Notícias do Mercado

-

23:59

GBP/JPY Price Analysis: Retraces after testing the 200-EMA in the 4-hour chart

- GBP/JPY registers decent gains of almost 0.20% as the Asian session begins.

- The GBP/JPY daily chart depicts the pair as neutral-biased, unable to challenge the 160.00-162.80 area.

- Short term, the pair tested the 200-EMA at the H4 chart, in which sellers leaned on, sending the GBP/JPY sliding towards the 162.20s area.

GBP/JPY is advancing as the Asian session begins, though it remains trading sideways for the twelve-consecutive trading day, inside the 160.00-162.80 range, at the time of writing. The GBP/JPY exchanges hand at 162.18, above its opening price..

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY remains neutral biased. For the last twelve days, the GBP/JPY has been trading within the 160.00-162.80 area, unable to break above/below the range extremes. It’s worth pointing out that the Relative Strength Index (RSI) is below the 50-midline, almost flat, while the 20-day EMA, at 161.84, is the first support level at the time of writing. On the upside, the GBP/JPY first resistance is the confluence of the 50, 100-EMAs, and a downslope trendline around the 162.80-163.00 area, which the pair had been unable to reach since August 17. On the downside, the GBP/JPY’s first support would be the September 5 daily low at 160.66.

Near term, the GBP/JPY four-hour chart illustrates the cross-currency hitting September’s 2 daily high at 162.52 before retracing some pips below the R1 daily pivot at 162.35. GBP/JPY traders should be aware of the 200-day EMA at around 162.46, a difficult resistance level to overcome for GBP/JPY buyers. Once they clear the latter, that would pave the way towards 163.00, opening the door for further gains.

On the other hand, the GBP/JPY first support would be the confluence of the 20, 50, and 100-EMAs at around 161.65-161,80. Once cleared, the GBP/JPY following support would be the daily pivot at 161.50, followed by the S1 daily pivot at 161.04.

GBP/JPY Key Technical Levels

-

23:54

GBP/USD advances towards 1.1600 on novel UK Leadership, US ISM Services PMI eyed

- GBP/USD is marching towards 1.1600 as Liz Truss's win warrants UK’s political stability.

- British energy supplier, Centrica is securing credit to offset collateral demand for volatile energy prices.

- Fed’s extreme hawkish stance is responsible for lower consensus for US ISM Services PMI.

The GBP/USD pair has given an upside break of the consolidation formed in a narrow range of 1.1512-1.1520 in the early Tokyo session. The asset has displayed a sheer upside as a volatility expansion has kicked in after a range breakout. Earlier, the cable witnessed a firmer rebound after hitting a low of 1.1450. Broadly, the asset was declining for the past few weeks amid political instability in the UK economy. Now, the announcement of a leadership change has strengthened the pound bulls.

After fighting for the leadership of the Conservative Party for more than two months, Liz Truss has finally won the elections and has been elected as the next UK Prime Minister. As announced by Liz Truss while presenting her capabilities for contender of UK leadership that she will scale down energy bills for households, pound bulls have started playing the road. Also, a situation of political stability in the UK economy will strengthen sterling.

Meanwhile, the impact of volatile energy prices has spread to energy suppliers. News from Financial Times cited that, Britain's largest energy supplier Centrica Plc is in talks with banks to secure billions of pounds in extra credit to meet soaring collateral demands as the energy market remains volatile.

On the dollar front, the US dollar index (DXY) has surrendered the psychological support of 110.00. The DXY is facing the heat of lower consensus for the US ISM Services PMI data. The economic data will decline to 55.5 from the prior release of 56.7. It seems that the consequences of the extremely hawkish Federal Reserve (Fed) are visible now and the US economic activities are declining. The unavailability of cheap money has forced the corporate to postpone the funds' channelization into afresh investment opportunities and expansion plans.

-

23:48

EUR/USD rebound eyes parity as DXY retreats ahead of US data

- EUR/USD portrays corrective bounce from the lowest levels since December 2002.

