Noticias del mercado

-

23:57

Schedule for today, Wednesday, May 4’2016:

(time / country / index / period / previous value / forecast)

06:45 France Trade Balance, bln March -5.18 -4.4

07:50 France Services PMI (Finally) April 49.9 50.8

07:55 Germany Services PMI (Finally) April 55.1 54.6

08:00 Eurozone Services PMI (Finally) April 53.1 53.2

08:30 United Kingdom PMI Construction April 54.2 54

09:00 Eurozone Retail Sales (MoM) March 0.2% -0.1%

09:00 Eurozone Retail Sales (YoY) March 2.4% 2.6%

11:00 U.S. MBA Mortgage Applications April -4.1%

12:15 U.S. ADP Employment Report April 200 194

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter I 3.3% 3.3%

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter I -2.2% -1.5%

12:30 U.S. International Trade, bln March -47.06 -41.5

13:45 U.S. Services PMI (Finally) April 51.3 52.1

14:00 U.S. Factory Orders March -1.7% 0.6%

14:00 U.S. ISM Non-Manufacturing April 54.5 54.7

14:30 U.S. Crude Oil Inventories April 1.999

-

21:29

U.S.: Total Vehicle Sales, mln, April 17.4 (forecast 17.3)

-

21:00

Dow -0.72% 17,761.58 -129.58 Nasdaq -0.92% 4,773.21 -44.38 S&P -0.85% 2,063.84 -17.59

-

20:21

American focus: the US dollar significantly higher against most major currencies

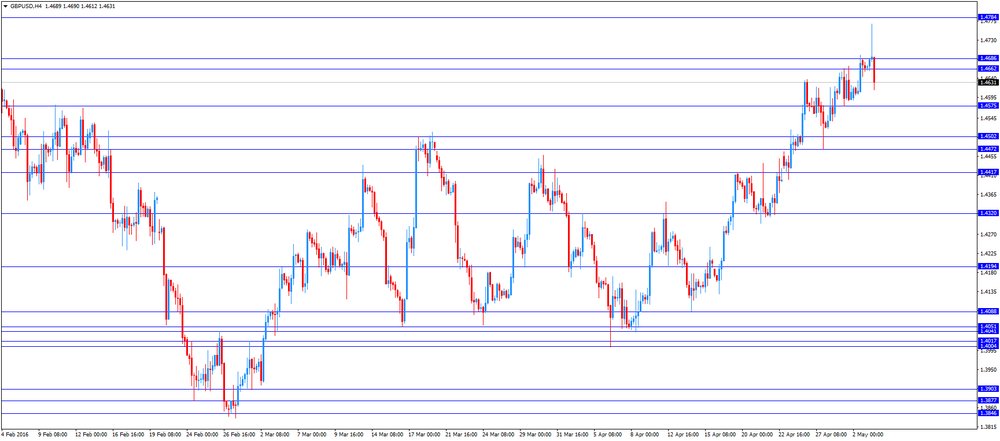

The British pound dropped significantly against the dollar, reaching a minimum of 28 April, which was caused by the publication of weak data on the UK and increased demand for the US currency ahead of the release of statistics on the labor market. In addition, some investors opted to take profits after the rise of the pair to a new 3-month high. As it became known, the business activity index of the manufacturing sector by Markit UK in April fell to 49.2 from 50.7 the previous value. Analysts had expected the index to rise to 51.2. Thus, the figure fell below the neutral value of 50 for the first time since March of 2013. The most significant decrease in activity is observed in the segment of consumer and investment goods. Investors are more likely to decide not to spend money in anticipation of the June referendum on Britain's membership of the European Union. New export orders fell amid slowing global growth.

Later this week, investors will be watching UK data on business activity in the construction sector and the service sector. That the PMI index is expected for the construction sector fell to 54.0 from 54.2, while the PMI index for the services sector fell to 53.6 from 53.7.

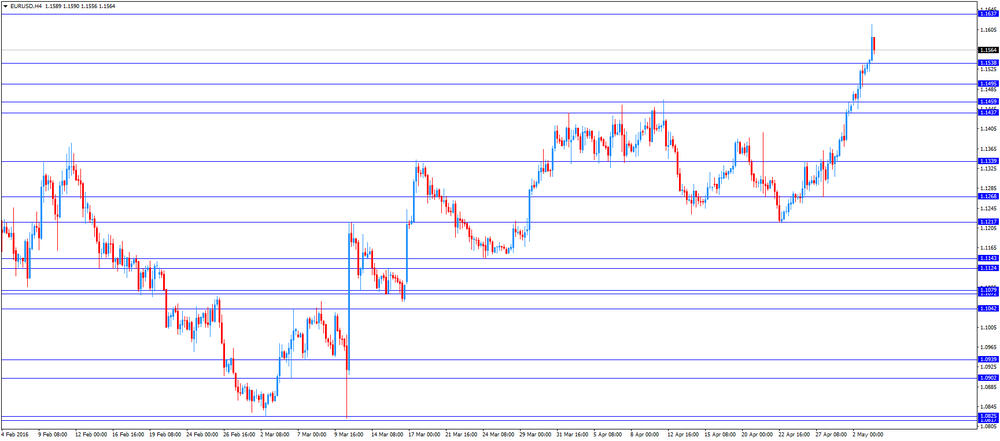

The euro fell significantly against the US dollar, having lost all previously-earned positions today. Experts point out that market participants are beginning to take profits on short positions on the US currency ahead of the release of Friday's employment report, which in recent years has been supporting the dollar.

