Notícias do Mercado

-

20:00

Dow +16.3 15,631.85 +0.10% Nasdaq +10.89 3,932.93 +0.28% S&P +4.69 1,766.33 +0.27%

-

19:21

American focus : the dollar fell against the euro

The euro rose against the dollar, which has been associated with the release of data on the U.S.. The Ministry of Commerce reported that up to September, the volume of industrial orders increased significantly , which followed a two-month decline. However , it was noticed a sharp decline in orders for machinery and other goods, which may indicate a slowdown in economic growth.

According to the report , the volume of industrial orders rose 1.7 percent in September , compared with a decline of 0.1 percent in August and a decrease of 2.8 percent in July. Note that this improvement primarily was due to 57.7 -percent increase in demand for airplanes. But , despite this significant growth rate could exceed the forecasts of experts at the level of 1.9 percent.

Meanwhile, we add that the orders for the so -called core capital goods, which include machinery and electronics, fell 1.3 percent in September . Such dynamics was related to the 23.6 -percent decline in demand for machinery, and also a large decrease in orders for construction machinery , electric turbines and generators. Note that many economists pay more attention to the major orders because they exclude more vollatilnye orders for defense and aircraft, and are the best indicator of readiness of business to invest. We add that the decline for the second time in three months indicates a weak activity in the manufacturing sector in the third quarter.

In addition , the data showed that orders for durable goods rose 3.8 percent in September , mainly due to increase in orders for aircraft . The large increase in demand for aircraft helped offset the 0.7 percent drop in demand for cars and auto parts . This decline is expected to be temporary , given the strength of car sales this year. Note also that the demand for non-durable goods fell 0.2 percent.

I should add that many analysts predict weak economic growth in the second half of the year . They predict that the increase in the annual rate of about 1.9 percent in the third quarter and about 2 percent in the last quarter . Both rates are lower than the 2.5 percent rate of growth recorded in the period from April to June.

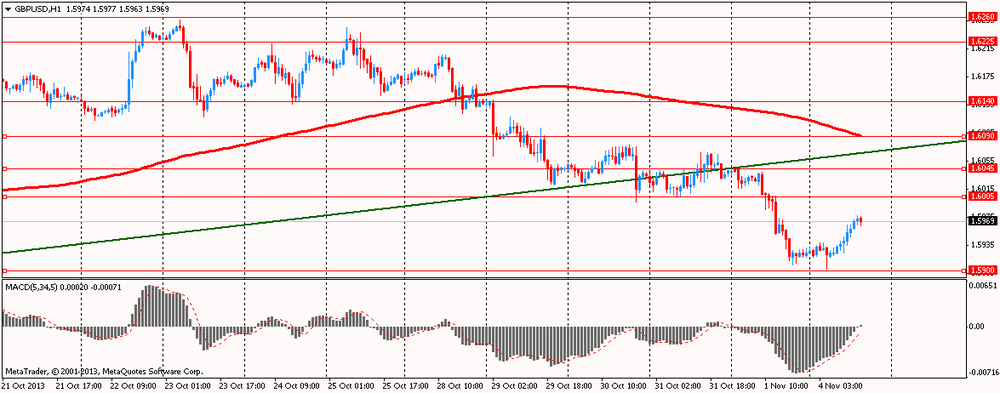

The pound outgrowth significantly against the dollar, which has been associated with the release of strong data on Britain. Note that the index of business activity in the UK construction sector has strengthened in the past month , and the growth rate was the highest since September 2007 . According to the report , the index of business activity in the construction sector Markit / CIPS PMI rose to 59.4 in October , beating economists' expectations , against 58.9 in September. The figures were the latest in a series of positive economic indicators , on Friday November 1 out strong report on the industrial sector . Economists are now focused on data on business activity in the services sector , which includes private companies outside the retail sector and sheds light on a much larger part of the British economy than construction .

"The volume of construction of the UK continue to grow, and we can all see rapid expansion early in the fourth quarter," said Markit economist Tim Moore . The construction sector suffered the most among the branches of the British economy since the financial crisis , due to the fall in the housing market and the austerity measures of the state: it was closed a lot of construction projects to save money . In the three months to September, an increase of 2.5% according to official data , the fastest pace since Q2 2010 . This however, is a relatively small part of the British economy.

"Proof that the construction sector continues to gain momentum is good news for the overall prospects of growth, but it must be remembered that the sector accounts for only 6.3 percent of national output ," - said IHS Global Insight economist Howard Archer.

