Notícias do Mercado

-

19:20

American focus: the Canadian dollar has fallen markedly against the U.S. dollar

The dollar traded higher against the euro with , although some of the previously lost positions gained . Influenced the course of trading data on orders for durable goods , which caused the dollar to plummet , as well as consumer confidence , which helped regain some positions.

As it became known , new orders for durable goods fell 4.3% in December from November to $ 229.3 billion These are the data of the Ministry of Trade . This second drop in three months , and was marked the steepest decline since July. The decrease was due to a decline in demand for civilian aircraft , which is a volatile category. But even excluding the transportation sector , orders for durable goods fell by 1.6 %, showing the biggest drop since March. Economists had forecast an increase of 2 % of orders for durable goods in December. The data indicate that consumers and businesses are still spending cautiously , despite signs that the U.S. economy is gaining strength in recent months of 2013.

Another report showed that consumer confidence index from the Conference Board, which rebounded in December , increased again in January. The index is currently 80.7 ( 1985 = 100) compared to 77.5 in December. The current conditions index rose to 79.1 from 75.3 . The expectations index rose to 81.8 from 79.0 last month.

" The consumer confidence index rose in January for the second month in a row ," said Lynn Franco , director of economic indicators in The Conference Board. " Estimation by consumers of the situation continues to improve. As business conditions, and the same situation on the labor market are evaluated more favorably . Looking ahead six months , consumers expect the economy and their incomes improve, but they were somewhat mixed about the prospects for jobs. In general, there is a confidence that the economy is on track and growing expectations suggest that the economy can gain some momentum in the coming months. "

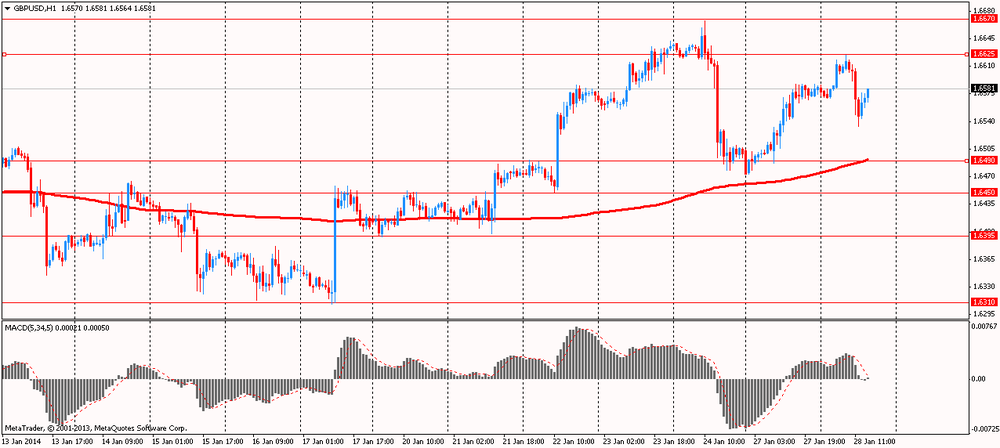

Pound returned to the level of opening of the session against the dollar, despite sharp fluctuations during the auction. Initially, the pressure on the currency had a report on Britain's GDP , which is not justified forecasts , but weak U.S. data ( on orders for durable goods ) helped to regain lost ground . However, another report by the USA ( potrebdoveriyu ) were much better than expected, which again put pressure on the pound and brought him back to the opening level .

As for the British report , it showed that the UK economy expanded in the fourth quarter , but the rate of expansion slowed slightly . Gross domestic product grew by 0.7 per cent compared with the previous quarter , when it grew by 0.8 percent. Economists had expected the economy to grow by 0.8 per cent . Issue increased by 0.5 percent in agriculture, 0.7 percent in manufacturing and 0.8 percent in services. However , construction output fell by 0.3 percent. On an annualized basis in the fourth quarter GDP grew by 2.8 percent. GDP is estimated to have increased by 1.9 percent in 2013 compared with 2012 . In the fourth quarter GDP was 1.3 percent below the peak in the first quarter of 2008. Since reaching a peak to a minimum of 2009 the economy contracted by 7.2 percent.

