Notícias do Mercado

-

23:33

Commodities. Daily history for Nov 3’2014:

(raw materials / closing price /% change)

Light Crude 78.20 -0.74%

Gold 1,165.30 -0.38%

-

23:32

Stocks. Daily history for Nov 3’2014:

(index / closing price / change items /% change)

Hang Seng 23,915.97 -82.09 -0.34%

Shanghai Composite 2,430.97 +10.79 +0.45%

FTSE 100 6,487.97 -58.50 -0.89%

CAC 40 4,194.03 -39.06 -0.92%

Xetra DAX 9,251.7 -75.17 -0.81%

S&P 500 2,017.81 -0.24 -0.01%

NASDAQ Composite 4,638.91 +8.17 +0.18%

Dow Jones 17,366.24 -24.28 -0.14%

-

23:24

Currencies. Daily history for Nov 3’2014:

(pare/closed(GMT +2)/change, %)

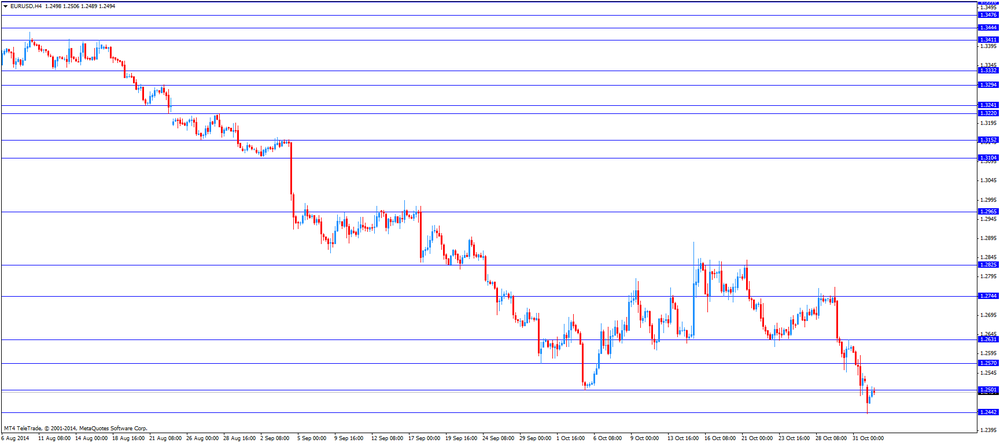

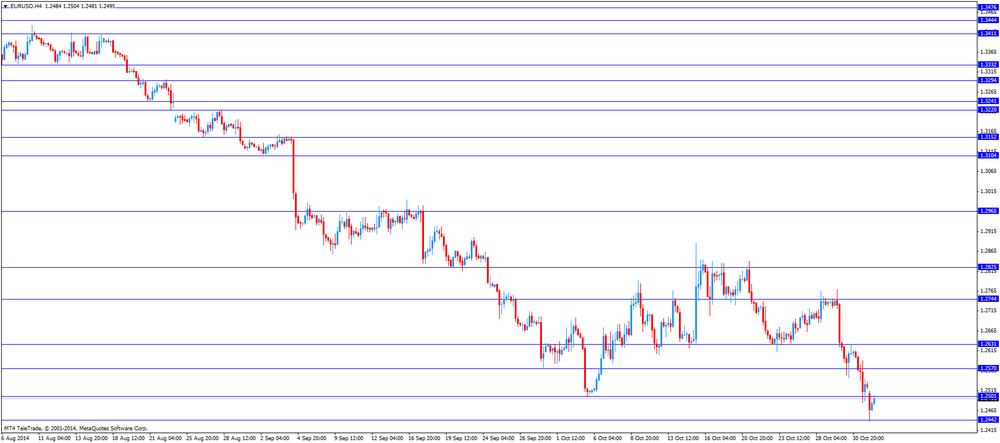

EUR/USD $1,2481 -0,35%

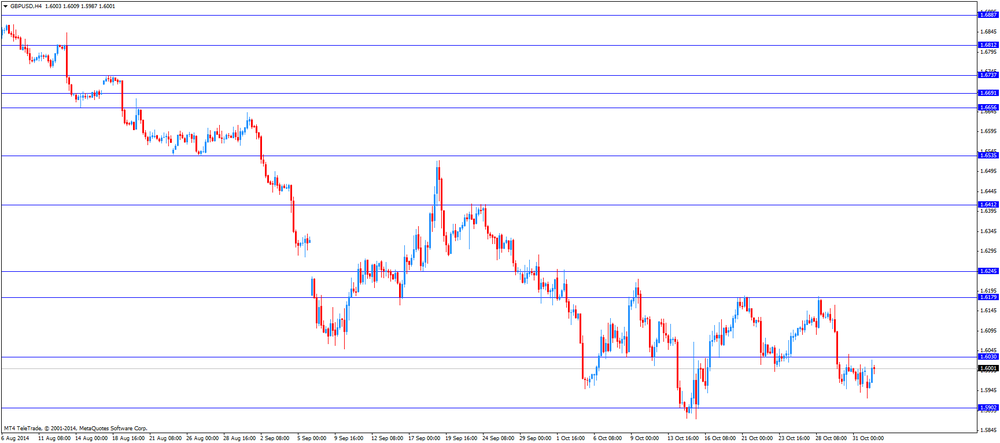

