Notícias do Mercado

-

20:01

U.S.: Consumer Credit , April 26.85 (forecast 16.6)

-

16:33

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the mixed U.S. jobs market data

The U.S. dollar traded higher against the most major currencies after the mixed U.S. jobs market data. The unemployment rate in the U.S. remained unchanged at 6.3% in May. Analysts had expected an increase to 6.4%.

The U.S. economy added 217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain in April. April’s figure was revised down from a 288,000 increase.

These figures seem to be another sign that the U.S. economy gaining the kind of sustained momentum.

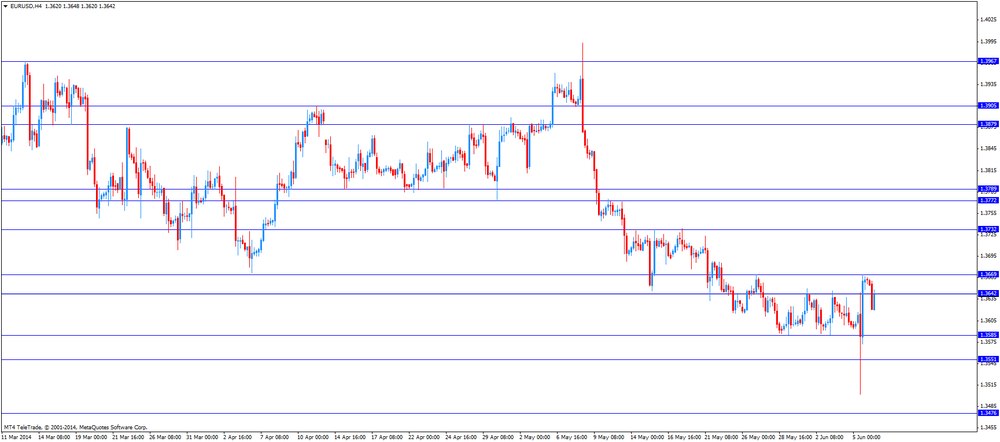

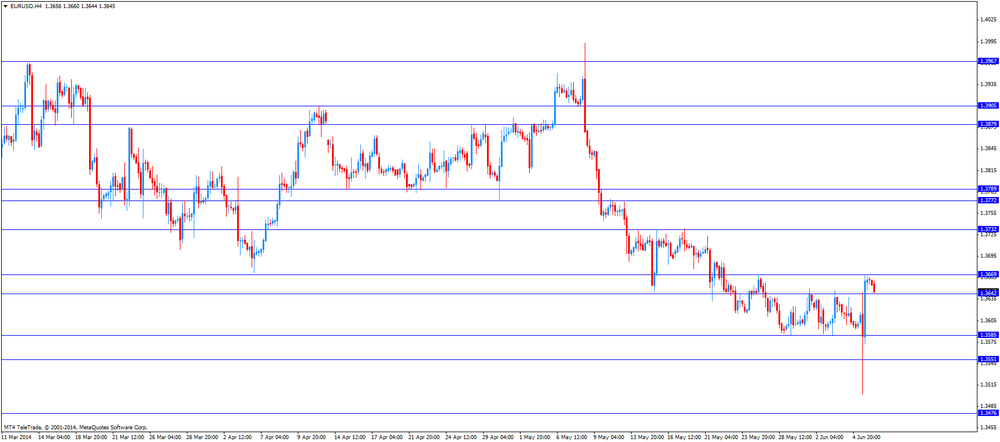

The euro traded lower against the U.S. dollar. Market participants seemed to be unimpressed by the stimulus measures by the European Central Bank.

German economic data was released. Germany's trade surplus climbed to €17.7 billion in April from €15.0 billion in March. March’s figure was revised up from a surplus of €14.8 billion. Analysts had expected Germany’s trade surplus to increase to €15.2 billion.

German industrial production rose 0.2% in April, missing expectations for a 0.4% gain, after a 0.5% decline in March. On a yearly basis, the industrial production in Germany increased 1.8% in April, after a 3.0% rise in March.

