Notícias do Mercado

-

19:20

American focus : the dollar rose against the euro

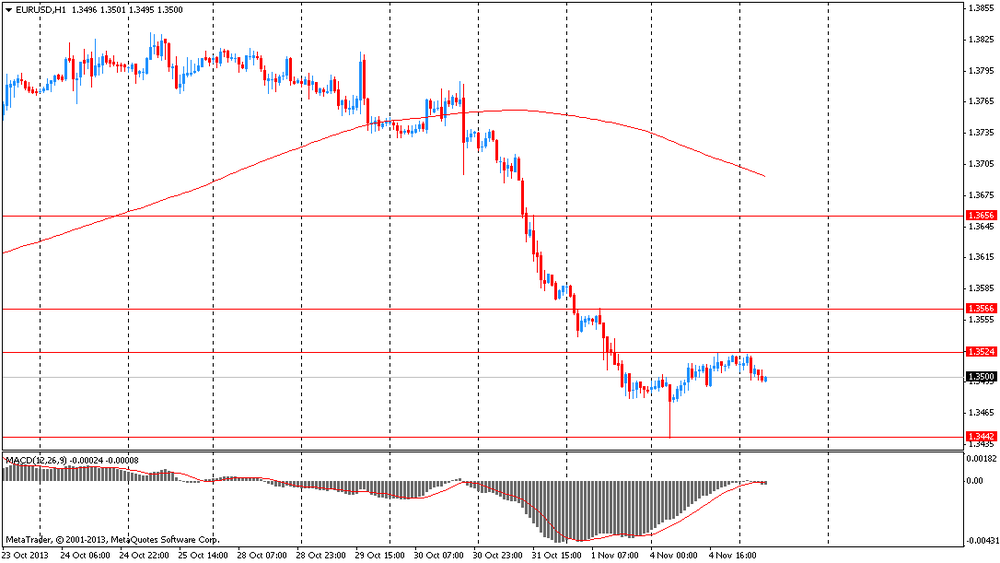

The euro exchange rate fell markedly against the U.S. dollar , though, and stepped back from session lows . Note that among the players on euro negative sentiment prevailed before the ECB meeting , scheduled for Thursday. Speculation pigeon rhetoric Mario Draghi continued to gain momentum after the release of the latest report on inflation in the euro zone , according to which consumer prices rose by 0.7 % y / y vs. 1.1 % previously , well below the target level of the ECB. This, together with the positioning will play against those who buy the euro. We add that the number of long positions on the euro reached a maximum level, which is not observed since May 2011 .

It should be noted that the pressure on the European currency also had a message saying that the European Commission reduced its economic growth forecast for the eurozone in 2014 and raised its estimate for unemployment for the same year, saying that growth will remain subdued , while the risks and uncertainties remains high . Commission reduced the outlook for euro area GDP in 2014 to 1.1 percent from 1.2 percent, as previously assumed, and also raised its forecast for the unemployment rate to 12.2 percent from 12.1 percent. The Commission expects that in 2013 the economy will expand 0.4 percent in the unemployment rate of 12.2 percent.

Meanwhile, we add that the strengthening of the dollar against the euro also helped the positive U.S. data , which showed that in October, the index of business activity in the U.S. service sector , which is calculated by the Institute for Supply Management (ISM) rose , reaching at the same level of 55.4, compared the September reading at around 54.4 . According to expert estimates , the value of this index was down slightly to 54.2 . All major sub- indexes in September remained in expansion ( more than 50). The greatest influence on the growth of the sub- indices have employment and business activity. Reducing the sub- indices showed new orders and prices.

