Notícias do Mercado

-

16:39

Foreign exchange market. American session: the euro hits 4-month lows against the U.S. dollar after the European Central Bank’s interest rate cut, but later recovered its losses and traded higher

The U.S. dollar traded lower against after the European Central Bank’s press conference and ahead of the U.S. job market data on Friday. The number of initial jobless claims in the week ending May 31 in the U.S. rose by 8,000 to 312,000 from 304,000 the previous week. The previous week figure was revised up from 300,000. Analysts had expected initial jobless claims to increase by 6,000 to 310,000.

The euro hits 4-month lows against the U.S. dollar after the European Central Bank cut its interest rate to 0.15% from 0.25%, but later recovered its losses and traded higher. Analysts had expected a cut to 0.1%.

The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

Retail sales in the Eurozone climbed 0.4% in April, exceeding expectations for a 0.1% gain, after a 0.3% increase in March. On a yearly basis, retail sales in the Eurozone rose 2.4% in April, exceeding expectations for a 1.3% increase, after a 0.9% gain in March.

German factory orders surged 3.1% in April, beating expectations for a 1.3% rise, after a 2.8% decrease in March.

The British pound increased against the U.S. dollar after the Bank of England’s interest rate decision. The BoE kept its interest rate unchanged at record low 0.50%. The stimulus program of the Bank of England remained unchanged at 375 billion pounds. Investors had expected this decision. Investors expect the BoE will raise interest rate in the first half of next year.

Earlier in the trading session, the U.K. house prices were released. The U.K. Halifax house price index increased 3.9% in May, exceeding expectations for a 0.4% rise, after a 0.3% decline in April. April’s figure was revised down from a 0.2% fall.

The Canadian dollar traded mixed against the U.S. dollar after the release of the Canadian building permits and the Ivey purchasing managers’ index. The building permits in Canada increased 1.1% in April, missing expectations for a 1.4% gain, after a 3.2% decline in March. March’s figure was revised down from a 3.0% decrease.

The Ivey purchasing managers’ index for Canada dropped to 48.2 in May from 54.1 in April, missing expectations for an increase to 58.6.

The New Zealand dollar increased against the U.S dollar recovering this week’s losses. A decline in dairy prices had a negative impact on the kiwi. No economic data was published in New Zealand.

The Australian dollar climbed against the U.S. dollar. The Australian trade deficit was A$122 million in April, after a surplus of A$902 million in March. March’s figure was revised up from a surplus of A$731 million. Analysts had expected an A$300 million surplus. Exports declined 1.5% caused by lower commodity prices.

The HSBC services purchase managers’ index for China sank to 50.7 in May from 51.4 in April.

The Japanese yen traded higher against the U.S. dollar. No economic data was released in Japan.

-

15:27

European Central Bank cut its interest rate to 0.15%

The European Central Bank (ECB) released its interest rate decision today. The ECB cut its interest rate to 0.15% from 0.25% to economic growth and avoid deflation in the Eurozone. Analysts had expected a cut to 0.1%.

The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

The European Central Bank President Mario Draghi announced other measures. Long term loans (longer term refinancing operations (TLTROs)) are to be offered to commercial banks at cheap rates until 2018. Two long term loans are scheduled to be launched in September and December 2014. Additional long terms loans will be launched on a quarterly basis until June 2016.

Draghi said interest rates are to remain at the current level for an extended period, further interest rate cuts are not planned and only minor adjustments are still possible. He added that more unconventional measures would be done, if necessary.

The ECB lowered its forecast for economic growth in the Eurozone in 2014 from 1.2% to 1.0% and increased its forecast for 2015 from 1.5% to 1.7%. Inflation rate in the Eurozone is expected to be 0.7% in 2014 (previously 1.0%) and 1.3% in 2015 of 1.3% (previously 1.1%).

