Market news

-

22:29

Stocks. Daily history for Oct 20’2016:

(index / closing price / change items /% change)

Nikkei 225 17,235.50 +236.59 +1.39%

Shanghai Composite 3,084.76 +0.0366 0.00%

S&P/ASX 200 5,442.14 +6.78 +0.12%

FTSE 100 7,026.90 +4.98 +0.07%

CAC 40 4,540.12 +19.82 +0.44%

Xetra DAX 10,701.39 +55.71 +0.52%

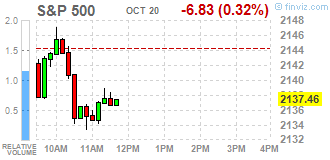

S&P 500 2,141.34 -2.95 -0.14%

Dow Jones Industrial Average 18,162.35 -40.27 -0.22%

S&P/TSX Composite 14,847.92 +7.43 +0.05%

-

19:00

DJIA 18189.16 -13.46 -0.07%, NASDAQ 5244.99 -1.42 -0.03%, S&P 500 2142.74 -1.55 -0.07%

-

16:00

European stocks closed: FTSE 7026.90 4.98 0.07%, DAX 10701.39 55.71 0.52%, CAC 4540.12 19.82 0.44%

-

15:45

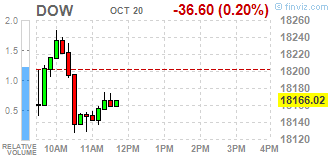

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes slightly fell on Thursday as weak earnings from index heavyweights such as Verizon dented optimism about the earnings season and as a drop in oil prices weighed on energy stocks.

Most of Dow stocks in negative area (21 of 30). Top gainer - American Express Company (AXP, +8.96%). Top loser - The Travelers Companies, Inc. (TRV, -4.87%).

Almost all S&P sectors also in negative area. Top gainer - Healthcare (+0.4%). Top loser - Technology (-0.5%).

At the moment:

