Notícias do Mercado

-

23:39

Commodities. Daily history for Sep 8'2014:

(raw materials / closing price /% change)

Light Crude 93.12 +0.50%

Gold 1,256.30 +0.16%

-

16:40

Oil: an overview of the market situation

Oil fell as falling Chinese imports bolstered concern that slower growth will worsen a global oil surplus. In China, imports fell for a second month as a property slump hurt domestic demand. The trade surplus climbed to a record of $49.8 billion in August as exports rose on the back of increased shipments to the U.S. and Europe.

WTI for October delivery dropped 1.35% to $92.12 a barrel on the New York Mercantile Exchange.

Brent for October settlement slipped 0.77% to $99.88 a barrel on the London-based ICE Futures Europe exchange.

-

16:20

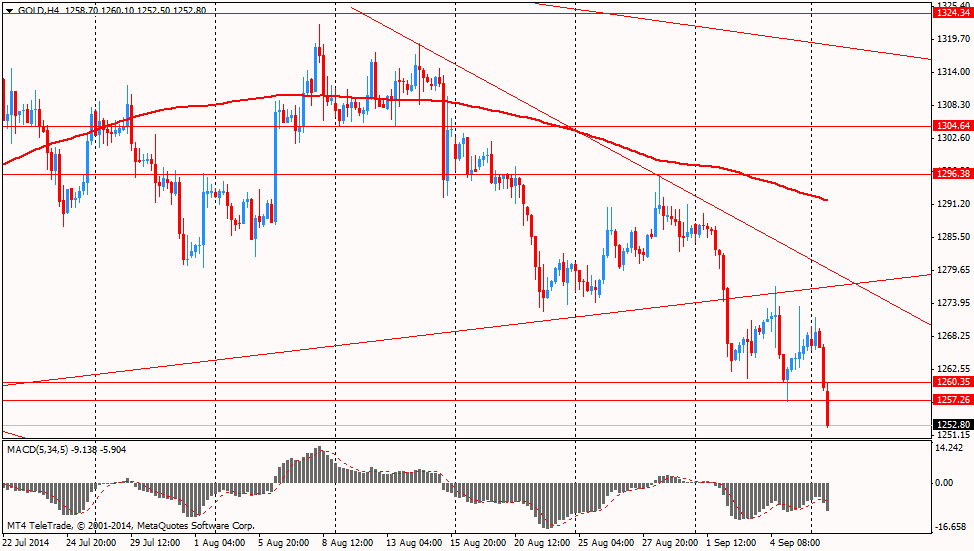

Gold: an overview of the market situation

Gold fell after U.S. Commodity Futures Trading Commission data showed that the net-long position in gold declined 20%to 74,031 futures and options in the week ended Sept. 2, the lowest since June 17. Short holdings betting on a drop increased 44%.

Other data showed that holdings in the SPDR Gold Trust, the biggest ETP backed by bullion, fell 1.2% to 785.72 tons last week, the biggest drop since May 2.

Gold for December delivery fell to $1,252.80 an ounce (-0.66%) on the Comex in New York.

-