-

15:00

Canada: Ivey Purchasing Managers Index, May 48.2 (forecast 58.6)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3460, $1.3500, $1.3550, $1.3600, $1.3650

USD/JPY Y102.25-30, Y102.75, Y102.80, Y103.00

GBP/USD $1.6700, $1.6890

EUR/GBP stg0.8100, stg0.8195

USD/CHF Chf0.9100

EUR/CHF Chf1.2200

AUD/USD $0.9200, $0.9225, $0.9295-9300, $0.9350

-

13:30

Canada: Building Permits (MoM) , April +1.1% (forecast +1.4%)

-

13:30

U.S.: Initial Jobless Claims, May 312 (forecast 314)

-

13:13

Foreign exchange market. European session: the euro dropped against the U.S. dollar after the European Central Bank cut its interest rate to 0.15% from 0.25%

Economic calendar (GMT0):

01:30 Australia Trade Balance April 0.90 0.53 -0.12

01:45 China HSBC Services PMI May 51.4 50.7

06:00 Germany Factory Orders s.a. (MoM) April -2.8% +1.3% +3.1%

06:00 Germany Factory Orders n.s.a. (YoY) April +1.5% +6.3%

07:00 United Kingdom Halifax house price index May -0.2% +0.4% +3.9%

07:00 United Kingdom Halifax house price index 3m Y/Y May +8.5% +8.7%

09:00 G7 G7 Meetings

09:00 Eurozone Retail Sales (MoM) April +0.3% +0.1% +0.4%

09:00 Eurozone Retail Sales (YoY) April +0.9% +1.3% +2.4%

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.25% 0.10% 0.15%

The U.S. dollar traded mixed against the most major currencies ahead of the release of initial jobless claims in the U.S. and the European Central Bank’s press conference. The number of initial jobless claims in the U.S should climb by 14,000 to 314,000.

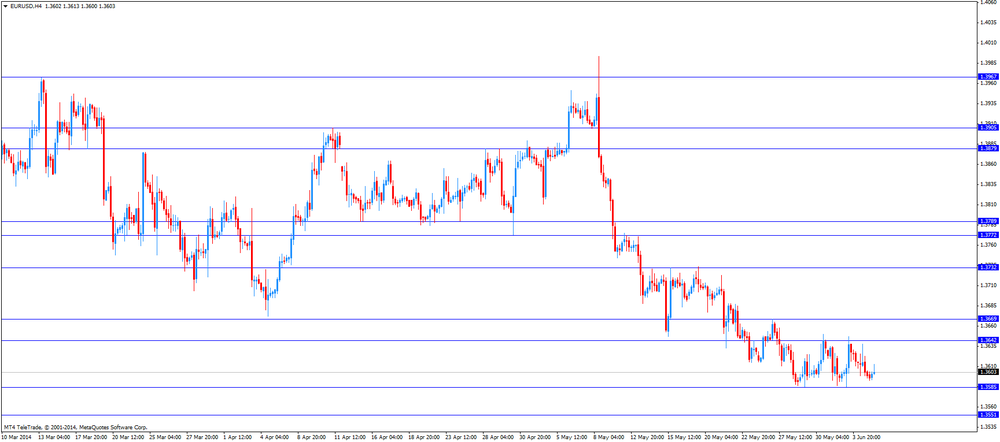

The euro dropped against the U.S. dollar after the European Central Bank cut its interest rate to 0.15% from 0.25%. Investors had expected that the ECB will cut its interest rate.

Retail sales in the Eurozone climbed 0.4% in April, exceeding expectations for a 0.1% gain, after a 0.3% increase in March. On a yearly basis, retail sales in the Eurozone rose 2.4% in April, exceeding expectations for a 1.3% increase, after a 0.9% gain in March.

German factory orders surged 3.1% in April, beating expectations for a 1.3% rise, after a 2.8% decrease in March.

The British pound increased against the U.S. dollar after the Bank of England’s interest rate decision, but later lost its gains. The BoE kept its interest rate unchanged at record low 0.50%. The stimulus program of the Bank of England remained unchanged at 375 billion pounds. Investors had expected this decision. Investors expect the BoE will raise interest rate in the first half of next year.

