ECB's Weidmann: Italian referendum could be a catalyst for reform

-

09:21

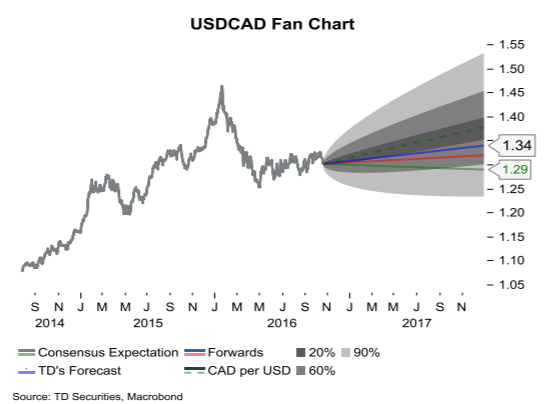

Whats next for USD/CAD after BoC? - TD

"USDCAD was on quite a thrill ride yesterday, dropping nearly 1% before recovering. Market participant's interpretation of the policy bias sparked much of the volatility in the market. Despite the confusion about the policy stance, our takeaway from the event was that the BoC reinforced its dovish bias introduced at the prior meeting. This rests on our view that the details of the MPR were a firm downgrade from the July report.

For USDCAD, we think this enhances the 1.30 floor, and we think dips will remain brief. We keep our sights on another stab at 1.33 but doubt this level will continue to hold.

Our view stems from the fact that in the context of the export puzzle, CAD strength is self-defeating against the need for economic rebalancing. Firmer oil prices could limit USDCAD upside, but in light of CAD's impact on the BoC's policy efforts, we think the risks to the pair are now heavily skewed to the upside".

Copyright © 2016 TD Securities, eFXnews™

-

08:39

UK Public sector net borrowing increased in September

Public sector net borrowing (excluding public sector banks) decreased by £2.3 billion to £45.5 billion in the current financial year-to-date (April to September 2016), compared with the same period in 2015.

Public sector net borrowing (excluding public sector banks) increased by £1.3 billion to £10.6 billion in September 2016, compared with September 2015.

Public sector net debt (excluding public sector banks) at the end of September 2016 was £1,627.2 billion, equivalent to 83.3% of gross domestic product (GDP); an increase of £39.5 billion compared with September 2015.

This month debt as a percentage of GDP fell by 1.0 percentage point compared with September 2015. This is the fourth successive month of debt falling on the year as a percentage of GDP and indicates that GDP is currently increasing (year-on-year) faster than net debt excluding public sector banks.

Central government net cash requirement decreased by £9.5 billion to £36.6 billion in the current financial year-to-date (April to September 2016), compared with the same period in 2015.

-

08:30

United Kingdom: PSNB, bln, September -10.12 (forecast -8.5)

-

08:22

Oil little changed

This morning, New York futures for Brent have fallen in price 0.14% to $ 50.56 and WTI trading flat at $ 51.38 per barrel. Thus, the black gold's rally stops for now, move caused by a strengthening dollar. The dollar rose to the highest level since March against major currencies, potentially limiting the oil demand, because the fuel has risen in price in countries with other currencies. But despite the decline, the oil market was optimistic, as financial investors are still keen to invest more in oil futures.

-

08:18

ECB: Inflation expectations have been revised marginally down for 2016 and 2018

-

Inflation expectations have been revised marginally down for 2016 and 2018, but are unchanged for 2017. Longer-term inflation expectations are unchanged at 1.8%.

-

Real GDP growth expectations have been revised up for 2016, but down for 2018 and further ahead.

-

Unemployment rate expectations have been revised down.

Respondents to the ECB's Survey of Professional Forecasters (SPF) for the fourth quarter of 2016 report average point forecasts for inflation in 2016, 2017 and 2018 of 0.2%, 1.2% and 1.4% respectively. This implies unchanged forecasts for 2017 and slight downward revisions, by 0.1 percentage point, for 2016 and 2018. Average longer-term inflation expectations (for 2021) remain unchanged at 1.8%. The expected strong pick-up in headline inflation between 2016 and 2017 reflects to a large extent the expected profile of oil price dynamics, while underlying inflation is expected to pick up at a more gradual pace.

