Notícias do Mercado

-

23:39

Commodities. Daily history for Sep 8'2014:

(raw materials / closing price /% change)

Light Crude 93.12 +0.50%

Gold 1,256.30 +0.16%

-

23:28

Stocks. Daily history for Sep 8'2014:

(index / closing price / change items /% change)

Nikkei 225 15,705.11 +36.43 +0.23%

Hang Seng 25,190.45 -49.70 -0.20%

Shanghai Composite 2,326.43 +19.57 +0.85%

FTSE 100 6,834.77 -20.33 -0.30%

CAC 40 4,474.93 -11.56 -0.26%

Xetra DAX 9,758.03 +11.01 +0.11%

S&P 500 2,001.54 -6.17 -0.31%

NASDAQ Composite 4,592.29 +9.38 +0.20%

Dow Jones 17,111.42 -25.94 -0.15%

-

23:22

Currencies. Daily history for Sep 8'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2899 -0,40%

GBP/USD $1,6092 -1,44%

USD/CHF Chf0,9350 +0,42%

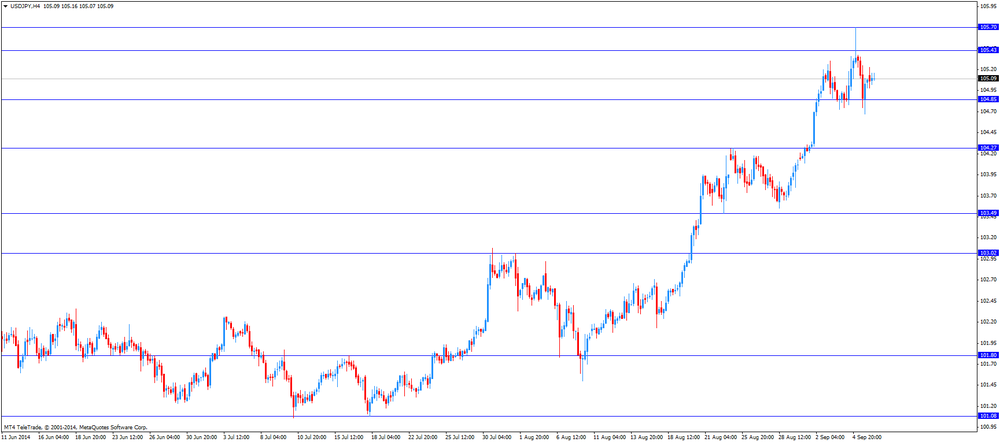

USD/JPY Y105,96 +0,83%

EUR/JPY Y136,68 +0,43%

GBP/JPY Y170,5 -0,61%

AUD/USD $0,9278 -1,05%

NZD/USD $0,8277 -0,62%

USD/CAD C$1,0979 +0,89%

-

23:00

Schedule for today, Tuesday, Sep 9’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence August 11

01:30 Australia Home Loans July +0.2% +1.1%

05:00 Japan Consumer Confidence August 41.5 42.3

06:00 Japan Prelim Machine Tool Orders, y/y August +37.7%

06:45 France Trade Balance, bln July -5.4 -5.0

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Industrial Production (MoM) July +0.3% +0.2%

08:30 United Kingdom Industrial Production (YoY) July +1.2% +1.3%

08:30 United Kingdom Manufacturing Production (MoM) July +0.3% +0.3%

08:30 United Kingdom Manufacturing Production (YoY) July +1.9% +2.2%

08:30 United Kingdom Trade in goods July -9.4 -9.1

12:15 Canada Housing Starts August 200 197

14:00 United Kingdom NIESR GDP Estimate August +0.6%

14:00 U.S. JOLTs Job Openings July 4.67 4.72

14:00 U.S. FOMC Member Tarullo Speaks

20:30 U.S. API Crude Oil Inventories September -0.5

23:50 Japan Core Machinery Orders July +8.8% +4.1%

23:50 Japan Core Machinery Orders, y/y July -3.0% +0.6%

-

20:02

U.S.: Consumer Credit , July 26.0 (forecast 17.4)

-

17:00

European stocks close: most stocks closed lower as tensions over Ukraine weighed on markets

Most stock indices traded lower as tensions over Ukraine weighed on markets. Market participants have concerns whether a ceasefire in eastern Ukraine would hold.

