Notícias do Mercado

-

20:00

Dow +55.55 15,934.66 +0.35% Nasdaq -14.12 4,114.05 -0.34% S&P +3.29 1,793.58 +0.18%

-

19:20

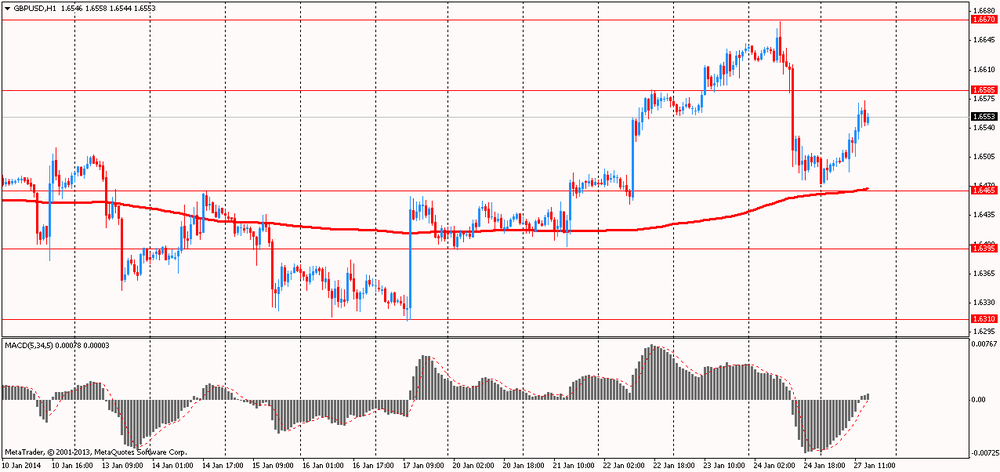

American focus : the pound has risen considerably against the U.S. dollar

The dollar traded slightly higher against the euro , though lost some previously won positions . We add that the growth of the U.S. dollar due to the expectations that the Federal Reserve will continue to minimize the quantitative easing program at the January meeting . More and more people are inclined to believe that the Fed will simply continue to reduce QE. In general, the economic recovery is strong enough , despite the recent negative statistical data from the United States. According to the median forecast of economists at the next meeting of the FOMC, which will be held January 28-29 , CB again reduce monthly asset purchases to $ 10 billion

Exerted pressure on the currency report , which showed that sales of newly built homes fell by 7% to a seasonally adjusted annual rate of 414,000 in December from 445,000 in November. Result November was revised down to 19,000 . Economists had forecast an annual rate of new home sales at 457,000 in December , although many of them noted that the unusually cold and windy weather may have contributed to the sales activity . New home sales in December were the weakest since the summer months , when mortgage rates jumped in response to reports that the Federal Reserve plans to reduce its bond-buying program .

Pound has risen considerably against the U.S. dollar , offsetting more than half the losses incurred in the last session . Add that traders continue to actively speculate that the Bank of England may be the first of the leading CB who will raise the interest rate. In addition, the growth of currency help expectations of tomorrow's publication of GDP data for the fourth quarter . Recall that in the third quarter of the UK economy grew at an annualized rate of 1.9 percent, while fixing the third consecutive quarterly increase and raising hopes that the UK economy has moved to let the recovery. It is expected that the GDP data for the fourth quarter show that the UK economy has continued to expand. Experts note that even if the pace of growth will be slightly slower , it probably will not affect the monetary policy of the Bank of England.