-

-

08:15

Major stock markets trading in the green zone: FTSE + 0.1%, DAX + 0.1%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX + 0.1%

-

07:21

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800 (EUR 711m) 1.0900 (1.55bln) 1.0920-25 (1.14bln) 1.0950 (624m) 1.0975 (364m) 1.1000 (2.25bln) 1.1050 (357m) 1.1075 (1.05bln)

GBP/USD 1.2245 (GBP 644m)

USD/JPY 103.55 (USD 280m) 103.70 (487m) 104.00 (376m) 104.20 (380m)

105.00 (366m) 105.25-30 (1.93bn) 105.50 (770m)

USD/CHF 1.0131 (USD 500m)

EUR/JPY: 115.00 (EUR 997m)

EUR/GBP 0.8850 (EUR 201m)

EUR/CHF 1.0800 (EUR 370m)

AUD/USD None of note

USD/CAD: 1.3000-10 (USD 970m) 1.3075 (200mn) 1.3100 (390m)

1.3200 (470m) 1.3250-55 (430m) 1.3300 (638m) 1.3325 (271m)

1.3350 (250m)

NZD/USD 0.7260 (NZD 225m)

USD/SGD 1.3850 (1.54bLn) 1.3925 (600m) 1.3950 (400m) 1.4125 (2.15bLn)

-

07:06

Today’s events

-

At 11:00 GMT the Bank of Japan Governor Haruhiko Kuroda will deliver a speech

-

At 12:00 GMT ECB Jens Weidmann will make a speech

-

At 17:15 GMT FOMC member Daniel Tarullo deliver a speech

-

At 21:30 GMT FOMC member John Williams will deliver a speech

-

Also, EU economic summit day 2.

-

-

06:44

Negative start expected on the major stock exchanges in Europe: DAX futures -0.1%, CAC40 -0.1%, FTSE flat

-

06:36

Options levels on friday, October 21, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1079 (1463)

$1.1045 (1618)

$1.1017 (615)

Price at time of writing this review: $1.0908

Support levels (open interest**, contracts):

$1.0884 (5358)

$1.0855 (2831)

$1.0821 (1886)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 39776 contracts, with the maximum number of contracts with strike price $1,1300 (3774);

- Overall open interest on the PUT options with the expiration date November, 4 is 44541 contracts, with the maximum number of contracts with strike price $1,1000 (7590);

- The ratio of PUT/CALL was 1.12 versus 1.20 from the previous trading day according to data from October, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.2503 (1124)

$1.2406 (861)

$1.2310 (1448)

Price at time of writing this review: $1.2246

Support levels (open interest**, contracts):

$1.2191 (943)

$1.2095 (1403)

$1.1997 (860)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 29905 contracts, with the maximum number of contracts with strike price $1,2800 (2051);

- Overall open interest on the PUT options with the expiration date November, 4 is 29953 contracts, with the maximum number of contracts with strike price $1,2300 (1712);

- The ratio of PUT/CALL was 1.00 versus 1.01 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:30

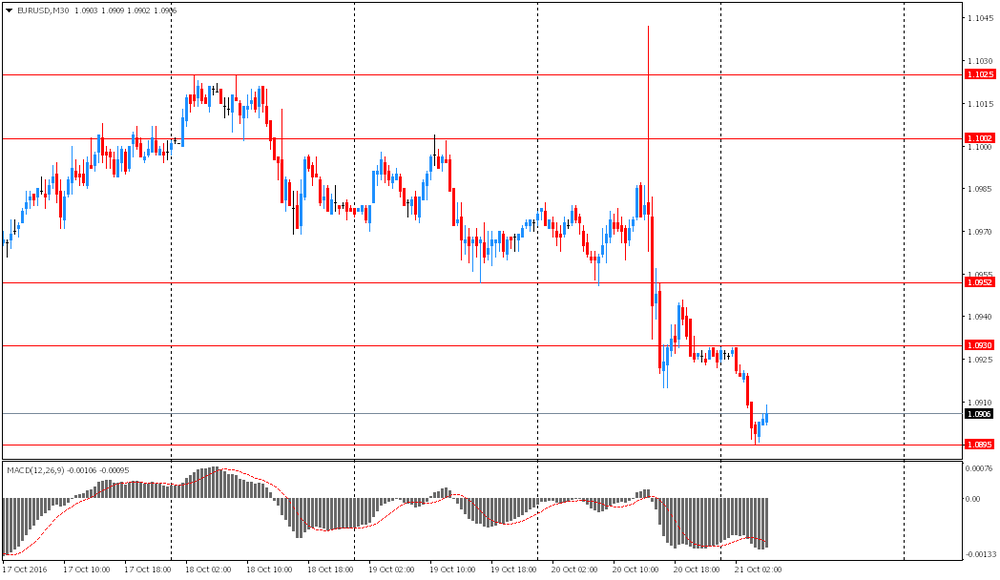

Asian session review: The euro fell continuing yesterday's decline

The euro fell, extending yesterday's decline after the ECB meeting. ECB left its key rate unchanged at a record low of 0%, which corresponded to the expectations. Central Bank President Mario Draghi at the press conference signaled that the bond purchase program may be continued after March 2017, but has not announced a clear intention to do so.

