Market news

-

23:25

Stocks. Daily history for Jan 30’2017:

(index / closing price / change items /% change)

Nikkei -98.55 19368.85 -0.51%

TOPIX -5.48 1543.77 -0.35%

FTSE 100 -66.01 7118.48 -0.92%

DAX -132.38 11681.89 -1.12%

CAC 40 -55.34 4784.64 -1.14%

DJIA -122.65 19971.13 -0.61%

S&P 500 -13.79 2280.90 -0.60%

NASDAQ -47.07 5613.71 -0.83%

S&P/TSX -170.69 15405.12 -1.10%

-

21:06

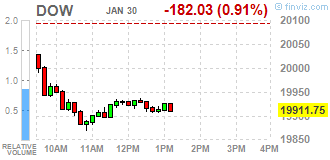

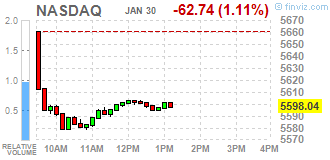

Major US stock indexes finished trading in negative territory

Major stock indexes in Wall Street closed in the red, as the decision of the President of Donald Trump to restrict entry and immigration to the United States from certain countries has caused uncertainty in the market. Thus, according to the presidential decree, the United States for 120 days suspend the refugee-hosting the program for 90 days and close the entrance for people from several countries with a predominantly Muslim population.

In addition, as it became known today, US consumer spending increased significantly in December, as households have purchased cars and a wide range of services amid rising wages, pointing to robust domestic demand, which could push the economy up to the more rapid growth in early 2017 of the year. The Commerce Department reported that consumer spending, which accounts for over two-thirds of US economic activity, rose 0.5% after growth of 0.2% in November. Economists forecast that consumer spending will grow by 0.5% last month. Consumer spending increased by 3.8% in 2016 after rising by 3.5% in 2015.

However, data provided by the Federal Reserve Bank of Dallas, showed that business activity Texas manufacturers rose again in January, registering the fifth consecutive monthly increase. According to the report, the Dallas Fed manufacturing index in January rose to 22.1 points from 17.7 points in December (revised from 15.5 points). Economists had expected the index to fall to 15.0 points. Recall index value above zero indicates growth in business activity.

Oil prices declined by about 1% as the news about the next increase in drilling activity in the US overshadowed the optimism of market participants regarding the conditions of production by OPEC reduction agreement. On Friday, Baker Hughes reported that according to the results ended Jan. 27 working weeks in the number of US rigs increased by 18 units to 712 units. The annualized figure rose to 93 pieces, or 15%.

DOW index components closed mostly in the red (24 of 30). Most remaining shares fell Caterpillar Inc. (CAT, -2.29%). Leaders of growth were shares of The Walt Disney Company (DIS, + 1.24%).

All business sectors S & P index finished trading in the red. Сonglomeratessectors fell most (-2.1%) .

At the close:

Dow -0.57% 19,970.03 -114.33

Nasdaq -0.83% 5,613.71 -47.07

S & P -0.55% 2,280.75 -12.61

-

20:00

DJIA -0.76% 19,931.66 -152.70 Nasdaq -0.96% 5,606.36 -54.42 S&P -0.75% 2,276.19 -17.17

-

18:20

Wall Street. Major U.S. stock-indexes fell

Majot U.S. stock-indexes were set for their worst day in more than three months on Monday, as President Donald Trump's orders to curb travel and immigration from some countries sparked uncertainty. Trump on Friday signed executive orders to suspend travel to the United States from seven Muslim-majority countries on grounds of national security, while also banning refugees from Syria.

Ком

Most of Dow stocks in negative area (27 of 30). Top loser - Caterpillar Inc. (CAT, -2.18%). Top gainer - Wal-Mart Stores, Inc. (WMT, +0.88%).

All S&P sectors in negative area. Top loser - Conglomerates (-2.0%).

