Noticias del mercado

-

21:00

Dow +0.13% 17,897.97 +22.55 Nasdaq +0.72% 4,945.49 +35.26 S&P +0.25% 2,081.42 +5.09

-

18:00

European stocks close: stocks closed slightly lower as investors are awaiting the release of Fed’s minutes

Stock indices closed slightly lower as investors are awaiting the release of Fed's minutes. Investors hope to get insight how the Fed plans to tighten its monetary policy. The Fed may start to hike its interest rate in June. It is unclear how the Fed want to raise its interest rate.

Retail sales in the Eurozone fell 0.2% in February, missing expectations for a 0.1% decrease, after a 0.9% gain in January. January's figure was revised down from a 1.1% rise.

The decline was driven by lower gasoline sales and lower sales of food and drinks.

On a yearly basis, retail sales in the Eurozone rose 3.0% in February, after a 3.2% increase in January. January's figure was revised down from a 3.7% gain.

German seasonal adjusted factory orders decreased 0.9% in February, missing expectations for a 1.5% increase, after a 2.6% drop in January. January's figure was revised up from a 3.9% decline.

Concerns over Greece's debt problems continue to weigh on markets. Greek Prime Minister Alexis Tsipras met Russian President Vladimir Putin in Moscow today.

The Bank of England released its quarterly Credit Conditions Survey on Wednesday. U.K. lenders expect the demand for secured lending for house purchase to increase in the second quarter of 2015.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,937.41 -24.36 -0.35 %

DAX 12,035.86 -87.66 -0.72 %

CAC 40 5,136.86 -14.33 -0.28 %

-

17:40

Oil: а review of the market situation

Oil prices fell sharply today, losing more than 2%, which is associated with the publication of a report on oil reserves in the United States, as well as news that Saudi Arabia increased oil production last month.

Data provided by US Department of Energy showed that during the week from 28 March to 3 April oil reserves increased by 10.9 million barrels to 482.4 million barrels, while experts waited for an increase of 3.4 million barrels. The report also reported that weekly growth of commercial oil reserves was the most significant since March 2001. Meanwhile, the oil terminal in Cushing rose by 1.2 million barrels to 60.2 million barrels, the highest since April 2004. Gasoline inventories rose by 817,000 barrels to 229.9 million barrels. Analysts had expected a decline of 1.3 million barrels. Distillate stocks fell by 250,000 barrels to 126.9 million barrels, while analysts had expected an increase of 900,000 barrels. Utilization rate of refining capacity increased by 0.7% to 90.1%. Analysts expected growth rate of 0.5%.

Meanwhile, today's oil minister of Saudi Arabia, Ali al-Naimi said that in March the kingdom from Central 10.3 million barrels per day, exceeding the previous record figure of 10.2 million award in August 2013. In the near future average daily production will remain close to 10 million barrels, said al-Naimi. Recall, Saudi Arabia, the world's largest oil exporter, accounting for more than 10% of world production. Meanwhile, Al-Naimi said again that Saudi Arabia is ready to raise rates, but only with the participation of non-OPEC.

"Although production may decline slightly in April and May, it is clear that Saudi Arabia responds to increased demand for its oil, despite the excess of oil on the market" - said the analyst Amrita Sen Energy Aspects.

Focus was also the monthly report from the International Energy Agency. Agency experts predict that the price of oil could fall to $ 15 a barrel next year, if the sanctions against Iran will be fully terminated in the event of reaching a final agreement on the country's nuclear program. "The increase in Iran's oil supply to the world market will reduce the IEA forecast oil prices in the $ 5-15. If a comprehensive agreement that will lead to the lifting of sanctions on Iran, is reached, the forecasts for the volume of oil supply, demand, and prices can significantly change, "- said the IEA. The agency estimates, Iran could increase production by at least 700 thousand. Barrels per day in 2016 (in March, the average volume of oil production in Iran 2.85 million barrels per day). According to the IEA, increase production Iran will lead to an increase in world oil reserves of about 500 thousand. Barrels per day in 2016. According to IEA forecasts (excluding the possible increase in production in Iran), the average price of WTI crude oil in 2016 will be $ 70 and Brent - $ 75.

May futures for US light crude oil WTI (Light Sweet Crude Oil) dropped to 51.66 dollars per barrel on the New York Mercantile Exchange.

May futures price for North Sea Brent crude oil mix fell 1.42 dollars to 56.95 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:38

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the Fed's March monetary policy meeting minutes

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the Fed's March monetary policy meeting minutes later in the day. Investors hope to get insight how the Fed plans to tighten its monetary policy. The central bank may start to hike its interest rate in June. It is unclear how the Fed want to raise its interest rate.

