Notícias do Mercado

-

23:22

Currencies. Daily history for Sep 8'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2899 -0,40%

GBP/USD $1,6092 -1,44%

USD/CHF Chf0,9350 +0,42%

USD/JPY Y105,96 +0,83%

EUR/JPY Y136,68 +0,43%

GBP/JPY Y170,5 -0,61%

AUD/USD $0,9278 -1,05%

NZD/USD $0,8277 -0,62%

USD/CAD C$1,0979 +0,89%

-

23:00

Schedule for today, Tuesday, Sep 9’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence August 11

01:30 Australia Home Loans July +0.2% +1.1%

05:00 Japan Consumer Confidence August 41.5 42.3

06:00 Japan Prelim Machine Tool Orders, y/y August +37.7%

06:45 France Trade Balance, bln July -5.4 -5.0

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Industrial Production (MoM) July +0.3% +0.2%

08:30 United Kingdom Industrial Production (YoY) July +1.2% +1.3%

08:30 United Kingdom Manufacturing Production (MoM) July +0.3% +0.3%

08:30 United Kingdom Manufacturing Production (YoY) July +1.9% +2.2%

08:30 United Kingdom Trade in goods July -9.4 -9.1

12:15 Canada Housing Starts August 200 197

14:00 United Kingdom NIESR GDP Estimate August +0.6%

14:00 U.S. JOLTs Job Openings July 4.67 4.72

14:00 U.S. FOMC Member Tarullo Speaks

20:30 U.S. API Crude Oil Inventories September -0.5

23:50 Japan Core Machinery Orders July +8.8% +4.1%

23:50 Japan Core Machinery Orders, y/y July -3.0% +0.6%

-

20:02

U.S.: Consumer Credit , July 26.0 (forecast 17.4)

-

16:38

Foreign exchange market. American session: the Canadian dollar fell against the U.S. dollar despite the better-than-expected Canadian building permits

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

The euro traded mixed against the U.S. dollar. Germany's trade surplus jumped to €22.2 billion in July from €16.4 billion in June, exceeding expectations for a surplus €17.3 billion. June's figure was revised up from a surplus of €16.2 billion.

The Sentix investor confidence index for the Eurozone dropped to -9.8 in September from 2.7 in August, missing forecasts of an increase to 3.2. That was the lowest level since July 2013.

The British pound recovered a part of its losses against the U.S. dollar after a weekend Scotland's independence poll, but traded lower. A weekend poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Swiss franc traded mixed against the U.S. dollar after the mixed economic data from Switzerland. Retail sales in Switzerland declined at an annualized rate of 0.6% in July, missing expectations for a rise of 2.6%, after a 3.3% in June. June's figure was revised down from a 3.4% increase.

Switzerland's consumer price index (CPI) was flat in August, missing expectations for a 0.1% decline, after a 0.4% decrease in July.

On a yearly basis, Swiss CPI increased 0.1% in August (July: 0.0%). Analysts had expected the index to remain flat.

Switzerland's unemployment rate remained unchanged at 3.2% in August, in line with expectations.

The Canadian dollar fell against the U.S. dollar despite the better-than-expected Canadian building permits. Building permits in Canada climbed 11.8% in July, beating expectations for a 4.2% increase, after a 16.4% gain in June. June's figure was revised up from a 13.5% rise.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar despite the better-than-expected job advertisements in Australia. Job advertisements in Australia rose 1.5% in August, after a 0.5% rise in July. July's figure was revised up from a 0.3% gain.

