Notícias do Mercado

-

20:01

Dow -170.89 15,757.67 -1.07% Nasdaq -44.55 4,053.41 -1.09% S&P-15.88 1,776.62 -0.89%

-

20:00

New Zealand: RBNZ Interest Rate Decision, 2.50% (forecast 2.50%)

-

19:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

19:00

U.S.: FOMC QE Decision, 65

-

18:40

American focus : Japanese yen has risen considerably against the U.S. dollar

Rate of the euro regained almost all previously lost ground against the dollar, while returning to levels opening of the session amid a lack of economic drivers, and in anticipation of the Fed's decision . Note that today completed the first in this year's meeting of the Open Market Committee (FOMC) of the Fed. This session will last for Ben Bernanke as chairman. But, why this meeting is important. The fact of change management fedrerva is not essential for the markets , as it is already priced in , and the name of the next head of the U.S. central bank has long been known . More important is the answer to the question whether the Fed will continue to curtail the program of quantitative easing (QE)? Most likely , the answer to this question is yes . But, there are a number of factors that reduce the likelihood of such an outcome and not exclude the possibility that the Fed will take a wait and see position , without making its monetary policy unchanged. Many experts say that the central bank is likely to reduce their monthly bond purchases to $ 10 billion , followed by further changes by the same amount over the next five meetings , and before the end of the year to announce the completion of the program.

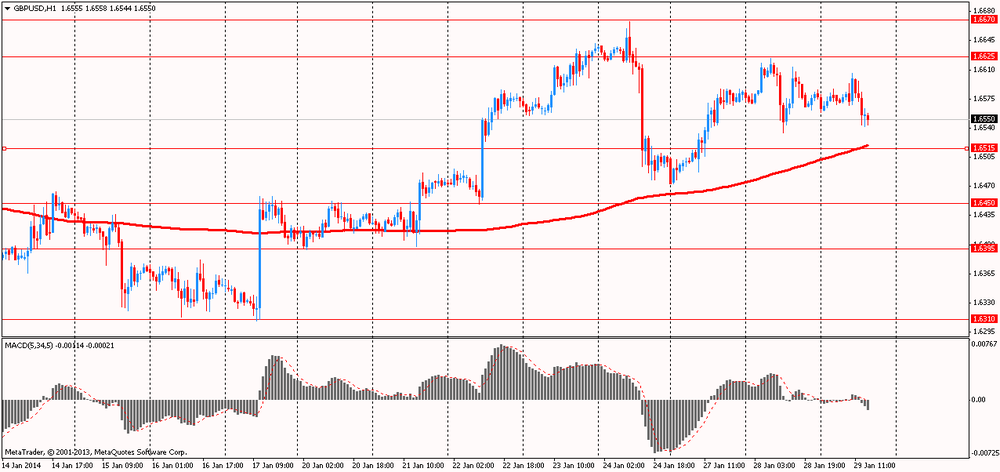

Pound retreated from a session low against the dollar , reaching levels opening trading today. Impact on the dynamics of the Bank of England comments , and expectations of the Fed meeting announcement . Add that today, Bank of England Governor Mark Carney said that rates will remain unchanged for some time to allow the economic recovery to gain a foothold . And their rise will be gradual , he said.

Speaking in Edinburgh , Carney said that he expects that the pound will cause moderate inflation and slower growth in consumption. He also made it clear that the MPC will soon submit the changes to the " policy of transparency."

Carney said that the need arises to partially abandon national sovereignty in the case If Scotland becomes an independent state , but continue to use the pound. Will need to create a banking union and impose strict financial rules to avoid problems later , which now have the eurozone. " Such risks are clearly discernible in the euro area in recent years , namely the sovereign debt crisis , financial fragmentation and large differences in economic growth ," said Carney .

