Notícias do Mercado

-

20:00

Dow -66.04 14,908.92 -0.44% Nasdaq -11.16 3,423.33 -0.32% S&P -4.01 1,610.95 -0.25%

-

19:20

American focus: the euro exchange rate against the dollar has declined markedly

The dollar rose significantly against the euro on data from the euro zone producer prices, which fell for the third month in succession. Producer prices were down 0.1% year on year, after falling 0.2% in April. Economists had forecast that prices will remain unchanged in May. On a monthly measurement of producer prices fell 0.3% in April after falling by 0.6%. But the rate of decline slightly above the consensus forecast of 0.2%.

Investors are waiting for the ECB meeting on Thursday. It is expected that the Central Bank will showcase a soft tone that will increase the downside risks for the pair. It is expected that Draghi will also mark the recent positive reports on the euro zone, indicating that the long-awaited recovery in the 2nd half of the year.

We also add that the dynamics of trading was influenced by the U.S. data. As it became known, the demand for manufactured goods in the U.S. rose in May, which was another sign that the company is stepping up spending after the sluggish winter.

Total production orders to a seasonally adjusted rose in May for $ 9.9 billion, or 2.1%, to $ 485 billion, compared with the previous month, the Commerce Department said Tuesday. Orders have been growing for three of the past four months.

The increase was due to growth in demand in the volatile aircraft sector, but demand for other items, such as computers, also rose, albeit slightly. Factory orders excluding transportation rose in May by 0.6%.

The growth of total orders matched economists' expectations. The report also showed that orders for durable goods - products intended for use longer than three years, such as cars and refrigerators - rose 3.7%, slightly stronger pace, as originally reported. This follows a similar increase in April.

However, a worrying sign was that orders for consumer goods were virtually unchanged, showing an increase of just 0.5% after falling in April and March. However, in a report on Tuesday also shown encouraging trends: companies replenishing their inventories in line with a slightly higher demand. And they're stepping up spending on equipment and software.

The British pound down on expectations the Bank of England, which will hold its first meeting led by M. Carney on Thursday. We also add that the impact of the currency had a statement of the representative of the Bank of England's Tucker, who said that the UK economy seems to be embarking on a path of sustained recovery, but high levels of household debt constrain growth. Recall that the UK economy grew by 0.3% in the first quarter and the British Chamber of Commerce on Tuesday announced its quarterly growth to 0.6% in April-June.

"We are now in a period when it seems that the economic recovery can be sustained," - said Paul Tucker, Deputy Governor of the Bank of England's financial stability. Tucker warned that "the road will be bumpy," referring to the heavy levels of debt in the UK, which hinder growth. "There is a lot of households and firms that have more or less reasonable levels of debt, their debt load is higher than anyone expected - said Tucker legislators. - Due to the household sector is a headwind, which constrains the recovery of demand."

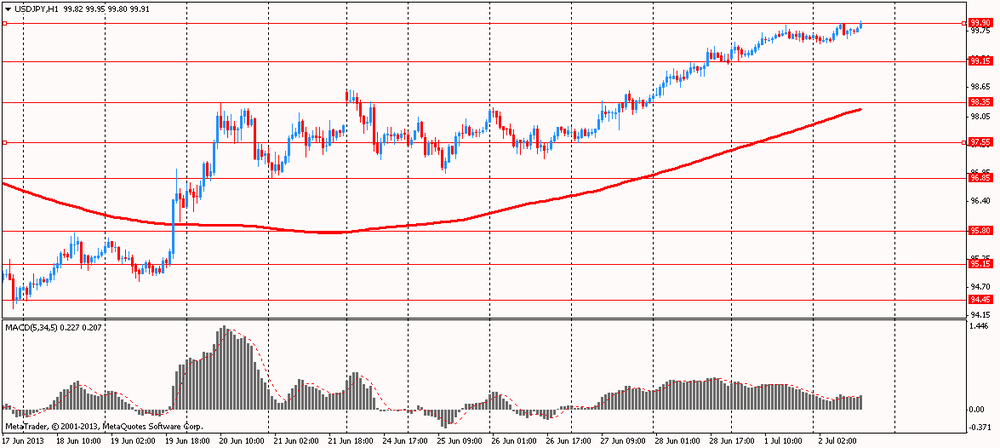

The U.S. dollar rose against the yen, again exceeding the level of 100 Japanese yen for the first time since the beginning of June, as traders become more confident that the Fed will slow the pace of monetary stimulus.