- Hopes over Germany’s stimulus, mixed US/EU data allowed bears to take a breather.

- US ISM Services PMI, Sino-American tension and energy crisis will be important for fresh impulse.

EUR/USD consolidates the week-start losses as traders brace for full markets, as well as the key US activity data, during early Tuesday in Asia. In doing so, the major currency pair takes a U-turn from the lowest levels since late 2002 while posting mild gains around 0.9950 by the press time.

Moody’s confidence in Germany’s stimulus and capacity to defend the region from slipping into a chronic economic slowdown appeared to have recently favored the EUR/USD buyers. Germany's third fiscal relief plan will assist economic growth, per the rating giant’s latest statement reported by Reuters.

On the same line could be the CME’s FedWatch Tool which suggests a nearly 61% chance of the Fed’s 0.75% rate hike in September, versus more than 70% expected the last week. The reason could be linked to the downbeat US Nonfarm Payrolls (NFP).

The quote’s previous weakness could be linked to the impending recession woes in the bloc, as well as the firmer odds of the US Federal Reserve’s (Fed) faster rate hikes despite the recently mixed data. It should, however, be noted that the US holidays limited the EUR/USD weakness the previous day even as downbeat EU statistics and fears of more pain due to the energy crisis were noted.

Russia’s halting of energy supplies to European worsened the situation for the old continent after it joined the other Group of Seven (G7) leaders to announce a price cap on Moscow’s oil. Also adding to the European energy crisis were dimming hopes of the US-Iran oil deal and the output cut from the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+.

Also, the US-China tussles over the trade deal and Taiwan escalated on Monday as the Biden Administration announced its intention to continue with the Trump-era tariffs for now. These tariffs were examined for removal and signaled the likely improvement in the relations previously. Further, the US readiness to sell arms to Taiwan and Taipei’s no-visa entry for some of its friendly country residents, including the US, teased Beijing to utter harsh words for the US-Taiwan ties and increases the tussles.

It should be observed that Eurozone Sentix Investor Confidence Index came in at -31.8 in September from -25.2 in August vs. -27.5 expected. However, the expectations index dropped to the lowest since December 2008 to -37.0 while the current conditions index fell to -26.5. Also, the recently softer PMIs hint at the faster pace of the bloc’s rush towards recession.

Given the latest recession fears and Friday’s softer US data, the ISM Services PMI for August, expected 55.5 versus 56.7 prior, will be eyed closely to gauge the EUR/USD moves.

Also read: ISM Services PMI Preview: High bar to help dollar bears pass through and take over

Technical analysis

A three-week-old descending resistance line, around the 1.000 psychological magnet, restricts the short-term EUR/USD recovery even if the oversold RSI puts a floor under the prices near the 0.9900 threshold.

-

23:18

AUD/USD Price Analysis: Downside looks likely to near 0.6700 ahead of RBA policy

- A downside bias is looming all-around ahead of the interest rate decision by the RBA.

- The asset may find a cushion around 0.6700 ahead as the downside looks imminent.

- A break into the 20.00-40.00 range by the RSI (14) is highly required to activate the declining mode.

The AUD/USD pair is experiencing modest selling pressure after facing barricades around 0.6800 in the late New York session. The major displayed a subdued performance on Monday after a gap down opening as investors shifted to the sidelines ahead of the interest rate decision by the Reserve Bank of Australia (RBA).

On a four-hour scale, the asset is declining towards the two-year low at 0.6682, recorded on July 14. A downside bias has been strengthened as the asset has faced barricades around the critical resistance placed from the August 30 low at 0.6846.

The 20-and 50-period Exponential Moving Averages (EMAs) at 0.6811 and 0.6846 respectively are declining, which adds to the downside filters.

However, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates a consolidation ahead. For downside momentum, the RSI (14) is required to drop into the bearish range of 20.00-40.00.

Should the asset drop below Thursday’s low at 0.6770, the greenback bulls will get activated and may drag the aussie bulls towards the round-level support at 0.6700, followed by the 6 March 2020 high at 0.6657.