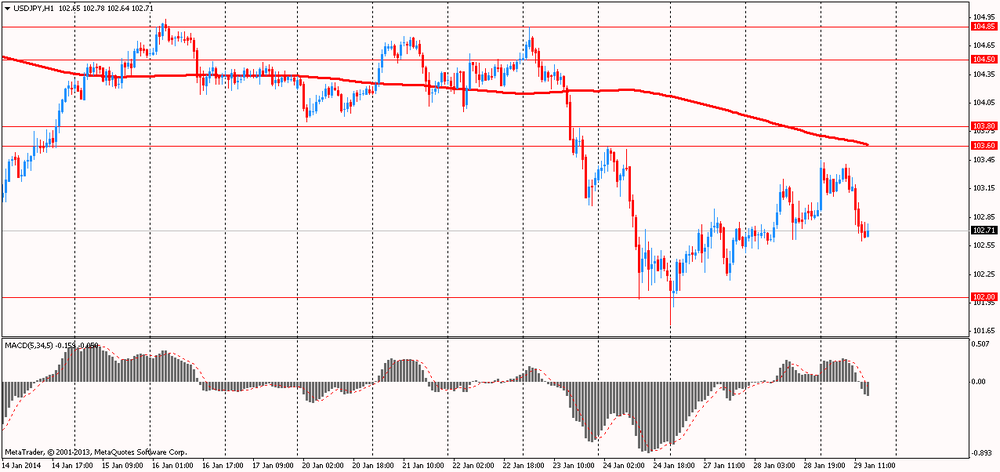

The yen has risen considerably against all but one of the 24 emerging market currencies , given the fact that the central bank of South Africa joined Turkey and raised its key interest rate. In addition, currency growth expectations associated with the announcement of the outcome of the Fed meeting . Experts note that if the Fed decides to minimize the program to $ 10 billion USD / JPY pair can recover positions lost when falling from the peaks near 105.00 . In another scenario, a couple can follow developing currencies in light of their recent sharp fall. The main scenario economists - QE3 completion in December 2014 , that is to minimize the $ 10 billion at each meeting . Despite the fact that this is an expected option, connect falling markets of emerging markets is likely to collapse next .

-

18:00

European stock close

European stocks fell, as banks and automakers declined, while the Turkish central bank’s interest rate increases failed to support emerging-market currencies.

The Stoxx Europe 600 Index dropped 0.6 percent to 322.3 at 4:30 p.m. in London, paring earlier losses of as much as 1.5 percent. The gauge had jumped as much as 1.2 percent after Turkey’s central bank raised interest rates.

“You see volatile equity markets today because of vulnerable emerging-market currencies,” said Markus Wallner, an equity strategist at Commerzbank AG in Frankfurt. “These events are reigniting fears in equity markets as a rise in interest rates by Turkey’s central bank does not appear to have helped. As we see with the Turkish lira today, this is a continuing problem which has not been solved yet.”

National benchmark gauges declined in 16 of the 18 western-European markets.

FTSE 100 6,544.28 -28.05 -0.43% CAC 40 4,156.98 -28.31 -0.68% DAX 9,336.73 -70.18 -0.75%

The Federal Reserve will conclude its final two-day monetary-policy meeting under Chairman Ben S. Bernanke today. He leaves his post on Jan. 31. The central bank will probably reduce its monthly bond purchases by $10 billion, followed by further increments of the same amount at the next five meetings before announcing an end to the program no later than December, according survey this month.

Fiat slid 4.8 percent to 7.19 euros. The Turin-based carmaker said fourth-quarter earnings before interest, taxes and one-time items rose 5 percent to 931 million euros ($1.27 billion) from 887 million euros a year earlier. That missed the 1.12 billion-euro average of analyst estimates.

Mulberry tumbled 28 percent to 645 pence. The British luxury-handbag maker also said full-year wholesale sales will fall by about 10 percent because of order cancellations from Korean customers.

J Sainsbury Plc lost 2.5 percent to 347.9 pence after announcing that Justin King will step down as chief executive officer in July after a decade in the role. Commercial Director Mike Coupe will succeed him as head of the U.K.’s third-biggest supermarket company.

Anglo American, which owns Anglo American Platinum Ltd., advanced 5.9 percent to 1,422.5 pence. The owner of the world’s biggest platinum mine said fourth-quarter production of the metal rose 25 percent as it recovered from labor disruptions. It also posted a 25 percent increase in output at its Kumba Iron Ore unit and a 24 percent rise in copper production.

Arkema SA (AKE) increased 3.7 percent to 80.08 euros. Goldman Sachs Group Inc. upgraded the French chemicals maker to conviction buy from neutral, citing the possibility of merger and acquisition activity in the industry because of high levels of cash, and the company’s exposure to an economic recovery in Europe.

