Notícias do Mercado

-

23:21

Currencies. Daily history for Nov 5’2014:

(pare/closed(GMT +2)/change, %)

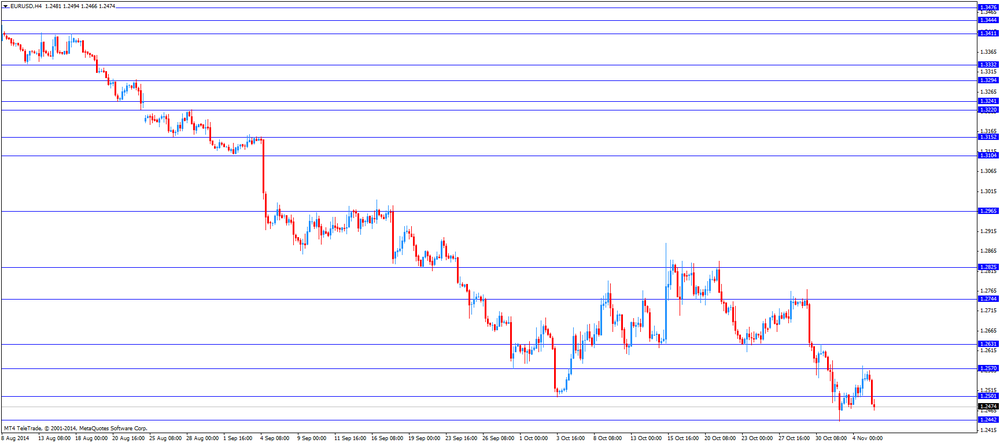

EUR/USD $1,2485 -0,49%

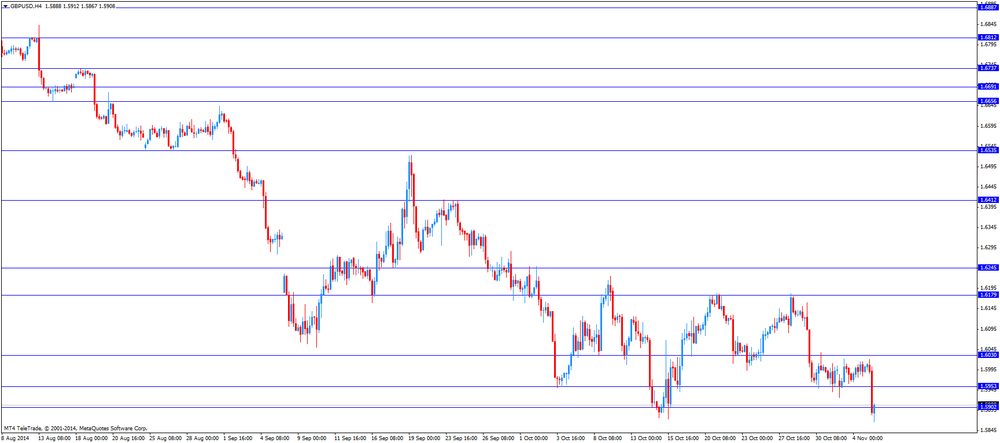

GBP/USD $1,5974 -0,17%

USD/CHF Chf0,9639 +0,45%

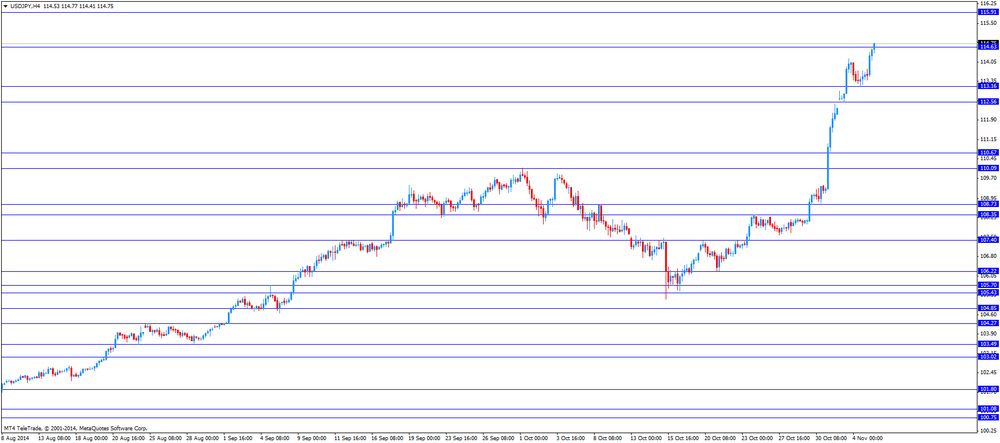

USD/JPY Y114,63 +0,91%

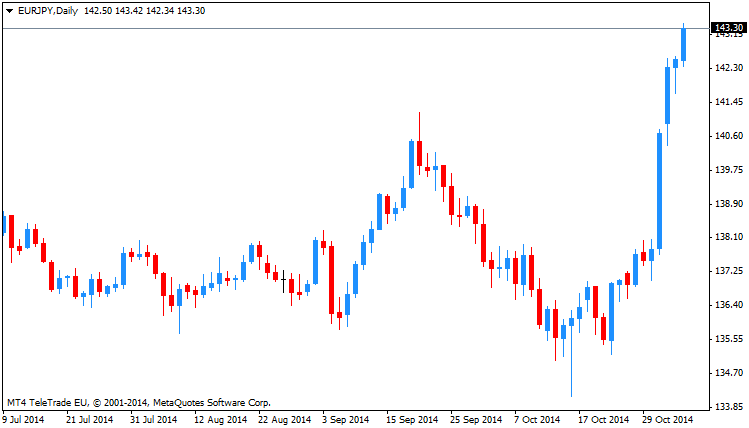

EUR/JPY Y143,13 +0,43%

GBP/JPY Y183,11 +0,74%

AUD/USD $0,8592 -1,68%

NZD/USD $0,7727 -1,06%

USD/CAD C$1,1384 -0,21%

-

23:01

Schedule for today, Thursday, Nov 6’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Changing the number of employed October -29.7 +10.3

00:30 Australia Unemployment rate October 6.1% 6.1%

05:00 Japan Leading Economic Index September 104.4 105.5

05:00 Japan Coincident Index September 108.3

06:45 Switzerland SECO Consumer Climate Quarter IV -1 -4

07:00 Germany Factory Orders s.a. (MoM) September -5.7% +2.2%

07:00 Germany Factory Orders n.s.a. (YoY) September -1.3%

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

09:00 Eurozone Eurogroup Meetings

09:30 United Kingdom Industrial Production (MoM) September 0.0% +0.5%

09:30 United Kingdom Industrial Production (YoY) September +2.5% +1.5%

09:30 United Kingdom Manufacturing Production (MoM) September +0.1% +0.3%

09:30 United Kingdom Manufacturing Production (YoY) September +3.9% +2.7%

10:00 Eurozone European Commission Economic Growth Forecasts

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 Canada Building Permits (MoM) September -27.3% +5.2%

13:30 U.S. Initial Jobless Claims October 287 285

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III +2.3% Revised From +2.5% +0.9%

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter III -0.1% Revised From +0.6% +1.0%

15:00 United Kingdom NIESR GDP Estimate October +0.7%

15:00 Canada Ivey Purchasing Managers Index October 58.6 59.2

22:30 Australia AiG Performance of Construction Index October 59.1

-

16:35

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data. Private sector in the U.S. added 230,000 jobs in October, according the ADP report on Wednesday. That was the second highest increase of 2014. September's figure was revised up to 225,000 jobs from a previous reading of 213,000 jobs. Analysts expected the private sector to add 214,000 jobs.

The ISM non-manufacturing purchasing manager's index for the U.S. declined to 57.1 in October from 58.6 in September, missing expectations for a fall to 58.2.

