Notícias do Mercado

-

19:21

American focus : the euro rose sharply against the U.S. dollar

The euro exchange rate has risen sharply against the U.S. dollar , helped by ECB head Draghi statement and rate decision . Today the European Central Bank left interest rates unchanged at a record low - 0.25% , after taken into account received in recent economic data and forecasts of economic development in all evrozone.Eto decision expected by economists. Deposit rate is left at zero , and the lending rate - at 0.75 %.

President Draghi at a press conference, said that if the situation will develop worse than expected , the Governing Council is ready to act to provide support to the economy in a significant amount . One of the options discussed measures is negative deposit rate . Another possibility is the purchase of assets and long-term loans to increase lending to companies and households . The ECB may also decide to publish the results of monthly meetings to improve interaction with the market.

Earlier, the ECB expected average inflation of 1.5 % this year and 1.3% in 2014 , economic contraction of 0.4 this year and an increase of 1 % in the next, but at a press conference Draghi has lowered the forecast inflation to 1.4 % this year and to 1.1% in 2014. GDP growth forecast for 2013 has not changed , and the GDP growth forecast for 2014 was raised from 1.0% to 1.1%. GDP growth forecast for 2015 - 1.5%.

Also influenced the course of trading data for the U.S. . Published today a report showed that U.S. gross domestic product grew by 3.6 per cent per annum in the third quarter , compared with the initial estimate of 2.8 % level , and experts forecast at around 3.1 %. It was also reported that the number of initial claims for unemployment benefits fell by 23 thousand - up to 298 000 , while fixing the third consecutive weekly decline .

Pound fell against the dollar against the decision of the Bank of England, which left its key interest rate unchanged in order to support the economic recovery gathers pace UK. This was stated by the results of the two-day meeting of the Committee on the monetary policy of the Bank of England. According to the statement , the interest rate remained unchanged at 0.5% , and the size of bond-buying program is stored in the same volume of $ 375 billion British pounds ( 614 billion U.S. dollars). This decision does not come as a surprise to investors. Usually in cases of code , monetary policy remains unchanged , the Bank of England does not release accompanying statements . Earlier in November , the Bank of England signaled Carney propensity bank representatives to the conservation policy in order to maintain growth and employment among Britons , while inflation has remained low-key . In addition, in the autumn forecast UK Treasury Minister of Finance noted improvement in the economic forecast of the Office of Budget Responsibility , as well as a number of initiatives for business development and the housing market.

The yen strengthened against the U.S. currency since yesterday the release of strong employment data from the U.S. ADP raised expectations that the Fed may start folding before, namely on December 17-18 and January 28-29 , when the Fed's meeting will be held . According to the survey , the labor market remains stable , despite the work stoppage government and uncertainty about the debt ceiling . Fed's Beige Book report , released yesterday , also showed that the level of employment or noted moderate growth or remained unchanged in the country . " In addition, the growth of the yen to help out tomorrow publication of the report on employment in the non-agricultural sector of the economy.

-

15:00

U.S.: Factory Orders , October -0.9% (forecast -0.7%)

-

15:00

Canada: Ivey Purchasing Managers Index, November 53.7 (forecast 60.2)

-

13:30

U.S.: Initial Jobless Claims, November 298 (forecast 322)

-

13:30

U.S.: GDP, q/q, Quarter III +3.6% (forecast +3.1%)

-

13:30

Canada: Building Permits (MoM) , October +7.4% (forecast +2.4%)

-

13:17

European session: the euro stabilized

11:15 United Kingdom Autumn Forecast Statement

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.25% 0.25% 0.25%

The euro is traded steadily after the announcement of the ECB's decision on interest rates. As expected, the central bank has kept unchanged the key interest rate at 0.25 %. Recall that at its previous meeting, the ECB took the unexpected decision - to lower the interest rate by 0.25 % trying to somehow improve the inflationary situation , which caused serious concern. After this reduction , many experts noted that this meeting will likely not will present no surprises , and the ECB will leave rates unchanged . But despite such a forecast , some of the comments and statements may be important to assess the future steps of the ECB. Now investors are waiting for a press conference the head of the ECB , which will start at 13:30 GMT.