Moderate pressure on the euro also provided updated projections by the European Commission. Currently, the European Commission expects the euro area GDP growth in 2016 will be around 1.6% against the previous forecast of 1.7% and EU GDP growth of 1.8% against the previous forecast of 1.9%. The growth of the EU's GDP in 2017 will be at 1.9% against the previous forecast of 2.0%. Inflation in the euro area in 2016 is projected to be 0.2% against the previous forecast of 0.5%. In 2017, inflation is expected to rise by 1.4% against the previous forecast of 1.5%. It is also expected in the European Commission, that unemployment in the eurozone in 2016 was 10.3% against the previous forecast of 10.5%. In 2017, unemployment is expected to reach 9.9% against the previous forecast of 10.2%. Eurozone budget deficit in 2016 is expected to reach 1.9% of GDP, and in 2017 at 1.6% of GDP. The European Commission believes that growth in the euro zone economy may put pressure slowing growth in China and in other developing countries, as well as the uncertainty associated with possible withdrawal of Great Britain from the EU.

The Australian dollar has fallen 2.3 percent against the US dollar, its lowest level since March 24. The negative impact of the currency have had the results of the meeting of the RBA, as well as the annual budget presented today. Additional pressure has had a widespread strengthening of the American currency. Recall, the Reserve Bank of Australia for the first time decided to lower the interest rate by 0.25% to a new record low of 1.75% this year. Most economists are not waiting for such decisive action. Central Bank lowered the rate trying to overcome the low inflation rate and become strong Australian currency. In general, according to the Central Bank, economic growth continues and is stable, but it is still lower compared to 2015. In addition, the increasing rate of the national currency could hamper economic recovery. Another reason for the rate cut was the situation in the labor market. The Central Bank said the recent labor market indicators have been sending mixed signals, but a very moderate growth in labor costs contribute to lower inflation forecasts.

As regards the annual budget, the Australian government announced that the budget deficit forecast at 39.9 billion in 2015-16 and fingodu 37.1 billion. Fingodu in 2016-17. Meanwhile, the government has lowered the forecast for GDP growth in 2016-17 fingodu to 2.5% from 2.75%. In addition, it became known that the government forecasts inflation of consumer prices in 2016-17 at the level of 2%. The government also lowered the forecast of unemployment in mid-2017 to 5.5% from 6.0%

-

18:05

Reuters reported on Tuesday that OPEC could not agree on a long-term strategy as Saudi Arabia and Iran did not agree, according to OPEC sources

-

18:00

European stocks closed: FTSE 100 6,185.59 -56.30 -0.90% CAC 40 4,371.98 -70.77 -1.59% DAX 9,926.77 -196.50 -1.94%

-

18:00

European stocks close: stocks traded lower on a drop in shares of the banking sector and on the weak manufacturing PMI data from China

Stock indices traded lower on a drop in shares of the banking sector and on the weak manufacturing purchasing managers' index (PMI) data from China. The Chinese Markit/Caixin manufacturing PMI fell to 49.4 in April from 49.7 in March. The decrease was driven by declines in total new orders and new export work. Output was little-changed, while employment continued to decline.

Market participants also eyed the economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index rose 0.3% in March, beating expectations for a 0.1% fall, after a 0.7% decrease in February.

On a yearly basis, Eurozone's producer price index dropped 4.2% in March, beating expectations for a 4.3% decline, after a 4.2% fall in February.

Eurozone's producer prices excluding energy fell 1.1% year-on-year in March, after a 0.8% decline in February. Energy prices dropped at an annual rate of 12.1% in March.

The European Commission released its Spring 2016 Economic Forecast report on Tuesday. The European Commission lowered its growth forecasts for this and next years. The Eurozone's economy is expected to expand 1.6% in 2016, down from its previous estimate of 1.7%, and 1.8% in 2017, down from its previous forecast of 1.9%.

Inflation was downgraded to 0.2% from 0.5% for this year, and to 1.4% from 1.5% for next year.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. dropped to 49.2 in April from 50.7 in March, missing expectations for a rise to 51.2. It was the lowest level since February 2013. March's figure was revised down from 51.0.

A reading above 50 indicates expansion, below indicates contraction.

The drop was driven by declines in output, new orders, employment and stocks of purchases.

"Manufacturing production is now falling at a quarterly pace of around 1%, and will likely act as a drag on the economy again during the second quarter and putting greater pressure on the service sector to sustain GDP growth," Markit's Senior Economist Rob Dobson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,185.59 -56.30 -0.90 %

DAX 9,926.77 -196.50 -1.94 %

CAC 40 4,371.98 -70.77 -1.59 %

-

17:49

Australian budget deficit is larger than previously expected

The Australian government released its annual budget on Tuesday. The government expects a deficit of A$39.9 billion in the current fiscal year, up from a December estimate of A$37.4 billion. The deficit is expected to decline to A$37.1 billion in the fiscal year 2017. Australian Treasurer Scott Morrison said that the budget would be balanced in the fiscal year 2021.

Morrison noted that the budget should support job creation and growth, and boost the economy.