The Markit final services purchasing manager's index for the U.S. to 57.1 in October from 57.3 in September. Analysts had expected the index to remain unchanged at 57.3.

The euro traded mixed against the U.S. dollar. Retail sales in the Eurozone fell 1.3% in September, missing expectations for a 0.6% decrease, after a 0.9% gain in August. August's figure was revised down from a 1.2% rise.

Eurozone's final services purchasing managers' index decreased to 52.3 in October from 52.4 in September. Analysts had expected the index to remain unchanged at 52.4.

Germany's final services purchasing managers' index fell to 54.4 in October from 54.8 in September. Analysts had expected the index to remain unchanged at 54.8.

France's final services purchasing managers' index rose to 48.3 in October from 48.1 in September. Analysts had expected the index to remain unchanged at 48.1.

The British pound traded higher against the U.S. dollar. The services purchasing managers' index in the U.K. fell to 56.2 in October from 58.7 in September. Analysts had expected the index to remain unchanged at 58.7.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's consumer price index was flat in October, beating expectations for a 0.1% decline, after a 0.1% rise in September.

The New Zealand dollar dropped against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the better-than-expected labour market data from New Zealand. New Zealand's unemployment rate decreased to 5.4% in the third quarter from 5.6% in the second quarter, exceeding expectations for a decline to 5.5%. That was the lowest level since March 2009.

Employment in New Zealand rose 0.8 % in the third quarter, beating forecasts of a 0.6% increase, after a 0.4% gain in the second quarter.

The Australian dollar fell against the U.S. dollar. Australia's AiG services index declined to 43.6 in October from 45.4 in September.

China's HSBC services index also weighed on the Aussie. The HSBC services index fell to 52.9 in October from 53.5 in September.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen decreased against the greenback after a speech by Bank of Japan (BoJ) Governor Haruhiko Kuroda. He said in a speech in Tokio on Wednesday that the central bank is ready to add further stimulus measures to achieve its 2% inflation target. He added that there is no limit to monetary policy measures, including purchases of Japanese government bonds.

Labour cash earnings in Japan climbed 0.8% in September, missing expectations for a 0.9 increase, after a 0.9% gain in August. August's figure was revised down from a 1.4% rise.

Japan's monetary base increased 36.9% in October, exceeding expectation for a 36.2% gain, after a 35.3% rise in September.

-

16:01

Bank of Japan Governor Haruhiko Kuroda: there is no limit to monetary policy measures to achieve the Bank of Japan’s 2% inflation target

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech in Tokio on Wednesday that the central bank is ready to add further stimulus measures to achieve its 2% inflation target. He added that there is no limit to monetary policy measures, including purchases of Japanese government bonds.

-

15:38

ISM non-manufacturing purchasing manager's index declined to 57.1 in October

The Institute of Supply Management (ISM) released its non-manufacturing purchasing manager's index for the U.S. today. The index declined to 57.1 in October from 58.6 in September, missing expectations for a fall to 58.2.

Many of the ISM indexes decreased in October. The ISM's new orders index fell to 59.1 last month from 61.0 in September.

The ISM business activity index declined to 60.0 in October from 62.9 the previous month.

The ISM employment index rose to 59.6 last month from 58.5 in September.

A reading above 50.0 indicates expansion of the non-manufacturing sector economy, below 50.0 indicates contraction of the sector.

-

15:30

U.S.: Crude Oil Inventories, October +0.5

-

15:00

U.S.: ISM Non-Manufacturing, October 57.1 (forecast 58.2)

-

14:45

U.S.: Services PMI, October 57.1 (forecast 57.3)

-

14:40

ADP report: private sector added 230,000 jobs in October

Private sector in the U.S. added 230,000 jobs in October, according the ADP report on Wednesday. That was the second highest increase of 2014.

September's figure was revised up to 225,000 jobs from a previous reading of 213,000 jobs.

Analysts expected the private sector to add 214,000 jobs.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate will remain unchanged at 5.9% in October. The U.S. economy is expected to add 229,000 jobs in October.