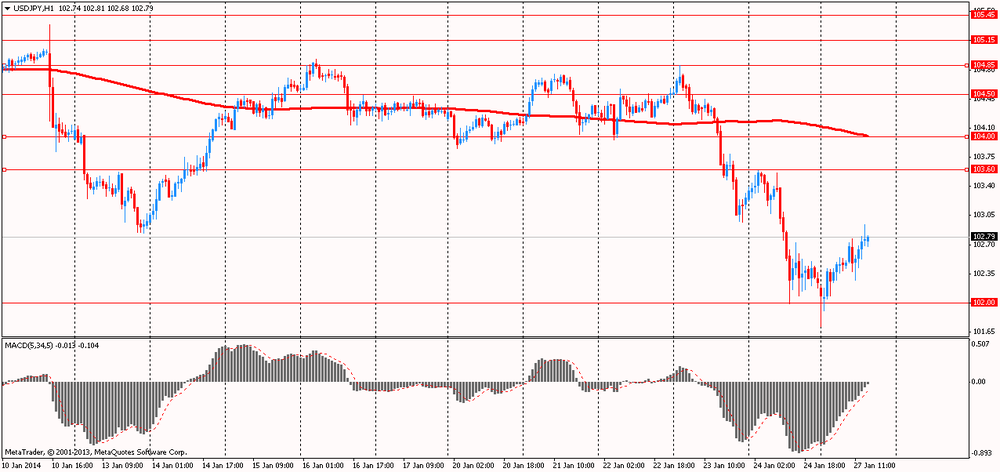

The yen traded lower against the U.S. dollar , despite the sharp rise at the opening of trading . Experts note that the attractiveness of the yen as a safe-haven currency continues to decline against the backdrop of an aggressive policy easing implemented by the Bank of Japan, and the deterioration in the current account balance of the country. As it became known , in December Japan's trade deficit remained at a high level JPY1.15 trillion . , Only slightly suzivshis compared with the November result JPY1.29 trillion . Import growth is likely to receive support due to a surge in demand in anticipation of increase in April sales tax. This process helps to neutralize the effects of growth of real exports , and eventually trade should be small brake in real GDP in the 4th quarter . In addition , the expected current account deficit in the 4th quarter . also help to contain the potential for strengthening of the yen in the short term .

-

18:20

European stock close

European stocks fell for a third day, sending the Stoxx Europe 600 Index to its lowest level in a month, with BG Group Plc and Vodafone Group Plc tumbling.

The Stoxx 600 dropped 0.8 percent. The Stoxx 600 has slumped 4.1 percent in the last three trading days after preliminary data showed Chinese manufacturing probably contracted in January for the first time in six months and Argentine policy makers allowed the peso to devalue by reducing support in the foreign-exchange market. The U.S. Federal Reserve reviews its stimulus policies this week.

In Germany, data today showed that the Ifo institute’s business climate index increased for a third month to 110.6 in January, exceeding the median prediction that forecast 110. The gauge, based on a survey of 7,000 executives, rose to 109.5 in December. A U.S. report showed that new-home sales dropped more than forecast in December. Sales fell 7 percent to a 414,000 annualized pace from a revised 445,000 rate the previous month. That compared with economists’ projections that called for a rate of 455,000.

National benchmark gauges fell in 17 of the 18 western-European markets.

FTSE 100 6,550.66 -113.08 -1.70% CAC 40 4,144.56 -16.91 -0.41% DAX 9,349.22 -42.80 -0.46%

BG Group plunged 14 percent to 1,080.5 pence, its biggest drop since October 2012, after saying reduced liquefied natural gas shipments from Egypt and U.S. forward-gas prices will hurt profit. Total earnings for 2013 will be $2.2 billion, or about 65 cents a share, BG said in a statement. The company expects production to be 590,000 to 630,000 barrels a day this year, lower than 2013’s 633,000 barrels a day.

Vodafone lost 3.7 percent to 224.1 pence. AT&T said it reserves the right to announce or participate in an offer after a six-month restricted period. Separately, people familiar with the matter said Vodafone is seeking to acquire Grupo Corporativo ONO SA as the Spanish cable operator prepares for an initial public offering.

Banco Popolare SC, Italy’s fourth-biggest bank, tumbled 15 percent to 1.29 euros for the biggest plunge since December 2008. The lender said last week it planned to sell as much as 1.5 billion euros ($2.1 billion) of shares to bolster capital.

