Notícias do Mercado

-

18:20

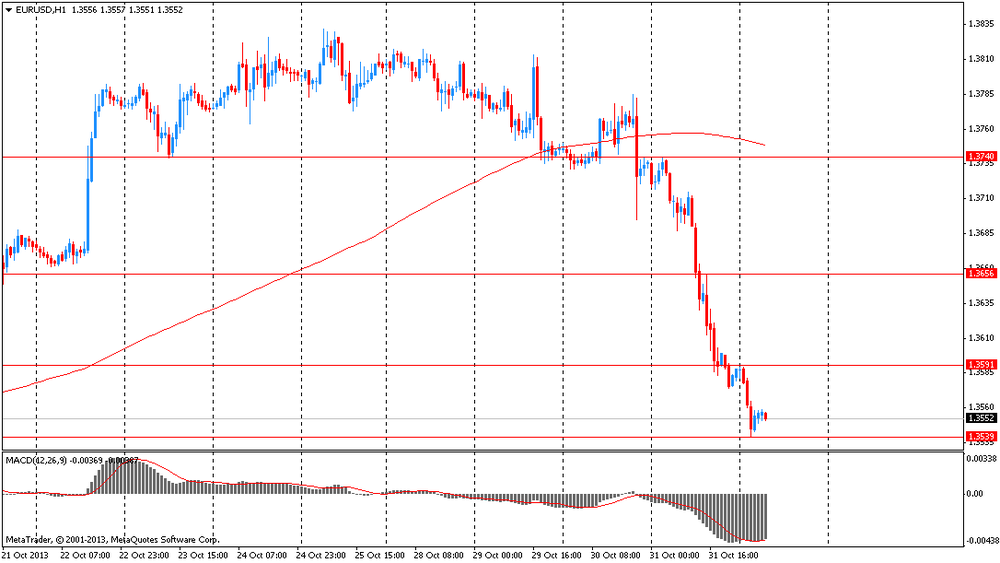

American focus : dollar is strengthening

The euro has decreased significantly against the dollar being under pressure amid increased expectations of a rate cut at the December meeting of the ECB. These conversations were triggered yesterday's inflation data , pointed to a sharp drop in the CPI. Furthermore , the rate b / d is at high level. In September, the euro zone CPI was 0.7 % , as reported by the agency Eurostat. Analysts had expected result of 1.1 %. Inflation continues to be under pressure from the problem of unemployment in the eurozone. Eurostat revised to increase the more optimistic figure of 12% ( at the level of September) to 12.2 %.

We add that the pair EUR / USD steady decline from the opening on Monday, and threatened to register today most massive drop in February on the week.

Recall that earlier euro strengthened mainly due to expectations that the Fed will postpone start rolling QE program at least until March due to weak employment growth and affected due to the first 17 years of the government shatdauna consumer confidence.

The dollar had evidence that the U.S. economic activity in the manufacturing sector in October rose for the fifth month in a row . Overall, the economy is growing throughout the 53rd consecutive month . The index of business activity in September rose 0.2 % to 56.2 . The index is growing every month since June, and the maximum value in October of 2013 . The new orders index in October rose by 0.1 % to 60.6 , the index of production fell by 1.8% to 60.8 %. Indices of new orders and production volume exceeds 60 for three consecutive months. The employment index fell by 2.2% to 53.2 . Comments respondents mostly positive about the business climate , though conflicting answers regarding the termination of the government and had the effect of potential default in October. Of the 18 industries 14 showed an increase in October.