-

17:30

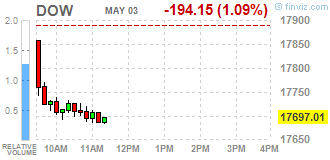

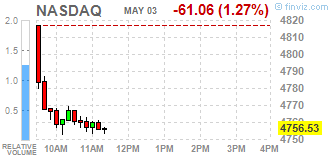

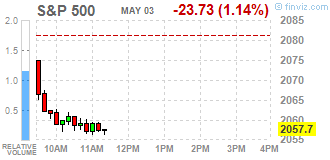

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday as weak Chinese economic data and a surprise rate cut by the Australian central bank fanned worries about the health of the global economy. Activity at China's factories shrank for the 14th straight month in April as demand stagnated, a private survey showed. Australia's central bank also sprang a surprise by cutting interest rates to a record low of 1,75%, the first easing in a year as it seeks to restrain a rising currency and insulate the economy from creeping deflation.

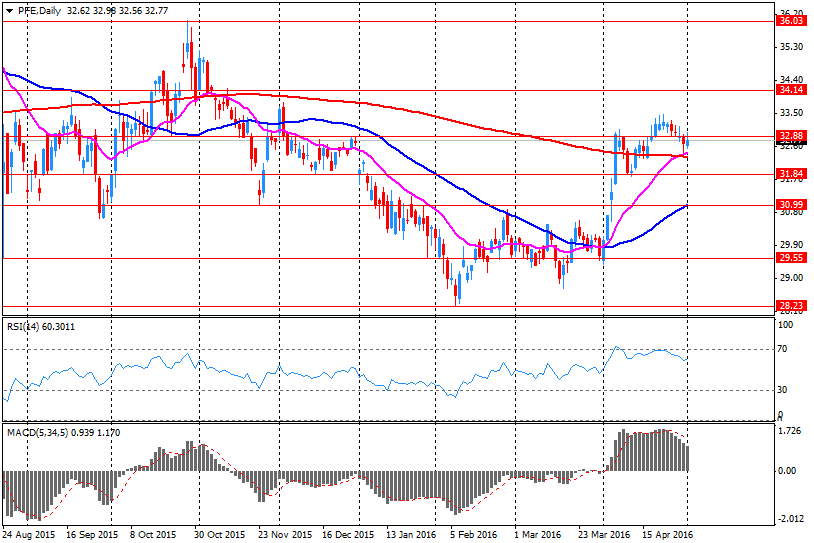

Most of Dow stocks in negative area (26 of 30). Top looser - JPMorgan Chase & Co. (JPM, -2,85%). Top gainer - Pfizer Inc. (PFE, +3,52%).

All S&P sectors in negative area. Top looser - Basic Materials (-3,0%).

At the moment:

Dow 17612.00 -187.00 -1.05%

S&P 500 2051.75 -22.50 -1.08%

Nasdaq 100 4330.25 -38.75 -0.89%

Oil 43.46 -1.32 -2.95%

Gold 1287.20 -8.60 -0.66%

U.S. 10yr 1.79 -0.07

-

17:23

Gold prices are back in the red zone

Gold prices rose moderately in the first half of the session, returning to 15-month high, however, renewed strengthening of the dollar led investors back to the precious metal sales. As a result, gold has fallen below the low of yesterday's session.

On the trading dynamics also affect expectations of speeches of officials of the Federal Reserve System. Analysts point out that their statements may contain clues about further rate hikes. Recall, last week, the Fed kept rates unchanged and did not give a clear signal as to whether it is going to produce an increase in June. This decision was taken by the central bank on a background of mixed signals from the global economy and the slowdown in inflation in the United States. "Many market participants believe that the monetary policy of the various central banks will remain soft for a long period of time, as the US central bank rate will stay low for longer", - said Commerzbank analyst Daniel Briseman.

This week, investors will be particularly closely monitor the US data to gauge the strength of the economy and its impact on the monetary policy of the Fed. The key will be a report on non-farm payrolls. It is expected that the US economy added 200,000 jobs in April, slightly lower than in March (215 thousand.).

As for prospects, gold prices are likely to decline due to lack of support from the basic data on demand and continued. "We believe that the increase in exhaled about $ 1,300, which is not least due to the alignment of investment demand over the past two weeks," - says Marsten Menke, an analyst at Julius Baer.

In addition, it became known that the gold reserves in the largest investment fund SPDR Gold Trust rose on Monday at 20.8 tons to 824.94 tons. The latest increase was the highest since February 22. Currently, stocks are at their highest level since December 2013.

The cost of the June gold futures on the COMEX fell to $ 1286.9 per ounce.

-

17:17

San Francisco Fed President John Williams: the U.S. economy is ready for further interest rate hikes

San Francisco Fed President John Williams said on Monday that the U.S. economy was ready for further interest rate hikes, adding that interest rate hikes should be gradual.

He expressed concerns that assets could drop if the Fed would raise its interest rate.

-

17:08

Atlanta Fed President Dennis Lockhart: an interest rate hike in June is still possible

Atlanta Fed President Dennis Lockhart said on Tuesday that an interest rate hike in June was still possible if the U.S. economy would improve. He added that two interest rate hikes were possible this year. But he noted that the possible Britain's exit from the European Union was a risk to the U.S. economy.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:37

Ifo economic climate index for the Eurozone declines to 112.7 in the second quarter

German Ifo Institute released its economic climate figures for the Eurozone on Tuesday. The Ifo economic climate index for the Eurozone declined to 112.7 in the second quarter from 118.9 in the first quarter. The decline was driven by a less favourable assessment of the current economic situation and slightly more sceptical business expectations.

