Notícias do Mercado

-

20:00

Dow +87.37 15,925.25 +0.55% Nasdaq +9.75 4,093.36 +0.24% S&P +10.33 1,791.89 +0.58%

-

19:20

American focus: the Canadian dollar has fallen markedly against the U.S. dollar

The dollar traded higher against the euro with , although some of the previously lost positions gained . Influenced the course of trading data on orders for durable goods , which caused the dollar to plummet , as well as consumer confidence , which helped regain some positions.

As it became known , new orders for durable goods fell 4.3% in December from November to $ 229.3 billion These are the data of the Ministry of Trade . This second drop in three months , and was marked the steepest decline since July. The decrease was due to a decline in demand for civilian aircraft , which is a volatile category. But even excluding the transportation sector , orders for durable goods fell by 1.6 %, showing the biggest drop since March. Economists had forecast an increase of 2 % of orders for durable goods in December. The data indicate that consumers and businesses are still spending cautiously , despite signs that the U.S. economy is gaining strength in recent months of 2013.

Another report showed that consumer confidence index from the Conference Board, which rebounded in December , increased again in January. The index is currently 80.7 ( 1985 = 100) compared to 77.5 in December. The current conditions index rose to 79.1 from 75.3 . The expectations index rose to 81.8 from 79.0 last month.

" The consumer confidence index rose in January for the second month in a row ," said Lynn Franco , director of economic indicators in The Conference Board. " Estimation by consumers of the situation continues to improve. As business conditions, and the same situation on the labor market are evaluated more favorably . Looking ahead six months , consumers expect the economy and their incomes improve, but they were somewhat mixed about the prospects for jobs. In general, there is a confidence that the economy is on track and growing expectations suggest that the economy can gain some momentum in the coming months. "

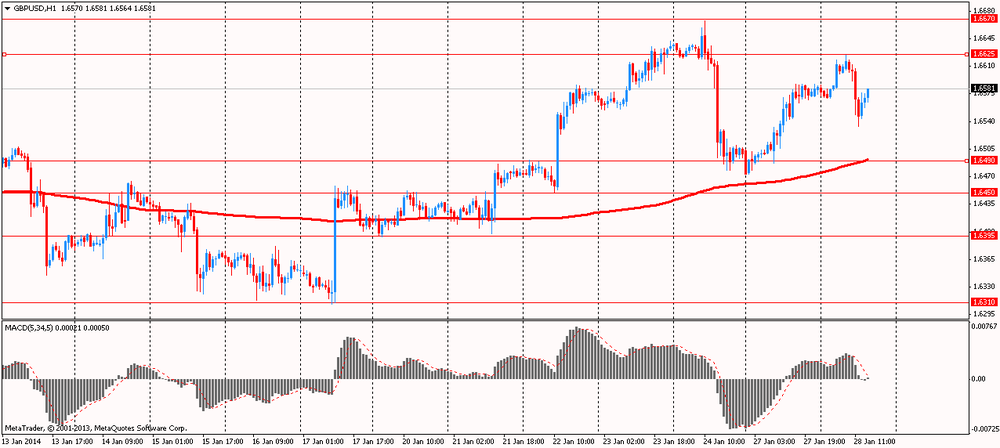

Pound returned to the level of opening of the session against the dollar, despite sharp fluctuations during the auction. Initially, the pressure on the currency had a report on Britain's GDP , which is not justified forecasts , but weak U.S. data ( on orders for durable goods ) helped to regain lost ground . However, another report by the USA ( potrebdoveriyu ) were much better than expected, which again put pressure on the pound and brought him back to the opening level .

As for the British report , it showed that the UK economy expanded in the fourth quarter , but the rate of expansion slowed slightly . Gross domestic product grew by 0.7 per cent compared with the previous quarter , when it grew by 0.8 percent. Economists had expected the economy to grow by 0.8 per cent . Issue increased by 0.5 percent in agriculture, 0.7 percent in manufacturing and 0.8 percent in services. However , construction output fell by 0.3 percent. On an annualized basis in the fourth quarter GDP grew by 2.8 percent. GDP is estimated to have increased by 1.9 percent in 2013 compared with 2012 . In the fourth quarter GDP was 1.3 percent below the peak in the first quarter of 2008. Since reaching a peak to a minimum of 2009 the economy contracted by 7.2 percent.

