Notícias do Mercado

-

19:20

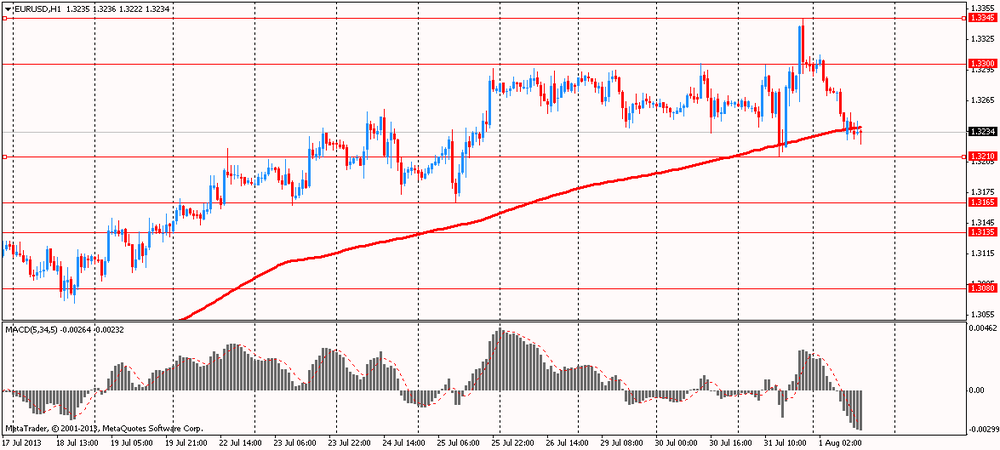

American focus: the U.S. currency rose against the euro

Value of the dollar against the euro has grown considerably, which helped the U.S. data. A report published by the Institute for Supply Management (ISM), showed that in July, manufacturing activity in the U.S. rose more than expected by economists. The PMI for the manufacturing sector in the United States July rose to 55.4 against 50.9 in May. A reading above 50 indicates expansion of industrial activity. Growth has exceeded the expectations of economists, who had forecast an increase to 52.1. Rise in the index was mainly due to good growth component of production, new orders and employment. At the same time, inventories and prices in July fell.

We also note that a significant fluctuation in the currency, which was noted earlier, was triggered by a statement of the ECB Draghi. He said that the base rate of the European Central Bank at 0.5% would not go up, at least until 2014, and should not be considered the beginning of 2014 as the time horizon of the proposed rate increase.

Thus, M.Dragi repeated statement that the ECB expects saving rates at current or lower levels for an "extended period." For the first time this phrase was used in the last press conference of the ECB.

"Long-term" does not imply a specific time benchmarks, but the head of the ECB has made it clear that we are talking about the period to mid-2014. So interpret statements M.Dragi most analysts, based on the phrase "Our monetary policy provides support for a gradual recovery in economic activity, which will continue until the end of 2013. In 2014.". In addition, the ECB is discussing the possibility of introducing the publication of minutes a few weeks after the meetings themselves, as it does, for example, the U.S. Federal Reserve. This issue will be addressed substantively in the autumn of this year.

Recall that earlier today the ECB left interest rates at 0.5% per annum. This decision coincided with the expectations of most analysts.

The pound dropped significantly against the dollar, losing the position of all previously earned. Note that initially helped by strong growth in the pound on the manufacturing PMI data and the decision of the Bank of England. It is learned that manufacturing activity in the UK in July showed the highest growth in over two years - Purchasing Managers Index (PMI) for the manufacturing sector rose to 54.6 against 52.9 in June.

Meanwhile, we add that today the Bank of England decided in line with expectations, leaving at current levels as the rate and the size of its asset purchase program (0.5% and £ 375 billion, respectively). Unlike last month, this time MPC refrained from accompanying statement.

But in spite of all the positive, the pound was unable to stay on the session high and has fallen off sharply, which is mainly contributed to the ECB President Draghi's comments, as well as U.S. data on manufacturing activity, which were presented later.

We also add that the strengthening of the dollar helped the expectations of tomorrow's publication of employment data, which will be closely monitored by investors, as the Federal Reserve Board has previously stated that the employment data will help determine actions on monetary policy. Economists expect that the U.S. created 180,000 jobs in July.

