Notícias do Mercado

-

23:50

Japan: Monetary Base, y/y, October +36.9% (forecast +36.2%)

-

23:34

Commodities. Daily history for Nov 4’2014:

(raw materials / closing price /% change)

Light Crude 77.33 +0.18%

Gold 1,168.20 +0.04%

-

23:31

Stocks. Daily history for Nov 4’2014:

(index / closing price / change items /% change)

Nikkei 225 16,862.47 +448.71 +2.73%

Hang Seng 23,845.66 -70.31 -0.29%

Shanghai Composite 2,430.74 +0.71 +0.03%

FTSE 100 6,453.97 -34.00 -0.52%

CAC 40 4,130.19 -63.84 -1.52%

Xetra DAX 9,166.47 -85.23 -0.92%

S&P 500 2,012.1 -5.71 -0.28%

NASDAQ Composite 4,623.64 -15.27 -0.33%

Dow Jones 17,383.84 +17.60 +0.10%

-

23:22

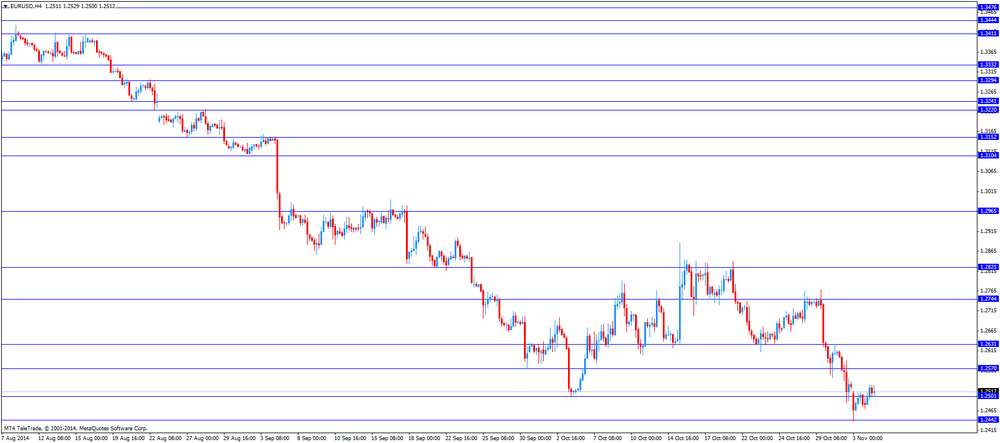

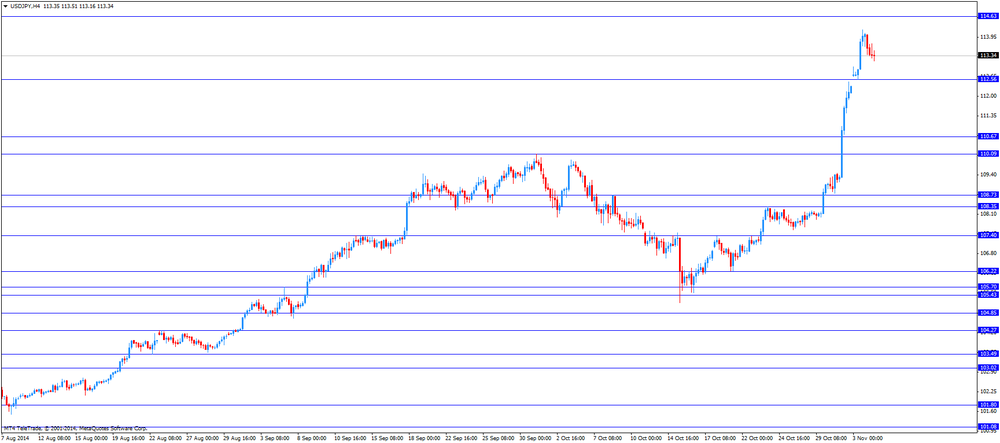

Currencies. Daily history for Nov 4’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,2546 +0,52%