-

18:20

European stock close

European stocks rose to a five-year high as HSBC Holdings Plc reported increased profit and investors awaited this week’s interest-rate decision from the European Central Bank.

The Stoxx Europe 600 Index gained 0.3 percent to 322.49 at 4:37 p.m. in London, the highest since May 2008. The benchmark measure climbed 0.4 percent last week, extending this year’s rally to 15 percent, as companies from BP Plc to Alcatel-Lucent SA posted results that exceeded analysts’ estimates and cooling inflation fueled speculation the ECB will ease monetary policy.

National benchmark indexes rose in 14 of the 18 western European markets this week.

FTSE 100 6,763.62 +28.88 +0.43% CAC 40 4,288.59 +15.40 +0.36% DAX 9,037.23 +29.40 +0.33%

Bank of America Corp., UBS (UBSN) and Royal Bank of Scotland Group Plc forecast the ECB will cut rates at the meeting on Thursday, according to survey of economists, with the rest predicting no change. The ECB last lowered its benchmark rate in May to a record 0.5 percent.

“Although the ECB meeting is still a few days away and expectations are for no change on current policy, traders are eagerly anticipating some form of dovish hint that looser conditions are on the way,” Jonathan Sudaria, a trader at Capital Spreads in London, wrote in e-mailed comments.

HSBC rose 3 percent to 707.7 pence. Third-quarter pretax profit advanced to $4.53 billion from $3.48 billion as costs as a proportion of revenue, excluding gains and losses in the value of the bank’s own debt, fell to 61 percent from 64 percent.

PostNL climbed 8.2 percent to 4.18 euros in Amsterdam, the highest price since March 2012. The company said it has cut costs and boosted its forecast for full-year underlying cash operating profit to 130 million euros ($175 million) to 160 million euros, compared with previous guidance of 50 million euros to 90 million euros.

K+S AG soared 8.7 percent to 20.88 euros, the largest gain since April 2009. Commerzbank AG upgraded Europe’s biggest producer of potash to hold from reduce and HSBC raised the shares to neutral from underweight. The stock has still plunged 40 percent this year.

Fuchs Petrolub SE increased 5.5 percent to 62.65 euros, the biggest rally in eight months, as the German maker of lubricants said earnings before interest and taxes gained 5.8 percent to 83.4 million euros in the third quarter.

Ryanair tumbled 12 percent to 5.34 euros, the biggest drop since July 2008. Europe’s largest discount airline said net income for the year ended March 31 will be in the range of 500 million euros to 520 million euros. The Dublin-based carrier had previously predicted profit of as little as 570 million euros and had cautioned that it may fall short of that number. Earnings last year were 569 million euros.

-

17:00

European stock close: FTSE 100 6,763.62 +28.88 +0.43% CAC 40 4,288.59 +15.40 +0.36% DAX 9,037.23 +29.40 +0.33%

-

16:40

Oil: an overview of the market situation

Oil prices have not changed in the course of trading , stabilized with near four-month low as the dollar weakened against most currencies , as signs of growth in the service sector in China and the jump in orders in the U.S. has become a factor increasing the demand outlook for energy.

Combination studies that have been carried out of China Federation of Logistics and Purchasing and the National Bureau of Statistics showed that China's non-manufacturing sector grew at a faster pace in October than in the previous month . According to the report , the official purchasing managers' index (PMI) for the service sector rose last month to the level of 56.3 points , compared to 55.4 points in September. Recall that in August, the value of this index was at 53.9 . Meanwhile, data showed that the volume of new orders in the service sector continued to grow in October, but to a lesser extent than in the previous month. Looking ahead, the non-manufacturing firms expect their business conditions to improve over the next three months.

Recall that on Friday , survey data released by the Bureau of Statistics showed that the growth of industrial production in China reached a 18-month high in October , as the company increased production. PMI for the manufacturing sector rose to 51.4 points, compared with 51.1 in September.

As for the U.S. data , they showed that in September promzakazy in the U.S. increased by 1.7 % compared to 0.1 % a month earlier. The result is almost coincided with market expectations . Also published a belated data for August : index fell by 0.1 % against 2.4% in July.

Note also that in the course of today's trading has affected the official statement of the Ministry of Oil Libya Ibrahim Al Awami . He said that the country is preparing to increase production and to restore operations at some export terminals. Meanwhile, the official added that Libya has the largest oil reserves in Africa, over the weekend increased production of raw materials up to 400 thousand barrels. This is approximately 100 thousand barrels more than at the beginning of the week. According to him, " soon" will resume the work of one of the country's export terminals , namely Hariga.

