Notícias do Mercado

-

23:37

Commodities. Daily history for Nov 5’2014:

(raw materials / closing price /% change)

Light Crude 78.93 +0.32%

Gold 1,140.00 -0.50%

-

23:30

Stocks. Daily history for Nov 5’2014:

(index / closing price / change items /% change)

Nikkei 225 16,937.32 +74.85 +0.44%

Hang Seng 23,695.62 -150.04 -0.63%

Shanghai Composite 2,420.4 -10.28 -0.42%

FTSE 100 6,539.14 +85.17 +1.32%

CAC 40 4,208.42 +78.23 +1.89%

Xetra DAX 9,315.48 +149.01 +1.63%

S&P 500 2,023.57 +11.47 +0.57%

NASDAQ Composite 4,620.72 -2.91 -0.06%

Dow Jones 17,484.53 +100.69 +0.58%

-

23:21

Currencies. Daily history for Nov 5’2014:

(pare/closed(GMT +2)/change, %)

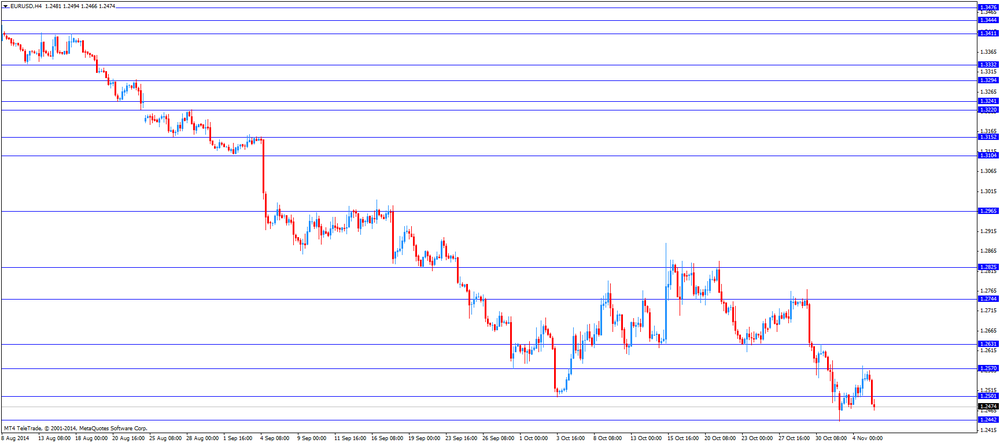

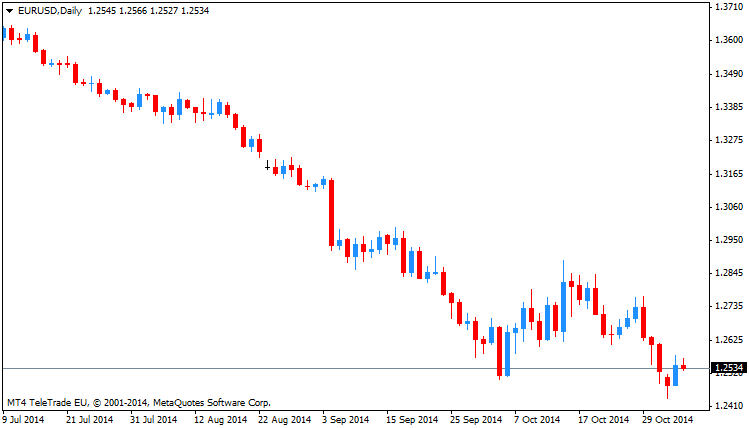

EUR/USD $1,2485 -0,49%

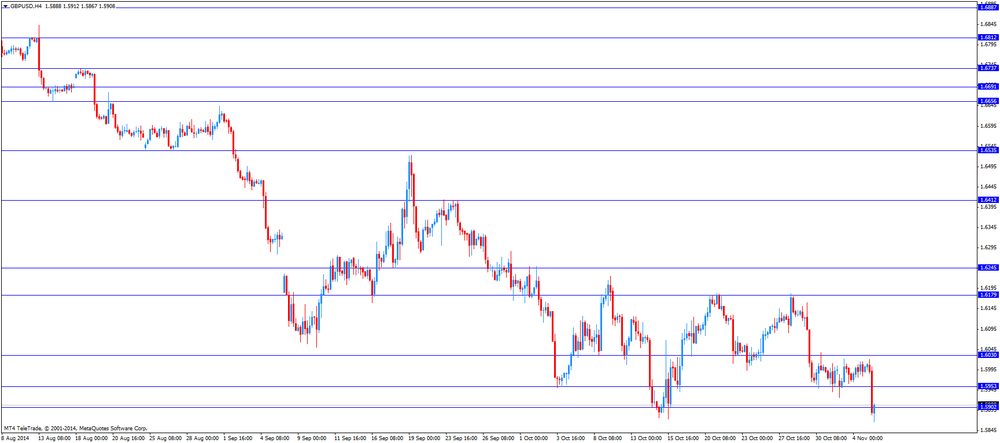

GBP/USD $1,5974 -0,17%

USD/CHF Chf0,9639 +0,45%

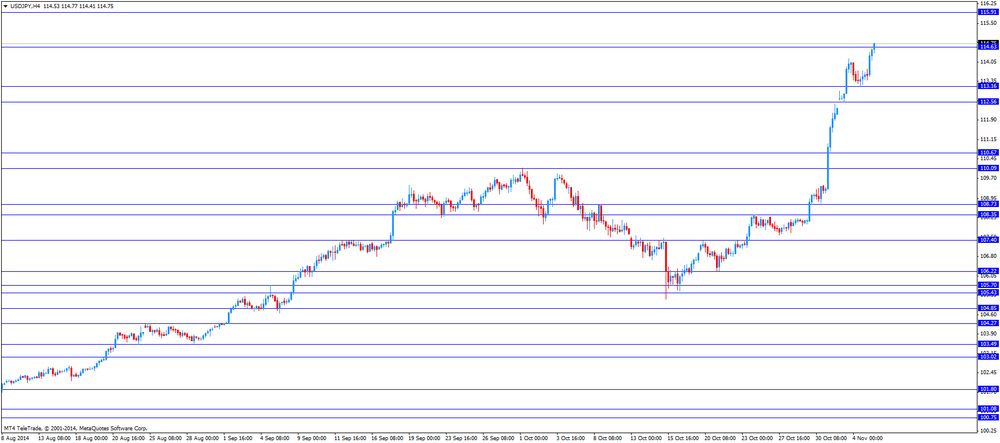

USD/JPY Y114,63 +0,91%

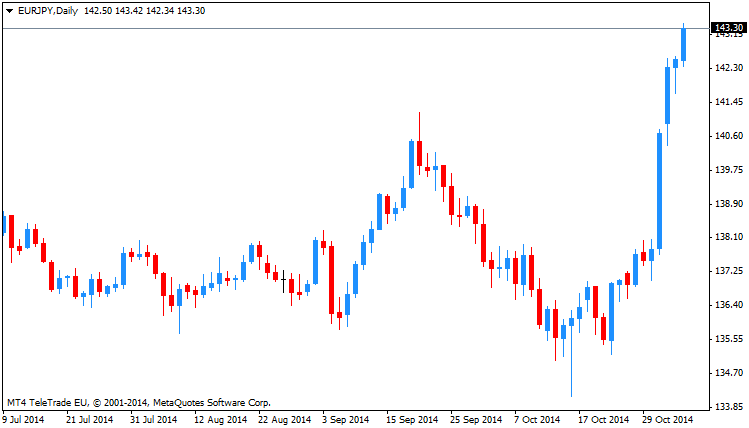

EUR/JPY Y143,13 +0,43%

GBP/JPY Y183,11 +0,74%

AUD/USD $0,8592 -1,68%

NZD/USD $0,7727 -1,06%

USD/CAD C$1,1384 -0,21%

-

23:01

Schedule for today, Thursday, Nov 6’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Changing the number of employed October -29.7 +10.3

00:30 Australia Unemployment rate October 6.1% 6.1%

05:00 Japan Leading Economic Index September 104.4 105.5

05:00 Japan Coincident Index September 108.3

06:45 Switzerland SECO Consumer Climate Quarter IV -1 -4

07:00 Germany Factory Orders s.a. (MoM) September -5.7% +2.2%

