Notícias do Mercado

-

20:00

Dow -58.18 15,856.44 -0.37% Nasdaq -5.64 4,031.56 -0.14% S&P -5.58 1,789.57 -0.31%

-

18:57

American focus : the euro rose sharply against the U.S. dollar

The euro exchange rate against the dollar rose sharply , returning with all previously lost ground , due to the expectations of Fed's Beige Book publication . Mixed reports from the U.S. showed positive results on the trade balance and the housing market , but the ISM index in the services sector disappointed investors . The data showed that non-manufacturing sector in the United States continued to rise in November , but it was slower than in October. The index of business activity in the non-manufacturing ISM from November declined from 55.4 in October to 53.9 . Economists had expected the index to remain unchanged . Readings above 50 indicate expansion of activity.

"Comments by respondents in most of the show that the non-manufacturing sector continued steady consistent growth outlook for the coming months positive" , - the report says ISM.

Sub- indexes in the survey also showed ISM continued growth in activity, but at a slower pace : the employment index fell to 52.5 from 56.2 , the new orders index fell to 56.4 from 56.8 , output index fell to 55.5 from 59.7 , inventories index fell to 54.0 from 54.5 . Price index fell from 56.1 in October and 57.2 in September to 52.2 .

From ISM index takes into account mainly the data from service companies , which makes up a large part of the U.S. economy , but also includes the construction and public administration.

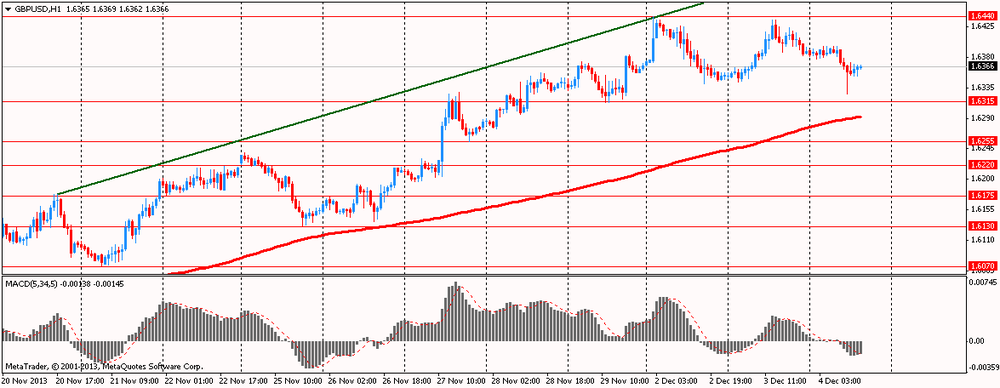

Pound strengthened against the dollar , approaching the maximum values of the session , which was associated with the release of a weak report on U.S. . In addition , market participants are waiting for tomorrow's meeting of the Bank of England. As expected, the Bank of England will leave monetary policy unchanged, despite signs of a strengthening economy, as fulfills the promise to keep the key rate level , while unemployment exceeds the benchmark .

Recall that at the last meeting of the committee on monetary policy the Bank of England unanimously decided to keep record low interest rates and the asset purchase program at 375 billion pounds. Note that this decision was not a surprise to the market. Earlier, the Bank of England announced plans not to raise interest rates as long as the unemployment rate will not fall until at least 7%.

All committee members agreed that it was not satisfied none of the many foreign terms of price stability , which would have forced to abandon the statements of intent , heard in August. Committee members also noted that there is still uncertainty regarding the recovery and the extent to which the rate of growth of supply will meet demand . There were also concerns about wages and pricing.

-

18:20

European stock close

European stocks declined for a fourth day, their longest losing streak in more than five months, as better-than-expected U.S. jobs data fueled concern the Federal Reserve will pare stimulus measures sooner than forecast.

The Stoxx Europe 600 Index slid 0.6 percent to 317.29 at 4:30 p.m. in London, after earlier losing as much as 1.1 percent. The benchmark fell 1.5 percent yesterday as investors weighed valuations before U.S. jobs data this week.

A private jobs report by ADP Research Institute showed that U.S. companies last month added 215,000 workers in November, the most in a year. The median forecast of economists was for an increase of 170,000. Labor Department data on Dec. 6 may show the unemployment rate fell to 7.2 percent, matching the lowest level in five years.