The Canadian dollar declined significantly against the U.S. dollar , reaching at this 4.5 -year low on expectations of further Fed folding and further commitment of the Bank of Canada's policy weak currency. Fed today begins 2 -day meeting . Expected to further minimize the quantitative easing program . Despite the weakness of the labor market , according to the consensus forecast is expected that the Central Bank will refrain from sharp folding , cutting 75 -billion program gradually , until the end of this year.

Meanwhile, we add that although the head of the Central Bank of Canada skid refrained from defining a target , he makes no secret of his desire to see the weak Canadian dollar. Both he and Prime Minister Stephen Harper stated that they would like to see growth in exports, which can stimulate the economy. A weaker Canadian dollar will help make the country's exports more attractive to U.S. imports and contribute to inflation in the domestic economy .

-

18:00

European stock close

European stocks advanced, following their largest three-day slump in seven months, as mining companies climbed and banks rebounded from a three-week low.

The Stoxx Europe 600 Index increased 0.7 percent to 324.19 at 4:30 p.m. in London. The benchmark retreated 4.2 percent from Jan. 22 through yesterday as the Argentinian government’s decision to allow its currency to devalue triggered a rout in emerging-market currencies.

In the U.K., the Office for National Statistics said gross domestic product expanded 0.7 percent in its initial estimate for the final three months of 2013. That completes the first full year since 2007 when the economy expanded in every quarter.

In the U.S., a Commerce Department report showed orders of durable goods unexpectedly dropped 4.3 percent in December after climbing a revised 2.6 percent in November. Analysts had predicted a gain of 1.8 percent. A separate release showed the Conference Board’s consumer-confidence index rose to 80.7 in January, beating the median economist estimate of 78. The index had a revised reading of 77.5 last month.

The Federal Reserve will begin its final two-day monetary-policy meeting under Chairman Ben S. Bernanke today. He leaves his post on Jan. 31. The central bank will probably reduce its monthly bond purchases in $10 billion increments over the next six meetings before announcing an end to the program no later than December.

National equity benchmarks rose in 15 of the 18 western-European markets today.

FTSE 100 6,572.33 +21.67 +0.33% CAC 40 4,185.29 +40.73 +0.98% DAX 9,406.91 +57.69 +0.62%

A gauge of mining companies rebounded from its lowest level in almost two weeks. Nomura Holdings Inc. raised its rating on the industry to neutral from bearish. The brokerage’s Tyler Broda said companies may reduce costs by more than analysts predict. BHP Billiton and Rio Tinto, which Nomura named as its top picks, rose 1.4 percent to 1,804 pence and 2.3 percent to 3,213.5 pence, respectively.

Santander climbed 1.6 percent to 6.37 euros. The shares lost 5.3 percent in the three days through yesterday as emerging-market currencies from the Argentinian peso to the Brazilian real weakened.

F&C Asset Management jumped 6.1 percent to 123.5 pence, its highest price since 2008. Bank of Montreal will pay 120 pence a share in cash for the money manager, the two companies said in a joint statement. F&C’s shareholders will also receive a dividend of 2 pence a share.

Siemens AG rose 1.6 percent to 98.94 euros as Europe’s largest engineering company said income from continuing operations in the first quarter of its financial year jumped 21 percent to 1.39 billion euros ($1.9 billion). The average estimate of analysts had called for 1.33 billion euros. The profit ">Software AG rallied 7.2 percent to 27.50 euros after the German company forecast that earnings before interest and taxes may increase by as much as 10 percent in 2014 from last year’s 260.7 million euros.

-

17:00

European stock close: FTSE 100 6,572.33 +21.67 +0.33% CAC 40 4,185.29 +40.73 +0.98% DAX 9,406.91 +57.69 +0.62%

-

16:40

Oil: an overview of the market situation

Crude oil futures rose on Tuesday as traders are awaiting the start of a two-day meeting of the Federal Reserve System, the outcome of which will depend on the future dynamics of oil prices.

Today starts the meeting of the Committee on the Federal Open Market , which resulted , as analysts suggest , the controller will cut another $ 10 billion program volume QEIII. Against this background , experts predict that the price of oil in the next two days will be traded in a limited range while maintaining prospects for further growth. Recall that last month the Fed surprised some investors when it announced plans to launch phase out its purchase of bonds to $ 75 billion to $ 85 billion . Since that time , the stock market retreated on concerns about economic growth in emerging markets , which potentially complicates the path to further reduce the bond purchases.

Meanwhile, traders say prices are rising amid lingering harsh weather conditions in the U.S., which lead to a reduction in the quantity of fuel in the country.