Dow 18088.00 -37.00 -0.20%

S&P 500 2131.50 -6.50 -0.30%

Nasdaq 100 4813.75 -16.50 -0.34%

Oil 50.80 -1.02 -1.97%

Gold 1266.50 -3.40 -0.27%

U.S. 10yr 1.74 -0.01

-

15:36

WSE: Session Results

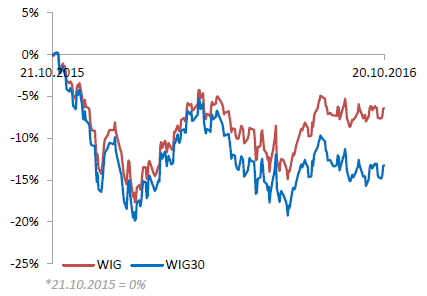

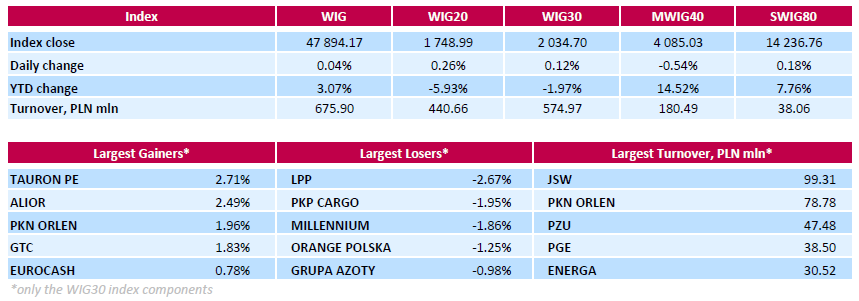

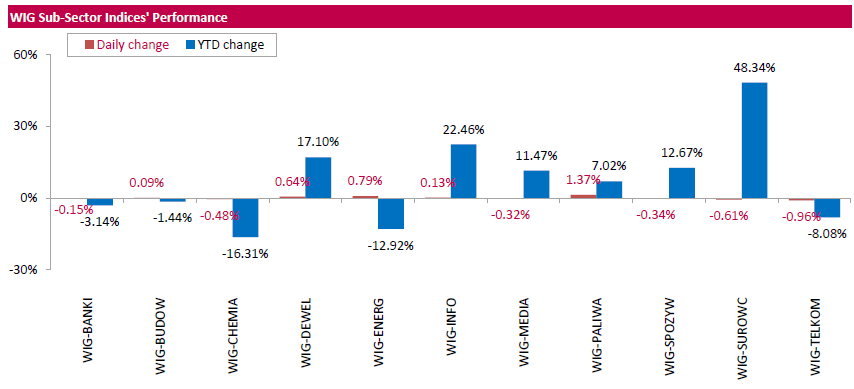

Polish equity market closed flat on Thursday. The broad market benchmark, the WIG Index, edged up 0.04%. Sector performance in the WIG Index was mixed. Oil and gas sector (+1.37%) recorded the biggest gains, while telecoms (-0.96%) lagged behind.

The large-cap stocks measure, the WIG30 Index, rose by 0.12%. In the index basket, genco TAURON (WSE: TPE) and bank ALIOR (WSE: ALR) were the best-performing names, advancing by 2.71% and 2.49% respectively. They were followed by oil refiner PKN ORLEN (WSE: PKN) and property developer GTC (WSE: GTC), gaining 1.96% and 1.83% respectively. On the other side of the ledge, clothing retailer LPP (WSE: LPP) demonstrated the worst performance, tumbling by 2.67%. Other major decliners were railway freight transport operator PKP CARGO (WSE: PKP), bank MILLENNIUM (WSE: MIL) and telecommunication services provider ORANGE POLSKA (WSE: OPL), which lost between 1.25% and 1.95%.

-

13:32

U.S. Stocks open: Dow -0.24%, Nasdaq -0.21%, S&P -0.23%

-

13:28

Before the bell: S&P futures -0.20%, NASDAQ futures -0.15%

U.S. stock-index futures slipped on concern that European Central Bank stimulus won't jump-start growth in the region's economy, while mixed earnings reports from American companies provided little direction.

Global Stocks:

Nikkei 17,235.50 +236.59 +1.39%

Hang Seng 23,374.40 +69.43 +0.30%

Shanghai 3,084.76 +0.0366 0.00%

FTSE 7,000.04 -21.88 -0.31%

CAC 4,501.15 -19.15 -0.42%

DAX 10,598.52 -47.16 -0.44%

Crude $51.08 (-1.43%)

Gold $1272.80 (+0.23%)

-

12:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.9

-0.14(-0.5178%)

13337

Amazon.com Inc., NASDAQ

AMZN

814.5

-3.19(-0.3901%)

15909

American Express Co

AXP

65.25

4.00(6.5306%)

310959

Apple Inc.

AAPL

116.91

-0.21(-0.1793%)

60447

AT&T Inc

T

38.94

-0.44(-1.1173%)

183346

Boeing Co

BA

136.1

-0.08(-0.0587%)

6763

Caterpillar Inc

CAT

87

-0.23(-0.2637%)

9175

Cisco Systems Inc

CSCO

30.4

0.05(0.1647%)

211

Citigroup Inc., NYSE

C

49.4

-0.08(-0.1617%)

11792

Exxon Mobil Corp

XOM

86.9

-0.27(-0.3097%)

4308

Facebook, Inc.

FB

129.99

-0.12(-0.0922%)

126330

Ford Motor Co.

F

12

-0.01(-0.0833%)

29783

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.95

-0.07(-0.6986%)

12688

General Electric Co

GE

29.11

0.05(0.1721%)

11235

General Motors Company, NYSE

GM

32

0.15(0.471%)

1500

Goldman Sachs

GS

173.8

-0.71(-0.4069%)

2995

Google Inc.

