Notícias do Mercado

-

16:39

Foreign exchange market. American session: the Canadian dollar declined against the U.S. dollar due to the weak Canadian trade balance data and the Bank of Canada’s interest rate decision

The U.S. dollar traded higher against the most major currencies after the strong ISM non-manufacturing index for the U.S. he Institute of Supply Management released its non-manufacturing index today. The index increased to 56.3 in May from 55.2 in April, exceeding expectations for a rise to 55.6.

According to the U.S. ADP employment report, private sector employment increased by 179,000 jobs for May, missing expectations for a gain by 217,000 jobs. April's figure was revised down to an increase of 215,000 from a rise of 220,000.

The U.S. trade deficit increased 6.9% to $47.2 billion in April, from a deficit of 44.18 in March. That was the largest figure since April 2012. March’s figure was revised down to a deficit of $44.18 billion from -40.40 billion U.S. dollar.

The Federal Reserve will release its Beige Book later in the day.

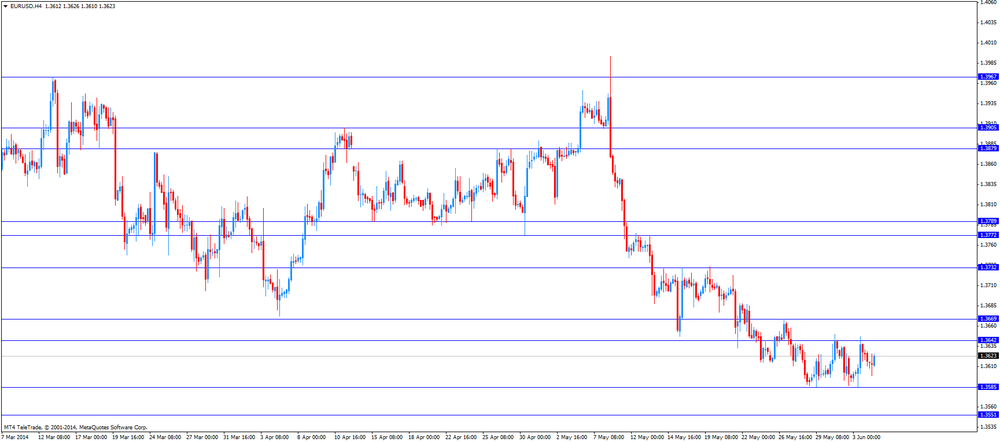

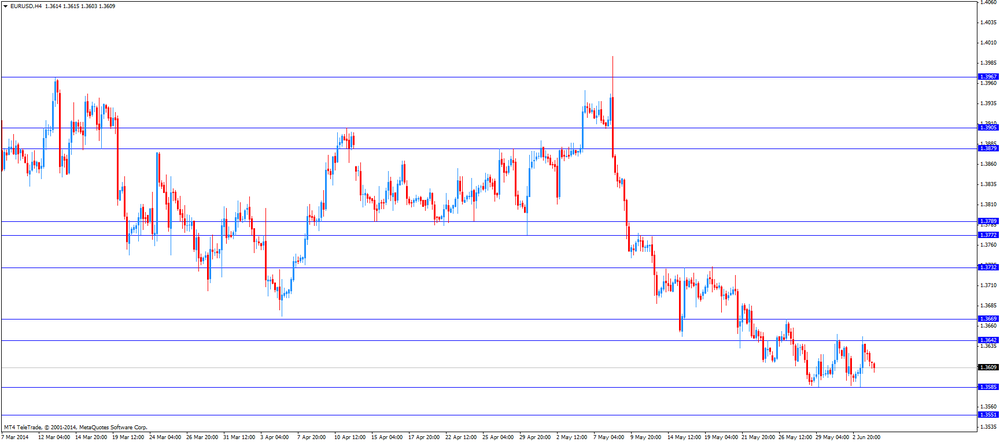

The euro traded mixed against the U.S. dollar. Eurozone’s services purchase managers’ index (PMI) declined to 53.2 in May from 53.5 in April. Analysts had expected that the index remains unchanged.

Eurozone’s gross domestic product remained unchanged at 0.2% in the first quarter, meeting analysts’ expectation.