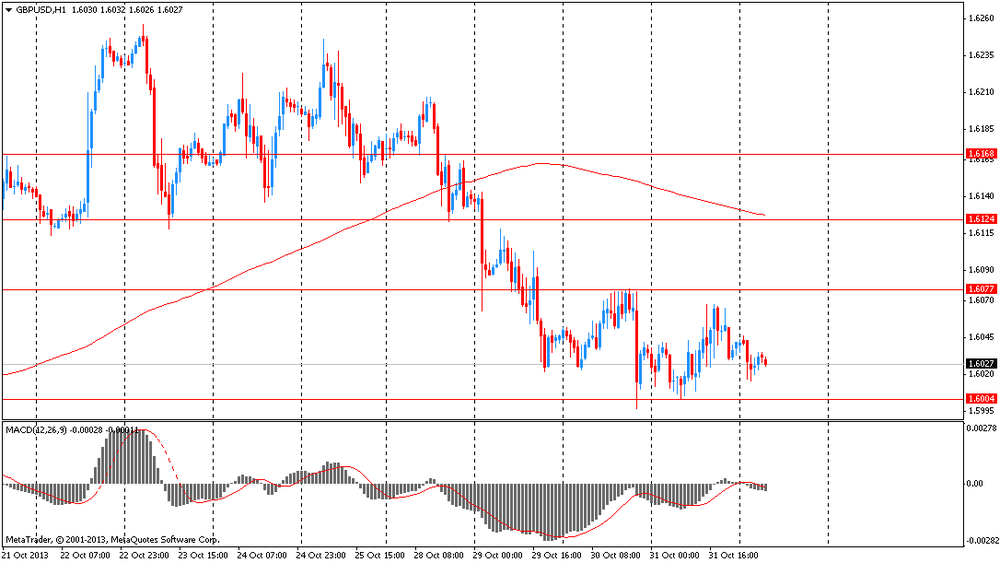

The pound fell against the dollar, which has been associated with the release of weak data on Britain. The results of recent studies that have been presented the Royal Institute of Purchasing and Supply and Markit Economics, showed that the increase in activity in the British manufacturing sector slowed slightly in October , exceeding while forecasts.

According to the report, the purchasing managers' index for the manufacturing sector fell in October to the level of 56 points, compared with a revised downwards index for September at 56.3 (initially reported 56.7 points). Add that to the experts according to the average value of this indicator should have been 56.5 . Recall also that the value of the index is above 50 , however, indicates expansion of the sector .

Economists say that despite the downturn, the increase in activity remains solid . PMI is currently above the 50 level for the seventh consecutive month. Meanwhile, the data showed that the new influx of orders increased in October , as domestic and foreign demand is gaining momentum . The number of new export orders rose at the fastest pace since February 2011 , said Markit.

In addition, it was reported that manufacturing employment rose for the sixth straight month in October. However , the pace of job growth has dropped from a 27-month peak, which was seen in September. We also add that the purchase price inflation continued to decline during the month of October , while wholesale prices rose , registering with the fourth monthly increase in a row.

The Swiss franc fell against the U.S. dollar after it became known that the growth in the industrial sector in Switzerland slowed in October , despite the forecasts of experts at a small improvement , while offsetting the rise in the previous month. It became known from the results of the study, which was published by Credit Suisse and procure.ch.

According to the report , the seasonally adjusted purchasing managers' index for the manufacturing sector fell this month to the level of 54.2 points compared to 55.3 points in September. Add that many experts had expected an increase of this index to the level of 55.4 . Recall that the index value above 50 suggests growth of activity in the manufacturing sector , while a decline below indicates decline. Note also that before the October decline in activity has increased seven consecutive months.

-

14:00

U.S.: ISM Manufacturing, October 56.4 (forecast 55.3)