The cost of the December futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 94.52 a barrel on the New York Mercantile Exchange.

December futures price for North Sea Brent crude oil mixture fell $ 0.16 to $ 105.70 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose slightly today as the dollar lost some of their positions . However, the precious metal remains under pressure on talk that the European Central Bank may ease monetary policy , as well as renewed speculation that the Federal Reserve may curtail monetary stimulus at the end of this year.

We add that the euro earlier reached a six-week low against the dollar as investors sold the single currency on speculation that the ECB may loosen policy in the near future , but was able to regain lost ground after data showed that the manufacturing sector continued to expand in October. The final report from Markit Economics showed manufacturing purchasing managers' index rose to 51.3 in October from 51.1 in September. The October result coincided with the preliminary estimates and forecasts of experts. Despite the modest rate of growth in general , increasing the active signals received from all but two countries in the study . Manufacturing output and new orders rose a fourth straight month in October. At the same time , employment declined twenty-first consecutive month of job cuts mainly reflects subdued demand growth and care costs.

It should also be noted that the outflow of gold from exchange-traded funds resumed on Friday . In the SPDR Gold Shares stated that stocks fell by 5.7 million tons , registering with the biggest one-day loss since October 21. The recent drop in stocks indicates that investors are willing to reduce their holdings in gold in favor of other asset classes. In recent years, more investment is directed to the U.S. stock markets , which put one record after another , and seems to be universally accepted , as opposed to gold.

We add that the sharp drop in prices last week has failed to revive the physical demand , some dealers say that the price may drop even below $ 1,300 to attract more buyers.

The cost of the December gold futures on COMEX today rose to $ 1318.60 per ounce.

-

15:00

U.S.: Factory Orders , August +1.7% (forecast +0.2%)

-

14:36

U.S. Stocks open: Dow 15,653.76 +38.21 +0.24%, Nasdaq 3,932.63 +10.59 +0.27%, S&P 1,765.96 +4.32 +0.25%

-

14:28

Before the bell: S&P futures +0.38%, Nasdaq futures +0.50%

U.S. stock-index futures rose as investors watched company earnings and awaited this week’s releases on employment and economic growth.

Global Stocks:

Hang Seng 23,189.62 -60.17 -0.26%

Shanghai Composite 2,149.63 +0.07 0.00%

FTSE 6,774.64 +39.90 +0.59%

CAC 4,292.79 +19.60 +0.46%

DAX 9,044.32 +36.49 +0.41%

Crude oil $94.25 -0.38%

Gold $1318.10 +0.37%

-

13:16

European session: the euro and pound rose

08:00 Eurozone ECB’s Vitor Constancio Speaks

08:48 France Manufacturing PMI (Finally) October 49.4 49.4 49.1

08:53 Germany Manufacturing PMI (Finally) October 51.5 51.5 51.7

08:58 Eurozone Manufacturing PMI (Finally) October 51.3 51.3 51.3

09:30 Eurozone Sentix Investor Confidence November 6.1 6.6 9.3

09:30 United Kingdom PMI Construction October 58.9 58.9 59.4

The euro rose against the dollar , supported by data on business activity in the manufacturing sector and the confidence of investors.

Eurozone manufacturing sector suffered a modest pace of recovery in the third quarter in the last quarter of the year , as originally expected, showed the final data from Markit Economics, published on Monday . The manufacturing purchasing managers' index rose to 51.3 in October from 51.1 in September. The October result coincided with the preliminary estimates and forecasts of experts.

Despite the modest rate of growth in general , increasing the active signals received from all but two countries in the study . Manufacturing output and new orders rose a fourth straight month in October. At the same time , employment declined twenty-first consecutive month of job cuts mainly reflects subdued demand growth and care costs.

At the same time , the level of investor confidence in the euro area has grown significantly in November , beating economists' expectations , and reached a two-and- a-half year high on Monday showed a monthly survey of the analytical center Sentix. The index of investor confidence rose in November, the fourth consecutive month to 9.3 from 6.1 in October. Economists had expected a slight increase to 6.6 .

The latter value is the highest since May 2011 and the strongest among the rest of the world , said the research team . Investors about the current economic situation is better than last month, according to the study . Assessment of the current situation index rose to -3.3 from -8.5 , while the expectations index rose to 22.8 from 21.8 .