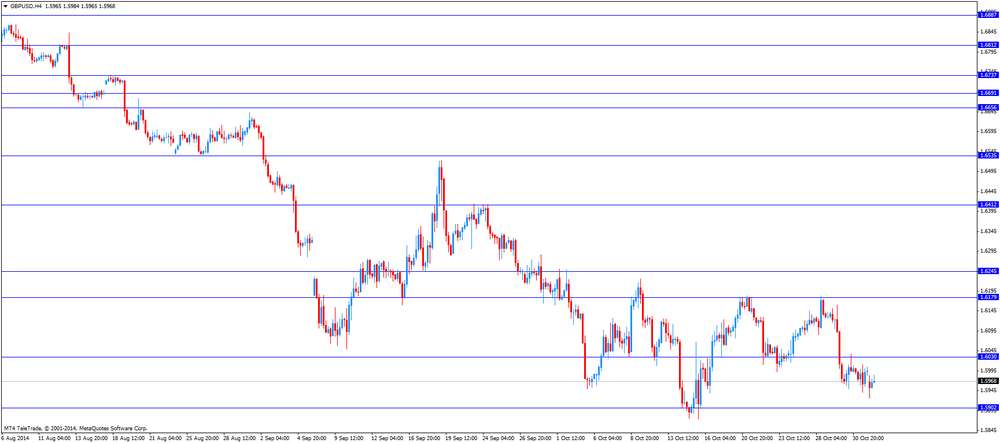

GBP/USD $1,5970 -0,15%

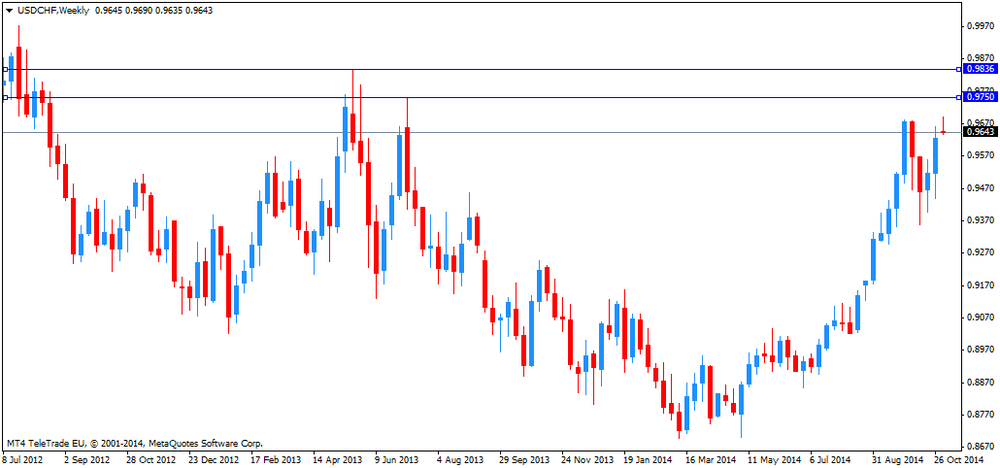

USD/CHF Chf0,9657 +0,35%

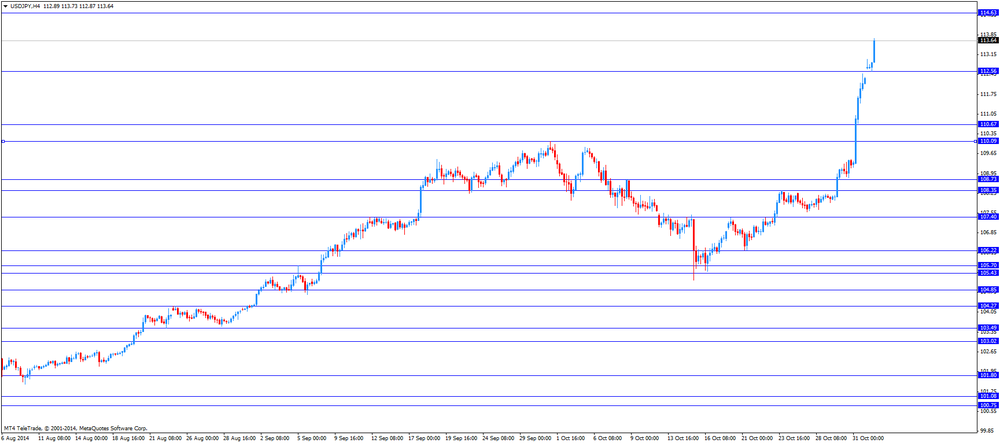

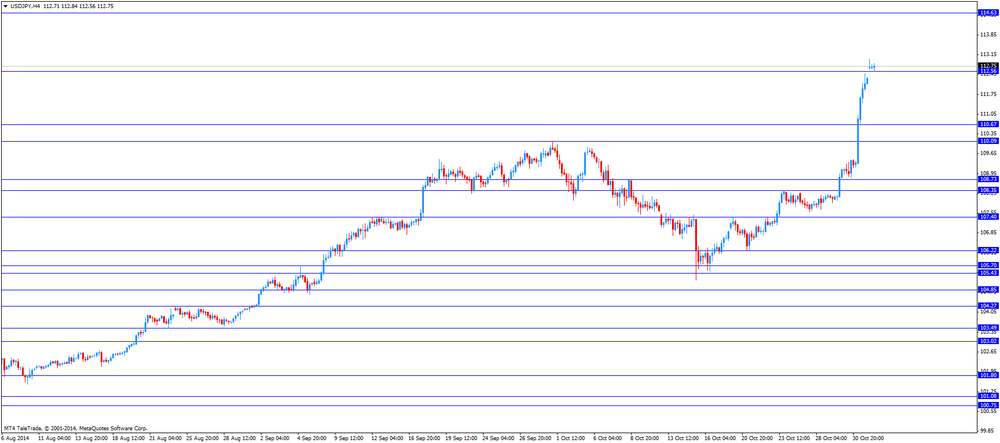

USD/JPY Y114,03 +1,50%

EUR/JPY Y142,33 +1,17%

GBP/JPY Y182,11 +1,35%

AUD/USD $0,8680 -1,34%

NZD/USD $0,7717 -0,98%

USD/CAD C$1,1356 +0,83%

-

23:00

Schedule for today, Tuesday, Nov 4’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail sales (MoM) September +0.1% +0.3%

00:30 Australia Trade Balance September -0.79 -1.78

00:30 Australia Retail Sales Y/Y September +5.1%

01:35 Japan Manufacturing PMI October 52.8 52.8

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

03:30 Australia RBA Rate Statement

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

09:30 United Kingdom PMI Construction October 64.2 63.5

10:00 Eurozone Producer Price Index, MoM September -0.1% 0.0%

10:00 Eurozone Producer Price Index (YoY) September -1.4% -1.5%

13:30 Canada Trade balance, billions September -0.6 -0.7

13:30 U.S. International Trade, bln September -40.1 -40.0

15:00 U.S. Factory Orders September -10.1% -0.4%

15:30 Canada BOC Gov Stephen Poloz Speaks

21:30 U.S. API Crude Oil Inventories October +3.2

21:45 New Zealand Employment Change, q/q Quarter III +0.4% +0.6%

21:45 New Zealand Unemployment Rate Quarter III 5.6% 5.5%

22:30 Australia AIG Services Index October 45.4

23:50 Japan Monetary Base, y/y October +35.3% +36.2%

-

20:00

Dow -27.03 17,363.49 -0.16% Nasdaq +2.43 4,633.17 +0.05% S&P -1.51 2,016.54 -0.07%