The Fed has said it will monitor labor-market gains before deciding when to pare its $85 billion of monthly bond purchases. The central bank will release its Beige Book report on economic conditions in the world’s largest economy after European markets close today.

A Commerce Department release showed U.S. new-home sales jumped in October by the most in three decades. Sales increased 25.4 percent to a 444,000 annualized pace, exceeding the 429,000 rate forecast by economists.

Another report showed the Institute for Supply Management’s non-manufacturing index fell to 53.9 in November from 55.4 a month earlier. Economists had projected a decline to 55.

The Federal Open Market Committee meets next on Dec. 17-18. Policy makers will probably pare the monthly pace of bond buying to $70 billion at their March 18-19 meeting, according to the median of estimates.

The euro area’s nascent recovery from a record-long recession nearly stalled in the third quarter, according to figures released today by the European Union’s statistics office in Luxembourg. Gross domestic product rose 0.1 percent after a 0.3 percent gain in the previous three months. That was in line with Eurostat’s initial estimate. From a year earlier, the economy contracted 0.4 percent.

National benchmark indexes declined in all of the western European markets except Iceland.

FTSE 100 6,509.97 -22.46 -0.34% CAC 40 4,148.52 -23.92 -0.57% DAX 9,140.63 -82.77 -0.90%

Elekta (EKTAB) dropped 5.4 percent to 91.35 kronor after the maker of radiation-surgery equipment reported second-quarter operating profit of 304 million kronor ($47 million), missing the average analyst estimate for 424 million kronor.

Standard Chartered slid 6.5 percent to 1,338 pence, the lowest price since August 2012. The U.K. bank that generates about three-quarters of its profits from Asia said full-year operating profit at its consumer-banking unit will decline at least 10 percent because of weakness in Korea.

Vestas Wind Systems A/S retreated 3.4 percent to 141.10 kroner after saying its Marena Renovables project in Mexico has been further delayed. The company said in a statement that it has agreed to extend the forbearance agreement from Nov. 30 until Feb. 28, 2014. Vestas said in May the project was facing “significant” delays.

Peugeot climbed 5.6 percent to 12.14 euros after Goldman Sachs added the shares to its conviction-buy list, citing a capital increase, asset disposals and a probable alliance in China. Goldman Sachs said in a note today that European carmakers will post profit growth through 2017 as sales and prices increase.

Sage Group Plc jumped 7.2 percent to 372.5 pence after proposing a final dividend of 7.44 pence a share, exceeding analysts’ projections of 7.1 pence. The software publisher posted sales of about 1.38 billion pounds ($2.26 billion) today, in line with analysts’ forecasts.

-

17:00

European stock close: FTSE 100 6,509.97 -22.46 -0.34% CAC 40 4,148.52 -23.92 -0.57% DAX 9,140.63 -82.77 -0.90%

-

16:40

Oil: an overview of the market situation

Prices for Brent crude declined moderately since the OPEC oil production quotas left unchanged, while the price of WTI crude oil rose , helped by a report on stocks in the United States . As it became known , the Ministers of the profile - Members of the countries - exporters of oil at today's meeting in Vienna agreed to maintain the current level of official limit oil cartel - 30 million barrels per day. Members of the meeting expressed satisfaction with current prices for crude oil, Brent Brent - above $ 112 which is considerably higher " minimum desired value " of $ 100 per barrel.

Total OPEC oil production quota is a formal reference , but the actual level of production cartel often does not coincide with the official . In November 2013. , According to industry experts, OPEC was producing slightly more than 30 million barrels per day.

As for stocks , the Department of Energy data on changes in stocks in the week November 25 - December 1 , showed :

- Oil reserves fell by 5.585 million barrels to 385.831 million barrels ;

- Gasoline inventories increased by 1,828 million barrels . to 212.432 million barrels . ;

- Distillate stocks increased by 2.649 million barrels . to 113.524 million barrels .

- Refining capacity utilization rate of 92.4 % against 89.4 % a week earlier .

