Notícias do Mercado

-

19:21

American focus : the dollar fell against the euro

The euro rose against the dollar, which has been associated with the release of data on the U.S.. The Ministry of Commerce reported that up to September, the volume of industrial orders increased significantly , which followed a two-month decline. However , it was noticed a sharp decline in orders for machinery and other goods, which may indicate a slowdown in economic growth.

According to the report , the volume of industrial orders rose 1.7 percent in September , compared with a decline of 0.1 percent in August and a decrease of 2.8 percent in July. Note that this improvement primarily was due to 57.7 -percent increase in demand for airplanes. But , despite this significant growth rate could exceed the forecasts of experts at the level of 1.9 percent.

Meanwhile, we add that the orders for the so -called core capital goods, which include machinery and electronics, fell 1.3 percent in September . Such dynamics was related to the 23.6 -percent decline in demand for machinery, and also a large decrease in orders for construction machinery , electric turbines and generators. Note that many economists pay more attention to the major orders because they exclude more vollatilnye orders for defense and aircraft, and are the best indicator of readiness of business to invest. We add that the decline for the second time in three months indicates a weak activity in the manufacturing sector in the third quarter.

In addition , the data showed that orders for durable goods rose 3.8 percent in September , mainly due to increase in orders for aircraft . The large increase in demand for aircraft helped offset the 0.7 percent drop in demand for cars and auto parts . This decline is expected to be temporary , given the strength of car sales this year. Note also that the demand for non-durable goods fell 0.2 percent.

I should add that many analysts predict weak economic growth in the second half of the year . They predict that the increase in the annual rate of about 1.9 percent in the third quarter and about 2 percent in the last quarter . Both rates are lower than the 2.5 percent rate of growth recorded in the period from April to June.

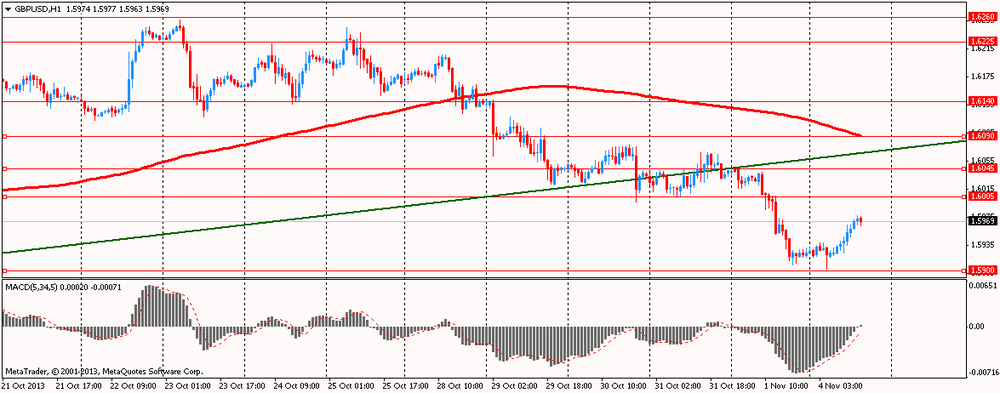

The pound outgrowth significantly against the dollar, which has been associated with the release of strong data on Britain. Note that the index of business activity in the UK construction sector has strengthened in the past month , and the growth rate was the highest since September 2007 . According to the report , the index of business activity in the construction sector Markit / CIPS PMI rose to 59.4 in October , beating economists' expectations , against 58.9 in September. The figures were the latest in a series of positive economic indicators , on Friday November 1 out strong report on the industrial sector . Economists are now focused on data on business activity in the services sector , which includes private companies outside the retail sector and sheds light on a much larger part of the British economy than construction .

"The volume of construction of the UK continue to grow, and we can all see rapid expansion early in the fourth quarter," said Markit economist Tim Moore . The construction sector suffered the most among the branches of the British economy since the financial crisis , due to the fall in the housing market and the austerity measures of the state: it was closed a lot of construction projects to save money . In the three months to September, an increase of 2.5% according to official data , the fastest pace since Q2 2010 . This however, is a relatively small part of the British economy.

"Proof that the construction sector continues to gain momentum is good news for the overall prospects of growth, but it must be remembered that the sector accounts for only 6.3 percent of national output ," - said IHS Global Insight economist Howard Archer.

