Notícias do Mercado

-

20:00

Dow +99.8 15,838.59 +0.63% Nasdaq +77.59 4,129.02 +1.92% S&P +20.38 1,794.58 +1.15%

-

19:20

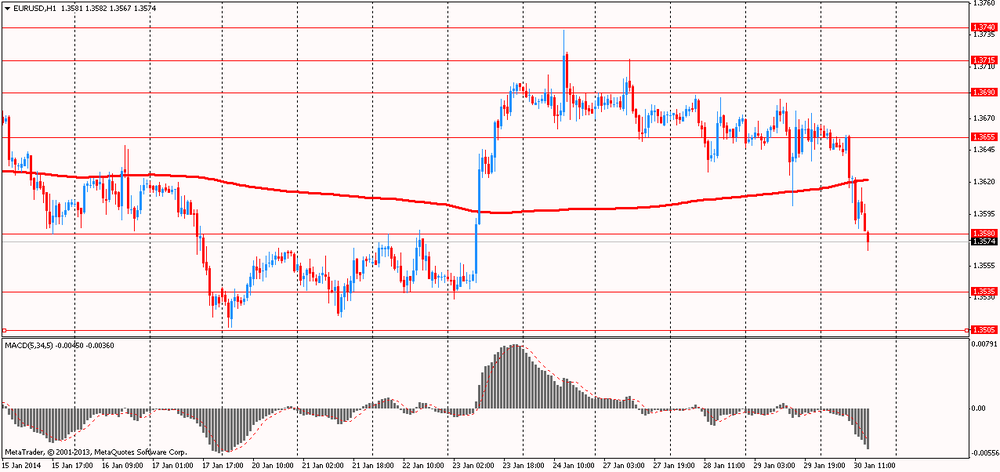

American focus: the euro has fallen against the U.S. dollar

The euro exchange rate dropped significantly against the dollar, after the German CPI data were worse than expected , bringing the EU one step deflation . The euro has also provided a report on the U.S, which confirmed estimates of economists. As it became known, consumer price inflation in Europe's largest economy fell to 1.3 percent in January from 1.4 percent in December. The forecast was for an inflation rate of 1.5 percent. Consumer prices fell by 0.6 percent compared to December, when they recorded an increase of 0.4 percent. Economists had expected a drop of 0.4 percent.

With regard to U.S. data, they showed that the gross domestic product, which is the broadest measure of goods and services produced in the economy , rose to a seasonally adjusted annual rate of 3.2% in the fourth quarter. Economists had expected in the fourth quarter activity will grow by 3.2%. Overall, in 2013 the economy grew by 1.9%. The last time the economy grew by more than 3 % per annum before the recession , when it reached 3.4% in 2005. In 2012, GDP grew by 2.8%. Recent GDP data show that the economy expanded by 3.7% in the second half of 2013. This rate was much higher than the growth of 1.8% in the first half of this year. This is the highest growth rate in the second half of 2003, when the economy expanded by 5.8%.