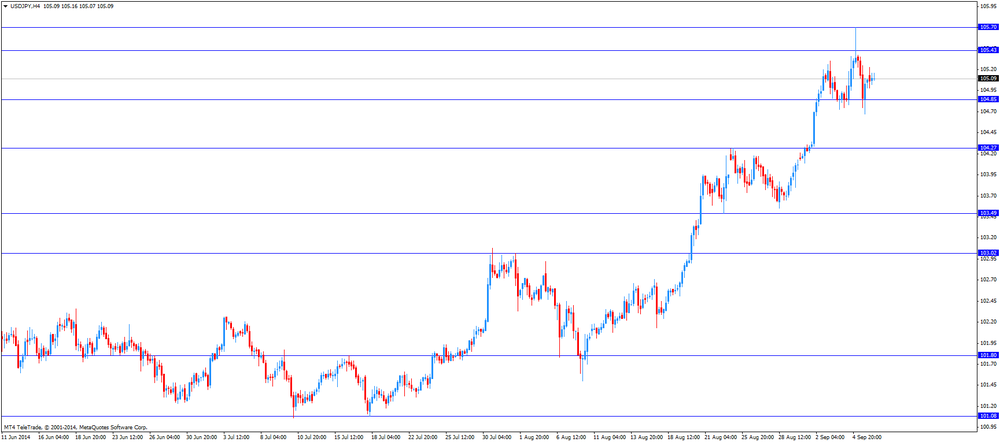

The Japanese yen declined against the U.S. dollar. Japan's gross domestic product (GDP) was revised down to a fall of 1.8% in the second quarter from the previous decline of 1.7%.

Japan's current account surplus fell to 99.3 billion yen in July, from 125.6 billion yen in June.

Japan's economy watchers' current conditions index decreased to 47.4 in August from 51.3 in July, missing expectations for an increase to 52.4.

Japan's economy watchers' future conditions index dropped to 50.4 in August from 51.5 in July.

-

13:30

Canada: Building Permits (MoM) , July +11.8% (forecast +4.2%)

-

13:07

Foreign exchange market. European session: the British pound dropped against the U.S. dollar after a weekend Scotland's independence poll

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:30 Australia ANZ Job Advertisements (MoM) August +0.5% +1.5%

01:30 China Trade Balance, bln August 47.3 40.8 49.83

05:00 Japan Eco Watchers Survey: Current August 51.3 52.4 47.4

05:00 Japan Eco Watchers Survey: Outlook August 51.5 50.4

05:45 Switzerland Unemployment Rate August 3.2% 3.2% 3.2%

06:00 Germany Trade Balance July 16.2 17.3 22.2

07:00 United Kingdom Halifax house price index August +1.4% +0.2% +0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2% +9.7%

07:15 Switzerland Retail Sales Y/Y July +3.3% Revised From +3.4% +3.7% -0.6%

07:15 Switzerland Consumer Price Index (MoM) August -0.4% -0.1% 0.0%

07:15 Switzerland Consumer Price Index (YoY) August 0.0% 0.0% +0.1%

08:30 Eurozone Sentix Investor Confidence September 2.7 3.2 -9.8

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by Friday's U.S. labour market data. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

The euro traded mixed against the U.S. dollar. Germany's trade surplus jumped to €22.2 billion in July from €16.4 billion in June, exceeding expectations for a surplus €17.3 billion. June's figure was revised up from a surplus of €16.2 billion.

The Sentix investor confidence index for the Eurozone dropped to -9.8 in September from 2.7 in August, missing forecasts of an increase to 3.2. That was the lowest level since July 2013.

The British pound dropped against the U.S. dollar after a weekend Scotland's independence poll. A weekend poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Swiss franc traded mixed against the U.S. dollar after the mixed economic data from Switzerland. Retail sales in Switzerland declined at an annualized rate of 0.6% in July, missing expectations for a rise of 2.6%, after a 3.3% in June. June's figure was revised down from a 3.4% increase.

Switzerland's consumer price index (CPI) was flat in August, missing expectations for a 0.1% decline, after a 0.4% decrease in July.

On a yearly basis, Swiss CPI increased 0.1% in August (July: 0.0%). Analysts had expected the index to remain flat.

Switzerland's unemployment rate remained unchanged at 3.2% in August, in line with expectations.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian building permits. Building permits are expected to increase 4.2% in July, after a 13.5% gain in June.