-

13:46

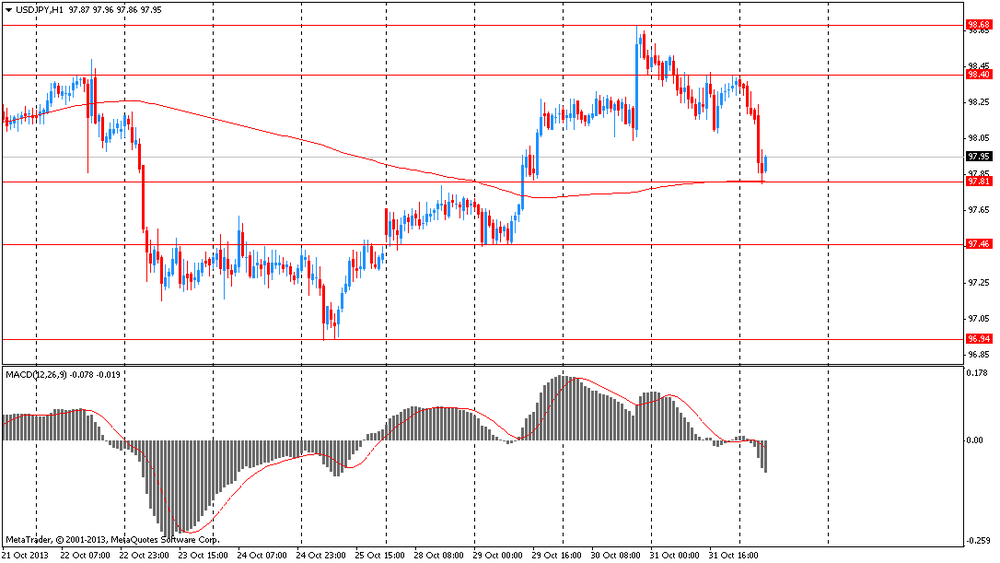

Option expiries for today's 1400GMT cut

USD/JPY Y96.50, Y97.00, Y97.50, Y98.00, Y98.10, Y98.20, Y98.30/35, Y98.50, Y99.00

EUR/JPY Y134.35

EUR/USD $1.3540, $1.3570, $1.3600, $1.3615, $1.3650, $1.3680, $1.3700

GBP/USD $1.6000, $1.6080, $1.6145, $1.6225

EUR/CHF Chf1.2305, Chf1.2320

AUD/USD $0.9350, $0.9400, $0.9450, $0.9460, $0.9550, $0.9600

AUD/JPY Y93.40

NZD/USD $0.8300

USD/CAD C$1.0400, C$1.0410, C$1.0470, C$1.0475, C$1.0485, C$1.0525

-

13:16

European session: the euro dropped significantly against the dollar

Data

00:30 Australia Producer Price Index q / q III m +0.1 % +0.3 % +1.3 %

00:30 Australia Producer Price Index y / y III quarter +1.2 % +1.9 %

1:00 China Manufacturing PMI 51.1 51.2 October 51.4

1:45 China Manufacturing PMI HSBC ( final data ) October 50.9 50.7 50.9

05:30 AU Commodity Index from the RBA , g / g III quarter -3.1 % -1.0 %

8:30 Switzerland The index of business activity in the manufacturing sector in October 55.3 55.4 54.2

09:30 UK Manufacturing PMI 56.7 56.5 October 56.0

13:00 USA index of business activity in the manufacturing sector (final ) October 51.1 51.1

13:10 Speech U.S. Federal Open Market Committee D. Bullard

The euro exchange rate against the dollar has decreased significantly , being under pressure amid increased expectations of a rate cut at the December meeting of the ECB. These conversations were triggered yesterday's inflation data , pointed to a sharp drop in the CPI. Furthermore , the rate b / d is at high level. In September, the euro zone CPI was 0.7 % , as reported by the agency Eurostat. Analysts had expected result of 1.1 %.

Inflation continues to be under pressure from the problem of unemployment in the eurozone. Eurostat revised to increase the more optimistic figure of 12% ( at the level of September) to 12.2 %.

We add that the pair EUR / USD steady decline from the opening on Monday, and threatened to register today most massive drop in February on the week.

Recall that earlier euro strengthened mainly due to expectations that the Fed will postpone start rolling QE program at least until March due to weak employment growth and affected due to the first 17 years of the government shatdauna consumer confidence.

The pound fell against the dollar, which has been associated with the release of weak data on Britain.

The results of recent studies that have been presented the Royal Institute of Purchasing and Supply and Markit Economics, showed that the increase in activity in the British manufacturing sector slowed slightly in October , exceeding while forecasts.