07:00 Germany Factory Orders n.s.a. (YoY) September -1.3%

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

09:00 Eurozone Eurogroup Meetings

09:30 United Kingdom Industrial Production (MoM) September 0.0% +0.5%

09:30 United Kingdom Industrial Production (YoY) September +2.5% +1.5%

09:30 United Kingdom Manufacturing Production (MoM) September +0.1% +0.3%

09:30 United Kingdom Manufacturing Production (YoY) September +3.9% +2.7%

10:00 Eurozone European Commission Economic Growth Forecasts

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 Canada Building Permits (MoM) September -27.3% +5.2%

13:30 U.S. Initial Jobless Claims October 287 285

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III +2.3% Revised From +2.5% +0.9%

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter III -0.1% Revised From +0.6% +1.0%

15:00 United Kingdom NIESR GDP Estimate October +0.7%

15:00 Canada Ivey Purchasing Managers Index October 58.6 59.2

22:30 Australia AiG Performance of Construction Index October 59.1

-

20:00

Dow +85.28 17,469.12 +0.49% Nasdaq -8.46 4,615.18 -0.18% S&P +9.13 2,021.23 +0.45%

-

17:05

European stocks close: stocks closed higher on results of the U.S. midterm elections

Stock indices closed lower higher on results of the U.S. midterm elections. Democrats lost control of the U.S. Senate. The Republican Party also extended their majority in the House of Representatives, their largest majority in the House of Representatives since the 1940s.