"The cold weather in the U.S. helped boost demand for heating oil and propane, as well as create a shortage of fuel supplies in the region" , - experts said Goldman Sachs Group Inc.

Add that analysts also expect a report tomorrow from the U.S. Energy Information Administration , which is estimated to show another weekly decline in distillate stocks . Stocks. Some experts also expect that crude oil inventories rose by more than 2 million barrels for the week ended January 24. If this forecast proves correct , it will be the second consecutive increase Nedalniy , after a seven-week fall.

Furthermore , we recall that today its inventory report will present the American Petroleum Institute , which will help better prepare for tomorrow's data, and possibly revise estimates

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $97.45 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture increased by 55 cents to $107.50 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices declined moderately today , after weak U.S. data on orders for durable goods decreased optimism regarding the strength of the economy , reducing expectations for a further reduction in stimulus from the Fed.

The U.S. Commerce Department said that new orders for durable goods fell 4.3% in December from November to $ 229.3 billion, which is the second drop in three months , and was marked the steepest decline since July. The decrease was due to a decline in demand for civilian aircraft , which is a volatile category. But even excluding the transportation sector , orders for durable goods fell by 1.6 %, showing the biggest drop since March. Economists had forecast an increase of 2 % of orders for durable goods in December. The data indicate that consumers and businesses are still spending cautiously , despite signs that the U.S. economy is gaining strength in recent months of 2013. The report also showed that demand in November was weaker than previously thought. New figures showed that overall orders for durable goods rose 2.6% in the same month , instead of the previously voiced 3.4%. Orders excluding transportation were revised downward to 0.1 % increase instead of 1.2%.

Meanwhile, adding that traders begin to prepare for the announcement of the two-day meeting on Wednesday and evaluate possible courses of action with respect to bond-buying program the central bank. This meeting will be the last for the current Fed chairman Ben Bernanke . In this position, it will replace the current Vice Chairman Janet Yellen . Market analysts expect the Fed to cut its bond-buying program to a level of $ 65 billion from the current $ 75 billion . Recall that the central bank announced its first reduction of monthly purchases of bonds in December , citing an improving economy . Results of Fed meeting will be crucial for gold in the short term . Further reduction of stimulus in the U.S. could lead to new large-scale sales of metal , while the delay to minimize the program , on the contrary , provoke purchase. Given the considerable uncertainty in this matter , gold in the short term , is likely to trade without significant changes.

Cost February gold futures on the COMEX today dropped to $ 1251.50 per ounce.

-

15:01

U.S.: Consumer confidence , January 80.7 (forecast 78.1)

-

15:00

U.S.: Richmond Fed Manufacturing Index, January 12 (forecast 13)

-

14:34

U.S. Stocks open: Dow 15,868.13 +30.25 +0.19%, Nasdaq 4,073.20 -10.41 -0.25%, S&P 1,783.44 +1.88 +0.11%

-

14:23

Before the bell: S&P futures +0.18%, Nasdaq futures -0.44%

U.S. stock futures pared gains, as orders for durable goods unexpectedly fell in December and investors awaited a Federal Reserve policy meeting.

Global markets:

Nikkei 14,980.16 -25.57 -0.17%

Hang Seng 21,960.64 -15.46 -0.07%

Shanghai Composite 2,038.51 +5.21 +0.26%

FTSE 6,571.42 +20.76 +0.32%

CAC 4,166.04 +21.48 +0.52%

DAX 9,374.85 +25.63 +0.27%

Crude oil $96.45 (+0.76%)

Gold $1257.60 (-0.47%).

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, November +13.7% (forecast +13.7%)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.40, Y102.90, Y103.00, Y103.80, Y104.25, Y104.50

EUR/JPY Y141.20

EUR/USD $1.3540, $1.3590, $1.3670, $1.3680, $1.3700

GBP/USD $1.6375

EUR/GBP stg0.8265

AUD/USD $0.8700, $0.8875

AUD/JPY Y91.30

USD/CAD C$1.0940, C$1.1050

-

13:30

U.S.: Durable Goods Orders , December -4.3% (forecast +2.0%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , December -1.6% (forecast +0.7%)

-

13:30

U.S.: Durable goods orders ex defense, December -3.7% (forecast +1.0%)

-

13:16

European session: the euro fell

07:45 France Consumer confidence January 85 85 86

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV +0.8% +0.8% +0.7%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.9% +2.9% +2.8%

