Notícias do Mercado

-

23:50

Japan: Monetary Base, y/y, October +36.9% (forecast +36.2%)

-

23:22

Currencies. Daily history for Nov 4’2014:

(pare/closed(GMT +2)/change, %)

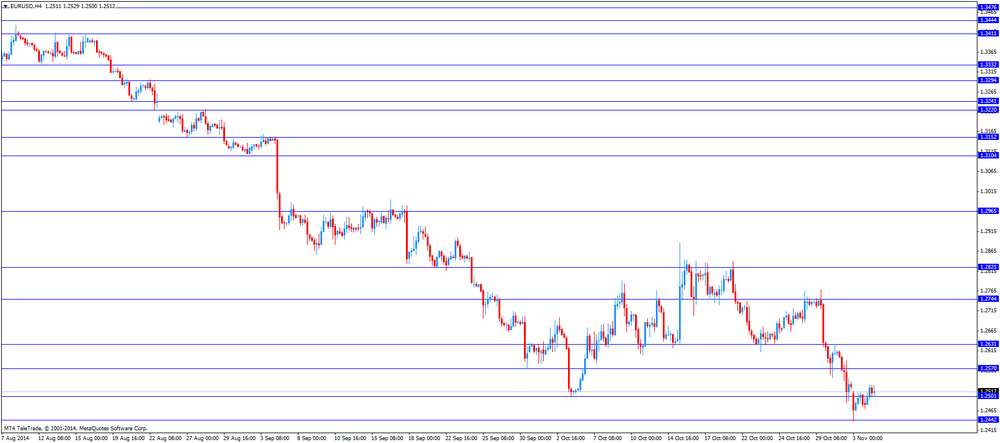

EUR/USD $ 1,2546 +0,52%

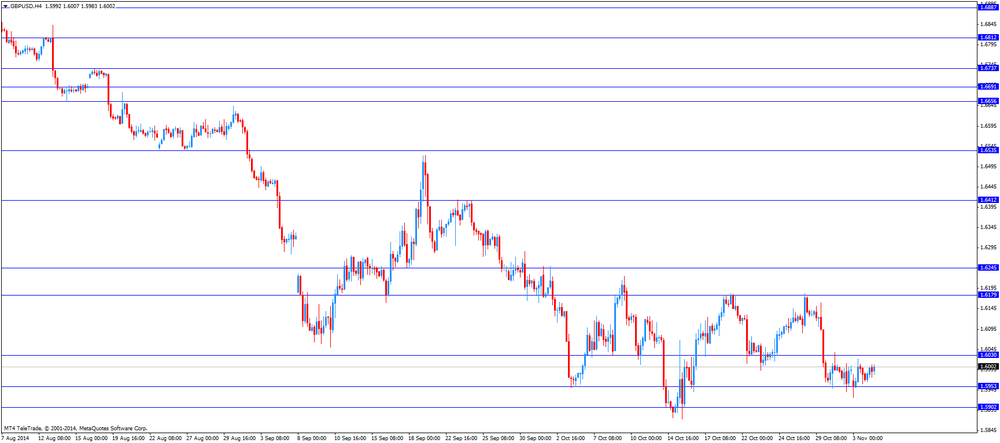

GBP/USD $1,6001 +0,19%

USD/CHF Chf0,9596 -0,64%

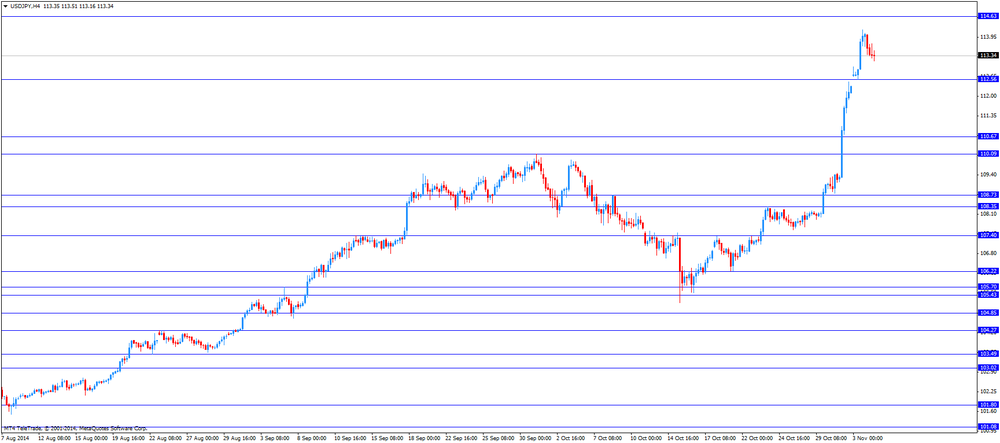

USD/JPY Y113,59 -0,39%

EUR/JPY Y142,51 +0,13%

GBP/JPY Y181,76 -0,19%

AUD/USD $0,8736 +0,64%

NZD/USD $0,7809 +1,18%

USD/CAD C$1,1408 +0,46%

-

23:01

Schedule for today, Wednesday, Nov 5’2014:

(time / country / index / period / previous value / forecast)

01:30 Japan Labor Cash Earnings, YoY September +0.9% Revised From +1.4% +0.9%

01:45 China HSBC Services PMI October 53.5

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 United Kingdom Halifax house price index October +0.6% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y October +9.6%

08:15 Switzerland Consumer Price Index (MoM) October +0.1% -0.1%

08:15 Switzerland Consumer Price Index (YoY) October -0.1% 0.0%

08:48 France Services PMI (Finally) October 48.1 48.1

08:53 Germany Services PMI (Finally) October 54.8 54.8

08:58 Eurozone Services PMI (Finally) October 52.4 52.4

09:30 United Kingdom Purchasing Manager Index Services October 58.7 58.7

10:00 Eurozone Retail Sales (MoM) September +1.2% -0.6%

10:00 Eurozone Retail Sales (YoY) September +1.9% +1.5%

13:15 U.S. ADP Employment Report October 213 214

14:15 U.S. FOMC Member Narayana Kocherlakota

14:45 U.S. Services PMI (Finally) October 57.3 57.3

15:00 U.S. ISM Non-Manufacturing October 58.6 58.2

15:30 U.S. Crude Oil Inventories October +2.1

23:50 Japan Monetary Policy Meeting Minutes

-

17:22

Bank of Canada Governor Stephen Poloz: “the current level of monetary stimulus remains appropriate”

The Bank of Canada (BoC) Governor Stephen Poloz said before the House of Commons Standing Committee on Finance on Tuesday that "the current level of monetary stimulus remains appropriate".

He also that financial stability risks such as household imbalances remain a concern to Canadian economy. Poloz added that the economy in Canada "faces significant headwinds and continued monetary policy stimulus is needed to offset them in order to achieve our inflation objective".