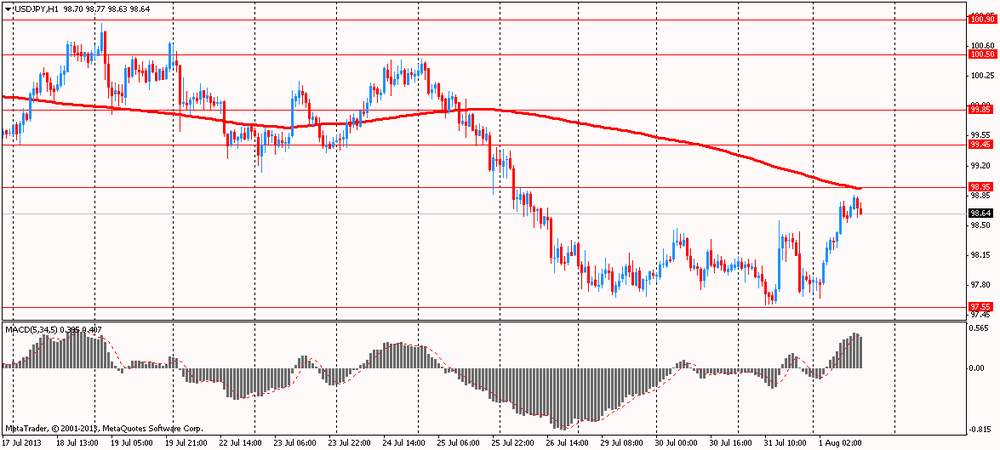

The Japanese yen fell significantly against the major currencies against the background of large-scale increase of Asian stock markets after more positive than-expected data on the manufacturing sector in China and under the influence of rising expectations of continuing the policy of ultra-low interest rates in the U.S., even after the collapse of the program of bond purchases.

The official report showed that the index of manufacturing activity in China rose at the end of last month to the level of 50.3, down from 50.1 in June. It is worth noting that the last reading was much better than the experts' forecasts - at the level of 49.8. We also add that the last time the official PMI declined below 50, which is the boundary reduction of activity in September 2012. However, we note that the index of manufacturing activity in China from HSBC sold with an official - he was down to 47.7 from the June value at 48.2. July data show that the index is in the drop zone for the third month in a row, including two months of testimony index from HSBC and different official

-

15:00

U.S.: Construction Spending, m/m, June -0.6% (forecast +0.4%)

-

15:00

U.S.: ISM Manufacturing, July 55.4 (forecast 52.1)

-

14:47

Option expiries for today's 1400GMT cut

EUR/USD $1.3050, $1.3100, $1.3200, $1.3250, $1.3275, $1.3300, $1.3350

USD/JPY Y97.30, Y97.35, Y97.50, Y98.00, Y98.30(large), Y98.50, Y98.75, Y99.00, Y99.25

GBP/USD $1.5130, $1.5165, $1.5170, $1.5190, $1.5200, $1.5225, $1.5265, $1.5300, $1.5335

EUR/GBP stg0.8565, stg0.8580, stg0.8640

EUR/CHF Chf1.2300, Chf1.2325, Chf1.2375, Chf1.2400

EUR/SEK 8.6565

AUD/USD $0.8870, $0.8900, $0.8970, $0.9000, $0.9030, $0.9050, $0.9070, $0.9155, $0.9170/75

EUR/AUD A$1.4600

USD/CAD C$1.0400

-

14:01

U.S.: Manufacturing PMI, July 53.7 (forecast 53.2)

-

13:30

U.S.: Initial Jobless Claims, July 326 (forecast 346)

-

13:22

European session: the pound rose on strong PMI and the decision of the Bank of England

07:50 France Manufacturing PMI (Finally) July 49.8 49.8 49.7

07:55 Germany Manufacturing PMI (Finally) July 50.3 50.3 50.7

08:00 Eurozone Manufacturing PMI (Finally) July 50.1 50.1 50.3

08:30 United Kingdom Purchasing Manager Index Manufacturing July 52.5 52.8 54.6

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.50% 0.50% 0.50%

The euro fell against the U.S. dollar despite the data on the growth of activity in the manufacturing sector in Germany and the euro zone.

Purchasing Managers Index (PMI) for the manufacturing sector in the euro area July rose to 50.3 against 48.8 in June. Thus, for the first time since July 2011, he was above the threshold level 50 which separates growth in activity from its decline. The July value was revised upward from a preliminary estimate of 50.1. Growth in the manufacturing sector of Germany was the fastest one and a half years, and Italian manufacturers reported an increase in activity for the first time in two years.

Today announced its decision to the ECB, which left interest rates unchanged at 0.50%. Euro has not reacted to this decision. Later, a press conference of the ECB, Mario Draghi, on which investors are waiting for comments on the policy of the central bank and the state of the eurozone economy.

The British pound rose against the dollar after strong data on manufacturing PMI and the decision of the Bank of England.

Manufacturing activity in the UK in July showed the highest growth in over two years. Total new orders rose at the fastest pace since February 2011, receiving support from the national and international market and increasing employment third consecutive month. Purchasing Managers Index (PMI) for the manufacturing sector, which is calculated by Markit and the Chartered Institute of Purchasing & Supply, in July rose to 54.6, its highest level since March 2011, against 52.9 in June.