-

17:00

European stock close: FTSE 100 6,544.28 -28.05 -0.43% CAC 40 4,156.98 -28.31 -0.68% DAX 9,336.73 -70.18 -0.75%

-

16:40

Oil: an overview of the market situation

Prices for WTI crude oil declined moderately , after a government report showed that U.S. crude inventories rose more than expected last week. In addition, the fall in prices was due to speculation that the Federal Reserve today announced reduction of the volume of economic incentives. The cost of oil brand Brent, meanwhile, rose slightly .

According to the Department of Energy on changes in stocks in the U.S. for the week January 20-26 :

- Crude oil inventories in the U.S. 6.421 million barrels to 357.645 million barrels

- Stocks of gasoline in the U.S. -0,819,000 barrels to 234.446 million barrels

- Distillate stocks in the U.S. -4,584,000 barrels to 116.154 million barrels

- In the U.S. refinery utilization to 88.2 % against 86.5 % a week earlier

Many experts expect that oil will rise significantly less , namely 2.25 million also predicted that distillate stocks fall to 2.55 million , while gasoline inventories rise by 1.6 million barrels .

"Inventories of crude oil rising, which indicates a weak fundamental picture ," said Gene McGillian , an analyst and broker at Tradition Energy in Stamford . " There are fears that the reduction of QE by the Fed can affect economic growth ."

We also recall that yesterday its reserves data voiced Institute of oil API. They showed :

- Oil reserves for the week 4.7 million barrels

- Distillate stocks last week 1.8 million barrels

- Gasoline inventories last week 0.363 million barrels

- Capacity utilization in the week 88.3% against 87.9 %

With regard to the outcome of the Federal Open Market Committee Federal Reserve , most analysts believe that will be announced reductions of the QE program by 10 billion - to $ 65 billion per month .

Meanwhile, adding that a further fall in prices was capped yield positive data in Germany. According to research by analyst firm Gfk, outpacing the consumer confidence index in Germany in February rose to 8.2 points from 7.7 points in January . The index has exceeded the expectations of analysts, forecast figure of 7.8 points.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 97.08 a barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture rose 34 cents to $ 107.78 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose significantly today as stock markets lost previously won positions in anticipation of the announcement of the outcome of the meeting of the Federal Reserve System . Many traders are waiting for news about the fact that the U.S. central bank will do its program of bond purchases , known as quantitative easing.

Fed policy is expected to announce a reduction of monthly purchases of Treasury and mortgage-backed securities to $ 5 billion , bringing the total monthly volume of asset purchases will be at the level of $ 65 billion . Recall that expectations about what the Fed will reduce emergency measures to stimulate the U.S. economy, which were introduced in the wake of the global financial crisis , have been a major factor in the fall in gold prices (last year the price of the precious metal fell by 28 per cent) .

Although a steady decline in the volume of QE now, mainly reflected in market prices , any indication that this change will be faster or slower than expected, can significantly affect the price of gold.

Precious metal recovered losses that were recorded in the first half of today's trading , as rising stock markets plays out on the news that the recovery in emerging markets is likely to be short-lived.

"The decline in the U.S. stock markets improved mood and appeal of gold as a safe investment ," - said an investment analyst at Phillip Futures Joyce Liu . Gold is considered a more reliable alternative to risky assets such as stocks . But Liu warned of the possibility of correction in prices approaching resistance level $ 1,275 per ounce.

I also add that the Chinese gold purchases slowed down this week as traders and consumers are beginning to prepare for the Lunar New Year, which starts on January 31. Chinese Gold Award for 99.99 fine on the Shanghai Gold Exchange have fallen to about $ 5.50 per ounce on Wednesday from $ 7 in the previous session. Recall that in early January, they were above $ 20. Trading volume on Wednesday was a little over 8 tons - the lowest since Dec. 31.

Cost February gold futures on the COMEX today rose to $ 1264.90 per ounce.

-

15:30

U.S.: Crude Oil Inventories, January +6.4

-

14:36

U.S. Stocks open: Dow 15,795.56 -133.00 -0.83%, Nasdaq 4,064.29 -33.67 -0.82%, S&P 1,778.02 -14.48 -0.81%

-

14:25

Before the bell: S&P futures -0.89%, Nasdaq futures -0.91%

U.S. stock futures fell, as forecasts from companies including Yahoo! Inc. and AT&T Inc. disappointed and investors awaited the Federal Reserve’s policy decision.