According to the report, the purchasing managers' index for the manufacturing sector fell in October to the level of 56 points, compared with a revised downwards index for September at 56.3 (initially reported 56.7 points). Add that to the experts according to the average value of this indicator should have been 56.5 . Recall also that the value of the index is above 50 , however, indicates expansion of the sector .

Economists say that despite the downturn, the increase in activity remains solid . PMI is currently above the 50 level for the seventh consecutive month.

Meanwhile, the data showed that the new influx of orders increased in October , as domestic and foreign demand is gaining momentum . The number of new export orders rose at the fastest pace since February 2011 , said Markit.

In addition, it was reported that manufacturing employment rose for the sixth straight month in October. However , the pace of job growth has dropped from a 27-month peak, which was seen in September. We also add that the purchase price inflation continued to decline during the month of October , while wholesale prices rose , registering with the fourth monthly increase in a row.

The Swiss franc fell against the U.S. dollar, after it became known that the growth in the industrial sector in Switzerland slowed in October , despite the forecasts of experts at a small improvement , while offsetting the rise in the previous month. This became of the results of the study, which was published by Credit Suisse and procure.ch.

According to the report , the seasonally adjusted purchasing managers' index for the manufacturing sector fell this month to the level of 54.2 points compared to 55.3 points in September. Add that many experts had expected an increase of this index to the level of 55.4 . Recall that the index value above 50 suggests growth of activity in the manufacturing sector , while a decline below indicates decline. We also note that the October decline in activity has increased seven consecutive months.

These also states that the decline in activity in October was due to the fall of the sub -index of production and order backlog , which , despite the deterioration remained in the growth zone . Meanwhile, it was reported that output grew in October for the seventh consecutive month. Employment also continued to improve, after the relevant sub- index of the growth zone in September, which was recorded for the first time in 12 months.

After a bumpy recovery , to date, employment seems to have ceased to decline, thus fulfilling one of the conditions required for the acceleration of recovery, the study said.

EUR / USD: during the European session, the pair fell to $ 1.3507

GBP / USD: during the European session, the pair rose to $ 1.5951

USD / JPY: during the European session, the pair fell to Y97.80, then rebounded to Y98.37

At 14:00 GMT the U.S. will release the ISM manufacturing index for October.

-

13:00

U.S.: Manufacturing PMI, October 51.8 (forecast 51.1)

-

12:45

Orders

EUR/USD

Offers $1.3690/700, $1.3660/65, $1.3650, $1.3615/20, $1.3600

Bids $1.3510/00, $1.3475/65, $1.3450, $1.3420

GBP/USD

Offers $1.6120, $1.6100/05, $1.6080, $1.6065/70, $1.6050

Bids $1.5980, $1.5965/60, $1.5950/40, $1.5870, $1.5850/40, $1.5820

AUD/USD

Offers $0.9600, $0.9575/80, $0.9545/50, $0.9500/10

Bids $0.9455/50, $0.9420, $0.9400, $0.9350

EUR/GBP

Offers stg0.8575/85, stg0.8520/30, stg0.8500, stg0.8480

Bids stg0.8445/40, stg0.8425/15, stg0.8400, stg0.8370/65

EUR/JPY

Offers Y134.10/20, Y134.00, Y133.50, Y133.20/30

Bids Y132.50, Y132.00, Y131.50

USD/JPY

Offers Y99.00, Y98.80, Y98.50

Bids Y97.50, Y97.20, Y97.00

-

09:57

Option expiries for today's 1400GMT cut

USD/JPY Y96.50, Y97.00, Y97.50, Y98.00, Y98.10, Y98.20, Y98.30/35, Y98.50, Y99.00

EUR/JPY Y134.35

EUR/USD $1.3540, $1.3570, $1.3600, $1.3615, $1.3650, $1.3680, $1.3700

GBP/USD $1.6000, $1.6080, $1.6145, $1.6225

EUR/CHF Chf1.2305, Chf1.2320

AUD/USD $0.9350, $0.9400, $0.9450, $0.9460, $0.9550, $0.9600

AUD/JPY Y93.40

NZD/USD $0.8300

USD/CAD C$1.0400, C$1.0410, C$1.0470, C$1.0475, C$1.0485, C$1.0525

-

09:29

United Kingdom: Purchasing Manager Index Manufacturing , October 56.0 (forecast 56.5)