GBP/USD $1,6001 +0,19%

USD/CHF Chf0,9596 -0,64%

USD/JPY Y113,59 -0,39%

EUR/JPY Y142,51 +0,13%

GBP/JPY Y181,76 -0,19%

AUD/USD $0,8736 +0,64%

NZD/USD $0,7809 +1,18%

USD/CAD C$1,1408 +0,46%

-

23:01

Schedule for today, Wednesday, Nov 5’2014:

(time / country / index / period / previous value / forecast)

01:30 Japan Labor Cash Earnings, YoY September +0.9% Revised From +1.4% +0.9%

01:45 China HSBC Services PMI October 53.5

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

08:15 Switzerland Consumer Price Index (MoM) October +0.1% -0.1%

08:15 Switzerland Consumer Price Index (YoY) October -0.1% 0.0%

08:48 France Services PMI (Finally) October 48.1 48.1

08:53 Germany Services PMI (Finally) October 54.8 54.8

08:58 Eurozone Services PMI (Finally) October 52.4 52.4

09:30 United Kingdom Purchasing Manager Index Services October 58.7 58.7

10:00 Eurozone Retail Sales (MoM) September +1.2% -0.6%

10:00 Eurozone Retail Sales (YoY) September +1.9% +1.5%

13:15 U.S. ADP Employment Report October 213 214

14:15 U.S. FOMC Member Narayana Kocherlakota

14:45 U.S. Services PMI (Finally) October 57.3 57.3

15:00 U.S. ISM Non-Manufacturing October 58.6 58.2

15:30 U.S. Crude Oil Inventories October +2.1

23:50 Japan Monetary Policy Meeting Minutes

-

20:00

Dow +18.98 17,385.22 +0.11% Nasdaq -17.29 4,621.62 -0.37% S&P -5.93 2,011.88 -0.29%

-

17:22

Bank of Canada Governor Stephen Poloz: “the current level of monetary stimulus remains appropriate”

The Bank of Canada (BoC) Governor Stephen Poloz said before the House of Commons Standing Committee on Finance on Tuesday that "the current level of monetary stimulus remains appropriate".

He also that financial stability risks such as household imbalances remain a concern to Canadian economy. Poloz added that the economy in Canada "faces significant headwinds and continued monetary policy stimulus is needed to offset them in order to achieve our inflation objective".

The BoC governor pointed out that Canadian export sector is less robust than in previous cycles.

Poloz said that the "U.S. economy is gaining traction, particularly in sectors that are beneficial to Canada's exports".

-

17:02

European stocks close: stocks closed lower as the European Commission lowered its growth and inflation forecast for the Eurozone

Stock indices closed lower as the European Commission (EC) lowered its growth and inflation forecast for the Eurozone. The EC cut its forecast for Eurozone's economic growth to 0.8% in 2014, down from 1.2%. The economic growth in the Eurozone is lowered to 1.1% in 2015, down from 1.7% previously.

The EC expects inflation in the Eurozone to remain below the European Central Bank's 2% target until at least 2016.

The EC lowered its forecasts due to a slowdown of the European economy and geopolitical crises.

Shares of oil companies declined due to falling oil prices.

Hugo Boss AG shares dropped 5.3% after lowering its 2014 sales forecast.

Securitas AB shares rose 9.1% after reporting better-than-estimated third-quarter net income.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,453.97 -34.00 -0.52%

DAX 9,166.47 -85.23 -0.92%

CAC 40 4,130.19 -63.84 -1.52%

-

17:00

European stocks close: FTSE 100 6,453.97 -34.00 -0.52% CAC 40 4,130.19 -63.84 -1.52% DAX 9,166.47 -85.23 -0.92%

-

16:40

Oil: an overview of the market situation

WTI oil prices fell sharply today, reaching a three-year low at the same time, since Saudi Arabia lowered the price to buyers from the US. The cost of Brent, the meanwhile, fell to a four-year low.