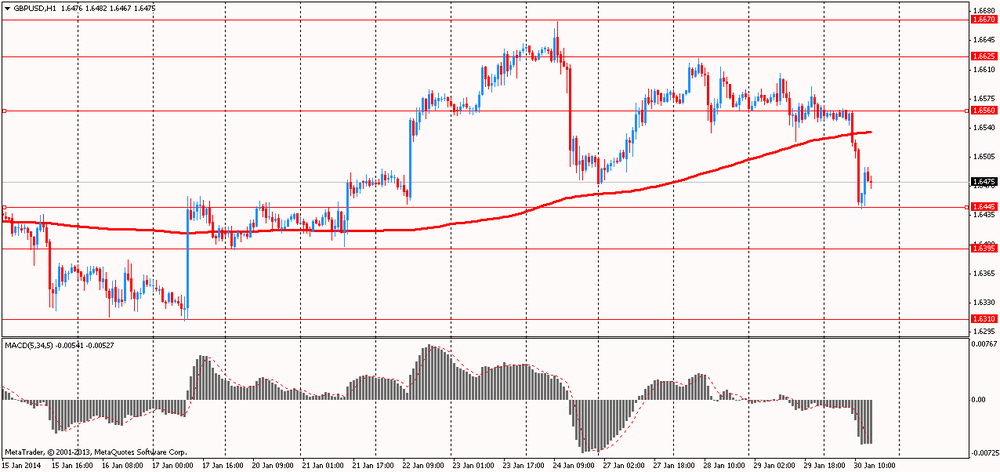

Pound has fallen markedly against the U.S. currency, which was associated with the publication of weak data on Britain. The report showed that the number of approved applications for mortgage loans in the UK in December rose less than forecast , but this figure was the highest in the last six years. The number of permits for house purchase rose to 71,638 in December from a revised 70,820 in November. Economists had expected the figure to rise to 72,500 by November initial 70,758 . The latter figure is the highest since January 2008, when the number of mortgage approvals was 71,999 . Loans secured by housing increased by 1.7 billion pounds , while economists expected an increase of 1.2 billion pounds. Consumer loans increased by 0.6 billion pounds, while economists had expected growth to 0.7 billion pounds.

We also learned that the monetary aggregate M4 lending decreased by 1.4 percent on a monthly basis , after growth of 0.1 percent in November. In annual terms M4 rose 0.2 percent after jumping 2.7 percent in the previous month.

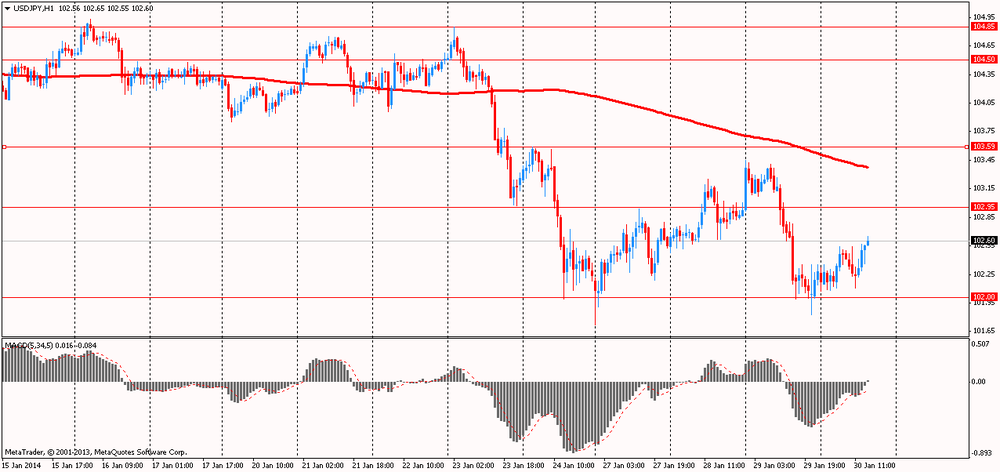

The Swiss franc lost nearly 100 points against the dollar amid falling demand on the franc as a safe haven , which was celebrated earlier this week . Couple also declined due to persisting worries about the spread of " contamination " in emerging markets, after the Turkish Central Bank was forced to raise rates to slow the fall of the Turkish lira .

Furthermore, the pressure on the franc had a report that showed that the indicator of economic activity in Switzerland rose tenth consecutive month in January, although at a slower pace, which indicates a good beginning of the new year. Such survey data, published by the Institute KOF.

The index of leading economic indicators rose from KOF to 1.98 in January from 1.95 in December, marking the tenth consecutive increase. The last time it reached a comparable level in July 2011 . Rise was driven mainly by improved domestic consumption. In January lending business has stabilized , while the construction sector has slowed somewhat . Recall that in the third quarter , the Swiss economy expanded faster than expected pace of 0.5 percent in the quarter dimension, with the same rate of expansion , as was shown in the previous three months . Exports and investment were the main growth drivers.

-

18:20

European stock close

European stocks rose, paring this month’s loss for the Stoxx Europe 600 Index (EC11CHPM), as companies from Givaudan SA (GIVN) to Hennes & Mauritz AB (HMB) reported earnings.