The level of confidence of German investors reached a record 30.2 in November , said the Sentix. November's value is the highest since the beginning of entering the data in 2009. In October confidence index was 28.3 . Improving investor expectations contributed to the growth of the index.

The pound rose against the dollar , which was associated with the release of strong data on activity in the construction sector in Britain.

Activity in the construction sector in the UK in October continued to increase, with the maximum rate of growth reached more than six years. Published data have filled up a list of evidence the UK economic recovery in the 4th quarter of this year , which continues to rise , which began in January.

According to data released by the company Markit , the index of purchasing managers in the construction sector (PMI) in October rose to 59.4 against 58.9 in September. The index remains above the threshold level of 50.0 sixth consecutive month. In Markit reported that participated in the survey respondents said housing as the main factor of growth in October.

EUR / USD: during the European session, the pair rose to $ 1.3513

GBP / USD: during the European session, the pair rose to $ 1.5972

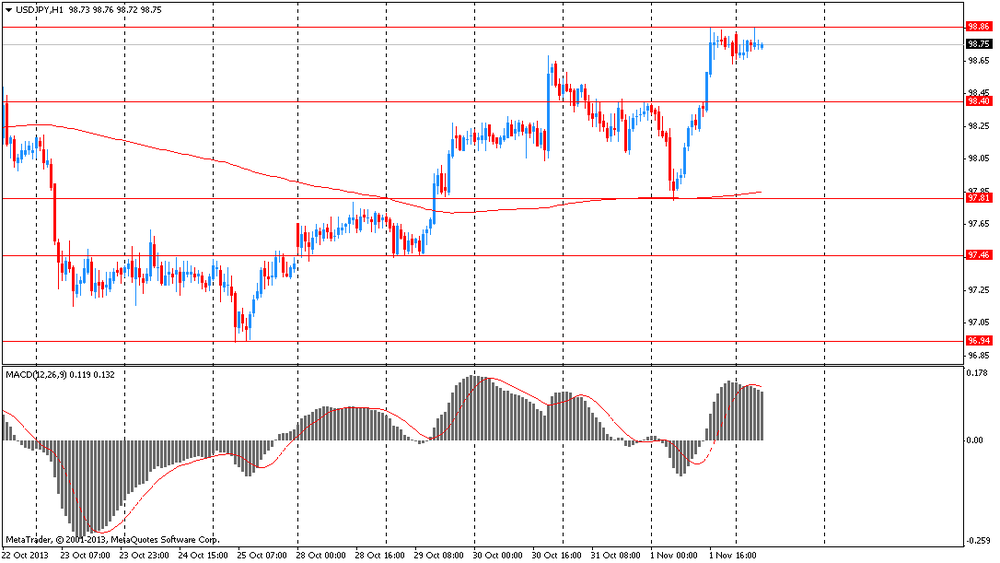

USD / JPY: during the European session, the pair fell to Y98.57

At 15:00 GMT the United States will change in the volume of production orders for August and September. At 16:20 GMT a speech Jerome Powell, a member of the FOMC . At 18:10 GMT a speech the Deputy Governor of the Bank of Canada Lawrence Schembri . At 21:00 GMT a speech FOMC member Eric Rosengren . At 21:45 GMT New Zealand will publish the change in the number of employed, the unemployment rate , changes in the level of wages in the private sector , excluding overtime for the 3rd quarter . At 22:30 GMT Australia will release the index of activity in the service of the AiG in October. At 23:50 GMT Japan will change in the monetary base in October.

-

11:33

European stocks rose

European stocks rose to near a five-year high as HSBC Holdings Plc reported increased profit and investors awaited this week’s interest-rate decision from the European Central Bank. U.S. index futures gained, while Asian shares declined.

The Stoxx Europe 600 Index gained 0.3 percent to 322.41 at 10:21 a.m. in London, extending this year’s rally to 15 percent.

HSBC rose 2 percent to 700.7 pence as third-quarter pretax profit advanced to $4.53 billion from $3.48 billion. Costs as a proportion of revenue, excluding gains and losses in the value of the bank’s own debt, fell to 61 percent from 64 percent.

PostNL climbed 6.9 percent to 4.13 euros in Amsterdam, the highest price since April 2012. The company said it has cut costs and boosted its forecast for full-year underlying cash operating profit to 130 million euros ($175 million) to 160 million euros, compared with previous guidance of 50 million euros to 90 million euros.

