Notícias do Mercado

-

23:19

Currencies. Daily history for March 24'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3838 +0,33%

GBP/USD $1,6495 +0,05%

USD/CHF Chf0,8807 -0,23%

USD/JPY Y102,22 -0,03%

EUR/JPY Y141,45 +0,32%

GBP/JPY Y168,60 +0,01%

AUD/USD $0,9125 +0,49%

NZD/USD $0,8545 +0,12%

USD/CAD C$1,1195 -0,22% -

22:59

Schedule for today, Tuesday, March 25’2014:

(time / country / index / period / previous value / forecast)02:00 China Leading Index February +1.2%

04:45 Australia RBA Assist Gov Lowe Speaks

07:00 United Kingdom Nationwide house price index March +0.6%

07:00 United Kingdom Nationwide house price index, y/y March +9.4%

09:00 Germany IFO - Business Climate March 111.3 110.9

09:00 Germany IFO - Current Assessment March 114.4 114.6

09:00 Germany IFO - Expectations March 108.3 107.7

09:30 United Kingdom Retail Price Index, m/m February -0.3% +0.5%

09:30 United Kingdom Retail prices, Y/Y February +2.8% +2.6%

09:30 United Kingdom RPI-X, Y/Y February +2.8% +2.6%

09:30 United Kingdom Producer Price Index - Input (MoM) February -0.9% +0.4%

09:30 United Kingdom Producer Price Index - Input (YoY) February -3.1% -5.3%

09:30 United Kingdom Producer Price Index - Output (MoM) February +0.3% +0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) February +1.2% +1.0%

09:30 United Kingdom BBA Mortgage Approvals February 50.0 50.0

09:30 United Kingdom HICP, m/m February -0.6% +0.5%

09:30 United Kingdom HICP, Y/Y February +1.9% +1.7%

09:30 United Kingdom HICP ex EFAT, Y/Y February +1.6% +1.6%

10:00 Eurozone Trade Balance s.a. January 13.7 13.9

11:00 United Kingdom CBI industrial order books balance March 37 30

13:00 U.S. Housing Price Index, m/m January +0.8% +0.7%

13:00 U.S. Housing Price Index, y/y January +7.7%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y January +13.4% +13.3%

14:00 U.S. Richmond Fed Manufacturing Index March -6 -1

14:00 U.S. Consumer confidence March 78.1 78.7

14:00 U.S. New Home Sales February 468 447

16:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. API Crude Oil Inventories March +5.9

22:30 Australia RBA Assist Gov Lowe Speaks

23:00 U.S. FOMC Member Charles Plosser Speaks

23:50 Japan CSPI, y/y February +0.8% +0.8% -

18:40

American focus : the euro exchange rate rose substantially against the U.S. dollar

The euro exchange rate against the dollar rose sharply , returning with all previously lost ground and setting a new high . Impact on the dynamics of the U.S. data , as well as statements by the Fed . As it became known , the index of business activity in the U.S. industry from Markit in March , according to preliminary data , down to 55.5 . Preliminary data include approximately 85% of the respondents' answers . The business activity index fell to 45 -month high , but growth continues. The growth rate was only slightly lower than the three-year high , which the index reached in February. Manufacturers say that the higher level of output due to an increase in new orders , and the desire to reduce the backlog . Companies began to overcome deceleration caused by weather conditions in the winter. The growth rate of export orders decreased but continues for the second month in a row.

Meanwhile , the president of the Federal Reserve Bank of San Francisco John Williams said that the Fed last week did not make assumptions about what the Fed will start raising rates earlier than expected . Investors appreciated earlier comments from Fed Chairman Janet Iellen on Monday that the first rate hike could begin six months after the completion of the redemption of bonds as a "hard" . Williams said that such expectations were on the market, and he sees nothing that would indicate intention to tighten monetary policy sooner than expected . Williams called regarded as a "signal of tightening policy" simply a response to a comment recently yield stronger -than-expected unemployment data.

The Australian dollar rose against the U.S. dollar, which has been associated with the decision agency Fitch, as well as U.S. data . Note that the rating agency Fitch announced its decision to leave Australia at the same rating at AAA with a stable outlook , as the country has managed to maintain stability to external shocks due to " the presence of a strong economic and institutional foundations , including the highly developed and flexible economy , as well as a reliable political rate and effective political and social institutions . " However, the agency noted factors , mainly related to the slowdown in China's economy that could potentially determine the downgrade in the future : deterioration in the trade balance, large-scale problems in the banking sector or unsuccessful rebalancing the economy.