At the moment:

Dow 19852.00 -160.00 -0.80%

S&P 500 2270.25 -18.75 -0.82%

Nasdaq 100 5114.75 -47.75 -0.92%

Oil 52.68 -0.49 -0.92%

Gold 1198.50 +7.40 +0.62%

U.S. 10yr 2.49 +0.01

-

17:00

European stocks closed: FTSE 100 -66.01 7118.48 -0.92% DAX -132.38 11681.89 -1.12% CAC 40 -55.34 4784.64 -1.14%

-

16:36

WSE: Session Results

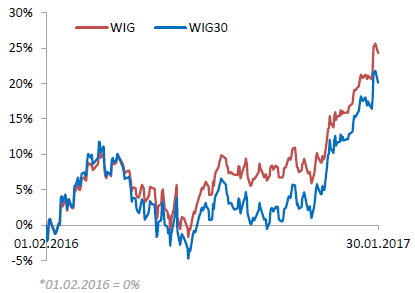

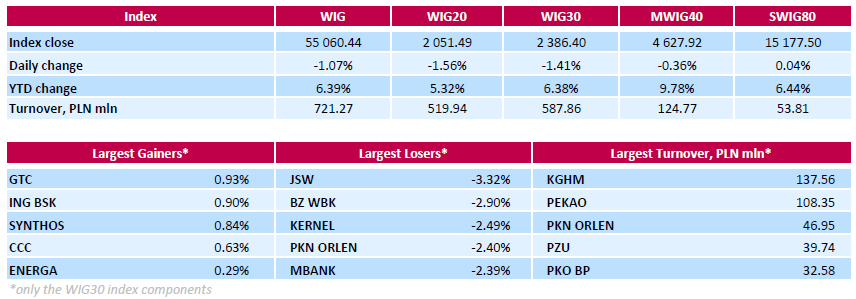

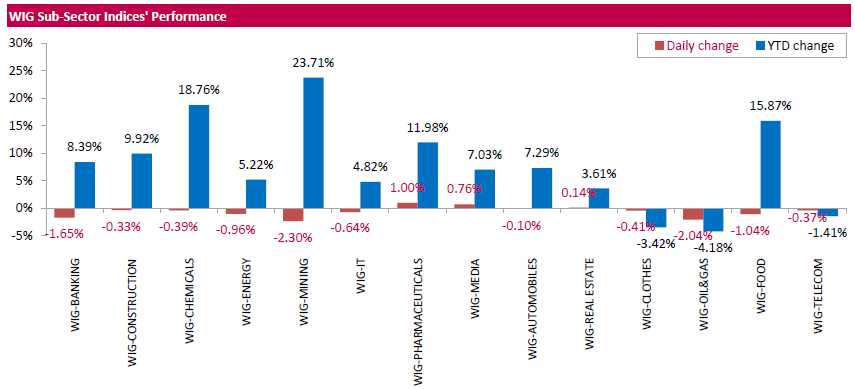

Polish equity market closed lower on Monday. The broad market measure, the WIG Index, declined by 1.07%, breaking a four day winning streak. The WIG sub-sector indices mostly closed in negative territory, with mining stocks benchmark, the WIG-MINING Index, (-2.3%) lagging behind.

The large-cap stocks' gauge, the WIG30 Index, dropped by 1.41%. A majority of the index components retreated, with coking coal miner JSW (WSE: JSW) underperforming with a 3.32% decline. Other major laggards were agricultural producer KERNEL (WSE: KER), oil refiner PKN ORLEN (WSE: PKN), copper producer KGHM (WSE: KGH) and three banking names BZ WBK (WSE: BZW), MBANK (WSE: MBK) and PEKAO (WSE: PEO), which tumbled by 2.14%-2.9%. At the same time, the few gainers included property developer GTC (WSE: GTC), bank ING BSK (WSE: ING), chemical producer SYNTHOS (WSE: SNS), footwear retailer CCC (WSE: CCC) and genco ENERGA (WSE: ENG), advancing by 0.29%-0.93%.

-

14:54

WSE: After start on Wall Street

The US market started from a discount of 0.42%, which leads to a large, such for the American conditions, downward gap. This is not a good signal, also for the Warsaw market. After spoiling the mood by Americans, our indices also went down slightly, and an hour before the close of trading the WIG20 index was at the level of 2,066 points (-0,85%).

-

14:32

U.S. Stocks open: Dow -0.38%, Nasdaq -0.48%, S&P -0.43%

-

14:24

Before the bell: S&P futures -0.33%, NASDAQ futures -0.31%

U.S. stock-index futures fell as investors assessed the implications of President Trump's executive order on immigration and the latest statistics on personal income/spending in the U.S.

