Notícias do Mercado

-

23:24

Currencies. Daily history for Nov 3’2014:

(pare/closed(GMT +2)/change, %)

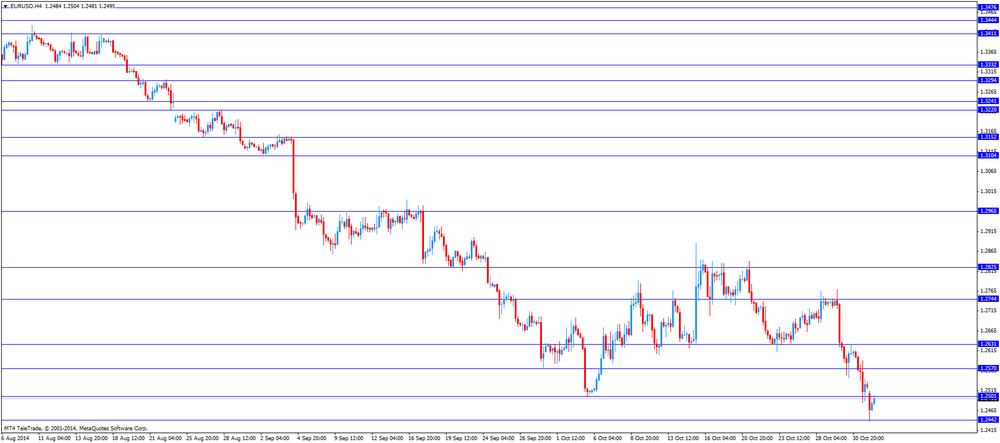

EUR/USD $1,2481 -0,35%

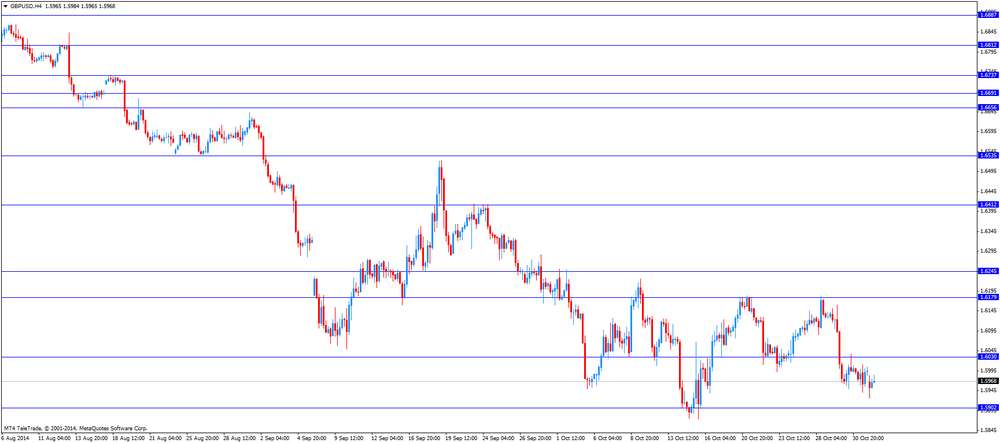

GBP/USD $1,5970 -0,15%

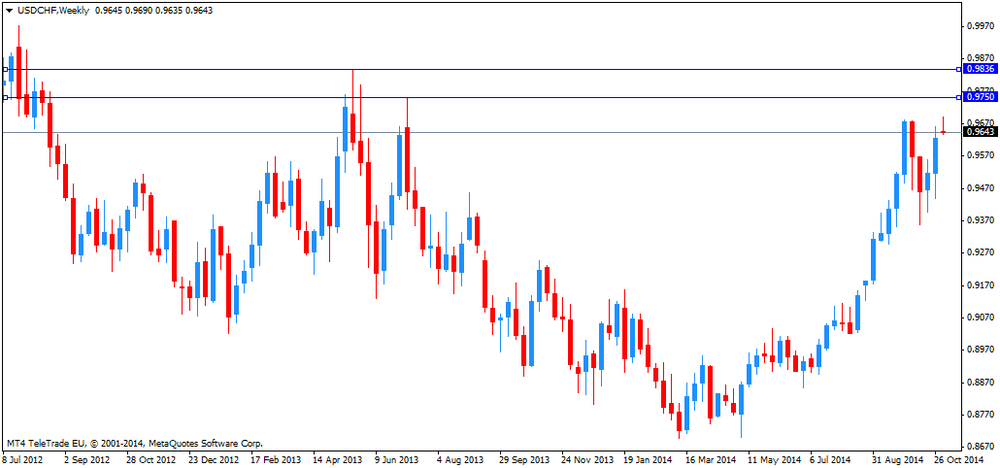

USD/CHF Chf0,9657 +0,35%

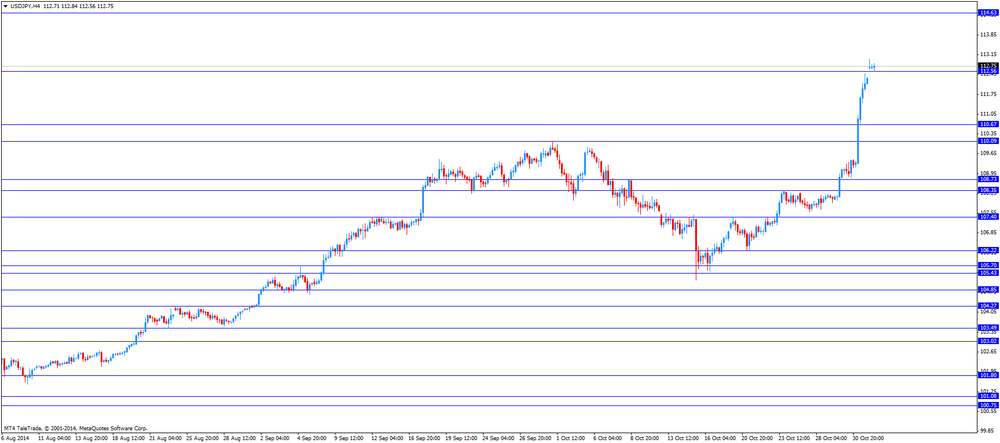

USD/JPY Y114,03 +1,50%

EUR/JPY Y142,33 +1,17%

GBP/JPY Y182,11 +1,35%

AUD/USD $0,8680 -1,34%

NZD/USD $0,7717 -0,98%

USD/CAD C$1,1356 +0,83%

-

23:00

Schedule for today, Tuesday, Nov 4’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail sales (MoM) September +0.1% +0.3%

00:30 Australia Trade Balance September -0.79 -1.78

00:30 Australia Retail Sales Y/Y September +5.1%

01:35 Japan Manufacturing PMI October 52.8 52.8

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

03:30 Australia RBA Rate Statement

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

09:30 United Kingdom PMI Construction October 64.2 63.5

10:00 Eurozone Producer Price Index, MoM September -0.1% 0.0%

10:00 Eurozone Producer Price Index (YoY) September -1.4% -1.5%

13:30 Canada Trade balance, billions September -0.6 -0.7

13:30 U.S. International Trade, bln September -40.1 -40.0

15:00 U.S. Factory Orders September -10.1% -0.4%

15:30 Canada BOC Gov Stephen Poloz Speaks

21:30 U.S. API Crude Oil Inventories October +3.2

21:45 New Zealand Employment Change, q/q Quarter III +0.4% +0.6%

21:45 New Zealand Unemployment Rate Quarter III 5.6% 5.5%

22:30 Australia AIG Services Index October 45.4

23:50 Japan Monetary Base, y/y October +35.3% +36.2%

-

20:00

U.S.: Total Vehicle Sales, mln, October 16.5 (forecast 16.6)

-

16:34

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index

The U.S. dollar traded higher against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index. The ISM manufacturing purchasing managers' index for the U.S. rose to 59.0 in October from 56.6 in September, beating expectations for a decline to 56.5. The rise was driven by the increase in new orders.