-

15:23

NBB business climate rises to -6.3 in March

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate rose to -6.3 in March from -8.3 in February, exceeding expectations for an increase to -7.5.

The increase was driven by better sentiment in all sectors.

-

13:45

U.S.: Manufacturing PMI, March 55.5 (forecast 56.6)

-

13:30

Option expiries for today's 1400GMT cut

USD/JPY Y100.35, Y100.65/75, Y101.25, Y101.50, Y101.75, Y102.00, Y103.00, Y103.10, Y103.20, Y103.25

EUR/USD $1.3800, $1.3900

AUD/USD $0.8985, $0.9100

EUR/JPY Y138.00

USD/CAD Cad1.1085, Cad1.1120

GBP/USD $1.6800

EUR/CHF Chf1.2200

AUD/JPY Y93.00

EUR/GBP stg0.8320

USD/CHF Chf0.8750, Chf0.8800

-

13:17

European session: the euro fell

07:58 France Manufacturing PMI (Preliminary) March 49.7 49.8 51.9

07:58 France Services PMI (Preliminary) March 47.2 47.9 51.4

08:28 Germany Manufacturing PMI (Preliminary) March 54.8 54.7 53.8

08:28 Germany Services PMI (Preliminary) March 55.9 55.9 54.0

08:58 Eurozone Manufacturing PMI (Preliminary) March 53.2 53.2 53.0

08:58 Eurozone Services PMI (Preliminary) March 52.6 52.6 52.4

11:00 Germany Bundesbank Monthly Report March

The euro rose against the dollar on strong data on private sector activity in France and then fell sharply to nedotyanuvshih forecasts to data on business activity in the euro zone and Germany.

French private sector returned to growth in March for the first time since last October , revealed on Monday showed preliminary surveys conducted Markit Economics. Composite activity index rose to 51.6 from 47.9 in February. Score above 50 indicates expansion , and the last reading indicates the fastest growth in 31 months . Expansion was broad-based and in the service sector and in manufacturing. The index of activity in services rose to 51.4 , a 26- month high , from 47.2 in February. Index , as expected , had to grow to 47.9 . In addition, the PMI index for the manufacturing sector has improved more than expected to 51.9 , a 33- month high , from 49.7 in the previous month . The index is projected to grow to was 49.8 .

Private sector growth slowed in Germany in March from 33 -month high , but growth remained markedly high on Monday showed preliminary data from surveys conducted in the Markit Economics. Composite activity index fell to 55.0 from February's 33 -month high of 56.4 . Weakening growth in business activity was broad-based , while both indices - for producers and service providers showed weaker growth than seen in February. Preliminary index of service sector activity fell more than expected to 54.0 from 55.9 in February. Predicted that the index would remain at 55.9 . Furthermore , preliminary manufacturing PMI 53.8 compared to 54.8 in February and below the expected reading of 54.7 .

Eurozone economy expanded ninth consecutive month in March , but the growth rate slowed slightly , data showed on Monday, Markit Economics . Consolidated activity index was 53.2 in March. Result was slightly lower than achieved in February of this year a 32- month high of 53.3 and above the expected level of 53.1 . The index remains above the neutral mark of 50, which indicates an increase in private sector activity . Eurozone economy in March continues to be in the strongest period of growth since the first half of 2011, said Markit. Preliminary PMI in service sector fell to 52.4 from 52.6 in February , while he , according to expectations , had to remain at the level of 52.6 . In addition, the manufacturing PMI fell to 53.0 from 53.2 in February. It was expected that the index will also remain unchanged at the February level .

The Australian dollar rose against the U.S. dollar after ratings agency Fitch announced its decision to leave Australia at the same rating at AAA with a stable outlook , as the country has managed to maintain stability to external shocks due to " the presence of a strong economic and institutional foundations, including the highly advanced and flexible economy, and reliable policies and effective political and social institutions . "

However, the agency noted factors , mainly related to the slowdown in China's economy that could potentially determine the downgrade in the future : deterioration in the trade balance, large-scale problems in the banking sector or unsuccessful rebalancing the economy.