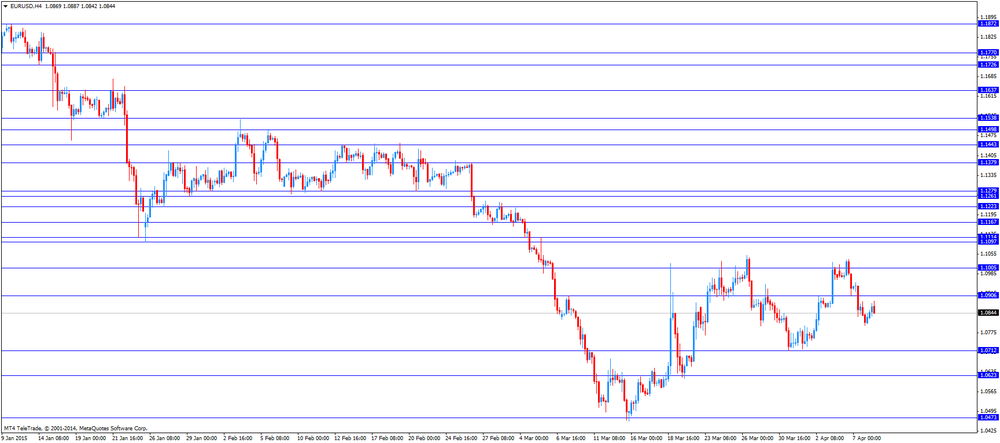

The euro traded lower against the U.S. dollar. Retail sales in the Eurozone fell 0.2% in February, missing expectations for a 0.1% decrease, after a 0.9% gain in January. January's figure was revised down from a 1.1% rise.

The decline was driven by lower gasoline sales and lower sales of food and drinks.

On a yearly basis, retail sales in the Eurozone rose 3.0% in February, after a 3.2% increase in January. January's figure was revised down from a 3.7% gain.

German seasonal adjusted factory orders decreased 0.9% in February, missing expectations for a 1.5% increase, after a 2.6% drop in January. January's figure was revised up from a 3.9% decline.

Concerns over Greece's debt problems continue to weigh on the euro. Greek Prime Minister Alexis Tsipras met Russian President Vladimir Putin in Moscow today.

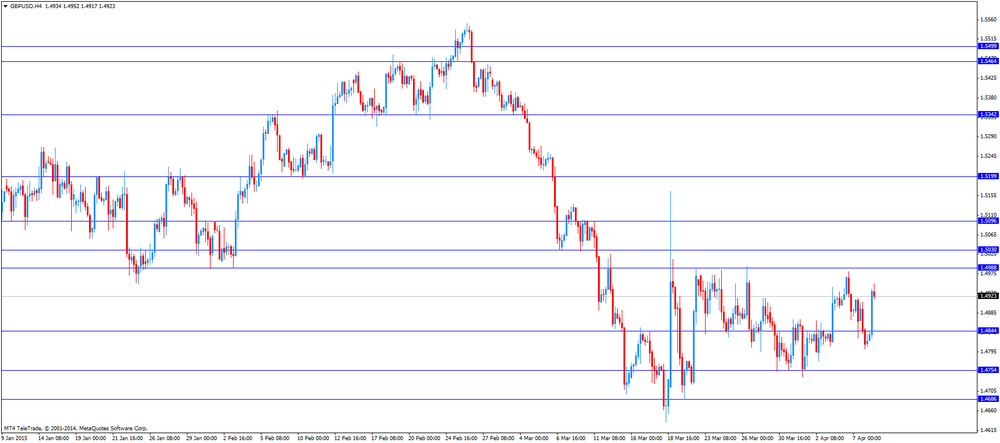

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England released its quarterly Credit Conditions Survey on Wednesday. U.K. lenders expect the demand for secured lending for house purchase to increase in the second quarter of 2015.

The Swiss franc traded lower against the U.S. dollar. Switzerland's consumer price index rose 0.3% in March, exceeding expectations for a 0.1% rise, after a 0.3% decline in February.

The rise was driven by higher prices for clothing, petroleum products and package holidays.

On a yearly basis, Switzerland's consumer price index declined to -0.9% in March from -0.8% in February, beating expectations for a drop to -1.0%. It was the lowest level since June 2012.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback in the absence of any economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback in the absence of any economic reports from Australia.

The Aussie remained supported by yesterday's Reserve Bank of Australia (RBA) interest rate decision. The RBA kept its interest rate unchanged at 2.25%.

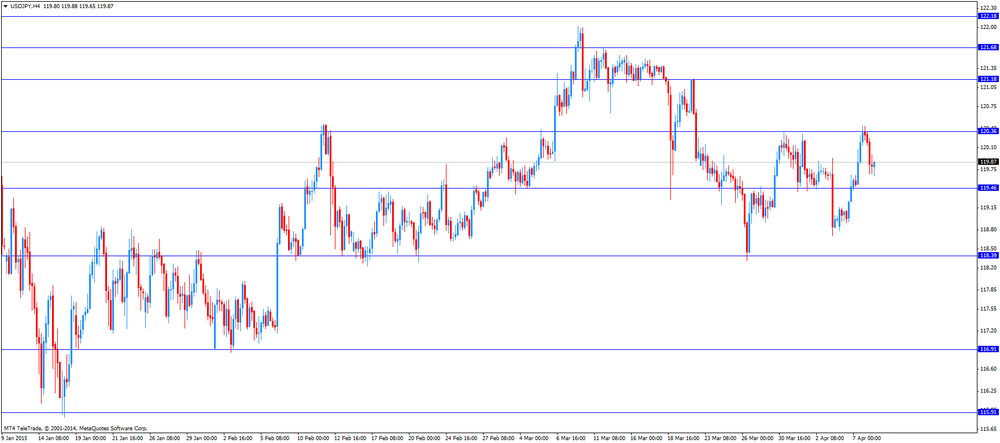

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback as the Bank of Japan (BoJ) kept its monetary policy unchanged. The central bank voted 8-1 to keep its monetary policy unchanged. Takahide Kiuchi wants the BoJ to cut its asset-purchase target by almost half.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the press conference on Wednesday that Japan's economy faces less risk now than it did last year. He noted that the stimulus boost in October has a positive impact on wages and prices.