The Stoxx 600 added 0.3 percent. The index today lost as much as 0.7 percent before rising as much as 0.6 percent. The index is heading for the biggest decline since June. European shares have fallen 1.5 percent in January as emerging-market currencies slid, fueling concern the global economic recovery is faltering. The gauge rallied 17 percent last year, the most since 2009.

A report today showed that a gauge of pending home sales fell 8.7 percent in December, following a revised 0.3 percent drop the previous month. The median projection of economists called for a 0.3 percent decline.

Separate data earlier showed the U.S. economy expanded at a 3.2 percent annualized rate in the fourth quarter, in line with the median forecast of economists. Another report showed more Americans than predicted filed applications for jobless benefits in the week ended Jan. 25.

The Federal Open Market Committee said yesterday it will cut monthly bond purchases by $10 billion to $65 billion, sticking to a plan for a gradual withdrawal from its unprecedented monetary easing. It was the first meeting without a dissent since June 2011. The Fed reiterated that it will probably hold its target interest rate near zero “well past the time” that unemployment falls below 6.5 percent.

A Chinese manufacturing gauge signaled the first contraction since July. A purchasing managers’ Index fell to 49.5 this month from 50.5 in December, HSBC Holdings Plc (HSBA) and Markit Economics said in a statement. The reading compared with the median 49.6 estimate of economists. A number below 50 indicates contraction.

National benchmark indexes advanced in 11 of the 18 western-European markets today.

FTSE 100 6,538.45 -5.83 -0.09% CAC 40 4,180.02 +23.04 +0.55% DAX 9,373.48 +36.75 +0.39%

Givaudan gained 6.5 percent to 1,344 Swiss francs. The world’s largest maker of flavors and fragrances said 2013 net income was 490 million francs ($543 million), exceeding the 464.5 million-franc analyst projection. The company said it will pay a dividend of 47 francs a share, beating the forecast of 42 francs.

Roche advanced 4.2 percent to 249.10 francs. The company said revenue will rise by a low to mid-single-digit percentage this year and profit will increase faster as sales climb for its biggest cancer drugs and a slate of new therapies. Roche also said net income last year gained 18 percent to 11.4 billion francs.

Ericsson AB rose 3.5 percent to 80.10 kronor. The world’s largest maker of wireless networks said gross ">H&M dropped 3.6 percent to 276.90 kronor. Europe’s second-biggest clothing retailer reported fourth-quarter net income of 5.61 billion kronor ($869 million), less than the average analyst projection of 6 billion kronor.

Serco Group Plc (SRP) slumped 17 percent to 423.5 pence. The U.K. services provider said it expects a 2013 revenue decline because it won fewer contracts.

Tod’s SpA dropped 8.1 percent to 101.20 euros after the retailer said fourth-quarter revenue was 214.9 million euros ($291.3 million), missing estimates.

TeliaSonera AB lost 2.8 percent to 48.77 kronor. Sweden’s largest phone operator said fourth-quarter net income fell to 2.19 billion kronor, trailing analyst estimates that called for a profit of 3.07 billion kronor.

-

17:00

European stock close: FTSE 100 6,538.45 -5.83 -0.09% CAC 40 4,180.02 +23.04 +0.55% DAX 9,373.48 +36.75 +0.39%

-

16:41

Oil: an overview of the market situation

Oil prices rose today , closer to $ 108 per barrel (Brent), which is a month high as strong frosts in the United States contributed to the growth in demand for oil . However, gains were limited by weak Chinese economic data , as well as the decision of the Federal Reserve to reduce the amount of QE. As the price of crude oil WTI, they rose above $ 98 per barrel.

We add that the report on China showed that the seasonally adjusted manufacturing PMI fell in January to a level of 49.5 points, compared with the initial assessment at the level of 49.6 points and 50.5 points in the previous month. Experts expect that this figure will remain unchanged compared with the original estimate. Reduction in the sector was the first since July , mainly due to the weakness in output and new orders. In addition, data showed that the company has reduced its staff at the fastest pace since March 2009 . On the price front, the average production costs declined at a moderate pace , while sales prices declined in the second month in a row.

With respect to actions by the Fed , some investors believed that the U.S. central bank may refrain from changing their programs , given the turmoil in emerging markets. Reduction in the stimulation strengthened the dollar , which affected the goods in terms of dollars , such as oil .