European markets advanced last week as the European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%, and the ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

The Sentix investor confidence index for the Eurozone dropped to -9.8 in September from 2.7 in August, missing forecasts of an increase to 3.2. That was the lowest level since July 2013.

German stocks were driven by the better-than-expected German trade surplus. Germany's trade surplus jumped to €22.2 billion in July from €16.4 billion in June, exceeding expectations for a surplus €17.3 billion. June's figure was revised up from a surplus of €16.2 billion.

Scotland's independence referendum weighed on British markets. A weekend poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

Electrolux AB shares rose 5.0% after purchasing General Electric Co.'s appliance unit.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,834.77 -20.33 -0.30%

DAX 9,758.03 +11.01 +0.11%

CAC 40 4,474.93 -11.56 -0.26%

-

16:40

Oil: an overview of the market situation

Oil fell as falling Chinese imports bolstered concern that slower growth will worsen a global oil surplus. In China, imports fell for a second month as a property slump hurt domestic demand. The trade surplus climbed to a record of $49.8 billion in August as exports rose on the back of increased shipments to the U.S. and Europe.

WTI for October delivery dropped 1.35% to $92.12 a barrel on the New York Mercantile Exchange.

Brent for October settlement slipped 0.77% to $99.88 a barrel on the London-based ICE Futures Europe exchange.

-

16:38

Foreign exchange market. American session: the Canadian dollar fell against the U.S. dollar despite the better-than-expected Canadian building permits

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

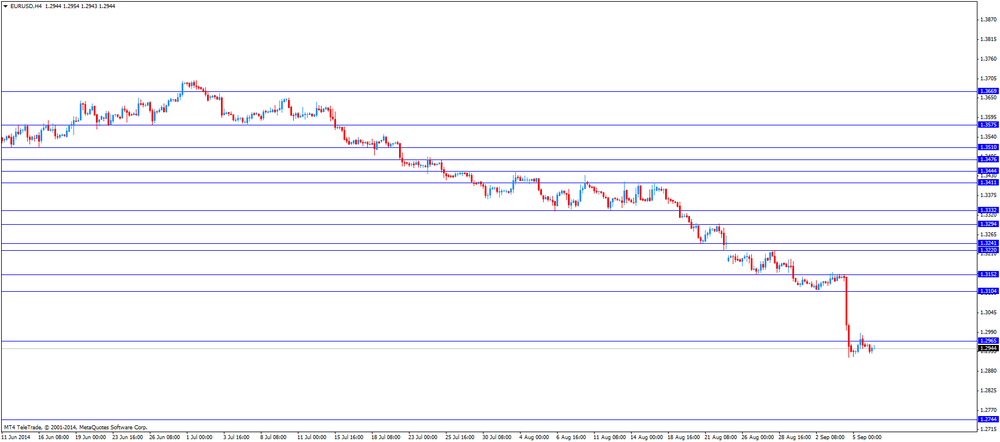

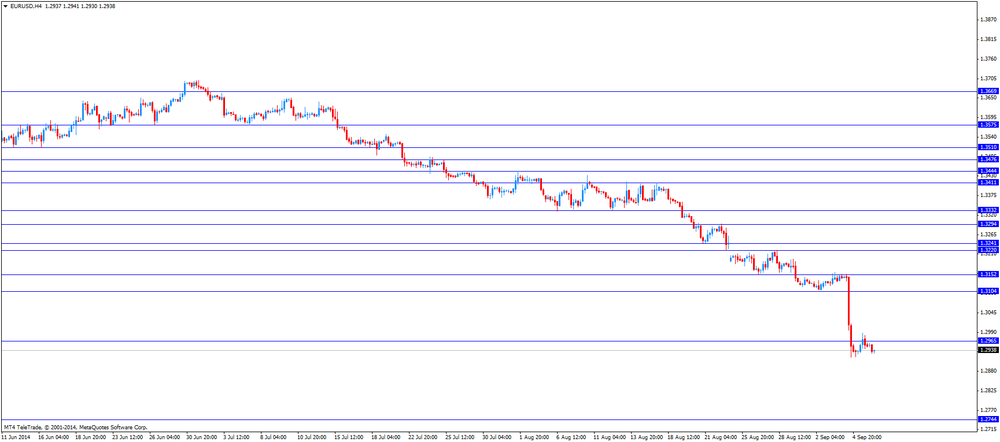

The euro traded mixed against the U.S. dollar. Germany's trade surplus jumped to €22.2 billion in July from €16.4 billion in June, exceeding expectations for a surplus €17.3 billion. June's figure was revised up from a surplus of €16.2 billion.