Today, the Bank of England decided, in line with expectations, leaving at current levels as the rate and the size of its asset purchase program (0.5% and £ 375 billion, respectively). Unlike last month, this time MPC refrained from accompanying statement. However, the Bank of England has confirmed its intention to streamline the communication process and to make their policies more transparent. "As previously announced, the Committee will respond to the request of the Minister of Finance to evaluate the benefits of using targets and" transparency policy "and this will be reflected in the report on inflation, which will be published on August 7.

The Japanese yen fell against most major currencies against the background of large-scale increase of Asian stock markets after more positive than-expected data on the manufacturing sector in China and under the influence of rising expectations of continuing the policy of ultra-low interest rates in the U.S., even after the collapse of the program of bond purchases. The official manufacturing Purchasing Managers Index (PMI) of China rose in July to 50.3 against 50.1 in June, easing concerns about the possibility of a sharp slowdown second-largest economy in the world. In this projected figure at 49.8. The data came after the Federal Reserve on Wednesday left unchanged loose monetary policy against the background of weak economic growth and low inflation in the 1st half of the year.

EUR / USD: during the European session, the pair fell to $ 1.3222

GBP / USD: during the European session, the pair rose to $ 1.5242

USD / JPY: during the European session, the pair rose to Y98.86

At 12:30 GMT will begin monthly press conference of the ECB. At 14:00 GMT the U.S. ISM manufacturing index will be released in July. At 23:50 GMT Japan will release the change in the monetary base in July.

-

13:00

Orders

EUR/USD

Offers $1.3400, $1.3380, $1.3350/55, $1.3345/50, $1.3280, $1.3250

Bids $1.3225, $1.3210/00, $1.3180, $1.3165/50

GBP/USD

Offers $1.5355, $1.5325/30, $1.5300, $1.5280, $1.5255

Bids $1.5125/20, $1.5100, $1.5080, $1.5060/50

AUD/USD

Offers $0.9120, $0.9100, $0.9075/80, $0.9020/40, $0.9000/10

Bids $0.8930/25, $0.8900, $0.8860/55, $0.8850

EUR/JPY

Offers Y131.80, Y131.50, Y131.20, Y131.00

Bids Y130.25/20, Y130.00, Y129.80, Y129.60/50, Y129.20

USD/JPY

Offers Y99.80, Y99.50, Y99.00

Bids Y98.00, Y97.55/50, Y97.10/00

EUR/GBP

Offers stg0.8860/70, stg0.8845/50, stg0.8830/35, stg0.8810/15, stg0.8790/00, stg0.8720/25

Bids stg0.8700/695, stg0.8680/75, stg0.8645/50

-

12:45

Eurozone: ECB Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

10:28

Option expiries for today's 1400GMT cut

EUR/USD $1.3050, $1.3100, $1.3250, $1.3275, $1.3300, $1.3350

USD/JPY Y97.30, Y97.35, Y97.50, Y98.00, Y98.30(large), Y98.50, Y98.75, Y99.00, Y99.25

GBP/USD $1.5130, $1.5165, $1.5170, $1.5190, $1.5200, $1.5225, $1.5265, $1.5300, $1.5335

EUR/GBP stg0.8565, stg0.8580, stg0.8640

UER/CHF Chf1.2300, Chf1.2325, Chf1.2375, Chf1.2400

AUD/USD $0.8870, $0.8900, $0.8970, $0.9000, $0.9030, $0.9050, $0.9070, $0.9155, $0.9170/75

EUR/AUD A$1.4600

USD/CAD C$1.0400

-

09:44

Asia Pacific stocks close

Asian stocks rose, paring this week’s loss, as a gauge of China’s manufacturing beat estimates and after the Federal Reserve maintained its bond-buying program at current levels.

Nikkei 225 14,005.77 +337.45 +2.47%

Hang Seng 22,054.87 +171.21 +0.78%

S&P/ASX 200 5,061.49 +9.51 +0.19%

Shanghai Composite 2,029.07 +35.27 +1.77%

Panasonic Corp., Japan’s largest consumer electronics maker, climbed 6.8 percent after posting profit that beat estimates.

STX Offshore & Shipbuilding Co. jumped 15 percent in Seoul after agreeing to restructure it debt.

Commonwealth Bank of Australia, the nation’s biggest lender, fell 1.5 percent, pacing losses among Australian banks on a report the government will impose a new tax on lenders.