Eurozone’s producer price index fell 0.1% in April, after a 0.2% decline in March. This figure was expected by analysts.

German final services PMI declined to 56.0 in May from 56.4 in April. Analysts had expected that the index remains unchanged.

French final services PMI sank to 49.1 in May from 49.2 in April. Analysts had expected that the index remains unchanged.

Market participants expect the European Central Bank will add further stimulus measures on Thursday. Investors are awaiting the ECB will cut interest rates and announce measures to boost lending to smaller businesses.

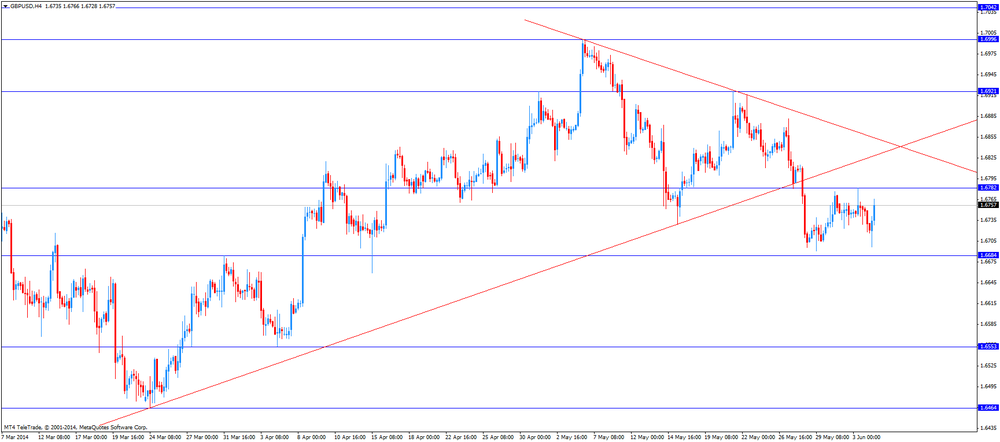

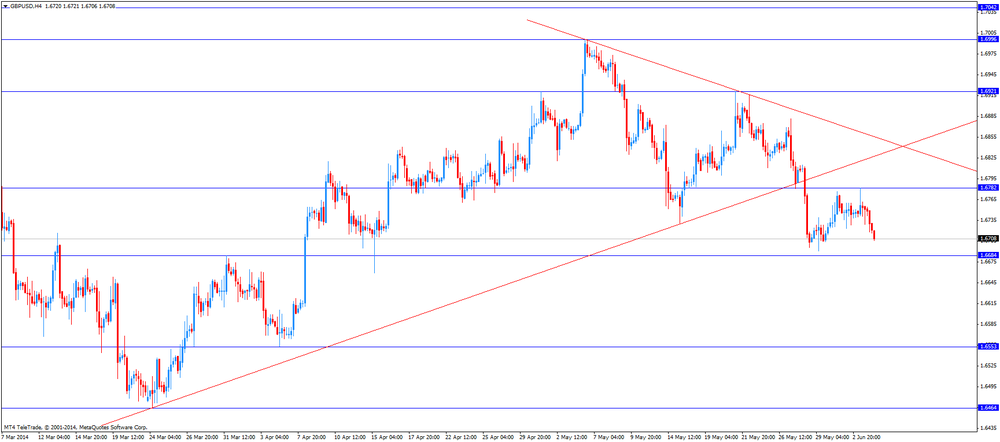

The British pound increased against the U.S. dollar due to the better-than-expected services PMI. The U.K. services purchasing managers' index declined to 58.6 in May, from 58.7 in April, but exceeding analysts’ expectations for a decline to 58.3.

The Canadian dollar declined against the U.S. dollar due to the weak Canadian trade balance data and the Bank of Canada’s interest rate decision. The Canadian trade deficit was $0.64 billion in April, after a surplus of C$0.77 billion in March. March’s figure was revised down from a surplus of C$0.80 billion. Analysts had expected the trade surplus to fall to C$0.10 billion.