Germany’s current account surplus declined to €18.4 billion in April from €19.5 billion in March.

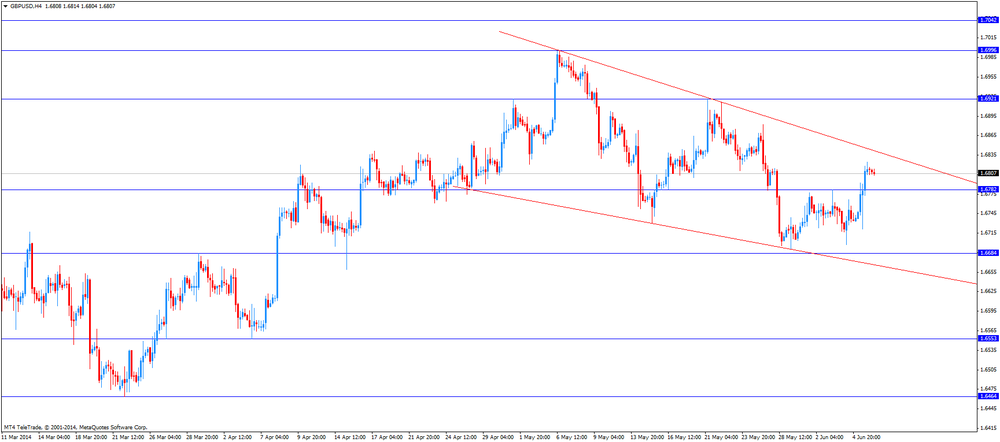

The British pound traded lower against the U.S. dollar. The U.K. trade deficit rose to £8.92 billion in April, from £8.29 billion in March. March’s figure was revised up from a deficit of £8.48 billion. Analysts had expected the U.K. trade deficit to increase to £8.65 billion.

The U.K. consumer inflation expectations declined to 2.6% from 2.8%.

The Swiss franc traded lower against the U.S. dollar. Switzerland’s consumer price index climbed 0.3% in May, exceeding expectations for a 0.2% gain, after a 0.1% rise in April.

The Canadian dollar declined against the U.S. dollar due to the higher unemployment rate in Canada. Canada's unemployment rate climbed to 7.0% in May, from 6.9% in April. Analysts had expected the unemployment rate to remain unchanged.

The Canadian economy added 25,800 in May, exceeding expectations for a 25,000 gain, after a 28,900 decline in April. Most of the gains were in part-time work. The job growth in the private sector was flat.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major reports in New Zealand.

The Australian dollar traded mixed against the U.S. dollar. The AI Group/HIA construction index for Australia increased to 46.7 in May from 45.9 in April. The index still remained in contractionary territory due to the weakness in engineering and commercial construction. Figures above 50 indicate expansion while figures below signal contraction.