Japan's current account surplus jumped to 1,440.1 billion yen in February from a 61.4 billion yen surplus in January, exceeding expectations for a surplus of 1,150 billion yen. It was the highest level since September 2011.

The increase was driven by the higher value in yen terms of income from overseas investments and a smaller trade deficit.

Japan's economy watchers' current conditions index climbed to 52.2 in March from 50.1 in February, exceeding expectations for an increase to 50.9.

Japan's economy watchers' future conditions index rose to 53.4 in March from 53.2 in February.

-

17:20

Gold: a review of the market situation

Gold prices declined moderately today, but remained above $ 1,200 per ounce, which is associated with the strengthening of the US dollar and expectations of the publication of the protocol of the last meeting of the FOMC. Remember, today at 18:00 GMT Fed will publish the minutes of the meeting of the Committee on Open Market (FOMC) Federal Reserve on March 17-18. "Gold will cost a little less $ 1,200 per ounce as the dollar remains stable. Investors will try to guess when the Fed will raise the rate, considering each statistics, every document," - said analysts IG Ltd. It is worth emphasizing the delay in raising interest rates tend to contribute to the demand for gold, as it reduces the relative cost of metal retention by ensuring increased profits for investors.

The course of trade also affected the statement made by the Fed Powell, who noted that a significant increase in the dollar has a negative impact on the economy. According to him, the first rate increase may occur in June, but the state of the US economy may force the regulator to push this decision at a later date. Powell added that markets alone can give a signal indicative of the need for policy tightening. At the same time, he spoke in favor of the "progressive" approach to raising the cost of lending.

Decline in gold prices is also due to the weakening of investment demand for gold bullion. Gold reserves in the largest investment fund SPDR Gold Trust fell Tuesday at 2.39 tons to the level of 733.06 tons, which is the lowest since January 16, 2015.

Physical demand for gold in China is not very high - the price of the Shanghai Gold Exchange is almost equal to the reference spot price. "The Chinese have a more interesting investment options than gold. Stocks are rising, and now they can still buy futures on bonds. With this in mind, investors do not see any reason to buy precious metals," - said an analyst at Phillip Futures Howie Lee.

May futures for gold on the COMEX today fell to 1204.00 dollars per ounce.

-

17:08

Bank of Japan Governor Haruhiko Kuroda: the stimulus boost in October has a positive impact on wages and prices

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the press conference on Wednesday that Japan's economy faces less risk now than it did last year. He noted that the stimulus boost in October has a positive impact on wages and prices.

The BoJ governor reiterated that the central will adjust its monetary policy if needed to achieve its 2% inflation target.

-

16:57

New York Federal Reserve President William Dudley: the Fed could still start to raise its interest in June

The New York Federal Reserve President William Dudley said on Wednesday that the Fed could still start to raise its interest in June if the economic data pick up in the coming months. He noted that it is better to wait to hike interest rate as the inflation is below the Fed's 2% target.

He pointed out that the pace of the interest rate increase will depend on market reaction.

-

16:34

Japan’s Eco Watchers' Indexes rise in March

Japan's Cabinet Office released Eco Watchers' Index figures on Wednesday. Japan's economy watchers' current conditions index climbed to 52.2 in March from 50.1 in February, exceeding expectations for an increase to 50.9.

Japan's economy watchers' future conditions index rose to 53.4 in March from 53.2 in February.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

16:30

U.S.: Crude Oil Inventories, April 10.949M

-

16:15

Federal Reserve Governor Jerome Powell: the Fed should wait longer before tightening its monetary policy

The Federal Reserve Governor Jerome Powell said in a speech in New York on Wednesday that the Fed should wait longer before tightening its monetary policy, but he expects the first interest rate hike "later this year". He added that he believes it's better to raise interest rate if the economic data better than expected.

Powell noted that the financial crisis damaged the productive capacity of the U.S. economy. "Given this uncertainty, it is even more difficult than usual to assess how much slack remains. It seems plausible that at least part of this supply-side damage could be reversed if the economy enjoys a period of sustained growth," he said.

The Federal Reserve governor expects that the labour market will continue to strengthen.

Powell noted that he expects the interest rate to increase "fairly gradually".

-

15:58

Bank of England’ quarterly Credit Conditions Survey: U.K. lenders expect the demand for secured lending for house purchase to increase in the second quarter of 2015

The Bank of England released its quarterly Credit Conditions Survey on Wednesday. U.K. lenders expect the demand for secured lending for house purchase to increase in the second quarter of 2015. The demand for secured lending for house purchase fell in the first quarter.

The demand for credit card lending by households also declined in the first quarter.