The Sentix investor confidence index for the Eurozone dropped to -9.8 in September from 2.7 in August, missing forecasts of an increase to 3.2. That was the lowest level since July 2013.

The British pound recovered a part of its losses against the U.S. dollar after a weekend Scotland's independence poll, but traded lower. A weekend poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Swiss franc traded mixed against the U.S. dollar after the mixed economic data from Switzerland. Retail sales in Switzerland declined at an annualized rate of 0.6% in July, missing expectations for a rise of 2.6%, after a 3.3% in June. June's figure was revised down from a 3.4% increase.

Switzerland's consumer price index (CPI) was flat in August, missing expectations for a 0.1% decline, after a 0.4% decrease in July.

On a yearly basis, Swiss CPI increased 0.1% in August (July: 0.0%). Analysts had expected the index to remain flat.

Switzerland's unemployment rate remained unchanged at 3.2% in August, in line with expectations.

The Canadian dollar fell against the U.S. dollar despite the better-than-expected Canadian building permits. Building permits in Canada climbed 11.8% in July, beating expectations for a 4.2% increase, after a 16.4% gain in June. June's figure was revised up from a 13.5% rise.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar despite the better-than-expected job advertisements in Australia. Job advertisements in Australia rose 1.5% in August, after a 0.5% rise in July. July's figure was revised up from a 0.3% gain.

The Japanese yen declined against the U.S. dollar. Japan's gross domestic product (GDP) was revised down to a fall of 1.8% in the second quarter from the previous decline of 1.7%.

Japan's current account surplus fell to 99.3 billion yen in July, from 125.6 billion yen in June.

Japan's economy watchers' current conditions index decreased to 47.4 in August from 51.3 in July, missing expectations for an increase to 52.4.

Japan's economy watchers' future conditions index dropped to 50.4 in August from 51.5 in July.

-

16:20

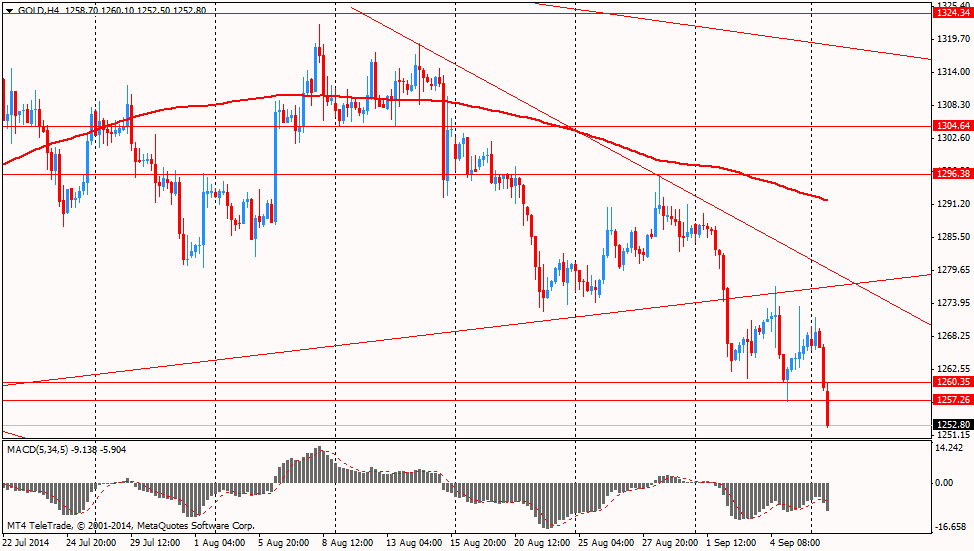

Gold: an overview of the market situation

Gold fell after U.S. Commodity Futures Trading Commission data showed that the net-long position in gold declined 20%to 74,031 futures and options in the week ended Sept. 2, the lowest since June 17. Short holdings betting on a drop increased 44%.