Ifo expects the Eurozone's economy to expand 1.6% this year, while inflation is expected to be 0.8%.

-

15:45

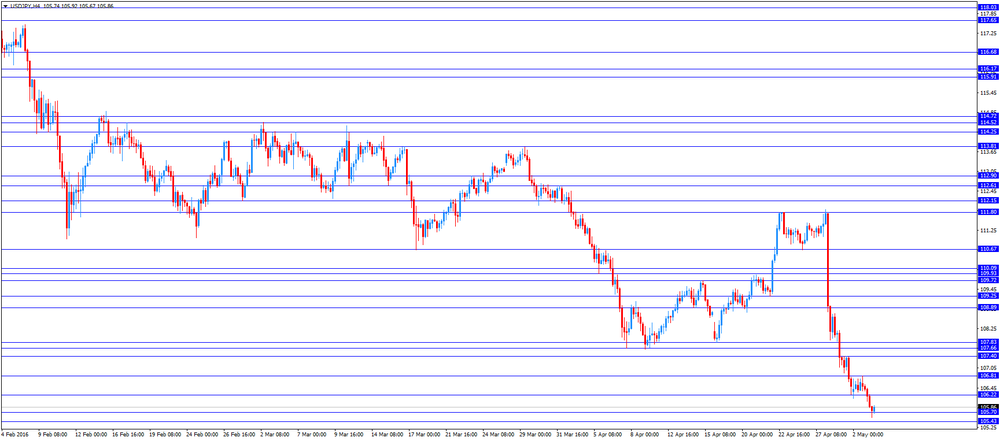

Bank of Japan Governor Haruhiko Kuroda: the recent rise in the yen may have a negative impact the recovery of Japan’s economy

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Monday that the recent rise in the yen may have a negative impact the recovery of Japan's economy.

"We are closely watching how such market developments could affect Japan's economy and prices," he added.

Kuroda reiterated that the BoJ was ready to add further stimulus measures if needed to reach 2% inflation target.

The BoJ pointed out that the central bank's monetary policy did not target the weakening of the yen.

-

15:40

Option expiries for today's 10:00 ET NY cut

USDJPY 107.00 (USD 200m)

EURUSD: 1.1320 (EUR 402m) 1.1340 (334m) 1.1400 (708m) 1.1485 (275m) 1.1500 (2.25bln) 1.1520 (430m) 1.1592 (315m)

GBPUSD 1.4500 (GBP 310m) 1.4590 (452m)

AUDUSD 0.7400 (AUD 577m) 0.7550 (458m) 0.7600 (365m) 0.7650 (276m)

-

15:34

U.S. Stocks open: Dow -0.67%, Nasdaq -0.71%, S&P -0.66%

-

15:26

Before the bell: S&P futures -0.58%, NASDAQ futures -0.56%

U.S. stock-index futures fell.

Global Stocks:

Nikkei Closed

Hang Seng 20,676.94 -390.11 -1.85%

Shanghai Composite 2,993.2 +54.87 +1.87%

FTSE 6,183.89 -58.00 -0.93%

CAC 4,380.37 -62.38 -1.40%

DAX 9,953.96 -169.31 -1.67%

Crude $44.28 (-1.12%)

Gold $1299.70 (+0.30%)

-

15:18

European Central Bank (ECB) Executive Board member Benoit Coeure: the ECB will not cut its deposit rate to “absurdly low levels”

European Central Bank (ECB) Executive Board member Benoit Coeure said in a speech on Tuesday that the central bank would not cut its deposit rate to "absurdly low levels".

"If anything, the smooth changeover to negative rates has only underlined the adaptability of market participants to this new environment, especially the money market funds industry," he said.

Coeure noted that banks' profitability improved, supported by the ECB's monetary policy.

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.7

-0.26(-2.3723%)

129355

ALTRIA GROUP INC.

MO

62.8

-0.32(-0.507%)

2133

Amazon.com Inc., NASDAQ

AMZN

679.48

-4.37(-0.639%)

20835

American Express Co

AXP

65.13

-0.55(-0.8374%)

671

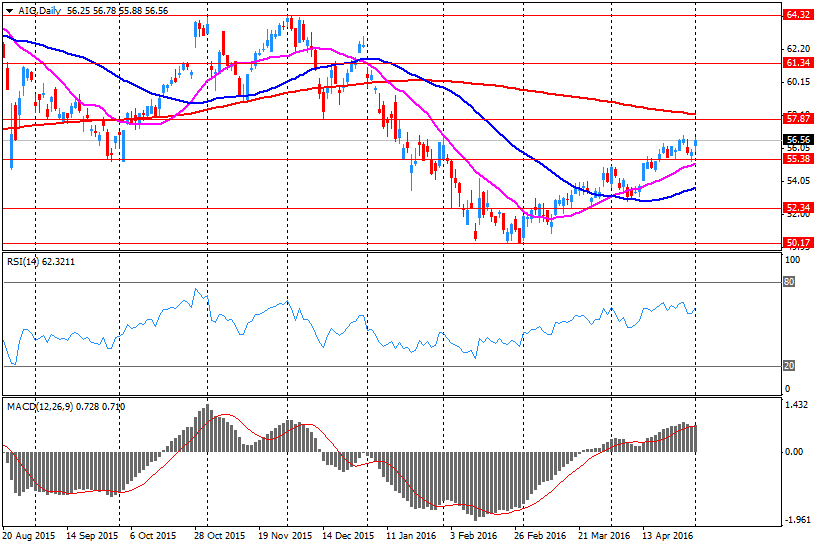

AMERICAN INTERNATIONAL GROUP

AIG

55.15

-1.44(-2.5446%)

47103

Apple Inc.

