Notícias do Mercado

-

19:20

American focus : the pound has risen considerably against the U.S. dollar

The dollar traded slightly higher against the euro , though lost some previously won positions . We add that the growth of the U.S. dollar due to the expectations that the Federal Reserve will continue to minimize the quantitative easing program at the January meeting . More and more people are inclined to believe that the Fed will simply continue to reduce QE. In general, the economic recovery is strong enough , despite the recent negative statistical data from the United States. According to the median forecast of economists at the next meeting of the FOMC, which will be held January 28-29 , CB again reduce monthly asset purchases to $ 10 billion

Exerted pressure on the currency report , which showed that sales of newly built homes fell by 7% to a seasonally adjusted annual rate of 414,000 in December from 445,000 in November. Result November was revised down to 19,000 . Economists had forecast an annual rate of new home sales at 457,000 in December , although many of them noted that the unusually cold and windy weather may have contributed to the sales activity . New home sales in December were the weakest since the summer months , when mortgage rates jumped in response to reports that the Federal Reserve plans to reduce its bond-buying program .

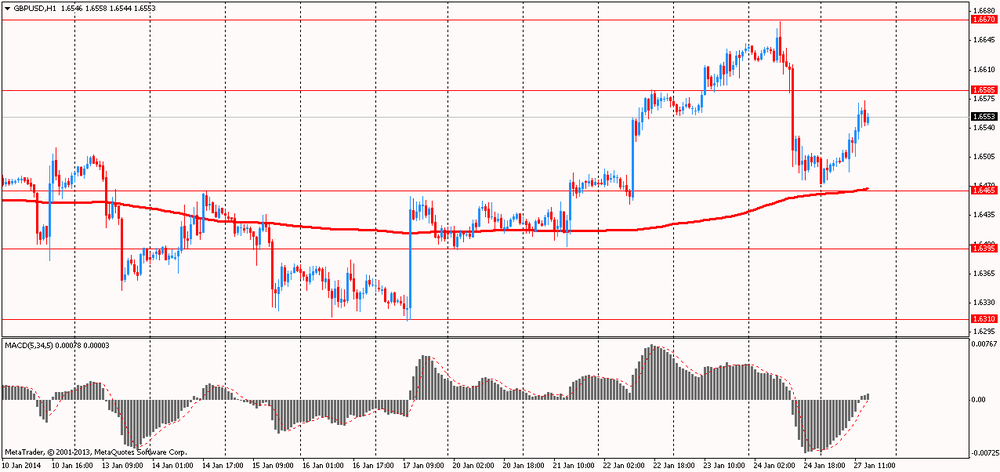

Pound has risen considerably against the U.S. dollar , offsetting more than half the losses incurred in the last session . Add that traders continue to actively speculate that the Bank of England may be the first of the leading CB who will raise the interest rate. In addition, the growth of currency help expectations of tomorrow's publication of GDP data for the fourth quarter . Recall that in the third quarter of the UK economy grew at an annualized rate of 1.9 percent, while fixing the third consecutive quarterly increase and raising hopes that the UK economy has moved to let the recovery. It is expected that the GDP data for the fourth quarter show that the UK economy has continued to expand. Experts note that even if the pace of growth will be slightly slower , it probably will not affect the monetary policy of the Bank of England.

