Noticias del mercado

-

22:07

The main US stock indexes completed the session almost unchanged

The main US stock indexes finished trading near zero. The negative impact on the mood of investors was provided by data on the US housing market, as well as reports that Trump could give the Russian Foreign Minister secret information concerning the threat posed by the terrorist organization Islamic State.

As it became known, bookings of new houses in the USA unexpectedly fell in April against the background of a constant decrease in the construction of multi-apartment houses and a modest rebound in one-family projects, which indicates a slowdown in the housing market recovery. The Ministry of Housing reported that bookings of new homes fell 2.6% to 1.17 million (seasonally adjusted). This was the lowest level since November 2016, after a downward revision to the level of 1.20 million in March. Economists predicted that last month's bookmarks rose to 1.26 million units from the previously announced level of 1.22 million units in March.

Meanwhile, the optimism of the market has added data on industrial production. The Federal Reserve said that industrial production in April rose at the fastest monthly pace in more than three years, thanks to the broad achievements in the manufacturing sector. According to the data, the volume of industrial production grew by 1% in April, exceeding the consensus forecast of growth economists by 0.3%. This was the fastest growth rate since February 2014.

The components of the DOW index showed mixed dynamics (15 in positive territory, 15 in negative territory). Most fell shares of UnitedHealth Group Incorporated (UNH, -2.06%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 1.53%).

Most sectors of the S & P index finished trading in the red. The conglomerate sector fell most of all (-1.2%). The leader of growth was the technological sector (+ 0.5%).

At closing:

DJIA -0.01% 20.979.54 -2.40

Nasdaq + 0.33% 6,169.87 +20.20

S & P -0.07% 2,400.64 -1.68

-

21:00

DJIA -0.06% 20,969.64 -12.30 Nasdaq +0.17% 6,159.90 +10.23 S&P -0.16% 2,398.48 -3.84

-

18:00

European stocks closed: FTSE 100 +67.66 7522.03 +0.91% DAX -2.51 12804.53 -0.02% CAC 40 -11.30 5406.10 -0.21%

-

15:35

U.S. Stocks open: Dow +0.17%, Nasdaq +0.15%, S&P +0.10%

-

15:28

Before the bell: S&P futures +0.20%, NASDAQ futures +0.21%

U.S. stock-index futures rose moderately as investors paused for a breather a day after the S&P 500 and the Nasdaq closed at record highs. Investors assessed statistics on the U.S. housing market and industrial production.

Stocks:

Nikkei 19,919.82 +49.97 +0.25%

Hang Seng 25,335.94 -35.65 -0.14%

Shanghai 3,113.50 +23.27 +0.75%

S&P/ASX 5,850.52 +12.12 +0.21%

FTSE 7,511.95 +57.58 +0.77%

CAC 5,407.06 -10.34 -0.19%

DAX 12,817.24 +10.20 +0.08%

Crude $49.26 (+0.84%)

Crude $1,235.30 (+0.44%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

960.57

2.60(0.27%)

10614

AMERICAN INTERNATIONAL GROUP

AIG

62.87

1.05(1.70%)

3768

Apple Inc.

AAPL

156.18

0.48(0.31%)

79932

AT&T Inc

T

38.6

0.01(0.03%)

1769

Barrick Gold Corporation, NYSE

ABX

17.04

0.14(0.83%)

37648

Caterpillar Inc

CAT

102.7

0.28(0.27%)

1116

Chevron Corp

CVX

107.5

0.65(0.61%)

1635

Cisco Systems Inc

CSCO

34.37

0.14(0.41%)

7045

Citigroup Inc., NYSE

C

61.5

0.08(0.13%)

3953

Exxon Mobil Corp

XOM

83

0.20(0.24%)

3273

Facebook, Inc.

FB

150.4

0.21(0.14%)

60536

Ford Motor Co.

F

11.02

0.08(0.73%)

138116

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.88

0.13(1.11%)

29422

General Motors Company, NYSE

GM

33.85

0.03(0.09%)

6408

Goldman Sachs

GS

225.1

-0.02(-0.01%)