Global markets:

Nikkei 15,383.91 +403.75 +2.70%

Hang Seng 22,141.61 +180.97 +0.82%

Shanghai Composite 2,049.91 +11.40 +0.56%

FTSE 6,488.98 -83.35 -1.27%

CAC 4,109.49 -75.80 -1.81%

DAX 9,221.3 -185.61 -1.97%

Crude oil $96.65 (-0.78%)

Gold $1265.40 (+1.19%).

-

13:15

European session: the euro fell

07:00 United Kingdom Nationwide house price index January +1.4% +0.7% +0.7%

07:00 United Kingdom Nationwide house price index, y/y January +8.4% +8.1% +8.8%

07:00 Germany Gfk Consumer Confidence Survey February 7.7 Revised From 7.6 7.8 8.2

07:00 Switzerland UBS Consumption Indicator December 1.43 1.81

09:00 Eurozone M3 money supply, adjusted y/y December +1.5% +1.0%

12:15 United Kingdom BOE Gov Mark Carney Speaks

Euro fell against the U.S. dollar , amid reducing lending to the private sector in the euro area . According to the European Central Bank lending to the private sector in the euro zone fell in December compared with the same period of the previous year as well significantly , as in the previous month. According to published data, in December , as well as in November , lending to the private sector decreased by 2.3%.

Last spring, the housekeeper eurozone emerged from a protracted recession, which was particularly severe in Southern Europe, where the cost of credit for small businesses is much higher than in other regions of the eurozone. Nevertheless, the economic recovery remains slow and insufficient to curb unemployment, which is held at a record high levels. According to economists , the economic recovery may not be sustainable if the banks start to lend more actively firms and households .

The report also showed that the M3 broad money supply grew by only 1 percent in December , after expanding by 1.5 percent in November. Economists had expected the index to rise 1.7 percent. During the period from October to December M3 money supply grew by 1.3 percent compared with the same period last year. Such growth rates are far below the " reference value " of the ECB 4.5 % , which, according to the central bank , consistent with the mandate of price stability.

Earlier, the euro rose , supported by data on the index of consumer confidence in Germany. German consumer confidence index improved for the fifth month in a row in February amid recovery of the growth momentum in the country. These are the results of a survey conducted by a group GfK. Expected consumer confidence index rose to confidently 8.2 points from a revised 7.7 points in January . The latter figure is the highest level since August 2007 . Economists had expected the index to rise only to 7.8 .

Income expectations index rose to a 13- year high of 46.2 points in January from 39.5 in December. Measure of economic expectations jumped to 35.3 from 23.3 . The result is the highest since July 2011 . Readiness Index to purchase rose to 50 from 46.1 , noting the highest level since the end of 2006 .

The British pound rose against the dollar earlier after the release of U.S. data on the growth in housing prices. In the UK house prices rose at the fastest pace in more than three and a half years in January, supported by strong growth in employment, record low mortgage interest rates and increasing confidence . Such a survey conducted nationwide housing society.

The housing price index rose by 8.8 per cent per annum in January , marking the fastest increase since May 2010 , when prices rose by 9.8 percent . Prices by about 4 per cent below the peak in 2007 . Economists had expected prices to rise in January by 8.1 percent . In December, the index recorded an increase of 8.4 per cent . Housing prices rose a seasonally adjusted 0.7 percent compared to December , when they rose 1.4 percent. Expectations were at a gain of 0.7 percent. The average house price in the UK has now reached 176,491 pounds, which is more than 175,826 pounds, registered in December.