The Bank of Canada (BoC) kept its interest rate unchanged at 1.00%. Monetary policy makers said that there are the risks posed by slow inflation remain. The BoC pointed out that the current monetary policy is appropriate and the timing and direction of the next change to the interest rate will be determined by future economic data.

The New Zealand dollar hits 3-month lows against the U.S dollar following a decline in dairy prices. Dairy product prices dropped 4.2% to the lowest level since February 2013. Whole milk powder prices slid 8.5%, extending their drop since a February 5, 2014 auction to 28%.

No economic data was published in New Zealand.

The Australian dollar climbed against the U.S. dollar due to strong economic growth in Australia, but lost a part of its gains. The Australian gross domestic product rose 1.1% in the first quarter, exceeding expectations of a 0.9% gain, after a 0.8% increase the previous quarter.

On a yearly basis, the gross domestic product in Australia increased 3.5% in the first quarter, after a 2.8% rise the previous quarter.

The AIG services index for Australia climbed to 49.9 in May from 48.6 in April.

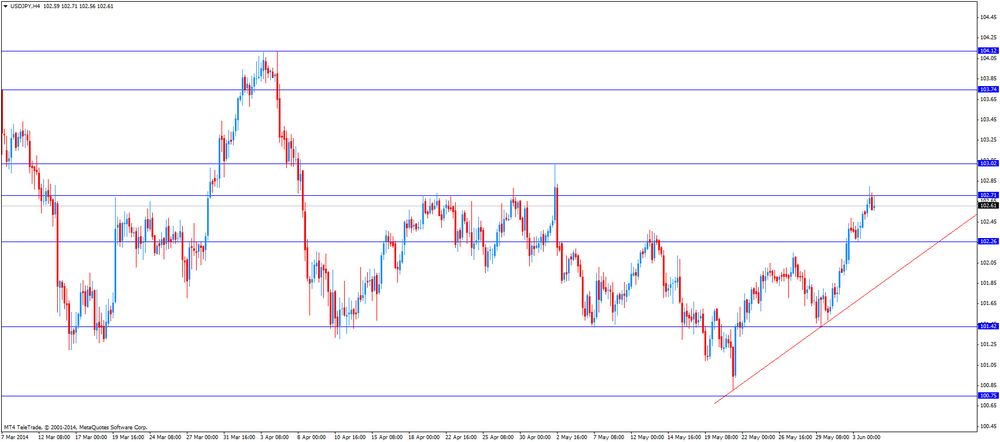

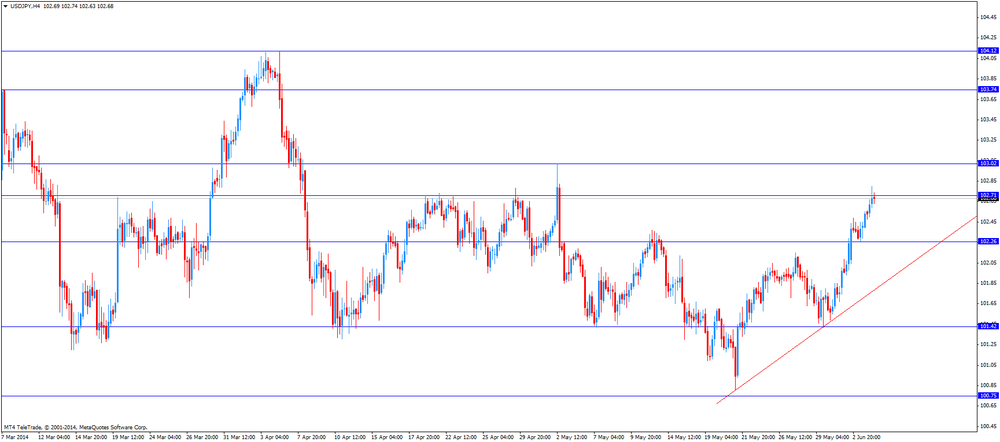

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports in Japan.

-

16:14

Bank of Canada kept its interest rate unchanged at 1.00%

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The BoC kept its interest rate unchanged at 1.00%. Monetary policy makers said that there are the risks posed by slow inflation remain.