1620

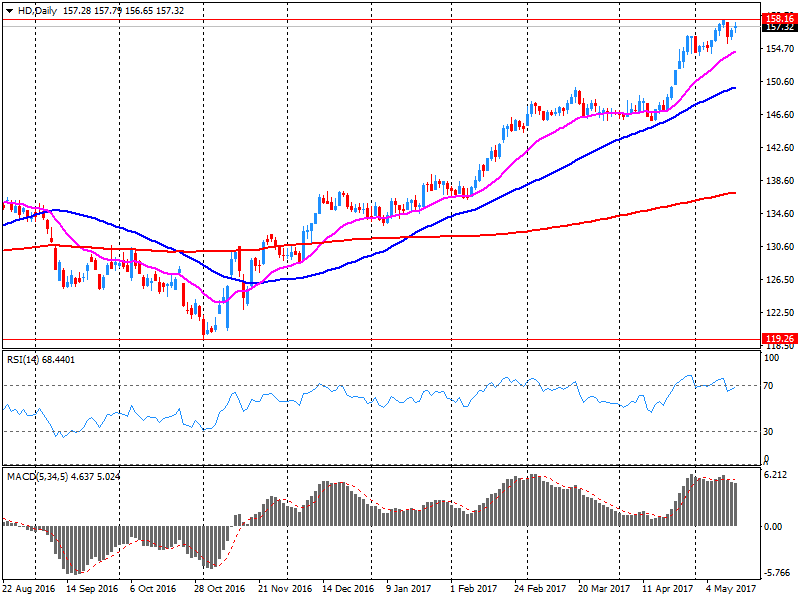

Home Depot Inc

HD

159.36

2.03(1.29%)

123780

Intel Corp

INTC

35.74

0.11(0.31%)

1934

JPMorgan Chase and Co

JPM

87.3

-0.04(-0.05%)

2191

Microsoft Corp

MSFT

68.2

0.16(0.24%)

16175

Nike

NKE

53.5

-0.27(-0.50%)

28935

Pfizer Inc

PFE

32.55

-0.57(-1.72%)

64195

Procter & Gamble Co

PG

86.68

0.35(0.41%)

6597

Starbucks Corporation, NASDAQ

SBUX

60.7

0.25(0.41%)

3289

Tesla Motors, Inc., NASDAQ

TSLA

318

2.12(0.67%)

47290

The Coca-Cola Co

KO

43.94

0.21(0.48%)

128

Twitter, Inc., NYSE

TWTR

19.39

0.16(0.83%)

87227

UnitedHealth Group Inc

UNH

171.02

-0.51(-0.30%)

11888

Verizon Communications Inc

VZ

45.5

0.12(0.26%)

5081

Visa

V

93.3

0.07(0.08%)

1359

Walt Disney Co

DIS

109

-0.13(-0.12%)

2672

Yahoo! Inc., NASDAQ

YHOO

50.09

0.23(0.46%)

302297

Yandex N.V., NASDAQ

YNDX

28.25

-0.65(-2.25%)

25632

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Pfizer (PFE) downgraded to Sell from Neutral at Citigroup

Other:

NIKE (NKE) initiated with a Buy at Berenberg; target $70

-

14:12

Company News: Home Depot (HD) Q1 EPS beat analysts’ expectations

Home Depot (HD) reported Q1 FY 2017 earnings of $1.67 per share (versus $1.44 in Q1 FY 2016), beating analysts' consensus estimate of $1.61.

The company's quarterly revenues amounted to $23.887 bln (+4.9% y/y), generally in-line with analysts' consensus estimate of $23.738 bln.

HD rose to $159.90 (+1.63%) in pre-market trading.

-

09:51

Major stock exchanges in Europe trading mixed: FTSE 7466.96 +12.59 + 0.17%, DAX 12797.32 -9.72 -0.08%, CAC 5391.88 -25.52 -0.47%

-

08:50

Moderate start of trading on the main European stock markets is expected: DAX flat, CAC40 flat, FTSE flat

-

07:40

Global Stocks

European equity-index gauges finished with modest gains Monday, scoring a fillip from commodity shares as oil and metals prices rose. The Stoxx Europe 600 index SXXP, +0.09% ended up 0.1% at 395.97, marking a second straight advance and keeping the index around its highest since August 2015. But the index moved between small gains and losses throughout the session. The oil-and-gas, basic-materials and financial sectors fared the best, but health-care, consumer-related and telecom shares struggled.

The S&P 500 and the Nasdaq Composite closed at fresh records on Monday as a jump in oil prices to a two-week high lifted Wall Street sentiment. The proposed extension still needs to be confirmed when the 13 members of the Organization of the Petroleum Exporting Countries gather for a closely watched meeting in Vienna on May 25.

Stock markets across Asia-Pacific lacked direction early Tuesday, with gains for regional energy and mining firms thanks to a jump in commodity prices, while Chinese markets again succumbed to selling pressure.

-

00:29

Stocks. Daily history for May 15’2017:

(index / closing price / change items /% change)

Nikkei -14.05 19869.85 -0.07%

TOPIX -0.71 1580.00 -0.04%

Hang Seng +215.25 25371.59 +0.86%

CSI 300 +13.81 3399.19 +0.41%

Euro Stoxx 50 +4.36 3641.88 +0.12%

FTSE 100 +18.98 7454.37 +0.26%

DAX +36.63 12807.04 +0.29%

CAC 40 +11.98 5417.40 +0.22%

DJIA +85.33 20981.94 +0.41%

S&P 500 +11.42 2402.32 +0.48%

NASDAQ +28.44 6149.68 +0.46%

S&P/TSX +91.59 15629.47 +0.59%

-