Earlier in the trading session, the U.K. house prices were released. The U.K. Halifax house price index increased 3.9% in May, exceeding expectations for a 0.4% rise, after a 0.3% decline in April. April’s figure was revised down from a 0.2% fall.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian building permits and the Ivey purchasing managers’ index. The building permits in Canada should climb 1.4% in April, after a 3.0% decline in March.

The Ivey purchasing managers’ index for Canada should increase to 58.6 in May from 54.1 in April.

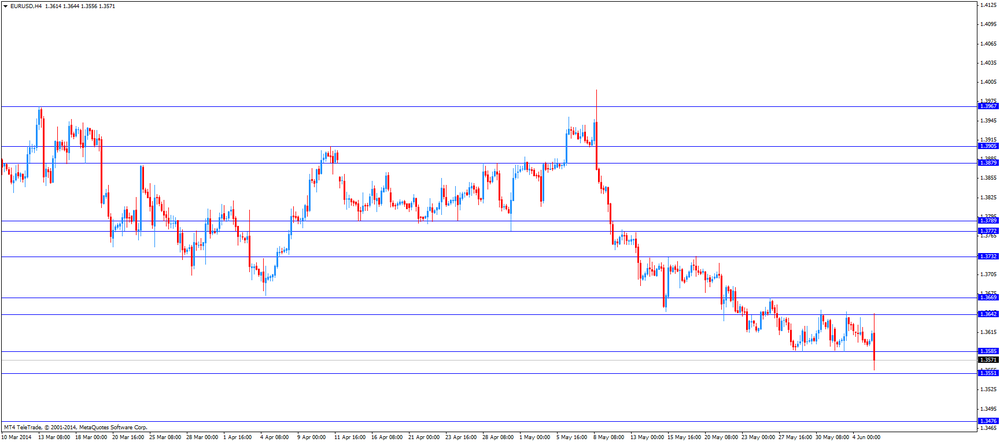

EUR/USD: the currency pair declined to $1.3556

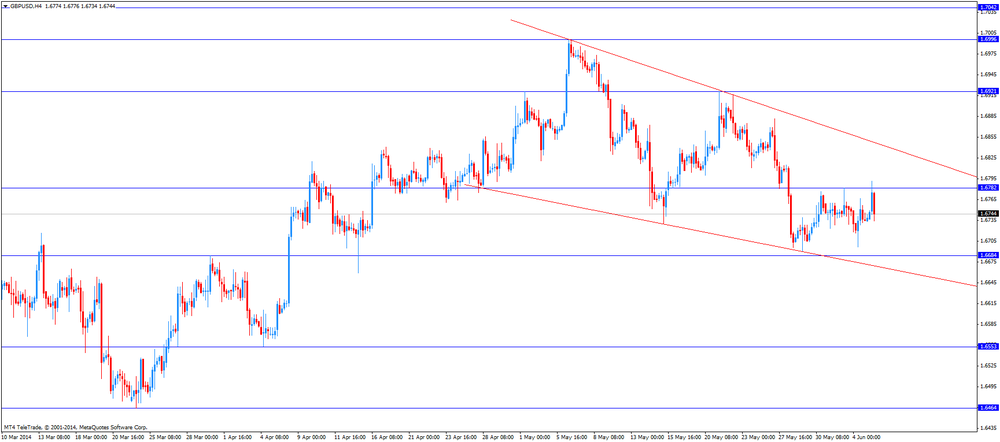

GBP/USD: the currency pair traded mixed

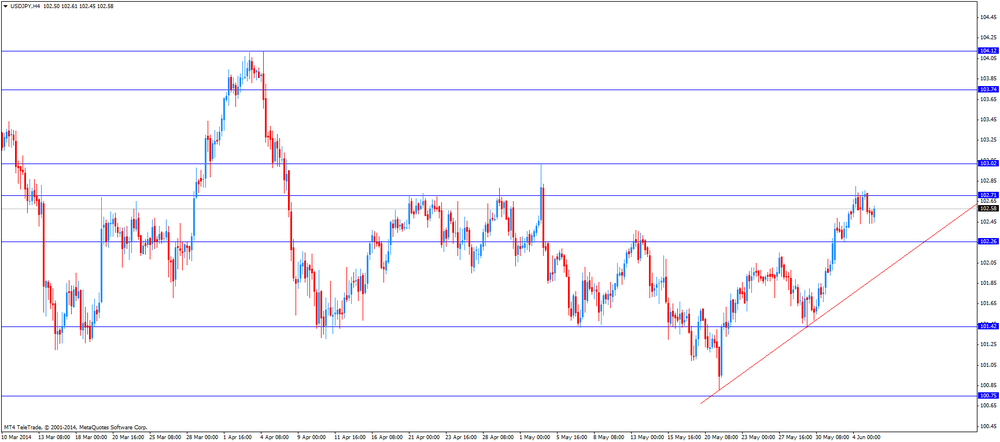

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) April -3.0% +1.4%

12:30 U.S. Initial Jobless Claims May 300 314

14:00 Canada Ivey Purchasing Managers Index May 54.1 58.6