As it became known today, Saudi Arabian Oil Company reported a decrease in export prices for oil for the US and Asia. "This move by Saudi Arabia indicates that it tries to keep its market share in the US, which has recently declined slightly. Apparently, the Saudis feel comfortable at this price and level of demand, "- said the expert Again Capital LLC John Kildaf. According to him, it seems that Saudi Arabia expects that growth in demand for oil in the winter will allow them to strengthen the position.

"Proposal of crude oil is very high, - said the representative of the consulting firm Energy Security Analysis Sarah Emerson. - The situation is still characterized by significant volatility. I would not be surprised if by the end of the year, Brent closer to $ 80, while also quite possible that it will be at the level of $ 95. "

Pressure on prices has also had today's decision of the European Commission lowered its forecast for economic growth of the eurozone for 2014, citing tensions in Ukraine and the Middle East, along with a lack of investment. The agency said it now expects gross domestic product growth in the block by 0.8% this year compared to the spring forecast of 1.2%. In 2015, the eurozone economy is likely to expand by 1.1% compared with the previous forecast of 1.7%.

Another reason for the decline in value is a concern about the weakening global demand, as well as signs that the Organization of Petroleum Exporting Countries will not cut production to support oil quotations, also exert pressure in recent weeks. Some market analysts believe that only a reduction in production in the oil cartel will stop the fall in prices.

The course of trade is also affected by expectations of the publication of new data on stocks of crude oil and petroleum products in the United States to gauge the strength of demand in the largest consumer in the world.

The cost of December futures on US light crude oil WTI (Light Sweet Crude Oil) fell to $ 76.58 a barrel on the New York Mercantile Exchange (NYMEX).

December futures price for North Sea petroleum mix of mark Brent fell $ 1.57 to $ 82.47 a barrel on the London exchange ICE Futures Europe.

-

16:37

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected factory orders from the U.S.

The U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected factory orders from the U.S. Factory orders in the U.S. declined 0.6% in September, missing expectations for a 0.4% fall, after a 10.0% drop in August. August's figure was revised up from a 10.1% decrease.

The U.S. trade deficit widened to $43.03 billion in September from a deficit of $40.0 in August. August's figure was revised up from a deficit of $40.1 billion.

The euro rose against the U.S. dollar. The European Commission (EC) lowered its forecast for Eurozone's economic growth to 0.8% in 2014, down from 1.2%. The economic growth in the Eurozone is lowered to 1.1% in 2015, down from 1.7% previously.

The EC expects inflation in the Eurozone to remain below the European Central Bank's 2% target until at least 2016.

The EC lowered its forecasts due to a slowdown of the European economy and geopolitical crises.

The British pound traded mixed against the U.S. dollar. The construction purchasing managers' index in the U.K. fell to 61.4 in October from 64.2 in September. Analysts had expected the index to decline to 63.5.

The Canadian dollar traded mixed against the U.S. dollar after the better-than-expected trade data from Canada. Canada's trade balance returned unexpectedly to surplus in September, driven by motor vehicle and parts shipments. The trade surplus was C$0.7 billion in September, up from a deficit of C$0.5 billion in August. August's figure was revised up from a deficit of C$0.6 billion. Analysts had expected the trade deficit to widen to C$0.7 billion.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie climbed against the greenback after the Reserve Bank of Australia's interest rate decision. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.50%. This decision was widely expected.

The Reserve Bank of Australia Governor Glenn Stevens said that "the Australian dollar remains above most estimates of its fundamental value".

Retail sales in Australia rose 1.2% in September, exceeding expectations for a 0.4% increase, after a 0.1% gain in August.

Australia's trade deficit increased to A$2.26 billion in September from A$1.01 billion in August. August's figure was revised down from a deficit of A$0.79 billion. Analysts had expected the trade deficit to increase to A$1.78 billion.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

-

16:20

Gold: an overview of the market situation

Gold prices rose slightly today, but stayed near four-year low, as the dollar's rebound from multi-year highs against the currency basket eased downward pressure on the metal.