The US dollar rose against major currencies amid growing investor confidence in a Fed hike. According to experts, the strong economic data and comments by Fed officials support the expectations of higher interest rates in December. On Wednesday evening, William Dudley said that the central bank may be able to raise interest rates by year end. Earlier this week, the same comments made by the Vice-Chairman Stanley Fischer. According to Fed funds futures the probability of a hike in December is 74% vs 69.5% earlier this week.

Also today, Haruhiko Kuroda said that the central bank may temper the optimistic forecasts next year. This indicates a continuous struggle to complete a deflationary cycle. "We are already in the middle of the fiscal year, but inflation is still in negative territory," - said Kuroda in the Parliament when discussing consumer prices, taking into account energy. According to him, the central bank may revise its forecast that core inflation will reach 2% in 2017 fiscal year.

EUR / USD: during the Asian session the pair fell to $ 1.0895

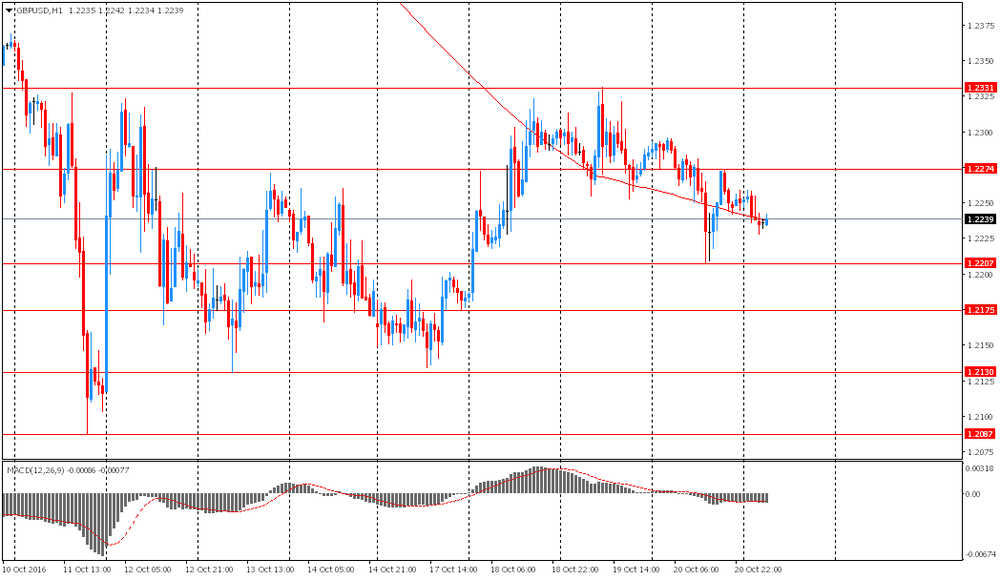

GBP / USD: during the Asian session the pair fell to $ 1.2225

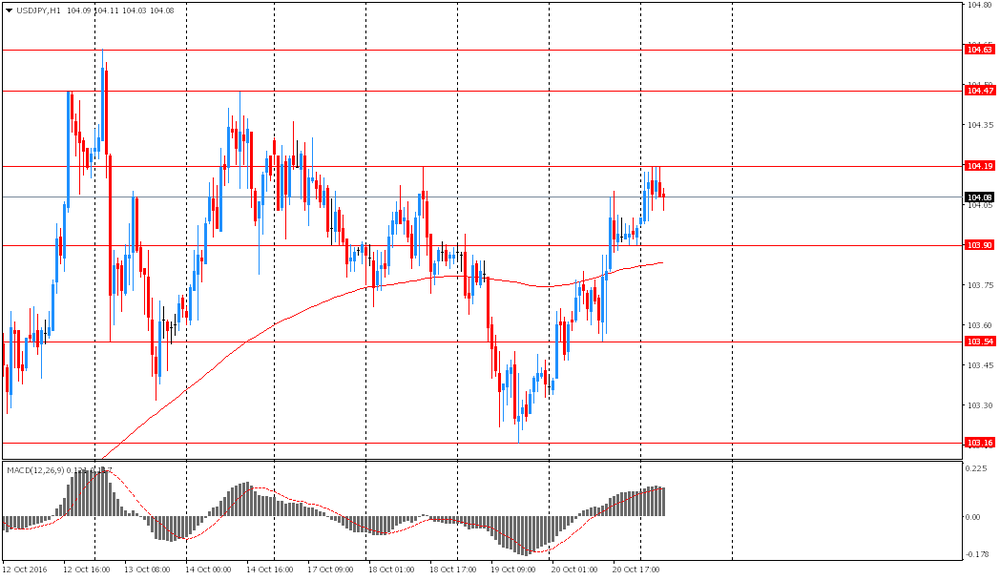

USD / JPY: during the Asian session, the pair rose to Y104.20

-

06:06

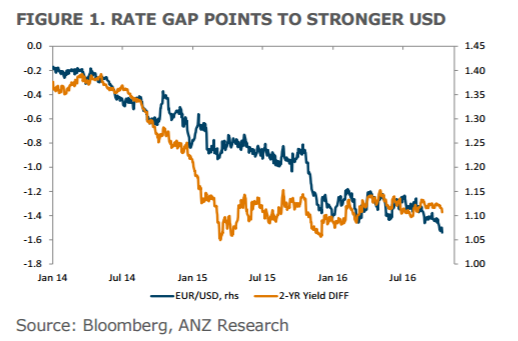

ANZ Says That The Divergence Trade is Back and EUR/USD down to 1.05

"The prospect for divergent monetary policies returning to reassert themselves as a material influence on EUR/USD seems greater in the coming months than it has been this year.