Experts point out that this is an important week for the currency market. Important even today, when in the calendar of economic data are scheduled publications likely to affect the market, except at night catechumen solutions of the Reserve Bank of Australia, but the currencies exhibit significant changes.

Add that investors are slowly buying U.S. dollars on Friday before publication of employment data in the U.S.. It is worth noting that at the end of May month increase in the number of employed in non-agricultural sector exceeded expectations, an increase of 175,000, although the April figures were revised downward. Most companies in the private sector continue to increase the number of their employees, led by the professional sector, a sector of business services, leisure and hospitality industries. We add that the continued decline in employment in manufacturing and the public sector. We also note that, on average, the economy has added just under 190,000 jobs each month this year, although the February reading and overestimated the overall trend. At the same time, adding that the unemployment rate rose 0.1 percentage points to 7.6%, although this was entirely due to rising levels of labor force participation.

According to experts, the decline in unemployment will confirm that the U.S. economy is headed in the right direction and that the Fed is on the way to reduce the amount of asset purchases in September.

-

18:20

European stock close

European stocks fell, following yesterday's rally for the Stoxx Europe 600 Index, as a report showed that U.K. construction expanded less than forecast.

The Stoxx 600 slipped 0.5 percent to 286.96 at 4:30 p.m. in London. The equity benchmark advanced yesterday as euro-area factory output contracted in June less than estimated and Japanese manufacturers turned optimistic for the first time since the third quarter of 2011. The Stoxx 600 advanced 1.7 percent last week as China sought to ease a cash crunch. The gauge still lost 5.3 percent in June after Federal Reserve Chairman Ben S. Bernanke said the central bank could reduce stimulus measures if the U.S. economy improves in line with its forecasts.

In the U.K., a report showed that construction rose less than forecast in June. An index of activity in the industry climbed to 51, from 50.8 in May. That missed the median economist estimate for a reading of 51.2.

In the U.S., a Commerce Department release showed that orders placed with U.S. factories rose 2.1 percent in May, following a revised 1.3 percent advance in April. The median forecast of economists had called for a 2 percent gain.

National benchmark indexes retreated in 13 of the 18 western-European markets today.

FTSE 100 6,303.94 -3.84 -0.06% CAC 40 3,742.57 -24.91 -0.66% DAX 7,910.77 -73.15 -0.92%

Fresenius Medical Care slumped 8.8 percent to 49.63 euros as the U.S. government's Health and Human Services Department proposed cutting payments to kidney-dialysis centers from next year. Payments to the German company, which runs clinics offering the procedure in the U.S., may drop 9.4 percent in 2014 under the plans to reduce spending on Medicare.

Telefonica Deutschland declined 1.5 percent to 5.45 euros after Commerzbank cut the German business of Telefonica SA to hold from buy. The brokerage said that new uncertainties, including a probable spectrum auction in Europe's largest economy in the next two years, limit the shares' upside.

RWE AG and EON SE led a gauge of European utilities lower, declining 4 percent to 22.32 euros and 2.1 percent to 12.17 euros, respectively. Morgan Stanley removed RWE from the list of its best ideas. The brokerage reduced its earnings-per-share estimates for 2014-15 by as much as 13 percent, saying that Germany's second-largest power producer faces a difficult market in the near term.

Erste Group Bank AG lost 2 percent to 20.01 euros as Austria's biggest lender sold 661 million euros ($861 million) of new shares to help repay state aid in a deal that reduces the stakes of its key shareholders.

Michelin & Cie. (ML) increased 2 percent to 70.55 euros after UBS raised Europe's largest tiremaker to buy from neutral, citing improved cost positions that enable more competitive pricing and higher profits.

-

17:00

European stock close in minus: FTSE 100 6,303.94 -3.84 -0.06% CAC 40 3,742.57 -24.91 -0.66% DAX 7,910.77 -73.15 -0.92%

-

16:40

Oil: an overview of the market situation

Oil prices rose modestly, while continuing yesterday's gain, which was due to concerns over supply disruptions from Libya, as well as political unrest in Egypt, which may hit oil supplies from the region.

It is learned that oil production in Libya has fallen to third place, after the protestors closed several fields, as anti-government demonstrations in Egypt have raised concerns about the stability of the entire region.

Prices were also supported by yesterday's data from the Institute for Supply Management, which showed that the results of last month's U.S. manufacturing activity grew.

Experts note that many investors took the opportunity to buy oil at relatively low prices after three consecutive quarters of decline, which was the longest string of losses since the 1997-1998. Analysts also point to the probability of an increase in refining capacity in the near future.