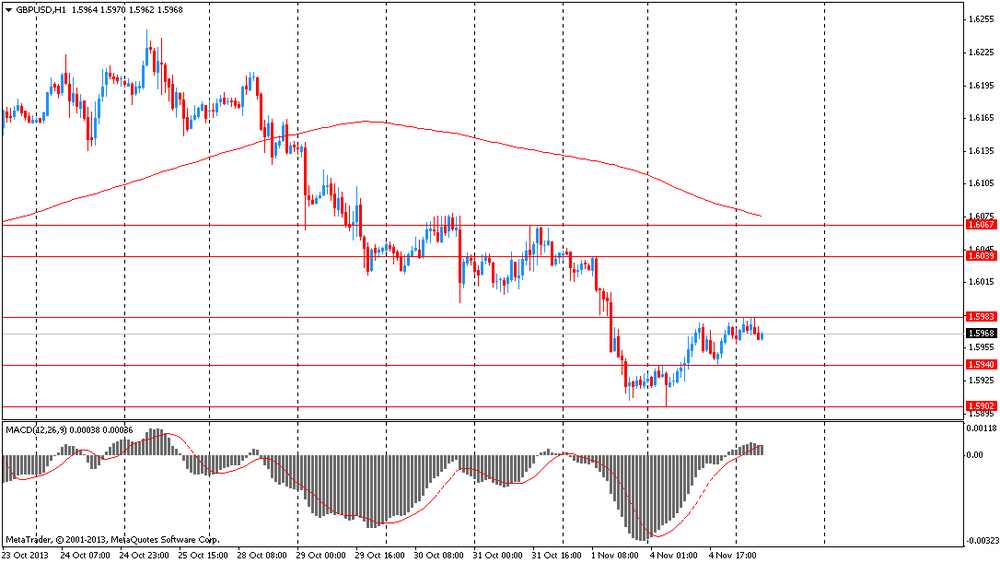

The pound rose sharply against the dollar, which has been associated with the release of strong data on service sector activity in Britain. Activity in the UK service sector expanded at the fastest pace in more than sixteen years , showed in October , a survey by Markit Economics and the Chartered Institute of Purchasing & Supply (CIPS). On a seasonally adjusted Business Activity Index rose to 62.5 in October from 60.3 in September. October value represents the strongest growth in activity since May 1997 . The survey found that the volume of new orders showed the strongest growth rate since records began the survey in July 1996. Also during the month significantly increased employment. The report also noted that inflation accelerated on rising wages.

The composite index PMI, which measures business activity in the UK as a whole throughout the private sector , reached a historic high 61.5 in October , up from 60.2 in September.

Also, the growth of the pound has helped a message stating that the European Commission raised its outlook for the UK economy , as domestic demand and exports to help growth.

"Gross domestic product will grow by 1.3 percent this year and 2.2 percent next year. That is, the forecast has been increased compared to the previous one, which involved an increase of 0.6 percent and 1.7 percent respectively, " - said the commission.

Confederation of British Industry and the National Institute of Economic and Social Studies this week raised their forecasts after the economy grew by 0.8 percent in the third quarter, the highest rate in more than three years . According to the updated forecast CBI, the economy will grow by 1.4 percent this year and 2.4 percent in 2014 , according to a quarterly report. In August, CBI had expected growth of 1.2 percent and 2.3 percent , respectively.

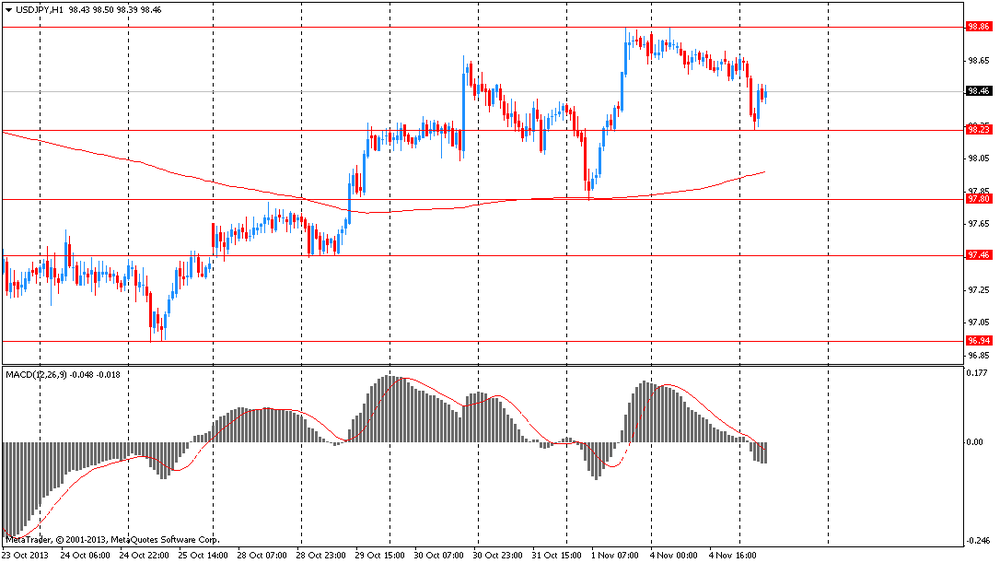

The yen declined significantly against the dollar, having lost all previously earned position. Note that the initial growth of the yen helped worsening economic outlook in the euro area. Last week, the euro zone released unexpectedly low inflation rates, which, coupled with high unemployment fueled speculation about a possible reduction in the refinancing rate of the ECB on Thursday . CPI inflation in the region has increased in September at 0.7% vs. 1.1 %. Rate b / d eurozone remains at a record high of 12.2%. Data on the Spanish labor market , released this morning showed that the unemployment rate rose by 87,028 in October. Pessimistic data led the ECB to lower the growth forecast for the euro area to 1.1 % compared with the May estimate.