The BoC governor pointed out that Canadian export sector is less robust than in previous cycles.

Poloz said that the "U.S. economy is gaining traction, particularly in sectors that are beneficial to Canada's exports".

-

16:37

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected factory orders from the U.S.

The U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected factory orders from the U.S. Factory orders in the U.S. declined 0.6% in September, missing expectations for a 0.4% fall, after a 10.0% drop in August. August's figure was revised up from a 10.1% decrease.

The U.S. trade deficit widened to $43.03 billion in September from a deficit of $40.0 in August. August's figure was revised up from a deficit of $40.1 billion.

The euro rose against the U.S. dollar. The European Commission (EC) lowered its forecast for Eurozone's economic growth to 0.8% in 2014, down from 1.2%. The economic growth in the Eurozone is lowered to 1.1% in 2015, down from 1.7% previously.

The EC expects inflation in the Eurozone to remain below the European Central Bank's 2% target until at least 2016.

The EC lowered its forecasts due to a slowdown of the European economy and geopolitical crises.

The British pound traded mixed against the U.S. dollar. The construction purchasing managers' index in the U.K. fell to 61.4 in October from 64.2 in September. Analysts had expected the index to decline to 63.5.

The Canadian dollar traded mixed against the U.S. dollar after the better-than-expected trade data from Canada. Canada's trade balance returned unexpectedly to surplus in September, driven by motor vehicle and parts shipments. The trade surplus was C$0.7 billion in September, up from a deficit of C$0.5 billion in August. August's figure was revised up from a deficit of C$0.6 billion. Analysts had expected the trade deficit to widen to C$0.7 billion.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie climbed against the greenback after the Reserve Bank of Australia's interest rate decision. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.50%. This decision was widely expected.

