Notícias do Mercado

-

20:00

Dow -66.29 15,823.48 -0.42% Nasdaq -11.65 4,026.35 -0.29% S&P -8.49 1,784.32 -0.47%

-

19:21

American focus : the euro rose sharply against the U.S. dollar

The euro exchange rate has risen sharply against the U.S. dollar , helped by ECB head Draghi statement and rate decision . Today the European Central Bank left interest rates unchanged at a record low - 0.25% , after taken into account received in recent economic data and forecasts of economic development in all evrozone.Eto decision expected by economists. Deposit rate is left at zero , and the lending rate - at 0.75 %.

President Draghi at a press conference, said that if the situation will develop worse than expected , the Governing Council is ready to act to provide support to the economy in a significant amount . One of the options discussed measures is negative deposit rate . Another possibility is the purchase of assets and long-term loans to increase lending to companies and households . The ECB may also decide to publish the results of monthly meetings to improve interaction with the market.

Earlier, the ECB expected average inflation of 1.5 % this year and 1.3% in 2014 , economic contraction of 0.4 this year and an increase of 1 % in the next, but at a press conference Draghi has lowered the forecast inflation to 1.4 % this year and to 1.1% in 2014. GDP growth forecast for 2013 has not changed , and the GDP growth forecast for 2014 was raised from 1.0% to 1.1%. GDP growth forecast for 2015 - 1.5%.

Also influenced the course of trading data for the U.S. . Published today a report showed that U.S. gross domestic product grew by 3.6 per cent per annum in the third quarter , compared with the initial estimate of 2.8 % level , and experts forecast at around 3.1 %. It was also reported that the number of initial claims for unemployment benefits fell by 23 thousand - up to 298 000 , while fixing the third consecutive weekly decline .

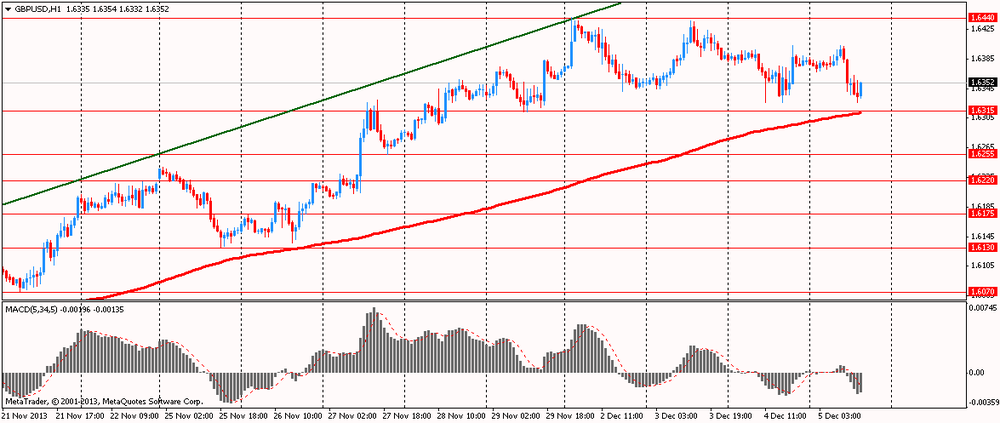

Pound fell against the dollar against the decision of the Bank of England, which left its key interest rate unchanged in order to support the economic recovery gathers pace UK. This was stated by the results of the two-day meeting of the Committee on the monetary policy of the Bank of England. According to the statement , the interest rate remained unchanged at 0.5% , and the size of bond-buying program is stored in the same volume of $ 375 billion British pounds ( 614 billion U.S. dollars). This decision does not come as a surprise to investors. Usually in cases of code , monetary policy remains unchanged , the Bank of England does not release accompanying statements . Earlier in November , the Bank of England signaled Carney propensity bank representatives to the conservation policy in order to maintain growth and employment among Britons , while inflation has remained low-key . In addition, in the autumn forecast UK Treasury Minister of Finance noted improvement in the economic forecast of the Office of Budget Responsibility , as well as a number of initiatives for business development and the housing market.