Retail sales in the Eurozone fell 1.3% in September, missing expectations for a 0.6% decrease, after a 0.9% gain in August. August's figure was revised down from a 1.2% rise.

Eurozone's final services purchasing managers' index decreased to 52.3 in October from 52.4 in September. Analysts had expected the index to remain unchanged at 52.4.

Germany's final services purchasing managers' index fell to 54.4 in October from 54.8 in September. Analysts had expected the index to remain unchanged at 54.8.

France's final services purchasing managers' index rose to 48.3 in October from 48.1 in September. Analysts had expected the index to remain unchanged at 48.1.

Investors are awaiting the European Central Bank's (ECB) interest decision and press conference tomorrow. They will analyse the ECB' President Mario Draghi's speech for signs for the further stimulus measures by the ECB to boost the economy in the Eurozone.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,539.14 +85.17 +1.32%

DAX 9,315.48 +149.01 +1.63%

CAC 40 4,208.42 +78.23 +1.89%

-

17:00

European stocks close: FTSE 100 6,539.14 +85.17 +1.32% CAC 40 4,208.42 +78.23 +1.89% DAX 9,315.48 +149.01 +1.63%

-

16:41

Oil: an overview of the market situation

Oil futures rose today, departing from the four-year low, as the positive data on the US labor market offset the negative reports from the Chinese.

Recall, the growth of manufacturing and non-manufacturing sectors of Chinese industry slowed in October, showed indices PMI, calculated HSBC / Markit. Meanwhile, it has become known, private sector employment increased by 230,000 jobs from September to October. It was expected that the figure will rise to 214 thousand.

Market participants also drew attention to the report on US crude stocks. US Department of Energy reported that in the week of 25 - Oct 31 commercial oil stocks rose 460,000 barrels to 380.2 million barrels, while the average forecast of anticipated increase of 2.2 million barrels. Inventories increased to a maximum of 4 July. Gasoline stocks fell 1.4 million barrels to 201.8 million barrels (minimum of 16 November 2012). Analysts expected gasoline stocks decline as compared to the previous week to 300,000 barrels. Distillate stocks fell by 724,000 barrels to 119,7,4 million barrels, up to a minimum since June 6, while analysts had expected a decrease of 1.8 million barrels. The utilization factor of refining capacity increased to 88.4% for the first 6 weeks. Earlier, analysts expected increase index by 0.3 percentage points.

Meanwhile, today intensified speculation in reducing production by OPEC. Leading oil traders believe that OPEC will reduce oil production at its meeting in November, despite the forecasts of analysts not to expect changes in the policy of the cartel. OPEC members Kuwait and Iran have stated that the organization is unlikely to cut production at a meeting on November 27. The largest OPEC exporter Saudi Arabia has not yet made a public statement on the matter, but analysts believe that the country will not cut production to maintain world prices and is ready to accept the price of oil at $ 70-80 per barrel.

The market also continues to affect the forecast decline in the economic growth of the eurozone by the European Commission. "Reducing the forecast for Europe was not unexpected, but reminded of the existence of risks. I think in this situation, oil prices should fall so to change the scope of supply. But how can cut prices, no one knows, "- said a senior analyst at CMC Markets in Sydney Rick Spooner.

The cost of December futures on US light crude oil WTI (Light Sweet Crude Oil) rose to $ 78.08 a barrel on the New York Mercantile Exchange (NYMEX).

December futures price for North Sea petroleum mix of mark Brent rose $ 0.62 to $ 83.22 a barrel on the London exchange ICE Futures Europe.

-

16:35

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data. Private sector in the U.S. added 230,000 jobs in October, according the ADP report on Wednesday. That was the second highest increase of 2014. September's figure was revised up to 225,000 jobs from a previous reading of 213,000 jobs. Analysts expected the private sector to add 214,000 jobs.

The ISM non-manufacturing purchasing manager's index for the U.S. declined to 57.1 in October from 58.6 in September, missing expectations for a fall to 58.2.

The Markit final services purchasing manager's index for the U.S. to 57.1 in October from 57.3 in September. Analysts had expected the index to remain unchanged at 57.3.

The euro traded mixed against the U.S. dollar. Retail sales in the Eurozone fell 1.3% in September, missing expectations for a 0.6% decrease, after a 0.9% gain in August. August's figure was revised down from a 1.2% rise.

Eurozone's final services purchasing managers' index decreased to 52.3 in October from 52.4 in September. Analysts had expected the index to remain unchanged at 52.4.

Germany's final services purchasing managers' index fell to 54.4 in October from 54.8 in September. Analysts had expected the index to remain unchanged at 54.8.

France's final services purchasing managers' index rose to 48.3 in October from 48.1 in September. Analysts had expected the index to remain unchanged at 48.1.