The demand for lending from large corporates rose in the first quarter, while the demand from small businesses and medium-sized companies remained unchanged.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E615mn), $1.0825/35(E600mn), $1.0900(E543mn), $1.0955(E401mn)

USD/JPY: Y119.50($700mn), Y120.00($806mn), Y120.50($301mn), Y120.65($400mn)

GBP/USD: $1.4700(Gbp516mn), $1.4900(Gbp900mn), $1.4930(Gbp301mn)

AUD/USD: $0.7725(A$213mn)

USD/CHF: Chf0.9710/20($420mn), Chf0.9825($500mn)

-

15:33

U.S. Stocks open: Dow +0.19%, Nasdaq +0.21%, S&P +0.17%

-

15:33

Switzerland’s consumer price inflation increases 0.3% in March

The Swiss Federal Statistics Office released its consumer inflation data on Wednesday. Switzerland's consumer price index rose 0.3% in March, exceeding expectations for a 0.1% rise, after a 0.3% decline in February.

The rise was driven by higher prices for clothing, petroleum products and package holidays.

On a yearly basis, Switzerland's consumer price index declined to -0.9% in March from -0.8% in February, beating expectations for a drop to -1.0%. It was the lowest level since June 2012.

Prices of domestic goods climbed 0.3% in March, while prices of imported goods fell 4.3%.

-

15:22

Before the bell: S&P futures +0.11%, NASDAQ futures +0.12%

U.S. stock-index futures rose before the Federal Reserve releases the minutes of its March meeting and as Alcoa Inc. unofficially kicks off earnings season.

Global markets:

Nikkei 19,789.81 +149.27 +0.76%

Hang Seng 26,236.86 +961.22 +3.80%

Shanghai Composite 3,995.5 +34.13 +0.86%

FTSE 6,987.88 +26.11 +0.38%

CAC 5,153.17 +1.98 +0.04%

DAX 12,089.04 -34.48 -0.28%

Crude oil $52.78 (-2.22%)

Gold $1206.50 (-0.34%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

United Technologies Corp

UTX

117.51

+0.02%

0.2K

Cisco Systems Inc

CSCO

27.40

+0.04%

42.5K

Microsoft Corp

MSFT

41.55

+0.05%

3.1K

Procter & Gamble Co

PG

82.45

+0.07%

3.6K

General Electric Co

GE

25.06

+0.16%

8.2K

Walt Disney Co

DIS

105.60

+0.16%

1.4K

Citigroup Inc., NYSE

C

51.60

+0.16%

4.2K

Visa

V

65.91

+0.17%

0.1K

Pfizer Inc

PFE

34.60

+0.17%

0.1K

Starbucks Corporation, NASDAQ

SBUX

94.25

+0.19%

0.3K

Amazon.com Inc., NASDAQ

AMZN

375.41

+0.27%

1.6K

FedEx Corporation, NYSE

FDX

171.62

+0.27%

0.3K

AMERICAN INTERNATIONAL GROUP

AIG

55.14

+0.29%

6.1K

Chevron Corp

CVX

108.87

+0.30%

8.1K

Ford Motor Co.

F

15.95

+0.31%

4.2K

JPMorgan Chase and Co

JPM

61.05

+0.33%

1.1K

Verizon Communications Inc

VZ

48.88

+0.33%

3.1K

American Express Co

AXP

78.60

+0.34%

3.3K

General Motors Company, NYSE

GM

35.87

+0.39%

3.0K

Deere & Company, NYSE

DE

88.80

+0.41%

0.2K

Exxon Mobil Corp

XOM

86.13

+0.44%

23.3K

ALTRIA GROUP INC.

MO

51.93

+0.44%

0.2K

Facebook, Inc.

FB

82.69

+0.45%

39.6K

Google Inc.

GOOG

539.69

+0.50%

0.1K

Hewlett-Packard Co.

HPQ

31.60

+0.57%

2.2K

AT&T Inc

T

32.88

+0.58%

51.7K

Yahoo! Inc., NASDAQ

YHOO

43.90

+0.66%

3.3K

Yandex N.V., NASDAQ

YNDX

17.14

+0.68%

0.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.13

+0.79%

24.1K

Caterpillar Inc

CAT

81.25

+0.88%

1.2K

Barrick Gold Corporation, NYSE

ABX

12.48

+0.97%

69.0K

Merck & Co Inc

MRK

58.05

+1.08%

6.3K

Twitter, Inc., NYSE

TWTR

53.61

+1.40%

195.1K

ALCOA INC.

AA

13.64

+1.56%

31.3K

Tesla Motors, Inc., NASDAQ

TSLA

208.99

+2.82%

215.1K

Intel Corp

INTC

31.26

0.00%

0.6K

Travelers Companies Inc

TRV

107.25

-0.08%

1.7K

Home Depot Inc

HD

114.00

-0.26%

0.4K

Apple Inc.

AAPL

125.65

-0.29%

322.9K

-

15:02

Eurozone’s retail sales decline 0.2% in February

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone fell 0.2% in February, missing expectations for a 0.1% decrease, after a 0.9% gain in January. January's figure was revised down from a 1.1% rise.

The decline was driven by lower gasoline sales and lower sales of food and drinks.

On a yearly basis, retail sales in the Eurozone rose 3.0% in February, after a 3.2% increase in January. January's figure was revised down from a 3.7% gain.

As oil prices have stabilised in recent months, the households spending sank.