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2475(E636mn), $1.2500(E3.84bn), $1.2515(E857mn), $1.2525(E284mn), $1.2530(E2.14bn), $1.2535(E527mn), $1.2550(E329mn), $1.2585(E631mn)$1.2600(E1.8bn)

EUR/GBP: stg0.7750(E240mn)

USD/CHF: Chf0.9600($250mn)

AUD/USD: $0.8600(A$400mn)...(Nov7 $0.8750 A$2bn)

NZD/USD: $0.7730(NZ$307mn), $0.7840(NZ$261mn)

USD/CAD: C$1.1350($890mn) -

13:15

U.S.: ADP Employment Report, October 230 (forecast 214)

-

13:04

Foreign exchange market. European session: the euro declined against the U.S. dollar after the weaker-than-expected retail sales from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Japan Labor Cash Earnings, YoY September +0.9% Revised From +1.4% +0.9% +0.8%

01:45 China HSBC Services PMI October 53.5 52.9

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:15 Switzerland Consumer Price Index (MoM) October +0.1% -0.1% 0.0%

08:15 Switzerland Consumer Price Index (YoY) October -0.1% 0.0% 0.0%

08:48 France Services PMI (Finally) October 48.1 48.1 48.3

08:53 Germany Services PMI (Finally) October 54.8 54.8 54.4

08:58 Eurozone Services PMI (Finally) October 52.4 52.4 52.3

09:30 United Kingdom Purchasing Manager Index Services October 58.7 58.7 56.2

10:00 Eurozone Retail Sales (MoM) September +0.9% Revised From +1.2% -0.6% -1.3%

10:00 Eurozone Retail Sales (YoY) September +1.9% +1.5% +0.6%

The U.S. dollar rose against the most major currencies ahead of the U.S. economic data. The greenback was supported by U.S. midterm elections. Democrats lost control of the U.S. Senate. The Republican Party also extended their majority in the House of Representatives, their largest majority in the House of Representatives since the 1940s.

The U.S. economy is expected to add 214,000 jobs in October, according to the ADP employment report.

The ISM non-manufacturing purchasing managers' index is expected to decline to 58.2 in October from 58.6 in September.

The euro declined against the U.S. dollar after the weaker-than-expected retail sales from the Eurozone. Retail sales in the Eurozone fell 1.3% in September, missing expectations for a 0.6% decrease, after a 0.9% gain in August. August's figure was revised down from a 1.2% rise.

Eurozone's final services purchasing managers' index decreased to 52.3 in October from 52.4 in September. Analysts had expected the index to remain unchanged at 52.4.

Germany's final services purchasing managers' index fell to 54.4 in October from 54.8 in September. Analysts had expected the index to remain unchanged at 54.8.

France's final services purchasing managers' index rose to 48.3 in October from 48.1 in September. Analysts had expected the index to remain unchanged at 48.1.

The British pound dropped against the U.S. dollar after the weaker-than-expected services PMI from the U.K. The services purchasing managers' index in the U.K. fell to 56.2 in October from 58.7 in September. Analysts had expected the index to remain unchanged at 58.7.

The Swiss franc fell against the U.S. dollar. Switzerland's consumer price index was flat in October, beating expectations for a 0.1% decline, after a 0.1% rise in September.

EUR/USD: the currency pair fell to $1.2466

GBP/USD: the currency pair dropped to $1.5867

USD/JPY: the currency pair rose to Y114.77

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report October 213 214

14:15 U.S. FOMC Member Narayana Kocherlakota

15:00 U.S. ISM Non-Manufacturing October 58.6 58.2

23:50 Japan Monetary Policy Meeting Minutes

-

12:45

Orders

EUR/USD

Offers $1.2600/10

Bids $1.2400, $1.2300

GBP/USD

Offers

Bids $1.5800

AUD/USD

Offers $0.8750, $0.8700, $0.8675/80

Bids $0.8600, 0.8550, $0.8500, 0.8450

EUR/JPY

Offers Y144.50, Y144.00, Y143.75/80, Y143.50

Bids Y142.50, Y142.00, Y141.55/50

USD/JPY

Offers Y116.00, Y115.50, Y115.00

Bids Y114.10/00, Y113.50, Y113.10/00, Y112.85/80

EUR/GBP

Offers

Bids stg0.7755/45

-

10:31

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2475(E636mn), $1.2500(E3.84bn), $1.2515(E857mn), $1.2525(E284mn), $1.2530(E2.14bn), $1.2535(E527mn), $1.2550(E329mn), $1.2585(E631mn)$1.2600(E1.8bn)