However, surprisingly good U.S. data could change the course of trade , throwing the yen against the dollar to levels of the session. The report showed that in October ISM in the U.S. service sector rose to 55.4 vs. 54.0 and 54.4 in September , indicating that the acceleration of growth in the category.

-

15:00

U.S.: ISM Non-Manufacturing, October 55.4 (forecast 54.2)

-

13:00

Orders

EUR/USD

Offers $1.3650, $1.3615/20, $1.3600, $1.3565/70, $1.3540/50, $1.3525

Bids $1.3470, $1.3450/40, $1.3420, $1.3385/80, $1.3350

GBP/USD

Offers $1.6160/65, $1.6140/50, $1.6120, $1.6100/05, $1.6065/70

Bids $1.5950, $1.5870, $1.5850/40

AUD/USD

Offers $0.9600, $0.9575/80, $0.9545/50, $0.9520

Bids $0.9450, $0.9420, $0.9400, $0.9350

EUR/GBP

Offers stg0.8700, stg0.8650/55, stg0.8600/05, stg0.8575/85, stg0.8520/30, stg0.8500, stg0.8480

Bids stg0.8400, stg0.8370/65

EUR/JPY

Offers Y134.00, Y133.50, Y132.80

Bids Y132.00, Y131.50

USD/JPY

Offers Y99.20, Y99.00

Bids Y98.00, Y97.80, Y97.50

-

11:16

Euro area September output prices fall more than forecast

Industrial producer prices in the Eurozone decreased at a faster-than-expected pace n September, with prices falling in the major industrial sectors, latest data showed Tuesday.

The producer price index decreased 0.9 percent in September from the same month of last year, following a 0.8 percent fall in August, statistical office Eurostat said. Economists had forecast a 0.8 percent decline for September.

The decline of the headline index primarily reflected a 1.5 percent fall in intermediate goods prices. Prices of energy products slid 2.7 percent, while non-durable consumer goods prices and capital goods prices advanced 1.6 percent and 0.6 percent respectively.

Among member states, the largest decreases in the total index were observed in Cyprus, Bulgaria, the Netherlands and Lithuania. The highest increases were registered in Estonia , Denmark, Ireland and the United Kingdom.

The producer price index edged up 0.1 percent compared to August, when they stayed unchanged. Expectations were for a 0.2 percent gain.

In the European Union (EU), output prices decreased at a faster annual rate of 0.5 percent in September than 0.4 percent a month earlier. Sequentially, prices moved up 0.1 percent in the EU, as they did in August, data showed.

-

11:00

UK service sector activity rises at fastest pace since 1997

British service sector activity expanded at the fastest pace in more than sixteen years in October, a survey by Markit Economics and the Chartered Institute of Purchasing & Supply (CIPS) revealed Tuesday.

The headline seasonally adjusted business activity index rose to 62.5 in October from September's 60.3. The October reading represented the sharpest rise in activity since May 1997.

"This has largely been the result of rising levels of incoming new business placed with service providers as market sentiment has improved in line with a strengthened economic climate," Markit said.

The survey found that incoming new work rose at the sharpest rate recorded since the survey began in July 1996. Employment increased markedly during the month. The report also noted that cost inflation accelerated on the back of higher utility and wage bills.

The all-sector PMI, measuring business activity across the UK private sector economy, hit an all-time high of 61.5 in October, up from 60.2 in September.

-

10:45

Swiss consumer prices fall more than expected in October

Switzerland's consumer prices declined further in October, and the rate of fall exceeded economists' expectations, latest data showed Tuesday.

The consumer price index dropped 0.3 percent in October from the same month of last year, following a 0.1 percent decline in September, the Federal Statistical Office said. Economists had forecast a 0.1 percent for October.

Consumer prices declined a seasonally adjusted 0.1 percent compared to September, contrary to expectations for a 0.1 percent increase. In September, prices had increased 0.3 percent month-on-month.

The harmonized index of consumer prices (HICP), measured under the EU methodology, stayed unchanged year-on-year in October, defying the forecast for a 0.2 percent gain.

Sequentially, the HICP edged down 0.1 percent. The index was expected to rise 0.1 percent month-on-month.