Global Stocks:

Nikkei 19,368.85 -98.55 -0.51%

Hang Seng - Closed

Shanghai - Closed

FTSE 7,127.94 -56.55 -0.79%

CAC 4,801.96 -38.02 -0.79%

DAX 11,730.13 -84.14 -0.71%

Crude $53.13 (-0.08%)

Gold $1,191.80 (+0.29%)

-

13:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.45

-0.22(-0.5999%)

3011

ALTRIA GROUP INC.

MO

56.55

-0.56(-0.9806%)

12008

Amazon.com Inc., NASDAQ

AMZN

831.4

-4.37(-0.5229%)

12398

American Express Co

AXP

76.77

-0.08(-0.1041%)

5675

Apple Inc.

AAPL

121.11

-0.84(-0.6888%)

104591

AT&T Inc

T

41.9

-0.11(-0.2618%)

1146

Barrick Gold Corporation, NYSE

ABX

17.94

0.15(0.8432%)

58082

Caterpillar Inc

CAT

98.4

-0.59(-0.596%)

4107

Chevron Corp

CVX

113.32

-0.47(-0.413%)

2339

Cisco Systems Inc

CSCO

30.88

-0.10(-0.3228%)

8026

Citigroup Inc., NYSE

C

56.55

-0.56(-0.9806%)

12008

Deere & Company, NYSE

DE

107.34

-0.65(-0.6019%)

705

E. I. du Pont de Nemours and Co

DD

77.22

-0.48(-0.6178%)

1806

Exxon Mobil Corp

XOM

85.25

-0.26(-0.3041%)

3061

Facebook, Inc.

FB

131.66

-0.52(-0.3934%)

114228

FedEx Corporation, NYSE

FDX

194

-1.92(-0.98%)

300

Ford Motor Co.

F

12.44

-0.05(-0.4003%)

24998

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.2

-0.17(-1.0385%)

43864

General Electric Co

GE

29.88

-0.13(-0.4332%)

13401

Goldman Sachs

GS

235

-1.95(-0.823%)

1783

Google Inc.

GOOG

818.06

-5.25(-0.6377%)

5893

Home Depot Inc

HD

137.71

-0.62(-0.4482%)

1897

Intel Corp

INTC

37.82

-0.16(-0.4213%)

21021

International Business Machines Co...

IBM

176.91

-0.39(-0.22%)

4886

JPMorgan Chase and Co

JPM

86.33

-0.60(-0.6902%)

6230

McDonald's Corp

MCD

122.44

-0.42(-0.3419%)

940

Merck & Co Inc

MRK

61.53

-0.22(-0.3563%)

1068

Microsoft Corp

MSFT

65.56

-0.22(-0.3345%)

60218

Pfizer Inc

PFE

31.45

0.03(0.0955%)

15905

Procter & Gamble Co

PG

86.5

-0.22(-0.2537%)

150

Starbucks Corporation, NASDAQ

SBUX

55.85

-0.27(-0.4811%)

12455

Tesla Motors, Inc., NASDAQ

TSLA

252.1

-0.85(-0.336%)

23623

The Coca-Cola Co

KO

41.4

-0.05(-0.1206%)

769

Twitter, Inc., NYSE

TWTR

16.59

0.02(0.1207%)

38894

Verizon Communications Inc

VZ

49.36

-0.24(-0.4839%)

4332

Visa

V

83.2

-0.57(-0.6804%)

650

Wal-Mart Stores Inc

WMT

65.4

-0.26(-0.396%)

5208

Walt Disney Co

DIS

109.76

0.46(0.4209%)

64727

Yandex N.V., NASDAQ

YNDX

23.38

-0.25(-1.058%)

1159

-

13:42

Upgrades and downgrades before the market open

Upgrades:

American Express (AXP) upgraded to Outperform from Mkt Perform at Keefe Bruyette

Walt Disney (DIS) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

DuPont (DD) downgraded to Hold from Buy at Argus

Other:

-

13:37

Earnings Season in U.S.: Major Reports of the Week

January 31

Before the Open:

Exxon Mobil (XOM). Consensus EPS $0.71, Consensus Revenues $60904.92 mln.