-

20:00

U.S.: Total Vehicle Sales, mln, October 16.5 (forecast 16.6)

-

17:01

European stocks close: stocks closed lower, PMIs from the Eurozone weighed on markets

Stock indices closed lower. PMIs from the Eurozone weighed on markets. Investors believe that the current stimulus measures by the European Central Bank would not be enough to boost the economy in the Eurozone.

Eurozone's final manufacturing purchasing managers' index fell to 50.6 in October from 50.7 in September. Analysts had expected the index to remain unchanged at 50.7.

Germany's final manufacturing purchasing managers' index declined to 51.4 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

France's final manufacturing purchasing managers' index rose to 48.5 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

Corporate earnings also weighed on markets.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,487.97 -58.50 -0.89%

DAX 9,251.7 -75.17 -0.81%

CAC 40 4,194.03 -39.06 -0.92%

-

17:00

European stocks close: FTSE 100 6,487.97 -58.50 -0.89% CAC 40 4,194.03 -39.06 -0.92% DAX 9,251.7 -75.17 -0.81%

-

16:40

Oil: an overview of the market situation

Oil prices dropped moderately during today's trading, registering with a third-session decline in a row amid speculation that Saudi Arabia will reduce the price of oil in the sale of its Asian countries.

It is learned that this week's state oil company of Saudi Arabia announce official selling prices for crude oil supplies to Asia in December. Results of the survey showed Bloomberg: 7 traders believe that the world's largest oil exporter offer discounts, 6 traders predict immutability prices, and 2 traders expect increasing.

Pressure on prices also had mixed data on manufacturing activity in China, although the news about strengthening manufacturing activity in the euro area constrain the fall. Recall that in October the index of purchasing managers in the manufacturing of HSBC China rose to 50.4 compared with 50.2 in September. The final index remained unchanged from the preliminary. It is worth emphasizing data contradict the official HSBC manufacturing index PMI, which fell to a 5-month low - 50.8 from 51.1 in September. Official data published on Saturday.

Meanwhile, the final value of the manufacturing PMI eurozone, calculated by Markit, was in October of 50.6 points versus 50.3 points in September and preliminary values of 50.7 points. Processing industry in Germany last month, returned to growth after a small reduction of activity in September, but in France, Italy, Greece and Austria, there is a weakening of indicators.

The course of trading continues to influence the Fed's decision. Following the results of a two-day policy meeting, the Fed completed its asset purchase program, referring to the improvement of the situation on the labor market, which also increased the demand for the US dollar. A strong dollar usually puts pressure on raw materials, reducing its appeal as an alternative asset and increasing the dollar price products for holders of other currencies.

Investors also are awaiting the OPEC meeting on November 27 where the decision will be made on further volumes of oil production.

The cost of December futures on US light crude oil WTI (Light Sweet Crude Oil) fell to $ 80.00 a barrel on the New York Mercantile Exchange (NYMEX).

December futures price for North Sea petroleum mix of mark Brent fell $ 0.59 to $ 85.69 a barrel on the London exchange ICE Futures Europe.

-

16:34

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index

The U.S. dollar traded higher against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index. The ISM manufacturing purchasing managers' index for the U.S. rose to 59.0 in October from 56.6 in September, beating expectations for a decline to 56.5. The rise was driven by the increase in new orders.

The euro traded lower against the U.S. dollar. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 50.6 in October from 50.7 in September. Analysts had expected the index to remain unchanged at 50.7.

Germany's final manufacturing purchasing managers' index declined to 51.4 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

France's final manufacturing purchasing managers' index rose to 48.5 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

The British pound fell against the U.S. dollar. The manufacturing purchasing managers' index in the U.K. climbed to 53.2 in October from 51.5 in September. September's figure was revised down from 51.6. Analysts had expected the index to remain at 51.5.