The British pound traded higher against the U.S. dollar. The services purchasing managers' index in the U.K. fell to 56.2 in October from 58.7 in September. Analysts had expected the index to remain unchanged at 58.7.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's consumer price index was flat in October, beating expectations for a 0.1% decline, after a 0.1% rise in September.

The New Zealand dollar dropped against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the better-than-expected labour market data from New Zealand. New Zealand's unemployment rate decreased to 5.4% in the third quarter from 5.6% in the second quarter, exceeding expectations for a decline to 5.5%. That was the lowest level since March 2009.

Employment in New Zealand rose 0.8 % in the third quarter, beating forecasts of a 0.6% increase, after a 0.4% gain in the second quarter.

The Australian dollar fell against the U.S. dollar. Australia's AiG services index declined to 43.6 in October from 45.4 in September.

China's HSBC services index also weighed on the Aussie. The HSBC services index fell to 52.9 in October from 53.5 in September.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen decreased against the greenback after a speech by Bank of Japan (BoJ) Governor Haruhiko Kuroda. He said in a speech in Tokio on Wednesday that the central bank is ready to add further stimulus measures to achieve its 2% inflation target. He added that there is no limit to monetary policy measures, including purchases of Japanese government bonds.

Labour cash earnings in Japan climbed 0.8% in September, missing expectations for a 0.9 increase, after a 0.9% gain in August. August's figure was revised down from a 1.4% rise.

Japan's monetary base increased 36.9% in October, exceeding expectation for a 36.2% gain, after a 35.3% rise in September.

-

16:20

Gold: an overview of the market situation

Gold prices fell significantly today, while reaching the lowest level since mid-2010, as a stronger dollar and a rise in price of shares weakened investment appeal of the precious metal. Rising dollar helped the news that rRespublikantsy won the first important victory in Kentucky and West Virginia in the midterm elections in the US Congress. This is evidenced by the results of common rapid survey of Americans leaving the polls. According to preliminary data, the Kentucky Republican minority leader in the Senate, Mitch McConnell took over his rival from the Democratic Party Alison Landergen Grimes. In West Virginia Republican candidate Shelley Moore Capito Natalie Tennant ahead in the race for the seat vacated by retired Democratic Senator Jay Rockefeller - representative of the famous dynasty of industrialists and financiers. Experts believe that the opposition Republican Party has a good chance that the results of these elections for the first time since 2006 to control the upper house of Congress.

Quotations decrease in gold also accelerated due to start technical sales after prices fell below the key support level near $ 1160 to provoke new applications for sale. Note, gold prices are under strong selling pressure in recent weeks amid speculation that the first time in eight years, the Federal Reserve closer to raising interest rates after the last month of its bond-buying program, also known as quantitative easing.

We also learned that the world's largest reserves of the gold-exchange-traded fund SPDR Gold Trust on Tuesday fell to 738.82 tons, the lowest level since September 2008. Recall that it was then, the largest US holding Lehman Brothers announced its bankruptcy, that was the beginning of a major international financial crisis.

"In the future, very few favorable factors. Despite the infusion of trillions of dollars into the economy in recent years, most central banks are concerned about deflation rather than inflation. In addition, the growth of the American stock market investors diverts funds from other markets, including gold, "- said analyst Edward Meir FCStone.

Meanwhile, adding that traders in Shanghai reported a decline in prices of local versus international. While buyers in Asia will continue to show restraint, gold prices will not easily find the bottom, analysts Commerzbank. This situation will not change even strong demand from retail investors in North America and Europe, the bank assured.

The cost of December gold futures on the COMEX today dropped to 1146.10 dollars per ounce.

-

16:01

Bank of Japan Governor Haruhiko Kuroda: there is no limit to monetary policy measures to achieve the Bank of Japan’s 2% inflation target

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech in Tokio on Wednesday that the central bank is ready to add further stimulus measures to achieve its 2% inflation target. He added that there is no limit to monetary policy measures, including purchases of Japanese government bonds.

-

15:38

ISM non-manufacturing purchasing manager's index declined to 57.1 in October

The Institute of Supply Management (ISM) released its non-manufacturing purchasing manager's index for the U.S. today. The index declined to 57.1 in October from 58.6 in September, missing expectations for a fall to 58.2.

Many of the ISM indexes decreased in October. The ISM's new orders index fell to 59.1 last month from 61.0 in September.

The ISM business activity index declined to 60.0 in October from 62.9 the previous month.

The ISM employment index rose to 59.6 last month from 58.5 in September.

A reading above 50.0 indicates expansion of the non-manufacturing sector economy, below 50.0 indicates contraction of the sector.