Ryanair tumbled 11 percent to 5.42 euros, the lowest level since January. Europe’s biggest discount airline said net income for the year ended March 31 will be in the range of 500 million euros to 520 million euros. The Dublin-based carrier had previously predicted profit of as little as 570 million euros and had cautioned that it may fall short of that number. Earnings last year were 569 million euros.

FTSE 100 6,764.48 +29.74 +0.44%

CAC 40 4,286.01 +12.82 +0.30%

DAX 9,039.03 +31.20 +0.35%

-

11:15

U.K. construction output logs fastest growth since 2007

The U.K. construction output grew at the steepest pace since September 2007, survey results from Markit Economics showed Monday.

The Markit/Chartered Institute of Purchasing & Supply construction Purchasing Managers' Index came in at 59.4 in October, up from 58.9 in September and above the 50.0 no-change threshold for the sixth consecutive month.

"The future is looking bright for the UK construction industry as it soars into the final quarter with its strongest performance in over six years, boosted by a strengthening surge in activity broadening out across all sectors," David Noble, Chief Executive Officer at CIPS said.

Housing activity remained the strongest performing area of the construction sector. Meanwhile, latest data pointed to robust and accelerated rises in both civil engineering and commercial activity.

Higher levels of new work contributed to a robust increase in staffing levels during October. Further, the rate of input buying growth was the sharpest since December 2007.

Stronger demand for raw materials and higher utility bills contributed to upward pressure on input prices in October. Overall cost inflation picked up to its fastest since August 2011.

-

11:00

Eurozone Sentix investor confidence at 2-1/2-year high

Eurozone investor confidence increased strongly in November, surpassing economists' expectations, to hit a two-and-a-half year high, a monthly survey by the think tank Sentix showed on Monday.

The investor confidence index rose for the fourth consecutive month to 9.3 from October's 6.1. Economists were looking for a modest increase to 6.5.

The latest score is the highest since May 2011 and the strongest among rest of the world, the research group said. Investors assessed the current economic situation better than last month, the survey said.

The current situation index climbed to -3.3 from -8.5, while the expectations index rose to 22.8 from 21.8.

German investor confidence hit a record high of 30.2 in November, Sentix said, the score being the highest since the series began in 2009. In October, the score was 28.3. An improvement in investor expectations drove the index higher, the group said.

-

10:45

Eurozone manufacturing expands as estimated in October

The Eurozone manufacturing sector carried its modest third quarter recovery into the final quarter of the year as initially estimated, final data from Markit Economics showed Monday.

The manufacturing Purchasing Managers' Index rose to 51.3, in line with flash estimate from 51.1 in September.

Though modest overall, growth continued to come from a broad base with expansions signaled in all but two of the nations covered by the survey.

Manufacturing production and new orders both rose for the fourth consecutive month in October. At the same time, employment declined for the twenty-first successive month, with cuts to payroll numbers mainly reflecting subdued demand growth and cost caution.

Average input prices increased for the second month running in October. Likewise, output charges rose for the second month.

-

10:24

Option expiries for today's 1400GMT cut

USD/JPY Y97.50, Y97.75, Y98.00, Y98.10, Y98.25, Y98.75, Y99.00, Y99.05, Y99.35, Y99.50, Y100.00

EUR/USD $1.3250, $1.3300, $1.3350, $1.3550, $1.3600, $1.3620, $1.3650

GBP/USD $1.6000, $1.6090, $1.6150, $1.6160

USD/CHF Chf0.9005, Chf0.9100

EUR/CHF Chf1.2300

AUD/USD $0.9400, $0.9475, $0.9500, $0.9520, $0.9575

-

09:41

Asia Pacific stocks close

Asian stocks fell after Federal Reserve Bank of Dallas President Richard Fisher said the U.S. central bank should end its record stimulus as soon as possible.

Nikkei 225 Closed

S&P/ASX 200 5,390.53 -20.59 -0.38%

Shanghai Composite 2,149.13 -0.43 -0.02%

South Korean financial companies including Shinhan Financial Group Co., Mirae Asset Securities Co. and Hana Financial Group Inc. dropped more than 3 percent.

Coca-Cola Amatil Ltd., Australia’s largest listed drinks company, slumped 4.7 percent after forecasting 2013 earnings will decline.

China Resources Enterprise Ltd., a brewer and retailer with businesses in Hong Kong and mainland China, gained 1.1 percent.