The Swiss franc traded lower against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland rose to 55.3 in October from 50.4 in September, exceeding expectations for a rise to 51.3.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie declined against the greenback after the release of the weaker-than-expected Australian building permits. Building permits in Australia dropped 11% in September, missing expectations for a 0.9% decline, after a 3.4% increase in August. August's figure was revised up from a 3.0% rise.

ANZ job advertisements rose 0.2% in October, after a 0.9% gain in September.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

Friday's decision by the Bank of Japan (BoJ) still weighed on the yen. The BoJ decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

-

16:20

Gold: an overview of the market situation

Gold prices fell slightly today, approaching with up to four-year low, helped by the rise of the dollar index to its highest level since mid-2010. Such dynamics is related to the speculation that the Federal Reserve will start tightening their monetary policy sooner than other major CB.

It is worth emphasizing that the demand for the precious metal tends to decrease when the economic outlook improves and investors buy riskier assets. Given that the US is moving towards higher interest rates, and the rest of the world, especially Europe and Asia, are moving in the direction of easing, the dollar is likely to continue. This will keep downward pressure on gold.

Market participants also continue to act out Friday's decision by the Bank of Japan. Recall, the Bank of Japan unexpectedly announced an increase in the volume of bond purchases to 80 trillion. yen against the previous target range of 60-70 trillion. yen. The central bank is hoping to revive economic activity and inflation by buying more government bonds in Japan.

Reduced price was also associated with the release of positive US data. A report published by the Institute for Supply Management (ISM), showed that in October, manufacturing activity in the US has improved, exceeding forecasts of economists expect a slight decrease in the index. PMI index for the US manufacturing grew in October to 59.0 against 56.6 in September. A reading above 50 indicates expansion of industrial activity. Note that the latter value was higher than the estimates of experts - expect a slight decrease to 56.5.

The pressure on the precious metal has and reduced demand for gold in China. Experts note that the sluggish demand for gold is particularly unusual for this time of year, when the premium on gold market usually grow: at this time, Chinese traders are stocking gold before the New Year according to the lunar calendar, which will be celebrated in February. The new year of the lunar calendar - the peak of the gold purchases in China. However, the dynamics of prices in Shanghai indicates that even the Chinese buyers are not going to buy gold at discount prices, in the expectation that gold will become cheaper.

"In the face of declining gold prices, consumers and traders are increasingly expecting a possible fall to the psychological level of $ 1,000. But in the second half of 2015 prices are likely to recover, "- said Gnanasekar Tiagaradzhan head Commtrendz Research.

The cost of December gold futures on the COMEX today dropped to 1168.30 dollars per ounce.

-

15:44

ISM manufacturing purchasing managers’ index rose 59.0 in October

The Institute for Supply Management (ISM) released its manufacturing purchasing managers' index for the U.S. The index rose to 59.0 in October from 56.6 in September, beating expectations for a decline to 56.5.

The rise was driven by the increase in new orders. The new orders index climbed to 65.8 in October from 60.0 in September.

-

15:00

U.S.: Construction Spending, m/m, September -0.4% (forecast +0.8%)

-

15:00

U.S.: ISM Manufacturing, October 59.0 (forecast 56.5)

-

14:45

U.S.: Manufacturing PMI, October 55.9 (forecast 56.2)

-

14:35

U.S. Stocks open: Dow 17,393.79 +3.27 +0.02%, Nasdaq 4,632.60 +1.86 +0.04%, S&P 2,019.10 +1.05 +0.05%

-

14:28

Before the bell: S&P futures -0.02%, Nasdaq futures +0.02%

U.S. stock-index futures were little changed as investors weighed equity valuations and global growth prospects.

Global markets:

Hang Seng 23,915.97 -82.09 -0.34%

Shanghai Composite 2,430.97 +10.79 +0.45%

FTSE 6,515.8 -30.67 -0.47%

CAC 4,215.95 -17.14 -0.40%

DAX 9,305.45 -21.42 -0.23%

Crude oil $80.90 (+0.46%)

Gold $1169.80 (-0.15%)

-

14:09

DOW components before the bell

(company / ticker / price / change, % / volume)

UnitedHealth Group Inc

UNH

95.20

+0.20%

0.1K

3M Co

MMM

153.77

0.00%

29.7K

American Express Co

AXP

89.95

0.00%

0.9K

Boeing Co

BA

124.91

0.00%

16.0K

Caterpillar Inc

CAT

101.41

0.00%

0.4K

E. I. du Pont de Nemours and Co

DD

69.15

0.00%

3.7K

International Business Machines Co...