Alternatively, the aussie bulls could regain strength and may send the asset towards Wednesday’s high at 0.6904 and August 23 high at 0.6964, if the asset oversteps Friday’s high at 0.6855 decisively.

AUD/USD four-hour chart

-

23:16

Gold Price Forecast: XAU/USD stays defensive above $1,700, US ISM Services PMI, full markets eyed

- Gold price treads water after beginning the key week on softer footing.

- European energy crisis, US-China tussles weigh on sentiment but US holiday restricts market moves.

- Fears of recession, hawkish Fed bets underpin DXY strength.

- US ISM Services PMI for August, US traders’ reaction to latest developments awaited.

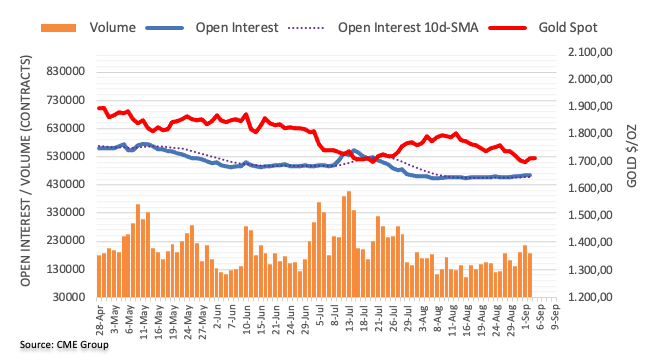

Gold price (XAU/USD) remains sidelined around $1,710, defensive after a softer start to the week, as traders await the key US data, as well as the return of the full markets on Tuesday. That said, the yellow metal’s losses could be linked to the escalating recession fears in Europe and the increasing tension between the US and China, not to forget fears of aggressive rates hikes by the US Federal Reserve (Fed).

Russia’s halting of energy supplies to European worsened the situation for the old continent after it joined the other Group of Seven (G7) leaders to announce a price cap of Moscow’s oil. Also adding to the European energy crisis were dimming hopes of the US-Iran oil deal and the output cut from the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+.

Elsewhere, the US-China tussles over the trade deal and Taiwan escalated on Monday as the Biden Administration announced intention to continue with the Trump-era tariffs for now. These tariffs were examined for removal and signalled the likely improvement in the relations previously.

Further, the US readiness to sell arms to Taiwan and Taipei’s no-visa entry for some of its friendly country residents, including the US, teased Beijing to utter harsh words for the US-Taiwan ties and increases the tussles.

Alternatively, Friday’s mixed US jobs report and People's Bank of China’s (PBOC) signals for a cut in the foreign exchange reserve requirement ratio (RRR) by 200 basis points (bps) to 6% from 8% beginning September 15, per Reuters, limited the bearish move.

Amid these plays, European equities were lower and the bond yields were firmer while the US Dollar Index (DXY) refreshed its 20-year high.

Looking forward, the full markets’ reactions to the latest recession fears and Friday’s softer US data will be crucial to watch for the XAU/USD traders. Also important will be ISM Services PMI for August, expected 55.5 versus 56.7 prior. Given the looming recession fears and the escalating geopolitical tension, any increase in the data could renew the hawkish Fed bets and favor the gold buyers.

Also read: ISM Services PMI Preview: High bar to help dollar bears pass through and take over

Technical analysis

Gold price seesaws inside a two-day-old symmetrical triangle as traders await the return of the full markets.

In addition to the triangle area between $1,709 and $1,715, the 50-HMA and the 200-HMA also restrict short-term XAU/USD moves around $1,707 and $1,727 in that order.

It’s worth noting, however, that the bearish MACD signals and the commodity’s pullback from the 38.2% Fibonacci retracement of August 25 to September 01 downturn, around $1,718, also keep sellers hopeful.

That said, a downside break of the $1,707 support comprising the 50-HMA won’t hesitate to drag the quote towards the monthly low near $1,688 before highlighting the yearly bottom marked in July, near $1,680.