-

15:30

U.S.: Crude Oil Inventories, October +0.5

-

15:00

U.S.: ISM Non-Manufacturing, October 57.1 (forecast 58.2)

-

14:45

U.S.: Services PMI, October 57.1 (forecast 57.3)

-

14:40

ADP report: private sector added 230,000 jobs in October

Private sector in the U.S. added 230,000 jobs in October, according the ADP report on Wednesday. That was the second highest increase of 2014.

September's figure was revised up to 225,000 jobs from a previous reading of 213,000 jobs.

Analysts expected the private sector to add 214,000 jobs.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate will remain unchanged at 5.9% in October. The U.S. economy is expected to add 229,000 jobs in October.

-

14:35

U.S. Stocks open: Dow 17,459.23 +75.39 +0.43%, Nasdaq 4,644.42 +20.78 +0.45%, S&P 2,021.85 +9.75 +0.48%

-

14:28

Before the bell: S&P futures +0.64%, Nasdaq futures +0.70%

U.S. equity-index futures rose after Republicans won their first Senate majority in eight years, taking control of both chambers of Congress, and data showed companies added more workers than estimated in October.

Global markets:

Nikkei 16,937.32 +74.85 +0.44%

Hang Seng 23,695.62 -150.04 -0.63%

Shanghai Composite 2,420.4 -10.28 -0.42%

FTSE 6,526.45 +72.48 +1.12%

CAC 4,194.86 +64.67 +1.57%

DAX 9,314.48 +148.01 +1.61%

Crude oil $77.48 (+0.39%)

Gold $1145.10 (-1.94%)

-

14:14

DOW components before the bell

(company / ticker / price / change, % / volume)

Johnson & Johnson

JNJ

108.87

+0.23%

3.4K

Wal-Mart Stores Inc

WMT

77.50

+0.31%

0.4K

Procter & Gamble Co

PG

88.94

+0.34%

5.0K

McDonald's Corp

MCD

94.85

+0.40%

2.5K

International Business Machines Co...

IBM

163.41

+0.47%

0.3K

Cisco Systems Inc

CSCO

25.00

+0.48%

22.5K

Exxon Mobil Corp

XOM

95.01

+0.52%

3.5K

Microsoft Corp

MSFT

47.82

+0.53%

0.5K

The Coca-Cola Co

KO

42.04

+0.53%

6.2K

AT&T Inc

T

35.01

+0.63%

32.4K

Visa

V

244.50

+0.63%

0.7K

Boeing Co

BA

125.90

+0.63%

4.5K

Chevron Corp

CVX

116.12

+0.65%

0.1K

Goldman Sachs

GS

191.52

+0.66%

0.1K

Caterpillar Inc

CAT

99.26

+0.66%

2.5K

General Electric Co

GE

25.88

+0.70%

6.0K

JPMorgan Chase and Co

JPM

60.70

+0.75%

1.5K

Pfizer Inc

PFE

30.25

+0.77%

2.3K

United Technologies Corp

UTX

107.75

+0.81%

1K

Verizon Communications Inc

VZ

50.75

+0.83%

2.1K

Nike

NKE

94.88

+0.99%

0.2K

Walt Disney Co

DIS

91.38

+1.14%

9.9K

UnitedHealth Group Inc

UNH

94.91

-0.07%

1.6K

E. I. du Pont de Nemours and Co

DD

68.15

-0.53%

63.4K

Intel Corp

INTC

34.05

-0.77%

65.8K

-

14:05

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intel (INTC) downgraded to Underperform from Mkt Perform at Bernstein

Other:

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2475(E636mn), $1.2500(E3.84bn), $1.2515(E857mn), $1.2525(E284mn), $1.2530(E2.14bn), $1.2535(E527mn), $1.2550(E329mn), $1.2585(E631mn)$1.2600(E1.8bn)

EUR/GBP: stg0.7750(E240mn)

USD/CHF: Chf0.9600($250mn)

AUD/USD: $0.8600(A$400mn)...(Nov7 $0.8750 A$2bn)

NZD/USD: $0.7730(NZ$307mn), $0.7840(NZ$261mn)

USD/CAD: C$1.1350($890mn) -

13:15

U.S.: ADP Employment Report, October 230 (forecast 214)

-

13:04

Foreign exchange market. European session: the euro declined against the U.S. dollar after the weaker-than-expected retail sales from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Japan Labor Cash Earnings, YoY September +0.9% Revised From +1.4% +0.9% +0.8%

01:45 China HSBC Services PMI October 53.5 52.9

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:15 Switzerland Consumer Price Index (MoM) October +0.1% -0.1% 0.0%

08:15 Switzerland Consumer Price Index (YoY) October -0.1% 0.0% 0.0%

08:48 France Services PMI (Finally) October 48.1 48.1 48.3

08:53 Germany Services PMI (Finally) October 54.8 54.8 54.4

08:58 Eurozone Services PMI (Finally) October 52.4 52.4 52.3

09:30 United Kingdom Purchasing Manager Index Services October 58.7 58.7 56.2

10:00 Eurozone Retail Sales (MoM) September +0.9% Revised From +1.2% -0.6% -1.3%

10:00 Eurozone Retail Sales (YoY) September +1.9% +1.5% +0.6%

The U.S. dollar rose against the most major currencies ahead of the U.S. economic data. The greenback was supported by U.S. midterm elections. Democrats lost control of the U.S. Senate. The Republican Party also extended their majority in the House of Representatives, their largest majority in the House of Representatives since the 1940s.