Ziggo NV dropped 2.6 percent to 32.39 euros. Liberty Global Plc, the company controlled by billionaire John Malone, agreed to take over the Dutch broadband provider for 4.9 billion euros. Ziggo is seeking 3.7 billion euros of loans to finance its buyout, said a person with knowledge of the matter.

Ericsson AB added 1.9 percent to 76.45 kronor. The network-equipment maker and Samsung Electronics Co. settled their patent dispute and struck a new licensing deal for wireless technology in smartphones, televisions, tablets and Blu-Ray disk players. The pact will increase Ericsson’s fourth-quarter sales by 4.2 billion kronor ($652 million) and boost net income by 3.3 billion kronor initially. It also includes continuing royalty payments to Ericsson, the Stockholm-based said in a statement.

-

17:00

European stock fell: FTSE 100 6,550.66 -113.08 -1.70% CAC 40 4,144.56 -16.91 -0.41% DAX 9,349.22 -42.80 -0.46%

-

16:40

Oil: an overview of the market situation

Oil prices declined moderately today , recording the second -session decline in a row, which was associated with the release of weak data on the U.S. housing market . With this in mind , experts have begun to show concern that demand for fuel in the U.S. - the world's largest consumer - may slow .

Prices fell by 1 percent , as a report showed that new home sales in 2013 ended weaker pace , emphasizing the existing threat to the recovery of the housing market from rising prices and mortgage rates . Sales of newly built homes fell by 7% to a seasonally adjusted annual rate of 414,000 in December from 445,000 in November. Result November was revised down to 19,000 . Economists had forecast an annual rate of new home sales at 457,000 in December , although many of them noted that the unusually cold and windy weather may have contributed to the sales activity . New home sales in December were the weakest since the summer months , when mortgage rates jumped in response to reports that the Federal Reserve plans to reduce its bond-buying program . Sales of new homes were close to an annual rate of 373,000 in July , but then recovered in the following months . The data also showed that the average selling price of a new home in December was $ 270,200 , which is 4.6 % higher than a year earlier and the highest level since April.

" The U.S. economy is stagnant , and I'm not very optimistic about this ," said Tom Finlon , head of Group LLC Energy Analytics. " There is some concern that without the stimulus the Fed , stock prices and oil prices will decline ."

Recall that on December 18 the Fed announced that reduces monthly purchases to $ 75 billion a month to $ 85 billion . Tomorrow policies will gather to consider the next step in its strategy of gradual reduction in the rate of bond purchases .

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 95.89 a barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture fell 84 cents to $ 106.93 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices fell markedly today , departing from the 10 - week highs as traders began to gradually fix their positions ahead of a key meeting of the Federal Reserve this week. Recall that at the end of last year, the Fed has decided to reduce the amount of their stimulus package of 10 billion dollars a month - up to $ 75 billion . Many experts expect the Fed will reduce the amount of bond purchases by 10 billion at each subsequent meeting to end QE this year.

We add that the decline in world gold reserves by 2.3 percent last week helped secure precious metals rise on the week , which turned out to be the fifth in a row. This is the longest series of growth since mid- 2012 .

Stock markets also continued to fall today as concerns over a slowdown in China's economic growth and its shadow banking sector , combined with the expectation that the Fed will reduce its purchase of bonds , increased pressure on emerging markets with regard to their dependence on external financing . In the longer term , any recovery actions, in all probability, will limit the rise in prices of the precious metal .

Meanwhile, adding that China's net imports of gold from Hong Kong grew by 24 percent in December compared with the previous month , bringing the procurement in 2013 reached a record 1,158 tons. Net exports to China, which is the world's largest consumer of gold , rose to 94.847 tons in December from 76.393 tons in November.

"In connection with the start of the Chinese New Year , demand is likely to fluctuate at the end of the week," analysts said.

Little support gold had a statement from the Ministry of Finance of India , in which it was said that by the end of March will be revised stringent restrictions on imports of gold.