We also recall that yesterday its reserves data provided the Institute of Oil API. They showed :

- Capacity utilization in the week 91.5% against 89.8 %

- Distillate stocks last week 0.540 million barrels

- Gasoline inventories last week -0.119 million barrels

- Oil reserves for the week 12.4 million barrels

Little support prices also provided employment report , which showed that private-sector employment increased by 215,000 jobs from October to November . According to the report , employment in producers increased by 40,000 jobs in November , compared to 29,000 in October.

Construction sector and manufacturing industry added 18,000 jobs each . Growth in the industry was the largest since 2012 .

The price of January futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 96.54 a barrel on the New York Mercantile Exchange.

January futures price for North Sea Brent crude oil mixture fell 24 cents to $ 112.64 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose sharply, while restoring all early losses , after mixed U.S. economic data , but remained near 5 -month low on uncertainty about when the Fed will begin to reduce the amount of their stimulus measures . Gold is under pressure as the markets believe that the improvement in the economic situation may prompt the Fed to reduce the amount of monthly purchases of bonds in December. Investors understand that the central bank will start reducing at some point , but the timing is questionable.

Noticeable influence on the bidding had U.S. data , which showed that private sector employment increased by 215,000 jobs from October to November . According to the report , employment in producers increased by 40,000 jobs in November , compared to 29,000 in October.

Construction sector and manufacturing industry added 18,000 jobs each . Growth in the industry was the largest since 2012 .

In the service sector added 176,000 jobs in November , compared with 156,000 in October - it was the biggest growth in the services sector in the year. Among the service industries sector trade, transport and utilities sector added the most jobs of 45,000 per month . Employment in business services increased by 38,000 , while the financial sector added 5,000 jobs .

Now market participants' attention shifted to tomorrow's U.S. GDP data and Friday's Change in Nonfarm Payrolls . They can be crucial for a decision regarding the QE at the next FOMC meeting , which is scheduled for December 17-18 .

Meanwhile, it became known today that stocks in SPDR Gold Trust fell by 1.80 tonnes on Tuesday - to the level of 841.41 tons , the lowest level since early 2009 .

The cost of the December gold futures on the COMEX today rose to $ 1227.20 per ounce.

-

15:30

U.S.: Crude Oil Inventories, November -5.6

-

15:01

U.S.: ISM Non-Manufacturing, November 53.9 (forecast 55.4)

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

15:00

U.S.: New Home Sales, September 354 (forecast 427)

-

15:00

U.S.: New Home Sales, October 444 (forecast 432)

-

14:34

U.S. Stocks open: Dow 15,877.50 -37.12 -0.23%, Nasdaq 4,019.55 -17.65 -0.44%, S&P 1,788.51 -6.64 -0.37%

-

14:25

Before the bell: S&P futures -0.29%, Nasdaq futures -0.27%

U.S. stock-index futures fell, as investors weighed whether a larger-than-forecast rise in jobs data will prompt the Federal Reserve to cut stimulus.

Global markets:

Nikkei 15,407.94 -341.72 -2.17%

Hang Seng 23,728.7 -181.77 -0.76%

Shanghai Composite 2,251.76 +29.09 +1.31%

FTSE 6,494.39 -38.04 -0.58%

CAC 4,136.51 -35.93 -0.86%

DAX 9,117.53 -105.87 -1.15%

Crude oil $97.02 (+1.02%).

Gold $1223.70 (+0.24%).

-

13:46

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.50, Y102.00, Y102.25, Y102.50, Y103.00, Y103.20/25, Y103.50, Y103.60, Y103.75

EUR/USD $1.3490, $1.3500, $1.3510, $1.3515, $1.3520, $1.3600, $1.3640, $1.3650

GBP/USD $1.6160, $1.6200

USD/CHF Chf0.9220

AUD/USD $0.9100, $0.9165

NZD/USD $0.8050

-

13:30

U.S.: International Trade, bln, October -40.6 (forecast -40.3)

-

13:30

Canada: Trade balance, billions, October 0.075 (forecast -0.7)

-

13:15

U.S.: ADP Employment Report, November 215 (forecast 174)

