Notícias do Mercado

-

20:00

New Zealand: RBNZ Interest Rate Decision, 2.50% (forecast 2.50%)

-

19:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

19:00

U.S.: FOMC QE Decision, 65

-

18:40

American focus : Japanese yen has risen considerably against the U.S. dollar

Rate of the euro regained almost all previously lost ground against the dollar, while returning to levels opening of the session amid a lack of economic drivers, and in anticipation of the Fed's decision . Note that today completed the first in this year's meeting of the Open Market Committee (FOMC) of the Fed. This session will last for Ben Bernanke as chairman. But, why this meeting is important. The fact of change management fedrerva is not essential for the markets , as it is already priced in , and the name of the next head of the U.S. central bank has long been known . More important is the answer to the question whether the Fed will continue to curtail the program of quantitative easing (QE)? Most likely , the answer to this question is yes . But, there are a number of factors that reduce the likelihood of such an outcome and not exclude the possibility that the Fed will take a wait and see position , without making its monetary policy unchanged. Many experts say that the central bank is likely to reduce their monthly bond purchases to $ 10 billion , followed by further changes by the same amount over the next five meetings , and before the end of the year to announce the completion of the program.

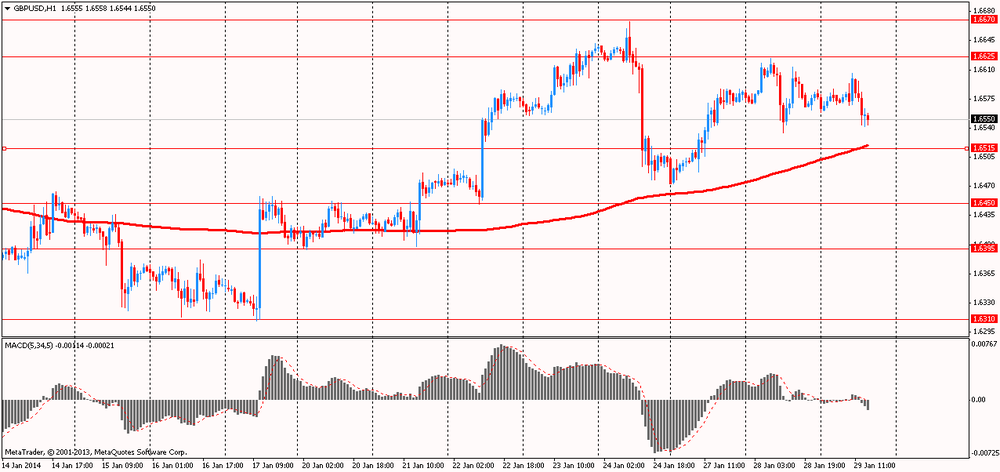

Pound retreated from a session low against the dollar , reaching levels opening trading today. Impact on the dynamics of the Bank of England comments , and expectations of the Fed meeting announcement . Add that today, Bank of England Governor Mark Carney said that rates will remain unchanged for some time to allow the economic recovery to gain a foothold . And their rise will be gradual , he said.

Speaking in Edinburgh , Carney said that he expects that the pound will cause moderate inflation and slower growth in consumption. He also made it clear that the MPC will soon submit the changes to the " policy of transparency."

Carney said that the need arises to partially abandon national sovereignty in the case If Scotland becomes an independent state , but continue to use the pound. Will need to create a banking union and impose strict financial rules to avoid problems later , which now have the eurozone. " Such risks are clearly discernible in the euro area in recent years , namely the sovereign debt crisis , financial fragmentation and large differences in economic growth ," said Carney .

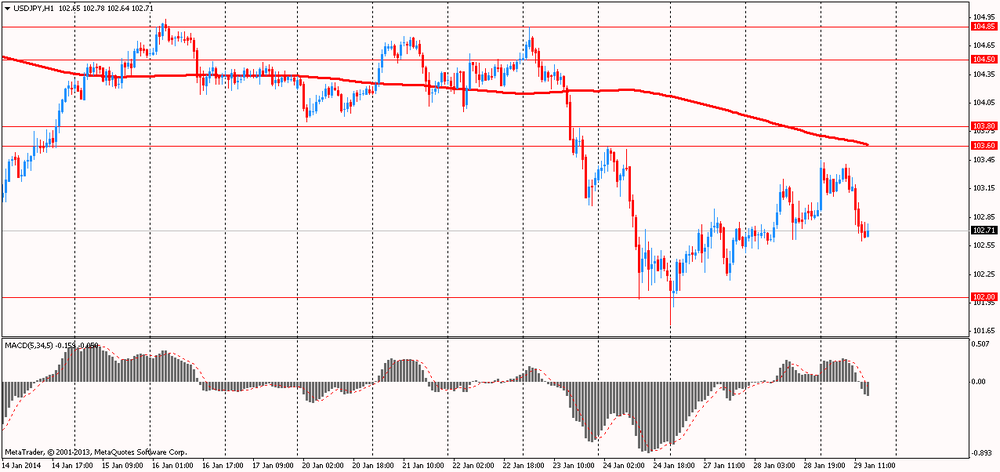

The yen has risen considerably against all but one of the 24 emerging market currencies , given the fact that the central bank of South Africa joined Turkey and raised its key interest rate. In addition, currency growth expectations associated with the announcement of the outcome of the Fed meeting . Experts note that if the Fed decides to minimize the program to $ 10 billion USD / JPY pair can recover positions lost when falling from the peaks near 105.00 . In another scenario, a couple can follow developing currencies in light of their recent sharp fall. The main scenario economists - QE3 completion in December 2014 , that is to minimize the $ 10 billion at each meeting . Despite the fact that this is an expected option, connect falling markets of emerging markets is likely to collapse next .