AAPL

93.96

0.32(0.3417%)

472334

AT&T Inc

T

39

-0.10(-0.2558%)

2133

Barrick Gold Corporation, NYSE

ABX

19.17

0.06(0.314%)

112170

Boeing Co

BA

133.06

-0.95(-0.7089%)

642

Caterpillar Inc

CAT

76.96

-0.88(-1.1305%)

2873

Chevron Corp

CVX

102.31

-1.00(-0.968%)

29985

Cisco Systems Inc

CSCO

27.22

-0.15(-0.548%)

5956

Citigroup Inc., NYSE

C

46.05

-0.63(-1.3496%)

47004

Exxon Mobil Corp

XOM

88.33

-0.80(-0.8976%)

18383

Facebook, Inc.

FB

117.85

-0.72(-0.6072%)

105378

Ford Motor Co.

F

13.55

-0.07(-0.5139%)

66619

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.23

-0.32(-2.3616%)

193965

General Electric Co

GE

30.71

-0.18(-0.5827%)

11716

General Motors Company, NYSE

GM

31.62

-0.13(-0.4094%)

10685

Goldman Sachs

GS

164.49

-1.69(-1.017%)

216

Google Inc.

GOOG

694.75

-3.46(-0.4956%)

2000

Hewlett-Packard Co.

HPQ

12.09

-0.03(-0.2475%)

2648

Home Depot Inc

HD

135.8

-0.25(-0.1838%)

508

Intel Corp

INTC

30.39

-0.22(-0.7187%)

20652

International Business Machines Co...

IBM

144.9

-0.37(-0.2547%)

852

Johnson & Johnson

JNJ

112.21

-0.54(-0.4789%)

2349

JPMorgan Chase and Co

JPM

63.19

-0.60(-0.9406%)

33997

McDonald's Corp

MCD

127.5

-0.70(-0.546%)

1223

Merck & Co Inc

MRK

55.02

-0.28(-0.5063%)

842

Microsoft Corp

MSFT

50.31

-0.30(-0.5928%)

26413

Nike

NKE

59.16

-0.43(-0.7216%)

1160

Pfizer Inc

PFE

33.55

0.75(2.2866%)

598553

Procter & Gamble Co

PG

80.65

-0.32(-0.3952%)

1525

Starbucks Corporation, NASDAQ

SBUX

56.68

-0.48(-0.8397%)

3486

Tesla Motors, Inc., NASDAQ

TSLA

238.5

-3.30(-1.3648%)

10061

Twitter, Inc., NYSE

TWTR

14.25

-0.15(-1.0417%)

29763

United Technologies Corp

UTX

102.75

-1.62(-1.5522%)

1235

UnitedHealth Group Inc

UNH

131.31

-0.79(-0.598%)

769

Verizon Communications Inc

VZ

51.05

-0.27(-0.5261%)

268

Visa

V

77.78

-0.68(-0.8667%)

2221

Wal-Mart Stores Inc

WMT

66.99

-0.60(-0.8877%)

13477

Walt Disney Co

DIS

103.85

-0.51(-0.4887%)

385

Yahoo! Inc., NASDAQ

YHOO

36.3

-0.23(-0.6296%)

8035

-

14:48

Building permits in Australia climb 3.7% in March

The Australian Bureau of Statistics released its building permits data on Tuesday. Building permits in Australia climbed 3.7% in March, beating expectations for a 3.0% drop, after a 2.9% rise in February. February's figure was revised down from a 3.1% increase.

Building permits for private sector houses rose 2.6% in March, while building permits for private sector dwellings excluding houses jumped 6.7%.

The seasonally adjusted estimate of the value of total building approved was down 0.9% in March.

On a yearly basis, building permits fell 6.5% in March, after a 9.0% decrease in February.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intl Paper (IP) downgraded to Hold from Buy at Jefferies

United Tech (UTX) downgraded to Sector Perform at RBC Capital Mkts; target lowered to $108

Barrick Gold (ABX) downgraded to Hold from Buy at Canaccord Genuity

Other:

Tesla Motors (TSLA) reiterated with a Buy at Stifel; target $325

Wal-Mart (WMT) initiated with a Underperform at RBC Capital Mkts; target $66

-

14:28

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the weaker-than-expected manufacturing PMI data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia Building Permits, m/m March 2.9% Revised From 3.1% -3% 3.7%

01:45 China Markit/Caixin Manufacturing PMI April 49.7 49.4

04:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 1.75%

04:30 Australia RBA Rate Statement

08:30 United Kingdom Purchasing Manager Index Manufacturing April 50.7 Revised From 51 51.2 49.2

09:00 Eurozone Producer Price Index, MoM March -0.7% -0.1% 0.3%

09:00 Eurozone Producer Price Index (YoY) March -4.2% -4.3% -4.2%

09:30 Australia Annual Budget Release

The U.S. dollar traded mixed against the most major currencies. No major economic reports in the U.S. will be released today.