Meanwhile, it is worth noting that Canada yesterday resumed work on the part of a major pipeline in Alberta, which was due to improved weather conditions.

Higher prices also contribute to the expectations of tomorrow's publication of data on oil reserves in the United States.

We also add that today its reserves data will present the American Petroleum Institute (API). Analysts expect the reduction of oil reserves by 2.63 million barrels last week, increasing the fuel reserves of 600 million barrels, distillate - by one million barrels.

The cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to 97.96 dollars a barrel on the New York Mercantile Exchange.

August futures price for North Sea Brent crude oil mixture rose $0.62 to $ 103.58 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices fell slightly today, and not being able to hold the position previously won, and broke a series of two-day growth in a row. Experts point out that this trend was due to the unexpected, and at the same time, the sharp strengthening of the dollar, as well as the expectations of the information regarding the scope of the program of bond purchases.

Note that during the first half of the trading price of gold showed growth, as traders were forced to cover their short positions against the background of much restoration, which followed after the biggest three-month fall since at least 1968. We also add that the closing of positions was due to expectations of the publication of the report on non-farm payrolls, which will be presented at the end of this week. Meanwhile, many investors are afraid to enter the market on the eve of Independence Day in the United States.

Gold lost 23% in the period from April to June, on speculation that the current monetary policy of the Federal Reserve System may be revised in the near future. This will contribute to an increase in interest rates, and to make gold less attractive.

Analysts have warned that the current recovery from a three-year low last week at $ 1,180.70 unlikely to last long, and some expect that prices are still, ultimately, may fall to $ 1,000 an ounce.

Meanwhile, data released today showed that the stock of gold in the SPDR Gold Trust - the world's largest gold exchange-traded fund, fell yesterday by 1.2 million tonnes to 968.30, the lowest level since February 2009. Its stock fell to 382.5 tonnes since the beginning of the year.

The cost of the August gold futures on COMEX today dropped to 1249.40 dollars an ounce.

-

15:30

Demand for U.S. factory goods rose in May

Demand for U.S. factory goods rose in May, the latest sign that businesses are stepping up spending after a sluggish winter.

Total factory orders rose by $9.9 billion, or 2.1%, to a seasonally adjusted $485 billion in May from the prior month, the Commerce Department reported Tuesday. Orders have risen for three of the past four months.

The increase was driven by a rise in demand in the volatile aircraft segment, but demand for other items, such as computers, also rose, though only modestly. Excluding transportation, orders rose 0.6% in May.

The rise in total orders exceeded economists' expectations of a 2% increase. The report also showed that orders for durable goods--items designed to last longer than three years, such as cars and refrigerators--rose by 3.7%, a slightly stronger pace than initially reported. That followed a similar increase in April.

In one troubling sign, orders of consumer goods were essentially flat, rising just 0.5% after falling in April and March. But Tuesday's report also showed encouraging trends: Companies are restocking their shelves to keep up with slightly higher demand. And they are stepping up spending on equipment and software.

Inventories rose for the sixth consecutive month. Meantime, orders for nondefense capital goods excluding aircraft--a proxy for business investment--rose 1.5%, after rising in April and March.

Factories are having a choppy year, amid a soft economy in the U.S. and woes in Europe and Asia.

A separate report Monday showed that factory activity expanded slightly in June, after contracting in May. The report from the Institute for Supply Management showed growth in new orders, production and inventories. But it also showed that the employment index contracted for the first time since September 2009.

-

15:00

U.S.: Factory Orders , May +2.1% (forecast +2.1%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.2985, $1.3000, $1.3050

USD/JPY Y99.50, Y99.60, Y100.00, Y100.20, Y100.50

USD/CHF Chf0.9450, Chf0.9500

AUD/USD $0.9150, $0.9200

-

14:34

U.S. Stocks open: Dow 14,951.76 -23.20 -0.15%, Nasdaq 3,433.62 -0.87 -0.03%, S&P 1,614.34 -0.62 -0.04%

-

14:25

Before the bell: S&P futures +0.02%, Nasdaq futures +0.15%

U.S. stock futures were little changed as investors awaited reports on U.S. factory orders and comments from Federal Reserve officials.