Total inflation in Canada increased to around 2% target due to the temporary effects of higher energy prices and weaker currency. The core inflation in Canada remains significantly below 2% target.

Canadian and global economy grew slower than expected in the first quarter of 2014. The slower growth was caused by severe weather and supply constraints.

The Bank of Canada Governor Stephen Poloz said in a statement on Wednesday the downside risks to the inflation outlook are as important as before.

The BoC pointed out that the current monetary policy is appropriate and the timing and direction of the next change to the interest rate will be determined by future economic data.

-

15:30

U.S.: Crude Oil Inventories, May -3.4

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

15:00

U.S.: ISM Non-Manufacturing, May 56.3 (forecast 55.6)

-

14:55

U.S. trade deficit widened to its highest level since April 2012

The Commerce Department released the trade balance data on Wednesday. The U.S. trade deficit increased 6.9% to $47.2 billion in April, from a deficit of 44.18 in March. That was the largest figure since April 2012. March’s figure was revised down to a deficit of $44.18 billion from -40.40 billion U.S. dollar.

Imports rose 1.2% in April to a record $240.6 billion from $237.8 billion in March. Exports declined 0.2% to $193.3 billion.

The trade gap with the European Union was the largest on record.

The trade gap with China jumped 16.3% to $27.3 billion in April from $20.4 billion in March.

-

14:45

U.S.: Services PMI, May 58.1 (forecast 58.4)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3600, $1.3650, $1.3685, $1.3700

USD/JPY Y102.05/10, Y102.15, Y103.50

USD/CAD Cad1.0925, Cad1.0935/40, Cad1.1000

AUD/USD $0.9200, $0.9300, $0.9325, $0.9340

GBP/USD $1.6830, $1.6910

USD/CHF Chf0.8895, Chf0.9005, Chf0.9025

-

14:10

Canada posts a weaker than expected trade deficit

The Canadian trade deficit was released on Wednesday. The trade deficit was $0.64 billion in April, after a surplus of C$0.77 billion in March. March’s figure was revised down from a surplus of C$0.80 billion.

Analysts had expected the trade surplus to fall to C$0.10 billion.

That development of trade balance was caused by energy exports drop. Energy exports dropped 11% in April.

Later in the trading session, the Bank of Canada (BoC) will release its interest rate decision. Analysts expect the BoC will keep interest rate unchanged at 1.00%.

-

13:57

ADP Employment Report: private sector employment rose weaker than expected

The U.S. ADP employment report was released on Wednesday. Private sector employment increased by 179,000 jobs for May, missing expectations for a gain by 217,000 jobs. April's figure was revised down to an increase of 215,000 from a rise of 220,000.

Goods-producing employment climbed by 29,000 jobs in May, up from 21,000 jobs gained in April. Service-providing employment increased by 150,000 jobs in May, down from 194,000 in April.

-

13:31

U.S.: Nonfarm Productivity, q/q, Quarter I -3.2% (forecast -2.2%)

-

13:30

Canada: Trade balance, billions, April -0.6 (forecast -0.2)

-

13:30

U.S.: International Trade, bln, April -47.2 (forecast -40.8)

-

13:15

U.S.: ADP Employment Report, May 179 (forecast 217)

-

13:08

Foreign exchange market. European session: the British pound rose against the U.S. dollar due to the better-than-expected services PMI

Economic calendar (GMT0):

01:30 Australia Gross Domestic Product (QoQ) Quarter I +0.8% +0.9% +1.1%

01:30 Australia Gross Domestic Product (YoY) Quarter I +2.8% +3.5%

07:48 France Services PMI (Finally) May 49.2 49.2 49.1

07:53 Germany Services PMI (Finally) May 56.4 56.4 56.0

07:58 Eurozone Services PMI May 53.5 53.5 53.2

08:30 United Kingdom Purchasing Manager Index Services May 58.7 58.3 58.6

09:00 Eurozone Producer Price Index, MoM April -0.2% -0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.6% -1.2% -1.2%

09:00 Eurozone GDP (QoQ) (Revised) Quarter I +0.2% +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Revised) Quarter I +0.9% +0.9% +0.9%

The U.S. dollar traded lower against the most major currencies ahead of the release of several U.S. economic reports.