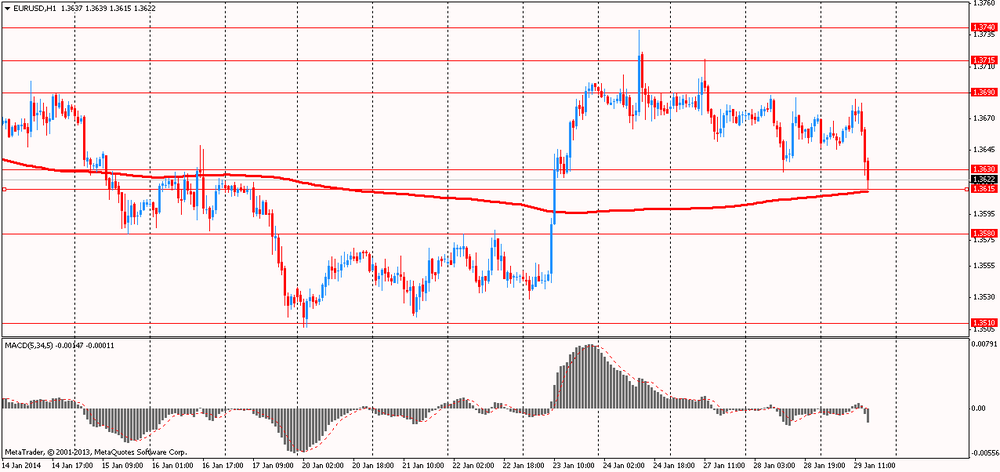

EUR / USD: during the European session, the pair rose to $ 1.3685 , but then fell to $ 1.3615

GBP / USD: during the European session, the pair rose to $ 1.6606 , but then fell to $ 1.6542

USD / JPY: during the European session, the pair dropped to Y102.60

At 19:00 GMT we will know the FOMC decision on the basic interest rate , the rate of repurchase program MBS and Treasury bonds, the accompanying statement will be made FOMC. At 20:00 GMT we will know the RBNZ decision on the basic interest rate , will be made accompanying statement RBNZ . At 21:45 GMT New Zealand will release the change in the volume of building permits issued in December. At 23:50 GMT , Japan will introduce a change in retail sales in December.

-

11:30

European stocks advanced

European stocks advanced for a second day as Turkey’s central bank increased interest rates to halt a currency slide that roiled global markets. U.S. stock-index futures and Asian shares also climbed.

The Stoxx Europe 600 Index climbed 0.8 percent to 326.79 at 8:09 a.m. in London.

Turkey’s lira jumped against the dollar today after the central bank raised its repurchase rate to 10 percent from 4.5 percent and boosted other key borrowing costs at a late-night emergency meeting.

In Germany, a gauge of consumer confidence will rise to 8.2 in February from a revised 7.7 in January, Nuremberg-based research company GfK AG said today. That would be the highest since August 2007. Analysts had expected a reading of 7.6, according to the median estimate in a Bloomberg News survey.

Anglo American advanced 5.3 percent to 1,414.5 pence. The owner of the world’s biggest platinum mine said fourth-quarter production of the metal rose 25 percent as it recovered from labor disruptions. It also posted a 25 percent increase in output at its Kumba Iron Ore unit and a 24 percent rise in copper production.

Lloyds added 0.9 percent to 83.6 pence. The lender has begun meeting institutional investors about selling between 30 percent and 50 percent of its TSB bank in an IPO, the Telegraph newspaper reported, citing unidentified fund managers.

Osram Licht AG, the lighting manufacturer that was spun off from Siemens AG, advanced 4.6 percent to 48.31 euros after reporting first-quarter net income of 68 million euros ($92.9 million), beating analyst forecasts for 56.6 million euros.

Mulberry Group Plc tumbled 19 percent to 728 pence after saying full-year pre-tax profit will be substantially below current market estimates. The British luxury-handbag maker said full-year wholesale sales will fall by about 10 percent because of order cancellations from Korean customers.

FTSE 100 6,588.58 +16.25 +0.25%

CAC 40 4,188.09 +2.80 +0.07%

DAX 9,440.02 +33.11 +0.35%

-

10:33

Option expiries for today's 1400GMT cut

USD/JPY Y102.50, Y103.00, Y103.50, Y103.60, Y104.65, Y104.75, Y105.00

EUR/USD $1.3560/65, $1.3600, $1.3605, $1.3625, $1.3665, $1.3700, $1.3710, $1.3745, $1.3770

GBP/USD $1.6460, $1.6540

GBP/CHF Chf1.5200

AUD/USD $0.8700, $0.8750, $0.8780/85, $0.8840, $0.8850, $0.8875, $0.8925, $0.8940

AUD/JPY Y91.40

NZD/USD $0.8050, $0.8275, $0.8320

USD/CAD C$1.1000, C$1.1025, C$1.1140. C$1.1150, C$1.1155, C$1.1170, C$1.1200

-

10:11

Asia Pacific stocks close

Asian stocks rose, with the regional benchmark index on course for its biggest advance in four months, after Turkey’s central bank more than doubled interest rates to arrest a currency slide that roiled global markets.