As the US labour market tightens, the prospect of a recovery in business investment is rising as firms substitute capital for wages and as skill shortages intensify. As the oil price stabilises and the US rig count increases, the drag on investment from the oil price collapse should stabilise. Consumer confidence is at post-GFC highs and average earnings growth is gradually picking-up (September +2.6% y/y). Wealth effects could also be a source of significant support. In Q2 2016, US household net worth was USD89.1trn - up sharply from USD56.2trn at the end of 2008. The savings rate has normalised (5.7%) and while there are material issues with inequality, under a new President, middle class tax cuts should help support future consumption. This economic backdrop seems materially more upbeat than in Europe.

There are elections planned in the Netherlands, France, and Germany, and if Italian PM Renzi fails in the 4 December referendum - which opinion polls suggest he will - there may be an election in Italy. The question of European integration given economic underperformance, immigration, Brexit, etc., all suggest some political risk premium for the euro and an overreliance on easy monetary policy for growth.

A lower EUR/USD looks probable - as does EUR underperformance against higher yielding APAC currencies.

Whilst forecasting direction in EUR/USD has been frustrating and fraught with many potholes over the past twelve months, the balance of fundamental risks seem to be stacking up in favour of USD strength in the coming months. We look for a move below 1.05 over the coming months".

Copyright © 2016 ANZ, eFXnews™

-

06:02

Bank of Japan Governor, Haruhito Kuroda: The Pace of Government Bonds purchases roughly in line with expectations in September

-

I do not expect a sharp drop in purchases

-

It is very likely that will eliminate the need to purchase Japanese government bonds in the amount of 80 trillion yen a year in the future

-

The pace of purchases roughly in line with expectations in September

-

No need to install a specific range for the yield on 10-year JGB's

-

The Bank of Japan will assess the appropriate yield curve of Japanese government bonds at each meeting, and it can change depending on economic development

-

At the previous meeting, the Bank of Japan's position was expressed by the monetary policy that the yield curve should be steeper

-

-

05:59

Fed Rate Rises Don't Necessarily Mean Continuous Dollar Gains - China Regulator

-

Fed Has Been Slow, Gradual, 'Very Cautious' to Raise Interest Rates

-

China's Supply, Demand for Foreign Exchange Improved in 3Q

-

Capital Outflow Pressure Eased in the First 3 Quarters

-

China Banks Sold Net US$28.4 Bln in September Vs Net Sales of US$43.50 Bln in Aug

-

-

05:56

Euro Hits 7-Month Low Against Dollar, Offshore Yuan Hits Record Low

-

05:55

New Zealand's net migration increased in September

According to rttnews, New Zealand's net migration increased in September from a year ago, driven both by more arrivals and fewer departures, figures from Statistics New Zealand showed Friday.

In the year to September 30, the country recorded a net migration of 70,000, surpassing the previous peak of 69,100 in August.

The seasonally adjusted net gain of migrants totaled 6,300 in September, which was above the previous record of 6,200 in November 2015.

Visitor arrivals to the country numbered 245,100 in September, up by 28,100 from a year ago. Overseas trips by New Zealand residents totaled 267,900, up by 32,300 as compared to same month last year.

"Most of the arrivals are people coming in with work visas, which also includes working holidaymakers," population statistics manager, Jo-Anne Skinner, said.

-

05:52

Powerful earthquake strikes western Japan

-

04:49

Global Stocks

European stock markets erased losses and closed higher on Thursday after European Central Bank President Mario Draghi hinted the December policy meeting will be key to deciding on further easing measures.

U.S. stocks closed lower Thursday, but off session lows, as a sharp drop in oil and telecommunications shares weighed on investors' sentiment. Investors also grappled with a mixed bag of economic data, earnings results, a steep drop in crude-oil prices, the prospect of a rate increase by the Federal Reserve and tumult wrought by the U.S. presidential election.

Asian stocks were mostly lower on Friday as the dollar climbed to seven-month highs against a basket of currencies and dragged down crude oil prices, cooling investor risk appetite. The greenback was boosted by a fall in the euro after the European Central Bank shot down talk it was contemplating tapering its monetary easing - sending the common currency to its lowest since March.

-