The euro increased against the U.S. dollar despite the weaker-than-expected economic data in the Eurozone. Eurozone’s services purchase managers’ index (PMI) declined to 53.2 in May from 53.5 in April. Analysts had expected that the index remains unchanged.

Eurozone’s gross domestic product remained unchanged at 0.2% in the first quarter, meeting analysts’ expectation.

Eurozone’s producer price index fell 0.1% in April, after a 0.2% decline in March. This figure was expected by analysts.

German final services PMI declined to 56.0 in May from 56.4 in April. Analysts had expected that the index remains unchanged.

French final services PMI sank to 49.1 in May from 49.2 in April. Analysts had expected that the index remains unchanged.

Market participants expect the European Central Bank will add further stimulus measures on Thursday. Investors are awaiting the ECB will cut interest rates and announce measures to boost lending to smaller businesses.

The British pound rose against the U.S. dollar due to the better-than-expected services PMI. The U.K. services purchasing managers' index declined to 58.6 in May, from 58.7 in April, but exceeding analysts’ expectations for a decline to 58.3.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian trade balance data and the Bank of Canada’s interest rate decision. The Canadian trade balance deficit should be 0.2 billion CAD, after a surplus of 0.1 billion CAD.

Interest rate in Canada should remain unchanged at 1.00%.

EUR/USD: the currency pair increased to $1.3626

GBP/USD: the currency pair climbed to $1.6766

USD/JPY: the currency pair decreased to Y102.56

The most important news that are expected (GMT0):

12:00 G7 G7 Meetings

12:15 U.S. ADP Employment Report May 220 217

12:30 Canada Trade balance, billions April 0.1 -0.2

12:30 U.S. International Trade, bln April -40.4 -40.8

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter I -1.7% -2.2%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada BOC Rate Statement

14:00 U.S. ISM Non-Manufacturing May 55.2 55.6

18:00 U.S. Fed's Beige Book

-

12:45

Orders

EUR/USD

Offers $1.3695/700, $1.3688, $1.3670/80, $1.3655, $1.3640

Bids $1.3600, $1.3585/80, $1.3570, $1.3550

GBP/USD

Offers $1.6835/40, $1.6782

Bids $1.6690

AUD/USD

Offers $0.9380, $0.9350, $0.9330, $0.9300

Bids $0.9255/50, $0.9235/30, $0.9210/00

EUR/JPY

Offers Y140.80, Y140.50, Y140.00

Bids Y139.50, Y139.20, Y139.00, Y138.85/80

USD/JPY

Offers Y103.50, Y103.00

Bids Y102.55/50, Y102.00, Y101.60

EUR/GBP

Offers stg0.8195/205, stg0.8160/65

Bids stg0.8080, stg0.8050

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3600, $1.3650, $1.3685, $1.3700

USD/JPY Y102.05/10, Y102.15, Y103.50

USD/CAD Cad1.0925, Cad1.0935/40, Cad1.1000

AUD/USD $0.9200, $0.9300, $0.9325, $0.9340

GBP/USD $1.6830, $1.6910

USD/CHF Chf0.8895, Chf0.9005, Chf0.9025

-

10:01

Eurozone: Producer Price Index, MoM , April -0.1% (forecast -0.1%)

-

10:01

Eurozone: Producer Price Index (YoY), May -1.2% (forecast -1.2%)

-

10:00

Eurozone: GDP (QoQ), Quarter I +0.2% (forecast +0.2%)

-

10:00

Eurozone: GDP (YoY), Quarter I +0.9% (forecast +0.9%)

-

09:52

Foreign exchange market. Asian session: the Australian dollar climbed against the U.S. dollar due to strong economic growth in Australia

Economic calendar (GMT0):

01:30 Australia Gross Domestic Product (QoQ) Quarter I +0.8% +0.9% +1.1%

01:30 Australia Gross Domestic Product (YoY) Quarter I +2.8% +3.5%

07:48 France Services PMI (Finally) May 49.2 49.2 49.1

07:53 Germany Services PMI (Finally) May 56.4 56.4 56.0

07:58 Eurozone Services PMI May 53.5 53.5 53.2

08:30 United Kingdom Purchasing Manager Index Services May 58.7 58.3 58.6

The U.S. dollar traded higher against the most major currencies due to strong factory orders in the U.S. The U.S. factory orders climbed 0.7% in April, beating expectations for 0.6% increase, after a 1.1% gain in March.