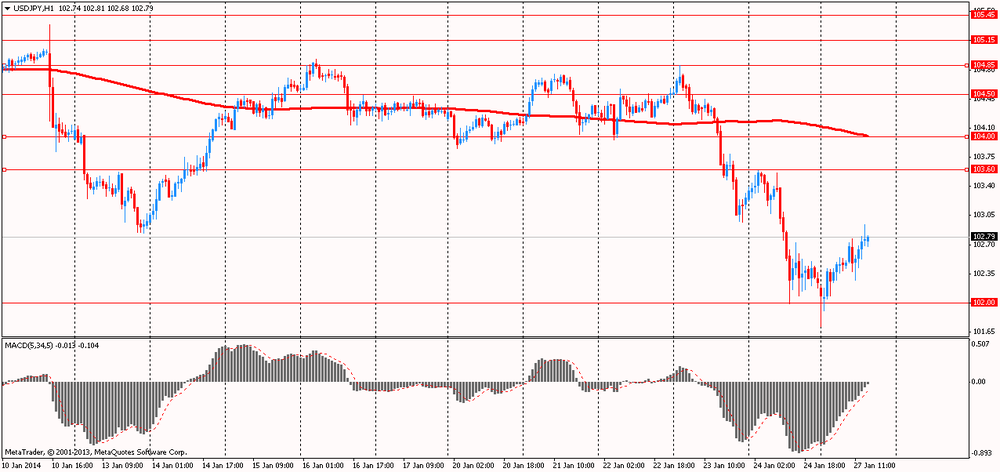

The yen traded lower against the U.S. dollar , despite the sharp rise at the opening of trading . Experts note that the attractiveness of the yen as a safe-haven currency continues to decline against the backdrop of an aggressive policy easing implemented by the Bank of Japan, and the deterioration in the current account balance of the country. As it became known , in December Japan's trade deficit remained at a high level JPY1.15 trillion . , Only slightly suzivshis compared with the November result JPY1.29 trillion . Import growth is likely to receive support due to a surge in demand in anticipation of increase in April sales tax. This process helps to neutralize the effects of growth of real exports , and eventually trade should be small brake in real GDP in the 4th quarter . In addition , the expected current account deficit in the 4th quarter . also help to contain the potential for strengthening of the yen in the short term .

-

15:00

U.S.: New Home Sales, December 414 (forecast 457)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.50, Y102.60, Y103.00, Y103.40-45, Y103.60, Y104.15, Y104.95, Y105.00

EUR/USD $1.3500, $1.3550, $1.3750, $1.3800

GBP/USD $1.6450, $1.6530, $1.6605

EUR/GBP stg0.8150, stg0.8300

AUD/USD $0.8600, $0.8625, $0.8650, $0.8700

USD/CAD C$1.0950, C$1.0975, C$1.1075, C$1.1100

-

13:15

European session: the euro fell

09:00 Germany IFO - Business Climate January 109.5 110.2 110.6

09:00 Germany IFO - Current Assessment January 111.6 112.2 112.4

09:00 Germany IFO - Expectations January 107.4 108.0 108.9

10:00 Eurozone Eurogroup Meetings January

11:00 Germany Bundesbank Monthly Report January

12:00 Eurozone ECB’s Vitor Constancio Speaks

Euro fell to its maximum value against the dollar, while back below the levels of the session. Early growth of the euro was fluff associated with the release of strong data from the institute Ifo, according to which the business climate index in January rose to 110.6 from 109.5 values unrevised December , reaching its highest level since July 2011 and exceeded economists' forecast . In turn , the index of current conditions rose to 112.4 compared to 111.6 in December. Figure was slightly higher than expected 112.2 . The expectations index also improved more than expected to 108.9 from 107.4 . The expected result was 108.

After a report analyst Carsten Brzeski ING said: " Looking ahead , strong labor market data , favorable financing conditions , the gradual growth of investment and new orders , and low wholesale inventories still make economic situation in Germany a unique case ."

In turn, in light of the strong performance of the German Ifo Caroline Newhouse from BNP Paribas said: " The study confirms the positive statistics IFO PMI, published last week. Composite PMI rose in January from 55 to 55.9 , the highest level since June 2011 , remained above the threshold of 50 for the ninth consecutive month . "

The yen lost previously won positions after the release of data on the trade balance of the country. Japan's trade deficit reached a historic high . The deficit amounted to 11.5 trillion . yen ( $ 113 billion ) , which is almost two times more than last year's figure 6.9 trillion . yen , according to the Finance Ministry in Tokyo. In December, imports increased by 25% compared with a year earlier , and exports gained 15% , resulting in a monthly deficit of $ 1.3 trillion . yen. The reason - the growth of energy supplies and the weakness of the yen .

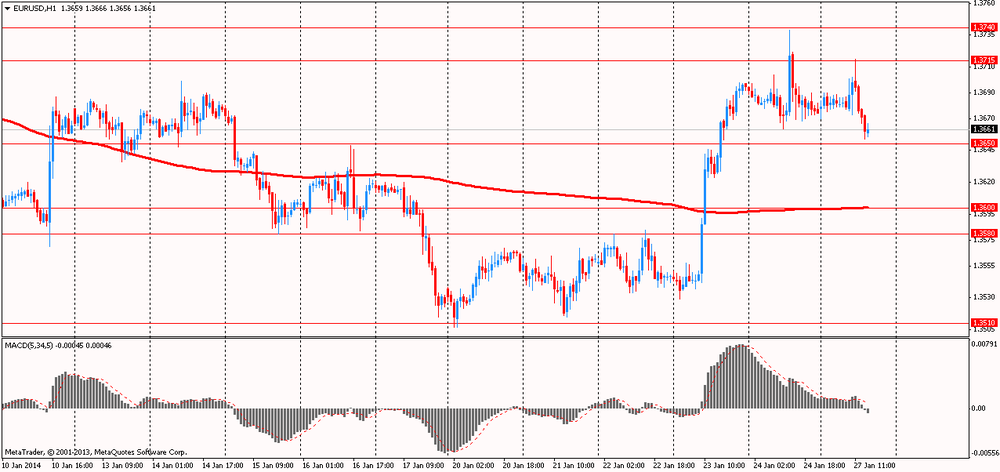

EUR / USD: during the European session, the pair rose to $ 1.3716 , but then fell to $ 1.3654

GBP / USD: during the European session, the pair rose to $ 1.6573

USD / JPY: during the European session, the pair rose to Y170.51

At 15:00 GMT the United States will sales in the primary market in December. At 18:00 GMT a speech ECB board member Jens Weidmann . At 23:00 GMT Australia is to publish an index of leading economic indicators from the Conference Board in November.