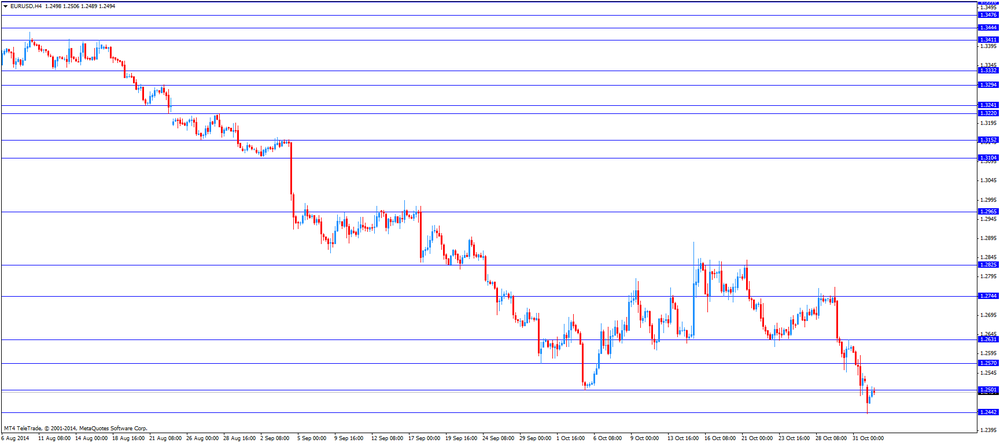

The euro traded lower against the U.S. dollar. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 50.6 in October from 50.7 in September. Analysts had expected the index to remain unchanged at 50.7.

Germany's final manufacturing purchasing managers' index declined to 51.4 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

France's final manufacturing purchasing managers' index rose to 48.5 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

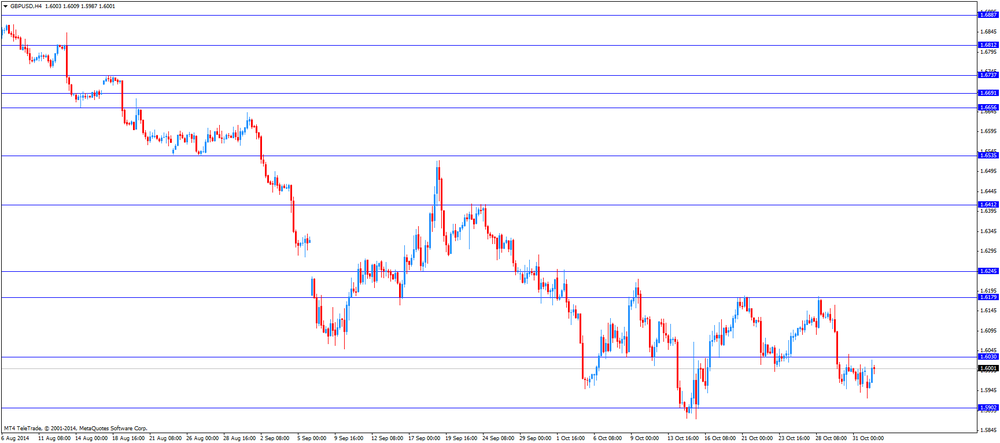

The British pound fell against the U.S. dollar. The manufacturing purchasing managers' index in the U.K. climbed to 53.2 in October from 51.5 in September. September's figure was revised down from 51.6. Analysts had expected the index to remain at 51.5.

The Swiss franc traded lower against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland rose to 55.3 in October from 50.4 in September, exceeding expectations for a rise to 51.3.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie declined against the greenback after the release of the weaker-than-expected Australian building permits. Building permits in Australia dropped 11% in September, missing expectations for a 0.9% decline, after a 3.4% increase in August. August's figure was revised up from a 3.0% rise.

ANZ job advertisements rose 0.2% in October, after a 0.9% gain in September.

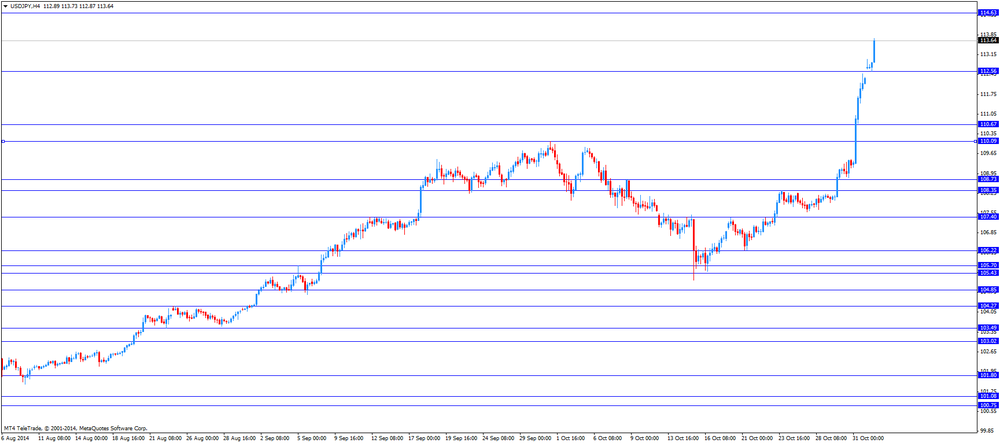

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

Friday's decision by the Bank of Japan (BoJ) still weighed on the yen. The BoJ decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

-

15:44

ISM manufacturing purchasing managers’ index rose 59.0 in October

The Institute for Supply Management (ISM) released its manufacturing purchasing managers' index for the U.S. The index rose to 59.0 in October from 56.6 in September, beating expectations for a decline to 56.5.

