Notícias do Mercado

-

16:40

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies despite of the disappointing ISM manufacturing purchase managers’ index

The U.S. dollar traded higher against the most major currencies despite of the disappointing ISM manufacturing purchase managers’ index in the U.S. The Institute of Supply Management released its manufacturing purchasing managers' index for the U.S. The index dropped to 53.2 in May, from 54.9 in April. Analysts had expected a gain to 55.5.

The construction spending in the U.S. remained unchanged at 0.2%, missing expectations for a 0.8% rise.

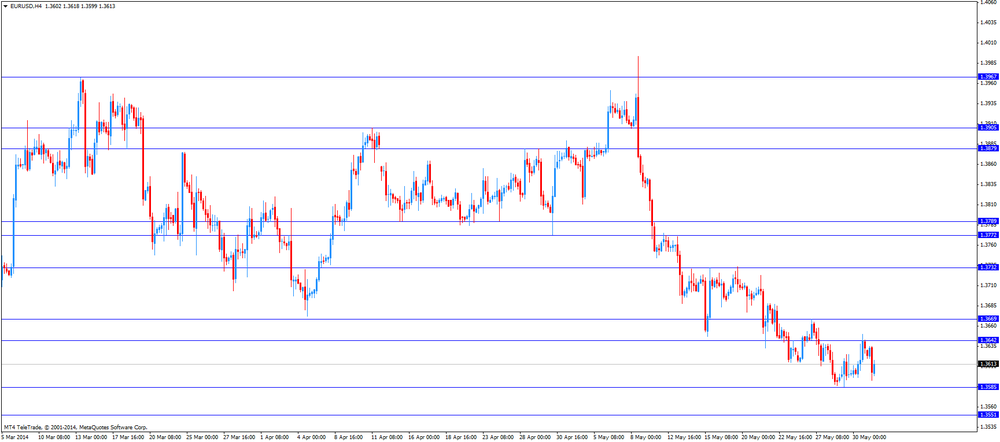

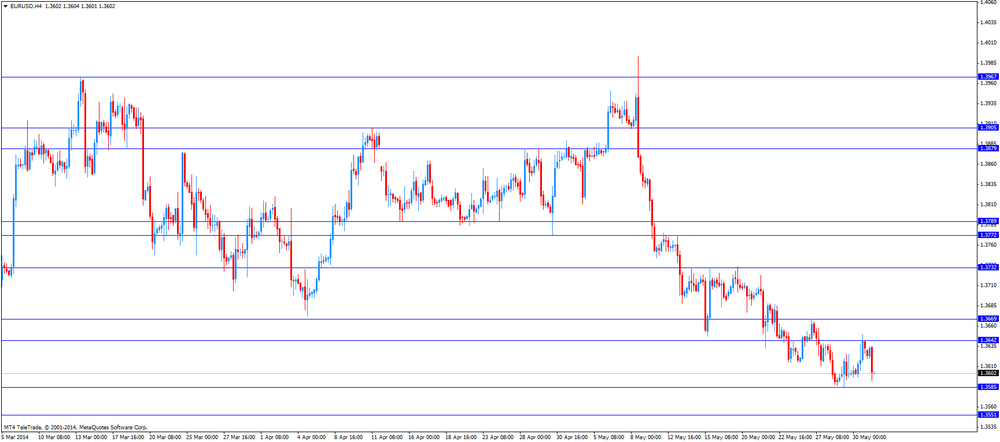

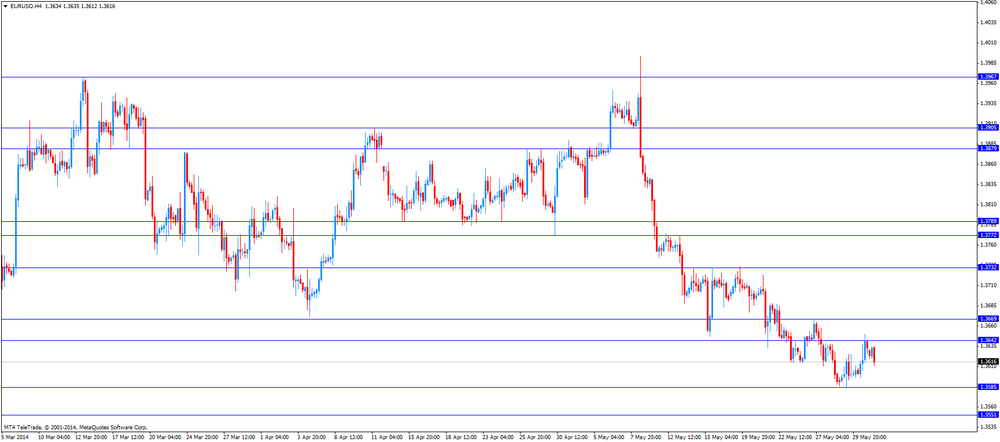

The euro traded lower against the U.S. dollar. Investors remained cautious ahead of the European Central Bank's decision on Thursday. There are speculations over further stimulus measures from the ECB.

German preliminary consumer price index fell 0.1% in May, after a decline of 0.2% in April. Analysts had expected a 0.1% rise.

On a yearly basis, German preliminary consumer price index rose 0.9% in May, after a 1.3% gain in April. Analysts had forecasted a 1.1% increase.

PMIs were also in focus in the Eurozone. Eurozone’s manufacturing purchase managers’ index (PMI) decreased to 52.2 in May from 52.5 in April. Analysts had expected that the index remained unchanged.

Germany’s manufacturing PMI fell to 52.3 in May from 54.1 in April. Analysts had forecasted a decline to 52.9.

France’s manufacturing PMI sank to 49.6 in May from 51.2 in April. Analysts had expected a decrease to 49.3.