-

15:30

U.S.: Crude Oil Inventories, January +6.4

-

13:15

European session: the euro fell

07:00 United Kingdom Nationwide house price index January +1.4% +0.7% +0.7%

07:00 United Kingdom Nationwide house price index, y/y January +8.4% +8.1% +8.8%

07:00 Germany Gfk Consumer Confidence Survey February 7.7 Revised From 7.6 7.8 8.2

07:00 Switzerland UBS Consumption Indicator December 1.43 1.81

09:00 Eurozone M3 money supply, adjusted y/y December +1.5% +1.0%

12:15 United Kingdom BOE Gov Mark Carney Speaks

Euro fell against the U.S. dollar , amid reducing lending to the private sector in the euro area . According to the European Central Bank lending to the private sector in the euro zone fell in December compared with the same period of the previous year as well significantly , as in the previous month. According to published data, in December , as well as in November , lending to the private sector decreased by 2.3%.

Last spring, the housekeeper eurozone emerged from a protracted recession, which was particularly severe in Southern Europe, where the cost of credit for small businesses is much higher than in other regions of the eurozone. Nevertheless, the economic recovery remains slow and insufficient to curb unemployment, which is held at a record high levels. According to economists , the economic recovery may not be sustainable if the banks start to lend more actively firms and households .

The report also showed that the M3 broad money supply grew by only 1 percent in December , after expanding by 1.5 percent in November. Economists had expected the index to rise 1.7 percent. During the period from October to December M3 money supply grew by 1.3 percent compared with the same period last year. Such growth rates are far below the " reference value " of the ECB 4.5 % , which, according to the central bank , consistent with the mandate of price stability.

Earlier, the euro rose , supported by data on the index of consumer confidence in Germany. German consumer confidence index improved for the fifth month in a row in February amid recovery of the growth momentum in the country. These are the results of a survey conducted by a group GfK. Expected consumer confidence index rose to confidently 8.2 points from a revised 7.7 points in January . The latter figure is the highest level since August 2007 . Economists had expected the index to rise only to 7.8 .

Income expectations index rose to a 13- year high of 46.2 points in January from 39.5 in December. Measure of economic expectations jumped to 35.3 from 23.3 . The result is the highest since July 2011 . Readiness Index to purchase rose to 50 from 46.1 , noting the highest level since the end of 2006 .

The British pound rose against the dollar earlier after the release of U.S. data on the growth in housing prices. In the UK house prices rose at the fastest pace in more than three and a half years in January, supported by strong growth in employment, record low mortgage interest rates and increasing confidence . Such a survey conducted nationwide housing society.

The housing price index rose by 8.8 per cent per annum in January , marking the fastest increase since May 2010 , when prices rose by 9.8 percent . Prices by about 4 per cent below the peak in 2007 . Economists had expected prices to rise in January by 8.1 percent . In December, the index recorded an increase of 8.4 per cent . Housing prices rose a seasonally adjusted 0.7 percent compared to December , when they rose 1.4 percent. Expectations were at a gain of 0.7 percent. The average house price in the UK has now reached 176,491 pounds, which is more than 175,826 pounds, registered in December.

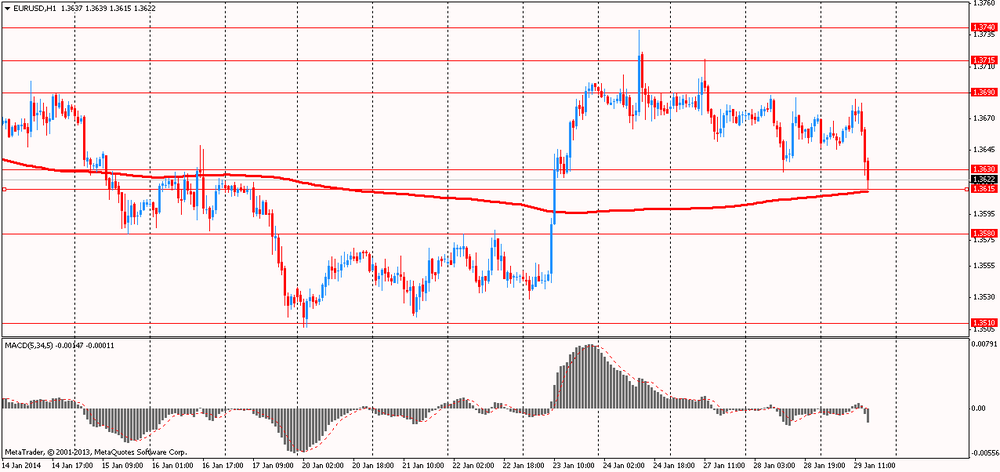

EUR / USD: during the European session, the pair rose to $ 1.3685 , but then fell to $ 1.3615