IBM

164.40

0.00%

0.7K

Johnson & Johnson

JNJ

107.78

0.00%

2.9K

Pfizer Inc

PFE

29.95

0.00%

2.0K

Travelers Companies Inc

TRV

100.80

0.00%

2.2K

United Technologies Corp

UTX

107.00

0.00%

0.1K

Intel Corp

INTC

34.00

-0.03%

0.5K

Exxon Mobil Corp

XOM

96.67

-0.04%

5.2K

JPMorgan Chase and Co

JPM

60.45

-0.05%

8.2K

The Coca-Cola Co

KO

41.86

-0.05%

0.8K

Goldman Sachs

GS

189.70

-0.15%

0.3K

Microsoft Corp

MSFT

46.88

-0.15%

2.8K

Walt Disney Co

DIS

91.24

-0.15%

7.5K

Chevron Corp

CVX

119.76

-0.16%

1.7K

Merck & Co Inc

MRK

57.85

-0.16%

0.2K

Visa

V

240.87

-0.23%

1K

Procter & Gamble Co

PG

87.05

-0.25%

3.6K

Cisco Systems Inc

CSCO

24.40

-0.29%

2.8K

General Electric Co

GE

25.73

-0.31%

12.2K

Wal-Mart Stores Inc

WMT

76.02

-0.33%

6.2K

Verizon Communications Inc

VZ

50.07

-0.36%

9.7K

AT&T Inc

T

34.67

-0.49%

14.1K

Home Depot Inc

HD

96.99

-0.54%

1.4K

-

13:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Home Depot (HD) downgraded to Mkt Perform from Outperform at Raymond James

Newmont Mining (NEM) downgraded to Hold from Buy at BB&T Capital Mkts

Other:

Facebook (FB) initiated with a Overweight at Morgan Stanley, target $90

Google A (GOOGL) initiated with a Equal-Weight at Morgan Stanley, target $600

Twitter (TWTR) initiated with a Equal-Weight at Morgan Stanley, target $42

-

13:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1,2500(E353mn), $1.2550(E500mn), $1.2600(E722mn)

AUD/USD: $0.8765(A$301mn)

-

13:00

Orders

EUR/USD

Offers

Bids $1.2485/80, $1.2400, $1.2300

GBP/USD

Offers

Bids $1.5900, $1.5800

AUD/USD

Offers $0.8900, $0.8850, $0.8800

Bids $0.8700, $0.8650, $0.8640/20

EUR/JPY

Offers Y143.00, Y142.50, Y142.00

Bids Y141.10/00, Y140.10/00, Y139.50

USD/JPY

Offers Y114.50, Y114.00, Y113.50

Bids Y112.85/80, Y112.20/00, Y111.55/50, Y111.00

EUR/GBP

Offers

Bids stg0.7755/45, stg0.7700

-

13:00

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the better-than-expected PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia Building Permits, m/m September +3.4% Revised From +3.0% -0.9% -11%

00:30 Australia Building Permits, y/y September +14.5% -13.4%

00:30 Australia ANZ Job Advertisements (MoM) October +0.9% +0.2%

01:00 China Non-Manufacturing PMI October 54.0 53.8

01:45 China HSBC Manufacturing PMI (Finally) October 50.4 50.4 50.4

05:30 Australia RBA Commodity prices, y/y October -16.8% -16.9%

08:30 Switzerland Manufacturing PMI October 50.4 51.3 55.3

08:48 France Manufacturing PMI (Finally) October 47.3 47.3 48.5

08:53 Germany Manufacturing PMI (Finally) October 51.8 51.8 51.4

08:58 Eurozone Manufacturing PMI (Finally) October 50.7 50.7 50.6

09:30 United Kingdom Purchasing Manager Index Manufacturing October 51.5 51.5 53.2

The U.S. dollar traded mixed against the most major currencies ahead of the ISM manufacturing purchasing managers' index. The index is expected to decline to 56.5 in October from 56.6 in September.