GOOG

800.89

-0.67(-0.0836%)

4791

Home Depot Inc

HD

126.5

0.61(0.4845%)

115

Intel Corp

INTC

35.44

-0.07(-0.1971%)

76726

International Business Machines Co...

IBM

151.35

0.09(0.0595%)

965

International Paper Company

IP

47.83

-0.45(-0.9321%)

1000

Johnson & Johnson

JNJ

114.64

0.05(0.0436%)

2893

JPMorgan Chase and Co

JPM

68.2

-0.15(-0.2195%)

6055

McDonald's Corp

MCD

111.22

-0.04(-0.036%)

295

Microsoft Corp

MSFT

57.6

0.07(0.1217%)

24245

Nike

NKE

51.99

0.19(0.3668%)

750

Pfizer Inc

PFE

32.55

-0.05(-0.1534%)

602

Procter & Gamble Co

PG

85.48

-0.06(-0.0701%)

2515

Starbucks Corporation, NASDAQ

SBUX

53.39

0.24(0.4516%)

1106

Tesla Motors, Inc., NASDAQ

TSLA

201.1

-2.46(-1.2085%)

60340

The Coca-Cola Co

KO

41.95

-0.10(-0.2378%)

7721

Travelers Companies Inc

TRV

113.13

-3.10(-2.6671%)

1175

Twitter, Inc., NYSE

TWTR

17.05

-0.02(-0.1172%)

22951

Verizon Communications Inc

VZ

49.25

-1.13(-2.243%)

478649

Visa

V

83.03

0.22(0.2657%)

14988

Wal-Mart Stores Inc

WMT

69

0.11(0.1597%)

765

Walt Disney Co

DIS

91.75

-0.18(-0.1958%)

2662

Yahoo! Inc., NASDAQ

YHOO

42.78

0.05(0.117%)

2614

Yandex N.V., NASDAQ

YNDX

19.86

0.01(0.0504%)

1000

-

12:43

Upgrades and downgrades before the market open

Upgrades:

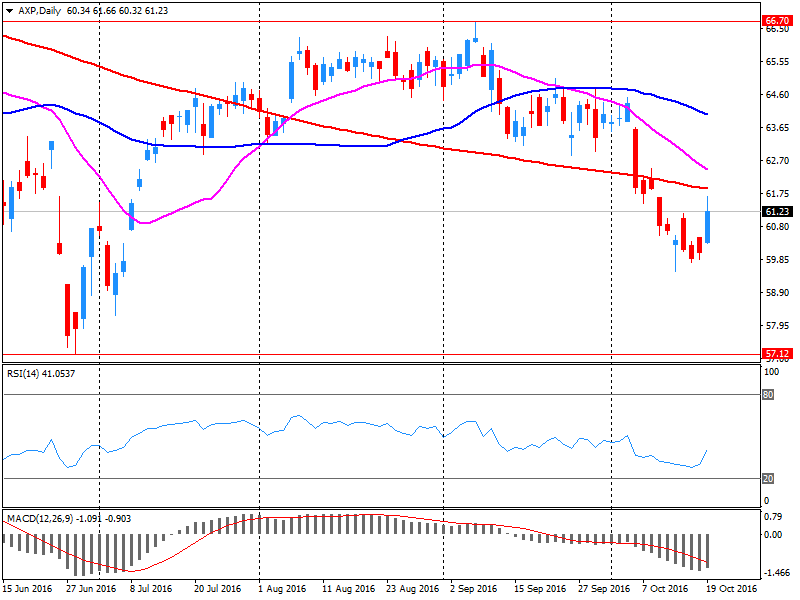

American Express (AXP) upgraded to Neutral from Underperform at BofA/Merrill

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Guggenheim

Other:

American Express (AXP) target lowered to $52 from $57 at RBC Capital

-

12:36

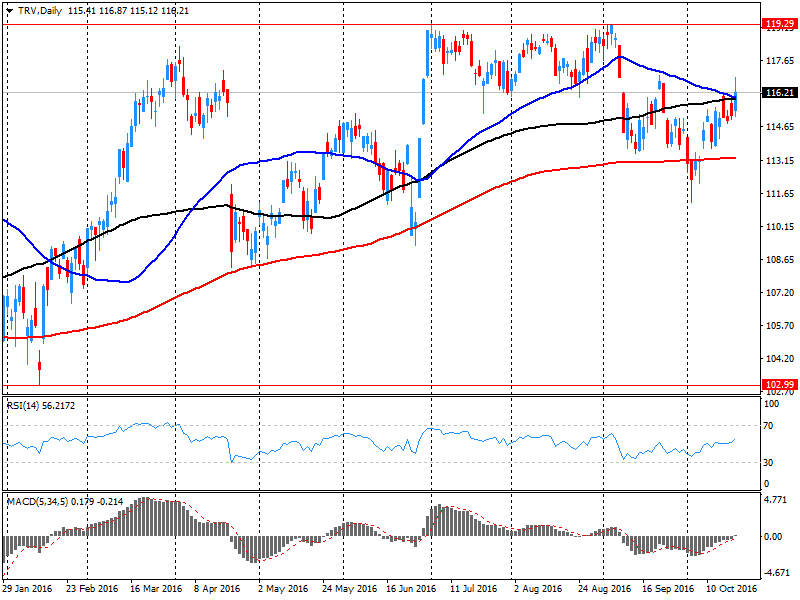

Company News: Travelers (TRV) Q3 results beat analysts’ forecasts

Travelers reported Q3 FY 2016 earnings of $2.40 per share (versus $2.93 in Q3 FY 2015), beating analysts' consensus estimate of $2.36.

The company's quarterly revenues amounted to $6.389 bln (+3.2% y/y), beating analysts' consensus estimate of $6.210 bln.

TRV fell to $114.00 (-1.92%) in pre-market trading.

-

12:31

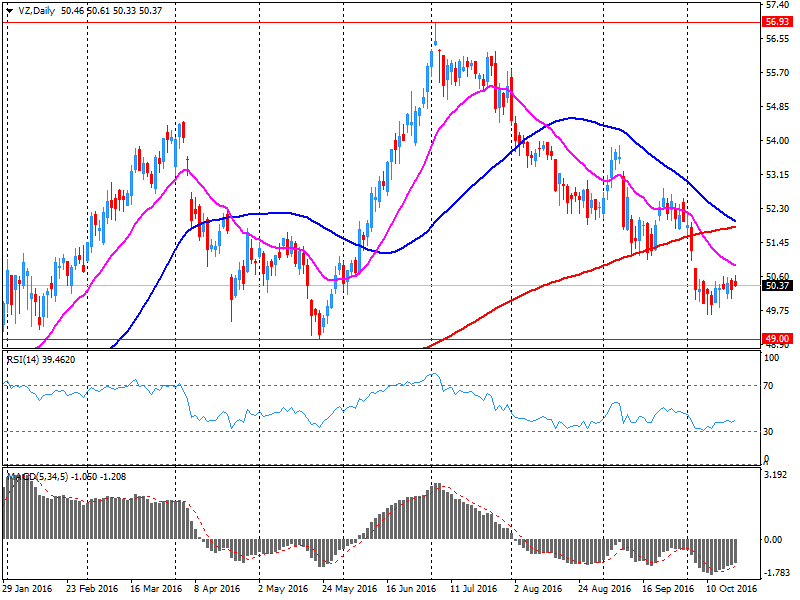

Company News: Verizon (VZ) Q3 EPS beat analysts’ estimate

Verizon reported Q3 FY 2016 earnings of $1.01 per share (versus $1.04 in Q3 FY 2015), beating analysts' consensus estimate of $0.99.