The euro traded mixed against the U.S. dollar after the release of the mixed producer price inflation data from the Eurozone. Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index rose 0.3% in March, beating expectations for a 0.1% fall, after a 0.7% decrease in February.

On a yearly basis, Eurozone's producer price index dropped 4.2% in March, beating expectations for a 4.3% decline, after a 4.2% fall in February.

Eurozone's producer prices excluding energy fell 1.1% year-on-year in March, after a 0.8% decline in February. Energy prices dropped at an annual rate of 12.1% in March.

The European Commission released its Spring 2016 Economic Forecast report on Tuesday. The European Commission lowered its growth forecasts for this and next years. The Eurozone's economy is expected to expand 1.6% in 2016, down from its previous estimate of 1.7%, and 1.8% in 2017, down from its previous forecast of 1.9%.

Inflation was downgraded to 0.2% from 0.5% for this year, and to 1.4% from 1.5% for next year.

The British pound traded lower against the U.S. dollar after the release of the weaker-than-expected manufacturing PMI data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. dropped to 49.2 in April from 50.7 in March, missing expectations for a rise to 51.2. It was the lowest level since February 2013. March's figure was revised down from 51.0.

A reading above 50 indicates expansion, below indicates contraction.

The drop was driven by declines in output, new orders, employment and stocks of purchases.

"Manufacturing production is now falling at a quarterly pace of around 1%, and will likely act as a drag on the economy again during the second quarter and putting greater pressure on the service sector to sustain GDP growth," Markit's Senior Economist Rob Dobson said.

The Canadian dollar traded lower against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz later in the day.

The Swiss franc traded higher against the U.S. dollar. The State Secretariat for Economic Affairs (SECO) released its consumer confidence index data for Switzerland on Tuesday. The index fell to -15 in April from -14 in January.

"Consumer sentiment has remained below the long-term average for several quarters. The latest survey in April 2016 shows hardly any major changes; only expectations over price trends have risen slightly," the State Secretariat for Economic Affairs said in a statement.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.4612

USD/JPY: the currency pair rose to Y105.92

The most important news that are expected (GMT0):

14:30 U.S. FOMC Member Mester Speaks

16:30 Canada BOC Gov Stephen Poloz Speaks

22:45 New Zealand Employment Change, q/q Quarter I 0.9% 0.7%

22:45 New Zealand Unemployment Rate Quarter I 5.3% 5.5%

-

13:56

Company News: Pfizer (PFE) Q1 results beat analysts’ expectations

Pfizer reported Q1 FY 2016 earnings of $0.67 per share (versus $0.51 in Q1 FY 2015), beating analysts' consensus of $0.55.

The company's quarterly revenues amounted to $13.005 bln (+19.3% y/y), beating consensus estimate of $12.008 bln.

Pfizer also issued upside guidance for FY 2016, projecting EPS of $2.38-2.48 (versus analysts' consensus of $2.28) and revenues of $51.0-53.0 bln (versus analysts' consensus of $51.31 bln).

PFE rose to $33.68 (+2.68%) in pre-market trading.

-

13:38

-

12:00

European stock markets mid session: stocks traded lower on the weak manufacturing PMI data from China

Stock indices traded lower on the weak manufacturing purchasing managers' index (PMI) data from China. The Chinese Markit/Caixin manufacturing PMI fell to 49.4 in April from 49.7 in March. The decrease was driven by declines in total new orders and new export work. Output was little-changed, while employment continued to decline.

Market participants also eyed the economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index rose 0.3% in March, beating expectations for a 0.1% fall, after a 0.7% decrease in February.

On a yearly basis, Eurozone's producer price index dropped 4.2% in March, beating expectations for a 4.3% decline, after a 4.2% fall in February.

Eurozone's producer prices excluding energy fell 1.1% year-on-year in March, after a 0.8% decline in February. Energy prices dropped at an annual rate of 12.1% in March.

The European Commission released its Spring 2016 Economic Forecast report on Tuesday. The European Commission lowered its growth forecasts for this and next years. The Eurozone's economy is expected to expand 1.6% in 2016, down from its previous estimate of 1.7%, and 1.8% in 2017, down from its previous forecast of 1.9%.

Inflation was downgraded to 0.2% from 0.5% for this year, and to 1.4% from 1.5% for next year.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. dropped to 49.2 in April from 50.7 in March, missing expectations for a rise to 51.2. It was the lowest level since February 2013. March's figure was revised down from 51.0.

A reading above 50 indicates expansion, below indicates contraction.

The drop was driven by declines in output, new orders, employment and stocks of purchases.

"Manufacturing production is now falling at a quarterly pace of around 1%, and will likely act as a drag on the economy again during the second quarter and putting greater pressure on the service sector to sustain GDP growth," Markit's Senior Economist Rob Dobson said.

Current figures:

Name Price Change Change %

FTSE 100 6,189.3 -52.59 -0.84 %

DAX 9,933.59 -189.68 -1.87 %

CAC 40 4,374.22 -68.53 -1.54 %

-

11:55

European Commission’s Spring 2016 Economic Forecast Report: the European Commission cuts its growth forecasts for this and next years

The European Commission released its Spring 2016 Economic Forecast report on Tuesday. The European Commission lowered its growth forecasts for this and next years. The Eurozone's economy is expected to expand 1.6% in 2016, down from its previous estimate of 1.7%, and 1.8% in 2017, down from its previous forecast of 1.9%.