The course of trading also contributed news from the European Commission. According to the European Commission's autumn economic forecast, next year, the region's economy will continue to grow at a slower pace environment of low inflation and high unemployment. According to the forecasts of the European Commission, GDP will grow this year by 0.8% (compared to the previous estimate of 1.2%), 1.1% in the next (against 1.7%), and 1.7% in 2016. Inflation will be 0.5% (compared to the previous estimate of 0.8) in 2014 year, 0.8% (vs. 1.2%) in 2015 and to 1.5% in 2016. The unemployment rate for this time only to fall to 10.8%. Sluggish recovery is mostly due to the weak state of the economy in France and Italy, as well as the stagnation in Germany. Geopolitical concerns and nervousness in the markets represent a great threat to the forecast of the eurozone.

Support prices were weak US data. As it became known, new orders for US factory goods fell for a second consecutive month in September, reflecting a temporary setback for the manufacturing sector. The Commerce Department reported that orders fell 0.6 percent. Orders in August were revised slightly to 10.0 per cent fall instead announced earlier decline of 10.1 percent. Economists had expected orders to fall by 0.4 percent. In September, orders, excluding the volatile transportation category were unchanged for the second month in a row.

Meanwhile, adding that analysts record decline in demand from China, the world's largest buyer of gold. On the one hand, on the sale of gold and luxury goods in China have adversely affected the new anti-corruption laws, the other - on a background of falling prices, investors are waiting for the metal cheaper still.

Also today it was announced that the world's largest reserves of the Fund ETF SPDR Gold Trust on Monday increased by only 0.01 tons, registering with the first increase since October 16. It is worth emphasizing that stocks are still close to a six-year low of 741 tons, which was reached last week.

The cost of December gold futures on the COMEX today rose to 1170.90 dollars per ounce.

-

15:01

Oil prices dropped after Saudi Arabia lowered sales prices to the United States

Brent crude oil declined more than 3% to near $82 a barrel after Saudi Arabia lowered sales prices to the United States. That was the lowest level since October 2010.

U.S. light crude oil fell to a session low of $75.92, the lowest level since October 2011.

Saudi Arabia cut on Monday its December official selling prices (OSPs) to Asia and Europe on Monday, but lowered its selling prices to the United States.

The growth and inflation forecast cut by the European Commission (EC) also weighed on oil prices. The EC cut its forecast for Eurozone's economic growth to 0.8% in 2014, down from 1.2%. The economic growth in the Eurozone is lowered to 1.1% in 2015, down from 1.7% previously.

-

15:00

U.S.: Factory Orders , September -0.6% (forecast -0.4%)

-

14:35

U.S. Stocks open: Dow 17,347.91 -18.33 -0.11%, Nasdaq 4,622.17 -16.74 -0.36%, S&P 2,013.57 -4.24 -0.21%

-

14:27

Before the bell: S&P futures -0.24%, Nasdaq futures -0.27%

U.S. stock-index futures dropped as energy companies slumped as oil reached a three-year low and forecasts from Sprint Corp. to Priceline Group Inc. disappointed investors.

Global markets:

Nikkei 16,862.47 +448.71 +2.73%

Hang Seng 23,845.66 -70.31 -0.29%

Shanghai Composite 2,430.74 +0.71 +0.03%

FTSE 6,478.27 -9.70 -0.15%

CAC 4,168.51 -25.52 -0.61%

DAX 9,235.36 -16.34 -0.18%

Crude oil $76.96 (-2.28%)

Gold $1168.40 (-0.10%)

-

14:23

Canada’s trade balance returned unexpectedly to surplus in September

Statistics Canada released the trade data on Tuesday. Canada's trade balance returned unexpectedly to surplus in September, driven by motor vehicle and parts shipments. The trade surplus was C$0.7 billion in September, up from a deficit of C$0.5 billion in August. August's figure was revised up from a deficit of C$0.6 billion. Analysts had expected the trade deficit to widen to C$0.7 billion.