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Apple (AAPL) downgraded from Buy to Hold at Societe Generale

Other:

FedEx (FDX) reiterated at Sector Perform at RBC Capital Mkts, target raised from $169 to $180

-

14:28

Japan’s current account surplus jumps to the highest level since September 2011

Japan's Ministry of Finance released its current account figures on late Tuesday. The current account surplus jumped to 1,440.1 billion yen in February from a 61.4 billion yen surplus in January, exceeding expectations for a surplus of 1,150 billion yen. It was the highest level since September 2011.

The increase was driven by the higher value in yen terms of income from overseas investments and a smaller trade deficit.

The trade balance deficit fell to 143.1 billion yen in February from the deficit of 864.2 billion yen in the previous month.

Falling oil prices helped to lower the trade deficit.

Exports rose at an annual rate of 0.4%, while imports dropped at an annual 6.2%.

-

14:04

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Eco Watchers Survey: Current March 50.1 50.9 52.2

05:00 Japan Eco Watchers Survey: Outlook March 53.2 53.4

06:00 Germany Factory Orders s.a. (MoM) February -2.6% Revised From -3.9% 1.5% -0.9%

06:00 Germany Factory Orders n.s.a. (YoY) February -0.3% Revised From -0.1% -1.3%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln February -3.7 -3.8 €-3.44B

07:15 Switzerland Consumer Price Index (MoM) March -0.3% 0.1% 0.3%

07:15 Switzerland Consumer Price Index (YoY) March -0.8% -1.0% -0.9%

08:30 United Kingdom BOE Credit Conditions Survey Quarter I

09:00 Eurozone Retail Sales (MoM) February 0.9% Revised From 1.1% -0.1% -0.2%

09:00 Eurozone Retail Sales (YoY) February 3.2% Revised From 3.7% 3.0%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the Fed's March monetary policy meeting minutes later in the day. Investors hope to get insight how the Fed plans to tighten its monetary policy. The central bank may start to hike its interest rate in June. It is unclear how the Fed want to raise its interest rate.

The euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone. Retail sales in the Eurozone fell 0.2% in February, missing expectations for a 0.1% decrease, after a 0.9% gain in January. January's figure was revised down from a 1.1% rise.

The decline was driven by lower gasoline sales and lower sales of food and drinks.

On a yearly basis, retail sales in the Eurozone rose 3.0% in February, after a 3.2% increase in January. January's figure was revised down from a 3.7% gain.

German seasonal adjusted factory orders decreased 0.9% in February, missing expectations for a 1.5% increase, after a 2.6% drop in January. January's figure was revised up from a 3.9% decline.

Concerns over Greece's debt problems continue to weigh on the euro. Greek Prime Minister Alexis Tsipras will meet Russian President Vladimir Putin in Moscow today.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England released its quarterly Credit Conditions Survey on Wednesday. U.K. lenders expect the demand for secured lending for house purchase to increase in the second quarter of 2015.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected consumer price inflation from Switzerland. Switzerland's consumer price index rose 0.3% in March, exceeding expectations for a 0.1% rise, after a 0.3% decline in February.

The rise was driven by higher prices for clothing, petroleum products and package holidays.

On a yearly basis, Switzerland's consumer price index declined to -0.9% in March from -0.8% in February, beating expectations for a drop to -1.0%. It was the lowest level since June 2012.

EUR/USD: the currency pair rose to $1.0887

GBP/USD: the currency pair increased to $1.4952

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. FOMC Member Dudley Speak

18:00 U.S. FOMC meeting minutes

-

13:50

Orders

EUR/USD

Offers 1.0950 1.0900

Bids 1.0825/26 1.0805/00 1.0750 1.0700

GBP/USD

Offers 1.5020/25 1.5000 1.4950

Bids 1.4905/00 1.4800

EUR/JPY

Offers 131.50 131.00 130.50

Bids 129.50 129.20/00 128.50

USD/JPY

Offers 121.00 120.50 120.20

Bids 119.50 119.00

EUR/GBP

Offers 0.7390

Bids 0.7250 0,7210/00

AUD/USD

Offers 0.7850 0.7780/00 0.7750

Bids 0.7685/80 0.7610/00 0.7550

-

13:29

Consumer credit in the U.S. rises by $15.5 billion in February

The Fed released its consumer credits figures on Tuesday. Consumer credit in the U.S. rose by $15.5 billion in February, exceeding expectations for a $13.6 billion increase, after a $10.8 billion gain January.

January's figure was revised down from a $11.6 billion rise.

The increase was driven by a gain in non-revolving credit. Non-revolving credit surged up by $19.2 billion in February, while revolving credit declined by $3.7 billion.

-

13:11

Canadian Prime Minister Stephen Harper ruled out another round of fiscal stimulus to help the economy

Canadian Prime Minister Stephen Harper on Tuesday ruled out another round of fiscal stimulus to help the economy, which has been hurt by lower oil prices. He said that the economy is still expected to grow, albeit at a slower pace than anticipated.

Canadian gross domestic product declined 0.1% in January and job creation over the past 12 months has been weak due to lower oil prices.

Harper confirmed the government intension to eliminate deficit ahead of the release of the federal budget later this month.

-

12:50

European stock markets mid-session: indices mixed – German factory orders and Eurozone Retail Sales weigh

European stocks are trading mixed today with the FTSE100 being the only index out of the three in positive territory. German factory orders and Eurozone Retail Sales weigh on stocks.