The euro traded slightly higher against the U.S. dollar after the release of PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 50.6 in October from 50.7 in September. Analysts had expected the index to remain unchanged at 50.7.

Germany's final manufacturing purchasing managers' index declined to 51.4 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

France's final manufacturing purchasing managers' index rose to 48.5 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

The British pound traded higher against the U.S. dollar after the better-than-expected PMI from the U.K. The manufacturing purchasing managers' index in the U.K. climbed to 53.2 in October from 51.5 in September. September's figure was revised down from 51.6. Analysts had expected the index to remain at 51.5.

The Swiss franc traded higher against the U.S. dollar after Switzerland's better-than-expected PMI. The manufacturing purchasing managers' index in Switzerland rose to 55.3 in October from 50.4 in September, exceeding expectations for a rise to 51.3.

EUR/USD: the currency pair rose to $1.2509

GBP/USD: the currency pair climbed to $1.6022

USD/JPY: the currency pair rose to Y113.73

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Finally) October 56.2 56.2

15:00 U.S. ISM Manufacturing October 56.6 56.5

17:50 Canada BOC Gov Stephen Poloz Speaks

-

12:00

European stock markets mid session: stocks traded lower after the weaker-than-expected PMIs from the Eurozone and China

The weaker-than-expected European and Chinese PMI and growing concerns about a slowdown in European economic growth caused losses on the European stock markets after a slightly positive start. At the moment the DAX is trading at 9,295 (-0.38%), the FTSE 100 at 6,521 (-0.34) and the CAC40 at 4,217 (-0.36%).

Eurozone's final manufacturing purchasing managers' index fell to 50.6 in October from 50.7 in September. Analysts had expected the index to remain unchanged at 50.7.

Germany's final manufacturing purchasing managers' index declined to 51.4 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

France's final manufacturing purchasing managers' index rose to 48.5 in October from 51.8 in September. Analysts had expected the index to remain unchanged at 51.8.

-

11:03

-

10:48

Asian Stocks close: stocks closed mixed on Chinese economic data

Asian stock indices closed mixed on Chinese economic data. China's final HSBC manufacturing purchasing managers' index was at 50.4 in October, in line with expectations.

China's non-manufacturing purchasing managers' index fell to 53.8 in October from 54.0 in September.

Markets in Japan were closed for a public holiday.

Indexes on the close:

Nikkei 225 closed

Hang Seng 23,915.97 -82.09 -0.34%

Shanghai Composite 2,430.97 +10.79 +0.45%

-

10:32

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1,2500(E353mn), $1.2550(E500mn), $1.2600(E722mn)

AUD/USD: $0.8765(A$301mn)

-

09:53

Foreign exchange market. Asian session: the Australian dollar fell against the U.S. dollar after the release of the weaker-than-expected Australian building permits

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia Building Permits, m/m September +3.4% Revised From +3.0% -0.9% -11%

00:30 Australia Building Permits, y/y September +14.5% -13.4%

00:30 Australia ANZ Job Advertisements (MoM) October +0.9% +0.2%

01:00 China Non-Manufacturing PMI October 54.0 53.8

01:45 China HSBC Manufacturing PMI (Finally) October 50.4 50.4 50.4

05:30 Australia RBA Commodity prices, y/y October -16.8% -16.9%

08:30 Switzerland Manufacturing PMI October 50.4 51.3 55.3

08:48 France Manufacturing PMI (Finally) October 47.3 47.3 48.5

08:53 Germany Manufacturing PMI (Finally) October 51.8 51.8 51.4

08:58 Eurozone Manufacturing PMI (Finally) October 50.7 50.7 50.6

09:30 United Kingdom Purchasing Manager Index Manufacturing October 51.6 51.5 53.2

The U.S. dollar traded higher against the most major currencies. The greenback was supported by Friday's U.S. economic data. The final Reuters/Michigan Consumer Sentiment Index jumped to 86.9 in October from 86.4 in September, exceeding expectations for a rise to 86.4.

The Chicago purchasing managers' index increased to 66.2 in October from 60.5 in September, beating expectations for a decline to 59.5.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar fell against the U.S. dollar after the release of the weaker-than-expected Australian building permits. Building permits in Australia dropped 11% in September, missing expectations for a 0.9% decline, after a 3.4% increase in August. August's figure was revised up from a 3.0% rise.