The company's quarterly revenues amounted to $30.937 bln (-6.7% y/y), missing analysts' consensus estimate of $31.066 bln.

VZ fell to $49.12 (-2.50%) in pre-market trading.

-

12:02

Company News: American Express (AXP) Q3 financials beat analysts’ forecasts

American Express reported Q3 FY 2016 earnings of $1.24 per share (versus $1.24 in Q3 FY 2015), beating analysts' consensus estimate of $0.96.

The company's quarterly revenues amounted to $7.774 bln (-5.1% y/y), slightly beating analysts' consensus estimate of $7.713 bln.

The company also raised its FY2016 EPS forecast to $5.90-6.00 from $5.40-5.70 versus analysts' consensus estimate of $5.60. It reaffirmed guidance for FY2017, projecting EPS of at least $5.60 versus analysts' consensus estimate of $5.55.

AXP rose to $65.05 (+6.20%) in pre-market trading.

-

10:37

Major stock indices in Europe trading mixed

European stocks remain near the opening level, move associated with the ECB meeting. In addition, investors continue to closely monitor the corporate reporting.

According to the forecast, ECB will leave the benchmark interest rate at zero and the deposit rate will remain at around -0.4%, while the marginal rate will remain at 0.25%. Most economists also expect that the Central Bank will hint at the possibility of extending the QE program, but a decision is unlikely to take place before December. "The tone of the ECB's statements probably signals a tendency to soft policy. We believe that the Central Bank refutes information about folding QE program until December and will not disclose details of the extension of the program. Perhaps in December, the ECB will extend the QE program until September 2017 and will adjust its structure ", - stated Bank of America Merrill Lynch.

The composite index of the largest companies in the region Stoxx Europe 600 trading lower by 0.05 percent. VStoxx Index, which measures the predicted volatility is dropping the third day in a row, and is now trading near a month low.

Capitalization of Publicis Groupe SA fell 6 percent after a report showed that the income of the French advertising company has not justified forecasts of experts in the 3rd quarter.

GEA Group has collapsed by 19 per cent, as the German engineering group said it expects a decrease in sales by the end of 2016.

Shares of Nestle SA fell 0.8 percent as the world's largest food company lowered its annual sales forecast.

The price Actelion shares It fell 3.1 percent after an improved outlook for the Swiss drugmaker earnings did not meet estimates.

Deutsche Lufthansa AG rose 7.8 percent after raising its forecast for airline profits.

At the moment:

FTSE 100 -4.46 7017.46 -0.06

DAX +28.73 10674.41 + 0.27%

CAC 40 +12.40 4532.70 + 0.27%

-

07:28

Major stock markets trading in the green zone: FTSE -0.1%, DAX + 0.2%, CAC40 + 0.1%, FTMIB + 0.2%, IBEX + 0.3%

-

06:52

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.4%, CAC 40 + 0.3%, FTSE + 0.3%

-

05:16

Global Stocks

U.K. stocks reversed course to finish higher Wednesday, supported by a rally in oil prices, but Travis Perkins PLC shares were hammered as the building products supplier flagged rough conditions stemming from the Brexit referendum. Oil extended its rally after the U.S. Energy Information Administration unexpectedly reported that weekly domestic crude supplies dropped by 5.2 million barrels. Analysts polled by S&P Global Platts expected a climb of 2.5 million barrel climb.

U.S. stocks closed higher for a second session Wednesday, boosted by a rally in the energy sector and stronger-than-expected quarterly results from Morgan Stanley. The Federal Reserve's Beige Book, an anecdotal economic survey, also indicated that the U.S. economy continues its modest, albeit steady, expansion.

Asian stocks advanced on Thursday, propelled by strong U.S. earnings and oil prices near a 15-month high, as the third and final U.S. presidential debate before the Nov. 8 election ended. In the final debate between Republican presidential candidate Donald Trump and Democrat Hillary Clinton, Trump tried to reverse the momentum in an election that polls show is tilting away from him.

-