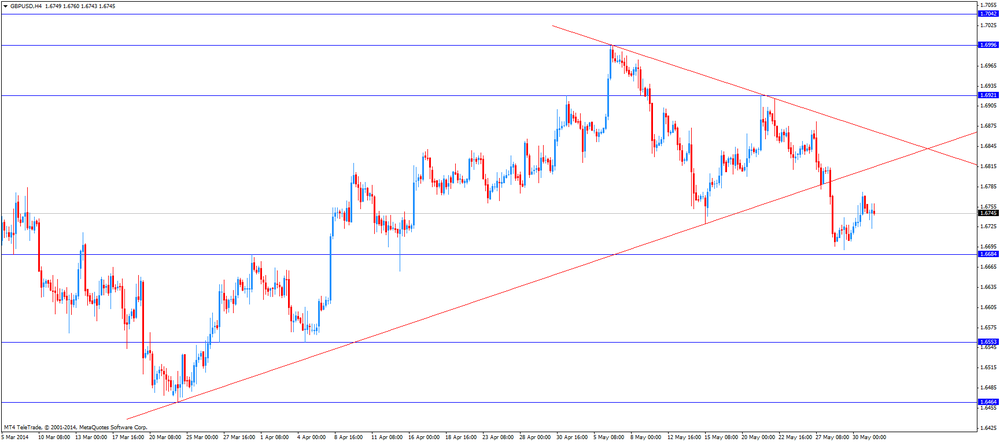

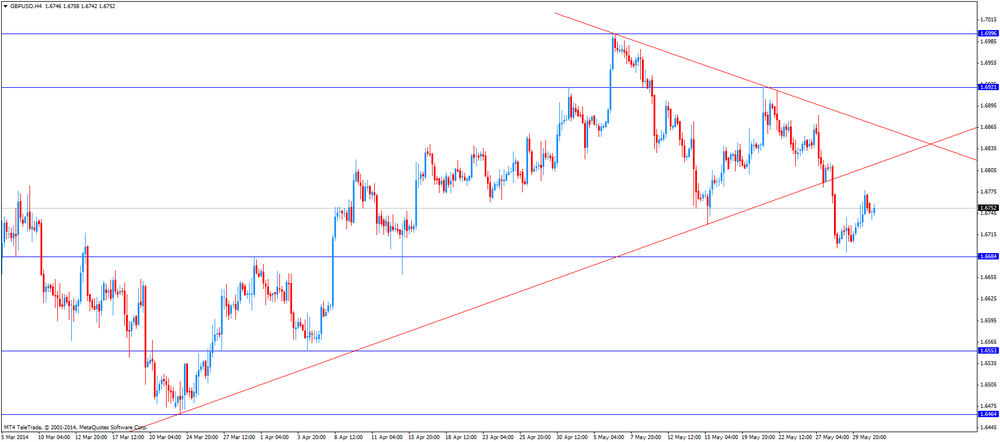

The British pound traded mixed against the U.S. dollar. Manufacturing purchase managers’ index in the U.K. declined to 57.0 in May from 57.3 in April. Analysts had forecasted a fall to 57.1.

Net lending to individuals in the U.K. increased by £2.4 billion in April, after a £2.8 billion rise in March. Analysts had expected a gain by £2.7 billion.

The number of mortgage approvals in the U.K. was 62,918 in April. That was the lowest number since July 2013.

The Swiss franc fell against the U.S. dollar. Switzerland’s manufacturing PMI sank to 52.5 in May from 55.8 in April. Analysts had expected a decrease to 55.7.

The Canadian dollar fell against the U.S. dollar due to the strength of the U.S. dollar and in the absence of any major economic reports in Canada.

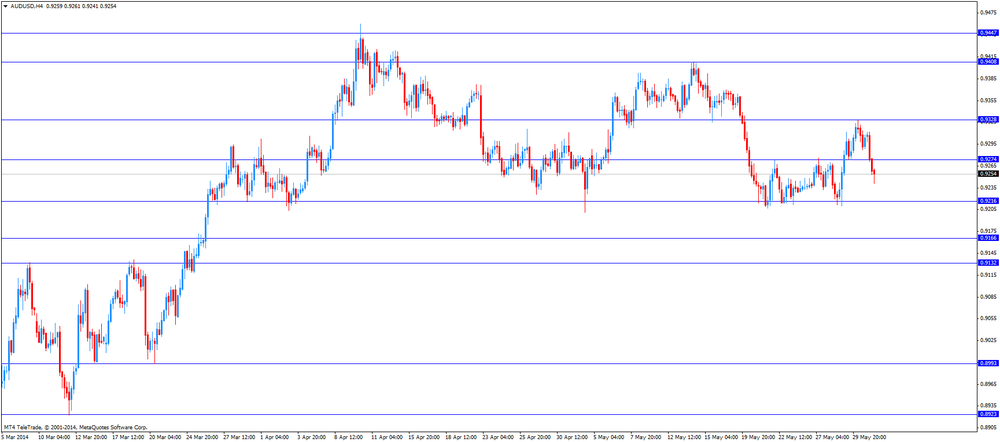

The New Zealand dollar traded lower against the U.S dollar. The decline of the kiwi was driven by the weakness of the Australian dollar. Markets in New Zealand were closed on Monday for a public holiday.

The Australian dollar slid against the U.S. dollar after the release of the weak building permits data in Australia. The number of building permits in Australia dropped 5.6% in April, after a decline of 4.8% in March. March’s figure was revised down to 4.8% from a decrease of 3.5%. Analysts had expected a 2.1% gain. On a yearly basis, the building permits in Australia rose 1.1% in April, after a 20.0% increase in March.

Company operating profits in Australia increased 3.1% in the first quarter, after a 1.7% rise the previous quarter. Analysts had forecasted a 2.6% gain.

AIG manufacturing index in Australia climbed to 49.2 in May from 44.8 in April.