The yen strengthened against the U.S. currency since yesterday the release of strong employment data from the U.S. ADP raised expectations that the Fed may start folding before, namely on December 17-18 and January 28-29 , when the Fed's meeting will be held . According to the survey , the labor market remains stable , despite the work stoppage government and uncertainty about the debt ceiling . Fed's Beige Book report , released yesterday , also showed that the level of employment or noted moderate growth or remained unchanged in the country . " In addition, the growth of the yen to help out tomorrow publication of the report on employment in the non-agricultural sector of the economy.

-

18:20

European stock close

European stocks slid, posting their longest losing streak in five months, as European Central Bank President Mario Draghi said that financial-market developments and low domestic demand may hurt the euro area’s economy.

The Stoxx Europe 600 Index lost 0.9 percent to 314.47 at 4:30 p.m. in London. The equity benchmark has gained 12 percent this year as central banks around the world pledged to keep interest rates low for a prolonged period of time. The Stoxx 600 slipped 0.6 percent yesterday as better-than-expected U.S. jobs data fueled concern that the Federal Reserve will reduce its monthly bond purchases sooner than forecast.

Draghi said that increased commodity prices, weaker domestic demand and slow export growth all posed downside risks to the outlook for the euro area’s economy. He also identified failure to implement structural reforms by the governments of the 18 countries that use the single currency as a risk.

“Developments in global money- and financial-market conditions and related uncertainties may have the potential to negatively affect economic conditions,” Draghi said.

ECB officials kept the main refinancing rate unchanged at 0.25 percent as predicted by every economist. The central bank for the euro area lowered interest rates to 0.25 percent from 0.5 percent last month.

In the U.K., the Bank of England left its key interest rate at a record low of 0.5 percent, in line with its own guidance on rates. The Office for Budget Responsibility raised its growth forecast for 2013 to 1.4 percent from the 0.6 percent that it predicted in March. The agency charged with making independent projections on the British economy also said that gross domestic product will climb 2.4 percent in 2014. It had projected growth next year of 1.8 percent.

Tomorrow’s U.S. payrolls report may help investors gauge the outlook for stimulus in the world’s largest economy. The Federal Open Market Committee meets on Dec. 17-18 to consider changes to its $85 billion of monthly bond buying. Officials said at their Oct. 29-30 meeting that they may slow their asset purchases if the economy improves as forecast.

FTSE 100 6,498.33 -11.64 -0.18% CAC 40 4,099.91 -48.61 -1.17% DAX 9,084.95 -55.68 -0.61%

FLSmidth declined 1.9 percent to 268 kroner. The company lowered its forecast earnings before interest, taxes and amortization ">Vienna Insurance dropped 5.6 percent to 34.43 euros. An unidentified investor offered 83 million euros of shares in the company. They were sold at 34.10 euros apiece, according to two people with knowledge of the deal.

Metro AG retreated 4.9 percent to 34.23 euros, its biggest slide since June. Morgan Stanley lowered Germany’s biggest retailer to equal weight, the equivalent of hold, from overweight. The brokerage cited the lack of near-term catalysts to support further gains in the share price. Metro has rallied 63 percent so far this year.

AZ Electronic Materials rallied 50 percent to 395 pence. Merck agreed to pay 403.5 pence a share for the Luxembourg-based company, it said in a statement. The acquisition will enable the German drugmaker’s chemicals division to expand into new markets. Merck rallied 5.9 percent to 131.70 euros.

Remy Cointreau SA advanced 2.6 percent to 61.97 euros after the maker of Remy Martin cognac said its board has authorized a buyback of as many as 2.5 million shares. The drinks company will cancel the shares that it purchases.

-

17:00

European stock close: FTSE 100 6,498.33 -11.64 -0.18% CAC 40 4,099.91 -48.61 -1.17% DAX 9,084.95 -55.68 -0.61%

-

16:40

Oil: an overview of the market situation

Oil prices rose slightly , closer to $ 111 per barrel (Brent), as many traders have begun to analyze , whether positive U.S. data prompt the Federal Reserve to start reducing its bond buying program .

Published today a report showed that U.S. gross domestic product grew by 3.6 per cent per annum in the third quarter , compared with the initial estimate of 2.8 % level , and experts forecast at around 3.1 %. It was also reported that the number of initial claims for unemployment benefits fell by 23 thousand - up to 298 000 , while fixing the third consecutive weekly decline .

Prices continue to provide support and information from the Administration 's energy , which were published earlier this week . They showed that oil stocks fell by 5.6 million barrels for the week ended November 29 , closer to the level of 36 million barrels.