Factory Orders in Germany, Eurozone's biggest economy, declined in February by -0.9%, below the estimated +1.5%. The January reading was -3.9%. Year on year Factory orders declined -1.3% compared to -0.1%. Orders fell for a second month, contradicting other positive reports on the German economy and its recovery.

The French Trade Balance rose unexpectedly last month with a reading of -3.44 billion euros, compared to forecasts of -3.8 billion and a previous reading of -3.7 billion.

Retail Sales in the Eurozone declined seasonally adjusted in February by -0.2%, more than the expected -0.1%. The data for January was revised from +1.1% down to +0.9%. Year on year Retail Sales for February came in at +3.0%. Last February's reading was revised down from +3.7% to +3.2%.

The FTSE 100 index is currently trading +0.54% quoted at 6,999.03 points. Germany's DAX 30 is trading at 12,066.65 points -0.47% close to intraday-lows. France's CAC 40 is currently trading at 5,146.42 points, -0.09%.

-

12:20

Oil: prices decline after yesterday’s rally ahead of U.S. stockpile data

Oil is trading lower today after yesterday's strong rally as data reported yesterday showed that U.S. stockpiles grew more-than-expected and Saudi Arabia, the OPEC's biggest producer reported a record output for March of 10.3 million barrels per day. Saudi Arabia's oil minister Ali al-Naimi said that the output is likely to remain at that level or eve increase with the return of Iran. Iranian exports are, according to experts, not likely to increase till 2016.

API Crude Oil Inventories rose by 12.2 million barrel, far more than the expected increase of 3.4 million barrels. Now market participants await the official weekly inventory report of the Energy Information Administration scheduled for 14:30 GMT.

Brent Crude lost -1.22% currently trading at USD58.38 a barrel. On January 13th Crude set a low at USD45.19. West Texas Intermediate dropped -2.22% currently quoted at USD52.78.

Oil prices declined sharply in recent months as worldwide supply exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

-

12:00

Gold trading moderately higher ahead of FOMC minutes – still above USD1,200

Gold is trading higher today, holding above the USD 1,200 level, after retreating for two days at the start of the week. Today the FOMC minutes will be in the focus for further indications on when the Federal Reserve is going to hike benchmark interest rates. Yesterday the U.S. Bureau of Labour Statistics released its Job Openings and Labour Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 5.133 million in February from 4.965 million in January. It was the highest level since January 2001. January's figure was revised down from 4.998 million. Analysts had expected job openings to rise to 4.978 million.

A stronger US dollar is putting pressure on gold, as it reduces the metal's appeal as an alternative asset and makes dollar-denominated commodities more expensive for holders of other currencies. Meanwhile, the delay in raising interest rates contributes to the demand for gold, as it reduces the relative cost of holding the precious metal.

Gold is currently quoted at USD1,210.90 +0,15% a troy ounce, still slightly above the USD1,200 level. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Tuesday the 17th of march gold traded as low as USD1,142.50, a three-month low.

-

11:30

Bank of Japan keeps rate at 0.10%

The Bank of Japan left the key interest rate unchanged at 0.10% after an 8 to 1 vote and kept the bank's Monetary Base Target unchanged at 275 billion. One member voted against and expressed that the stimulus should be reduced but was voted down. Takahide Kiuchi wants the BoJ to cut its asset-purchase target by almost half. The bank should make inflation at 2% a medium to long term target. Tensions on the board are intensifying.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E615mn), $1.0825/35(E600mn), $1.0900(E543mn), $1.0955(E401mn)

USD/JPY: Y119.50($700mn), Y120.00($806mn), Y120.50($301mn), Y120.65($400mn)

GBP/USD: $1.4700(Gbp516mn), $1.4900(Gbp900mn), $1.4930(Gbp301mn)

AUD/USD: $0.7725(A$213mn)

USD/CHF: Chf0.9710/20($420mn), Chf0.9825($500mn)

-

11:00

Eurozone: Retail Sales (MoM), February -0.2% (forecast -0.1%)

-

11:00

Eurozone: Retail Sales (YoY), February 3.0%

-

10:30

Press Review: Forget Interest Rates, the Fed Has Another Big Decision to Make in the Next Year

BLOOMBERG

Forget Interest Rates, the Fed Has Another Big Decision to Make in the Next Year

In case exiting years of zero interest rates won't be hard enough, Federal Reserve officials have another challenge approaching quickly: when to begin unwinding trillions of dollars of bond purchases that constitute the world's largest fixed-income portfolio.

Less than a year from now, the Fed must decide whether to reinvest $216 billion of proceeds from Treasury debt maturing in 2016, or shrink its balance sheet by allowing it to expire. By not reinvesting, the Fed would increase the supply of securities available to investors and put upward pressure on yields.

Shrinking the $4.2 trillion portfolio will add to the monetary tightening from increases in the benchmark interest rate officials envision for this year. That would mark a reversal of the easing the Fed achieved when it bought bonds to speed a recovery from the worst recession since the 1930s.

REUTERS

Oil down on U.S. stock build, record Saudi output(Reuters) - Oil prices fell more than a percent on Wednesday as industry data showed a larger-than-expected weekly increase in U.S. stockpiles and as Saudi Arabia reported record output in March.