On the dynamics of trade also affected the U.S. data , which showed that the economy expanded at a solid pace in the fourth quarter as consumers and businesses committed expenditure invested by marking one of the best six-month periods of growth in the last decade .

Gross domestic product, which is the broadest measure of goods and services produced in the economy , rose to a seasonally adjusted annual rate of 3.2% in the fourth quarter , said the Ministry of Commerce on Thursday . Economists had expected in the fourth quarter activity will grow by 3.2%. Overall, in 2013 the economy grew by 1.9%. The last time the economy grew by more than 3 % per annum before the recession , when it reached 3.4% in 2005. In 2012, GDP grew by 2.8%.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 98.41 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture increased by 21 cents to $ 108.02 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices fell by about 1 percent , which was associated with a significant appreciation of the U.S. currency after the U.S. Federal Reserve lowered the volume again its monetary stimulus . Decline in value was also due to the fact that many investors began to take profits the previous session. Recall that yesterday Operations Committee on the Federal Open Market said it will cut bond purchases to $ 65 billion in February from $ 75 billion in January. The Fed also said that the program will continue to reduce purchases of bonds next month , confirming its strategy of rolling this program in small steps during each of the meetings , while the economic situation continues to improve. Add that Fed officials gave a mixed assessment of performance of the economy. On the one hand , the Fed said that data released since the December meeting , "indicate that the growth of economic activity has accelerated in recent quarters ." However, Fed officials called labor market indicators " mixed " , meaning probably disappointing December employment report . They also noted that the recovery in the labor market " has slowed ."

"There is nothing surprising in the fact that the reduction of QE will continue ," said Mitsubishi analyst Jonathan Butler. " Against the background of the absence of any major changes in the macroeconomic situation in the U.S., we continue to believe that by the end of the year , probably , this program will be completed ," the expert added. Recall that the reduction of QE is usually considered negative for gold prices. Gold fell 28 percent last year amid the improving economy and expectations that the Fed will curtail incentives.

Also today it was announced that the gold reserves in the SPDR Gold Trust increased yesterday by 2.10 tons - up to 792.56 thousand tons. But this figure is still close to the five-year minimum.

Little support gold prices provided Chinese purchases that are likely to weaken after the Lunar New Year, which is celebrated on January 31 , analysts say. We also add that the volume of trading on the Shanghai Gold Exchange was at 1.5 tonnes on Thursday , compared with 8.4 tonnes on Wednesday and 14 tonnes on Tuesday .

Cost February gold futures on the COMEX today dropped to $ 1242.10 per ounce.

-

15:00

U.S.: Pending Home Sales (MoM) , December -8.7% (forecast -0.1%)

-

14:36

U.S. Stocks open: Dow 15,826.80 +88.0 +0.56%, Nasdaq 4,103.82 +52.39 +1.29%, S&P 1,789.20 +15.00 +0.85%

-

14:27

Before the bell: S&P futures +0.71%, Nasdaq futures +0.86%

U.S. stock futures rose, as companies from Facebook Inc. (FB) to PulteGroup Inc. posted better-than-estimated results and consumer spending picked up.

Global markets:

Nikkei 15,007.06 -376.85 -2.45%

Hang Seng 22,035.42 -106.19 -0.48%

Shanghai Composite 2,033.08 -16.83 -0.82%

FTSE 6,552.27 +7.99 +0.12%

CAC 4,184.54 +27.56 +0.66%

DAX 9,384.1 +47.37 +0.51%

Crude oil $98.10 (+0.76%)

Gold $1239.90 (-1.77%).