The Canadian dollar declined significantly against the U.S. dollar , reaching at this 4.5 -year low on expectations of further Fed folding and further commitment of the Bank of Canada's policy weak currency. Fed today begins 2 -day meeting . Expected to further minimize the quantitative easing program . Despite the weakness of the labor market , according to the consensus forecast is expected that the Central Bank will refrain from sharp folding , cutting 75 -billion program gradually , until the end of this year.

Meanwhile, we add that although the head of the Central Bank of Canada skid refrained from defining a target , he makes no secret of his desire to see the weak Canadian dollar. Both he and Prime Minister Stephen Harper stated that they would like to see growth in exports, which can stimulate the economy. A weaker Canadian dollar will help make the country's exports more attractive to U.S. imports and contribute to inflation in the domestic economy .

-

15:01

U.S.: Consumer confidence , January 80.7 (forecast 78.1)

-

15:00

U.S.: Richmond Fed Manufacturing Index, January 12 (forecast 13)

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, November +13.7% (forecast +13.7%)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.40, Y102.90, Y103.00, Y103.80, Y104.25, Y104.50

EUR/JPY Y141.20

EUR/USD $1.3540, $1.3590, $1.3670, $1.3680, $1.3700

GBP/USD $1.6375

EUR/GBP stg0.8265

AUD/USD $0.8700, $0.8875

AUD/JPY Y91.30

USD/CAD C$1.0940, C$1.1050

-

13:30

U.S.: Durable Goods Orders , December -4.3% (forecast +2.0%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , December -1.6% (forecast +0.7%)

-

13:30

U.S.: Durable goods orders ex defense, December -3.7% (forecast +1.0%)

-

13:16

European session: the euro fell

07:45 France Consumer confidence January 85 85 86

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV +0.8% +0.8% +0.7%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.9% +2.9% +2.8%

10:00 Eurozone ECOFIN Meetings January

The euro fell against the U.S. dollar against the background data on import prices in Germany. As shown by the data published by the Federal Statistical Office , import prices in Germany fell twelfth consecutive month in December, but in a lesser degree than in the previous month . The import price index fell by 2.3 percent in December compared with the corresponding month in 2012 . This followed a 2.9 percent drop in November. Prices are already falling regularly since December 2012 . Economists had forecast a slower decline by 2.2 percent in December 2013 . Index was influenced by a 5 percent fall in energy prices as well as falling to 15.5 per cent in the cost of non-ferrous metals . Prices for the products of iron, steel and alloys were 5.4 percent lower than a year earlier.

On a monthly basis , import prices were unchanged in December , after an increase in November to 0.1 percent. Expectations were level rise by 0.2 percent. Overall, in 2013 the import price index fell by 2.6 per cent per annum, after rising 2.2 percent in 2012 . The decrease was due mainly to a fall 7 percent in energy prices.

Department of Statistics also reported that in Germany, export prices decreased at a slower annual rate of 1 percent in December compared with a decline of 1.1 percent in the previous month . On a monthly measurement of export prices fell by 0.1 percent , after being unchanged in November.

At the beginning of the session, some support for the single currency was data on consumer confidence in France. The consumer confidence index rose to 86 in January from 85 in December and 84 in November. Economists had forecast the index to remain unchanged at December . Estimation by consumers of their past financial situation was essentially unchanged in January compared with the previous month . Meanwhile , their expectations of personal finances in the coming months were more optimistic, corresponding sub-indicator rose to -18 from -20 in December.

The survey showed that the number of households that said in January the best time to make major purchases and savings increased. Similarly , their expectations about future ability to save , were more optimistic. Measure attitudes households past state of the French economy grew by 2 points to -71 in January. At the same time , their expectations for the future state of the economy showed further improvement . Prospects indicator rose to -45 from -49 .