The decline in prices followed a rally on Tuesday, when U.S. crude approached 2015 highs following strong jobs data and government forecasts for lower U.S. crude production growth and higher global demand for oil.

"We're going to need to see a very big uptick in demand to offset that supply," Ben Le Brun, analyst at OptionsXpress in Sydney said. "There is a glut of supply in oil at the moment."

Source: http://www.reuters.com/article/2015/04/08/us-markets-oil-idUSKBN0MZ03320150408

BLOOMBERG

Shell Will Buy BG Group for $70 Billion in Cash and Shares

Royal Dutch Shell Plc agreed to buy BG Group Plc for about 47 billion pounds ($70 billion) in cash and shares, the oil and gas industry's biggest deal in at least a decade.

The acquisition is the most significant response yet to the slump in oil prices and could set in motion a series of mergers as the largest energy companies look to cut costs and restore profits.

Shell will pay 383 pence in cash and 0.4454 of Shell's B shares for each BG share, BG said in a statement today. That's equal to about 1,367 pence a share and gives BG a market value of about 47 billion pounds. It's a premium of about 50 percent on BG's closing share price yesterday.

-

10:00

European stock markets first hour: Indices mixed with the FTSE and CAC40 up, German DAX down on Factory Orders

European stocks open mixed on Wednesday after lower-than-expected German factory orders and ahead of data on Eurozone's Retail Sales scheduled for 09:00 GMT.

Factory Orders in Germany, Eurozone's biggest economy, declined in February by -0.9%, below the estimated +1.5%. The January reading was -3.9%. Year on year Factory orders declined -1.3% compared to -0.1%. Orders fell for a second month, contradicting other positive reports on the German economy and its recovery.

The French Trade Balance rose unexpectedly last month with a reading of -3.44 billion euros, compared to forecasts of -3.8 billion and a previous reading of -3.7 billion.

The FTSE 100 index is currently trading +0.44% quoted at 6,992.37 points. Germany's DAX 30 is trading at 12,085.97 points -0.31%. France's CAC 40 is currently trading at 5,154.73 points, +0.07%.

-

09:15

Switzerland: Consumer Price Index (MoM) , March 0.3% (forecast 0.1%)

-

09:15

Switzerland: Consumer Price Index (YoY), March -0.9% (forecast 1.0%)

-

09:00

Global Stocks: Wall Street slightly down, Nikkei at 15-year high, Chinese stocks extend rally

U.S. stocks ended slightly down on Tuesday reversing early gains. The S&P 500 closed -0.21% with a final quote of 2,076.33 points. The DOW JONES index declined by -0.03%, closing at 17,875.42 points. Investors worry about the impact of the strong dollar on corporate earnings but sentiment is supported by the fact that a rate hike by the FED could be delayed. Today at 13:30 GMT FOMC Member Dudley speaks and at 18:00 the FOMC minutes of the last policy meeting will be published.

Chinese stocks extended gains amid speculations on further economic stimulus by the PBoC. The economic slowdown in China, the world's second largest economy, is already seen bottoming and China has lots of options left in order to spur the economy. Hong Kong's Hang Seng is trading +2.49% at 25,904.25 points. China's Shanghai Composite is currently trading at 3,990.28 points +0.73%. In today's session the index surpassed the 4,000 points mark for the first time since 2008, doubling since January 2014.

The Nikkei rose to a 15-year high on Wednesday. The index rose +0.76% to 19,789.81 points. The Bank of Japan left the key interest rate unchanged at 0.10% after an 8 to 1 vote and kept the bank's Monetary Base Target unchanged at 275 billion. One member voted for a lower target but was voted down. The current Eco Watchers Survey for March increased above estimates to 52.2, beating forecasts of an increase to 50.9 from a previous reading of 50.1. The Eco Watchers Outlook rose from 53.2. to 53.4. At 06:30 GMT the Bo J will hold a press conference.

-

08:45

France: Trade Balance, bln, February €-3.5B (forecast -3.8)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly lower against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Eco Watchers Survey: Current March 50.1 50.9 52.2

05:00 Japan Eco Watchers Survey: Outlook March 53.2 53.4

06:00 Germany Factory Orders s.a. (MoM) February -3.9% 1.5% -0.9%

06:00 Germany Factory Orders n.s.a. (YoY) February -0.1% -1.3%

The U.S. dollar is trading broadly lower against its major peers after yesterday's better-than-expected U.S. job openings figures did not lend further support and a possible rate hike delay weighed on the currency. Job openings climbed to 5.133 million in February from 4.965 million in January. It was the highest level since January 2001. January's figure was revised down from 4.998 million. Analysts had expected job openings to rise to 4.978 million. Today at 13:30 GMT FOMC Member Dudley speaks and at 18:00 the FOMC minutes of the last policy meeting will be published.

The Australian dollar continued to add gains against the U.S. dollar after the RBA left rates unchanged at 2.25% yesterday but said that future rate cuts could be necessary and appropriate in order to keep growth and inflation consistent with the target.

New Zealand's dollar booked gains against the greenback during the Asian in the absence of any major economic news.