The Reserve Bank of Australia Governor Glenn Stevens said that "the Australian dollar remains above most estimates of its fundamental value".

Retail sales in Australia rose 1.2% in September, exceeding expectations for a 0.4% increase, after a 0.1% gain in August.

Australia's trade deficit increased to A$2.26 billion in September from A$1.01 billion in August. August's figure was revised down from a deficit of A$0.79 billion. Analysts had expected the trade deficit to increase to A$1.78 billion.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:00

U.S.: Factory Orders , September -0.6% (forecast -0.4%)

-

14:23

Canada’s trade balance returned unexpectedly to surplus in September

Statistics Canada released the trade data on Tuesday. Canada's trade balance returned unexpectedly to surplus in September, driven by motor vehicle and parts shipments. The trade surplus was C$0.7 billion in September, up from a deficit of C$0.5 billion in August. August's figure was revised up from a deficit of C$0.6 billion. Analysts had expected the trade deficit to widen to C$0.7 billion.

Exports increased 1.1% in September. Motor vehicle and parts shipments rose 6.0%, while consumer goods exports climbed 6.6%.

Imports declined 1.5% in September. Energy dropped 19.4%.

-

14:08

U.S. trade deficit widened to $43.03 billion in September

The U.S. Commerce Department released on Tuesday the trade data. The U.S. trade deficit widened to $43.03 billion in September from a deficit of $40.0 in August. August's figure was revised up from a deficit of $40.1 billion.

The increase of the trade deficit was driven by exports that fell 1.5% in September. Exports reached the lowest level since April 2014.

Exports to the European Union declined 6.5% in September. Exports to China fell 3.2%, while exports to Japan dropped 14.7%.

Imports were unchanged in September.

-

13:48

Reserve Bank of Australia kept its interest rate unchanged at 2.50%

The Reserve Bank of Australia (RBA) released its interest rate decision on Tuesday. The RBA kept its interest rate unchanged at 2.50%. This decision was widely expected.

The Reserve Bank of Australia Governor Glenn Stevens said that "the Australian dollar remains above most estimates of its fundamental value".

He noted that the economy grew moderately, but the growth in the next several quarters is expected to be a little below trend.

The RBA governor pointed out that monetary policy remains accommodative.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2500(E5.09bn), $1.2525(E439mn), $1.2550(E1.09bn)...($1.2500 Nov5 E2.3bn)

USD/JPY: Y113.00($250mn)

USD/CHF: Chf0.9600($433mn)

AUD/USD: $0.8850(A$960mn)

-

13:30

Canada: Trade balance, billions, September +0.7 (forecast -0.7)

-

13:30

U.S.: International Trade, bln, September -43.0 (forecast -40.0)

-

13:07

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the after the European Commission (EC) lowered its growth and inflation forecast for the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail sales (MoM) September +0.1% +0.3% +1.2%

00:30 Australia Trade Balance September -1.01 Revised From -0.79 -1.78 -2.26

01:35 Japan Manufacturing PMI October 52.8 52.8 52.4

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction October 64.2 63.5 61.4

10:00 Eurozone Producer Price Index, MoM September -0.2% Revised From -0.1% 0.0% +0.2%

10:00 Eurozone Producer Price Index (YoY) September -1.4% -1.5% -1.4%

The U.S. dollar traded mixed against the most major currencies ahead of the trade data and factory orders from the U.S. The U.S. trade deficit is expected to decline to $40.0 billion in September from a deficit of $40.1 billion in August.

Factory orders in the U.S. are expected to decline 0.4% in September, after a 10.1% drop in August.

The euro traded mixed against the U.S. dollar after the European Commission (EC) lowered its growth and inflation forecast for the Eurozone. The EC cut its forecast for Eurozone's economic growth to 0.8% in 2014, down from 1.2%. The economic growth in the Eurozone is lowered to 1.1% in 2015, down from 1.7% previously.

The EC expects inflation in the Eurozone to remain below the European Central Bank's 2% target until at least 2016.

The EC lowered its forecasts due to a slowdown of the European economy and geopolitical crises.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected construction PMI from the U.K. The construction purchasing managers' index in the U.K. fell to 61.4 in October from 64.2 in September. Analysts had expected the index to decline to 63.5.