The U.S. economy is expected to add 214,000 jobs in October, according to the ADP employment report.

The ISM non-manufacturing purchasing managers' index is expected to decline to 58.2 in October from 58.6 in September.

The euro declined against the U.S. dollar after the weaker-than-expected retail sales from the Eurozone. Retail sales in the Eurozone fell 1.3% in September, missing expectations for a 0.6% decrease, after a 0.9% gain in August. August's figure was revised down from a 1.2% rise.

Eurozone's final services purchasing managers' index decreased to 52.3 in October from 52.4 in September. Analysts had expected the index to remain unchanged at 52.4.

Germany's final services purchasing managers' index fell to 54.4 in October from 54.8 in September. Analysts had expected the index to remain unchanged at 54.8.

France's final services purchasing managers' index rose to 48.3 in October from 48.1 in September. Analysts had expected the index to remain unchanged at 48.1.

The British pound dropped against the U.S. dollar after the weaker-than-expected services PMI from the U.K. The services purchasing managers' index in the U.K. fell to 56.2 in October from 58.7 in September. Analysts had expected the index to remain unchanged at 58.7.

The Swiss franc fell against the U.S. dollar. Switzerland's consumer price index was flat in October, beating expectations for a 0.1% decline, after a 0.1% rise in September.

EUR/USD: the currency pair fell to $1.2466

GBP/USD: the currency pair dropped to $1.5867

USD/JPY: the currency pair rose to Y114.77

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report October 213 214

14:15 U.S. FOMC Member Narayana Kocherlakota

15:00 U.S. ISM Non-Manufacturing October 58.6 58.2

23:50 Japan Monetary Policy Meeting Minutes

-

12:45

Orders

EUR/USD

Offers $1.2600/10

Bids $1.2400, $1.2300

GBP/USD

Offers

Bids $1.5800

AUD/USD

Offers $0.8750, $0.8700, $0.8675/80

Bids $0.8600, 0.8550, $0.8500, 0.8450

EUR/JPY

Offers Y144.50, Y144.00, Y143.75/80, Y143.50

Bids Y142.50, Y142.00, Y141.55/50

USD/JPY

Offers Y116.00, Y115.50, Y115.00

Bids Y114.10/00, Y113.50, Y113.10/00, Y112.85/80

EUR/GBP

Offers

Bids stg0.7755/45

-

11:55

European stock markets mid-session: European indices continue to go up

European stock indices continued to rise after their good start although Eurozone Retail Sales were worse than expected (MoM -1.3% / forecast -0.6%) but good company results helped the markets continue its way north. UK's FTSE 100 index was up 0.89% to 6,511.11 points. Germany's DAX 30 climbed 1.23% to 9,279.19 points, while France's CAC 40 gained 1.24% to 4,181.33.

But the bullish markets could come to an end and we might see some downside if the European Central Bank fails on Thursday to deliver a plan for a new economic stimulus.

"The market is rising today, but without real conviction. There's no real trend on the market at the moment, and flows from investors remain thin," said Jean-Louis Cussac, head of Paris-based firm Perceval Finance.

About halfway into Europe's earnings season, 64 percent of companies have managed to meet or beat profit forecasts, and 59 percent met or beat revenue forecasts, according to Thomson Reuters StarMine data.

-

11:07

Gold continues to fall to a new four-year low below USD1150

Currently priced at USD1,144.70 gold continues its weakness as the strong U.S. dollar cuts demand for the safe-haven asset and physical demand failed to support. Investors' holdings in bullion-backed funds dropped to a five-year low as they are moving to riskier asset classes. The Federal Reserve, as other central banks is considering raising interest rates to help their economies putting further pressure on gold often used as inflation hedge. U.S. jobs report on Friday could also boost economic optimism and the dollar so gold could see further downside.

-

10:31

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2475(E636mn), $1.2500(E3.84bn), $1.2515(E857mn), $1.2525(E284mn), $1.2530(E2.14bn), $1.2535(E527mn), $1.2550(E329mn), $1.2585(E631mn)$1.2600(E1.8bn)

EUR/GBP: stg0.7750(E240mn)

USD/CHF: Chf0.9600($250mn)

AUD/USD: $0.8600(A$400mn)...(Nov7 $0.8750 A$2bn)

NZD/USD: $0.7730(NZ$307mn), $0.7840(NZ$261mn)

USD/CAD: C$1.1350($890mn) -

10:00

Eurozone: Retail Sales (MoM), September -1.3% (forecast -0.6%)

-

10:00

Eurozone: Retail Sales (YoY), September +0.6% (forecast +1.5%)

-

09:47

Press Review: Dollar up after U.S. elections, euro weakness to test SNB's floor

REUTERS

Dollar up after U.S. elections, euro weakness to test SNB's floor

The dollar rose to a seven-year high against the Japanese yen on Wednesday after a victory by Republicans in the United States' mid-term elections raised hopes for an easing of political gridlock in Washington, boosting sentiment for riskier assets.