-

10:19

Option expiries for today's 1400GMT cut

USD/JPY Y97.00, Y97.25, Y97.75, Y98.00, Y98.25, Y98.60/65/70, Y99.00, Y99.10

EUR/USD $1.3350, $1.3400, $1.3450, $1.3500, $1.3520, $1.3525, $1.3530, $1.3560, $1.3600

GBP/USD $1.5875, $1.5975, $1.6000, $1.6165, $1.6200

EUR/GBP stg0.8470, stg0.8475

EUR/CHF Chf1.2300

AUD/USD $0.9400, $0.9505, $0.9510, $0.9540, $0.9550, $0.9630

NZD/USD $0.8300, $0.8355

USD/CAD C$1.0395, C$1.0475, C$1.0500, C$1.0525

-

10:00

Eurozone: Producer Price Index, MoM , September +0.1% (forecast +0.3%)

-

10:00

Eurozone: Producer Price Index (YoY) , September -0.9% (forecast -0.8%)

-

09:29

United Kingdom: Purchasing Manager Index Services, October 62.5 (forecast 60.4)

-

08:15

Switzerland: Consumer Price Index (MoM) , October -0.1% (forecast +0.1%)

-

08:15

Switzerland: Consumer Price Index (YoY), October -0.3% (forecast -0.1%)

-

07:02

Asian session: The euro declined

00:01 United Kingdom BRC Retail Sales Monitor y/y October +0.7% +1.1% +0.8%

01:45 China HSBC Services PMI October 52.4 52.6

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

07:45 Japan BOJ Governor Haruhiko Kuroda Speaks

The euro declined versus the yen before European Central Bank President Mario Draghi speaks today ahead of a policy meeting this week as traders weigh the prospects for monetary stimulus in the region. European Union Economic and Monetary Affairs Commissioner Olli Rehn will release economic growth forecasts for the region in Brussels today. The ECB meets on Nov. 7, with 65 of 68 economists surveyed by Bloomberg News predicting policy makers will hold the key rate at a record-low 0.5 percent. Bank of America Corp., UBS AG and Royal Bank of Scotland Group Plc forecast a cut.

The yen advanced versus its 16 major peers as regional equities erased gains, boosting haven demand.

The dollar fell for a second day against Japan’s currency before a report predicted to show an expansion in U.S. services slowed last month, weighing on expectations the Federal Reserve will move to reduce stimulus. The Institute for Supply Management’s U.S. non-manufacturing index probably dropped to a four-month low of 54 in October, from 54.4 the previous month, according to the median forecast in a Bloomberg survey before today’s report. A reading above 50 indicates expansion.

The Australian dollar dropped after the Reserve Bank said the currency is “uncomfortably high.” “The Australian dollar, while below its level earlier in the year, is still uncomfortably high,” Governor Glenn Stevens said in a statement. “A lower level of the exchange rate is likely to be needed to achieve balanced growth in the economy.”

EUR / USD: during the Asian session the pair traded in the range of $ 1.3495-25

GBP / USD: during the Asian session, the pair traded in the range of $ 1.5960-85

USD / JPY: during the Asian session the pair fell to Y98.25

The European calendar gets underway at 0800GMT, with the release of the Spanish unemployment data for October. The PMI manufacturing data released Monday saw the employment index fall to the lowest levels since April. At 1000GMT, the EMU September PPI data will be published. PPI is seen up 0.2% on month, down 0.8% on year. Also due Tuesday are the EU's own "Autumn Economic Forecasts." The only UK data scheduled for release comes at 0928GMT, with the release of the October CIPS/Markit Services PMI numbers. However, the data is unlikely to impact on Thursday's BOE policy decision, with both rates, QE and forward guidance left unchanged. -

06:23

Currencies. Daily history for Nov 4'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3513 +0,20%

GBP/USD $1,5967 +0,27%

USD/CHF Chf0,9096 -0,29%

USD/JPY Y98,59 +0,15%

EUR/JPY Y133,24 +0,11%

GBP/JPY Y157,42 +0,20%

AUD/USD $0,9509 +0,76%

NZD/USD $0,8283 +0,22%

USD/CAD C$1,0422 +0,04%

-

06:04

Schedule for today, Tuesday, Nov 5’2013:

00:01 United Kingdom BRC Retail Sales Monitor y/y October +0.7% +1.1% +0.8%

01:45 China HSBC Services PMI October 52.4 52.6

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

07:45 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 United Kingdom Halifax house price index October +0.3% +0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y October +6.2% +7.0%

08:15 Switzerland Consumer Price Index (YoY) October -0.1% -0.1%

08:15 Switzerland Consumer Price Index (MoM) October +0.3% +0.1%

09:30 United Kingdom Purchasing Manager Index Services October 60.3 60.4

10:00 Eurozone Economic Growth Forecasts from European Commission

10:00 Eurozone Producer Price Index, MoM September 0.0% +0.3%

10:00 Eurozone Producer Price Index (YoY) September -0.8% -0.8%

13:30 Eurozone ECB President Mario Draghi Speaks

15:00 U.S. ISM Non-Manufacturing October 54.4 54.2

21:30 U.S. API Crude Oil Inventories October +5.9

21:45 New Zealand Employment Change, q/q Quarter III +0.4% 0.5%

21:45 New Zealand Unemployment Rate Quarter III 6.4% 6.2%

23:50 Japan Monetary Policy Meeting Minutes

-