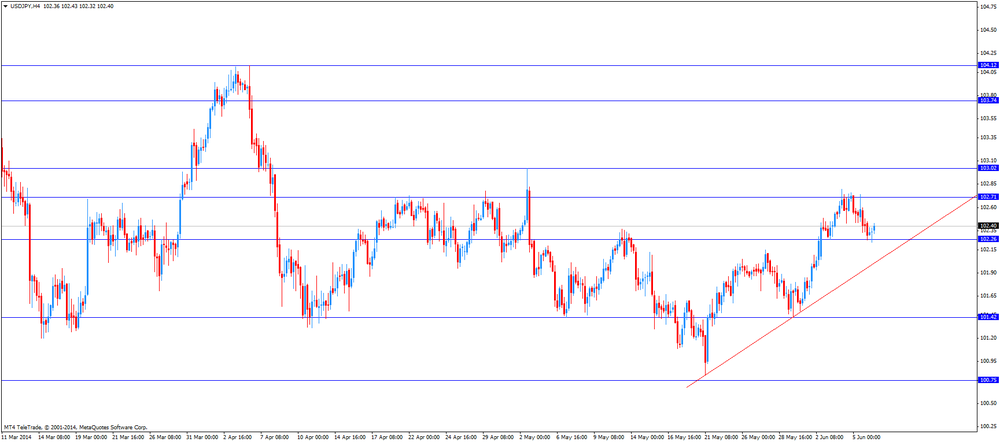

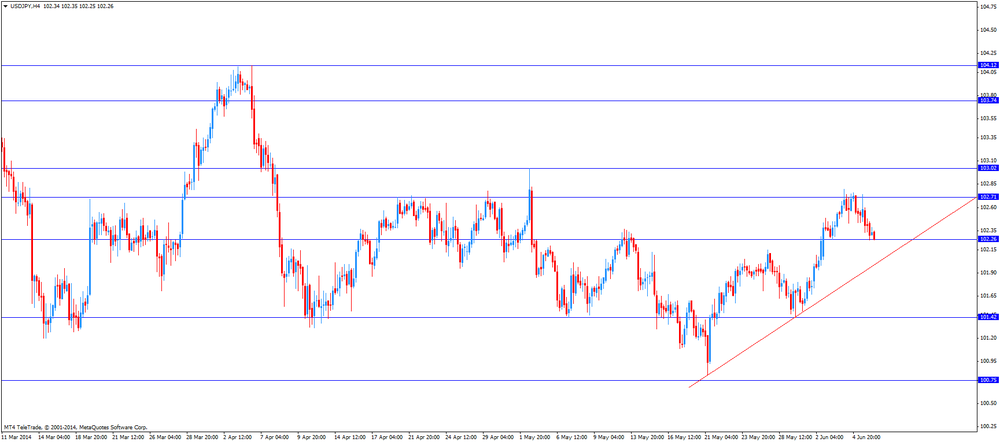

The Japanese yen declined against the U.S. dollar after the U.S. labour market data. Japan’s leading economic index declined to 106.6 in April from 107.1 in March, but exceeding expectations for a decline to 106.2.

Japan’s coincident index slid to 111.1 in April from 114.5 in March.

-

15:35

Canadian unemployment rate climbs to 7% in May

Statistics Canada released the labour market data on Friday. Canada's unemployment rate climbed to 7.0% in May, from 6.9% in April. Analysts had expected the unemployment rate to remain unchanged.

The Canadian economy added 25,800 in May, exceeding expectations for a 25,000 gain, after a 28,900 decline in April. Most of the gains were in part-time work. The job growth in the private sector was flat.

Full-time employment slid by 29,100 in May while part-time jobs rose by 54,900.

-

14:51

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3545-50, $1.3600, $1.3650

USD/JPY Y102.25, Y102.35, Y102.50, Y102.75-80, Y102.90-103.00

GBP/USD $1.6725, $1.6765, $1.6850

EUR/GBP stg0.8150, stg0.8220

USD/CHF Chf0.8905

AUD/USD $0.9275-80, $0.9300

USD/CAD C$1.0900-15, C$1.0925, C$1.0945-50, C$1.0985-90

-

14:37

U.S. unemployment rate remained unchanged at 6.3% in May

The Labor Department released its monthly report on hiring and joblessness on Friday. The unemployment rate remained unchanged at 6.3% in May. Analysts had expected an increase to 6.4%.

The U.S. economy added 217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain in April. April’s figure was revised down from a 288,000 increase.

Total U.S. payrolls reached 138.5 million in May, exceeding the previous peak level of employment in the U.S. set in January 2008.

These figures seem to be another sign that the U.S. economy gaining the kind of sustained momentum.