Global Stocks open:

Nikkei 14,098.74 +246.24 +1.78%

Hang Seng 20,658.65 -144.64 -0.70%

Shanghai Composite 2,006.56 +11.32 +0.57%

FTSE 6,270.23 -37.55 -0.60%

CAC 3,733.7 -33.78 -0.90%

DAX 7,883.92 -100.00 -1.25%

Crude oil $98.56 +0.58%

Gold $1251.40 +0.34%

-

14:15

Japan labor cash earnings remain flat for second month

Japan's total labor cash earnings stayed unchanged for a second consecutive month in May, preliminary figures from the Labor Ministry showed Tuesday.

Total wages in May amounted to JPY 267,567. Wages have been falling almost steadily since May 2012.

Regular pay declined 0.2 percent from a year earlier in May, while special cash earnings rose 4.5 percent. Contractual cash earnings were down 0.2 percent from last year. Overtime pay slipped 0.1 percent.

-

13:47

Upgrades and downgrades before the market open:

Upgrades:

JPMorgan Chase (JPM) upgraded from Outperform to Strong Buy at Raymond James

Downgrades:

Other:

Goldman Sachs (GS) target raised to $169 at Evercore

-

13:25

European session: the euro fell

08:30 United Kingdom PMI Construction June 50.8 51.3 51.0

09:00 Eurozone Producer Price Index, MoM May -0.6% -0.2% -0.3%

09:00 Eurozone Producer Price Index (YoY) May -0.2% 0.0% -0.1%

09:00 United Kingdom MPC Member Tucker Speaks

09:00 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

The euro fell against the U.S. dollar against the background data on producer prices eurozone, which fell for the third month in succession. Producer prices were down 0.1% year on year, after falling 0.2% in April. Economists had forecast that prices will remain unchanged in May. On a monthly measurement of producer prices fell 0.3% in April after falling by 0.6%. But the rate of decline slightly above the consensus forecast of 0.2%.

Investors are waiting for the ECB meeting on Thursday. It is expected that the Central Bank will showcase a soft tone that will increase the downside risks for the pair. It is expected that Draghi will also mark the recent positive reports on the euro zone, indicating that the long-awaited recovery in the 2nd half of the year.

The British pound down on expectations the Bank of England, which will hold its first meeting led by M. Carney on Thursday.

"The obstacles in the form of cost-saving measures of inflation and recession in the eurozone mean that the Bank of England will have to work hard to support the economic recovery. While we agree with the forecast that the prospects for expanding QE this year declined, Carney can emphasize that the Bank of England is accommodative position. most obvious tool that Carney can use this proactive management, "said Jane Foley, strategist at Rabobank.

Earlier, the pound rose against the dollar after a report showed that activity in the UK construction sector grew in June the second straight month, helped by government initiatives in the housing market. The index of purchasing managers in the construction sector, calculated by Markit and the Chartered Institute of Purchasing & Supply, in June rose to 51.0 against 50.8 in May. As a result of growth in June, the index reached the highest level since May 2012. A reading above 50 indicates an increase in activity, and lower - at its reduction.

The Australian dollar fell against the U.S. dollar after the Reserve Bank of Australia left the door open to lower interest rates in the coming months and said the currency could fall even more. RBA left interest rates unchanged at a record low of 2.75%, but said that the weak inflation gives room for further lowering of the rates if the economy falters.

EUR / USD: during the European session, the pair fell to $ 1.3012

GBP / USD: during the European session, the pair fell to $ 1.5155

USD / JPY: during the European session, the pair rose to Y99.95

In the U.S., will be released at 14:00 Factory Orders for May, and at 20:30 - changes in stocks of crude oil, according to API. End the day at 23:30 Australia data on the index of activity in the service of the AiG in June.

-

11:33

European stocks retreated

European stocks retreated, following yesterday's rally for the Stoxx Europe 600 Index, as investors awaited a report on American factory orders. U.S. index futures and Asian shares climbed.

In the U.K., a report showed that construction rose in June less than forecast. An index of activity in the industry climbed to 51, from 50.8 in May. That missed the median economist estimate in a Bloomberg survey for a reading of 51.2.

Fresenius Medical Care slumped 8.7 percent to 49.70 euros as the U.S. government's Health and Human Services Department proposed cutting payments to kidney-dialysis centers from next year. Payments to the German company, which runs clinics offering the procedure in the U.S., may drop 9.4 percent in 2014 under the plans to reduce spending on Medicare. A gauge of European health-care companies declined, with Fresenius SE, which owns 94 percent of Fresenius Medical Care, sliding 3.7 percent to 91.96 euros.