Exports increased 1.1% in September. Motor vehicle and parts shipments rose 6.0%, while consumer goods exports climbed 6.6%.

Imports declined 1.5% in September. Energy dropped 19.4%.

-

14:11

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Outperform from Underperform at Credit Agricole

Downgrades:

Other:

-

14:09

DOW components before the bell

(company / ticker / price / change, % / volume)

United Technologies Corp

UTX

106.50

+0.19%

2.5K

Walt Disney Co

DIS

92.33

+0.68%

13.0K

Travelers Companies Inc

TRV

99.95

0.00%

0.5K

Johnson & Johnson

JNJ

107.40

-0.06%

2.9K

3M Co

MMM

153.20

-0.07%

1.4K

Merck & Co Inc

MRK

58.88

-0.07%

0.1K

Procter & Gamble Co

PG

87.30

-0.09%

2.1K

UnitedHealth Group Inc

UNH

94.75

-0.12%

0.2K

Home Depot Inc

HD

95.94

-0.16%

1.1K

International Business Machines Co...

IBM

164.09

-0.16%

1.6K

Boeing Co

BA

125.81

-0.17%

0.6K

Nike

NKE

93.27

-0.19%

1.9K

McDonald's Corp

MCD

93.41

-0.21%

0.1K

General Electric Co

GE

25.64

-0.23%

10.8K

AT&T Inc

T

34.75

-0.26%

3.6K

The Coca-Cola Co

KO

41.70

-0.26%

1.6K

Wal-Mart Stores Inc

WMT

76.08

-0.26%

11.3K

Verizon Communications Inc

VZ

50.25

-0.28%

19.1K

Cisco Systems Inc

CSCO

24.50

-0.33%

1.0K

Intel Corp

INTC

34.19

-0.35%

0.6K

Visa

V

240.66

-0.36%

3.0K

Microsoft Corp

MSFT

47.27

-0.36%

14.6K

Goldman Sachs

GS

190.10

-0.38%

1.9K

Pfizer Inc

PFE

30.05

-0.46%

15.6K

Caterpillar Inc

CAT

99.75

-0.47%

1.3K

JPMorgan Chase and Co

JPM

60.35

-0.87%

27.7K

Chevron Corp

CVX

115.75

-0.88%

18.3K

Exxon Mobil Corp

XOM

94.36

-0.94%

30.7K

-

14:08

U.S. trade deficit widened to $43.03 billion in September

The U.S. Commerce Department released on Tuesday the trade data. The U.S. trade deficit widened to $43.03 billion in September from a deficit of $40.0 in August. August's figure was revised up from a deficit of $40.1 billion.

The increase of the trade deficit was driven by exports that fell 1.5% in September. Exports reached the lowest level since April 2014.

Exports to the European Union declined 6.5% in September. Exports to China fell 3.2%, while exports to Japan dropped 14.7%.

Imports were unchanged in September.

-

13:48

Reserve Bank of Australia kept its interest rate unchanged at 2.50%

The Reserve Bank of Australia (RBA) released its interest rate decision on Tuesday. The RBA kept its interest rate unchanged at 2.50%. This decision was widely expected.

The Reserve Bank of Australia Governor Glenn Stevens said that "the Australian dollar remains above most estimates of its fundamental value".

He noted that the economy grew moderately, but the growth in the next several quarters is expected to be a little below trend.

The RBA governor pointed out that monetary policy remains accommodative.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2500(E5.09bn), $1.2525(E439mn), $1.2550(E1.09bn)...($1.2500 Nov5 E2.3bn)

USD/JPY: Y113.00($250mn)

USD/CHF: Chf0.9600($433mn)

AUD/USD: $0.8850(A$960mn)

-

13:30

Canada: Trade balance, billions, September +0.7 (forecast -0.7)

-

13:30

U.S.: International Trade, bln, September -43.0 (forecast -40.0)

-

13:07

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the after the European Commission (EC) lowered its growth and inflation forecast for the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail sales (MoM) September +0.1% +0.3% +1.2%