The rise was driven by the increase in new orders. The new orders index climbed to 65.8 in October from 60.0 in September.

-

15:00

U.S.: Construction Spending, m/m, September -0.4% (forecast +0.8%)

-

15:00

U.S.: ISM Manufacturing, October 59.0 (forecast 56.5)

-

14:45

U.S.: Manufacturing PMI, October 55.9 (forecast 56.2)

-

13:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1,2500(E353mn), $1.2550(E500mn), $1.2600(E722mn)

AUD/USD: $0.8765(A$301mn)

-

13:00

Orders

EUR/USD

Offers

Bids $1.2485/80, $1.2400, $1.2300

GBP/USD

Offers

Bids $1.5900, $1.5800

AUD/USD

Offers $0.8900, $0.8850, $0.8800

Bids $0.8700, $0.8650, $0.8640/20

EUR/JPY

Offers Y143.00, Y142.50, Y142.00

Bids Y141.10/00, Y140.10/00, Y139.50

USD/JPY

Offers Y114.50, Y114.00, Y113.50

Bids Y112.85/80, Y112.20/00, Y111.55/50, Y111.00

EUR/GBP

Offers

Bids stg0.7755/45, stg0.7700

-

13:00

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the better-than-expected PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia Building Permits, m/m September +3.4% Revised From +3.0% -0.9% -11%

00:30 Australia Building Permits, y/y September +14.5% -13.4%

00:30 Australia ANZ Job Advertisements (MoM) October +0.9% +0.2%

01:00 China Non-Manufacturing PMI October 54.0 53.8

01:45 China HSBC Manufacturing PMI (Finally) October 50.4 50.4 50.4

05:30 Australia RBA Commodity prices, y/y October -16.8% -16.9%

08:30 Switzerland Manufacturing PMI October 50.4 51.3 55.3

08:48 France Manufacturing PMI (Finally) October 47.3 47.3 48.5

08:53 Germany Manufacturing PMI (Finally) October 51.8 51.8 51.4

08:58 Eurozone Manufacturing PMI (Finally) October 50.7 50.7 50.6

09:30 United Kingdom Purchasing Manager Index Manufacturing October 51.5 51.5 53.2

The U.S. dollar traded mixed against the most major currencies ahead of the ISM manufacturing purchasing managers' index. The index is expected to decline to 56.5 in October from 56.6 in September.

The euro traded slightly higher against the U.S. dollar after the release of PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 50.6 in October from 50.7 in September. Analysts had expected the index to remain unchanged at 50.7.

Germany's final manufacturing purchasing managers' index declined to 51.4 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

France's final manufacturing purchasing managers' index rose to 48.5 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

The British pound traded higher against the U.S. dollar after the better-than-expected PMI from the U.K. The manufacturing purchasing managers' index in the U.K. climbed to 53.2 in October from 51.5 in September. September's figure was revised down from 51.6. Analysts had expected the index to remain at 51.5.

The Swiss franc traded higher against the U.S. dollar after Switzerland's better-than-expected PMI. The manufacturing purchasing managers' index in Switzerland rose to 55.3 in October from 50.4 in September, exceeding expectations for a rise to 51.3.

EUR/USD: the currency pair rose to $1.2509

GBP/USD: the currency pair climbed to $1.6022

USD/JPY: the currency pair rose to Y113.73

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Finally) October 56.2 56.2

15:00 U.S. ISM Manufacturing October 56.6 56.5

17:50 Canada BOC Gov Stephen Poloz Speaks

-

11:03

-

10:32

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1,2500(E353mn), $1.2550(E500mn), $1.2600(E722mn)

AUD/USD: $0.8765(A$301mn)

-

09:53

Foreign exchange market. Asian session: the Australian dollar fell against the U.S. dollar after the release of the weaker-than-expected Australian building permits

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia Building Permits, m/m September +3.4% Revised From +3.0% -0.9% -11%