Inflation was downgraded to 0.2% from 0.5% for this year, and to 1.4% from 1.5% for next year.

"Growth in Europe is holding up despite a more difficult global environment. There are signs that policy efforts are gradually delivering more jobs and supporting investment. But we have much more to do to tackle inequality," Pierre Moscovici, Commissioner for Economic and Financial Affairs, Taxation and Customs, said.

"The recovery in the euro area remains uneven, both between Member States and between the weakest and the strongest in society," he added.

-

11:45

State Secretariat for Economic Affairs’ consumer confidence index data for Switzerland declines to -15 in April

The State Secretariat for Economic Affairs (SECO) released its consumer confidence index data for Switzerland on Tuesday. The index fell to -15 in April from -14 in January.

"Consumer sentiment has remained below the long-term average for several quarters. The latest survey in April 2016 shows hardly any major changes; only expectations over price trends have risen slightly," the State Secretariat for Economic Affairs said in a statement.

The household expectations sub-index declined to -17 in April from -16 in January, while the expected unemployment sub-index was up to 70 from 68.

The sub-index that measures price trends in the past twelve months climbed to 7 in April from -4 in January, while the sub-index for expected price trends increased to 22 from 16.

-

11:37

Eurozone's producer price index rises 0.3% in March

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index rose 0.3% in March, beating expectations for a 0.1% fall, after a 0.7% decrease in February.

Intermediate goods prices fell 0.1% in March, capital goods prices were flat, non-durable consumer goods prices were down 0.1% and durable consumer goods prices were up 0.2%, while energy prices increased 1.2%.

On a yearly basis, Eurozone's producer price index dropped 4.2% in March, beating expectations for a 4.3% decline, after a 4.2% fall in February.

Eurozone's producer prices excluding energy fell 1.1% year-on-year in March, after a 0.8% decline in February. Energy prices dropped at an annual rate of 12.1% in March.

-

11:08

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. slides to 49.2 in April, the lowest level since February 2013

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. dropped to 49.2 in April from 50.7 in March, missing expectations for a rise to 51.2. It was the lowest level since February 2013.

March's figure was revised down from 51.0.

A reading above 50 indicates expansion, below indicates contraction.

The drop was driven by declines in output, new orders, employment and stocks of purchases.

"Manufacturing production is now falling at a quarterly pace of around 1%, and will likely act as a drag on the economy again during the second quarter and putting greater pressure on the service sector to sustain GDP growth," Markit's Senior Economist Rob Dobson said.

"Manufacturers are emphasising slower domestic demand growth and declining new export orders as the key weaknesses they are facing, amid rising uncertainty about the global economy, the oil & gas industry, retail sector and the EU referendum," he added.

-

11:00

Eurozone: Producer Price Index, MoM , March -0.7% (forecast -0.1%)

-

11:00

Eurozone: Producer Price Index (YoY), March -4.2% (forecast -4.3%)

-

10:44

Swiss National Bank President Thomas Jordan: the Swiss franc remains significantly overvalued

The Swiss National Bank (SNB) President Thomas Jordan said in a speech on Monday that the Swiss franc remained significantly overvalued. He also said that the central bank's monetary policy helped "to stabilise price developments and support economic activity".

"The SNB will continue to make the most of the latitude afforded by monetary sovereignty to respond pragmatically to the challenges ahead," he noted.

"However, monetary policy cannot remedy all economic ills, especially those of a structural nature," Jordan added.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , April 49.2 (forecast 51.2)

-

10:23

Chinese Markit/Caixin manufacturing PMI decreases to 49.4 in April

The Chinese Markit/Caixin manufacturing PMI fell to 49.4 in April from 49.7 in March. The decrease was driven by declines in total new orders and new export work. Output was little-changed, while employment continued to decline.

"The fluctuations indicate the economy lacks a solid foundation for recovery and is still in the process of bottoming out," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

"The government needs to keep a close watch on the risk of a further economic downturn," he added.

-

10:10

Reserve Bank of Australia keeps its interest rate cuts its interest rate to 1.75% in May

The Reserve Bank of Australia (RBA) lowers its interest rate to 1.75% from 2.00% on Tuesday. This decision was not expected by analysts.

The RBA Governor Glenn Stevens said that the interest rate cut was needed to reach a sustainable growth in the economy and to boost inflation.

He pointed out that the reason for the interest rate cut was a larger-than-expected drop in inflationary pressures.

The RBA governor also said that the Australian economy continued to rebalance after the mining investment boom, adding that the economic growth was expected to expand at a more moderate pace, while labour market indicators were more mixed.

Stevens also said that inflation was expected to be lower than previously estimated.

He noted that a stronger Australian dollar could complicate the adjustment of the economy in Australia.