Other data showed that holdings in the SPDR Gold Trust, the biggest ETP backed by bullion, fell 1.2% to 785.72 tons last week, the biggest drop since May 2.

Gold for December delivery fell to $1,252.80 an ounce (-0.66%) on the Comex in New York.

-

14:33

U.S. Stocks open: Dow 17,121.82 -15.54 -0.09%, Nasdaq 4,579.63 -3.27 -0.07%, S&P 2,006.19 -1.52 -0.08%

-

14:28

Before the bell: S&P futures -0.19%, Nasdaq futures -0.08%

U.S. stock-index futures declined after Standard & Poor's 500 Index reached historical high.

Global markets:

Nikkei 15,705.11 +36.43 +0.23%

Hang Seng 25,190.45 -49.70 -0.20%

Shanghai Composite 2,326.43 +19.57 +0.85%

FTSE 6,796.91 -58.19 -0.85%

CAC 4,467.01 -19.48 -0.43%

DAX 9,729.63 -17.39 -0.18%

Crude oil $92.39 (-1.09%)

Gold $1265.00 (-0.15%)

-

14:13

DOW components before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

35.01

+0.03%

29.0K

General Electric Co

GE

26.13

+0.11%

30.5K

United Technologies Corp

UTX

109.00

+0.28%

0.1K

Travelers Companies Inc

TRV

94.00

+0.36%

0.1K

Microsoft Corp

MSFT

46.18

+0.59%

72.4K

Boeing Co

BA

125.71

+0.82%

4.1K

AT&T Inc

T

35.15

0.00%

4.9K

Verizon Communications Inc

VZ

49.93

-0.02%

1.7K

Walt Disney Co

DIS

90.83

-0.12%

4.7K

Merck & Co Inc

MRK

61.09

-0.15%

11.6K

Procter & Gamble Co

PG

83.63

-0.17%

0.1K

Cisco Systems Inc

CSCO

24.95

-0.20%

1.6K

JPMorgan Chase and Co

JPM

59.79

-0.20%

6.7K

McDonald's Corp

MCD

92.88

-0.20%

4.3K

American Express Co

AXP

89.42

-0.21%

2.3K

International Business Machines Co...

IBM

190.78

-0.22%

1.2K

Goldman Sachs

GS

179.34

-0.23%

0.5K

Caterpillar Inc

CAT

108.25

-0.27%

0.3K

Chevron Corp

CVX

127.05

-0.27%

427.8K

Nike

NKE

81.82

-0.27%

2.3K

Johnson & Johnson

JNJ

104.13

-0.28%

1K

UnitedHealth Group Inc

UNH

87.49

-0.30%

1.8K

Home Depot Inc

HD

91.33

-0.31%

1.3K

Pfizer Inc

PFE

29.55

-0.34%

0.1K

E. I. du Pont de Nemours and Co

DD

65.77

-0.35%

0.1K

Exxon Mobil Corp

XOM

98.88

-0.38%

5.1K

The Coca-Cola Co

KO

41.68

-0.38%

1K

Visa

V

213.36

-0.40%

61.2K

Wal-Mart Stores Inc

WMT

77.19

-0.41%

0.1K

-

14:08

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded from Neutral to Buy at Goldman, target $19

Downgrades:

Ford Motor (F) downgraded to Underweight at Morgan Stanley, target lowered to $16 from $17

Other:

Tesla Motors (TSLA) initiated with an Outperform at FBN Securities, target $325

-

13:30

Canada: Building Permits (MoM) , July +11.8% (forecast +4.2%)

-

13:07

Foreign exchange market. European session: the British pound dropped against the U.S. dollar after a weekend Scotland's independence poll

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:30 Australia ANZ Job Advertisements (MoM) August +0.5% +1.5%

01:30 China Trade Balance, bln August 47.3 40.8 49.83

05:00 Japan Eco Watchers Survey: Current August 51.3 52.4 47.4

05:00 Japan Eco Watchers Survey: Outlook August 51.5 50.4

05:45 Switzerland Unemployment Rate August 3.2% 3.2% 3.2%

06:00 Germany Trade Balance July 16.2 17.3 22.2

07:00 United Kingdom Halifax house price index August +1.4% +0.2% +0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2% +9.7%

07:15 Switzerland Retail Sales Y/Y July +3.3% Revised From +3.4% +3.7% -0.6%

07:15 Switzerland Consumer Price Index (MoM) August -0.4% -0.1% 0.0%

07:15 Switzerland Consumer Price Index (YoY) August 0.0% 0.0% +0.1%

08:30 Eurozone Sentix Investor Confidence September 2.7 3.2 -9.8

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by Friday's U.S. labour market data. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

The euro traded mixed against the U.S. dollar. Germany's trade surplus jumped to €22.2 billion in July from €16.4 billion in June, exceeding expectations for a surplus €17.3 billion. June's figure was revised up from a surplus of €16.2 billion.