-

09:30

United Kingdom: PMI Construction, October 59.4 (forecast 58.9)

-

09:00

Eurozone: Manufacturing PMI, October 51.3 (forecast 51.3)

-

08:53

Germany: Manufacturing PMI, October 51.7 (forecast 51.5)

-

08:48

France: Manufacturing PMI, October 49.1 (forecast 49.4)

-

08:45

FTSE 100 6,766.22 +31.48 +0.47%, CAC 40 4,284.83 +11.64 +0.27%, Xetra DAX 9,043.13 +35.30 +0.39%

-

07:24

European bourses are initially seen trading higher Monday: the FTSE up 20, the DAX up 34, the CAC up 17.

-

06:59

Asian session: The euro fell

00:00 Japan Bank holiday

00:30 Australia Retail sales (MoM) September +0.4% +0.5% +0.8%

00:30 Australia Retail Sales Y/Y September +2.3% +2.9%

00:30 Australia House Price Index (QoQ) Quarter III +2.4% +2.3% +1.9%

00:30 Australia House Price Index (YoY) Quarter III +5.1% +7.6% +7.6%

00:30 Australia ANZ Job Advertisements (MoM) October +0.2% -0.1%

The euro fell to its lowest level in more than six weeks before European Central Bank Executive Board member Joerg Asmussen speaks in the run-up to a policy meeting amid signs further stimulus may be needed in the region.

Europe’s common currency extended its biggest weekly drop since July 2012 before the Mario Draghi-led ECB meets on Nov. 7, when economists predict it will keep interest rates at 0.5 percent. Bank of America Corp., UBS AG and Royal Bank of Scotland Group Plc forecast the ECB will cut rates at this week’s meeting, according to a Bloomberg News survey of 68 economists, with the rest predicting no change. The ECB last lowered its benchmark rate in May to a record 0.5 percent.

The dollar added to gains from last week against most major peers after Federal Reserve Bank of Dallas President Richard Fisher said the central bank should resume normal monetary policy as soon as possible. “I am not a proponent of ever-increasing government spending,” Fisher, who will hold a vote on monetary policy next year, said in the partial text of a speech in Sydney today. “I mention this simply to illustrate a point: Unlike in most recoveries, government has played a countercyclical, suppressive role. The inability of our government to get its act together has countered the procyclical policy of the Federal Reserve.”

The Aussie climbed after data today showed retail sales grew at the fastest pace in seven months, adding to prospects the Reserve Bank won’t cut interest rates tomorrow. Retail sales rose 0.8 percent in September, compared with the median forecast for a 0.4 percent advance in a Bloomberg survey.

EUR / USD: during the Asian session the pair fell to $ 1.3440

GBP / USD: during the Asian session, the pair fell to $ 1.5900

USD / JPY: during the Asian session the pair traded in the range of Y98.65-85

Eurozone mfg PMI data for release this morning and could influence via the cross, with UK construction PMI providing the main domestic interest during the morning. Focus this weeks turns to Thursday's ECB rate decision, following the recent release of soft EZ inflation data, with US NFP following on Friday.

-

06:04

Schedule for today, Monday, Nov 4’2013:

00:00 Japan Bank holiday

00:30 Australia Retail sales (MoM) September +0.4% +0.5%

00:30 Australia Retail Sales Y/Y September +2.3%

00:30 Australia House Price Index (QoQ) Quarter III +2.4% +2.3%

00:30 Australia House Price Index (YoY) Quarter III +5.1% +7.6%

00:30 Australia ANZ Job Advertisements (MoM) October +0.2%

08:00 Eurozone ECB’s Vitor Constancio Speaks

08:48 France Manufacturing PMI (Finally) October 49.4 49.4

08:53 Germany Manufacturing PMI (Finally) October 51.5 51.5

08:58 Eurozone Manufacturing PMI (Finally) October 51.3 51.3

09:30 Eurozone Sentix Investor Confidence November 6.1 6.6

09:30 United Kingdom PMI Construction October 58.9 58.9

15:00 U.S. Factory Orders August -2.4% +0.2%

16:40 U.S. FOMC Member Jerome Powell Speaks

18:10 Canada BOC Deputy Governor Lawrence Schembri Speaks

21:00 U.S. FOMC Member Rosengren Speaks

22:30 Australia AIG Services Index October 47.1

23:50 Japan Monetary Base, y/y October +46.1% 48.3%

-