British pound reacted negatively to the preliminary data on GDP. Economic growth in the UK fell in the last quarter of 2013, and it is a slight slowdown can strengthen the authorities' determination to continue to promote , to support further growth . British National Bureau of Statistics (ONS) said on Tuesday that the gross domestic product in the 4th quarter increased by 0.7 % compared to the 3rd quarter , after rising 0.8% in the previous two quarters.

Compared with the same period of the previous year , GDP grew by 2.8%. Downturn in the construction industry in November was a major factor slowing , reported ONS, which estimates that production decline in the sector for the quarter was 0.3 %. In other sectors, there was an increase .

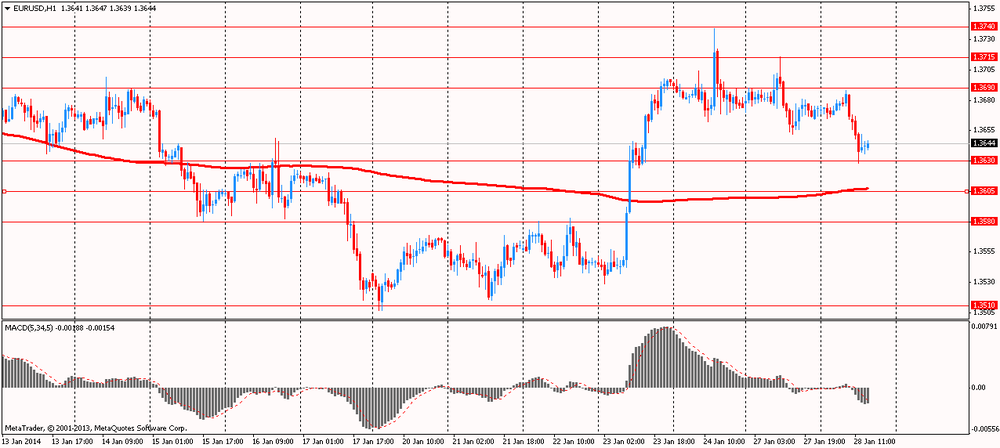

EUR / USD: during the European session, the pair rose to $ 1.3688 , but then fell to $ 1.3628

GBP / USD: during the European session, the pair rose to $ 1.6624 , but then fell to $ 1.6534

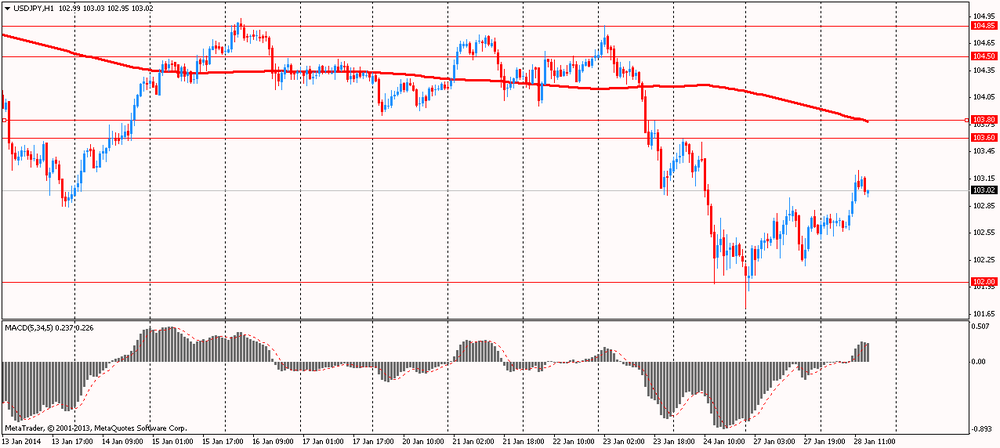

USD / JPY: during the European session, the pair rose to Y103.25

In the U.S. at 13:30 GMT will change in orders for durable goods , including excluding transport equipment for December, in 14:00 GMT - the index of home prices in 20 major cities of S & P / Case-Shiller, national composite house price index S & P / CaseShiller November in 15:00 GMT - indicator of consumer confidence for January . At 23:30 GMT Australia will present leading index of economic activity from the Westpac-MI in December.

