Notícias do Mercado

-

23:45

New Zealand: GDP q/q, Quarter I +1.0% (forecast +1.2%)

-

23:45

New Zealand: GDP y/y, Quarter I +3.8% (forecast +3.7%)

-

19:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

19:00

U.S.: FOMC QE Decision, 35 (forecast 35)

-

16:42

Foreign exchange market. American session: the U.S. dollar traded slightly lower against the most major currencies ahead of the Fed’s interest decision

The U.S. dollar traded slightly lower against the most major currencies ahead of the Fed’s interest decision today. Market participants expect the Fed will cut its monthly asset purchases by another $10 billion to $35 billion, but the Fed will keep its interest rate unchanged until 2015.

The U.S. current account deficit increased to $111.2 billion in the first quarter from -$87.3 billion in the fourth quarter of 2013. That was the largest level in 18 months. The fourth quarter of 2013 figure was revised down from a deficit of $81.1 billion. Analysts had expected the trade deficit to widen to $96.9 billion.

Exports declined by 1.3% during the first quarter, while imports climbed by 1.5%.

The euro increased against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded lower against the U.S. dollar after the Bank of England’s June meeting minutes. The BoE’s monetary policy committee voted unanimously to leave interest rates unchanged at their record low of 0.5% and quantitative easing at £375bn.

The Bank of England policymakers were surprised that markets had not saw a higher chance of an interest rate hike in 2014. But there are still concerns over interest hike this year. The BoE said interest rise could reduce production capacity and it is difficult to revoke the decision.

The Swiss franc traded higher against the U.S. dollar. Credit Suisse ZEW indicator declined to 4.8 points in June from 7.4 in May, missing expectations for an increase to 10.0 points.

The Canadian dollar traded mixed against the U.S. dollar after the wholesale sales in Canada. The wholesale sales in Canada climbed 1.2% in April, exceeding expectations for a 0.3% gain, after a 0.4% decline in March.

The New Zealand dollar increased against the U.S dollar ahead of the Fed’s interest decision. New Zealand’s current account rose to a surplus of NZ$1.41 billion in the first quarter, from a deficit of NZ$1.51 billion in the fourth quarter of 2013. The fourth quarter of 2013 figure was revised down from a deficit of NZ$1.43 billion. Analysts had expected an increase to a surplus of NZ$1.30 billion.

The Australian dollar traded little changed against the U.S. dollar ahead of the Fed’s interest decision. The Conference Board released its leading index for Australia. The index declined 0.1% in April, after a flat reading in March.

The Japanese yen traded higher against the U.S. dollar. The Bank of Japan released its monetary policy meeting minutes. The BoJ said the country's economy is expected to continue its moderate recovery and the current monetary easing appears to be having the intended results.

The BoJ reported that the political unrest in Thailand could impact Japan's exports.

Japan's merchandise trade deficit reached Y909 billion in May, after a deficit of Y811.7 billion in April. Analysts had expected the trade deficit to widen to Y1,189.3 billion.

Japan’s exports declined 2.7% year-on-year in May. That was the first decline in 15 months. Imports dropped at annual rate by 3.6%.

-

15:30

U.S.: Crude Oil Inventories, June -0.6 (forecast -0.6)

-

14:47

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3540, $1.3575/85, $1.3640

USD/JPY Y101.40/50, Y102.30, Y102.60

USD/CAD Cad1.0800, Cad1.0870

AUD/USD $0.9340/50, $0.9400, $0.9450, $0.9500

GBP/USD $1.6915

EUR/GBP stg0.7975, stg0.8075

-

13:30

Canada: Wholesale Sales, m/m, April +1.2% (forecast +0.3%)

-

13:30

U.S.: Current account, bln, Quarter I -111.2 (forecast -96)

-

13:05

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the Bank of England’s June meeting minutes

Economic calendar (GMT0):

00:00 Australia Conference Board Australia Leading Index April 0.0% -0.1%

00:30 Australia Leading Index April -0.5% +0.1%

08:30 United Kingdom Bank of England Minutes

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June 7.4 10.0 4.8

11:15 United Kingdom MPC Member Weale Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the Fed’s interest decision today. Market participants expect the Fed will cut its monthly asset purchases by another $10 billion to $35 billion, but the Fed will keep its interest rate unchanged until 2015.

The U.S. currency was still supported by the yesterday’s better-than expected U.S. consumer inflation. The consumer price index in the U.S. rose 0.4% in May, exceeding expectations for a 0.2% gain, after a 0.3% increase in April.