-

10:02

Option expiries for today's 10:00 ET NY cut

USD/JPY 107.00 (USD 200m)

EUR/USD: 1.1320 (EUR 402m) 1.1340 (334m) 1.1400 (708m) 1.1485 (275m) 1.1500 (2.25bln) 1.1520 (430m) 1.1592 (315m)

GBP/USD 1.4500 (GBP 310m) 1.4590 (452m)

AUD/USD 0.7400 (AUD 577m) 0.7550 (458m) 0.7600 (365m) 0.7650 (276m)

-

08:38

Options levels on tuesday, May 3, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1632 (3343)

$1.1601 (3451)

$1.1576 (6375)

Price at time of writing this review: $1.1555

Support levels (open interest**, contracts):

$1.1486 (293)

$1.1461 (1063)

$1.1428 (1401)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 42830 contracts, with the maximum number of contracts with strike price $1,1500 (6375);

- Overall open interest on the PUT options with the expiration date May, 6 is 61769 contracts, with the maximum number of contracts with strike price $1,1000 (10024);

- The ratio of PUT/CALL was 1.44 versus 1.38 from the previous trading day according to data from May, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5001 (709)

$1.4901 (281)

$1.4803 (1171)

Price at time of writing this review: $1.4733

Support levels (open interest**, contracts):

$1.4690 (701)

$1.4595 (327)

$1.4498 (899)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 24781 contracts, with the maximum number of contracts with strike price $1,4400 (2063);

- Overall open interest on the PUT options with the expiration date May, 6 is 35740 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.44 versus 1.37 from the previous trading day according to data from May, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

Asian session: The Aussie fell

The Aussie fell as more than a year since the last time the Reserve Bank of Australia cut interest rates. That could change when the central bank wraps up its May policy meeting Tuesday afternoon in Sydney. Last week, a quarterly measure of inflation came in well below expectations, stoking a massive run-up in expectations for a hike at Tuesday's meeting.

Regardless of the central bank's decision, it is likely we'll see a strong reaction in the currency. But if the bank follows through with a cut, a sharp selloff could materialize, market strategists said.

The Aussie is widely viewed as a proxy for investors' economic views on China. The currency often reacts strongly to Chinese economic data. But the shifts in investors' expectations for a possible cut are more firmly rooted in the domestic economic outlook. Namely, a recent report on Australian inflation which came in unexpectedly weak.

EUR/USD: during the Asian session the pair traded in the range of $1.1520-40

GBP/USD: during the Asian session the pair traded in the range of $1.4660-85

USD/JPY: during the Asian session the pair fell to Y106.00

Based on Reuters materials

-

06:19

Global Stocks

European stocks ended mostly lower Monday as bank shares fell in some regional markets, although German stocks pulled ahead thanks to the pharmaceutical and reinsurance sectors.

Stocks closed higher and near session highs Monday, with the Nasdaq Composite snapping a seven-day streak of losses after data showed slow-but-steady economic growth unfolding in the U.S. On the data front, the Institute for Supply Management said its manufacturing index fell to 50.8% last month from 51.8% in March. The reading, coming in above 50%, indicates expansion, albeit at a slower-than-expected pace.

Asian stocks swung between gains and losses as weaker-than-forecast Chinese manufacturing dragged mainland firms trading in Hong Kong lower and investors awaited a finely balanced interest-rate decision in Australia. The Caixin China manufacturing purchasing managers' index declined to 49.4 in April from 49.7, missing the average 49.8 forecast of economists. The data comes after the release of an official index at the weekend. Readings below 50 signal a contraction.

Based on MarketWatch materials

-

04:05

Hang Seng 20,837.91 -229.14 -1.09 %, S&P/ASX 200 5,286.3 +43.33 +0.83 %, Shanghai Composite 2,940.6 +2.27 +0.08 %

-

03:30

Australia: Building Permits, m/m, March 3.7% (forecast -3%)

-

00:35

Commodities. Daily history for May 2’2016:

(raw materials / closing price /% change)

Oil 44.83 +0.11%

Gold 1,293.40 -0.19%

-

00:31

Stocks. Daily history for Sep Apr May 2’2016:

(index / closing price / change items /% change)

Nikkei 225 16,147.38 -518.67 -3.11 %

S&P/ASX 200 5,242.97 -9.25 -0.18 %

Xetra DAX 10,123.27 +84.30 +0.84 %

S&P 500 2,081.43 +16.13 +0.78 %

NASDAQ Composite 4,817.59 +42.24 +0.88 %

Dow Jones 17,891.16 +117.52 +0.66 %

-

00:30

Currencies. Daily history for May 2’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1526 +0,65%

GBP/USD $1,4665 +0,40%

USD/CHF Chf0,9547 -0,48%

USD/JPY Y106,40 -0,08%

EUR/JPY Y122,66 +0,75%

GBP/JPY Y156,03 +0,45%

AUD/USD $0,7661 +0,74%

NZD/USD $0,7016 0,57%

USD/CAD C$1,2533 -0,22%

-

00:02

Schedule for today, Tuesday, May 3’2016:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

01:30 Australia Building Permits, m/m March 3.1% -3%

01:45 China Markit/Caixin Manufacturing PMI April 49.7

04:30 Australia Announcement of the RBA decision on the discount rate 2% 2%

04:30 Australia RBA Monetary Policy Statement

08:30 United Kingdom Purchasing Manager Index Manufacturing April 51 51.2

09:00 Eurozone Producer Price Index, MoM March -0.7% -0.1%

09:00 Eurozone Producer Price Index (YoY) March -4.2% -4.3%

09:30 Australia Annual Budget Release

14:30 U.S. FOMC Member Mester Speaks

16:30 Canada BOC Gov Stephen Poloz Speaks

20:00 U.S. Total Vehicle Sales, mln April 16.57 17.15

22:45 New Zealand Employment Change, q/q Quarter I 0.9%

22:45 New Zealand Unemployment Rate Quarter I 5.3%

23:30 Australia AIG Services Index April 49.5

-