Meanwhile, recovery remains elusive until crossing the 200-HMA hurdle near $1,727, a break of which could propel the XAU/USD buyers towards the August-end swing high near $1,745.

Overall, gold bears are in control but the room towards the south is limited.

Gold: Hourly chart

Trend: Further weakness expected

-

23:00

EUR/JPY Price Analysis: Subdued around the 138.50-139.50 area

- EUR/JPY edges slightly up as the Asian Pacific session begins on positive sentiment.

- The cross-currency daily chart portrays the pair as neutral.

- In the near term, the EUR/JPY could reach 140.82 if it reclaims 139.87; otherwise, a fall towards 138.30s is on the cards.

The EUR/JPY is almost flat as the Asian Pacific session begins after registering minimal gains of 0.01% on Monday, hitting a daily high at 139.64. As the Asian Pacific session begins, the EUR/JPY is trading at 139.62, above its opening price, amidst a positive market mood.

EUR/JPY Price Analysis: Technical outlook

From a daily chart perspective, the EUR/JPY is neutral-biased, as the pair failed to break above/below the 133.39-142.32 range. Even though it’s a wide range, the daily moving averages (DMAs)begin to intersect in the 134.59-139.55 area, with a horizontal slope. Therefore, the cross-currency pair is sideways.

Short term, the EUR/JPY rising wedge, seen in the one-hour scale, broke below the bottom trendline, opening the door for Monday’s low at 138.68, before recovering some ground above the 139.00 mark. It is worth noting that the Relative Strength Index, although in bullish territory, is almost horizontal, meaning consolidation lies ahead.

In the scenario for the EUR/JPY breaking upwards, the first resistance would be the R1 daily pivot at 139.87. Once cleared, the next supply zones would be the confluence of the R2 pivot and the bottom-trendline of the rising wedge around 140.23 before reaching the R3 daily pivot point at 140.82.

On the flip side, the EUR/JPY first support would be the daily pivot at 139.27. a breach of the latter will expose the S1 pivot at 138.91, followed by the S2 pivot at 138.32.

EUR/JPY Key Technical Levels

-

22:50

USD/JPY oscillates around 141.80 ahead of US ISM Services PMI

- USD/JPY is juggling around 141.60 as the focus shifts to US ISM Services PMI data.

- The asset is displaying a loss in upside momentum amid lower consensus for Services PMI.

- An increment in Japan’s Overall Households Spending data may step up the inflation rate ahead.

The USD/JPY pair is displaying a lackluster performance in the early Tokyo session as investors are awaiting the release of the US ISM services PMI data. The asset is displaying back-and-forth moves in a narrow range of 140.53-140.60. On Monday, the asset printed a fresh 24-year high at 140.80. However, a follow-up momentum loss structure is indicating that investors are discounting lower consensus for the US ISM Services PMI data.

As per the preliminary estimates, the Services PMI will decline to 55.5 against the prior release of 56.7. Also, the forward-looking Services New Orders Index will remain subdued at 59.5 vs. 59.9. The consequences of adopting sheer pace in hiking interest rates by the Federal Reserve (Fed) are visible in the service sector. Also, the big tech boys have already halted their recruitment process ahead of a decline in economic activities.

Apart from that, the speech from Fed chair Jerome Powell scheduled on Thursday will be of utmost importance. Fed’s Powell may dictate the likely monetary policy action in September so the market participants could gear up for the unexpected.

On the Tokyo front, investors are awaiting the release of the Overall Household Spending data. The economic data is seen higher at 4.2% against the former print of 3.5%. An acceleration in households’ payouts may support the inflation rate, and the Bank of Japan (BOJ) will move apparently towards the path of a ‘neutral’ stance on monetary policy.

-

22:21

NZD/USD Price Analysis: Bulls are holding the fort at key support

- NZD/USD bulls are lining up at a key support area on the lower time frames.

- The trendline resistance is holding things up, but a breakout could be immanant.