-

13:08

European session: the euro rose

08:15 Switzerland Industrial Production (YoY) Quarter III -1.1% +0.7%

08:48 France Services PMI (Finally) November 48.8 48.8 48.0

08:53 Germany Services PMI (Finally) November 54.5 54.5 55.7

08:58 Eurozone Services PMI (Finally) November 50.9 50.9 51.2

09:00 OPEC OPEC Meetings

09:30 United Kingdom Purchasing Manager Index Services November 62.5 62.1 60.0

10:00 Eurozone Retail Sales (MoM) October -0.6% +0.2% -0.2%

10:00 Eurozone Retail Sales (YoY) October +0.3% +1.0% -0.1%

10:00 Eurozone Household Consumption (QoQ) Quarter III +0.2% +0.1% +0.1%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III +0.1% +0.1% +0.1%

10:00 Eurozone GDP (YoY) (Revised) Quarter III -0.4% -0.4% -0.4%

The euro has recovered from the losses incurred earlier in the session against the dollar , returning to the opening day. Mixed dynamics of the single currency associated with released data on service sector activity , GDP and retail sales .

According to the data , the composite Purchasing Managers Index (PMI) of the eurozone , the monthly index of activity in the manufacturing sector and the service sector in November fell to 51.7 from 51.9 in October. Index value above 50 indicates expanding activity . PMI in the service sector of the eurozone rose to 51.2 compared with a preliminary estimate of 50.9 . These data were better than the preliminary assessment , published last month, but indicate that private sector activity slowed during the month.

Retail sales in the eurozone fell for the second month in a row in October , mainly due to lower sales in the non-food sector, informed by statistical office Eurostat . The volume of retail sales fell by 0.2 percent in October compared with the previous month , after falling 0.6 percent in September . Economists had forecast that sales will grow by 0.2 percent in October .

Eurozone economic growth was moderate in the third quarter, according to a preliminary estimate showed the final data published by Eurostat. Gross domestic product grew by 0.1 percent in the third quarter compared with the previous quarter . Eurozone emerged from the longest recession in the history of the region in the second quarter , with GDP growth of 0.3 percent. On an annual basis , GDP fell by 0.4 percent after a contraction of 0.6 percent in the second quarter . All figures are consistent with the preliminary estimates .

The British pound fell against the dollar after data on service sector activity . Activity in the UK service sector slowed in November , but remained confident , with demand growing strong pace. PMI for the services sector , which includes everything from banks to restaurants, fell to 60.0 in November . This is the lowest value of the index in five months , and it is lower than the 62.5 in October. Economists had expected the November index was 62.1 .

These data came after strong reports on manufacturing and construction sector , published earlier this week , and they can encourage UK Finance Minister George Osborne to do some respite from government spending cuts and tax increases . On Thursday, Osborne will present a new report , which includes government forecasts for the economy and information on the progress in reducing the budget deficit.

EUR / USD: during the European session, the pair fell to $ 1.3566 , and then rose to $ 1.3600

GBP / USD: during the European session, the pair fell to $ 1.6326

USD / JPY: during the European session, the pair rose to Y102.84, and then decreased to Y102.27

At 13:15 GMT the U.S. will release the change in the number of employees from ADP for the 3rd quarter . At 13:30 GMT the United States and Canada, there are data on its trade balance for October. At 15:00 GMT we will know the decision of the Bank of Canada's main interest rate and the accompanying statement will be made the Bank of Canada . In the U.S. at 15:00 GMT will composite index ISM non-manufacturing areas in November , sales in the primary market in September and October , at 15:30 GMT will be published data on crude oil inventories from the Energy Department . At 19:00 GMT Economic Outlook publication held by the Fed regions " Beige Book ."

-

12:45

Orders

EUR/USD

Offers $1.3690/710, $1.3660/65, $1.3650, $1.3620/30, $1.3600

Bids $1.3570/65, $1.3525/15, $1.3490/80

GBP/USD

Offers $1.6500, $1.6480, $1.6450, $1.6400, $1.6370/80

Bids $1.6310/00, $1.6280/75, $1.6260/55

AUD/USD

Offers $0.9200, $0.9180, $0.9150, $0.9100, $0.9060/70

Bids $0.9000, $0.8950, $0.8900

EUR/GBP

Offers stg0.8345/55, stg0.8320/25

Bids stg0.8260, stg0.8250, stg0.8220, stg0.8205/00

USD/JPY

Offers Y103.50, Y103.20, Y102.90/00

Bids Y102.25/20, Y102.10/00, Y101.80, Y101.50, Y101.00

EUR/JPY

Offers Y140.50, Y140.00, Y139.80

Bids Y138.80, Y138.55/50, Y138.20, Y138.00

-

11:30

European stocks declined for a fourth day

European stocks declined for a fourth day as investors awaited U.S. jobs, services and home-sales data to gauge the timing of the Federal Reserve’s paring of stimulus. U.S. futures were little changed, while Asian shares fell.