10:00 Eurozone ECOFIN Meetings January

The euro fell against the U.S. dollar against the background data on import prices in Germany. As shown by the data published by the Federal Statistical Office , import prices in Germany fell twelfth consecutive month in December, but in a lesser degree than in the previous month . The import price index fell by 2.3 percent in December compared with the corresponding month in 2012 . This followed a 2.9 percent drop in November. Prices are already falling regularly since December 2012 . Economists had forecast a slower decline by 2.2 percent in December 2013 . Index was influenced by a 5 percent fall in energy prices as well as falling to 15.5 per cent in the cost of non-ferrous metals . Prices for the products of iron, steel and alloys were 5.4 percent lower than a year earlier.

On a monthly basis , import prices were unchanged in December , after an increase in November to 0.1 percent. Expectations were level rise by 0.2 percent. Overall, in 2013 the import price index fell by 2.6 per cent per annum, after rising 2.2 percent in 2012 . The decrease was due mainly to a fall 7 percent in energy prices.

Department of Statistics also reported that in Germany, export prices decreased at a slower annual rate of 1 percent in December compared with a decline of 1.1 percent in the previous month . On a monthly measurement of export prices fell by 0.1 percent , after being unchanged in November.

At the beginning of the session, some support for the single currency was data on consumer confidence in France. The consumer confidence index rose to 86 in January from 85 in December and 84 in November. Economists had forecast the index to remain unchanged at December . Estimation by consumers of their past financial situation was essentially unchanged in January compared with the previous month . Meanwhile , their expectations of personal finances in the coming months were more optimistic, corresponding sub-indicator rose to -18 from -20 in December.

The survey showed that the number of households that said in January the best time to make major purchases and savings increased. Similarly , their expectations about future ability to save , were more optimistic. Measure attitudes households past state of the French economy grew by 2 points to -71 in January. At the same time , their expectations for the future state of the economy showed further improvement . Prospects indicator rose to -45 from -49 .

British pound reacted negatively to the preliminary data on GDP. Economic growth in the UK fell in the last quarter of 2013, and it is a slight slowdown can strengthen the authorities' determination to continue to promote , to support further growth . British National Bureau of Statistics (ONS) said on Tuesday that the gross domestic product in the 4th quarter increased by 0.7 % compared to the 3rd quarter , after rising 0.8% in the previous two quarters.

Compared with the same period of the previous year , GDP grew by 2.8%. Downturn in the construction industry in November was a major factor slowing , reported ONS, which estimates that production decline in the sector for the quarter was 0.3 %. In other sectors, there was an increase .

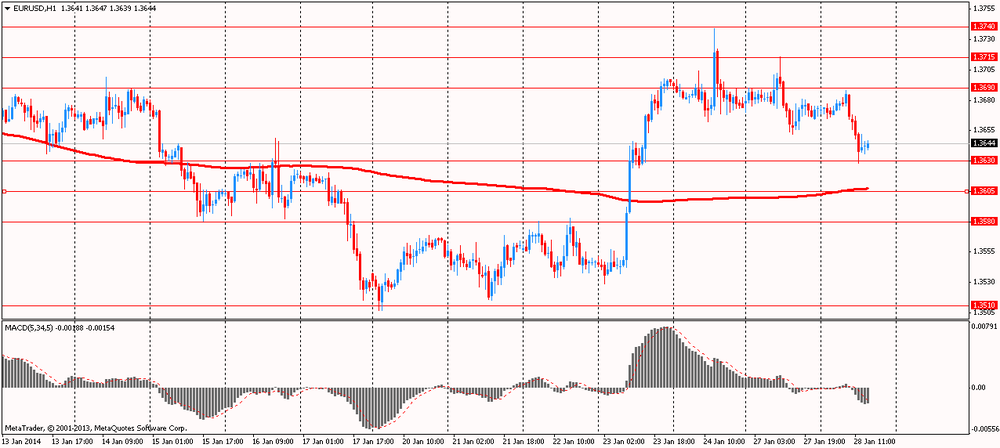

EUR / USD: during the European session, the pair rose to $ 1.3688 , but then fell to $ 1.3628

GBP / USD: during the European session, the pair rose to $ 1.6624 , but then fell to $ 1.6534