The Sentix investor confidence index for the Eurozone dropped to -9.8 in September from 2.7 in August, missing forecasts of an increase to 3.2. That was the lowest level since July 2013.

The British pound dropped against the U.S. dollar after a weekend Scotland's independence poll. A weekend poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Swiss franc traded mixed against the U.S. dollar after the mixed economic data from Switzerland. Retail sales in Switzerland declined at an annualized rate of 0.6% in July, missing expectations for a rise of 2.6%, after a 3.3% in June. June's figure was revised down from a 3.4% increase.

Switzerland's consumer price index (CPI) was flat in August, missing expectations for a 0.1% decline, after a 0.4% decrease in July.

On a yearly basis, Swiss CPI increased 0.1% in August (July: 0.0%). Analysts had expected the index to remain flat.

Switzerland's unemployment rate remained unchanged at 3.2% in August, in line with expectations.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian building permits. Building permits are expected to increase 4.2% in July, after a 13.5% gain in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6102

USD/JPY: the currency pair rose to Y105.33

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) July +13.5% +4.2%

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Tertiary Industry Index July -0.1% -0.3%

-

12:48

Orders

EUR/USD

Offers $1.3050, $1.3000

Bids $1.2900, $1.2840-50, $1.2800

GBP/USD

Offers $1.6290-300, $1.6250/55, $1.6200/05, $1.6180/85, $1.6150/55

Bids $1.6100, $1.6080, 1.6050

AUD/USD

Offers $0.9450, $0.9415/20, $0.9375/80

Bids $0.9320, $0.9300, $0.9280, $0.9255/50

EUR/JPY

Offers Y137.00, Y136.80, Y136.50

Bids Y135.50, Y135.25, Y135.00, Y134.75

USD/JPY

Offers Y106.00, Y105.80, Y105.75, Y105.45/50, Y105.25

Bids Y104.55/50, Y104.00

EUR/GBP

Offers stg0.8150, stg0.8100, stg0.8040

Bids stg0.7900

-

12:05

European stock markets mid session: stocks traded lower due to profit-taking

Stock indices traded lower due to profit-taking. European markets advanced last week as the European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%, and the ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

Germany's trade surplus jumped to €22.2 billion in July from €16.4 billion in June, exceeding expectations for a surplus €17.3 billion. June's figure was revised up from a surplus of €16.2 billion.

The Sentix investor confidence index for the Eurozone dropped to -9.8 in September from 2.7 in August, missing forecasts of an increase to 3.2. That was the lowest level since July 2013.

Scotland's independence referendum weighed on British markets. A weekend poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

Electrolux AB shares rose 6.4% after purchasing General Electric Co.'s appliance unit.

Current figures:

Name Price Change Change %

FTSE 100 6,787.9 -67.20 -0.98%

DAX 9,736.66 -10.36 -0.11%

CAC 40 4,471.91 -14.58 -0.32%

-

10:45

Asian Stocks close: stocks closed mixed after the better-than-expected Chines trade surplus

Asian stock indices closed mixed after the better-than-expected Chines trade surplus. China's trade surplus rose to $49.83 billion in August from $47.3 billion in July. Analysts had expected the trade surplus to decline to $40.8 billion.

Chinese exports increased 9.4% in August, while imports dropped 2.4%.

China's mainland markets were closed for a holiday.

Japan's gross domestic product (GDP) was revised down to a fall of 1.8% in the second quarter from the previous decline of 1.7%.

Japan's current account surplus fell to 99.3 billion yen in July, from 125.6 billion yen in June.

Japan's economy watchers' current conditions index decreased to 47.4 in August from 51.3 in July, missing expectations for an increase to 52.4.