The euro area’s nascent recovery from a record-long recession nearly stalled in the third quarter, according to figures released today by the European Union’s statistics office in Luxembourg. Gross domestic product rose 0.1 percent after a 0.3 percent gain in the previous three months. That was in line with Eurostat’s initial estimate. From a year earlier, the economy contracted 0.4 percent.

Elekta dropped 4.3 percent to 92.45 kronor after the maker of radiation-surgery equipment reported second-quarter operating profit of 304 million kronor ($47 million), missing the average analyst estimate for 424 million kronor.

Standard Chartered slid 6.7 percent to 1,334.5 pence, the lowest price since August 2012. The U.K. bank that generates about three-quarters of its profits from Asia said full-year operating profit at its consumer-banking unit will decline at least 10 percent because of weakness in Korea.

Peugeot climbed 2.2 percent to 11.75 euros after Goldman Sachs Group Inc. added the shares to its conviction-buy list, citing a capital increase, asset disposals and a probable alliance in China. Renault SA rose 0.4 percent to 62.12 euros after the brokerage upgraded the carmaker to neutral from sell.

FTSE 100 6,521.75 -10.68 -0.16%

CAC 40 4,167.57 -4.87 -0.12%

DAX 9,222.68 -0.72 -0.01%

-

10:16

Asia Pacific stocks close

Asian stocks fell after the yen strengthened and valuations on the regional equities gauge climbed to a six-month high, with investors awaiting U.S. job data this week that may provide further evidence as to when the Federal Reserve will reduce stimulus.

Nikkei 225 15,407.94 -341.72 -2.17%

Hang Seng 23,756.84 -153.63 -0.64%

S&P/ASX 200 5,273.8 +17.73 +0.34%

Shanghai Composite 2,252.38 +29.71 +1.34%

Toyota Motor Corp., Asia’s largest carmaker, sank 1.7 percent as Japan’s Nikkei 225 Stock Average retreated from a six-year high.

Toppan Printing Co. lost 6.7 percent in Tokyo after saying it will sell 80 billion yen ($781 million) of convertible bonds.

Speco Co. surged 5.7 percent, leading South Korean defense firms higher after two lawmakers said North Korean leader Kim Jong Un’s uncle Jang Song Thaek may have been dismissed as vice chairman of the National Defense Commission.

-

10:01

Eurozone: GDP (QoQ), Quarter III +0.1% (forecast +0.1%)

-

10:01

Eurozone: GDP (YoY), Quarter III -0.4% (forecast -0.4%)

-

10:00

Eurozone: Retail Sales (MoM), October -0.2% (forecast +0.2%)

-

10:00

Eurozone: Retail Sales (YoY), October -0.1% (forecast +1.0%)

-

09:28

United Kingdom: Purchasing Manager Index Services, November 60.0 (forecast 62.1)

-

09:00

Eurozone: Services PMI, November 51.2 (forecast 50.9)

-

08:53

Germany: Services PMI, November 55.7 (forecast 54.5)

-

08:48

France: Services PMI, November 48.0 (forecast 48.8)

-

08:38

FTSE 100 6,534.63 +2.20 +0.03%, CAC 40 4,184.3 +11.86 +0.28%, Xetra DAX 9,240.26 +16.86 +0.18%

-

08:15

Switzerland: Industrial Production (YoY), Quarter III -2.3%

-

07:20

European bourses are seen trading a touch higher from the getgo Wednesday: the FTSE up 2, the DAX up 2 and the CAC up 5.