-

13:32

Canada: Labor Productivity, Quarter I -0.1% (forecast +0.7%)

-

13:30

U.S.: Nonfarm Payrolls, May 217 (forecast 219)

-

13:30

U.S.: Unemployment Rate, May 6,3% (forecast 6.4%)

-

13:30

Canada: Employment , May +25.8 (forecast +12.3)

-

13:30

Canada: Unemployment rate, May 7.0% (forecast 6.9%)

-

13:12

Foreign exchange market. European session: the euro traded lower against the U.S. dollar, but recovered a part of its losses

Economic calendar (GMT0):

05:00 Japan Leading Economic Index April 107.1 106.2 106.6

05:00 Japan Coincident Index April 114.5 111.1

06:00 Germany Trade Balance April 14.8 14.3 17.7

06:00 Germany Industrial Production s.a. (MoM) April -0.5% +0.4% +0.2%

06:00 Germany Industrial Production (YoY) April +3.0% +1.8%

06:00 Germany Current Account April 19.5 18.4

06:45 France Trade Balance, bln April -4.9 -5.0 -3.9

07:00 Switzerland Foreign Currency Reserves April 438.9 444.4

07:15 Switzerland Consumer Price Index (MoM) May +0.1% +0.2% +0.3%

07:15 Switzerland Consumer Price Index (YoY) May 0.0% +0.1% +0.2%

08:30 United Kingdom Consumer Inflation Expectations Quarter II +2.8% +2.6%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. jobs market data. The unemployment rate in the U.S. should increase to 6.4% in May, after 6.3% in April.

The number of additional jobs in the private sector should climb by 218,000 jobs in May, after 288,000 jobs in April.

The euro traded lower against the U.S. dollar, but recovered a part of its losses. Market participants seemed to be unimpressed by the stimulus measures by the European Central Bank.

German economic data was released. Germany's trade surplus climbed to €17.7 billion in April from €15.0 billion in March. March’s figure was revised up from a surplus of €14.8 billion. Analysts had expected Germany’s trade surplus to increase to €15.2 billion.

German industrial production rose 0.2% in April, missing expectations for a 0.4% gain, after a 0.5% decline in March. On a yearly basis, the industrial production in Germany increased 1.8% in April, after a 3.0% rise in March.

Germany’s current account surplus declined to €18.4 billion in April from €19.5 billion in March.

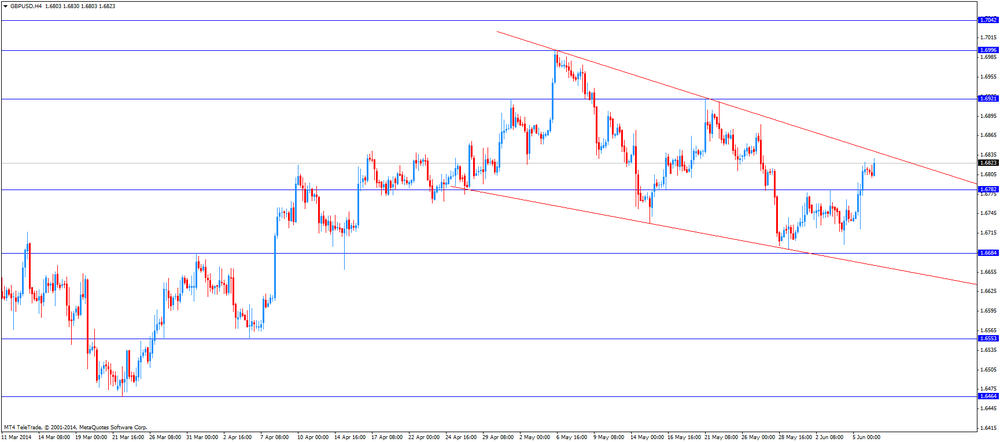

The British pound traded mixed against the U.S. dollar. The U.K. trade deficit rose to £8.92 billion in April, from £8.29 billion in March. March’s figure was revised up from a deficit of £8.48 billion. Analysts had expected the U.K. trade deficit to increase to £8.65 billion.

The U.K. consumer inflation expectations declined to 2.6% from 2.8%.