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , July 54.6 (forecast 52.8)

-

08:59

Eurozone: Manufacturing PMI, July 50.3 (forecast 50.1)

-

08:56

Germany: Manufacturing PMI, July 50.7 (forecast 50.3)

-

08:48

France: Manufacturing PMI, July 49.7 (forecast 49.8)

-

08:05

United Kingdom: Halifax house price index, July (forecast +0.3%)

-

08:05

United Kingdom: Halifax house price index 3m Y/Y, July

-

07:02

Asian session: The yen fell

01:00 Australia HIA New Home Sales, m/m June +1.6% +3.4%

01:00 China Manufacturing PMI July 50.1 49.8 50.3

01:30 Australia Import Price Index, q/q Quarter II 0.0% +1.9% -0.3%

01:30 Australia Export Price Index, q/q Quarter II +2.8% +0.3% -0.3%

01:45 China HSBC Manufacturing PMI (Finally) July 47.7 47.7 47.7

The yen fell against all of its 16 major peers as a rebound in Asian stocks reduced demand for Japan’s haven assets.

The greenback traded 0.5 percent from a six-week low versus the euro after the Federal Open Market Committee said persistently slow inflation could hamper U.S. economic expansion, spurring bets monetary stimulus will be maintained. Chairman Ben S. Bernanke and his colleagues cited “further improvements” in the labor market, while saying economic growth was “modest” and not indicating the timing for a trim to bond purchases. They are debating whether the economy is strong enough to warrant scaling back stimulus even as the jobless rate persists at 7.6 percent and inflation through May was well below their longer-run target of 2 percent.

The pound touched the weakest in more than four months versus the euro before policy decisions by the Bank of England and the European Central Bank.

Australia’s dollar touched the lowest in almost three years as bets the Reserve Bank will cut interest rates next week outweighed better-than-expected manufacturing data out of China, the nation’s biggest trading partner. China’s manufacturing PMI was at 50.3, the National Bureau of Statistics and China Federation of Logistics and Purchasing said today in Beijing. That compared with the 49.8 median forecast of 35 analysts in a Bloomberg News survey and June’s 50.1 level.

EUR / USD: during the Asian session the pair fell to $ 1.3270

GBP / USD: during the Asian session the pair fell to $ 1.5150

USD / JPY: during the Asian session the pair rose to Y98.35

The UK also releases the CIPS/Markit Manufacturing PMI at 0828GMT. For central banks, the Bank of England is first up, at 1100GMT, although analysts are near-united in the view that the MPC will not vote to expand its 375 billion quantitative easing program. The European Central Bank decision is due at 1145GMT but the successful foray into forward guidance along with positive signs from the real economy point to a steady hand. The monthly press conference follows at 1230GMT and ECB President Mario Draghi should keep the door for further interest rate cuts wide open while investors pay particular attention to his comments on lending as a first signal that the Eurotower may be gearing up for further action. Also at 1230GMT, US initial jobless claims are expected to rise by 2,000 to 345,000 in the July 27 week, as second straight increase. The final US Markit PMI then follows at 1258GMT, while the weekly Bloomberg Comfort Index is due at 1345GMT. Further US data sees the 1400GMT release of both Construction Spending and the latest ISM Index. Late US data see the 2030GMT release of M2 Money Supply data.

-

06:21

Currencies. Daily history for Jul 31'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3297 +0,26%

GBP/USD $1,5196 -0,26%

USD/CHF Chf0,9263 -0,37%

USD/JPY Y97,98 -0,07%

EUR/JPY Y129,92 -0,07%

GBP/JPY Y149,18 -0,11%

AUD/USD $0,9021 -0,51%

NZD/USD $0,7975 -0,16%

USD/CAD C$1,0279 -0,25%

-

06:00

Schedule for today, Thursday Aug 1’2013:

01:00 Australia HIA New Home Sales, m/m June +1.6% +3.4%

01:00 China Manufacturing PMI July 50.1 49.8 50.3

01:30 Australia Import Price Index, q/q Quarter II 0.0% +1.9% -0.3%

01:30 Australia Export Price Index, q/q Quarter II +2.8% +0.3% -0.3%

01:45 China HSBC Manufacturing PMI (Finally) July 47.7 47.7 47.7

06:30 Australia RBA Commodity prices, y/y July -10.5%

07:00 United Kingdom Halifax house price index July +0.6% +0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y July +3.7%

07:00 Switzerland Bank holiday

07:50 France Manufacturing PMI (Finally) July 49.8 49.8

07:55 Germany Manufacturing PMI (Finally) July 50.3 50.3

08:00 Eurozone Manufacturing PMI (Finally) July 50.1 50.1

08:30 United Kingdom Purchasing Manager Index Manufacturing July 52.5 52.8

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.50% 0.50%

12:30 Eurozone ECB Press Conference

12:30 U.S. Initial Jobless Claims July 343 346

13:00 U.S. Manufacturing PMI (Finally) July 53.2 53.2

14:00 U.S. Construction Spending, m/m June +0.5% +0.4%

14:00 U.S. ISM Manufacturing July 50.9 52.1

23:50 Japan Monetary Base, y/y July +36.0% +43.2%

-