Market news

-

23:31

Stocks. Daily history for Jan 10’2017:

(index / closing price / change items /% change)

Nikkei -152.89 19301.44 -0.79%

TOPIX -11.01 1542.31 -0.71%

Hang Seng +186.16 22744.85 +0.83%

CSI 300 -5.63 3358.27 -0.17%

Euro Stoxx 50 -2.76 3306.21 -0.08%

FTSE 100 +37.70 7275.47 +0.52%

DAX +19.31 11583.30 +0.17%

CAC 40 +0.66 4888.23 +0.01%

DJIA -31.85 19855.53 -0.16%

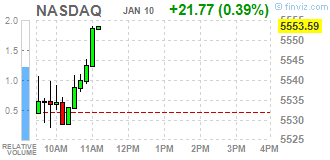

NASDAQ +20.00 5551.82 +0.36%

S&P/TSX +37.33 15426.28 +0.24%

-

20:00

DJIA 19877.18 -10.20 -0.05%, NASDAQ 5550.50 18.68 0.34%, S&P 500 2270.91 2.01 0.09%

-

17:00

European stocks closed: FTSE 7275.47 37.70 0.52%, DAX 11583.30 19.31 0.17%, CAC 4888.23 0.66 0.01%

-

16:29

WSE: Session Results

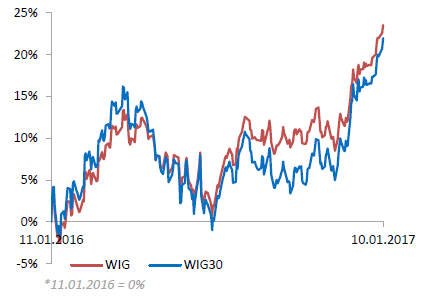

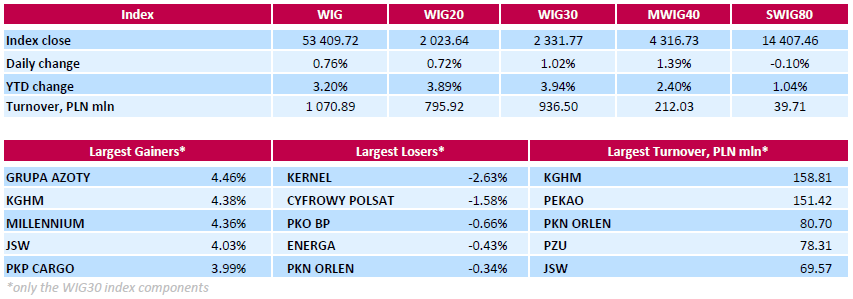

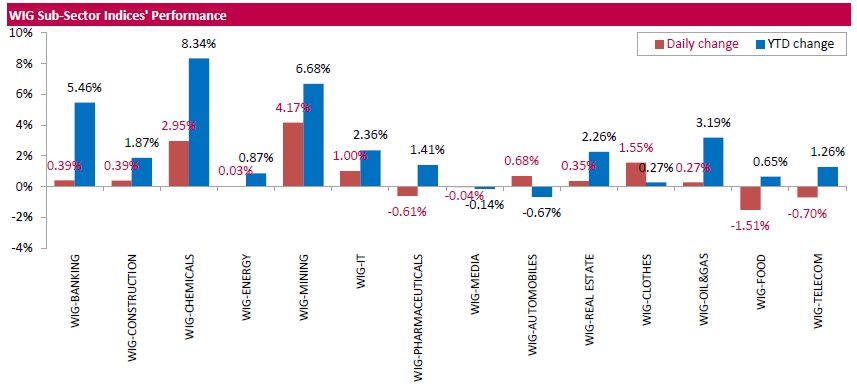

Polish equity market continued its upward trajectory on Tuesday. The broad market measure, the WIG Index, added 0.76%. The WIG sub-sector indices were mainly higher with mining stock gauge (+4.17%) outperforming.

The large-cap companies' measure, the WIG30 Index, recorded a 1.02% gain. A majority of the index components generated positive returns. The exception were agricultural producer KERNEL (WSE: KER), media group CYFROWY POLSAT (WSE: CPS), bank PKO BP (WSE: PKO), oil refiner PKN ORLEN (WSE: PKN) and three utilities names ENERGA (WSE: ENG), PGE (WSE: PGE) and ENEA (WSE: ENA), declining between 0.1% and 2.63%. At the same time, chemical producer GRUPA AZOTY (WSE: ATT) was the strongest performer with a 4.46% advance, followed by copper producer KGHM (WSE: KGH), bank MILLENNIUM (WSE: MIL) and coking coal miner JSW (WSE: JSW)), which quotations went up by 4.38%, 4.36% and 4.03% respectively.

-

16:14

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock indexes slightly rose on Tuesday. Banks have led a record-breaking run in U.S. equities since Donald Trump's election on Nov 8. But the rally's momentum has stalled of late as investors now wait to see if he can deliver on his promises of fiscal stimulus. The U.S. President-elect will hold a news conference on Wednesday, his first since his election.