NZD/USD is trapped below a trendline resistance but there is a bullish structure that is forming on the 4 and 1-hour charts as the following analysis illustrates. However, there is still a lot of work that needs to be done before a breakout to the upside can fully unfold. The Reserve Bank of Australia could be the catalyst to move the needle in the antipodeans for the day ahead.

NZD/USD H4 charts

We have a series of bullish W-formations on the table. This signifies a breakout to the upside could be imminent. Encouraging, we also have two inside bars and a break of the prior candle's highs, near 0.6105 will likely solidify the bullish case.

NZD/USD H1 chart

The hourly time frame has seen a pull back into the support area that coincides with a 61.8% ratio that is so far holding up, so this adds to the bullish conviction for the near term.

-

21:35

Oil slides from session highs but holds in positive territory

- WTI bulls are taking up the bullish territory above $88.00.

- Iran remains the wild card for energy markets.

Oil prices have been supported by expectations gas prices would leap in Europe and WTI rallied to a high of $90.37 from a low of $87.06 with the European energy crisis dominating news as the gas supply from Russia has been halted indefinitely.

Meanwhile, OPEC+ met on and was expected to keep oil output quotas unchanged for October if not only a small production cut to bolster prices that have slid due to fears of an economic slowdown in Europe and China which is suffering from lockdowns due to COVID-19.

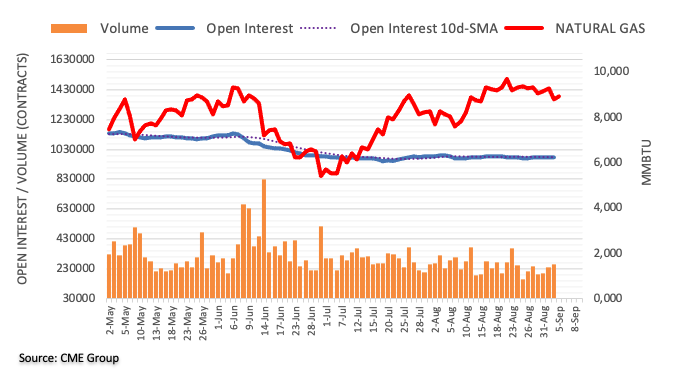

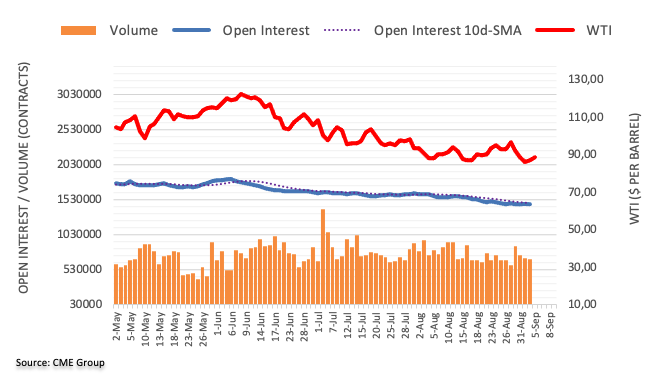

''Crude oil prices are revealing an extremely damaged microstructure, featuring vanishing liquidity with open interest and net speculative positioning declining to multi-year lows, contributing to wild price swings. On the surface, energy prices are melting as we stare down the barrel of a recession, with Chinese demand continuously at risk from the nation's zero-covid strategy,'' analysts at TD Securities explained.

As for OPEC, the cartel modestly cut oil production by 100,000 barrels a day, rolling back the increase they approved a month ago with the group being determined to defend a price level of around $100 a barrel. ''OPEC Plus is also demonstrating that it is willing to shrug off the entreaties of the Biden administration, which has been lobbying Saudi Arabia, the United Arab Emirates and other oil producers to increase output to help bring down the price of gasoline, in part to avoid a backlash against the war in Ukraine for causing higher energy prices,'' the New York Times reported.

Elsewhere, the Iran nuclear deal is a wildcard for oil markets. The analysts at TD Securities explained that there us potential to put an end to the pandemic-era bull market by substantially adding to the world's spare capacity, thereby allowing other producers to play catch-up.