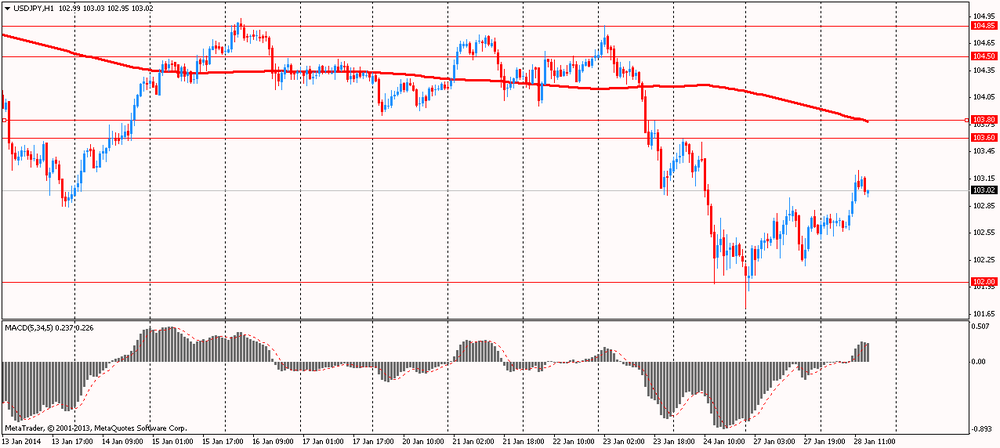

USD / JPY: during the European session, the pair rose to Y103.25

In the U.S. at 13:30 GMT will change in orders for durable goods , including excluding transport equipment for December, in 14:00 GMT - the index of home prices in 20 major cities of S & P / Case-Shiller, national composite house price index S & P / CaseShiller November in 15:00 GMT - indicator of consumer confidence for January . At 23:30 GMT Australia will present leading index of economic activity from the Westpac-MI in December.

-

11:30

European stocks advanced

European stocks advanced, following their largest three-day slump in seven months, as mining companies climbed and Siemens AG posted profit that beat estimates. U.S. futures also gained, while Asian shares fell.

In the U.K., the Office for National Statistics said gross domestic product expanded 0.7 percent in the final three months of 2013 in its initial estimate. That completes the first full year since 2007 when the economy expanded in every quarter.

In the U.S., a report at 8:30 a.m. in Washington will probably show orders of durable goods increased 1.8 percent in December, economists predicted. They rose 3.4 percent in November. A separate release at 10 a.m. may show the Conference Board’s consumer-confidence index slipped in January to 78 from 78.1 in December, according to the median economist estimate.

A gauge of mining companies rebounded from its lowest level in almost two weeks, dragging the Stoxx 600 higher. Nomura Holdings Inc. raised its rating on the industry to neutral from bearish. Analyst Tyler Broda said companies may reduce costs by more than analysts predict. BHP Billiton and Rio Tinto, which Nomura named as its top picks, rose 1.4 percent to 1,805 pence and 2.5 percent to 3,219 pence, respectively.

Siemens rose 0.8 percent to 98.20 euros as Europe’s largest engineering company said income from continuing operations in the first quarter of its financial year jumped 21 percent to 1.39 billion euros ($1.9 billion). The average estimate of analysts surveyed by Bloomberg had called for 1.33 billion euros. The profit ">Software AG rallied 6.5 percent to 27.33 euros after the Germany company forecast that earnings before interest and taxes may increase by as much as 10 percent in 2014 from last year’s 260.7 million euros.

FTSE 100 6,578.28 +27.62 +0.42%

CAC 40 4,178.27 +33.71 +0.81%

DAX 9,415.08 +65.86 +0.70%

-

10:30

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.40, Y102.90, Y103.00, Y103.80, Y104.25, Y104.50

EUR/JPY Y141.20

EUR/USD $1.3540, $1.3590, $1.3670, $1.3680, $1.3700

GBP/USD $1.6375

EUR/GBP stg0.8265

AUD/USD $0.8700, $0.8875

AUD/JPY Y91.30

USD/CAD C$1.0940

-

10:08

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index on course to drop for a fourth day, amid concern over the Federal Reserve’s plan to cut stimulus and as profit growth at China’s industrial companies slowed.

Nikkei 225 14,980.16 -25.57 -0.17%

Hang Seng 21,965.03 -11.07 -0.05%

S&P/ASX 200 5,175.11 -65.82 -1.26%

Shanghai Composite 2,038.51 +5.21 +0.26%

BHP Billiton Ltd., the world’s biggest mining company that counts China as its No. 1 market, fell 2 percent to be the biggest drag on the index as Australian markets opened after a holiday.