Swiss inflation data showed a growing threat of deflation, and that is likely to put pressure on the SNB to intervene in the currency market to weaken the franc.

Source: http://uk.reuters.com/article/2014/11/05/us-markets-forex-idUKKBN0IP03920141105

BLOOMBERG

Yen Slides to Seven-Year Low on Kuroda Comments; Dollar Advances

The yen fell to a seven-year low against the dollar as Bank of Japan Governor Haruhiko Kuroda said he saw no limit to the steps the central bank may take to defeat deflation.

BLOOMBERG

Iceland Unexpectedly Cuts Rates for First Time Since 2011

Iceland's central bank unexpectedly cut its benchmark interest rate for the first time since early 2011 after currency interventions strengthened the krona and brought down inflation.

BLOOMBERG

Prepare for Gold Rally If Swiss Bullion Referendum Passes

The proposal from the "Save Our Swiss Gold" proponents is simple: Force the central bank to build its bullion position up to at least 20 percent of total assets from 8 percent today. Holding 522 billion Swiss francs ($544 billion) of assets in its coffers, the Swiss National Bank would have to buy at least 1,500 tons of gold, costing about $56.3 billion at current prices, to get to the required threshold by 2019. Source: http://www.bloomberg.com/news/2014-11-05/prepare-for-gold-rally-if-swiss-bullion-referendum-passes.html

-

09:30

United Kingdom: Purchasing Manager Index Services, October 56.2 (forecast 58.7)

-

09:24

European Stocks. First hour: European indices with a strong start

European stock indices rose significantly at the start. UK's FTSE 100 index was up 0.60% to 6492.53 points. Germany's DAX 30 climbed 1.06% to 9,263.59 points, while France's CAC 40 gained 0.85% to 4,165.44.

European indices rose today and compensated previous trading day's losses mostly due to solid earnings reports and the result of the U.S. mid-term elections.

About halfway into Europe's earnings season, 64 percent of companies have managed to meet or beat profit forecasts, and 59 percent met or beat revenue forecasts, according to Thomson Reuters StarMine data.

-

09:00

Eurozone: Services PMI, October 52.3 (forecast 52.4)

-

09:00

European Stocks. First hour: European indices rally after better-than expected German data

European stocks are trading stronger recouping some of yesterday's losses after the ECB did not announce immediate monetary policy action. Inflation forecast for the Eurozone was lowered to 0.5% in 2014 from the previous estimate of 0.6%, to 0.7% in 2015 from the previous estimate 1.1% and to 1.3% in 2016 from the previous estimate 1.4%.

The ECB also cut its economic growth forecast for the Eurozone through 2016. The growth was lowered to 0.8% 2014 the previous estimate of 0.9%, to 1.0% in 2015 from the previous estimate of 1.6% and to 1.5% in 2016 from the previous estimate of 1.9%. The ECB warned that new inflation forecasts did not take into account the recent decline in oil prices.

German factory orders adjusted for seasonal swings and inflation beat expectations, a sign of recovery of the Eurozone's largest economy. Factory orders rose +2.5% in October, a plus of +1.4% compared with September. Analyst's forecasted an increase of +0.6%. Markets are now awaiting U.S. Nonfarm Payrolls and the Unemployment Rate being published at 13:30 GMT, average earnings and factory orders and Eurozone's GDP earlier in the session at 10:00 GMT.

The FTSE 100 index is currently trading +1.03% quoted at 6,731.94 points, Germany's DAX 30 added +1.25% at 9,974.50, just below the important 10,000 points level. France's CAC 40 gained +1.21%, currently trading at 4,376.98 points.

-

09:00

European Stocks. First hour: European indices rally after better-than expected German data

European stocks are trading stronger recouping some of yesterday's losses after the ECB did not announce immediate monetary policy action. Inflation forecast for the Eurozone was lowered to 0.5% in 2014 from the previous estimate of 0.6%, to 0.7% in 2015 from the previous estimate 1.1% and to 1.3% in 2016 from the previous estimate 1.4%.

The ECB also cut its economic growth forecast for the Eurozone through 2016. The growth was lowered to 0.8% 2014 the previous estimate of 0.9%, to 1.0% in 2015 from the previous estimate of 1.6% and to 1.5% in 2016 from the previous estimate of 1.9%. The ECB warned that new inflation forecasts did not take into account the recent decline in oil prices.

