Market news

-

23:30

Commodities. Daily history for Nov 14’2016:

(raw materials / closing price /% change)

Oil 43.72 +0.92%

Gold 1,221.00 -0.06%

-

15:50

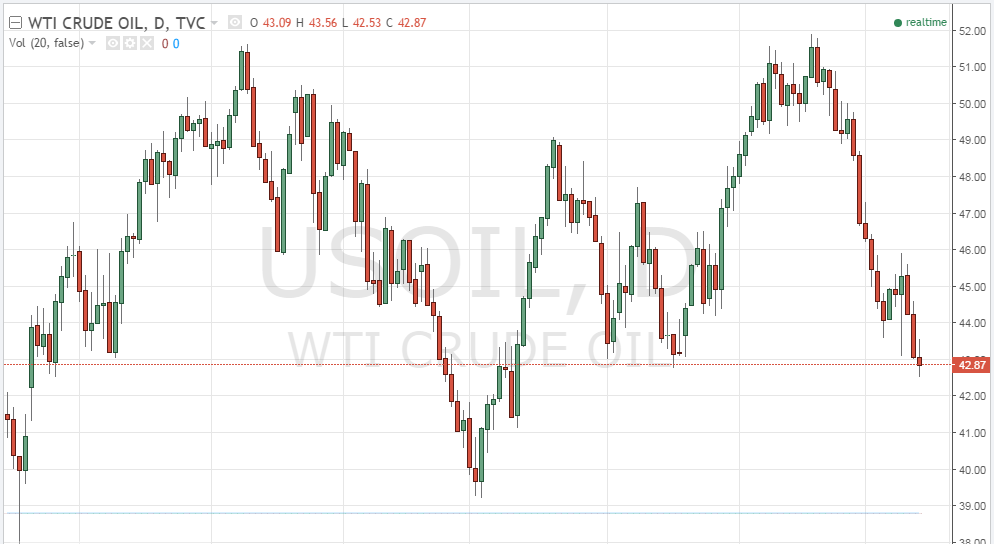

Crude oil futures have stabilized somewhat

Crude oil futures continued to collapse Monday morning amid a stronger dollar and after the IEA warned about a worsening supply glut, according to rttnews.

Meanwhile, OPEC's Monthly Oil Market Report revealed daily oil production for the cartel of 33.64 million barrels for October.

That's up by 240,000 bpd from September.

Elsewhere, the IEA predicted a 500,000-barrel increase in oil production outside the cartel for 2017.

WTI light sweet crude oil was down 72 cents at $42.70 a barrel, its lowest since mid-summer.

-

15:26

Gold continue to decline

Gold price was trading down Monday in London, pressured by a stronger U.S. dollar in the aftermath of Donald Trump's victory in the U.S. presidential election, says Dow Jones.

The Wall Street Journal Dollar Index, which weighs the dollar against a basket of other currencies, was up 0.8%. A stronger dollar is bearish for gold, which is priced in the greenback.

"Gold is still facing considerable headwind: the U.S. dollar is continuing to appreciate," said analysts at Commerzbank.

The prospect of the U.S. Federal Reserve hiking interest rates in December is also pressuring investor sentiment in gold, which doesn't bear interest so struggles to compete when rates rise.

Traders in the market for Fed-funds futures, derivatives used to bet on the timing of Fed interest-rate decisions, reflect an 81% probability of a rate rise by December, according to CME Group.

Among other precious metals, silver fell 0.9% to $17.23 an ounce, platinum shed 0.3% to $940.60 an ounce, and palladium fell 1.5% to $674.20 an ounce.

-

09:26

Oil is trading lower

This morning, the New York futures for Brent dropped 0.48% to $ 43.20 and WTI fell 0.36% to $ 44.59 per barrel. Thus, the black gold is traded in the red zone on the background of an increase in production in the OPEC countries, as well as an increase in the number of drilling rigs in the United States. Recall Friday, the cartel said that in October, oil production was higher by nearly 240 thousand barrels per day as compared to September, up to 33.64 million barrels per day. On Thursday, November 10, the International Energy Agency (IEA) also stated that total production of oil increased 230 thousand barrels per day as compared to September, to a record high of 33.83 million barrels per day.

-