-

10:19

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.50, Y102.60, Y103.00, Y103.40-45, Y103.60, Y104.15, Y104.95, Y105.00

EUR/USD $1.3500, $1.3550, $1.3750, $1.3800

GBP/USD $1.6450, $1.6530, $1.6605

EUR/GBP stg0.8150, stg0.8300

AUD/USD $0.8600, $0.8625, $0.8650, $0.8700

USD/CAD C$1.0950, C$1.0975, C$1.1075, C$1.1100

-

09:00

Germany: IFO - Business Climate, January 110.6 (forecast 110.2)

-

09:00

Germany: IFO - Current Assessment , January 112.4 (forecast 112.2)

-

09:00

Germany: IFO - Expectations , January 108.9 (forecast 108.0)

-

07:04

Asian session: The yen touched a seven-week high

The yen touched a seven-week high versus the dollar after a selloff in emerging-market assets boosted its appeal as a haven. Emerging-market equities extended their biggest decline since November, after volatility surged the most in two years. Japan’s currency held its biggest weekly gain since August against its U.S. peer before the Federal Reserve starts a two-day policy meeting tomorrow. The dollar held weekly declines against the yen and euro even as economists forecast the Federal Open Market Committee will reduce monthly asset purchases, now at $75 billion, by $10 billion at each meeting to end the program this year, according to the median forecasts in a Jan. 10 Bloomberg News survey.

Gains in Japan’s currency were limited after the finance ministry said the country’s trade deficit widened to a record in 2013. The shortfall was 11.5 trillion yen ($112.3 billion), almost double the previous year’s 6.9 trillion yen, as energy shipments and weakness in the currency pumped up the import bill.

The euro was supported before a report today forecast to show German business confidence climbed. In Germany, the Ifo Institute’s business climate index, based on a survey of 7,000 executives, probably increased for a third month to 110 in January, according to a Bloomberg poll.

Australia’s dollar rose from a 3 1/2-year low. “There’s a feeling that the decline in the Aussie over the last couple of days might have been a bit overdone,” said Mitul Kotecha, the global head of foreign-exchange strategy at Credit Agricole Corporate & Investment Bank SA in Hong Kong. “I don’t think we’ll see a substantial decline in the Aussie from these levels.”

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3675-90

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6475-05

USD / JPY: on Asian session the pair fell to Y101.70

There is a much quieter calendar across the board Monday, although the German IfO release and the US flash services PMI data will be closely watched. However, much attention will focus on the Fed's latest 2-day FOMC meet that starts Tuesday, with continues chatter the FOMC could further reduce their monthly bond buying programme. The European calendar gets underway at 0830GMT, with the release of the Dutch January Producer confidence index, seen coming at at 0.4, up from -0.1 in December. Also at 0830GMT, ECB Ewald Nowotny speaks with EBRD's Zettemeyer, as the pair present the EBRD's transition plan. The day's main Euro area release comes at 0900GMT, with the release of the German January IfO business climate index. At 1115GMT, French and German Finance Ministers will face the press following a Franco-German meeting in Paris. Then, at 1130GMT, ECB board member Ignazio Visco and BOE's Sir Jon Cunliffe will talk, in Brussels. At 1400GMT, Euro area Finance Minister will gather in Brussels for a Eurogroup meeting.

-

06:01

Schedule for today, Monday, Jan 27’2013:

09:00 Germany IFO - Business Climate January 109.5 110.2

09:00 Germany IFO - Current Assessment January 111.6 112.2

09:00 Germany IFO - Expectations January 107.4 108.0

10:00 Eurozone Eurogroup Meetings January

11:00 Germany Bundesbank Monthly Report January

12:00 Eurozone ECB’s Vitor Constancio Speaks

15:00 U.S. New Home Sales December 464 457

18:00 Eurozone ECB's Jens Weidmann Speaks

23:00 Australia Conference Board Australia Leading Index November +0.5%

23:50 Japan CSPI, y/y December +1.0% 1.1%

-