Traders are also awaiting deteriorating weather conditions in the North Sea , which threaten to disrupt oil supplies from the region. Until now , however, is only one small oil platform was shut down by the storm .

The course of trade also affects the decision of the Organization of Petroleum Exporting Countries (OPEC), which yesterday kept its oil output at 30 million barrels per day. According to their estimates, the price of Brent crude will average $ 105 in 2014.

" Some members of the Organization of Petroleum Exporting Countries , in particular Saudi Arabia , admit the need to reduce production later in 2014 to prevent overproduction ," analysts said BNP Paribas SA and corporations Citigroup Inc. Iraq, Libya and Iran said they plan to increase exports in the next few months.

The price of January futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 97.94 a barrel on the New York Mercantile Exchange.

January futures price for North Sea Brent crude oil mixture rose 10 cents to $ 111.67 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices dropped significantly , losing more than 1.5 percent, as today's events have forced many investors to reconsider their views on the program of quantitative easing, the Fed . Even despite the fact that the European Central Bank and Bank of England opposed the introduction of new monetary measures , the markets have been fixated on U.S. economic data and waited at least some signals about when the Fed may begin to reduce its purchase program bonds.

Data published by the Ministry of Commerce showed that the U.S. economy in the third quarter rose more than previously reported, due to the very large growth stocks since the beginning of 1998 consumer spending growth has stalled . In annual terms, GDP growth in the third quarter was 3.6 %, above the previously reported 2.8%. This is the highest growth in the first quarter of 2012 . The median estimate of economists was 3.1%. Ratings were within 2.2% -3.6 %. Third , the final estimate of GDP growth in the third quarter will be released on December 20. Recall that in the second quarter , GDP grew by 2.5% in the first - 1.1%.

Another report showed that the number of initial claims for unemployment benefits fell by 23,000 and amounted to a seasonally adjusted 298,000 in the week ended November 30. Economists had forecast 322,000 new claims . Value for the previous week was revised up to 321,000 from 316,000 initially sounded . The four-week moving average of claims , which smooths the volatile weekly data , fell to 322,250 . Analyst Ministry of Labour stated that there were no unusual factors affecting the final report . Although he noted that such holidays as Veterans Day and Thanksgiving - that do not always fall in the same week of the month - may complicate the seasonal adjustments. Since seasonal factors create some volatility in the numbers , economists warn against to attach great importance to data on unemployment in November and December.

Given these positive data , the head of the Federal Reserve Bank of Atlanta's Lockhart said that the question of reducing the rate of asset purchases may take place in December or on other upcoming policy meeting of the Federal Reserve System. Lockhart was careful in his statements , and said nothing about the fact whether he supports reducing QE at the next meeting on December 17-18 . Lockhart said he would " wait for evidence of momentum in the economy , as well as the absence of factors that may limit or even overshadow the progress."

Also today it was announced that the gold reserves in the SPDR Gold Trust fell by 2.70 tonnes yesterday - up to 838.71 million tonnes ( the lowest level since the beginning of 2009)

The cost of the December gold futures on the COMEX today dropped to $ 1223.90 per ounce.

-

15:00

U.S.: Factory Orders , October -0.9% (forecast -0.7%)

-

15:00

Canada: Ivey Purchasing Managers Index, November 53.7 (forecast 60.2)

-

14:34

U.S. Stocks open: Dow 15,849.44 -40.33 -0.25%, Nasdaq 4,036.76 -1.24 -0.03%, S&P 1,789.28 -3.53 -0.20%

-

14:29

Before the bell: S&P futures -0.24%, Nasdaq futures +0.02%

U.S. stock-index futures erased earlier gains, after data showing faster-than-forecast economic growth fueled speculation the Federal Reserve will curb stimulus spending.

Global markets:

Nikkei 15,177.49 -230.45 -1.50 %

Hang Seng 23,712.57 -16.13 -0.07 %

Shanghai Composite 2,247.06 -4.70 -0.21 %

FTSE 6,496.63 -13.34 -0.20 %

CAC 4,126.43 -22.09 -0.53 %

DAX 9,114.43 -26.20 -0.29 %

Crude oil $97.25 (+0.05%).

Gold $1224.80 (-1.80%).