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y101.95, Y102.00, Y102.25, Y102.50, Y103.00, Y103.80, Y103.90, Y104.00

EUR/JPY Y140.00

EUR/USD $1.3500, $1.3550, $1.3600, $1.3625, $1.3630, $1.3650, $1.3665, $1.3675

GB{/USD $1.6625, $1.6680

EUR/GBP stg0.8200, stg0.8250, stg0.8275, stg0.8295

AUD/USD $0.8650, $0.8700, $0.8770, $0.8800, $0.8850, $0.8865, $0.8875, $0.8890

AUD/JPY Y89.00, Y89.45

AUD/NZD NZ$1.0550

NZD/USD $0.8200, $0.8285, $0.8340

USD/CAD C$1.1075. C$1.1150

-

13:32

U.S.: PCE price index ex food, energy, q/q, Quarter IV +1.1% (forecast +1.5%)

-

13:30

U.S.: Initial Jobless Claims, January 348 (forecast 331)

-

13:30

U.S.: GDP, q/q, Quarter III +3.2% (forecast +3.2%)

-

13:30

U.S.: PCE price index, q/q, Quarter IV +3.3% (forecast +1.4%)

-

13:19

European session: the euro fell

08:00 Switzerland KOF Leading Indicator January 1.95 2.02 1.98

08:55 Germany Unemployment Change January -15 -5 -28

08:55 Germany Unemployment Rate s.a. January 6.9% 6.9% 6.8%

09:30 United Kingdom Net Lending to Individuals, bln December 1.5 1.9 1.7

09:30 United Kingdom Mortgage Approvals December 70.8 72.5 71.6

10:00 Eurozone Business climate indicator January 0.2 Revised From 0.27 0.34 0.19

10:00 Eurozone Economic sentiment index January 100.4 Revised From 100.0 101.0 100.9

10:00 Eurozone Industrial confidence January -3.4 -3.0 -3.9

13:00 Germany CPI, m/m (Preliminary) January +0.4% -0.4% -0.6%

13:00 Germany CPI, y/y (Preliminary) January +1.4% +1.5% +1.3%

Euro fell against the U.S. dollar despite the strong data on the labor market in Germany sentiment in the eurozone economy . German unemployment fell in January, more than forecast , as companies were more confident in the strength of Europe's largest economy . Number of people out of work fell by a seasonally adjusted 28,000 to 2.93 million , after falling by 19,000 in December , reported the Federal Labour Agency . Economists had forecast a drop of 5000 . Adjusted unemployment rate was 6.8 percent, almost unchanged from December , and remained near the minimum of twenty years . Unemployment fell by 16,000 in West Germany and 12,000 in the eastern part .

In turn, in the euro area level of economic confidence rose ninth consecutive month in January , data showed on Thursday a survey from the European Commission .

Economic sentiment index rose to 100.9 in January from 100.4 in the previous month . But at the same time the reading was slightly lower than expected level of 101.

Confidence in industry fell unexpectedly by 0.5 to -3.9 in January , as a consequence of the management worsened assessment of stocks of finished products. The result was predicted to improve to -3.0 . Confidence in the services sector grew by 1.9 points to 2.3 , resulting in improved estimates of expected demand and past business situation , while the assessment of the past demand has not changed much .

In addition , consumer confidence has improved markedly to 11.7 , being in accordance with a preliminary estimate , compared with 13.5 in December. The increase was primarily due to improved expectations about future unemployment and the general economic situation . The result was above its long-term average for the first time since July 2011 . Confidence in the retail sector increased to -3.4 -5 , due to improvements in all of its three components, namely the present and expected business situation and the assessment of stocks.

Meanwhile , confidence in the construction sector fell strongly to -30.1 from -26.4 as a result of a marked deterioration in ratings portfolio managers orders and deteriorating employment expectations . In January, the business climate indicator for the euro area almost unchanged at 0.19 compared to 0.20 in December. Economists had expected the result 0.34. Production expectations leaders , their assessment of past production, and general and export order book remained broadly unchanged . At the same time , the level of stocks of finished products was evaluated more negatively .

The British pound fell against the dollar after the number of approved applications for mortgage loans in the UK in December rose less than forecast , but this figure was the highest in the last six years. These are the data published by the Bank of England on Thursday .

The number of permits for house purchase rose to 71,638 in December from a revised 70,820 in November. Economists had expected the figure to rise to 72,500 by November initial 70,758 .

The latter figure is the highest since January 2008 , when the number of mortgage approvals was 71,999 .

Loans secured by housing increased by 1.7 billion pounds , while economists expected an increase of 1.2 billion pounds .