EUR/GBP: stg0.7750(E240mn)

USD/CHF: Chf0.9600($250mn)

AUD/USD: $0.8600(A$400mn)...(Nov7 $0.8750 A$2bn)

NZD/USD: $0.7730(NZ$307mn), $0.7840(NZ$261mn)

USD/CAD: C$1.1350($890mn) -

10:00

Eurozone: Retail Sales (MoM), September -1.3% (forecast -0.6%)

-

10:00

Eurozone: Retail Sales (YoY), September +0.6% (forecast +1.5%)

-

09:47

Press Review: Dollar up after U.S. elections, euro weakness to test SNB's floor

REUTERS

Dollar up after U.S. elections, euro weakness to test SNB's floor

The dollar rose to a seven-year high against the Japanese yen on Wednesday after a victory by Republicans in the United States' mid-term elections raised hopes for an easing of political gridlock in Washington, boosting sentiment for riskier assets.

Swiss inflation data showed a growing threat of deflation, and that is likely to put pressure on the SNB to intervene in the currency market to weaken the franc.

Source: http://uk.reuters.com/article/2014/11/05/us-markets-forex-idUKKBN0IP03920141105

BLOOMBERG

Yen Slides to Seven-Year Low on Kuroda Comments; Dollar Advances

The yen fell to a seven-year low against the dollar as Bank of Japan Governor Haruhiko Kuroda said he saw no limit to the steps the central bank may take to defeat deflation.

BLOOMBERG

Iceland Unexpectedly Cuts Rates for First Time Since 2011

Iceland's central bank unexpectedly cut its benchmark interest rate for the first time since early 2011 after currency interventions strengthened the krona and brought down inflation.

BLOOMBERG

Prepare for Gold Rally If Swiss Bullion Referendum Passes

The proposal from the "Save Our Swiss Gold" proponents is simple: Force the central bank to build its bullion position up to at least 20 percent of total assets from 8 percent today. Holding 522 billion Swiss francs ($544 billion) of assets in its coffers, the Swiss National Bank would have to buy at least 1,500 tons of gold, costing about $56.3 billion at current prices, to get to the required threshold by 2019. Source: http://www.bloomberg.com/news/2014-11-05/prepare-for-gold-rally-if-swiss-bullion-referendum-passes.html

-

09:30

United Kingdom: Purchasing Manager Index Services, October 56.2 (forecast 58.7)

-

09:00

Eurozone: Services PMI, October 52.3 (forecast 52.4)

-

08:55

Germany: Services PMI, October 54.4 (forecast 54.8)

-

08:50

France: Services PMI, October 48.3 (forecast 48.1)

-

08:15

Switzerland: Consumer Price Index (MoM) , October 0.0% (forecast -0.1%)

-

08:15

Switzerland: Consumer Price Index (YoY), October 0.0% (forecast 0.0%)

-

07:48

Foreign exchange market. Asian session: the kiwi traded higher after the better-than-expected labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

23:50 Japan Monetary Base, y/y October +35.3% +36.2% +36.9%

01:30 Japan Labor Cash Earnings, YoY September +0.9% [Revised From +1.4%] +0.9% +0.8%

01:45 China HSBC Services PMI October 53.5 52.9

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

The U.S. dollar rose to a seven year high reaching JPY114.42 yesterday, the highest level since December 2007 after the Republicans victory in U.S. mid-term elections.