-

13:30

U.S.: Initial Jobless Claims, November 298 (forecast 322)

-

13:30

U.S.: GDP, q/q, Quarter III +3.6% (forecast +3.1%)

-

13:30

Canada: Building Permits (MoM) , October +7.4% (forecast +2.4%)

-

13:17

European session: the euro stabilized

11:15 United Kingdom Autumn Forecast Statement

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.25% 0.25% 0.25%

The euro is traded steadily after the announcement of the ECB's decision on interest rates. As expected, the central bank has kept unchanged the key interest rate at 0.25 %. Recall that at its previous meeting, the ECB took the unexpected decision - to lower the interest rate by 0.25 % trying to somehow improve the inflationary situation , which caused serious concern. After this reduction , many experts noted that this meeting will likely not will present no surprises , and the ECB will leave rates unchanged . But despite such a forecast , some of the comments and statements may be important to assess the future steps of the ECB. Now investors are waiting for a press conference the head of the ECB , which will start at 13:30 GMT.

British Pound halted decline against the dollar amid Bank of England decision , which left its key interest rate unchanged in order to support the economic recovery gathers pace UK. This was stated by the results of the two-day meeting of the Committee on the monetary policy of the Bank of England. According to the statement , the interest rate remained unchanged at 0.5% , and the size of bond-buying program is stored in the same volume of $ 375 billion British pounds ( 614 billion U.S. dollars). This decision does not come as a surprise to investors. Usually in cases of code , monetary policy remains unchanged , the Bank of England does not release accompanying statements . Earlier in November , the Bank of England signaled Carney propensity bank representatives to the conservation policy in order to maintain growth and employment among Britons , while inflation has remained low-key . In addition, in the autumn forecast UK Treasury Minister of Finance noted improvement in the economic forecast of the Office of Budget Responsibility , as well as a number of initiatives for business development and the housing market.

EUR / USD: during the European session, the pair rose to $ 1.3638 , and then fell to $ 1.3580

GBP / USD: during the European session, the pair rose to $ 1.6403 , and then fell to $ 1.6326

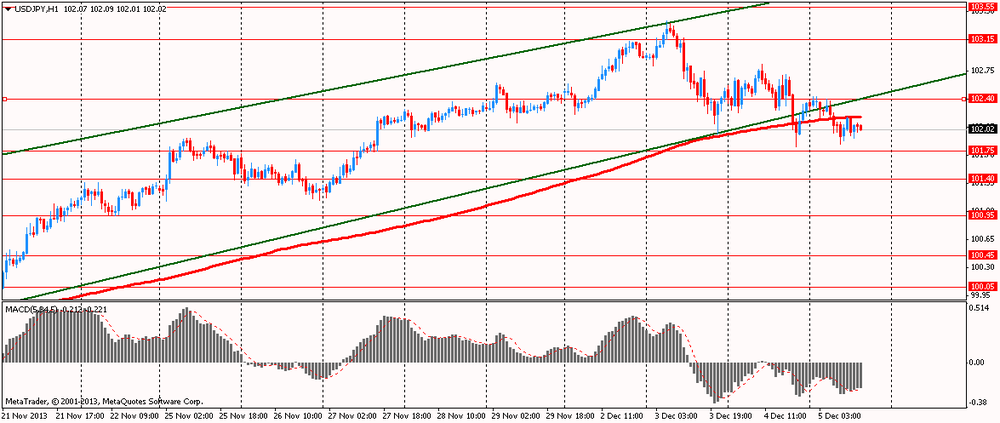

USD / JPY: during the European session, the pair fell to Y101.84

At 13:30 GMT will be held monthly press conference of the ECB. At 13:30 GMT , Canada will release the change in the volume of building permits issued in October. At 13:30 GMT the United States will come in updated information on changes in the volume of GDP, the GDP price index , the index of personal consumption expenditures , the main index of personal consumption expenditures for the 3rd quarter , the number of initial claims for unemployment insurance , the number of repeated applications for unemployment benefits. At 15:00 GMT , Canada will release from the Ivey PMI index for November. At 15:00 GMT the United States will change in the volume of industrial orders for October.