-

15:00

U.S.: Factory Orders , August +1.7% (forecast +0.2%)

-

13:16

European session: the euro and pound rose

08:00 Eurozone ECB’s Vitor Constancio Speaks

08:48 France Manufacturing PMI (Finally) October 49.4 49.4 49.1

08:53 Germany Manufacturing PMI (Finally) October 51.5 51.5 51.7

08:58 Eurozone Manufacturing PMI (Finally) October 51.3 51.3 51.3

09:30 Eurozone Sentix Investor Confidence November 6.1 6.6 9.3

09:30 United Kingdom PMI Construction October 58.9 58.9 59.4

The euro rose against the dollar , supported by data on business activity in the manufacturing sector and the confidence of investors.

Eurozone manufacturing sector suffered a modest pace of recovery in the third quarter in the last quarter of the year , as originally expected, showed the final data from Markit Economics, published on Monday . The manufacturing purchasing managers' index rose to 51.3 in October from 51.1 in September. The October result coincided with the preliminary estimates and forecasts of experts.

Despite the modest rate of growth in general , increasing the active signals received from all but two countries in the study . Manufacturing output and new orders rose a fourth straight month in October. At the same time , employment declined twenty-first consecutive month of job cuts mainly reflects subdued demand growth and care costs.

At the same time , the level of investor confidence in the euro area has grown significantly in November , beating economists' expectations , and reached a two-and- a-half year high on Monday showed a monthly survey of the analytical center Sentix. The index of investor confidence rose in November, the fourth consecutive month to 9.3 from 6.1 in October. Economists had expected a slight increase to 6.6 .

The latter value is the highest since May 2011 and the strongest among the rest of the world , said the research team . Investors about the current economic situation is better than last month, according to the study . Assessment of the current situation index rose to -3.3 from -8.5 , while the expectations index rose to 22.8 from 21.8 .

The level of confidence of German investors reached a record 30.2 in November , said the Sentix. November's value is the highest since the beginning of entering the data in 2009. In October confidence index was 28.3 . Improving investor expectations contributed to the growth of the index.

The pound rose against the dollar , which was associated with the release of strong data on activity in the construction sector in Britain.

Activity in the construction sector in the UK in October continued to increase, with the maximum rate of growth reached more than six years. Published data have filled up a list of evidence the UK economic recovery in the 4th quarter of this year , which continues to rise , which began in January.

According to data released by the company Markit , the index of purchasing managers in the construction sector (PMI) in October rose to 59.4 against 58.9 in September. The index remains above the threshold level of 50.0 sixth consecutive month. In Markit reported that participated in the survey respondents said housing as the main factor of growth in October.