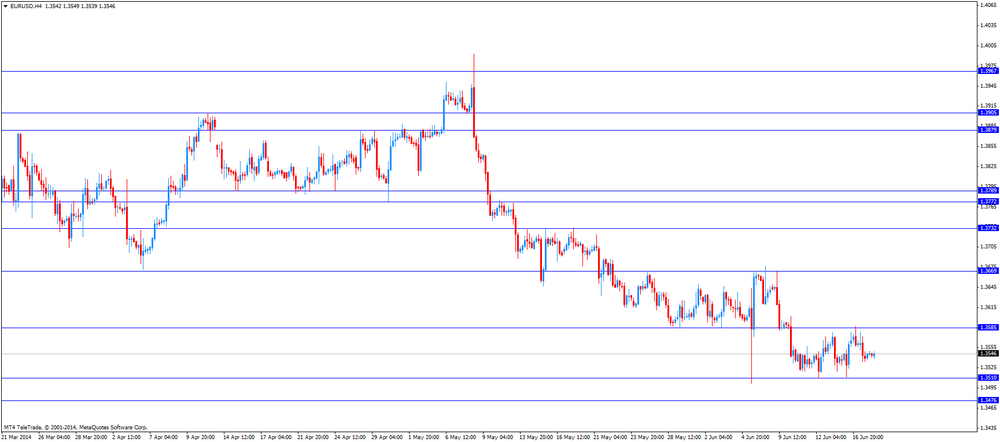

The euro increased against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded lower against the U.S. dollar after the Bank of England’s June meeting minutes. The BoE’s monetary policy committee voted unanimously to leave interest rates unchanged at their record low of 0.5% and quantitative easing at £375bn.

The Bank of England policymakers were surprised that markets had not saw a higher chance of an interest rate hike in 2014. But there are still concerns over interest hike this year. The BoE said interest rise could reduce production capacity and it is difficult to revoke the decision.

The Swiss franc traded higher against the U.S. dollar. Credit Suisse ZEW indicator declined to 4.8 points in June from 7.4 in May, missing expectations for an increase to 10.0 points.

The Canadian dollar traded mixed against the U.S. dollar ahead of the wholesale sales in Canada. The wholesale sales in Canada should climb 0.3% in April, after a 0.4% decline in March.