Telefonica Deutschland declined 3 percent to 5.36 euros after Commerzbank cut the German business of Telefonica SA to hold from buy. The brokerage said that new uncertainties, including a probable spectrum auction in Europe's largest economy in the next two years, limit the shares' upside.

Michelin & Cie. increased 1.9 percent to 70.46 euros after UBS raised Europe's largest tiremaker to buy from neutral, citing improved cost positions that enable more competitive pricing and higher profits.

FTSE 100 6,284.25 -23.53 -0.37%

CAC 40 3,753.9 -13.58 -0.36%

DAX 7,918.81 -65.11 -0.82%

-

11:02

UK construction activity at one-year high

British construction sector activity expanded for a second consecutive month in June and at the strongest pace in over a year, a survey report from Markit Economics and the Chartered Institute of Purchasing & Supply showed Tuesday.

The headline purchasing managers' index rose to 51 in June from 50.8 in May. The June reading was the highest since May 2012.

Readings above 50 indicate expansion of the sector. The index has now remained above 50 for a second successive month in June.

Higher output levels were driven by a solid rate of new order growth in June, and this in turn contributed to rising employment levels in the construction sector during the latest survey period, the report said.

New order growth was the strongest in 13 months. In June, the rate of job creation was the most marked since September 2012. The survey also found that business confidence among builders was at its highest level since April 2012.

Residential building activity improved for a fifth consecutive month, but the rate of expansion eased from May's 26-month high. Business activity stabilized in commercial and civil engineering sub-sectors.

-

10:46

Eurozone producer prices fall for second month

Eurozone producer prices declined for the second consecutive month in May, largely reflecting weak energy prices, data published by Eurostat revealed Tuesday.

Producer prices slipped 0.1 percent on a yearly basis, after falling 0.2 percent in April. This was the second consecutive fall in prices. Economists had forecast prices to remain flat in May.

Month-on-month, producer prices fell 0.3 percent, which was slower than the 0.6 percent decline seen in April. But the rate of decline slightly exceeded the consensus forecast of 0.2 percent.

Prices in total industry excluding the energy sector increased 0.5 percent from a year ago, following a 0.6 percent rise.

Durable consumer goods gained 0.7 percent and non-durable consumer goods rose 2 percent. Likewise, capital goods increased by 0.6 percent, it said.

Meanwhile, prices in the energy sector decreased 1.8 percent and intermediate goods fell by 0.5 percent.

-

10:29

Option expiries for today's 1400GMT cut

EUR/USD $1.2985, $1.3000, $1.3050, $1.3100, $1.3130

USD/JPY Y98.00, Y98.50, Y99.00, Y99.50, Y99.60, Y100.00, Y100.50

USD/CHF Chf0.9450, Chf0.9500

AUD/USD $0.9150, $0.9200, $0.9365

-

10:01

Eurozone: Producer Price Index, MoM , May -0.3% (forecast -0.2%)

-

10:00

Eurozone: Producer Price Index (YoY) , May -0.1% (forecast 0.0%)

-

09:31

United Kingdom: PMI Construction, June 51.0 (forecast 51.3)

-

09:07

Asia Pacific stocks close

Asian stocks rose, with the regional benchmark index heading for a fifth day of gains, after U.S. manufacturing expanded faster than forecast.

Nikkei 225 14,098.74 +246.24 +1.78%

Hang Seng 20,775.35 -27.94 -0.13%

S&P/ASX 200 4,834 +123.71 +2.63%

Shanghai Composite 2,006.24 +11.00 +0.55%

Li & Fung Ltd., a supplier of toys and clothes to retailers including Wal-Mart Stores Inc., climbed 4.3 percent in Hong Kong.

Newcrest Mining Ltd., Australia's largest gold producer jumped 6.8 percent as the bullion advanced for a third day.

SK Hynix Inc., the world's second-largest maker of computer memory chips, sank 8.7 percent in Seoul after CLSA Asia Pacific Markets lowered the stock's rating.

-

08:40

FTSE 100 6,300.13 -7.65 -0.12%, CAC 40 3,776.2 +8.72 +0.23%, Xetra DAX 7,967.11 -16.81 -0.21%

-

07:22

European bourses are initially seen trading lower Tuesday: the FTSE down 19, the DAX down 25 and the CAC down 10.

-

07:03

Asian session: The dollar was 0.6 percent from the highest level

01:00 Japan Labor Cash Earnings, YoY May +0.3% +0.6% 0.0%

04:30 Australia Announcement of the RBA decision on the discount rate 2.75% 2.75% 2.75%

04:30 Australia RBA Rate Statement

The dollar was 0.6 percent from the highest level in almost a month against the euro as signs of improvement in the U.S. economy buoyed speculation the Federal Reserve will soon start scaling back asset purchases.