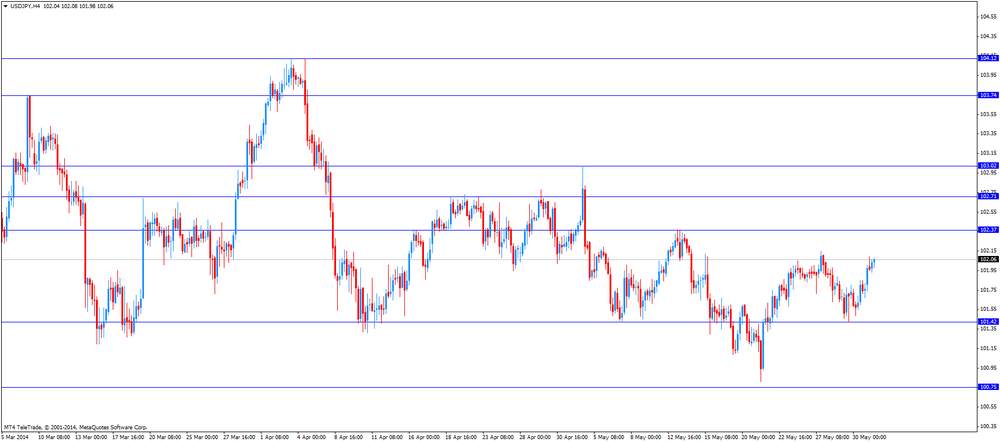

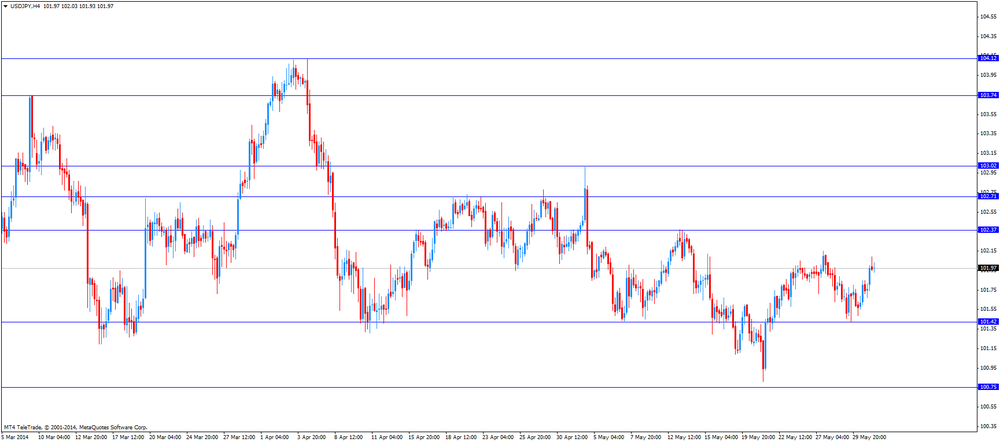

The Japanese yen declined against the U.S. dollar after release of the better-than-expected manufacturing purchasing managers' index (PMI) in China. China’s PMI increased to 50.8 in May, beating expectations of a rise to 50.7 from 50.4 in April.

Capital spending in Japan climbed 7.4% in the first quarter, after a 4.0% increase the previous quarter.

-

15:00

U.S.: Construction Spending, m/m, April +0.2% (forecast +0.8%)

-

15:00

U.S.: ISM Manufacturing, May 53.2 (forecast 55.7)

-

14:45

U.S.: Manufacturing PMI, May 56.4 (forecast 56.2)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3615, $1.3650, $1.3710

USD/JPY Y101.50-55, Y102.00, Y102.25, Y102.50

GBP/USD $1.6700

EUR/GBP stg0.8200, stg0.8245

USD/CHF Chf0.9035

AUD/USD $0.9350

USD/CAD C$1.0845, C$1.0850, C$1.0890, C$1.0950

-

13:15

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of the release of ISM manufacturing purchase managers’ index in the U.S.