00:30 Australia Trade Balance September -1.01 Revised From -0.79 -1.78 -2.26

01:35 Japan Manufacturing PMI October 52.8 52.8 52.4

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction October 64.2 63.5 61.4

10:00 Eurozone Producer Price Index, MoM September -0.2% Revised From -0.1% 0.0% +0.2%

10:00 Eurozone Producer Price Index (YoY) September -1.4% -1.5% -1.4%

The U.S. dollar traded mixed against the most major currencies ahead of the trade data and factory orders from the U.S. The U.S. trade deficit is expected to decline to $40.0 billion in September from a deficit of $40.1 billion in August.

Factory orders in the U.S. are expected to decline 0.4% in September, after a 10.1% drop in August.

The euro traded mixed against the U.S. dollar after the European Commission (EC) lowered its growth and inflation forecast for the Eurozone. The EC cut its forecast for Eurozone's economic growth to 0.8% in 2014, down from 1.2%. The economic growth in the Eurozone is lowered to 1.1% in 2015, down from 1.7% previously.

The EC expects inflation in the Eurozone to remain below the European Central Bank's 2% target until at least 2016.

The EC lowered its forecasts due to a slowdown of the European economy and geopolitical crises.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected construction PMI from the U.K. The construction purchasing managers' index in the U.K. fell to 61.4 in October from 64.2 in September. Analysts had expected the index to decline to 63.5.

The Canadian dollar fell against the U.S. dollar ahead of the trade data from Canada. The Canadian trade deficit is expected to widen to C$0.7 billion in September from a deficit of C$0.6 in August.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y113.16

The most important news that are expected (GMT0):

13:30 Canada Trade balance, billions September -0.6 -0.7

13:30 U.S. International Trade, bln September -40.1 -40.0

15:00 U.S. Factory Orders September -10.1% -0.4%

15:30 Canada BOC Gov Stephen Poloz Speaks

21:45 New Zealand Employment Change, q/q Quarter III +0.4% +0.6%

21:45 New Zealand Unemployment Rate Quarter III 5.6% 5.5%

-

13:00

Orders

EUR/USD

Offers $1.2600/05

Bids $1.2400

GBP/USD

Offers $1.6100

Bids $1.5900

AUD/USD

Offers $0.8900, $0.8850, $0.8820, $0.8800

Bids $0.8680, 0.8640/20, $0.8600

EUR/JPY

Offers Y143.50, Y143.00, Y142.20/25

Bids Y141.55/50, Y141.10/00, Y140.80, Y140.10/00

USD/JPY

Offers Y115.00, Y114.50, Y113.70/75

Bids Y113.10/00, Y112.85/80, Y112.20/00

EUR/GBP

Offers

Bids stg0.7755/45

-

12:25

European stock markets mid session: after a slightly positive start in the morning European stock indices turned negative

At the moment the FTSE 100 is down -0.16% trading at 6,477.49, the DAX -0.01% at 9,250.34 points and the CAC 40 -0.26% at 4,183.08 points making the DAX the biggest loser trading in the first hour at +0.40% after the European Commission cut its growth forecast for the euro zone. Gross domestic product will rise by 0.8 percent this year and 1.1 percent in 2015, down from projections for 1.2% and 1.7% in May, the European Commission announced today. Lower projections for Germany and inflation in the euro area will be even weaker than the ECB predicts.

-

11:23

Gold price turning positive after last week trading at 4-year-low

Gold prices further declined Monday but turned positive today currently trading at $1171.50 as the USD declined relieving some pressure after investors speculated on future interest rate rises of the Federal Reserve after ending bond-buying last month and the unexpected expansion of Bank of Japans stimulus. But the market sentiment on gold still stays negative.

U.S. data later that week with potential impact on the USD and U.S. monetary policy will be in the focus. A strong USD tends to push down gold, which is priced in USD, as it is getting more expensive for holders of other currencies.