The Canadian dollar fell against the U.S. dollar ahead of the trade data from Canada. The Canadian trade deficit is expected to widen to C$0.7 billion in September from a deficit of C$0.6 in August.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y113.16

The most important news that are expected (GMT0):

13:30 Canada Trade balance, billions September -0.6 -0.7

13:30 U.S. International Trade, bln September -40.1 -40.0

15:00 U.S. Factory Orders September -10.1% -0.4%

15:30 Canada BOC Gov Stephen Poloz Speaks

21:45 New Zealand Employment Change, q/q Quarter III +0.4% +0.6%

21:45 New Zealand Unemployment Rate Quarter III 5.6% 5.5%

-

13:00

Orders

EUR/USD

Offers $1.2600/05

Bids $1.2400

GBP/USD

Offers $1.6100

Bids $1.5900

AUD/USD

Offers $0.8900, $0.8850, $0.8820, $0.8800

Bids $0.8680, 0.8640/20, $0.8600

EUR/JPY

Offers Y143.50, Y143.00, Y142.20/25

Bids Y141.55/50, Y141.10/00, Y140.80, Y140.10/00

USD/JPY

Offers Y115.00, Y114.50, Y113.70/75

Bids Y113.10/00, Y112.85/80, Y112.20/00

EUR/GBP

Offers

Bids stg0.7755/45

-

10:28

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2500(E5.09bn), $1.2525(E439mn), $1.2550(E1.09bn)...($1.2500 Nov5 E2.3bn)

USD/JPY: Y113.00($250mn)

USD/CHF: Chf0.9600($433mn)

AUD/USD: $0.8850(A$960mn)

-

10:00

Eurozone: Producer Price Index, MoM , September +0.2% (forecast 0.0%)

-

10:00

Eurozone: Producer Price Index (YoY), September -1.4% (forecast -1.5%)

-

09:59

United Kingdom: PMI Construction October 61.4 (forecast 63.5)

-

09:37

Press Review: Dollar wins more fans, hits four-year high

Bloomberg

JPMorgan Faces U.S. Criminal Probe Into Currency Trading

JPMorgan Chase & Co. (JPM) said it faces a U.S. criminal probe into foreign-exchange dealings and boosted its maximum estimate for "reasonably possible" losses on legal cases to the highest in more than a year.

Reuters

FOREX-Dollar wins more fans, hits four-year high

SYDNEY, Nov 4 (Reuters) - The dollar hovered at four-year highs early on Tuesday, having cemented its status as the favoured one as investors sought the greenback against just about every other major currency.

Source: http://www.reuters.com/article/2014/11/03/markets-forex-idUSL4N0ST63V20141103

Bloomberg

Euro Woes Pressuring Eastern EU States Into More Easing

Low inflation, flagging growth, and the European Central Bank's stimulus bias will probably force eastern members of the European Union to cut interest rates to record lows this week.

-

06:17

Options levels on monday, November 4, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2713 (4815)

$1.2635 (2386)

$1.2581 (673)

Price at time of writing this review: $ 1.2523

Support levels (open interest**, contracts):

$1.2416 (3049)

$1.2378 (5423)

$1.2337 (2321)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 61623 contracts, with the maximum number of contracts with strike pric $1,2900 (6972);

- Overall open interest on the PUT options with the expiration date November, 7 is 60223 contracts, with the maximum number of contracts with strike price $1,2600 (5952);

- The ratio of PUT/CALL was 0.98 versus 1.03 from the previous trading day according to data from October, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.6201 (2850)

$1.6102 (1640)

$1.6005 (482)

Price at time of writing this review: $1.5989

Support levels (open interest**, contracts):

$1.5897 (3757)

$1.5799 (1497)

$1.5700 (772)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 28297 contracts, with the maximum number of contracts with strike price $1,6200 (2850);

- Overall open interest on the PUT options with the expiration date November, 7 is 34755 contracts, with the maximum number of contracts with strike price $1,5900 (3757);

- The ratio of PUT/CALL was 1.23 versus 1.20 from the previous trading day according to data from October, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Australia: Announcement of the RBA decision on the discount rate, 2.50% (forecast 2.50%)

-

01:36

Japan: Manufacturing PMI, October 52.4 (forecast 52.8)

-

00:30

Australia: Retail sales (MoM), September +1.2% (forecast +0.3%)

-

00:30

Australia: Trade Balance , September -2.26 (forecast -1.78)

-