-

10:30

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.40, Y102.90, Y103.00, Y103.80, Y104.25, Y104.50

EUR/JPY Y141.20

EUR/USD $1.3540, $1.3590, $1.3670, $1.3680, $1.3700

GBP/USD $1.6375

EUR/GBP stg0.8265

AUD/USD $0.8700, $0.8875

AUD/JPY Y91.30

USD/CAD C$1.0940

-

09:30

United Kingdom: GDP, q/q, Quarter IV +0.7% (forecast +0.8%)

-

09:30

United Kingdom: GDP, y/y, Quarter III +2.8% (forecast +2.9%)

-

07:45

France: Consumer confidence , January 86 (forecast 85)

-

07:06

Asian session: Japan’s currency fell

00:30 Australia National Australia Bank's Business Confidence December 5 6

05:00 Japan Small Business Confidence January 51.1 51.3

Japan’s currency fell as its haven appeal waned on speculation Turkey’s central bank will raise interest rates at an extraordinary meeting today, and after China’s largest lender said investors in a troubled high-yield trust can recoup funds. Turkey’s central bank said it will “take the necessary policy measures for price stability” at a meeting today, fueling speculation that it could do everything from raise rates by 3 percentage points to impose capital controls. A decision by policy makers last week to keep rates on hold was partly responsible for the currency’s biggest weekly selloff in almost four years.

The dollar rose versus the yen before the Federal Reserve begins a two-day meeting amid forecasts it will cut monthly asset purchases by $10 billion.

The pound has climbed against 13 of its 16 major peers this year on signs the U.K. economy is strengthening. Gross domestic product probably rose 2.8 percent in the fourth quarter from a year ago, the fastest expansion since the first three months of 2008, according to the median of estimates in a Bloomberg survey.

EUR / USD: during the Asian session, the pair rose to $ 1.3680

GBP / USD: during the Asian session, the pair rose to $ 1.6620

USD / JPY: on Asian session the pair traded in the range of Y102.50-80

Today's release of UK Q4 GDP at 0930GMT, with most expecting a positive outcome (median forecast 0.70% Q/Q, 2.8% y/y). -

06:24

Currencies. Daily history for Jan 27'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3673 -0,01%

GBP/USD $1,6583 +0,51%

USD/CHF Chf0,8964 +0,22%

USD/JPY Y102,55 +0,30%

EUR/JPY Y140,20 +0,28%

GBP/JPY Y170,03 +0,79%

AUD/USD $0,8737 +0,49%

NZD/USD $0,8229 -0,18%

USD/CAD C$1,1114 +0,40%

-

06:10

Schedule for today, Tuesday, Jan 28’2013:

00:30 Australia National Australia Bank's Business Confidence December 5

05:00 Japan Small Business Confidence January 51.1

07:45 France Consumer confidence January 85 85

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV +0.8% +0.8%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III +1.9% +2.9%

10:00 Eurozone ECOFIN Meetings January

13:30 U.S. Durable Goods Orders December +3.5% +2.0%

13:30 U.S. Durable Goods Orders ex Transportation December +1.2% +0.7%

13:30 U.S. Durable goods orders ex defense December +3.5% +1.0%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November +13.6% +13.7%

15:00 U.S. Richmond Fed Manufacturing Index January 13 13

15:00 U.S. Consumer confidence January 78.1 78.1

21:30 U.S. API Crude Oil Inventories January +4.9

23:30 Australia Leading Index December -0.1%

-