17:30 U.S. FOMC Member Narayana Kocherlakota

-

13:00

Orders

EUR/USD

Offers $1.3688, $1.3665/80, $1.3648-50, $1.3635-40

Bids $1.3585/80, $1.3570, $1.3550, $1.3525/20

GBP/USD

Offers $1.6860, $1.6835/40

Bids $1.6700-90

AUD/USD

Offers $0.9350, $0.9330, $0.9300

Bids $0.9255/50, $0.9235/30, $0.9220, $0.9210/00

EUR/JPY

Offers Y140.80, Y140.50, Y140.00

Bids Y139.20, Y139.00, Y138.85/80, Y138.50

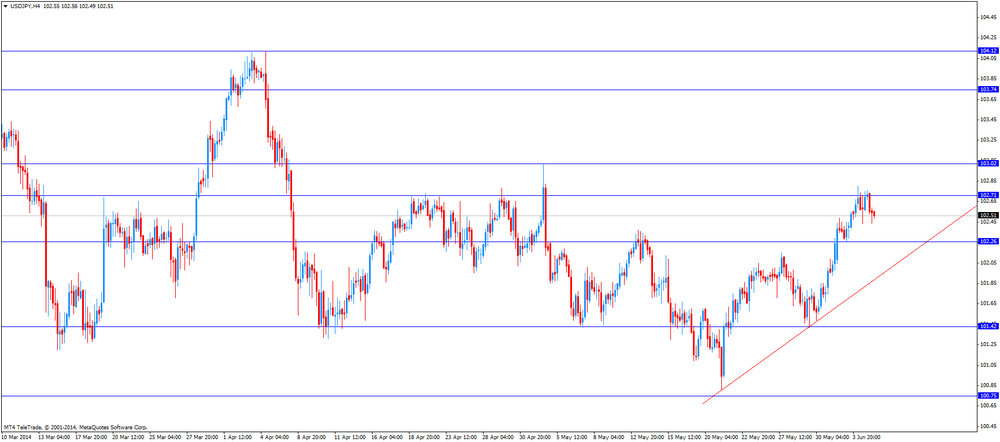

USD/JPY

Offers Y103.50, Y103.00, Y102.75/80

Bids Y102.40, Y102.00, Y101.60

EUR/GBP

Offers stg0.8215-25, stg0.8195/205, stg0.8160/65, stg0.8150

Bids stg0.8080, stg0.8050

-

12:47

Bank of England kept its interest rate unchanged at 0.50%

The Bank of England (BoE) released its interest rate decision today. The BoE kept its interest rate unchanged at record low 0.50%. The stimulus program of the Bank of England remained unchanged at 375 billion pounds. Investors had expected this decision.