Economic calendar (GMT0):

00:30 Australia MI Inflation Gauge, m/m May +0.4% +0.3%

00:30 Australia MI Inflation Gauge, y/y May +2.8% +2.9%

01:30 Australia Building Permits, m/m April -4.8% +2.1% -5.6%

01:30 Australia Building Permits, y/y April +20.0% +1.1%

01:30 Australia Company Operating Profits Quarter I +1.7% +2.6% +3.1%

06:30 Australia Commodity Prices, Y/Y May -12.6% -12.8%

07:30 Switzerland Manufacturing PMI May 55.8 55.7 52.5

07:48 France Manufacturing PMI (Finally) May 51.2 49.3 49.6

07:53 Germany Manufacturing PMI (Finally) May 54.1 52.9 52.3

07:58 Eurozone Manufacturing PMI (Finally) May 52.5 52.5 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing May 57.3 57.1 57.0

08:30 United Kingdom Net Lending to Individuals, bln April 2.9 2.7 2.4

08:30 United Kingdom Mortgage Approvals April 67 64 62.9

12:00 Germany CPI, m/m (Preliminary) May -0.2% +0.1% -0.1%

12:00 Germany CPI, y/y (Preliminary) May +1.3% +1.1% +0.9%

The U.S. dollar traded higher against the most major currencies ahead of the release of ISM manufacturing purchase managers’ index in the U.S. The index should climb to 55.7 in May from 54.9 in April.

The euro declined against the U.S. dollar. Investors remained cautious ahead of the European Central Bank's decision on Thursday. There are speculations over further stimulus measures from the ECB.

German preliminary consumer price index fell 0.1% in May, after a decline of 0.2% in April. Analysts had expected a 0.1% rise.

On a yearly basis, German preliminary consumer price index rose 0.9% in May, after a 1.3% gain in April. Analysts had forecasted a 1.1% increase.

PMIs were also in focus in the Eurozone. Eurozone’s manufacturing purchase managers’ index (PMI) decreased to 52.2 in May from 52.5 in April. Analysts had expected that the index remained unchanged.

Germany’s manufacturing PMI fell to 52.3 in May from 54.1 in April. Analysts had forecasted a decline to 52.9.

France’s manufacturing PMI sank to 49.6 in May from 51.2 in April. Analysts had expected a decrease to 49.3.

The British pound traded mixed against the U.S. dollar. Manufacturing purchase managers’ index in the U.K. declined to 57.0 in May from 57.3 in April. Analysts had forecasted a fall to 57.1.

Net lending to individuals in the U.K. increased by £2.4 billion in April, after a £2.8 billion rise in March. Analysts had expected a gain by £2.7 billion.

The number of mortgage approvals in the U.K. was 62,918 in April. That was the lowest number since July 2013.

The Swiss franc fell against the U.S. dollar. Switzerland’s manufacturing PMI sank to 52.5 in May from 55.8 in April. Analysts had expected a decrease to 55.7.

EUR/USD: the currency pair declined to $1.3593

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y102.08

The most important news that are expected (GMT0):

14:00 U.S. ISM Manufacturing May 54.9 55.7

23:50 Japan Monetary Base, y/y May +48.5% +51.2%

-

13:00

Germany: CPI, m/m, May -0.3% (forecast +0.1%)

-

13:00

Germany: CPI, y/y , May +0.9% (forecast +1.1%)

-

12:45

Orders

EUR/USD

Offers $1.3695/700, $1.3688, $1.3670/80, $1.3655

Bids $1.3585/80, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6860, $1.6835/40, $1.6770/80

Bids $1.6725, $1.6690

AUD/USD

Offers $0.9350, $0.9330, $0.9300

Bids $0.9220, $0.9210/00

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.45/50

Bids Y138.50, Y138.00, Y137.80, Y137.50, Y137.00

USD/JPY

Offers Y102.80, Y102.25/30

Bids Y101.60, Y101.05/00

EUR/GBP

Offers stg0.8215-25, stg0.8195/205, stg0.8160/65

Bids stg0.8080

-

11:11

The currency pair EUR/USD declines due to speculation the European Central Bank will add further stimulus measures and disappointing manufacturing purchase managers’ index (PMI)

The currency pair EUR/USD declines due to speculation the European Central Bank will add further stimulus measures and disappointing manufacturing purchase managers’ index (PMI). The ECB will release its interest rates decision on Thursday.