FTSE 100 6,572.33 +21.67 +0.33%

CAC 40 4,185.29 +40.73 +0.98%

Xetra DAX 9,406.91 +57.69 +0.62%

Honda Motor Co., which gets 83 percent of its car sales outside Japan, climbed 3 percent as the yen weakened against the dollar.

Atlas Iron Ltd. jumped 10 percent in Sydney after the producer of the metal used to make steel raised its shipment target.

Advantest Corp., a maker of electronic measuring instruments, sank 4.4 percent in Tokyo after widening its full-year net loss forecast.

-

09:05

FTSE 100 6,631.32 +58.99 +0.90%, CAC 40 4,233.75 +48.46 +1.16%, Xetra DAX 9,516.2 +109.29 +1.16%

-

09:01

Eurozone: M3 money supply, adjusted y/y, December +1.0%

-

07:40

European bourses are seen trading higher Wednesday: the FTSE is higher by 0.7%, the DAX up 0.4% and the CAC up 0.7%

-

07:23

Asian session: The yen and Swiss franc declined

The yen and Swiss franc declined against their major peers after Turkey’s central bank took steps to stem a selloff in the lira, reducing demand for haven assets. Turkey’s central bank raised the benchmark repo rate to 10 percent from 4.5 percent, according to a statement posted on its website. It said investors should now treat the repo rate as the main indicator, instead of the lending rate.

Japan’s currency weakened for a third day versus the dollar before the Federal Reserve ends a two-day meeting amid forecasts it will reduce stimulus that has devalued the greenback. The Federal Open Market Committee will reduce monthly asset purchases, now at $75 billion, by $10 billion at each meeting to end the stimulus program this year, according to the median forecasts of analysts in a Jan. 10 Bloomberg News survey.

The Australian and New Zealand dollars gained along with the currencies of South Africa and South Korea. New Zealand’s central bank decides policy tomorrow. Traders see 51 percent odds that the Reserve Bank of New Zealand will raise its benchmark lending rate from a record low 2.5 percent tomorrow, swaps data compiled by Bloomberg show.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3635-70

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6560-85

USD / JPY: during the Asian session, the pair rose to Y103.25

There is a full calendar ahead Wednesday, with the standout feature set to be the FOMC's latest policy decision, expected at 1900GMT. At 071GMT, the German February GfK consumer confidence data will be released, with forecasts looking for an unchanged 7.6. At 0800GMT, Spain's Q4 flash GDP data will cross the wires, at the same time as the Spanish December retail sales index will be published. At 0900GMT, the EMU December M3 data will be released. Italy's January ISTAT business survey data will be released at the same time. German Chancellor Angela Merkel gives the annual government declaration before parliament, in Berlin, at 1000GMT. The Bank of Ireland will release its quarterly report at 1100GMT. At 1300GMT, EU Commission President Jose Manuel Barroso and Italian PM Enrico Letta brief press in Brussels. At 1315GMT, BOE Governor Mark Carney will deliver a speech in Scotland.

-

07:02

Switzerland: UBS Consumption Indicator, December 1.81

-

07:00

Germany: Gfk Consumer Confidence Survey, February 8.2 (forecast 7.8)

-

07:00

United Kingdom: Nationwide house price index, y/y, January +8.8% (forecast +8.1%)

-

07:00

United Kingdom: Nationwide house price index , January +0.7% (forecast +0.7%)

-

06:04

Schedule for today, Wednesday, Jan 28’2013:

07:00 United Kingdom Nationwide house price index January +1.4% +0.7%

07:00 United Kingdom Nationwide house price index, y/y January +8.4% +8.1%

07:00 Germany Gfk Consumer Confidence Survey February 7.6 7.8

07:00 Switzerland UBS Consumption Indicator December 1.43

09:00 Eurozone M3 money supply, adjusted y/y December +1.5%

12:15 United Kingdom BOE Gov Mark Carney Speaks

15:30 U.S. Crude Oil Inventories January +1.0

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:00 U.S. FOMC QE Decision 75

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.50% 2.50%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Building Permits, m/m December +11.1% -12.0%

23:50 Japan Retail sales, y/y December +4.0% +3.9%

-