Investors expect the BoE will raise interest rate in the first half of next year.

The Bank of England governor Mark Carney mentioned before that the BoE would not raise interest rate until joblessness fell below 7%. The unemployment rate is 6.8% now.

-

12:45

Eurozone: ECB Interest Rate Decision, 0.15% (forecast 0.10%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

10:21

Option expiries for today's 1400GMT cut

EUR/USD $1.3460, $1.3500, $1.3550, $1.3600, $1.3650

USD/JPY Y102.25-30, Y102.75, Y102.80, Y103.00

GBP/USD $1.6700, $1.6890

EUR/GBP stg0.8100, stg0.8195

USD/CHF Chf0.9100

EUR/CHF Chf1.2200

AUD/USD $0.9200, $0.9225, $0.9295-9300, $0.9350

-

10:07

Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after the release of weak economic data in Australia and China

Economic calendar (GMT0):

01:30 Australia Trade Balance April 0.90 0.53 -0.12

01:45 China HSBC Services PMI May 51.4 50.7

06:00 Germany Factory Orders s.a. (MoM) April -2.8% +1.3% +3.1%

06:00 Germany Factory Orders n.s.a. (YoY) April +1.5% +6.3%

07:00 United Kingdom Halifax house price index May -0.2% +0.4% +3.9%

07:00 United Kingdom Halifax house price index 3m Y/Y May +8.5% +8.7%

09:00 G7 G7 Meetings

09:00 Eurozone Retail Sales (MoM) April +0.3% +0.1% +0.4%

09:00 Eurozone Retail Sales (YoY) April +0.9% +1.3% +2.4%

The U.S. dollar traded slightly lower against the most major currencies due to the weak economic data in the U.S. According to the U.S. ADP employment report, private sector employment increased by 179,000 jobs for May, missing expectations for a gain by 217,000 jobs. April's figure was revised down to an increase of 215,000 from a rise of 220,000.

The U.S. trade deficit increased 6.9% to $47.2 billion in April, from a deficit of 44.18 in March. That was the largest figure since April 2012. March’s figure was revised down to a deficit of $44.18 billion from -40.40 billion U.S. dollar.

The New Zealand dollar traded higher against the U.S dollar recovering a part of its losses. A decline in dairy prices had a negative impact on the kiwi. No economic data was published in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the release of weak economic data in Australia and China. The Australian trade deficit was A$122 million in April, after a surplus of A$902 million in March. March’s figure was revised up from a surplus of A$731 million. Analysts had expected an A$300 million surplus. Exports declined 1.5% caused by lower commodity prices.

The HSBC services purchase managers’ index for China sank to 50.7 in May from 51.4 in April.

The Japanese yen traded higher against the U.S. dollar ahead the European Central Bank’s interest rate decision. No economic data was released in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y102.45

The most important news that are expected (GMT0):

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.25% 0.10%

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) April -3.0% +1.4%

12:30 U.S. Initial Jobless Claims May 300 314

14:00 Canada Ivey Purchasing Managers Index May 54.1 58.6

17:30 U.S. FOMC Member Narayana Kocherlakota

-

10:00

Eurozone: Retail Sales (MoM), April +0.4% (forecast +0.1%)

-

10:00

Eurozone: Retail Sales (YoY), April +2.4% (forecast +1.3%)

-

08:00

United Kingdom: Halifax house price index, May +3.9% (forecast +0.4%)

-

08:00

United Kingdom: Halifax house price index 3m Y/Y, May +8.7%

-

07:00

Germany: Factory Orders s.a. (MoM), April +3.1% (forecast +1.3%)

-

06:26

Options levels on thursday, June 5, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3727 (4418)

$1.3694 (2048)

$1.3646 (387)

Price at time of writing this review: $ 1.3602

Support levels (open interest**, contracts):

$1.3572 (5612)

$1.3555 (3275)

$1.3532 (4637)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 59604 contracts, with the maximum number of contracts with strike price $1,3850 (6340);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 77739 contracts, with the maximum number of contractswith strike price $1,3500 (8700);

- The ratio of PUT/CALL was 1.30 versus 1.32 from the previous trading day according to data from June, 4.