ANZ job advertisements rose 0.2% in October, after a 0.9% gain in September.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

Friday's decision by the Bank of Japan (BoJ) still weighed on the yen. The BoJ decided to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion. This decision was not expected by analysts.

EUR/USD: the currency pair declined to $1.2439

GBP/USD: the currency pair fell to $1.5926

USD/JPY: the currency pair rose to Y112.98

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Finally) October 56.2 56.2

15:00 U.S. ISM Manufacturing October 56.6 56.5

17:50 Canada BOC Gov Stephen Poloz Speaks

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , October 53.2 (forecast 51.5)

-

09:00

Eurozone: Manufacturing PMI, October 50.6 (forecast 50.7)

-

08:55

Germany: Manufacturing PMI, October 51.4 (forecast 51.8)

-

08:51

France: Manufacturing PMI, October 48.5 (forecast 47.3)

-

08:30

Switzerland: Manufacturing PMI, October 55.3 (forecast 51.3)

-

06:20

Options levels on monday, November 3, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2713 (4815)

$1.2635 (2386)

$1.2581 (673)

Price at time of writing this review: $ 1.2487

Support levels (open interest**, contracts):

$1.2416 (3049)

$1.2378 (5423)

$1.2337 (2321)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 61623 contracts, with the maximum number of contracts with strike pric $1,2900 (6972);

- Overall open interest on the PUT options with the expiration date November, 7 is 60223 contracts, with the maximum number of contracts with strike price $1,2600 (5952);

- The ratio of PUT/CALL was 0.98 versus 1.03 from the previous trading day according to data from October, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.6201 (2850)

$1.6102 (1640)

$1.6005 (482)

Price at time of writing this review: $1.5969

Support levels (open interest**, contracts):

$1.5897 (3757)

$1.5799 (1497)

$1.5700 (772)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 28297 contracts, with the maximum number of contracts with strike price $1,6200 (2850);

- Overall open interest on the PUT options with the expiration date November, 7 is 34755 contracts, with the maximum number of contracts with strike price $1,5900 (3757);

- The ratio of PUT/CALL was 1.23 versus 1.20 from the previous trading day according to data from October, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:00

Hang Seng 24,020.13 +22.07 +0.09%, S&P/ASX 200 5,512.1 -14.50 -0.26%, Shanghai Composite 2,425.22 +5.05 +0.21%

-

01:45

China: HSBC Manufacturing PMI, October 50.4 (forecast 50.4)

-

00:59

China: Non-Manufacturing PMI, October 53.8

-

00:32

Australia: Building Permits, y/y, September -13.4%

-

00:31

Australia: ANZ Job Advertisements (MoM), October +0.2%

-

00:30

Australia: Building Permits, m/m, September -11% (forecast -0.9%)

-

00:06

Commodities. Daily history for Oct 31'2014:

(raw materials / closing price /% change)

Light Crude 80.70 +0.20%

Gold 1,173.50 +0.16%

-

00:04

Stocks. Daily history for Oct 31'2014:

(index / closing price / change items /% change)

Nikkei 225 16,413.76 +755.56 +4.83 %

Hang Seng 23,998.06 +296.02 +1.25 %

Shanghai Composite 2,420.18 +29.10 +1.22 %

FTSE 100 6,546.47 +82.92 +1.28 %

CAC 40 4,233.09 +91.85 +2.22 %

Xetra DAX 9,326.87 +212.03 +2.33 %

S&P 500 2,018.05 +23.40 +1.17 %

NASDAQ Composite 4,630.74 +64.60 +1.41 %

Dow Jones 17,390.52 +195.10 +1.13 %

-

00:00

Currencies. Daily history for Oct 31'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2525 -0,69%

GBP/USD $1,5994 -0,04%

USD/CHF Chf0,9623 +0,69%

USD/JPY Y112,32 +2,73%

EUR/JPY Y140,67 +2,04%

GBP/JPY Y179,65 +2,69%

AUD/USD $0,8796 -0,48%

NZD/USD $0,7793 -0,65%

USD/CAD C$1,1262 +0,68%

-