-

08:30

Switzerland: Manufacturing PMI, October 54.2 (forecast 55.4)

-

07:02

Asian session: The euro declined to the lowest level in two weeks

00:30 Australia Producer price index, q / q Quarter III +0.1% +0.3% +1.3%

00:30 Australia Producer price index, y/y Quarter III +1.2% +1.9%

01:00 China Manufacturing PMI October 51.1 51.2 51.4

01:45 China HSBC Manufacturing PMI (Finally) October 50.9 50.7 50.9

05:30 Australia RBA Commodity prices, y/y Quarter III -3.1% -1.0%

The euro declined to the lowest level in two weeks against the dollar and the yen as signs of economic weakness in the currency bloc fueled speculation the European Central Bank will cut interest rates.

The 17-nation currency extended its biggest drop in more than a year versus the greenback before data forecast to show manufacturing contracted in France. An index based on a survey of French purchasing managers in manufacturing fell to 49.4 in October, the lowest since June, according to a separate poll for the Nov. 4 data. That would confirm the initial reading released on Oct. 24. Reports yesterday showed the euro region’s inflation slowed and unemployment climbed to a record. The euro area’s annual consumer-price index declined to 0.7 percent last month, the least since November 2009, from 1.1 percent in September, the European Union’s statistics office said yesterday. Euro-area unemployment stood at a record 12.2 percent in September, separate data showed.

The Australian dollar pared declines after data showed Chinese manufacturing expanded at the fastest pace in 18 months, boosting trade prospects. China’s Purchasing Managers’ Index rose to 51.4 in October, the highest since April 2012 and up from 51.1 in September, National Bureau of Statistics and China Federation of Logistics and Purchasing said in Beijing today. China is Australia’s biggest export market.

EUR / USD: during the Asian session the pair fell to $ 1.3540

GBP / USD: during the Asian session, the pair fell to $ 1.6015

USD / JPY: during the Asian session the pair fell to Y97.80

UK manufacturing PMI data due at 0928GMT and will provide the main domestic focus (f'cast 56.4 vs last 56.7). For the afternoon, US PMI and ISM data will provide interest. Fed Bullard speaks at 1310GMT. -

06:24

Currencies. Daily history for Oct 31'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3588 -1,09%

GBP/USD $1,6042 +0,04%

USD/CHF Chf0,9064 +0,79%

USD/JPY Y98,37 -0,07%

EUR/JPY Y133,65 -1,18%

GBP/JPY Y157,78 -0,03%

AUD/USD $0,9457 -0,25%

NZD/USD $0,8255 -0,11%

USD/CAD C$1,0434 -0,40%

-

06:03

Schedule for today, Friday, Nov 1’2013:

00:30 Australia Producer price index, q / q Quarter III +0.1% +0.3% +1.3%

00:30 Australia Producer price index, y/y Quarter III +1.2%

01:00 China Manufacturing PMI October 51.1 51.2 51.4

01:45 China HSBC Manufacturing PMI (Finally) October 50.9 50.7 50.9

05:30 Australia RBA Commodity prices, y/y Quarter III -3.1%

08:30 Switzerland Manufacturing PMI October 55.3 55.4

09:30 United Kingdom Purchasing Manager Index Manufacturing October 56.7 56.5

13:00 U.S. Manufacturing PMI (Finally) October 51.1 51.1

13:10 U.S. FOMC Member James Bullard Speaks

14:00 U.S. ISM Manufacturing October 56.2 55.3

-