-

07:02

Asian session: The euro was 0.2 percent from its strongest level in a month

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.6% +0.7% +0.6%

00:30 Australia Gross Domestic Product (YoY) Quarter III +2.6% +2.5% +2.3%

01:45 China HSBC Services PMI November 52.6 52.5

The euro was 0.2 percent from its strongest level in a month before European Central Bank officials gather for a policy meeting tomorrow, when they are forecast to refrain from cutting the benchmark interest rate. ECB officials will probably keep the benchmark at a record-low 0.25 percent when they meet tomorrow, according to the median estimate in a Bloomberg survey of economists. President Mario Draghi and his board unexpectedly cut the rate by a quarter-percentage point last month after inflation slowed in October to the least in four years.

Australia’s dollar slid to a three-month low after data today showed the nation’s economy grew less than analysts forecast in the third quarter. Australian economic growth slowed to a 2.3 percent annual pace in the three months through September, the statistics bureau said today, compared with the forecast for 2.6 percent in a Bloomberg News survey of analysts.

The yen remained higher versus the dollar as Asian stocks slumped and technical indicators signaled the currency’s recent declines may have been overdone.

The pound was near the highest since 2011 after a report showed U.K. construction expanded at the fastest pace in more than six years. The Bank of England sets policy tomorrow. Analysts polled by Bloomberg predict the U.K. central bank will hold its key rate at 0.5 percent tomorrow.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3580-95

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6375-95

USD / JPY: during the Asian session, the pair traded in the range of Y102.25-70

Focus today will turn to the release of services PMI data at 0928GMT. Market will be waiting to see if the release will complete a strong set of PMI data after mfg and construction PMI's came in above forecasts.

-

06:28

Commodities. Daily history for Dec 3’2013:

WTI +2.46% $96.12

Gold -0.04% $1221.90

-

06:27

Stocks. Daily history for Dec 3’2013:

Nikkei 225 15,749.66 +94.59 +0.60%

S&P/ASX 200 5,256.07 -23.44 -0.44%

Shanghai Composite 2,222.67 +15.30 +0.69%

FTSE 100 6,595.33 -55.24 -0.83%

CAC 40 4,289.64 -5.57 -0.13%

DAX 9,408.87 +3.57 +0.04%

Dow -94.15 15,914.62 -0.59%

Nasdaq -8.06 4,037.20 -0.20%

S&P -5.74 1,795.16 -0.32%

-

06:27

Currencies. Daily history for Dec 3'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3588 +0,35%

GBP/USD $1,6389 +0,21%

USD/CHF Chf0,9042 -0,48%

USD/JPY Y102,50 -0,42%

EUR/JPY Y139,28 -0,07%

GBP/JPY Y167,99 -0,20%

AUD/USD $0,9135 +0,36%

NZD/USD $0,8241 +0,69%

USD/CAD C$1,0647 +0,05%

-

06:08

Schedule for today, Wednesday, Dec 4’2013:

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.6% +0.7%

00:30 Australia Gross Domestic Product (YoY) Quarter III +2.6% +2.5%

01:45 China HSBC Services PMI November 52.6

08:00 United Kingdom Halifax house price index November +0.7% +0.8%

08:00 United Kingdom Halifax house price index 3m Y/Y November +6.9% +7.2%

08:15 Switzerland Industrial Production (YoY) Quarter III -1.1%

08:48 France Services PMI (Finally) November 48.8 48.8

08:53 Germany Services PMI (Finally) November 54.5 54.5

08:58 Eurozone Services PMI (Finally) November 50.9 50.9

09:00 OPEC OPEC Meetings

09:30 United Kingdom Purchasing Manager Index Services November 62.5 62.1

10:00 Eurozone Retail Sales (MoM) October -0.6% +0.2%

10:00 Eurozone Retail Sales (YoY) October +0.3% +1.0%

10:00 Eurozone Household Consumption (QoQ) Quarter III +0.2% +0.1%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III +0.1% +0.1%

10:00 Eurozone GDP (YoY) (Revised) Quarter III -0.4% -0.4%

13:15 U.S. ADP Employment Report November 130 174

13:30 Canada Trade balance, billions October -0.4 -0.7

13:30 U.S. International Trade, bln October -41.8 -40.3

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada BOC Rate Statement

15:00 U.S. ISM Non-Manufacturing November 55.4 55.4

15:00 U.S. New Home Sales September 421 427

15:00 U.S. New Home Sales October 432

15:30 U.S. Crude Oil Inventories November +3.0

19:00 U.S. Fed's Beige Book December

-