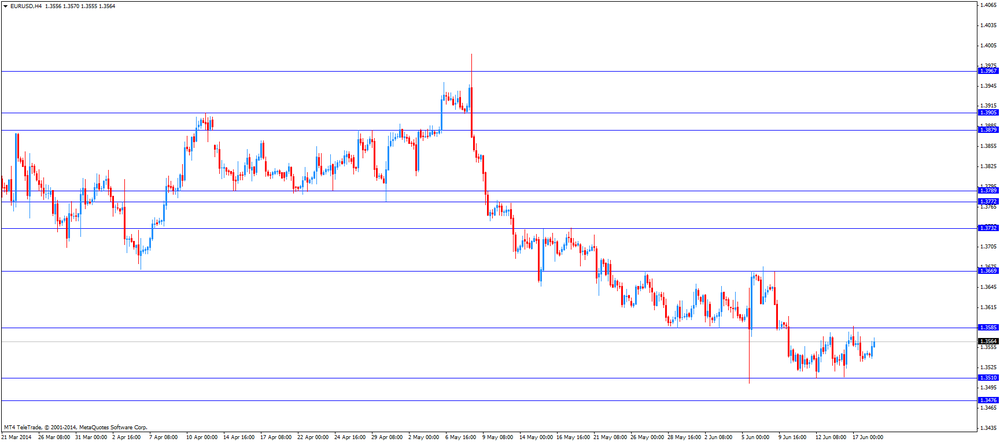

EUR/USD: the currency pair increased to $1.3570

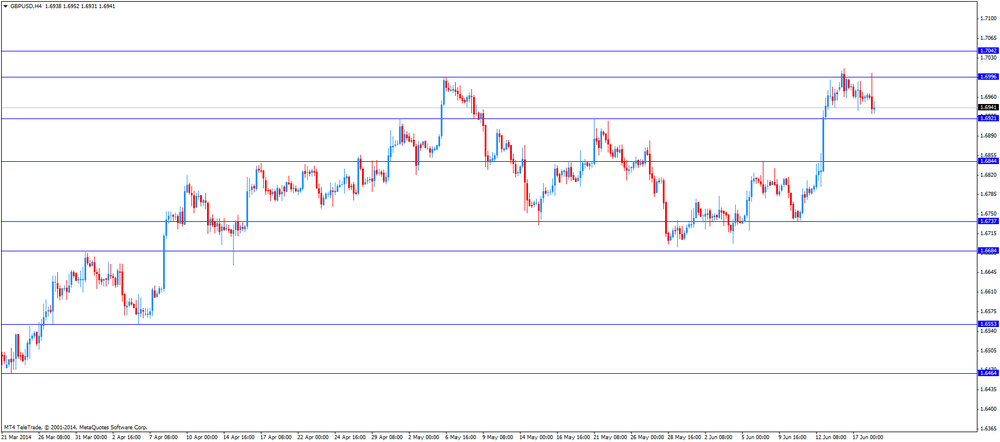

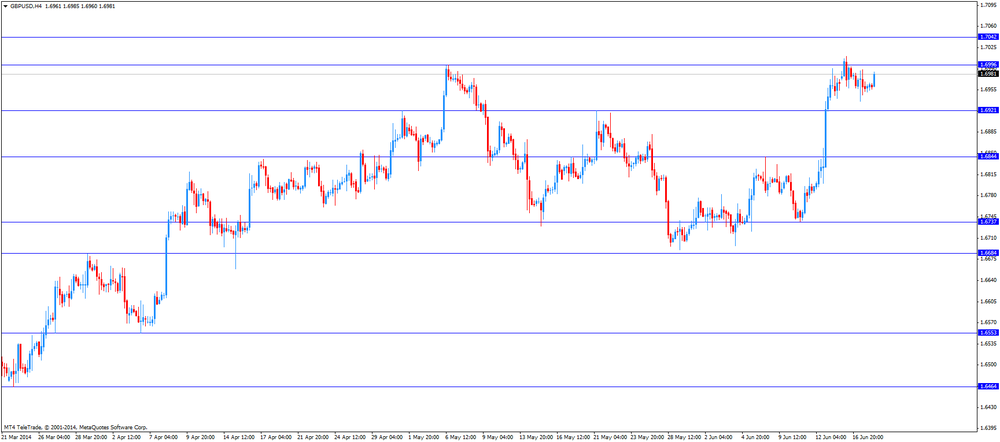

GBP/USD: the currency pair declined to $1.6931

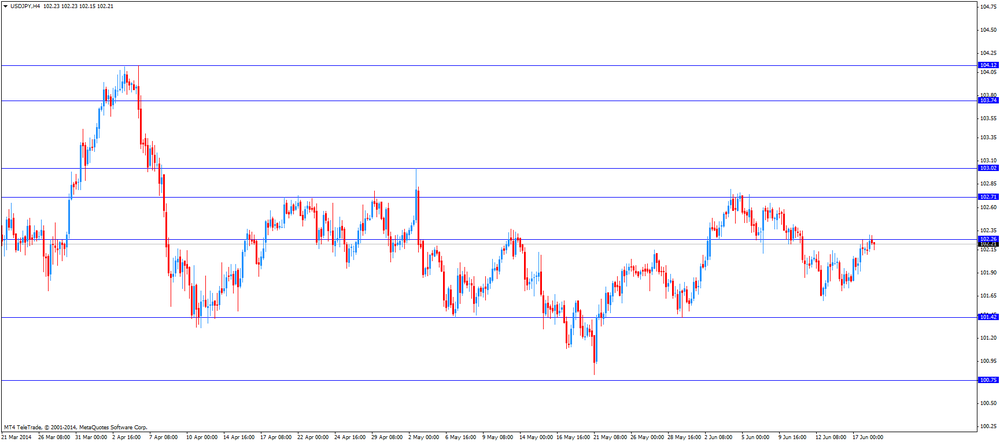

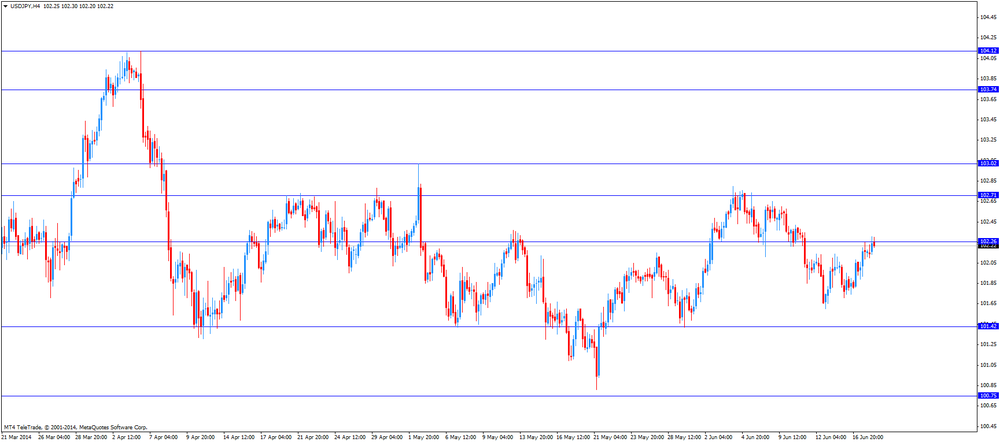

USD/JPY: the currency pair fell to Y102.15

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m April -0.4% +0.3%

12:30 U.S. Current account, bln Quarter I -81 -96

17:30 United Kingdom MPC Member Andy Haldane Speaks

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 45 35

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I +0.9% +1.2%

22:45 New Zealand GDP y/y Quarter I +3.1% +3.7%

-

13:00

Orders

EUR/USD

Offers $1.3630-50, $1.3610/15, $1.3600, $1.3565

Bids $1.3535, $1.3515/10, $1.3500, $1.3485/80, $1.3450

GBP/USD

Offers $1.7080/85, $1.7040/50, $1.7015-20

Bids $1.6930/20, $1.6910/00, $1.6885/80, $1.6820

AUD/USD

Offers $0.9450, $0.9400, $0.9375/80, $0.9350

Bids $0.9320, $0.9300, $0.9280

EUR/JPY

Offers Y139.50, Y139.20, Y139.00, Y138.80

Bids Y138.00, Y137.50, Y137.20, Y137.00

USD/JPY

Offers Y102.75/80, Y102.50

Bids Y102.00, Y101.70, Y101.50

EUR/GBP

Offers stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

-

11:49

Bank of England’s meeting minutes: the Bank of England policymakers were surprised that markets had not saw a higher chance of an interest rate hike in 2014

The Bank of England released its June meeting minutes:

- The BoE’s

monetary policy committee voted unanimously to leave interest rates unchanged

at their record low of 0.5% and quantitative easing at £375bn;

- The Bank of

England policymakers were surprised that markets had not saw a higher chance of

an interest rate hike in 2014;

- There are still

concerns over weak growth in earnings and inflation;

- Some Bank

of England policymakers said "the policy decision had become more balanced in