Cost February gold futures on the COMEX today dropped to $ 1260.80 per ounce.

-

15:00

U.S.: New Home Sales, December 414 (forecast 457)

-

14:35

U.S. Stocks open: Dow 15,879.11 0.00 0.00%, Nasdaq 4,132.99 +4.82 +0.12%, S&P 1,792.77 +2.48 +0.14%

-

14:26

Before the bell: S&P futures +0.36%, Nasdaq futures +0.19%

Standard & Poor’s 500 Index (SPX) futures rose, while Treasuries retreated.

Global markets:

Nikkei 15,005.73 -385.83 -2.51%

Hang Seng 21,976.1 -473.96 -2.11%

Shanghai Composite 2,033.3 -21.09 -1.03%

FTSE 6,577.43 -86.31 -1.30%

CAC 4,158.31 -3.16 -0.08%

DAX 9,375.94 -16.08 -0.17%

Crude oil $97.11 (+0.49%)

Gold $1261.20 (-0.26%).

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.50, Y102.60, Y103.00, Y103.40-45, Y103.60, Y104.15, Y104.95, Y105.00

EUR/USD $1.3500, $1.3550, $1.3750, $1.3800

GBP/USD $1.6450, $1.6530, $1.6605

EUR/GBP stg0.8150, stg0.8300

AUD/USD $0.8600, $0.8625, $0.8650, $0.8700

USD/CAD C$1.0950, C$1.0975, C$1.1075, C$1.1100

-

13:15

European session: the euro fell

09:00 Germany IFO - Business Climate January 109.5 110.2 110.6

09:00 Germany IFO - Current Assessment January 111.6 112.2 112.4

09:00 Germany IFO - Expectations January 107.4 108.0 108.9

10:00 Eurozone Eurogroup Meetings January

11:00 Germany Bundesbank Monthly Report January

12:00 Eurozone ECB’s Vitor Constancio Speaks

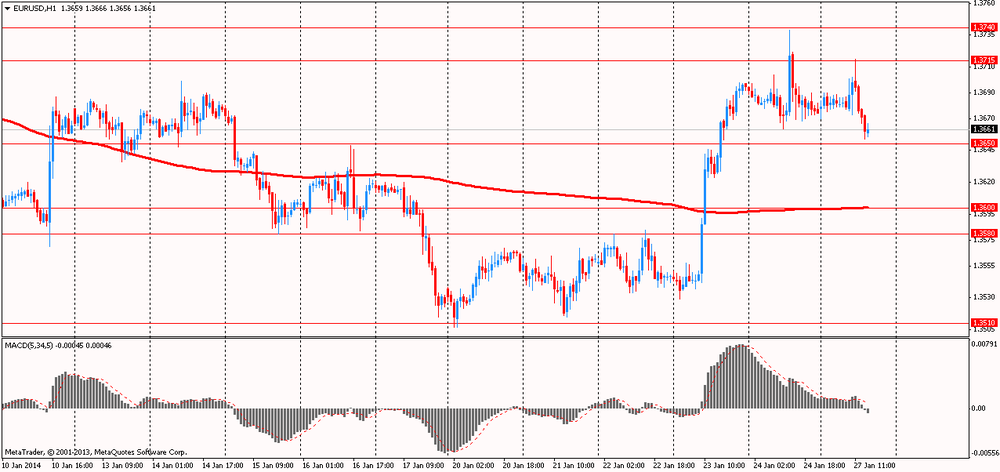

Euro fell to its maximum value against the dollar, while back below the levels of the session. Early growth of the euro was fluff associated with the release of strong data from the institute Ifo, according to which the business climate index in January rose to 110.6 from 109.5 values unrevised December , reaching its highest level since July 2011 and exceeded economists' forecast . In turn , the index of current conditions rose to 112.4 compared to 111.6 in December. Figure was slightly higher than expected 112.2 . The expectations index also improved more than expected to 108.9 from 107.4 . The expected result was 108.