Most of Dow stocks in positive area (19 of 30). Top gainer - Caterpillar Inc. (CAT, +1.56%). Top loser - International Business Machines Corporation (IBM, -0.72%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+0.6%). Top loser - Utilities (-0.1%).

At the moment:

Dow 19837.00 +9.00 +0.05%

S&P 500 2267.00 +2.00 +0.09%

Nasdaq 100 5027.75 +5.75 +0.11%

Oil 51.27 -0.69 -1.33%

Gold 1188.60 +3.70 +0.31%

U.S. 10yr 2.37 0.00

-

14:53

WSE: After start on Wall Street

After yesterday's withdrawal the US market today began trading at a neutral level. For the Warsaw market it does not matter, we are relatively stronger and the WIG20 index remains at a safe height above the level of 2,000 points. An hour before the close of trading it was 2,030 points (+ 1.04%).

-

14:36

Yahoo! (YHOO) will change its name and will reduce the composition of the Board of Directors after the deal with Verizon Communications (VZ)

-

14:34

U.S. Stocks open: Dow -0.20%, Nasdaq +0.13%, S&P -0.04%

-

14:28

Before the bell: S&P futures -0.04%, NASDAQ futures -0.01%

U.S. stock-index futures were flat as investors await U.S. President-elect Donald Trump's news conference (due on Wednesday) and the begining of the earnings season (due this week).

Global Stocks:

Nikkei 19,301.44 -152.89 -0.79%

Hang Seng 22,744.85 +186.16 +0.83%

Shanghai 3,161.89 -9.34 -0.29%

FTSE 7,258.71 +20.94 +0.29%

CAC 4,888.49 +0.92 +0.02%

DAX 11,578.92 +14.93 +0.13%

Crude $52.18 (+0.42%)

Gold $1,182.00 (-0.24%)

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30

0.52(1.7639%)

17280

Amazon.com Inc., NASDAQ

AMZN

797.03

0.11(0.0138%)

4841

American Express Co

AXP

76.26

0.40(0.5273%)

1521

Apple Inc.

AAPL

118.94

-0.05(-0.042%)

51125

AT&T Inc

T

40.64

-0.16(-0.3922%)

6225

Barrick Gold Corporation, NYSE

ABX

30

0.52(1.7639%)

17280

Caterpillar Inc

CAT

92.99

0.62(0.6712%)

1720

Chevron Corp

CVX

115.66

-0.18(-0.1554%)

3979

Cisco Systems Inc

CSCO

30.15

-0.03(-0.0994%)

871

Citigroup Inc., NYSE

C

60.14

-0.08(-0.1328%)

468

Facebook, Inc.

FB

124.88

-0.02(-0.016%)

46952

Ford Motor Co.

F

12.65

0.02(0.1584%)

26288

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.28

0.60(4.0872%)

379016

General Motors Company, NYSE

GM

36.31

0.30(0.8331%)

1400

Google Inc.

GOOG

807.75

1.10(0.1364%)

1481

JPMorgan Chase and Co

JPM

86.1

-0.08(-0.0928%)

935

Microsoft Corp

MSFT

62.65

0.01(0.016%)

18227

Nike

NKE

53.42

0.04(0.0749%)

14522

Procter & Gamble Co

PG

84.39

-0.01(-0.0118%)

200

Tesla Motors, Inc., NASDAQ

TSLA

230.78

-0.50(-0.2162%)

5991

The Coca-Cola Co

KO

41.3

-0.02(-0.0484%)

25501

Travelers Companies Inc

TRV

115.53

-1.79(-1.5257%)

521

Verizon Communications Inc

VZ

52.66

-0.02(-0.038%)

3067

Visa

V

81.8

0.05(0.0612%)

14088

Walt Disney Co

DIS

108.09

-0.27(-0.2492%)

11063

Yahoo! Inc., NASDAQ

YHOO

41.8

0.46(1.1127%)

8001

-

13:49

Upgrades and downgrades before the market open

Upgrades:

American Express (AXP) upgraded to Outperform from Perform at Oppenheimer

Downgrades:

Chevron (CVX) downgraded to Hold from Buy at HSBC Securities

Travelers (TRV) downgraded to Sell from Neutral at Goldman

Goldman Sachs (GS) downgraded to Sell from Neutral at Citigroup

Other:

-

12:01

WSE: Mid session comment

In the forenoon phase of today's session, the Warsaw market has consistently realized the growth plan. At the halfway point of trading the level of turnover in the blue chips segment was amounted to PLN 350 million, what is a quite good result. The market is strong and the WIG20 index remains more than 20 points above the level of 2,000 points. Among the largest companies the leader of growth is KGH with approx. 3% rate of increase To favor returned JSW (component of the WIG40 index), which shares gaining over 6%.

In the middle of trading the WIG20 index was at the level of 2.027 points (+0,89%).

-

11:46

Major European stock indices trading in the green zone

European stock indices show a slight increase, fueled by the financial results of companies, as well as higher prices of commodities. At the same time, the British FTSE 100 continues to update the historical highs against the backdrop of sterling's fall.