Pfizer (PFE). Consensus EPS $0.51, Consensus Revenues $13689.67 mln.

After the Close:

Apple (AAPL). Consensus EPS $3.23, Consensus Revenues $77107.67 mln.

Arconic (ARNC). Consensus EPS $0.18, Consensus Revenues $3041.08 mln.

February 1

Before the Open:

Altria (MO). Consensus EPS $0.67, Consensus Revenues $4798.25 mln.

After the Close:

Facebook (FB). Consensus EPS $1.31, Consensus Revenues $8494.58 mln.

February 2

Before the Open:

Intl Paper (IP). Consensus EPS $0.71, Consensus Revenues $5319.52 mln.

Merck (MRK). Consensus EPS $0.89, Consensus Revenues $10233.89 mln.

After the Close:

Amazon (AMZN). Consensus EPS $1.42, Consensus Revenues $44689.93 mln.

Visa (V). Consensus EPS $0.78, Consensus Revenues $4278.65 mln.

-

12:04

WSE: Mid session comment

In the first hour of today's trading the Warsaw market presented better than its surrounding. Into the southern phase of trade we have already entered with the discount in the main index of 0.8%, which meant a good correlation with similar declines in the environment. Weaker posture present today the banks sector, which index go down by more than 1%. Still we have to deal with poor investor's activity.

At the halfway point of today's quotations the WIG20 index was at the level of 2,070 points (-0,65%). The turnover in the segment of biggest companies was amounted to PLN 195 million.

-

08:34

Major stock markets in Europe trading in the red zone: FTSE -0.6%, DAX -0.5%, CAC40 -0.4%, FTMIB -1.0%, IBEX -0.6%

-

08:18

WSE: After opening

WIG20 index opened at 2082.83 points (-0.06%)*

WIG 55651.36 -0.01%

WIG30 2417.56 -0.12%

mWIG40 4655.10 0.23%

*/ - change to previous close

The cash market (the WIG20 index) started the day from a modest discount at moderate turnover. Positively at the opening performed Polimex (WSE: PXM) and GetinNoble Bank (WSE: GTN) where for this second company fosters information about a possible sale of the Idea Bank, which means that the funds will go to recapitalize GetinNoble. The wide market is dominated by increases, what means that the condition of the market at the beginning of the week specifically does not change.

After fifteen minutes of trading the WIG20 index was at the level of 2,083 points (-0,01%).

-

07:39

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.4%, FTSE -0.4%

-

07:28

WSE: Before opening

Today's morning, the capital market has shown some shift away from risk, especially in the form of a lower opening of contracts in the United States. This may be due to the fact that in the US President Donald Trump shifted attention back to protectionism. As for the regulation issued blocking the possibility of the arrival of refugees and immigrants from seven Arab countries. This sparked protests and some legal confusion in the country. In Asia because of the new year will not work exchanges in six countries: China, Hong Kong, Taiwan, South Korea, Singapore and Malaysia.

The Japan Nikkei has lost 0.5%. On the commodity market there is also seen a downward pressure on prices, though small. The macro calendar at the beginning of the week will be calm, we will see the publication of the revenue and expenditure of the Americans, which rather should not confuse a lot on the market, unless indeed will differ from expectations.

The beginning of the new week brings a slightly stronger zloty, mainly in relation to the US dollar. Polish currency is valued by investors as follows: PLN 4.3338 per euro, 4.0440 against the US dollar and PLN 5.0732 in relation to the pound sterling.

-

06:32

Global Stocks

European stocks fell from a 13-year high on Friday, closing in negative territory as UBS Group PLC lead banking shares lower after a financial update. The Stoxx Europe 600 index SXXP, -0.30% shed 0.3% to 366.38, trimming its weekly gain to 1.1%.

U.S. stocks closed mostly lower on Friday after a monumental week that pushed the Dow Jones Industrial Average above 20,000 for the first time as investors weighed disappointing fourth-quarter data on domestic economic growth and a spate of earnings.

President Donald Trump's executive order on immigration and muted American GDP data have put traders in Asia back into risk-off positions, though many markets in the region are on a holiday break. Late Friday, Trump suspended the U.S. refugee program for four months and banned for 90 days entry into the U.S. for nationals from Iran, Iraq, Libya, Somali, Sudan, Syria and Yemen.

-