Japan's economy watchers' future conditions index dropped to 50.4 in August from 51.5 in July.

Indexes on the close:

Nikkei 225 15,705.11 +36.43 +0.23%

Hang Seng 25,190.45 -49.70 -0.20%

Shanghai Composite closed

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.2940(E100mn), $1.3000(E164mn), $1.3100(E1.02bn)

USD/JPY Y104.50($770mn), Y105.00($451mn), Y105.25($410mn), Y105.75-80($347mn)

GBP/USD $1.6280(stg100mn), $1.6300(stg246mn), $1.6350($182mn)

EUR/GBP stg0.7950(E299mn)

AUD/USD $0.9300(A$307mn), $0.9355(A$184mn)

NZD/USD $0.8350(NZ$168mn), $0.8375(NZ$472mn)

USD/CAD C$1.0815-20($425mn), C$1.0870($400mn), C$1.0900-10($203M), C$1.0950-55($630M)

-

09:57

Foreign exchange market. Asian session: the Japanese yen traded mixed against the U.S. dollar after the weak economic data from Japan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:30 Australia ANZ Job Advertisements (MoM) August +0.5% +1.5%

01:30 China Trade Balance, bln August 47.3 40.8 49.83

05:00 Japan Eco Watchers Survey: Current August 51.3 52.4 47.4

05:00 Japan Eco Watchers Survey: Outlook August 51.5 50.4

05:45 Switzerland Unemployment Rate August 3.2% 3.2% 3.2%

06:00 Germany Trade Balance July 16.2 17.3 22.2

07:00 United Kingdom Halifax house price index August +1.4% +0.2% +0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2% +9.7%

07:15 Switzerland Retail Sales Y/Y July +3.3% Revised From +3.4% +3.7% -0.6%

07:15 Switzerland Consumer Price Index (MoM) August -0.4% -0.1% 0.0%

07:15 Switzerland Consumer Price Index (YoY) August 0.0% 0.0% +0.1%

08:30 Eurozone Sentix Investor Confidence September 2.7 3.2 -9.8

The U.S. dollar traded higher against the most major currencies. The greenback was supported by Friday's U.S. labour market data. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar despite the better-than-expected job advertisements in Australia. Job advertisements in Australia rose 1.5% in August, after a 0.5% rise in July. July's figure was revised up from a 0.3% gain.

The Japanese yen traded mixed against the U.S. dollar after the weak economic data from Japan. Japan's gross domestic product (GDP) was revised down to a fall of 1.8% in the second quarter from the previous decline of 1.7%.

Japan's current account surplus fell to 99.3 billion yen in July, from 125.6 billion yen in June.

Japan's economy watchers' current conditions index decreased to 47.4 in August from 51.3 in July, missing expectations for an increase to 52.4.

Japan's economy watchers' future conditions index dropped to 50.4 in August from 51.5 in July.

EUR/USD: the currency pair fell to $1.2931

GBP/USD: the currency pair dropped to $1.6176

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) July +13.5% +4.2%

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Tertiary Industry Index July -0.1% -0.3%

-

08:16

Switzerland: Retail Sales Y/Y, July -0.6% (forecast +3.7%)

-

08:15

Switzerland: Consumer Price Index (MoM) , August 0.0% (forecast -0.1%)

-

08:15

Switzerland: Consumer Price Index (YoY), August +0.1% (forecast 0.0%)

-

07:59

United Kingdom: Halifax house price index, August +0.1% (forecast +0.2%)

-

07:59

United Kingdom: Halifax house price index 3m Y/Y, August +9.7%

-

07:00

Germany: Trade Balance, July 22.2 (forecast 17.3)

-

06:45

Switzerland: Unemployment Rate, August 3.2% (forecast 3.2%)

-

03:01

China: Trade Balance, bln, August 49.83 (forecast 40.8)

-

02:59

Nikkei 225 15,693.45 +24.77 +0.16%, Hang Seng 25,197.42 -42.73 -0.17%, S&P/ASX 200 5,586.4 -12.29 -0.22%

-

02:30

Australia: ANZ Job Advertisements (MoM), August +1.5%

-

00:51

Japan: Current Account (adjusted), bln, July 99.3

-

00:50

Japan: GDP, q/q, Quarter II -1.8%

-