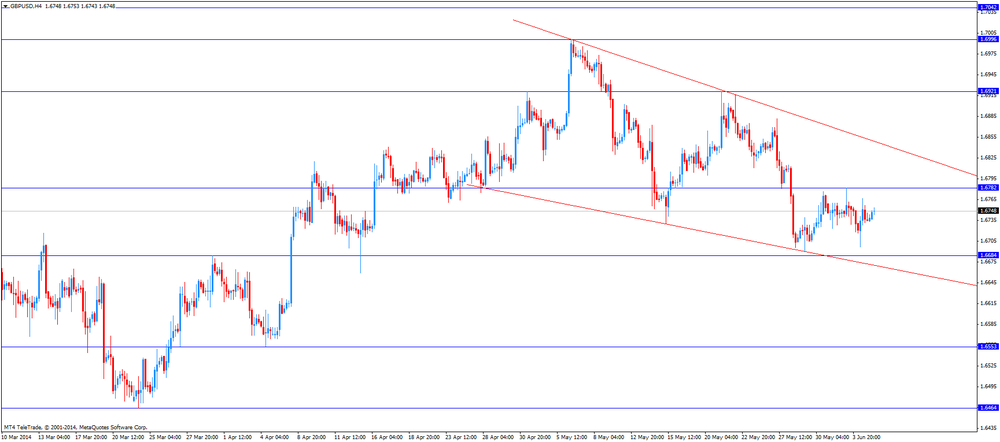

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2729)

$1.6901 (2301)

$1.6802 (1421)

Price at time of writing this review: $1.6742

Support levels (open interest**, contracts):

$1.6697 (2603)

$1.6599 (2504)

$1.6500 (974)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24855 contracts, with the maximum number of contracts with strike price $1,7000 (2729);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 26991 contracts, with the maximum number of contracts with strike price $1,6700 (2603);

- The ratio of PUT/CALL was 1.09 versus 1.10 from the previous trading day according to data from June, 4.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:45

China: HSBC Services PMI, May 50.7

-

02:31

Australia: Trade Balance , April -0.12 (forecast 0.53)

-

00:20

Currencies. Daily history for June 04'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3599 -0,20%

GBP/USD $1,6735 -0,08%

USD/CHF Chf0,8969 +0,08%

USD/JPY Y102,72 +0,18%

EUR/JPY Y139,69 -0,01%

GBP/JPY Y171,89 +0,11%

AUD/USD $0,9275 +0,11%

NZD/USD $0,8418 -0,17%

USD/CAD C$1,0939 +0,29%

-

00:00

Schedule for today, Thursday, June 05’2014:

(time / country / index / period / previous value / forecast)01:30 Australia Trade Balance April 0.73 0.53

01:45 China HSBC Services PMI May 51.4

06:00 Germany Factory Orders s.a. (MoM) April -2.8% +1.3%

06:00 Germany Factory Orders n.s.a. (YoY) April +1.5%

07:00 United Kingdom Halifax house price index May -0.2% +0.4%

07:00 United Kingdom Halifax house price index 3m Y/Y May +8.5%

09:00 G7 G7 Meetings

09:00 Eurozone Retail Sales (MoM) April +0.3% +0.1%

09:00 Eurozone Retail Sales (YoY) April +0.9% +1.3%

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.25% 0.10%

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) April -3.0% +1.4%

12:30 U.S. Initial Jobless Claims May 300 314

14:00 Canada Ivey Purchasing Managers Index May 54.1 58.6

17:30 U.S. FOMC Member Narayana Kocherlakota

23:30 Australia AiG Performance of Construction Index May 45.9

-