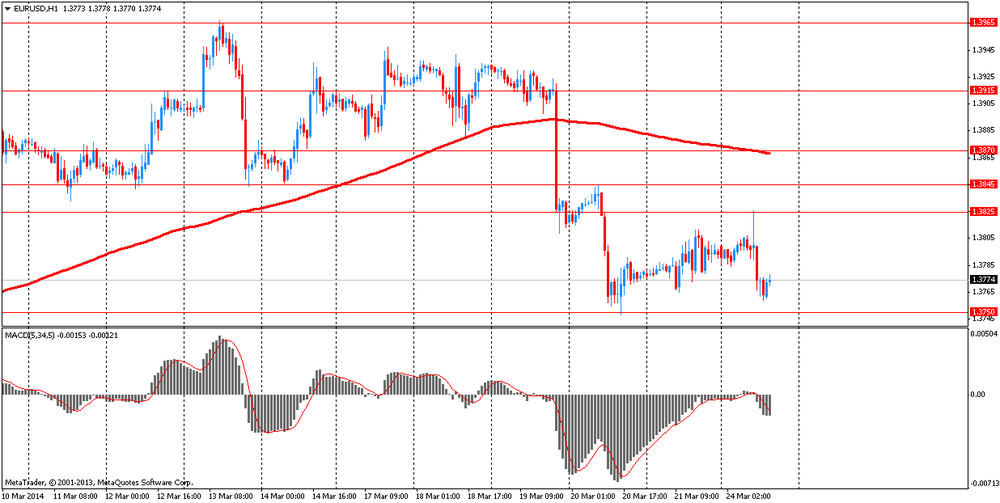

EUR / USD: during the European session, the pair rose to $ 1.3826 , but then fell to $ 1.3759

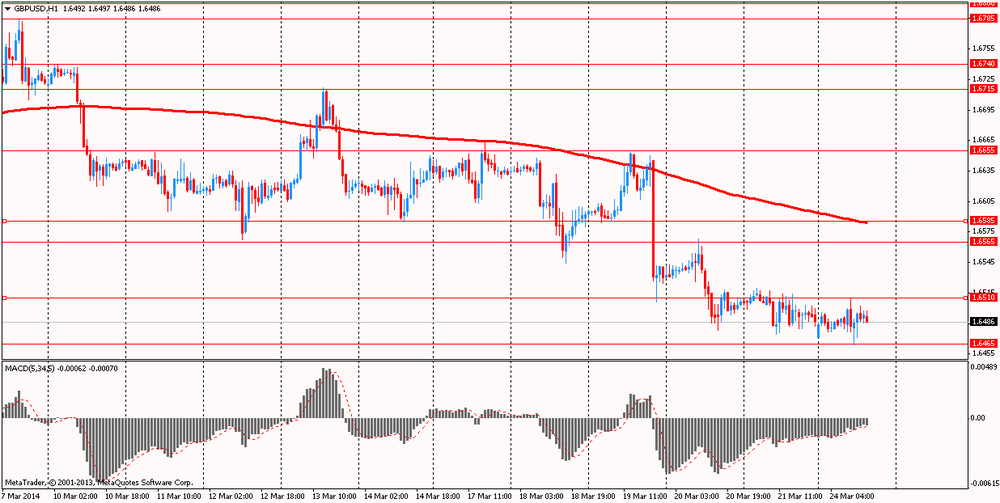

GBP / USD: during the European session, the pair rose to $ 1.6510 , but then fell to $ 1.6464

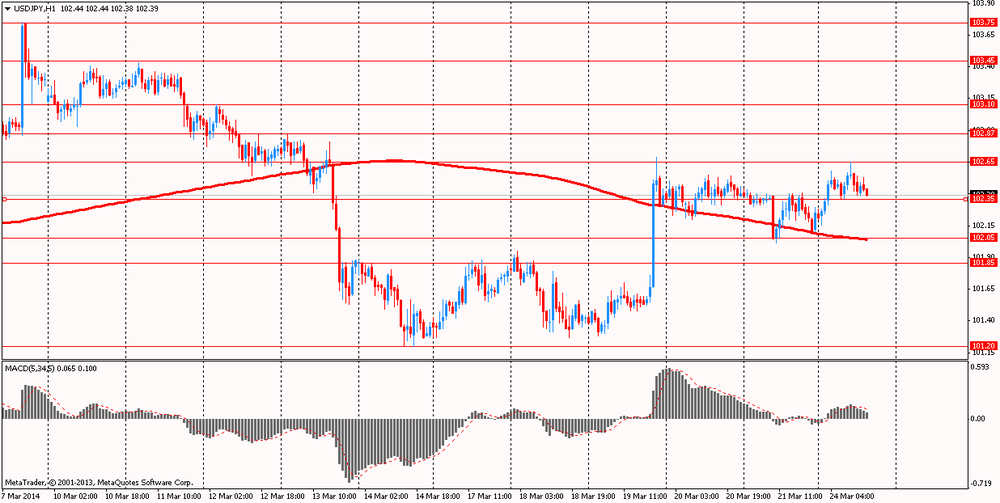

USD / JPY: during the European session, the pair rose to Y102.65 and stepped

At 13:45 GMT the United States will index of business activity in the manufacturing sector in March.