After a report analyst Carsten Brzeski ING said: " Looking ahead , strong labor market data , favorable financing conditions , the gradual growth of investment and new orders , and low wholesale inventories still make economic situation in Germany a unique case ."

In turn, in light of the strong performance of the German Ifo Caroline Newhouse from BNP Paribas said: " The study confirms the positive statistics IFO PMI, published last week. Composite PMI rose in January from 55 to 55.9 , the highest level since June 2011 , remained above the threshold of 50 for the ninth consecutive month . "

The yen lost previously won positions after the release of data on the trade balance of the country. Japan's trade deficit reached a historic high . The deficit amounted to 11.5 trillion . yen ( $ 113 billion ) , which is almost two times more than last year's figure 6.9 trillion . yen , according to the Finance Ministry in Tokyo. In December, imports increased by 25% compared with a year earlier , and exports gained 15% , resulting in a monthly deficit of $ 1.3 trillion . yen. The reason - the growth of energy supplies and the weakness of the yen .

EUR / USD: during the European session, the pair rose to $ 1.3716 , but then fell to $ 1.3654

GBP / USD: during the European session, the pair rose to $ 1.6573

USD / JPY: during the European session, the pair rose to Y170.51

At 15:00 GMT the United States will sales in the primary market in December. At 18:00 GMT a speech ECB board member Jens Weidmann . At 23:00 GMT Australia is to publish an index of leading economic indicators from the Conference Board in November.

-

11:34

European stocks fell for a third day

European stocks fell for a third day, sending the Stoxx Europe 600 Index to its lowest level in a month, after a rout in emerging-market currencies spurred concern the global economic recovery is faltering. Asian shares sank, while U.S. index futures gained.

Benchmark equity gauges in Japan, Hong Kong, South Korea, Taiwan and India declined today, while emerging-market currencies weakened. Last week, currencies from Turkey to Argentina sank with developing-market stocks on signs Chinese manufacturing is slowing as the Federal Reserve reviews its stimulus policies this week.

In Germany, data today showed that the Ifo institute’s business climate index increased for a third month to 110.6 in January, exceeding the median prediction in a Bloomberg News poll that forecast 110. The gauge, based on a survey of 7,000 executives, was at 109.5 in December.

BG Group Plc plunged 15 percent after the U.K. oil and gas producer said 2013 earnings would be lower than expected.

Vodafone Group Plc lost 5 percent after AT&T Inc. said it doesn’t intend to make an offer for Europe’s largest mobile-phone operator.

Banco Popolare SC, Italy’s fourth-biggest bank, was suspended from trading in Milan after slumping the most in five years. The lender said last week it planned to sell as much as 1.5 billion euros ($2.1 billion) of shares to bolster capital.

FTSE 100 6,559.27 -104.47 -1.57%

CAC 40 4,142.39 -19.08 -0.46%

DAX 9,343.33 -48.69 -0.52%

-

10:19

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.50, Y102.60, Y103.00, Y103.40-45, Y103.60, Y104.15, Y104.95, Y105.00

EUR/USD $1.3500, $1.3550, $1.3750, $1.3800

GBP/USD $1.6450, $1.6530, $1.6605

EUR/GBP stg0.8150, stg0.8300

AUD/USD $0.8600, $0.8625, $0.8650, $0.8700

USD/CAD C$1.0950, C$1.0975, C$1.1075, C$1.1100

-

10:06

Asia Pacific stocks close

Asian stocks declined, with the region’s benchmark index heading for its steepest loss since June, as concern that the global economic recovery is faltering spurred investors to sell riskier assets.

Nikkei 225 15,005.73 -385.83 -2.51%

S&P/ASX 200 5,240.93 -22.06 -0.42%

Shanghai Composite 2,032.95 -21.44 -1.04%

Sony Corp. fell 3 percent in Tokyo, pacing losses among Japanese exporters.

Tata Motors Ltd., India’s largest automaker by revenue, tumbled 4.7 percent in Mumbai after Managing Director Karl Slym died in Bangkok.