British Pound halted decline against the dollar amid Bank of England decision , which left its key interest rate unchanged in order to support the economic recovery gathers pace UK. This was stated by the results of the two-day meeting of the Committee on the monetary policy of the Bank of England. According to the statement , the interest rate remained unchanged at 0.5% , and the size of bond-buying program is stored in the same volume of $ 375 billion British pounds ( 614 billion U.S. dollars). This decision does not come as a surprise to investors. Usually in cases of code , monetary policy remains unchanged , the Bank of England does not release accompanying statements . Earlier in November , the Bank of England signaled Carney propensity bank representatives to the conservation policy in order to maintain growth and employment among Britons , while inflation has remained low-key . In addition, in the autumn forecast UK Treasury Minister of Finance noted improvement in the economic forecast of the Office of Budget Responsibility , as well as a number of initiatives for business development and the housing market.

EUR / USD: during the European session, the pair rose to $ 1.3638 , and then fell to $ 1.3580

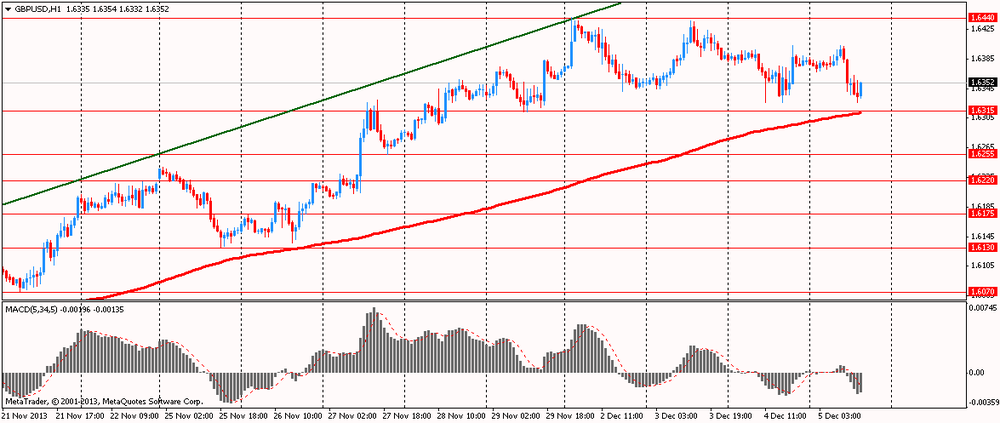

GBP / USD: during the European session, the pair rose to $ 1.6403 , and then fell to $ 1.6326

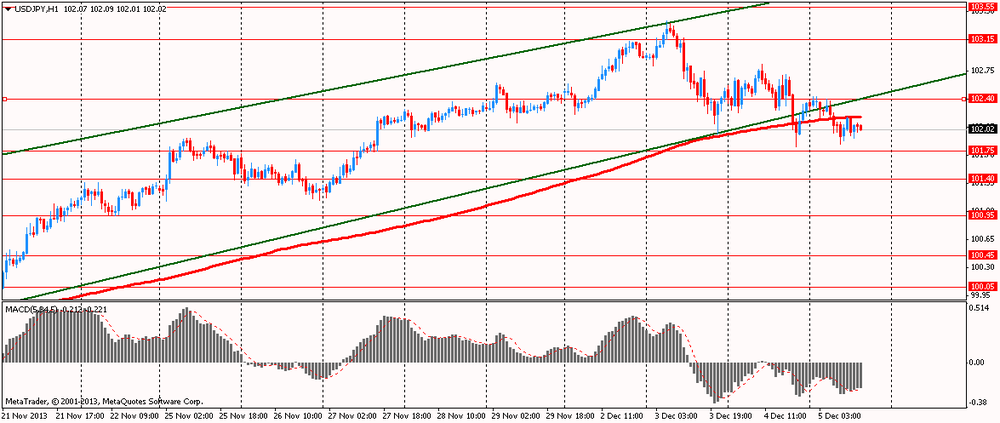

USD / JPY: during the European session, the pair fell to Y101.84

At 13:30 GMT will be held monthly press conference of the ECB. At 13:30 GMT , Canada will release the change in the volume of building permits issued in October. At 13:30 GMT the United States will come in updated information on changes in the volume of GDP, the GDP price index , the index of personal consumption expenditures , the main index of personal consumption expenditures for the 3rd quarter , the number of initial claims for unemployment insurance , the number of repeated applications for unemployment benefits. At 15:00 GMT , Canada will release from the Ivey PMI index for November. At 15:00 GMT the United States will change in the volume of industrial orders for October.