-

12:45

Orders

EUR/USD

Offers $1.3930, $1.3890-910, $1.3870, $1.3845/50, $1.3830, $1.3800/10

Bids $1.3755-30, $1.3725/20, $1.3710/00, $1.3694

GBP/USD

Offers $1.6600, $1.6580/85

Bids $1.6455/50, $1.6410/00, $1.6385/80, $1.6350

AUD/USD

Offers $0.9200, $0.9150, $0.9120

Bids $0.9080, $0.9020/10, $0.9000

EUR/JPY

Offers Y142.50, Y142.00, Y141.45/50

Bids Y140.50/40, Y140.00

USD/JPY

Offers Y103.00, Y102.80

Bids Y102.00, Y101.80, Y101.25/20, Y101.00

EUR/GBP

Offers stg0.8467, stg0.8450, stg0.8435/40, stg0.8420/25, stg0.8400/10

Bids stg0.8320/15, stg0.8280/75

-

10:07

Option expiries for today's 1400GMT cut

USD/JPY Y100.35, Y100.65/75, Y101.25, Y101.50, Y101.75, Y102.00, Y103.00, Y103.10, Y103.20, Y103.25

EUR/USD $1.3800, $1.3900

AUD/USD $0.8985, $0.9100

EUR/JPY Y138.00

USD/CAD Cad1.1085, Cad1.1120

GBP/USD $1.6800

EUR/CHF Chf1.2200

AUD/JPY Y93.00

EUR/GBP stg0.8320

USD/CHF Chf0.8750, Chf0.8800

-

09:00

Eurozone: Manufacturing PMI, March 53.0 (forecast 53.2)

-

09:00

Eurozone: Services PMI, March 52.4 (forecast 52.6)

-

08:30

Germany: Manufacturing PMI, March 53.8 (forecast 54.7)

-

08:30

Germany: Services PMI, March 54.0 (forecast 55.9)

-

08:00

France: Manufacturing PMI, March 51.9 (forecast 49.8)

-

08:00

France: Services PMI, March 51.4 (forecast 47.9)

-

06:22

Asian session: The yen slid against the euro and the dollar

01:45 China HSBC Manufacturing PMI (Preliminary) March 48.5 48.7 48.1

The yen slid against the euro and the dollar before Bank of Japan Deputy Governor Kikuo Iwata speaks today amid bets the BOJ will boost stimulus to ease the impact of a planned tax increase due to take effect next week. In Japan, Iwata will speak about the BOJ’s monetary policy at a two-hour forum that starts at 2 p.m. Tokyo time today. The central bank will adjust monetary policy if its target of 2 percent inflation is deemed impossible to achieve, he told lawmakers on March 6. Thirty-five percent of 34 economists polled expect the BOJ to expand stimulus as early as next month when the government increases the sales tax to 8 percent from 5 percent, according to the most recent Bloomberg News survey conducted Feb. 26 to March 4.

Australia’s currency weakened against most of its 16 major peers after China’s factory data fell short of economist estimates. The Purchasing Managers’ Index for China’s manufacturing dropped to 48.1 in March, HSBC Holdings Plc and Markit Economics Ltd. said today. The preliminary reading compares with the 48.7 median estimate of analysts surveyed by Bloomberg News and the final number of 48.5 in February. Numbers below 50 signal contraction.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3785-00

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6475-95

USD / JPY: during the Asian session, the pair rose to Y102.60

There is a fairly quiet start to the data calendar this week, although the markets will get an early look at how the Crimea crisis has impacted on eurozone sentiment when flash PMI indicators are released. The European calendar gets underway at 0758GMT, when the French March flash manufacturing and services PMIs are set to cross the wires. The numbers will reflect sentiment on the Ukraine, but not the overnight local election results. Analysts are looking for a slight dip in the manufacturing number and a modest pick up in services. The German flash data will be released at 0828GMT, with the amalgamated eurozone numbers published at 0858GMT. German manufacturing is seen a touch lower at 54.5, with services at 55.5, down from 55.9. At 1000GMT, ECB Governing Council member Erkki Liikanen is set to brief the press on monetary policy and the global economy, in Helsinki. US President Barack Obama attends a nuclear security summit in The Netherlands. Obama and other G7 leaders will also meet to discuss the Ukraine crisis. The Belgian National Bank releases their March business survey at 1400GMT. The index is seen slightly lower, with forecasts for a reading of -5, down from -4 in February.

-

01:45

China: HSBC Manufacturing PMI, March 48.1 (forecast 48.7)

-