Consumer loans increased by 0.6 billion pounds , while economists had expected growth to 0.7 billion pounds.

EUR / USD: during the European session, the pair fell to $ 1.3582

GBP / USD: during the European session, the pair fell to $ 1.6443

USD / JPY: during the European session, the pair rose to Y102.65

In the U.S. at 13:30 GMT will be released preliminary data on changes in GDP , the GDP price index , the index of personal consumption expenditures , the main index of personal consumption expenditures for the 4th quarter , in 15:00 GMT - the change in volume of pending home sales for December. At 21:45 New Zealand will present the trade balance (for 12 months , from the beginning of the year ) , the balance of foreign trade in December. At 23:00 GMT a speech control RBNZ Graham Wheeler . At 23:30 GMT , Japan will release the change in the volume of expenditure of households , CPI , consumer price index excluding prices for fresh food , the consumer price index excluding prices for food and energy in December , Tokyo CPI , CPI Tokyo prices excluding fresh food , Tokyo CPI excluding prices for food and energy in January . At 23:50 GMT , Japan is to publish preliminary data on industrial production in December.

-

13:00

Germany: CPI, m/m, January -0.6% (forecast -0.4%)

-

13:00

Germany: CPI, y/y , January +1.3% (forecast +1.5%)

-

11:31

European stocks dropped

European stocks dropped after the Federal Reserve trimmed bond buying for a second straight meeting and companies from Diageo Plc to Hennes & Mauritz AB posted results that missed analyst estimates. The Federal Open Market Committee said yesterday it will cut monthly bond purchases by $10 billion to $65 billion, sticking to a plan for a gradual withdrawal from its unprecedented monetary easing. It was the first meeting without a dissent since June 2011. The Fed reiterated that it will probably hold its target interest rate near zero “well past the time” that unemployment falls below 6.5 percent.

A Chinese manufacturing gauge signaled the first contraction since July. A Purchasing Managers’ Index fell to 49.5 this month from 50.5 in December, HSBC Holdings Plc and Markit Economics said in a statement. The reading compared with the median 49.6 estimate in a Bloomberg News survey of 14 economists. A number below 50 indicates contraction.

Diageo lost 6.7 percent, the most since February 2009, to 1,782 pence. Organic sales rose 1.8 percent in the six months through December, missing the median analyst estimate of 3.5 percent. The maker of Smirnoff vodka and Johnnie Walker whisky said operating profit excluding some items was 2.06 billion pounds ($3.4 billion).

H&M, Europe’s second-biggest clothing retailer, dropped 3.7 percent to 276.60 kronor. The company reported fourth-quarter net income of 5.61 billion kronor ($869 million), less than the average analyst projection of 6 billion kronor.

Givaudan climbed 5.6 percent to 1,332 francs. The world’s largest maker of flavors and fragrances said 2013 net income was 490 million francs, exceeding the 464.5 million-franc analyst projection. The company said it will pay a dividend of 47 francs a share, beating the Bloomberg Dividend Forecast of 42 francs.

Ericsson AB rose 2.8 percent to 79.55 kronor. The world’s largest maker of wireless networks said gross ">FTSE 100 6,522.86 -21.42 -0.33%

CAC 40 4,141.92 -15.06 -0.36%

DAX 9,298.81 -37.92 -0.41%

-

10:35

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y101.95, Y102.00, Y102.25, Y102.50, Y103.00, Y103.80, Y103.90, Y104.00

EUR/JPY Y140.00

EUR/USD $1.3500, $1.3550, $1.3600, $1.3625, $1.3630, $1.3650, $1.3665, $1.3675

GB{/USD $1.6625, $1.6680

EUR/GBP stg0.8200, stg0.8250, stg0.8275, stg0.8295

AUD/USD $0.8650, $0.8700, $0.8770, $0.8800, $0.8850, $0.8865, $0.8875, $0.8890

AUD/JPY Y89.00, Y89.45

AUD/NZD NZ$1.0550

NZD/USD $0.8200, $0.8285, $0.8340

USD/CAD C$1.1075. C$1.1150

-

10:10

Asia Pacific stocks close

Asian stocks fell, heading for the largest monthly slide in eight months, after the Federal Reserve pressed on with cuts to U.S. economic stimulus and as a report showed China’s manufacturing industry contracted.