the past couple of months than earlier in the year";

- “The more

gradual the intended rise in Bank Rate, the earlier it might be necessary to

start tightening policy”;

- "The

economy was starting to return to normal. Part of that normalisation would be a

rise in Bank Rate at some point".

- The BoE’s

monetary policy committee voted unanimously to leave interest rates unchanged

at their record low of 0.5% and quantitative easing at £375bn;

-

11:22

Bank of Japan’s meeting minutes: the economy is expected to continue its moderate recovery

The Bank of Japan (BoJ) released its May meeting minutes:

- The

country's economy is expected to continue its moderate recovery;

- The current

monetary easing appears to be having the intended results;

- The

political unrest in Thailand could impact Japan's exports;

- The BOJ

board decided by a unanimous vote to keep its interest rate unchanged at 0.10%.

- The

country's economy is expected to continue its moderate recovery;

-

10:27

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3540, $1.3575/85, $1.3640

USD/JPY Y101.40/50, Y102.30, Y102.60

USD/CAD Cad1.0800, Cad1.0870

AUD/USD $0.9340/50, $0.9400, $0.9450, $0.9500

GBP/USD $1.6915

EUR/GBP stg0.7975, stg0.8075

-

10:00

Switzerland: Credit Suisse ZEW Survey (Expectations), June 4.8 (forecast 10.0)

-

09:59

Foreign exchange market. Asian session: the Japanese yen traded lower against the U.S. dollar after the release of the Bank of Japan’s monetary policy meeting minutes and Japan’s trade balance

Economic calendar (GMT0):

00:00 Australia Conference Board Australia Leading Index April 0.0% -0.1%

00:30 Australia Leading Index April -0.5% +0.1%

08:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed against the most major currencies ahead of the Fed’s interest decision today. Market participants expect the Fed will cut its asset purchase program by another $10 billion, but the Fed will keep its interest rate unchanged until 2015.