''However,'' they say, ''US most recently raised doubts that an agreement can be reached by characterizing Iran's latest response as 'not constructive'. Further, any potential resolution appears plagued with legal and political risks which blur the outlook. What is more clear, is that failure to reach a deal would likely translate into a sharp repricing of supply risk premia, which should once again begin to insulate energy prices from a downturn in demand.''

-

20:36

Forex Today: Dollar reigns as risk aversion leads

What you need to take care of on Tuesday, September 6:

The greenback started the week advancing against most major rivals, although a Federal holiday in the US maintained volumes at their lows and major pairs within limited intraday ranges.

The EUR/USD pair fell to 0.9877, a fresh 22-year low, as the energy crisis steepens. Russian gas provider Gazprom shut down the Nord Stream 1 pipeline on Friday, reporting a leakage. On Monday, news agencies reported that Moscow’s decision to cut energy to Europe would continue until Western nations lift sanctions imposed after the Ukraine invasion. Germany announced it will keep maintaining two nuclear power plants until April. Uncertainty ahead of the winter is likely to maintain the shared currency on the negative side of the equation.

The GBP/USD pair settled at 1.1515 after falling to 1.1442. The United Kingdom confirmed Liz Truss would become the next Prime Minister after beating Rishi Sunak as Tory leader.

USD/CAD is lifeless around 1.3140, while the AUD/USD pair battles the 0.6800 level ahead of the Reserve Bank of Australia monetary policy decision. The central bank is expected to hike the cash rate by 50 bps for a fourth consecutive month.

Safe-haven gold saw no action, stuck around $1,710 a troy ounce. The OPEC+ announced plans to cut production targets by about 100,000 K barrels per day starting October. The announcement lifted oil prices, although the US holiday limited activity around WTI, now changing hands at $88.80 a barrel.

The USD/JPY pair trades at around 140.50, while USD/CHF hovers around 0.9800.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Whale Watching 101 – Guppies vs Goldfish

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:22

Gold Price Forecast: XAU/USD drops from daily highs but still above the $1700 figure

- Gold price barely slides 0.13%, weighed by higher US T-bond yields and a strong US dollar.

- Tensions between Europe and Russia threaten to worsen Europe’s energy crisis.

- US Calendar: Fed’s Mester, and Powell, to hit the stand on Wednesday and Thursday, respectively.

Gold price losses some of its brightness at the beginning of the week, down by 0.49%, in a thin liquidity trading day, with US markets, closed in the observance of Labour day. At the time of writing, the XAU/USD is trading at $1710 a troy ounce.

Monday’s market narrative includes tensions arising due to the energy crisis in Europe. Russia’s Gazprom halted natural gas flows through the Nord Stream 1 pipeline, citing a leak. Nevertheless, the headline crossed newswires after a G7 reunion put a lid on Russian oil prices.

In the meantime, the US Dollar Index, a measure of the buck’s value vs. a basket of six currencies, gains 0.20%, a headwind for the yellow metal, up at 109.826. The US 10-year benchmark note rate followed suit, gaining four bps at 3.231%.

Last week’s employment figures, released on Friday by the US Department of Labor, revealed that the US economy added 315K jobs in August, higher than forecasts to 298K. Although it was a positive reading, reinforcing the case for the Fed going 75 bps, the previous two months were downward revised by 107K.

Worth noting that the Unemployment Rate ticked up 3.7%, showing signs of softening. After data’s released, Federal Fund rates (FFR) futures easied a tone. Markets expected that the US central bank would tighten 63.9 basis points instead of 68.

What to watch

The US economic docket will feature Fed speakers, led by Cleveland President Loretta Mester, on Wednesday and Jerome Powell’s speech on Thursday. On Thursday, Initial Jobless Claims for the week ending on September 2, alongside the S&P Global and ISM Services PMI, would be eyed by investors looking for clues of how the US economy fares.