Nikkei 225 15,007.06 -376.85 -2.45%

Hang Seng 22,035.42 -106.19 -0.48%

S&P/ASX 200 5,188.06 -40.95 -0.78%

Shanghai Composite 2,033.08 -16.83 -0.82%

Honda Motor Co., which gets 83 percent of its auto sales abroad, lost 2.5 percent as Japanese exporters retreated after the yen gained from the close of equity markets in Tokyo yesterday.

Treasury Wine Estates Ltd. slumped by a record 20 percent in Sydney as the world’s second-largest publicly traded wine maker said earnings fell.

Hitachi Metals Ltd. surged 5.1 percent in Tokyo, leading gains on the regional benchmark index, after profit at the steel manufacturer topped analyst estimates.

-

10:01

Eurozone: Industrial confidence, January -3.9 (forecast -3.0)

-

10:00

Eurozone: Economic sentiment index , January 100.9 (forecast 101.0)

-

10:00

Eurozone: Business climate indicator , January 0.19 (forecast 0.34)

-

09:44

FTSE 100 6,544.28 -28.05 -0.43%, CAC 40 4,250.6 +25.46 +0.60%, Xetra DAX 9,336.73 -70.18 -0.75%

-

09:30

United Kingdom: Mortgage Approvals, December 71.6 (forecast 72.5)

-

09:30

United Kingdom: Net Lending to Individuals, bln, December 1.7 (forecast 1.9)

-

08:56

Germany: Unemployment Rate s.a. , January 6.8% (forecast 6.9%)

-

08:55

Germany: Unemployment Change, January -28 (forecast -5)

-

08:00

Switzerland: KOF Leading Indicator, January 1.98 (forecast 2.02)

-

07:19

European bourses are seen lower Thursday: the FTSE down 0.2%, the DAX down 0.6% and the CAC down 0.7%.

-

07:09

Asian session: The greenback rose

00:00 Australia HIA New Home Sales, m/m December +7.5% +0.4%

00:30 Australia Import Price Index, q/q Quarter IV +6.1% +2.1% -0.6%

00:30 Australia Export Price Index, q/q Quarter IV +4.2% -0.5% -0.5%

01:45 China HSBC Manufacturing PMI (Finally) January 49.6 49.6 49.5

The greenback rose yesterday against most emerging-market currencies as the Federal Reserve cut monthly bond buying by $10 billion, offsetting efforts in South Africa and Turkey to bolster their currencies through interest-rate increases. The Fed said yesterday it will trim its monthly bond buying to $65 billion from $75 billion, sticking to its plan for a gradual withdrawal from departing Chairman Ben S. Bernanke’s unprecedented easing policy. It has undertaken three rounds of bond buying since 2008 under the quantitative-easing stimulus strategy, swelling its balance sheet to a record $4 trillion.

Data in the U.S. today will show gross domestic product expanded at a 3.2 percent annualized pace in the fourth quarter, while private consumption grew 3.7 percent, according to the median forecasts of economists surveyed by Bloomberg.

The Australian and New Zealand dollars fell after a private report signaled a slowdown in Chinese manufacturing. A Purchasing Managers Index by HSBC Holdings Plc and Markit Economics of China’s manufacturing sector declined to 49.5 in January from 50.5 a month earlier, and compared to the 49.6 median forecast in a Bloomberg survey. A number below 50 indicates contraction.

Demand for the kiwi also weakened as its central bank held rates steady, disappointing some traders who were betting on an increase. In New Zealand, Reserve Bank Governor Graeme Wheeler kept benchmark rates at a record-low 2.5 percent at a policy meeting today. Swaps trading prior to the decision had priced about an even chance of an increase. The kiwi dollar slumped 0.5 percent to 81.74 U.S. cents and fell 0.4 percent 83.69 yen.