-

10:28

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2500(E5.09bn), $1.2525(E439mn), $1.2550(E1.09bn)...($1.2500 Nov5 E2.3bn)

USD/JPY: Y113.00($250mn)

USD/CHF: Chf0.9600($433mn)

AUD/USD: $0.8850(A$960mn)

-

10:00

Eurozone: Producer Price Index, MoM , September +0.2% (forecast 0.0%)

-

10:00

Eurozone: Producer Price Index (YoY), September -1.4% (forecast -1.5%)

-

09:59

United Kingdom: PMI Construction October 61.4 (forecast 63.5)

-

09:37

Press Review: Dollar wins more fans, hits four-year high

Bloomberg

JPMorgan Faces U.S. Criminal Probe Into Currency Trading

JPMorgan Chase & Co. (JPM) said it faces a U.S. criminal probe into foreign-exchange dealings and boosted its maximum estimate for "reasonably possible" losses on legal cases to the highest in more than a year.

Reuters

FOREX-Dollar wins more fans, hits four-year high

SYDNEY, Nov 4 (Reuters) - The dollar hovered at four-year highs early on Tuesday, having cemented its status as the favoured one as investors sought the greenback against just about every other major currency.

Source: http://www.reuters.com/article/2014/11/03/markets-forex-idUSL4N0ST63V20141103

Bloomberg

Euro Woes Pressuring Eastern EU States Into More Easing

Low inflation, flagging growth, and the European Central Bank's stimulus bias will probably force eastern members of the European Union to cut interest rates to record lows this week.

-

09:23

European Stocks. First hour: stocks climbed at the start

European stock indices rose at the start. Germany's DAX 30 climbed 0.40% to 9,288.77 points, UK's FTSE 100 index was up 0.09% to 6,493.56 points, while France's CAC 40 gained 0.08% to 4,197.40 although a slightly lower S&P 500 and DOW Jones. Despite weaker Asian markets the Nikkei climbed over 17,000 points for the first time since 2007 due to Bank of Japans market stimulus. Market participants are awaiting the Eurozone Producer Price Index, the ongoing reporting season and during the night the final results of the US midterm elections.

-

06:17

Options levels on monday, November 4, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2713 (4815)

$1.2635 (2386)

$1.2581 (673)

Price at time of writing this review: $ 1.2523

Support levels (open interest**, contracts):

$1.2416 (3049)

$1.2378 (5423)

$1.2337 (2321)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 61623 contracts, with the maximum number of contracts with strike pric $1,2900 (6972);

- Overall open interest on the PUT options with the expiration date November, 7 is 60223 contracts, with the maximum number of contracts with strike price $1,2600 (5952);

- The ratio of PUT/CALL was 0.98 versus 1.03 from the previous trading day according to data from October, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.6201 (2850)

$1.6102 (1640)

$1.6005 (482)

Price at time of writing this review: $1.5989

Support levels (open interest**, contracts):

$1.5897 (3757)

$1.5799 (1497)

$1.5700 (772)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 28297 contracts, with the maximum number of contracts with strike price $1,6200 (2850);

- Overall open interest on the PUT options with the expiration date November, 7 is 34755 contracts, with the maximum number of contracts with strike price $1,5900 (3757);

- The ratio of PUT/CALL was 1.23 versus 1.20 from the previous trading day according to data from October, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Australia: Announcement of the RBA decision on the discount rate, 2.50% (forecast 2.50%)

-

02:02

Nikkei 225 16,952.02 +538.26 +3.28%, Hang Seng 23,836.74 -79.23 -0.33%, S&P/ASX 200 5,506.9 +0.01 0.00%, Shanghai Composite 2,425.33 -4.70 -0.19%

-

01:36

Japan: Manufacturing PMI, October 52.4 (forecast 52.8)

-

00:30

Australia: Retail sales (MoM), September +1.2% (forecast +0.3%)

-

00:30

Australia: Trade Balance , September -2.26 (forecast -1.78)

-