LG Display Co. lost 3.3 percent in Seoul after customer Apple Inc. forecast sales that trailed analyst estimates.

Komatsu Ltd., the world’s second-largest maker of construction equipment, gained 1 percent in Tokyo after bigger rival Caterpillar Inc. projected earnings that topped expectations.

-

09:56

FTSE 100 6,568.16 +17.50 +0.27%, CAC 40 4,170.49 +25.93 +0.63%, Xetra DAX 9,406 +56.78 +0.61%

-

09:30

United Kingdom: GDP, q/q, Quarter IV +0.7% (forecast +0.8%)

-

09:30

United Kingdom: GDP, y/y, Quarter III +2.8% (forecast +2.9%)

-

07:45

France: Consumer confidence , January 86 (forecast 85)

-

07:22

European stock futures are seen edging lower in early trade Tuesday: the FTSE down 0.1%, the CAC down 0.4% and the DAX down 0.1%.

-

07:06

Asian session: Japan’s currency fell

00:30 Australia National Australia Bank's Business Confidence December 5 6

05:00 Japan Small Business Confidence January 51.1 51.3

Japan’s currency fell as its haven appeal waned on speculation Turkey’s central bank will raise interest rates at an extraordinary meeting today, and after China’s largest lender said investors in a troubled high-yield trust can recoup funds. Turkey’s central bank said it will “take the necessary policy measures for price stability” at a meeting today, fueling speculation that it could do everything from raise rates by 3 percentage points to impose capital controls. A decision by policy makers last week to keep rates on hold was partly responsible for the currency’s biggest weekly selloff in almost four years.

The dollar rose versus the yen before the Federal Reserve begins a two-day meeting amid forecasts it will cut monthly asset purchases by $10 billion.

The pound has climbed against 13 of its 16 major peers this year on signs the U.K. economy is strengthening. Gross domestic product probably rose 2.8 percent in the fourth quarter from a year ago, the fastest expansion since the first three months of 2008, according to the median of estimates in a Bloomberg survey.

EUR / USD: during the Asian session, the pair rose to $ 1.3680

GBP / USD: during the Asian session, the pair rose to $ 1.6620

USD / JPY: on Asian session the pair traded in the range of Y102.50-80

Today's release of UK Q4 GDP at 0930GMT, with most expecting a positive outcome (median forecast 0.70% Q/Q, 2.8% y/y). -

06:24

Commodities. Daily history for Jan 27’2013:

Gold $1,254.01 -$16.05 -1.26%

Oil $95.88 -$0.76 -0.79%

-

06:24

Stocks. Daily history for Jan 27’2013:

Nikkei 225 15,005.73 -385.83 -2.51%

S&P/ASX 200 5,240.93 -22.06 -0.42%

Shanghai Composite 2,032.95 -21.44 -1.04%

FTSE 100 6,550.66 -113.08 -1.70%

CAC 40 4,144.56 -16.91 -0.41%

DAX 9,349.22 -42.80 -0.46%

Dow -24.22 15,854.89 -0.15%

Nasdaq -44.56 4,083.61 -1.08%

S&P -8.75 1,781.54 -0.49%

-

06:24

Currencies. Daily history for Jan 27'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3673 -0,01%

GBP/USD $1,6583 +0,51%

USD/CHF Chf0,8964 +0,22%

USD/JPY Y102,55 +0,30%

EUR/JPY Y140,20 +0,28%

GBP/JPY Y170,03 +0,79%

AUD/USD $0,8737 +0,49%

NZD/USD $0,8229 -0,18%

USD/CAD C$1,1114 +0,40%

-

06:10

Schedule for today, Tuesday, Jan 28’2013:

00:30 Australia National Australia Bank's Business Confidence December 5

05:00 Japan Small Business Confidence January 51.1

07:45 France Consumer confidence January 85 85

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV +0.8% +0.8%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.9% +2.9%

10:00 Eurozone ECOFIN Meetings January

13:30 U.S. Durable Goods Orders December +3.5% +2.0%

13:30 U.S. Durable Goods Orders ex Transportation December +1.2% +0.7%

13:30 U.S. Durable goods orders ex defense December +3.5% +1.0%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November +13.6% +13.7%

15:00 U.S. Richmond Fed Manufacturing Index January 13 13

15:00 U.S. Consumer confidence January 78.1 78.1

21:30 U.S. API Crude Oil Inventories January +4.9

23:30 Australia Leading Index December -0.1%

-