-

13:01

Orders

EUR/USD

Offers $1.3750, $1.3690/710, $1.3660/65, $1.3650, $1.3640

Bids $1.3585/80, $1.3550/40, $1.3525/15

GBP/USD

Offers $1.6500, $1.6480, $1.6450, $1.6400/05

Bids $1.6300, $1.6280/75

AUD/USD

Offers $0.9200, $0.9180, $0.9165/70, $0.9150, $0.9100, $0.9070/75, $0.9060

Bids $0.8980, $0.8950

EUR/GBP

Offers stg0.8345/55, stg0.8320/25

Bids stg0.8260, stg0.8250, stg0.8220, stg0.8205/00

USD/JPY

Offers Y103.50, Y103.30/35, Y103.20, Y102.85/00, Y102.70, Y102.50

Bids Y101.85/80, Y101.70, Y101.50, Y101.15-00

EUR/JPY

Offers Y140.20, Y140.00, Y139.80/85, Y139.35/40

Bids Y138.55/40, Y138.20, Y138.00, Y137.80, Y137.50

-

12:45

Eurozone: ECB Interest Rate Decision, 0.25% (forecast 0.25%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:31

European stocks were little changed

European stocks were little changed, following a four-day decline, as investors awaited interest-rate decisions from the European Central Bank and the Bank of England. U.S. index futures fluctuated, while Asian shares fell.

ECB President Mario Draghi releases inflation and growth projections today at the central bank’s first meeting since the Governing Council cut interest rates to a record low.

Officials will keep the benchmark rate unchanged this time, according to every economist in a Bloomberg News survey. Policy makers will announce their decision at 1:45 p.m. in Frankfurt. Draghi will host a press conference, setting out the forecasts, 45 minutes later.

In the U.K., Chancellor of the Exchequer George Osborne delivers his Autumn Statement today. The Office for Budget Responsibility will also raise its growth forecast for 2013 to 1.4 percent from the 0.6 percent that it predicted in March, according to the median estimate in a Bloomberg survey.

The Bank of England will announce its interest-rate decision at 12 p.m. in London. The central bank will leave its benchmark rate at a record low and its bond-buying program unchanged, separate surveys show.

AZ Electronic Materials rallied 52 percent to 398.5 pence. Merck agreed to pay 403.5 pence a share for the Luxembourg-based company, it said in a statement. The acquisition will enable the German drugmaker’s chemicals division to expand into new markets. Merck climbed 3.5 percent to 128.75 euros, the highest price since its initial public offering in October 1995.

Remy Cointreau SA advanced 3.4 percent to 62.46 euros after the maker of Remy Martin cognac said its board has authorized a buyback of as many as 2.5 million shares. The drinks company will cancel the shares that it purchases.

FLSmidth declined 1.1 percent to 270.30 kroner. The company lowered its forecast earnings before interest, taxes and amortization ">FTSE 100 6,509.13 -0.84 -0.01%

CAC 40 4,145.33 -3.19 -0.08%

DAX 9,151.59 +10.96 +0.12%

-

10:25

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.25, Y102.00, Y102.10, Y102.50, Y103.00, Y103.25, Y104.00

EUR/USD $1.3400, $1.3460, $1.3485, $1.3490, $1.3500, $1.3520, $1.3565, $1.3570, $1.3580, $1.3590

GBP/USD $1.6200

AUD/USD $0.9000, $0.9075, $0.9150

AUD/JPY Y92.75, Y94.60

USD/CAD C$1.0550, C$1.0700

-

09:45

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index heading for a three-week low, amid concern signs of improvement in the U.S. jobs market will prompt the Federal Reserve to bring forward cuts to stimulus.

Nikkei 225 15,177.49 -230.45 -1.50%

S&P/ASX 200 5,197.96 -75.79 -1.44%

Shanghai Composite 2,247.06 -4.70 -0.21%

Nissan Motor Co., a Japanese carmaker that gets 34 percent of its revenue in North America, dropped 3.5 percent.

Qantas Airways Ltd. tumbled 11 percent after Australia’s largest carrier announced job cuts and forecast a A$300m ($271 million) first-half loss amid competition.

Standard Chartered Plc sank 4.8 percent in Hong Kong after the U.K. lender said full-year operating profit at its consumer-banking unit will drop at least 10 percent, hurt by its Korean business.

-

08:47

FTSE 100 6,506.11 -3.86 -0.06%, CAC 40 4,142.56 -5.96 -0.14%, Xetra DAX 9,138.84 -1.79 -0.02%

-

07:22

European bourses are initially seen trading narrowly mixed Thursday: the FTSE down 5, the DAX down 3 and the CAC up 3.