GCL-Poly Energy Holdings Ltd., the world’s largest maker of polysilicon, declined 4.4 percent in Hong Kong after China set a lower-than-expected target for installed solar-energy capacity this year.

-

09:00

Germany: IFO - Business Climate, January 110.6 (forecast 110.2)

-

09:00

Germany: IFO - Current Assessment , January 112.4 (forecast 112.2)

-

09:00

Germany: IFO - Expectations , January 108.9 (forecast 108.0)

-

07:19

European stocks are seen sharply lower Monday, pressured by the US sell-of Friday and weakness across Asia: the FTSE down 1.1%, the DAX down 2.6% and the CAC down 2.8%

-

07:04

Asian session: The yen touched a seven-week high

The yen touched a seven-week high versus the dollar after a selloff in emerging-market assets boosted its appeal as a haven. Emerging-market equities extended their biggest decline since November, after volatility surged the most in two years. Japan’s currency held its biggest weekly gain since August against its U.S. peer before the Federal Reserve starts a two-day policy meeting tomorrow. The dollar held weekly declines against the yen and euro even as economists forecast the Federal Open Market Committee will reduce monthly asset purchases, now at $75 billion, by $10 billion at each meeting to end the program this year, according to the median forecasts in a Jan. 10 Bloomberg News survey.

Gains in Japan’s currency were limited after the finance ministry said the country’s trade deficit widened to a record in 2013. The shortfall was 11.5 trillion yen ($112.3 billion), almost double the previous year’s 6.9 trillion yen, as energy shipments and weakness in the currency pumped up the import bill.

The euro was supported before a report today forecast to show German business confidence climbed. In Germany, the Ifo Institute’s business climate index, based on a survey of 7,000 executives, probably increased for a third month to 110 in January, according to a Bloomberg poll.

Australia’s dollar rose from a 3 1/2-year low. “There’s a feeling that the decline in the Aussie over the last couple of days might have been a bit overdone,” said Mitul Kotecha, the global head of foreign-exchange strategy at Credit Agricole Corporate & Investment Bank SA in Hong Kong. “I don’t think we’ll see a substantial decline in the Aussie from these levels.”

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3675-90

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6475-05

USD / JPY: on Asian session the pair fell to Y101.70

There is a much quieter calendar across the board Monday, although the German IfO release and the US flash services PMI data will be closely watched. However, much attention will focus on the Fed's latest 2-day FOMC meet that starts Tuesday, with continues chatter the FOMC could further reduce their monthly bond buying programme. The European calendar gets underway at 0830GMT, with the release of the Dutch January Producer confidence index, seen coming at at 0.4, up from -0.1 in December. Also at 0830GMT, ECB Ewald Nowotny speaks with EBRD's Zettemeyer, as the pair present the EBRD's transition plan. The day's main Euro area release comes at 0900GMT, with the release of the German January IfO business climate index. At 1115GMT, French and German Finance Ministers will face the press following a Franco-German meeting in Paris. Then, at 1130GMT, ECB board member Ignazio Visco and BOE's Sir Jon Cunliffe will talk, in Brussels. At 1400GMT, Euro area Finance Minister will gather in Brussels for a Eurogroup meeting.

-

06:01

Schedule for today, Monday, Jan 27’2013:

09:00 Germany IFO - Business Climate January 109.5 110.2

09:00 Germany IFO - Current Assessment January 111.6 112.2

09:00 Germany IFO - Expectations January 107.4 108.0

10:00 Eurozone Eurogroup Meetings January

11:00 Germany Bundesbank Monthly Report January

12:00 Eurozone ECB’s Vitor Constancio Speaks

15:00 U.S. New Home Sales December 464 457

18:00 Eurozone ECB's Jens Weidmann Speaks

23:00 Australia Conference Board Australia Leading Index November +0.5%

23:50 Japan CSPI, y/y December +1.0% 1.1%

-