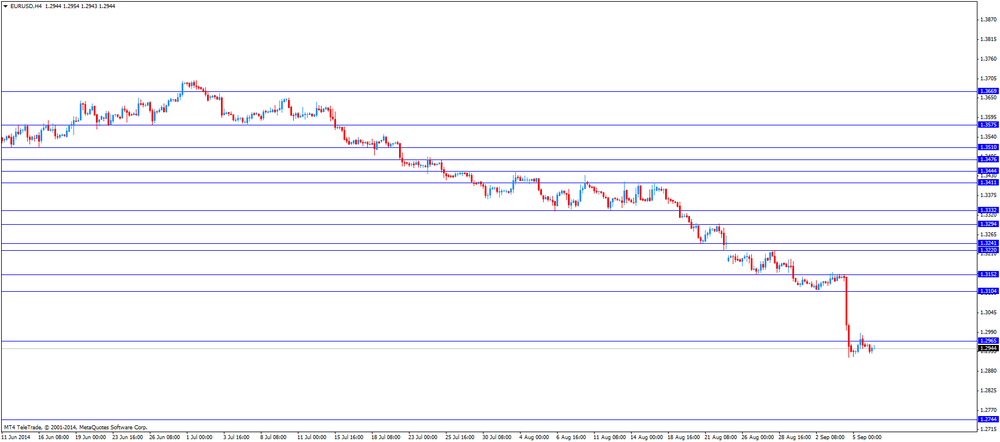

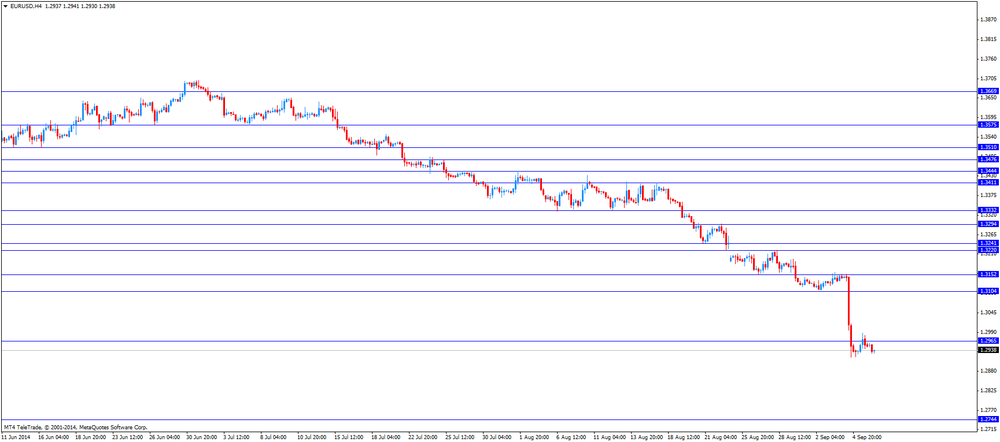

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6102

USD/JPY: the currency pair rose to Y105.33

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) July +13.5% +4.2%

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Tertiary Industry Index July -0.1% -0.3%

-

12:48

Orders

EUR/USD

Offers $1.3050, $1.3000

Bids $1.2900, $1.2840-50, $1.2800

GBP/USD

Offers $1.6290-300, $1.6250/55, $1.6200/05, $1.6180/85, $1.6150/55

Bids $1.6100, $1.6080, 1.6050

AUD/USD

Offers $0.9450, $0.9415/20, $0.9375/80

Bids $0.9320, $0.9300, $0.9280, $0.9255/50

EUR/JPY

Offers Y137.00, Y136.80, Y136.50

Bids Y135.50, Y135.25, Y135.00, Y134.75

USD/JPY

Offers Y106.00, Y105.80, Y105.75, Y105.45/50, Y105.25

Bids Y104.55/50, Y104.00

EUR/GBP

Offers stg0.8150, stg0.8100, stg0.8040

Bids stg0.7900

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.2940(E100mn), $1.3000(E164mn), $1.3100(E1.02bn)