The New Zealand dollar hits 3-month lows against the U.S dollar following a decline in dairy prices. Dairy product prices dropped 4.2% to the lowest level since February 2013. Whole milk powder prices slid 8.5%, extending their drop since a February 5, 2014 auction to 28%.

No economic data was published in New Zealand.

The Australian dollar climbed against the U.S. dollar due to strong economic growth in Australia. The Australian gross domestic product rose 1.1% in the first quarter, exceeding expectations of a 0.9% gain, after a 0.8% increase the previous quarter.

On a yearly basis, the gross domestic product in Australia increased 3.5% in the first quarter, after a 2.8% rise the previous quarter.

The AIG services index for Australia climbed to 49.9 in May from 48.6 in April.

The Japanese yen hits 1-month lows against the U.S. dollar due to overnight gains in U.S. Treasury yields.

EUR/USD: the currency pair declined to $1.3610

GBP/USD: the currency pair decreased to $1.6720

USD/JPY: the currency pair climbed to Y102.80

The most important news that are expected (GMT0):

09:00 Eurozone Producer Price Index, MoM April -0.2% -0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.6% -1.2%

09:00 Eurozone GDP (QoQ) (Revised) Quarter I +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Revised) Quarter I +0.9% +0.9%

12:00 G7 G7 Meetings

12:15 U.S. ADP Employment Report May 220 217

12:30 Canada Trade balance, billions April 0.1 -0.2

12:30 U.S. International Trade, bln April -40.4 -40.8

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter I -1.7% -2.2%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada BOC Rate Statement

14:00 U.S. ISM Non-Manufacturing May 55.2 55.6

18:00 U.S. Fed's Beige Book

-

09:31

United Kingdom: Purchasing Manager Index Services, May 58.6 (forecast 58.3)

-

09:00

Eurozone: Services PMI, May 53.2 (forecast 53.5)

-

08:55

Germany: Services PMI, May 56.0 (forecast 56.4)

-

08:52

France: Services PMI, May 49.1 (forecast 49.2)

-

06:25

Options levels on wednesday, June 4, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3732 (3983)

$1.3701 (1840)

$1.3658 (351)

Price at time of writing this review: $ 1.3614

Support levels (open interest**, contracts):

$1.3572 (3325)

$1.3547 (4514)

$1.3515 (4706)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 58273 contracts, with the maximum number of contracts with strike price $1,3850 (6354);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 76662 contracts, with the maximum number of contractswith strike price $1,3500 (8943);

- The ratio of PUT/CALL was 1.32 versus 1.35 from the previous trading day according to data from June, 3.

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2741)

$1.6900 (2089)

$1.6802 (1319)

Price at time of writing this review: $1.6722

Support levels (open interest**, contracts):

$1.6697 (2601)

$1.6599 (2451)

$1.6500 (979)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24585 contracts, with the maximum number of contracts with strike price $1,7000 (2741);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 26971 contracts, with the maximum number of contracts with strike price $1,6700 (2601);

- The ratio of PUT/CALL was 1.10 versus 1.10 from the previous trading day according to data from June, 3.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Australia: Gross Domestic Product (QoQ), Quarter I +1.1% (forecast +0.9%)

-

02:30

Australia: Gross Domestic Product (YoY), Quarter I +3.5%

-

00:30

Australia: AIG Services Index, May 49.9

-

00:20

Currencies. Daily history for June 03'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3626 +0,21%

GBP/USD $1,6748 +0,01%

USD/CHF Chf0,8962 -0,23%

USD/JPY Y102,53 +0,16%

EUR/JPY Y139,71 +0,37%

GBP/JPY Y171,70 +0,16%

AUD/USD $0,9265 +0,27%

NZD/USD $0,8432 -0,20%

USD/CAD C$1,0907 +0,09%

-