-

13:01

Orders

EUR/USD

Offers $1.3750, $1.3690/710, $1.3660/65, $1.3650, $1.3640

Bids $1.3585/80, $1.3550/40, $1.3525/15

GBP/USD

Offers $1.6500, $1.6480, $1.6450, $1.6400/05

Bids $1.6300, $1.6280/75

AUD/USD

Offers $0.9200, $0.9180, $0.9165/70, $0.9150, $0.9100, $0.9070/75, $0.9060

Bids $0.8980, $0.8950

EUR/GBP

Offers stg0.8345/55, stg0.8320/25

Bids stg0.8260, stg0.8250, stg0.8220, stg0.8205/00

USD/JPY

Offers Y103.50, Y103.30/35, Y103.20, Y102.85/00, Y102.70, Y102.50

Bids Y101.85/80, Y101.70, Y101.50, Y101.15-00

EUR/JPY

Offers Y140.20, Y140.00, Y139.80/85, Y139.35/40

Bids Y138.55/40, Y138.20, Y138.00, Y137.80, Y137.50

-

12:45

Eurozone: ECB Interest Rate Decision, 0.25% (forecast 0.25%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

10:25

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.25, Y102.00, Y102.10, Y102.50, Y103.00, Y103.25, Y104.00

EUR/USD $1.3400, $1.3460, $1.3485, $1.3490, $1.3500, $1.3520, $1.3565, $1.3570, $1.3580, $1.3590

GBP/USD $1.6200

AUD/USD $0.9000, $0.9075, $0.9150

AUD/JPY Y92.75, Y94.60

USD/CAD C$1.0550, C$1.0700

-

07:04

Asian session: The euro held a two-day gain before the European Central Bank

00:30 Australia Trade Balance October -0.28 -0.33 -0.53

JPMorgan Chase & Co.’s Global FX Volatility Index advanced for a fourth day ahead of U.S. government figures forecast to show the economy expanded in the third quarter and payrolls increased last month. A second estimate today may show the U.S. economy grew an annualized 3.1 percent in the three months through September from the previous period, according to the median forecast in a Bloomberg News survey of economists. That would be up from a 2.8 percent initial reading and a final figure of 2.5 percent for the second quarter. Employers in the U.S., which is the world’s biggest economy, added 185,000 jobs last month after boosting positions by 204,000 in October, a separate poll showed before the Labor Department’s report tomorrow. Companies increased hiring by 215,000 in November, according to figures released yesterday from the ADP Research Institute.

The yen remained higher versus its 16 major peers as Asian equities fell.

The euro held a two-day gain before the European Central Bank sets monetary policy today. The ECB will keep the 17-nation region’s benchmark at a record-low 0.25 percent today, according to economists polled by Bloomberg. President Mario Draghi and his board unexpectedly cut the main refinancing rate by a quarter-percentage point last month after inflation slowed in October to the least in four years.

The pound traded near the highest in more than two years before the Bank of England decides on interest rates. U.K. central bank policy makers led by Governor Mark Carney also meeting today will leave the key rate unchanged at 0.5 percent, a separate survey showed.

EUR / USD: during the Asian session, the pair rose to $ 1.3615

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6365-90

USD / JPY: on Asian session the pair fell to Y102.00

The busy UK session gets underway at 0900GMT, with the release of the November SMMT Car Registration data. At 1115GMT, the Chancellor George Osborne will deliver the 2013 Autumn Statement, along with the latest OBR forecasts. At 1200GMT, probably as the Chancellor is on his feet speaking, the BOE will announce its latest policy decision. Analysts forecast no change in rates, QE levels or forward guidance parameters.

-

06:24

Currencies. Daily history for Dec 4'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3593 +0,04%

GBP/USD $1,6382 -0,04%

USD/CHF Chf0,9022 -0,22%

USD/JPY Y102,35 -0,15%

EUR/JPY Y139,13 -0,11%

GBP/JPY Y167,67 -0,19%

AUD/USD $0,9027 -1,20%

NZD/USD $0,8195 -0,56%

USD/CAD C$1,0682 +0,33%

-

06:00

Schedule for today, Thursday, Dec 5’2013:

00:30 Australia Trade Balance October -0.28 -0.33 -0.53

08:00 United Kingdom Halifax house price index November +0.7% +0.8%

08:00 United Kingdom Halifax house price index 3m Y/Y November +6.9% +7.2%

11:15 United Kingdom Autumn Forecast Statement

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.25% 0.25%

13:30 Eurozone ECB Press Conference

13:30 Canada Building Permits (MoM) October +1.7% +2.4%

13:30 U.S. PCE price index, q/q Quarter III +1.5% +1.5%

13:30 U.S. Initial Jobless Claims November 316 322

13:30 U.S. GDP, q/q (Revised) Quarter III +2.8% +3.1%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +1.4% +1.4%

15:00 Canada Ivey Purchasing Managers Index November 62.8 60.2

15:00 U.S. Factory Orders October +1.7% -0.7%

-