Eurozone’s manufacturing purchase managers’ index (PMI) decreased to 52.2 in May from 52.5 in April. Analysts had expected that the index remained unchanged.

Germany’s manufacturing PMI fell to 52.3 in May from 54.1 in April. Analysts had forecasted a decline to 52.9.

France’s manufacturing PMI sank to 49.6 in May from 51.2 in April. Analysts had expected a decrease to 49.3.

-

09:55

Foreign exchange market. Asian session: the Australian dollar slid against the U.S. dollar after the release of the weak building permits data

Economic calendar (GMT0):

00:30 Australia MI Inflation Gauge, m/m May +0.4% +0.3%

00:30 Australia MI Inflation Gauge, y/y May +2.8% +2.9%

01:30 Australia Building Permits, m/m April -4.8% +2.1% -5.6%

01:30 Australia Building Permits, y/y April +20.0% +1.1%

01:30 Australia Company Operating Profits Quarter I +1.7% +2.6% +3.1%

06:30 Australia Commodity Prices, Y/Y May -12.6% -12.8%

07:30 Switzerland Manufacturing PMI May 55.8 55.7 52.5

07:48 France Manufacturing PMI (Finally) May 51.2 49.3 49.6

07:53 Germany Manufacturing PMI (Finally) May 54.1 52.9 52.3

07:58 Eurozone Manufacturing PMI (Finally) May 52.5 52.5 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing May 57.3 57.1 57.0

08:30 United Kingdom Net Lending to Individuals, bln April 2.9 2.7 2.4

08:30 United Kingdom Mortgage Approvals April 67 64 62.9

The U.S. dollar traded higher against the most major currencies despite Friday's mixed U.S. economic growth data. The personal spending in the U.S. declined 0.1% in April, after a 0.9% in March. Analysts had expected a rise of 0.2%.

The personal income in the U.S. increased 0.3% in April, meeting expectations, after a 0.5% gain in March.

Reuters/Michigan consumer sentiment index declined to 81.9 in May, from 82.8 in April. Analysts had forecasted the index to climb to 82.9.

The New Zealand dollar traded lower against the U.S dollar. The decline of the kiwi was driven by the weakness of the Australian dollar. Markets in New Zealand were closed on Monday for a public holiday.

The Australian dollar slid against the U.S. dollar after the release of the weak building permits data in Australia. The number of building permits in Australia dropped 5.6% in April, after a decline of 4.8% in March. March’s figure was revised down to 4.8% from a decrease of 3.5%. Analysts had expected a 2.1% gain. On a yearly basis, the building permits in Australia rose 1.1% in April, after a 20.0% increase in March.

Company operating profits in Australia increased 3.1% in the first quarter, after a 1.7% rise the previous quarter. Analysts had forecasted a 2.6% gain.

AIG manufacturing index in Australia climbed to 49.2 in May from 44.8 in April.

The Japanese yen declined against the U.S. dollar after release of the better-than-expected manufacturing purchasing managers' index (PMI) in China. China’s PMI increased to 50.8 in May, beating expectations of a rise to 50.7 from 50.4 in April.

Capital spending in Japan climbed 7.4% in the first quarter, after a 4.0% increase the previous quarter.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.6735

USD/JPY: the currency pair climbed to Y102.10

AUD/USD: the currency pair dropped to $0.9258

The most important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) May -0.2% +0.1%

12:00 Germany CPI, y/y (Preliminary) May +1.3% +1.1%

14:00 U.S. ISM Manufacturing May 54.9 55.7

23:50 Japan Monetary Base, y/y May +48.5% +51.2%

-

09:31

United Kingdom: Net Lending to Individuals, bln, April 2.4 (forecast 2.7)

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , May 57.0 (forecast 57.1)