The Swiss franc traded mixed against the U.S. dollar. Switzerland’s consumer price index climbed 0.3% in May, exceeding expectations for a 0.2% gain, after a 0.1% rise in April.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in the Canada should remain unchanged at 6.9% in May.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Labor Productivity Quarter I +1.0% +0.7%

12:30 Canada Employment May -28.9 +12.3

12:30 Canada Unemployment rate May 6.9% 6.9%

12:30 U.S. Average hourly earnings May 0.0% +0.2%

12:30 U.S. Nonfarm Payrolls May 288 219

12:30 U.S. Unemployment Rate May 6.3% 6.4%

-

13:00

Orders

EUR/USD

Offers $1.3695/700, $1.3688, $1.3670/80

Bids $1.3605/00, $1.3500

GBP/USD

Offers $1.6890-900, $1.6860, $1.6835/40

Bids $1.6800

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9300, $0.9255/50, $0.9235/30

EUR/JPY

Offers Y140.80, Y140.50, Y140.00

Bids Y139.10/00, Y138.50

USD/JPY

Offers Y103.50, Y103.00, Y102.75/80, Y102.50

Bids Y102.00, Y101.60, Y101.50

EUR/GBP

Offers stg0.8160/65, stg0.8150

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

10:26

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3545-50, $1.3600, $1.3650

USD/JPY Y102.25, Y102.35, Y102.50, Y102.75-80, Y102.90-103.00

GBP/USD $1.6725, $1.6765, $1.6850

EUR/GBP stg0.8150, stg0.8220

USD/CHF Chf0.8905

AUD/USD $0.9275-80, $0.9300

USD/CAD C$1.0900-15, C$1.0925, C$1.0945-50, C$1.0985-90

-

09:53

Foreign exchange market. Asian session: the U.S. dollar traded lower against the most major currencies after the European Central Bank’ interest rate cut

Economic calendar (GMT0):

05:00 Japan Leading Economic Index April 107.1 106.2 106.6

05:00 Japan Coincident Index April 114.5 111.1

06:00 Germany Trade Balance April 14.8 14.3 17.7

06:00 Germany Industrial Production s.a. (MoM) April -0.5% +0.4% +0.2%

06:00 Germany Industrial Production (YoY) April +3.0% +1.8%

06:00 Germany Current Account April 19.5 18.4

06:45 France Trade Balance, bln April -4.9 -5.0 -3.9

07:00 Switzerland Foreign Currency Reserves April 438.9 444.4

07:15 Switzerland Consumer Price Index (MoM) May +0.1% +0.2% +0.3%

07:15 Switzerland Consumer Price Index (YoY) May 0.0% +0.1% +0.2%

08:30 United Kingdom Consumer Inflation Expectations Quarter II +2.8% +2.6%

The U.S. dollar traded lower against the most major currencies after the European Central Bank’ interest rate cut. The European Central Bank cut its interest rate to 0.15% from 0.25%. Analysts had expected a cut to 0.1%.

The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

Investors are awaiting the U.S. jobs market data later in the day.

The New Zealand dollar increased against the U.S dollar. The kiwi was supported by after the European Central Bank’ interest rate cut. No economic data was published in New Zealand.

The Australian dollar traded lower against the U.S. dollar after the release of the AI Group/HIA construction index in Australia, but later recovered its losses. The AI Group/HIA construction index for Australia increased to 46.7 in May from 45.9 in April. The index still remained in contractionary territory due to the weakness in engineering and commercial construction. Figures above 50 indicate expansion while figures below signal contraction.

The Japanese yen traded higher against the U.S. dollar after the European Central Bank’ interest rate cut. Japan’s leading economic index declined to 106.6 in April from 107.1 in March, but exceeding expectations for a decline to 106.2.