BOJ Govenor Kuroda confirms his 2% inflation target to end Japan's deflationary spiral.

The Japanese yen further weakened against the euro that reached a 7 month-high trading at JPY143.42.

The euro further recovered from its two-year low against the U.S. dollar of USD1.2439 on Monday although the uncertainty about more ECB actions.

The kiwi reached USD0.7842 as the jobless rate fell to its lowest in over five years.

EUR/JPY: the currency pair rose to Y143.42

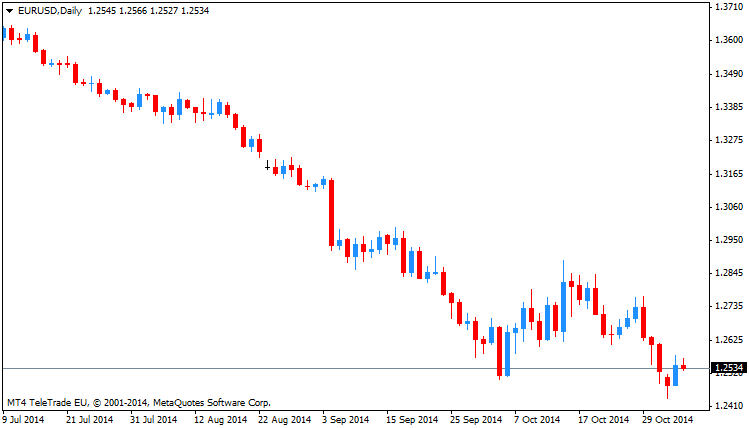

EUR/USD: the currency pair rose to $1.2534

USD/JPY: the currency pair rose to Y114.29

The most important news that are expected (GMT0):

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

08:15 Switzerland Consumer Price Index (MoM) October +0.1% -0.1%

08:15 Switzerland Consumer Price Index (YoY) October -0.1% 0.0%

08:48 France Services PMI (Finally) October 48.1 48.1

08:53 Germany Services PMI(Finally) October 54.8 54.8

08:58 Eurozone Services PMI (Finally) October 52.4 52.4

09:30 United Kingdom Purchasing Manager Index Services October 58.7 58.7

10:00 Eurozone Retail Sales (MoM) September +1.2% -0.6%

10:00 Eurozone Retail Sales (YoY) September +1.9% +1.5%

13:15 U.S. ADP Employment Report October 213 214

14:15 U.S. FOMC Member Narayana Kocherlakota

14:45 U.S. Services PMI(Finally) October 57.3 57.3

15:00 U.S. ISM Non-Manufacturing October 58.6 58.2

15:30 U.S. Crude Oil Inventories October +2.1

-

06:29

Options levels on wednesday, November 5, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2719 (5065)

$1.2650 (4281)

$1.2590 (444)

Price at time of writing this review: $ 1.2536

Support levels (open interest**, contracts):

$1.2486 (5526)

$1.2450 (6628)

$1.2420 (3781)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 65389 contracts, with the maximum number of contracts with strike pric $1,2900 (6937);

- Overall open interest on the PUT options with the expiration date November, 7 is 65566 contracts, with the maximum number of contracts with strike price $1,2400 (8100);

- The ratio of PUT/CALL was 1.00 versus 0.98 from the previous trading day according to data from November, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.6200 (2851)

$1.6102 (1757)

$1.6005 (523)

Price at time of writing this review: $1.5969

Support levels (open interest**, contracts):

$1.5898 (4134)

$1.5799 (1512)

$1.5700 (759)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 29604 contracts, with the maximum number of contracts with strike price $1,6200 (2851);

- Overall open interest on the PUT options with the expiration date November, 7 is 34760 contracts, with the maximum number of contracts with strike price $1,5900 (4134);

- The ratio of PUT/CALL was 1.17 versus 1.23 from the previous trading day according to data from November, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:45

China: HSBC Services PMI, October 52.9

-

01:30

Japan: Labor Cash Earnings, YoY, September +0.8% (forecast +0.9%)

-