The U.S. currency was still supported by the yesterday’s better-than expected U.S. consumer inflation. The consumer price index in the U.S. rose 0.4% in May, exceeding expectations for a 0.2% gain, after a 0.3% increase in April.

The New Zealand dollar increased against the U.S dollar ahead of the Fed’s interest decision. New Zealand’s current account rose to a surplus of NZ$1.41 billion in the first quarter, from a deficit of NZ$1.51 billion in the fourth quarter of 2013. The fourth quarter of 2013 figure was revised down from a deficit of NZ$1.43 billion. Analysts had expected an increase to a surplus of NZ$1.30 billion.

The Australian dollar traded little changed against the U.S. dollar ahead of the Fed’s interest decision. The Conference Board released its leading index for Australia. The index declined 0.1% in April, after a flat reading in March.

The Japanese yen traded lower against the U.S. dollar after the release of the Bank of Japan’s monetary policy meeting minutes and Japan’s trade balance. The BoJ said the country's economy is expected to continue its moderate recovery and the current monetary easing appears to be having the intended results.

The BoJ reported that the political unrest in Thailand could impact Japan's exports.

Japan's merchandise trade deficit reached Y909 billion in May, after a deficit of Y811.7 billion in April. Analysts had expected the trade deficit to widen to Y1,189.3 billion.

Japan’s exports declined 2.7% year-on-year in May. That was the first decline in 15 months. Imports dropped at annual rate by 3.6%.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y102.24

The most important news that are expected (GMT0):

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June 7.4 10.0

11:15 United Kingdom MPC Member Weale Speaks

12:30 Canada Wholesale Sales, m/m April -0.4% +0.3%

12:30 U.S. Current account, bln Quarter I -81 -96

17:30 United Kingdom MPC Member Andy Haldane Speaks

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 45 35

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I +0.9% +1.2%

22:45 New Zealand GDP y/y Quarter I +3.1% +3.7%

-

06:22

Options levels on wednesday, June 18, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3614 (1799)

$1.3593 (395)

$1.3566 (67)

Price at time of writing this review: $ 1.3548

Support levels (open interest**, contracts):

$1.3522 (1009)

$1.3506 (3648)

$1.3483 (4394)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 29418 contracts, with the maximum number of contracts with strike price $1,3700 (3651);

- Overall open interest on the PUT options with the expiration date July, 3 is 41910 contracts, with the maximum number of contracts with strike price $1,3500 (4848);

- The ratio of PUT/CALL was 1.43 versus 1.43 from the previous trading day according to data from June, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.7201 (1437)

$1.7102 (1703)

$1.7005 (2206)

Price at time of writing this review: $1.6959

Support levels (open interest**, contracts):

$1.6895 (1021)

$1.6798 (1706)

$1.6699 (2120)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 18035 contracts, with the maximum number of contracts with strike price $1,7000 (2206);

- Overall open interest on the PUT options with the expiration date July, 3 is 21918 contracts, with the maximum number of contracts with strike price $1,6750 (2253);

- The ratio of PUT/CALL was 1.22 versus 1.20 from the previous trading day according to data from June, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:31

Australia: Leading Index, April +0.1%

-

01:01

Australia: Conference Board Australia Leading Index, April -0.1%

-

00:50

Japan: Adjusted Merchandise Trade Balance, bln, May -909 (forecast -1100)

-

00:20

Currencies. Daily history for June 17'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3546 -0,18%

GBP/USD $1,6961 -0,11%

USD/CHF Chf0,8992 +0,24%

USD/JPY Y102,16 +0,34%

EUR/JPY Y138,38 +0,15%

GBP/JPY Y173,25 +0,23%

AUD/USD $0,9334 -0,69%

NZD/USD $0,8653 -0,27%

USD/CAD C$1,0857 +0,15%

-

00:00

Schedule for today, Wednesday, June 18’2014:

(time / country / index / period / previous value / forecast)00:00 Australia Conference Board Australia Leading Index April 0.0%

00:00 Australia Conference Board Australia Leading Index April 0.0%

00:30 Australia Leading Index April -0.5%

08:30 United Kingdom Bank of England Minutes

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June 7.4

12:30 Canada Wholesale Sales, m/m April -0.4% +0.3%

12:30 U.S. Current account, bln Quarter I -81 -96

14:30 U.S. Crude Oil Inventories June -2.6

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 45

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I +0.9% +1.2%

22:45 New Zealand GDP y/y Quarter I +3.1%

-