Japan’s coincident index slid to 111.1 in April from 114.5 in March.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y102.25

The most important news that are expected (GMT0):

12:30 Canada Labor Productivity Quarter I +1.0% +0.7%

12:30 Canada Employment May -28.9 +12.3

12:30 Canada Unemployment rate May 6.9% 6.9%

12:30 U.S. Average hourly earnings May 0.0% +0.2%

12:30 U.S. Nonfarm Payrolls May 288 219

12:30 U.S. Unemployment Rate May 6.3% 6.4%

-

09:30

United Kingdom: Consumer Inflation Expectations, Quarter II +2.6%

-

08:15

Switzerland: Consumer Price Index (MoM) , May +0.3% (forecast +0.2%)

-

08:15

Switzerland: Consumer Price Index (YoY), May +0.2% (forecast +0.1%)

-

08:01

Switzerland: Foreign Currency Reserves, April 444.4

-

07:45

France: Trade Balance, bln, April -3.9 (forecast -5.0)

-

07:00

Germany: Trade Balance, April 17.7 (forecast 14.3)

-

07:00

Germany: Current Account , April 18.4

-

07:00

Germany: Industrial Production s.a. (MoM), April +0.2% (forecast +0.4%)

-

06:25

Options levels on friday, June 6, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3751 (4505)

$1.3720 (4418)

$1.3674 (1351)

Price at time of writing this review: $ 1.3657

Support levels (open interest**, contracts):

$1.3638 (5646)

$1.3584 (4462)

$1.3544 (5474)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 62208 contracts, with the maximum number of contracts with strike price $1,3850 (6552);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 78666 contracts, with the maximum number of contractswith strike price $1,3500 (8454);

- The ratio of PUT/CALL was 1.26 versus 1.30 from the previous trading day according to data from June, 5.

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (1852)

$1.7000 (2704)

$1.6901 (2117)

Price at time of writing this review: $1.6809

Support levels (open interest**, contracts):

$1.6700 (2602)

$1.6600 (2477)

$1.6500 (974)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24576 contracts, with the maximum number of contracts with strike price $1,7000 (2704);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 26897 contracts, with the maximum number of contracts with strike price $1,6700 (2602);

- The ratio of PUT/CALL was 1.09 versus 1.09 from the previous trading day according to data from June, 5.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: AiG Performance of Construction Index, May 46.7

-

00:20

Currencies. Daily history for June 05'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3662 +0,46%

GBP/USD $1,6813 +0,46%

USD/CHF Chf0,8912 -0,64%

USD/JPY Y102,41 -0,30%

EUR/JPY Y139,93 +0,17%

GBP/JPY Y172,18 +0,17%

AUD/USD $0,9335 +0,64%

NZD/USD $0,8494 +0,89%

USD/CAD C$1,0922 -0,16%

-

00:00

Schedule for today, Friday, June 06’2014:

(time / country / index / period / previous value / forecast)05:00 Japan Leading Economic Index April 107.1 106.2

05:00 Japan Coincident Index April 114.5

06:00 Germany Trade Balance April 14.8 14.3

06:00 Germany Industrial Production s.a. (MoM) April -0.5% +0.4%

06:00 Germany Industrial Production (YoY) April +3.0%

06:00 Germany Current Account April 19.5

06:45 France Trade Balance, bln April -4.9 -5.0

07:00 Switzerland Foreign Currency Reserves April 438.9

07:15 Switzerland Consumer Price Index (MoM) May +0.1% +0.2%

07:15 Switzerland Consumer Price Index (YoY) May 0.0% +0.1%

08:30 United Kingdom Consumer Inflation Expectations Quarter II +2.8%

12:30 Canada Labor Productivity Quarter I +1.0% +0.7%

12:30 Canada Employment May -28.9 +12.3

12:30 Canada Unemployment rate May 6.9% 6.9%

12:30 U.S. Average workweek May 34.5

12:30 U.S. Average hourly earnings May 0.0% +0.2%

12:30 U.S. Nonfarm Payrolls May 288 219

12:30 U.S. Unemployment Rate May 6.3% 6.4%

19:00 U.S. Consumer Credit April 17.5 16.6

-