USD/JPY Y104.50($770mn), Y105.00($451mn), Y105.25($410mn), Y105.75-80($347mn)

GBP/USD $1.6280(stg100mn), $1.6300(stg246mn), $1.6350($182mn)

EUR/GBP stg0.7950(E299mn)

AUD/USD $0.9300(A$307mn), $0.9355(A$184mn)

NZD/USD $0.8350(NZ$168mn), $0.8375(NZ$472mn)

USD/CAD C$1.0815-20($425mn), C$1.0870($400mn), C$1.0900-10($203M), C$1.0950-55($630M)

-

09:57

Foreign exchange market. Asian session: the Japanese yen traded mixed against the U.S. dollar after the weak economic data from Japan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:30 Australia ANZ Job Advertisements (MoM) August +0.5% +1.5%

01:30 China Trade Balance, bln August 47.3 40.8 49.83

05:00 Japan Eco Watchers Survey: Current August 51.3 52.4 47.4

05:00 Japan Eco Watchers Survey: Outlook August 51.5 50.4

05:45 Switzerland Unemployment Rate August 3.2% 3.2% 3.2%

06:00 Germany Trade Balance July 16.2 17.3 22.2

07:00 United Kingdom Halifax house price index August +1.4% +0.2% +0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2% +9.7%

07:15 Switzerland Retail Sales Y/Y July +3.3% Revised From +3.4% +3.7% -0.6%

07:15 Switzerland Consumer Price Index (MoM) August -0.4% -0.1% 0.0%

07:15 Switzerland Consumer Price Index (YoY) August 0.0% 0.0% +0.1%

08:30 Eurozone Sentix Investor Confidence September 2.7 3.2 -9.8

The U.S. dollar traded higher against the most major currencies. The greenback was supported by Friday's U.S. labour market data. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar despite the better-than-expected job advertisements in Australia. Job advertisements in Australia rose 1.5% in August, after a 0.5% rise in July. July's figure was revised up from a 0.3% gain.

The Japanese yen traded mixed against the U.S. dollar after the weak economic data from Japan. Japan's gross domestic product (GDP) was revised down to a fall of 1.8% in the second quarter from the previous decline of 1.7%.

Japan's current account surplus fell to 99.3 billion yen in July, from 125.6 billion yen in June.

Japan's economy watchers' current conditions index decreased to 47.4 in August from 51.3 in July, missing expectations for an increase to 52.4.

Japan's economy watchers' future conditions index dropped to 50.4 in August from 51.5 in July.

EUR/USD: the currency pair fell to $1.2931

GBP/USD: the currency pair dropped to $1.6176

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) July +13.5% +4.2%

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Tertiary Industry Index July -0.1% -0.3%

-

08:16

Switzerland: Retail Sales Y/Y, July -0.6% (forecast +3.7%)

-

08:15

Switzerland: Consumer Price Index (YoY), August +0.1% (forecast 0.0%)

-

08:15

Switzerland: Consumer Price Index (MoM) , August 0.0% (forecast -0.1%)

-

07:59

United Kingdom: Halifax house price index, August +0.1% (forecast +0.2%)

-

07:59

United Kingdom: Halifax house price index 3m Y/Y, August +9.7%

-

07:00

Germany: Trade Balance, July 22.2 (forecast 17.3)

-

06:45

Switzerland: Unemployment Rate, August 3.2% (forecast 3.2%)

-

03:01

China: Trade Balance, bln, August 49.83 (forecast 40.8)

-

02:30

Australia: ANZ Job Advertisements (MoM), August +1.5%

-

00:51

Japan: Current Account (adjusted), bln, July 99.3

-

00:50

Japan: GDP, q/q, Quarter II -1.8%

-