The Japanese yen traded higher against the greenback in the Asian session. The Bank of Japan left the key interest rate unchanged at 0.10% after an 8 to 1 vote and kept the bank's Monetary Base Target unchanged at 275 billion. One member voted for a lower target but was voted down. The current Eco Watchers Survey for March increased above estimates to 52.2, beating forecasts of an increase to 50.9 from a previous reading of 50.1. The Eco Watchers Outlook rose from 53.2. to 53.4. At 06:30 GMT the Bo J will hold a press conference.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling booked gains against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln February -3.7 -3.8

07:00 United Kingdom Halifax house price index March -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y March 8.3%

07:15 Switzerland Consumer Price Index (MoM) March -0.3% 0.1%

07:15 Switzerland Consumer Price Index (YoY) March -0.8% 1.0%

08:30 United Kingdom BOE Credit Conditions Survey Quarter I

09:00 Eurozone Retail Sales (MoM) February 1.1% -0.1%

09:00 Eurozone Retail Sales (YoY) February 3.7%

13:30 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories April 4.8

18:00 U.S. FOMC meeting minutes

23:01 United Kingdom RICS House Price Balance March 14% 15%

23:30 Australia AiG Performance of Construction Index March 43.9

-

08:22

Options levels on wednesday, April 8, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1015 (1985)

$1.0946 (1060)

$1.0901 (116)

Price at time of writing this review: $1.0838

Support levels (open interest**, contracts):

$1.0764 (1221)

$1.0724 (1783)

$1.0673 (3142)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 44184 contracts, with the maximum number of contracts with strike price $1,1200 (6149);

- Overall open interest on the PUT options with the expiration date May, 8 is 60793 contracts, with the maximum number of contracts with strike price $1,0000 (7533);

- The ratio of PUT/CALL was 1.38 versus 1.38 from the previous trading day according to data from April, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.5111 (1334)

$1.5015 (1281)

$1.4919 (690)

Price at time of writing this review: $1.4846

Support levels (open interest**, contracts):

$1.4778 (2387)

$1.4682 (2758)

$1.4586 (602)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 17580 contracts, with the maximum number of contracts with strike price $1,5100 (1334);

- Overall open interest on the PUT options with the expiration date May, 8 is 24297 contracts, with the maximum number of contracts with strike price $1,4700 (2758);

- The ratio of PUT/CALL was 1.38 versus 1.46 from the previous trading day according to data from April, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Factory Orders s.a. (MoM), February -0.9% (forecast 1.5%)

-

07:02

Japan: Eco Watchers Survey: Outlook, March 53.4

-

07:00

Japan: Eco Watchers Survey: Current , March 52.2 (forecast 50.9)

-

05:41

Japan: Bank of Japan Monetary Base Target, 275

-

04:01

Nikkei 225 19,734.48 +93.94 +0.48 %, Hang Seng 25,792.74 +517.10 +2.05 %, Shanghai Composite 3,944.65 -16.73 -0.42 %

-

01:55

Japan: Current Account, bln, February 1140 (forecast 1150)

-

00:35

Commodities. Daily history for Apr 7’2015:

(raw materials / closing price /% change)

Oil 53.98 +3.53%

Gold 1,208.20 -0.20%

-

00:33

Stocks. Daily history for Apr 7’2015:

(index / closing price / change items /% change)

Nikkei 225 19,640.54 +242.56 +1.25 %

Hang Seng 25,275.64 +192.89 +0.77 %

Shanghai Composite 3,960.98 +97.05 +2.51 %

FTSE 100 6,961.77 +128.31 +1.88 %

CAC 40 5,151.19 +77.05 +1.52 %

Xetra DAX 12,123.52 +156.13 +1.30 %

S&P 500 2,076.33 -4.29 -0.21 %

NASDAQ Composite 4,910.23 -7.08 -0.14 %

Dow Jones 17,875.42 -5.43 -0.03 %

-

00:32

Currencies. Daily history for Apr 7’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0811 -1,13%

GBP/USD $1,4813 -0,51%

USD/CHF Chf0,9663 +0,86%

USD/JPY Y120,30 +0,67%

EUR/JPY Y130,06 -0,45%

GBP/JPY Y178,2 +0,17%

AUD/USD $0,7637 +0,45%

NZD/USD $0,7497 -0,65%

USD/CAD C$1,2506 +0,27%

-

00:00

Schedule for today, Wednesday, Apr 8’2015:

(time / country / index / period / previous value / forecast)

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Eco Watchers Survey: Current March 50.1 50.9

05:00 Japan Eco Watchers Survey: Outlook March 53.2

06:00 Germany Factory Orders s.a. (MoM) February -3.9% 1.5%

06:00 Germany Factory Orders n.s.a. (YoY) February -0.1%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln February -3.7 -3.8

07:00 United Kingdom Halifax house price index March -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y March 8.3%

07:15 Switzerland Consumer Price Index (MoM) March -0.3% 0.1%

07:15 Switzerland Consumer Price Index (YoY) March -0.8% 1.0%

08:30 United Kingdom BOE Credit Conditions Survey Quarter I

09:00 Eurozone Retail Sales (MoM) February 1.1% -0.1%

09:00 Eurozone Retail Sales (YoY) February 3.7%

13:30 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories April 4.8

18:00 U.S. FOMC meeting minutes

23:01 United Kingdom RICS House Price Balance March 14% 15%

23:30 Australia AiG Performance of Construction Index March 43.9

-