The greenback was supported before a report today that may show factory orders gained by the most in three months, and ahead of data this week forecast to indicate a decline in the unemployment rate as companies in the world's biggest economy continued to add jobs. The U.S. Commerce Department will probably say today orders placed with factories climbed 2 percent in May following a 1 percent gain in the previous month, according to the median estimate of economists surveyed by Bloomberg News. If confirmed, that would be the biggest advance since February. Companies in the U.S. added 160,000 workers last month after increasing positions by 135,000 in May, analysts in a separate poll predicted before a report tomorrow by the Roseland, New Jersey-based ADP Research Institute.

New York Fed President William C. Dudley is scheduled to speak on the economy later today in Stamford, Connecticut.

The Australian dollar weakened after an advance yesterday that was the biggest in two weeks before the Reserve Bank announces a policy decision today. RBA Governor Glenn Stevens and his board will probably keep the nation's benchmark interest rate at 2.75 percent at a meeting today, according to 25 of 28 economists polled by Bloomberg. There's a 20 percent chance officials will cut the rate to 2.5 percent, interest-rate swaps data compiled by Bloomberg show.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3050/70

GBP / USD: during the Asian session the pair is trading around $ 1.5200

USD / JPY: during the Asian session the pair traded in the range of Y99.50/75

At 0700GMT, June's Spanish unemployment data is set for release, along with French Jun car registrations. At the same time, EU Economics and Monetary Affairs Commissioner Olli Rehn is slated to speak on the outcome of June's EU Council to European Parliament. ECB Governing Council member Christian Noyer will give a press conference on a report about credit card security, in Paris from 0800GMT. At 0900GMT, EMU May PPI numbers will be published. At 2100GMT, Bundesbank Board member Andreas Dombret speech at a Bundesbank event in New York.

-

06:21

Commodities. Daily history for Jul 1’2013:

Change % Change Last

GOLD 1,251.90 28.20 2.30%

OIL (WTI) 97.90 1.34 1.39%

-

06:20

Currencies. Daily history for Jul 1'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3061 +0,19%

GBP/USD $1,5217 -0,26%

USD/CHF Chf0,9451 +0,01%

USD/JPY Y99,61 +1,18%

EUR/JPY Y130,11 +1,37%

GBP/JPY Y151,57 +0,92%

AUD/USD $0,9233 -0,53%

NZD/USD $0,7820 +0,29%

USD/CAD C$1,0495 +0,19%

-

06:20

Stocks. Daily history for Jul 1’2013:

Nikkei 225 13,852.5 175,18 1,28%

Hang Seng 20,803.29 363,21 1,78%

S & P / ASX 200 4,710.3 -92,29 -1,92%

Shanghai Composite 1,995.24 16,04 0,81%

FTSE 100 6,307.78 +92.31 +1.49%

CAC 40 3,767.48 +28.57 +0.76%

DAX 7,983.92 +24.70 +0.31%

Dow +63.82 14,973.42 +0.43%

Nasdaq +31.24 3,434.49 +0.92%

S&P +8.57 1,614.85 +0.53%

-

06:01

Schedule for today, Tuesday, July 2’2013:

01:00 Japan Labor Cash Earnings, YoY May +0.3% +0.6%

04:30 Australia Announcement of the RBA decision on the discount rate 2.75% 2.75%

04:30 Australia RBA Rate Statement

07:00 United Kingdom Halifax house price index June +0.4% +0.4%

07:00 United Kingdom Halifax house price index 3m Y/Y June +2.6% +3.6%

08:30 United Kingdom PMI Construction June 50.8 51.3

09:00 Eurozone Producer Price Index, MoM May -0.6% -0.2%

09:00 Eurozone Producer Price Index (YoY) May -0.2% 0.0%

09:00 United Kingdom MPC Member Tucker Speaks

09:00 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

14:00 U.S. Factory Orders May +1.0% +2.1%

16:30 U.S. FOMC Member Dudley Speak

20:30 U.S. API Crude Oil Inventories June -0.03

21:45 U.S. FOMC Member Jerome Powell Speaks

23:30 Australia AIG Services Index June 40.6

-

05:30

Australia: Announcement of the RBA decision on the discount rate, 2.75% (forecast 2.75%)

-