-

07:04

Asian session: The euro held a two-day gain before the European Central Bank

00:30 Australia Trade Balance October -0.28 -0.33 -0.53

JPMorgan Chase & Co.’s Global FX Volatility Index advanced for a fourth day ahead of U.S. government figures forecast to show the economy expanded in the third quarter and payrolls increased last month. A second estimate today may show the U.S. economy grew an annualized 3.1 percent in the three months through September from the previous period, according to the median forecast in a Bloomberg News survey of economists. That would be up from a 2.8 percent initial reading and a final figure of 2.5 percent for the second quarter. Employers in the U.S., which is the world’s biggest economy, added 185,000 jobs last month after boosting positions by 204,000 in October, a separate poll showed before the Labor Department’s report tomorrow. Companies increased hiring by 215,000 in November, according to figures released yesterday from the ADP Research Institute.

The yen remained higher versus its 16 major peers as Asian equities fell.

The euro held a two-day gain before the European Central Bank sets monetary policy today. The ECB will keep the 17-nation region’s benchmark at a record-low 0.25 percent today, according to economists polled by Bloomberg. President Mario Draghi and his board unexpectedly cut the main refinancing rate by a quarter-percentage point last month after inflation slowed in October to the least in four years.

The pound traded near the highest in more than two years before the Bank of England decides on interest rates. U.K. central bank policy makers led by Governor Mark Carney also meeting today will leave the key rate unchanged at 0.5 percent, a separate survey showed.

EUR / USD: during the Asian session, the pair rose to $ 1.3615

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6365-90

USD / JPY: on Asian session the pair fell to Y102.00

The busy UK session gets underway at 0900GMT, with the release of the November SMMT Car Registration data. At 1115GMT, the Chancellor George Osborne will deliver the 2013 Autumn Statement, along with the latest OBR forecasts. At 1200GMT, probably as the Chancellor is on his feet speaking, the BOE will announce its latest policy decision. Analysts forecast no change in rates, QE levels or forward guidance parameters.

-

06:25

Commodities. Daily history for Dec 4’2013:

Oil (WTI) +1.18% $97.12

Gold +2.02% $1245.00

-

06:25

Stocks. Daily history for Dec 4’2013:

Nikkei 225 15,407.94 -341.72 -2.17%

Hang Seng 23,756.84 -153.63 -0.64%

S&P/ASX 200 5,273.8 +17.73 +0.34%

Shanghai Composite 2,252.38 +29.71 +1.34%

FTSE 100 6,509.97 -22.46 -0.34%

CAC 40 4,148.52 -23.92 -0.57%

DAX 9,140.63 -82.77 -0.90%

Dow -23.95 15,890.67 -0.15%

Nasdaq +0.8 4,038.00 +0.02%

S&P -2.29 1,792.86 -0.13%

-

06:24

Currencies. Daily history for Dec 4'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3593 +0,04%

GBP/USD $1,6382 -0,04%

USD/CHF Chf0,9022 -0,22%

USD/JPY Y102,35 -0,15%

EUR/JPY Y139,13 -0,11%

GBP/JPY Y167,67 -0,19%

AUD/USD $0,9027 -1,20%

NZD/USD $0,8195 -0,56%

USD/CAD C$1,0682 +0,33%

-

06:00

Schedule for today, Thursday, Dec 5’2013:

00:30 Australia Trade Balance October -0.28 -0.33 -0.53

08:00 United Kingdom Halifax house price index November +0.7% +0.8%

08:00 United Kingdom Halifax house price index 3m Y/Y November +6.9% +7.2%

11:15 United Kingdom Autumn Forecast Statement

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.25% 0.25%

13:30 Eurozone ECB Press Conference

13:30 Canada Building Permits (MoM) October +1.7% +2.4%

13:30 U.S. PCE price index, q/q Quarter III +1.5% +1.5%

13:30 U.S. Initial Jobless Claims November 316 322

13:30 U.S. GDP, q/q (Revised) Quarter III +2.8% +3.1%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.4% +1.4%

15:00 Canada Ivey Purchasing Managers Index November 62.8 60.2

15:00 U.S. Factory Orders October +1.7% -0.7%

-