00:30 Australia Building Permits, y/y September +14.5% -13.4%

00:30 Australia ANZ Job Advertisements (MoM) October +0.9% +0.2%

01:00 China Non-Manufacturing PMI October 54.0 53.8

01:45 China HSBC Manufacturing PMI (Finally) October 50.4 50.4 50.4

05:30 Australia RBA Commodity prices, y/y October -16.8% -16.9%

08:30 Switzerland Manufacturing PMI October 50.4 51.3 55.3

08:48 France Manufacturing PMI (Finally) October 47.3 47.3 48.5

08:53 Germany Manufacturing PMI (Finally) October 51.8 51.8 51.4

08:58 Eurozone Manufacturing PMI (Finally) October 50.7 50.7 50.6

09:30 United Kingdom Purchasing Manager Index Manufacturing October 51.6 51.5 53.2

The U.S. dollar traded higher against the most major currencies. The greenback was supported by Friday's U.S. economic data. The final Reuters/Michigan Consumer Sentiment Index jumped to 86.9 in October from 86.4 in September, exceeding expectations for a rise to 86.4.

The Chicago purchasing managers' index increased to 66.2 in October from 60.5 in September, beating expectations for a decline to 59.5.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar fell against the U.S. dollar after the release of the weaker-than-expected Australian building permits. Building permits in Australia dropped 11% in September, missing expectations for a 0.9% decline, after a 3.4% increase in August. August's figure was revised up from a 3.0% rise.

ANZ job advertisements rose 0.2% in October, after a 0.9% gain in September.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

Friday's decision by the Bank of Japan (BoJ) still weighed on the yen. The BoJ decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

EUR/USD: the currency pair declined to $1.2439

GBP/USD: the currency pair fell to $1.5926

USD/JPY: the currency pair rose to Y112.98

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Finally) October 56.2 56.2

15:00 U.S. ISM Manufacturing October 56.6 56.5

17:50 Canada BOC Gov Stephen Poloz Speaks

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , October 53.2 (forecast 51.5)

-

09:00

Eurozone: Manufacturing PMI, October 50.6 (forecast 50.7)

-

08:55

Germany: Manufacturing PMI, October 51.4 (forecast 51.8)

-

08:51

France: Manufacturing PMI, October 48.5 (forecast 47.3)

-

08:30

Switzerland: Manufacturing PMI, October 55.3 (forecast 51.3)

-

06:20

Options levels on monday, November 3, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2713 (4815)

$1.2635 (2386)

$1.2581 (673)

Price at time of writing this review: $ 1.2487

Support levels (open interest**, contracts):

$1.2416 (3049)

$1.2378 (5423)

$1.2337 (2321)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 61623 contracts, with the maximum number of contracts with strike pric $1,2900 (6972);

- Overall open interest on the PUT options with the expiration date November, 7 is 60223 contracts, with the maximum number of contracts with strike price $1,2600 (5952);

- The ratio of PUT/CALL was 0.98 versus 1.03 from the previous trading day according to data from October, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.6201 (2850)

$1.6102 (1640)

$1.6005 (482)

Price at time of writing this review: $1.5969

Support levels (open interest**, contracts):

$1.5897 (3757)

$1.5799 (1497)

$1.5700 (772)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 28297 contracts, with the maximum number of contracts with strike price $1,6200 (2850);

- Overall open interest on the PUT options with the expiration date November, 7 is 34755 contracts, with the maximum number of contracts with strike price $1,5900 (3757);

- The ratio of PUT/CALL was 1.23 versus 1.20 from the previous trading day according to data from October, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:45

China: HSBC Manufacturing PMI, October 50.4 (forecast 50.4)

-

00:59

China: Non-Manufacturing PMI, October 53.8

-

00:32

Australia: Building Permits, y/y, September -13.4%

-

00:31

Australia: ANZ Job Advertisements (MoM), October +0.2%

-

00:30

Australia: Building Permits, m/m, September -11% (forecast -0.9%)

-

00:00

Currencies. Daily history for Oct 31'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2525 -0,69%

GBP/USD $1,5994 -0,04%

USD/CHF Chf0,9623 +0,69%

USD/JPY Y112,32 +2,73%

EUR/JPY Y140,67 +2,04%

GBP/JPY Y179,65 +2,69%

AUD/USD $0,8796 -0,48%

NZD/USD $0,7793 -0,65%

USD/CAD C$1,1262 +0,68%

-