-

09:01

Eurozone: Manufacturing PMI, May 52.2 (forecast 52.5)

-

08:56

Germany: Manufacturing PMI, May 52.3 (forecast 52.9)

-

08:50

France: Manufacturing PMI, May 49.6 (forecast 49.3)

-

08:30

Switzerland: Manufacturing PMI, May 52.5 (forecast 55.7)

-

07:31

Australia: Commodity Prices, Y/Y, May -12.8%

-

06:19

Options levels on monday, June 2, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3770 (3696)

$1.3735 (3550)

$1.3683 (692)

Price at time of writing this review: $ 1.3627

Support levels (open interest**, contracts):

$1.3579 (3606)

$1.3551 (4853)

$1.3518 (3879)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56541 contracts, with the maximum number of contracts with strike price $1,3850 (6047);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 74225 contracts, with the maximum number of contractswith strike price $1,3500 (7191);

- The ratio of PUT/CALL was 1.31 versus 1.32 from the previous trading day according to data from May, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2772)

$1.6901 (2102)

$1.6803 (1205)

Price at time of writing this review: $1.6742

Support levels (open interest**, contracts):

$1.6697 (2647)

$1.6599 (2480)

$1.6500 (979)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24529 contracts, with the maximum number of contracts with strike price $1,7000 (2772);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 27156 contracts, with the maximum number of contracts with strike price $1,6700 (2647);

- The ratio of PUT/CALL was 1.11 versus 1.12 from the previous trading day according to data from May, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Australia: Building Permits, m/m, April -3.5% (forecast +2.1%)

-

02:30

Australia: Building Permits, y/y, April +1.1%

-

01:30

Australia: MI Inflation Gauge, m/m, May +0.3%

-

01:30

Australia: MI Inflation Gauge, y/y, May +2.9%

-

00:50

Japan: Capital Spending, Quarter I +7.4%

-

00:30

Australia: AIG Manufacturing Index, May 49.2

-

00:20

Currencies. Daily history for May 30'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3633 +0,23%

GBP/USD $1,6753 +0,22%

USD/CHF Chf0,8951 -0,29%

USD/JPY Y101,76 +0,03%

EUR/JPY Y138,71 +0,25%

GBP/JPY Y170,45 +0,24%

AUD/USD $0,9308 +0,04%

NZD/USD $0,8498 +0,11%

USD/CAD C$1,0844 +0,07%

-

00:00

Schedule for today, Monday, June 02’2014:

(time / country / index / period / previous value / forecast)00:00 China Bank holiday

00:30 Australia MI Inflation Gauge, m/m May +0.4%

00:30 Australia MI Inflation Gauge, y/y May +2.8%

01:30 Australia Building Permits, m/m April -3.5% +2.1%

01:30 Australia Building Permits, y/y April +20.0%

01:30 Australia Company Operating Profits Quarter I +1.7% +2.6%

06:30 Australia Commodity Prices, Y/Y May -12.6%

07:30 Switzerland Manufacturing PMI May 55.8 55.7

07:48 France Manufacturing PMI (Finally) May 51.2 49.3

07:53 Germany Manufacturing PMI (Finally) May 54.1 52.9

07:58 Eurozone Manufacturing PMI (Finally) May 52.5 52.5

08:30 United Kingdom Purchasing Manager Index Manufacturing May 57.3 57.1

08:30 United Kingdom Net Lending to Individuals, bln April 2.9 2.7

08:30 United Kingdom Mortgage Approvals April 67 64

12:00 Germany CPI, m/m (Preliminary) May -0.2% +0.1%

12:00 Germany CPI, y/y (Preliminary) May +1.3% +1.1%

13:43 U.S. Manufacturing PMI (Finally) May 56.2 56.2

14:00 U.S. Construction Spending, m/m April +0.2% +0.8%

14:00 U.S. ISM Manufacturing May 54.9 55.7

23:50 Japan Monetary Base, y/y May +48.5% +51.2%

-