German factory orders adjusted for seasonal swings and inflation beat expectations, a sign of recovery of the Eurozone's largest economy. Factory orders rose +2.5% in October, a plus of +1.4% compared with September. Analyst's forecasted an increase of +0.6%. Markets are now awaiting U.S. Nonfarm Payrolls and the Unemployment Rate being published at 13:30 GMT, average earnings and factory orders and Eurozone's GDP earlier in the session at 10:00 GMT.

The FTSE 100 index is currently trading +1.03% quoted at 6,731.94 points, Germany's DAX 30 added +1.25% at 9,974.50, just below the important 10,000 points level. France's CAC 40 gained +1.21%, currently trading at 4,376.98 points.

-

08:55

Germany: Services PMI, October 54.4 (forecast 54.8)

-

08:50

France: Services PMI, October 48.3 (forecast 48.1)

-

08:15

Switzerland: Consumer Price Index (MoM) , October 0.0% (forecast -0.1%)

-

08:15

Switzerland: Consumer Price Index (YoY), October 0.0% (forecast 0.0%)

-

07:48

Foreign exchange market. Asian session: the kiwi traded higher after the better-than-expected labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

23:50 Japan Monetary Base, y/y October +35.3% +36.2% +36.9%

01:30 Japan Labor Cash Earnings, YoY September +0.9% [Revised From +1.4%] +0.9% +0.8%

01:45 China HSBC Services PMI October 53.5 52.9

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

The U.S. dollar rose to a seven year high reaching JPY114.42 yesterday, the highest level since December 2007 after the Republicans victory in U.S. mid-term elections.

BOJ Govenor Kuroda confirms his 2% inflation target to end Japan's deflationary spiral.

The Japanese yen further weakened against the euro that reached a 7 month-high trading at JPY143.42.

The euro further recovered from its two-year low against the U.S. dollar of USD1.2439 on Monday although the uncertainty about more ECB actions.

The kiwi reached USD0.7842 as the jobless rate fell to its lowest in over five years.

EUR/JPY: the currency pair rose to Y143.42

EUR/USD: the currency pair rose to $1.2534

USD/JPY: the currency pair rose to Y114.29

The most important news that are expected (GMT0):

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

08:15 Switzerland Consumer Price Index (MoM) October +0.1% -0.1%

08:15 Switzerland Consumer Price Index (YoY) October -0.1% 0.0%

08:48 France Services PMI (Finally) October 48.1 48.1

08:53 Germany Services PMI(Finally) October 54.8 54.8

08:58 Eurozone Services PMI (Finally) October 52.4 52.4

09:30 United Kingdom Purchasing Manager Index Services October 58.7 58.7

10:00 Eurozone Retail Sales (MoM) September +1.2% -0.6%

10:00 Eurozone Retail Sales (YoY) September +1.9% +1.5%

13:15 U.S. ADP Employment Report October 213 214

14:15 U.S. FOMC Member Narayana Kocherlakota

14:45 U.S. Services PMI(Finally) October 57.3 57.3

15:00 U.S. ISM Non-Manufacturing October 58.6 58.2

15:30 U.S. Crude Oil Inventories October +2.1

-

06:29

Options levels on wednesday, November 5, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2719 (5065)

$1.2650 (4281)

$1.2590 (444)

Price at time of writing this review: $ 1.2536

Support levels (open interest**, contracts):

$1.2486 (5526)

$1.2450 (6628)

$1.2420 (3781)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 65389 contracts, with the maximum number of contracts with strike pric $1,2900 (6937);

- Overall open interest on the PUT options with the expiration date November, 7 is 65566 contracts, with the maximum number of contracts with strike price $1,2400 (8100);

- The ratio of PUT/CALL was 1.00 versus 0.98 from the previous trading day according to data from November, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.6200 (2851)

$1.6102 (1757)

$1.6005 (523)

Price at time of writing this review: $1.5969

Support levels (open interest**, contracts):

$1.5898 (4134)

$1.5799 (1512)

$1.5700 (759)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 29604 contracts, with the maximum number of contracts with strike price $1,6200 (2851);

- Overall open interest on the PUT options with the expiration date November, 7 is 34760 contracts, with the maximum number of contracts with strike price $1,5900 (4134);

- The ratio of PUT/CALL was 1.17 versus 1.23 from the previous trading day according to data from November, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:00

Nikkei 225 16,807.03 -55.44 -0.33%, Hang Seng 23,764.04 -81.62 -0.34%, S&P/ASX 200 5,486.6 -33.32 -0.60%, Shanghai Composite 2,432.17 +1.49 +0.06%

-

01:45

China: HSBC Services PMI, October 52.9

-

01:30

Japan: Labor Cash Earnings, YoY, September +0.8% (forecast +0.9%)

-