GBP / USD: during the European session, the pair rose to $ 1.6606 , but then fell to $ 1.6542

USD / JPY: during the European session, the pair dropped to Y102.60

At 19:00 GMT we will know the FOMC decision on the basic interest rate , the rate of repurchase program MBS and Treasury bonds, the accompanying statement will be made FOMC. At 20:00 GMT we will know the RBNZ decision on the basic interest rate , will be made accompanying statement RBNZ . At 21:45 GMT New Zealand will release the change in the volume of building permits issued in December. At 23:50 GMT , Japan will introduce a change in retail sales in December.

-

10:33

Option expiries for today's 1400GMT cut

USD/JPY Y102.50, Y103.00, Y103.50, Y103.60, Y104.65, Y104.75, Y105.00

EUR/USD $1.3560/65, $1.3600, $1.3605, $1.3625, $1.3665, $1.3700, $1.3710, $1.3745, $1.3770

GBP/USD $1.6460, $1.6540

GBP/CHF Chf1.5200

AUD/USD $0.8700, $0.8750, $0.8780/85, $0.8840, $0.8850, $0.8875, $0.8925, $0.8940

AUD/JPY Y91.40

NZD/USD $0.8050, $0.8275, $0.8320

USD/CAD C$1.1000, C$1.1025, C$1.1140. C$1.1150, C$1.1155, C$1.1170, C$1.1200

-

09:01

Eurozone: M3 money supply, adjusted y/y, December +1.0%

-

07:23

Asian session: The yen and Swiss franc declined

The yen and Swiss franc declined against their major peers after Turkey’s central bank took steps to stem a selloff in the lira, reducing demand for haven assets. Turkey’s central bank raised the benchmark repo rate to 10 percent from 4.5 percent, according to a statement posted on its website. It said investors should now treat the repo rate as the main indicator, instead of the lending rate.

Japan’s currency weakened for a third day versus the dollar before the Federal Reserve ends a two-day meeting amid forecasts it will reduce stimulus that has devalued the greenback. The Federal Open Market Committee will reduce monthly asset purchases, now at $75 billion, by $10 billion at each meeting to end the stimulus program this year, according to the median forecasts of analysts in a Jan. 10 Bloomberg News survey.

The Australian and New Zealand dollars gained along with the currencies of South Africa and South Korea. New Zealand’s central bank decides policy tomorrow. Traders see 51 percent odds that the Reserve Bank of New Zealand will raise its benchmark lending rate from a record low 2.5 percent tomorrow, swaps data compiled by Bloomberg show.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3635-70

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6560-85

USD / JPY: during the Asian session, the pair rose to Y103.25

There is a full calendar ahead Wednesday, with the standout feature set to be the FOMC's latest policy decision, expected at 1900GMT. At 071GMT, the German February GfK consumer confidence data will be released, with forecasts looking for an unchanged 7.6. At 0800GMT, Spain's Q4 flash GDP data will cross the wires, at the same time as the Spanish December retail sales index will be published. At 0900GMT, the EMU December M3 data will be released. Italy's January ISTAT business survey data will be released at the same time. German Chancellor Angela Merkel gives the annual government declaration before parliament, in Berlin, at 1000GMT. The Bank of Ireland will release its quarterly report at 1100GMT. At 1300GMT, EU Commission President Jose Manuel Barroso and Italian PM Enrico Letta brief press in Brussels. At 1315GMT, BOE Governor Mark Carney will deliver a speech in Scotland.

-

07:02

Switzerland: UBS Consumption Indicator, December 1.81

-

07:00

Germany: Gfk Consumer Confidence Survey, February 8.2 (forecast 7.8)

-

07:00

United Kingdom: Nationwide house price index, y/y, January +8.8% (forecast +8.1%)

-

07:00

United Kingdom: Nationwide house price index , January +0.7% (forecast +0.7%)

-

06:04

Schedule for today, Wednesday, Jan 28’2013:

07:00 United Kingdom Nationwide house price index January +1.4% +0.7%

07:00 United Kingdom Nationwide house price index, y/y January +8.4% +8.1%

07:00 Germany Gfk Consumer Confidence Survey February 7.6 7.8

07:00 Switzerland UBS Consumption Indicator December 1.43

09:00 Eurozone M3 money supply, adjusted y/y December +1.5%

12:15 United Kingdom BOE Gov Mark Carney Speaks

15:30 U.S. Crude Oil Inventories January +1.0

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC QE Decision 75

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.50% 2.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Building Permits, m/m December +11.1% -12.0%

23:50 Japan Retail sales, y/y December +4.0% +3.9%

-