EUR / USD: during the Asian session the pair fell to $ 1.3640

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6540-60

USD / JPY: during the Asian session, the pair rose to Y102.55

It will be another busy day on both sides of the Atlantic Thursday, although markets will continue to look back at the FOMC's decision to continue reducing new stimulus in the US economy. The European calendar kicks off at 0700GMT, with the release of the German December ILO employment data. Then, at 0800GMT, German Economy Minister Sigmar Gabriel speaks before parliament, in Berlin. Also set for release at 0800GMT is the Swiss January KOFeconomic barometer numbers. The official German state unemployment release wilcross the wires at 0855GMT. Amalgamated EMU data set for release at 1000GMT includes the January economic sentiment survey, the business and consumer survey and the business climate index.

-

06:21

Stocks. Daily history for Jan 29’2013:

Nikkei 225 15,383.91 +403.75 +2.70%

Hang Seng 22,141.61 +180.97 +0.82%

Shanghai Composite 2,049.91 +11.40 +0.56%

FTSE 100 6,544.28 -28.05 -0.43%

CAC 40 4,156.98 -28.31 -0.68%

DAX 9,336.73 -70.18 -0.75%

Dow -189.71 15,738.85 -1.19%

Nasdaq -46.53 4,051.43 -1.14%

S&P -18.3 1,774.20 -1.02%

-

06:21

Commodities. Daily history for Jan 29’2013:

Gold $1,266.85 +10.02 +0.80%

Oil $97.21 -0.20 -0.21%

-

06:20

Currencies. Daily history for Jan 29'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3663 -0,05%

GBP/USD $1,6564 -0,08%

USD/CHF Chf0,8945 -0,28%

USD/JPY Y102,28 -0,63%

EUR/JPY Y139,71 -0,72%

GBP/JPY Y169,41 -0,71%

AUD/USD $0,8737 -0,45%

NZD/USD $0,8212 -0,52%

USD/CAD C$1,1169 +0,17%

-

06:01

Schedule for today, Thursday, Jan 30’2013:

00:00 Australia HIA New Home Sales, m/m December +7.5% +0.4%

00:30 Australia Import Price Index, q/q Quarter IV +6.1% +2.1% -0.6%

00:30 Australia Export Price Index, q/q Quarter IV +4.2% -0.5% -0.5%

01:45 China HSBC Manufacturing PMI (Finally) January 49.6 49.6 49.5

08:00 Switzerland KOF Leading Indicator January 1.95 2.02

08:55 Germany Unemployment Change January -15 -5

08:55 Germany Unemployment Rate s.a. January 6.9% 6.9%

09:30 United Kingdom Net Lending to Individuals, bln December 1.5 1.9

09:30 United Kingdom Mortgage Approvals December 70.8 72.5

10:00 Eurozone Business climate indicator January 0.27 0.34

10:00 Eurozone Economic sentiment index January 100.0 101.0

10:00 Eurozone Industrial confidence January -3.4 -3.0

13:00 Germany CPI, m/m (Preliminary) January +0.4% -0.4%

13:00 Germany CPI, y/y (Preliminary) January +1.4% +1.5%

13:30 U.S. PCE price index, q/q Quarter IV +2.0% +1.4%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4% +1.5%

13:30 U.S. Initial Jobless Claims January 326 331

13:30 U.S. GDP, q/q (Preliminary) Quarter III +4.1% +3.2%

15:00 U.S. Pending Home Sales (MoM) December +0.2% -0.1%

21:45 New Zealand Trade Balance, mln December 183 500

23:00 New Zealand RBNZ Governor Graeme Wheeler Speaks

23:15 Japan Manufacturing PMI January 55.2 54.7

23:30 Japan Household spending Y/Y December +0.2% +1.3%

23:30 Japan Unemployment Rate December 4.0% 3.9%

23:30 Japan Tokyo Consumer Price Index, y/y January +0.9% +0.7%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January +0.7% +0.7%

23:30 Japan National Consumer Price Index, y/y December +1.5% +1.4%

23:30 Japan National CPI Ex-Fresh Food, y/y December +1.2% +1.2%

23:50 Japan Industrial Production (MoM) (Preliminary) December -0.1% +1.5%

23:50 Japan Industrial Production (YoY) (Preliminary) December +4.8% +5.4%

-