EUR / USD: during the European session, the pair rose to $ 1.3513

GBP / USD: during the European session, the pair rose to $ 1.5972

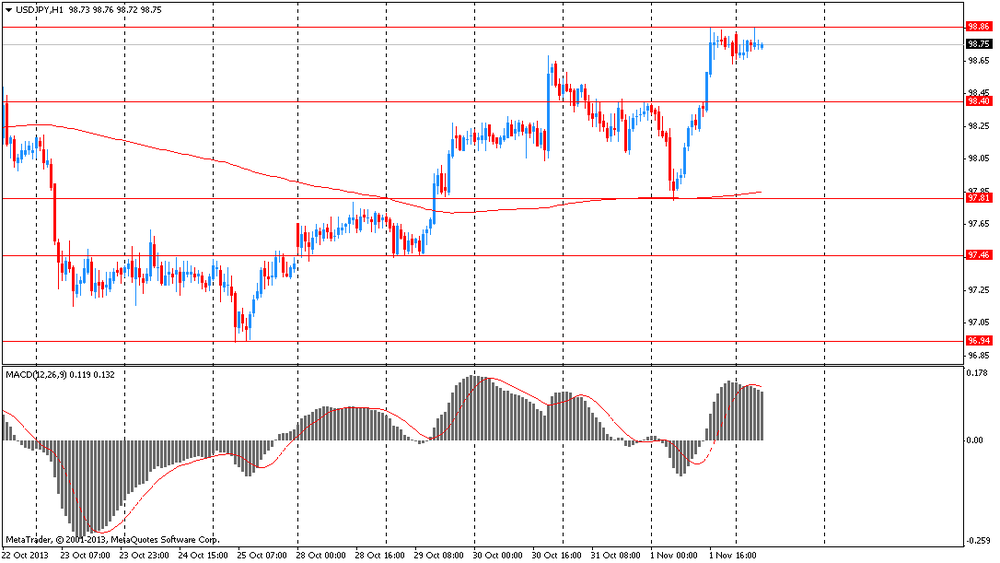

USD / JPY: during the European session, the pair fell to Y98.57

At 15:00 GMT the United States will change in the volume of production orders for August and September. At 16:20 GMT a speech Jerome Powell, a member of the FOMC . At 18:10 GMT a speech the Deputy Governor of the Bank of Canada Lawrence Schembri . At 21:00 GMT a speech FOMC member Eric Rosengren . At 21:45 GMT New Zealand will publish the change in the number of employed, the unemployment rate , changes in the level of wages in the private sector , excluding overtime for the 3rd quarter . At 22:30 GMT Australia will release the index of activity in the service of the AiG in October. At 23:50 GMT Japan will change in the monetary base in October.

-

11:15

U.K. construction output logs fastest growth since 2007

The U.K. construction output grew at the steepest pace since September 2007, survey results from Markit Economics showed Monday.

The Markit/Chartered Institute of Purchasing & Supply construction Purchasing Managers' Index came in at 59.4 in October, up from 58.9 in September and above the 50.0 no-change threshold for the sixth consecutive month.

"The future is looking bright for the UK construction industry as it soars into the final quarter with its strongest performance in over six years, boosted by a strengthening surge in activity broadening out across all sectors," David Noble, Chief Executive Officer at CIPS said.

Housing activity remained the strongest performing area of the construction sector. Meanwhile, latest data pointed to robust and accelerated rises in both civil engineering and commercial activity.

Higher levels of new work contributed to a robust increase in staffing levels during October. Further, the rate of input buying growth was the sharpest since December 2007.

Stronger demand for raw materials and higher utility bills contributed to upward pressure on input prices in October. Overall cost inflation picked up to its fastest since August 2011.

-

11:00

Eurozone Sentix investor confidence at 2-1/2-year high

Eurozone investor confidence increased strongly in November, surpassing economists' expectations, to hit a two-and-a-half year high, a monthly survey by the think tank Sentix showed on Monday.

The investor confidence index rose for the fourth consecutive month to 9.3 from October's 6.1. Economists were looking for a modest increase to 6.5.

The latest score is the highest since May 2011 and the strongest among rest of the world, the research group said. Investors assessed the current economic situation better than last month, the survey said.

The current situation index climbed to -3.3 from -8.5, while the expectations index rose to 22.8 from 21.8.

German investor confidence hit a record high of 30.2 in November, Sentix said, the score being the highest since the series began in 2009. In October, the score was 28.3. An improvement in investor expectations drove the index higher, the group said.

-

10:45

Eurozone manufacturing expands as estimated in October

The Eurozone manufacturing sector carried its modest third quarter recovery into the final quarter of the year as initially estimated, final data from Markit Economics showed Monday.

The manufacturing Purchasing Managers' Index rose to 51.3, in line with flash estimate from 51.1 in September.

Though modest overall, growth continued to come from a broad base with expansions signaled in all but two of the nations covered by the survey.

Manufacturing production and new orders both rose for the fourth consecutive month in October. At the same time, employment declined for the twenty-first successive month, with cuts to payroll numbers mainly reflecting subdued demand growth and cost caution.

Average input prices increased for the second month running in October. Likewise, output charges rose for the second month.