Some influence on the course of trading provided statistics from Britain and France. According to the British Retail Consortium (BRC) comparable retail sales in the UK in December increased by 1% compared to the same month a year ago. Head of retail department, Paul Martin said that retailers were lucky with the timing. The fact that Christmas fell on Sunday, giving customers the chance to use the weekend for final purchases in shops, which increased sales.

Meanwhile, the statistical office Insee said that the volume of industrial production in France rose in November by 2.2% compared with a decrease of 0.1% in October. Economists had forecast growth of only 0.6%. Thus the data significantly exceeded the expectations of most experts and were the most positive in the last three months. Production of coking coal and refined petroleum products increased by 6.3%, transport equipment by 3.4%. The volume of mineral production grew by 1.5%. Meanwhile, construction fell in November by 0.3%, after rising 2% in the previous month.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.03 percent, to 363.79. Shares of automobile companies also rose 0.4 percent after the German automaker Volkswagen said that the steady growth of sales in China and Eastern Europe helped offset losses from environmental scandal in major markets. Shares of Volkswagen rose about 1 percent.

Banking stocks show a negative dynamics, as in the Italian banking shows new problems. Popolare di Vicenza and Veneto Banca, which were saved in the past year, have to offer a deal to shareholders, which could cost the banks more than 600 million euros.

Capitalization of WM Morrison rose 4.2 percent after the British retailer has improved its forecast for profit in response to the very high volume of Christmas sales for the past seven years.

Tesco value increased by 4.4 percent, as the retailer recorded the bigest sales among the four largest supermarkets during the 4th quarter of 2016.

At the moment:

FTSE 100 +25.99 7263.76 + 0.36%

DAX +24.74 11588.73 + 0.21%

CAC 40 +4.78 4892.35 + 0.10%

-

08:39

Major stock markets in Europe trading mixed: FTSE + 0.2%, new record high of 7,256.94, DAX + 0.2%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX -0.2%

-

08:17

WSE: Before opening

WIG20 index opened at 2007.40 points (-0.09%)*

WIG 53095.46 0.17%

WIG30 2312.97 0.20%

mWIG40 4264.40 0.16%

*/ - change to previous close

The cash market started the day from a small discount at modest turnover traditionally focused on KGHM shares. After the first transaction we go up and course of the WIG20 index rises clearly above the level of 2,000 points. In Europe the German DAX gaining approx. 0.2%.

After fifteen minutes of trading the WIG 20 index reached the level of 2,014 points (+ 0.25%).

-

07:22

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.2%

-

07:14

WSE: Before opening

Monday's session on the New York stock exchange has brought a historical record of the Nasdaq Comp., which was driven by increases of biotech companies, but also declines in the Dow Jones and S&P 500. The dollar weakened against the yen and euro. Heavily dropped the price of crude oil. The Nasdaq Comp. went up at the close of 0.19 percent, the Dow Jones Industrial fell 0.38 percent. while the S&P 500 lost 0.35 percent.

Yesterday the Warsaw Stock Exchange managed to breach the 2,000 point barrier for the WIG20 index, even under the adverse conditions. Now this movement requires confirmation, and the environment for doing it has not changed and remains unfavorable.

At the beginning of today's session there is no positive information. The British pound remains weak, oil become cheaper and gold was strengthened by uncertainty. In the morning, contracts in the US are slightly weaker. In Asia, the Nikkei lost 0.8% and the only consolation is better behavior of the remaining Asian parquets.

Today's macro calendar does not bring readings valuable for investors. In addition, publication of the results of the Alcoa company has been postponed to January 24. The only plus in the morning is the increase in copper prices.

Polish Finance Ministry confirmed earlier information that is prepared a plan to increase the taxation of foreign currencies assets of the banks to encourage them to voluntary conversion of loans denominated in foreign currencies to the zloty. It is a reminder about the ongoing problem of the domestic banking sector.

-

06:14

Global Stocks

European stocks lost altitude Monday, with Lufthansa, Fresenius and William Hill among the biggest losers after they gave discouraging updates on their businesses.

U.S. stocks retreated Monday as the Dow Jones Industrial Average pulled back further from the psychologically significant 20,000 milestone, although the Nasdaq bucked the weak trend to finish at an all-time closing high for a second session in a row. Equities have been strong performers recently, highlighted by a nearly 10% climb over the past three months. Most of the gains in stocks have been the result of the presidential election in the U.S. Investors have bet that the policies president-elect Donald Trump is expected to support will accelerate economic growth - a bullish scenario for stocks.

China's consumer inflation slowed in December, losing speed for the first time in four months, but producer inflation quickened at a pace much faster than economists expected, official data showed Tuesday. China's consumer price index increased 2.1% in December from a year earlier, rising at slower pace than a 2.3% year-over-year gain in November, the National Bureau of Statistics said, adding that a higher base for comparison from the year-earlier period was the main factor weighing on the headline figure.

-