-

10:24

Option expiries for today's 1400GMT cut

USD/JPY Y97.50, Y97.75, Y98.00, Y98.10, Y98.25, Y98.75, Y99.00, Y99.05, Y99.35, Y99.50, Y100.00

EUR/USD $1.3250, $1.3300, $1.3350, $1.3550, $1.3600, $1.3620, $1.3650

GBP/USD $1.6000, $1.6090, $1.6150, $1.6160

USD/CHF Chf0.9005, Chf0.9100

EUR/CHF Chf1.2300

AUD/USD $0.9400, $0.9475, $0.9500, $0.9520, $0.9575

-

09:30

United Kingdom: PMI Construction, October 59.4 (forecast 58.9)

-

09:00

Eurozone: Manufacturing PMI, October 51.3 (forecast 51.3)

-

08:53

Germany: Manufacturing PMI, October 51.7 (forecast 51.5)

-

08:48

France: Manufacturing PMI, October 49.1 (forecast 49.4)

-

06:59

Asian session: The euro fell

00:00 Japan Bank holiday

00:30 Australia Retail sales (MoM) September +0.4% +0.5% +0.8%

00:30 Australia Retail Sales Y/Y September +2.3% +2.9%

00:30 Australia House Price Index (QoQ) Quarter III +2.4% +2.3% +1.9%

00:30 Australia House Price Index (YoY) Quarter III +5.1% +7.6% +7.6%

00:30 Australia ANZ Job Advertisements (MoM) October +0.2% -0.1%

The euro fell to its lowest level in more than six weeks before European Central Bank Executive Board member Joerg Asmussen speaks in the run-up to a policy meeting amid signs further stimulus may be needed in the region.

Europe’s common currency extended its biggest weekly drop since July 2012 before the Mario Draghi-led ECB meets on Nov. 7, when economists predict it will keep interest rates at 0.5 percent. Bank of America Corp., UBS AG and Royal Bank of Scotland Group Plc forecast the ECB will cut rates at this week’s meeting, according to a Bloomberg News survey of 68 economists, with the rest predicting no change. The ECB last lowered its benchmark rate in May to a record 0.5 percent.

The dollar added to gains from last week against most major peers after Federal Reserve Bank of Dallas President Richard Fisher said the central bank should resume normal monetary policy as soon as possible. “I am not a proponent of ever-increasing government spending,” Fisher, who will hold a vote on monetary policy next year, said in the partial text of a speech in Sydney today. “I mention this simply to illustrate a point: Unlike in most recoveries, government has played a countercyclical, suppressive role. The inability of our government to get its act together has countered the procyclical policy of the Federal Reserve.”

The Aussie climbed after data today showed retail sales grew at the fastest pace in seven months, adding to prospects the Reserve Bank won’t cut interest rates tomorrow. Retail sales rose 0.8 percent in September, compared with the median forecast for a 0.4 percent advance in a Bloomberg survey.

EUR / USD: during the Asian session the pair fell to $ 1.3440

GBP / USD: during the Asian session, the pair fell to $ 1.5900

USD / JPY: during the Asian session the pair traded in the range of Y98.65-85

Eurozone mfg PMI data for release this morning and could influence via the cross, with UK construction PMI providing the main domestic interest during the morning. Focus this weeks turns to Thursday's ECB rate decision, following the recent release of soft EZ inflation data, with US NFP following on Friday.

-

06:04

Schedule for today, Monday, Nov 4’2013:

00:00 Japan Bank holiday

00:30 Australia Retail sales (MoM) September +0.4% +0.5%

00:30 Australia Retail Sales Y/Y September +2.3%

00:30 Australia House Price Index (QoQ) Quarter III +2.4% +2.3%

00:30 Australia House Price Index (YoY) Quarter III +5.1% +7.6%

00:30 Australia ANZ Job Advertisements (MoM) October +0.2%

08:00 Eurozone ECB’s Vitor Constancio Speaks

08:48 France Manufacturing PMI (Finally) October 49.4 49.4

08:53 Germany Manufacturing PMI (Finally) October 51.5 51.5

08:58 Eurozone Manufacturing PMI (Finally) October 51.3 51.3

09:30 Eurozone Sentix Investor Confidence November 6.1 6.6

09:30 United Kingdom PMI Construction October 58.9 58.9

15:00 U.S. Factory Orders August -2.4% +0.2%

16:40 U.S. FOMC Member Jerome Powell Speaks

18:10 Canada BOC Deputy Governor Lawrence Schembri Speaks

21:00 U.S. FOMC Member Rosengren Speaks

22:30 Australia AIG Services Index October 47.1

23:50 Japan Monetary Base, y/y October +46.1% 48.3%

-