Gold (XAU/USD) Key Technical Levels

-

20:13

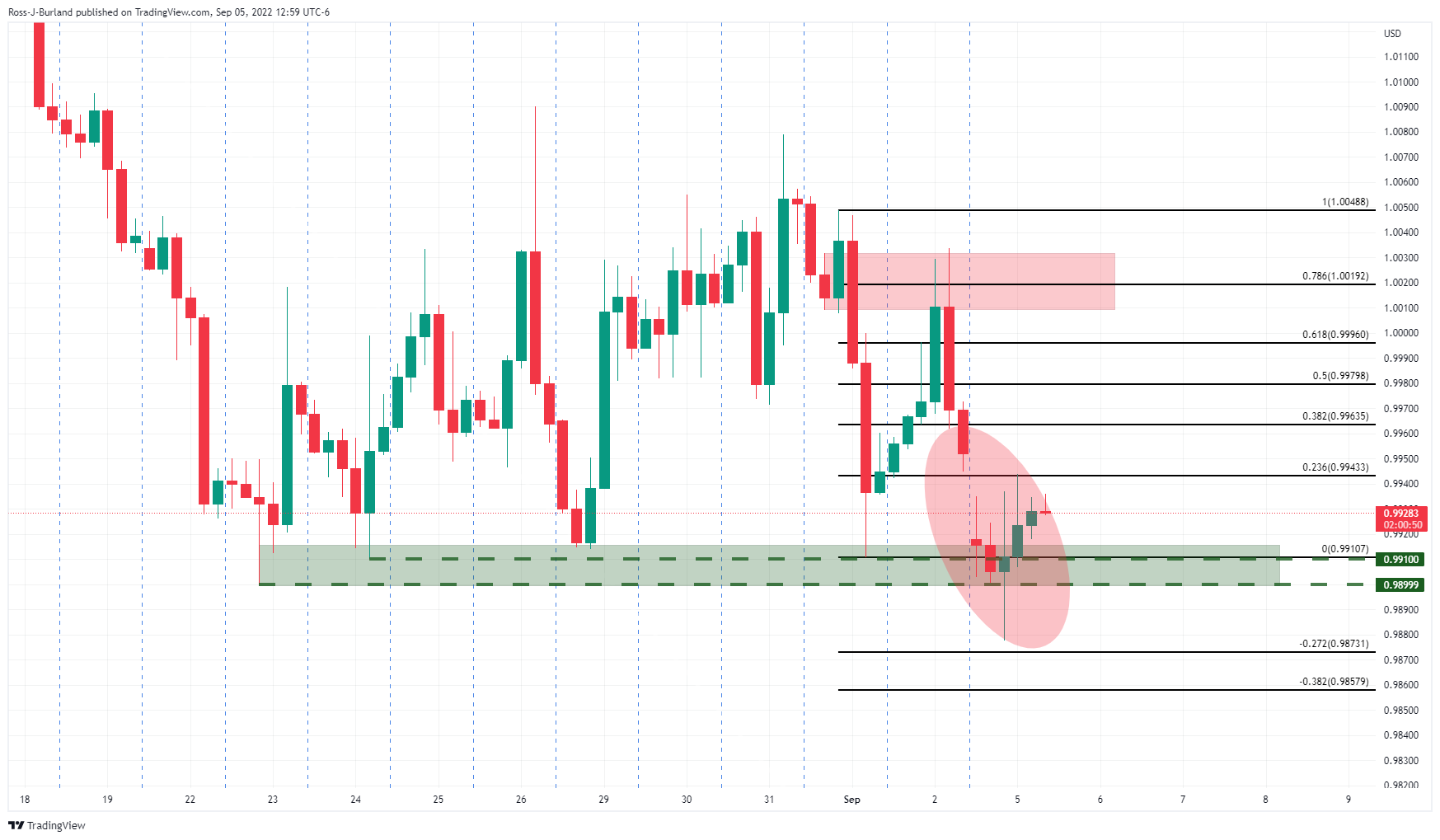

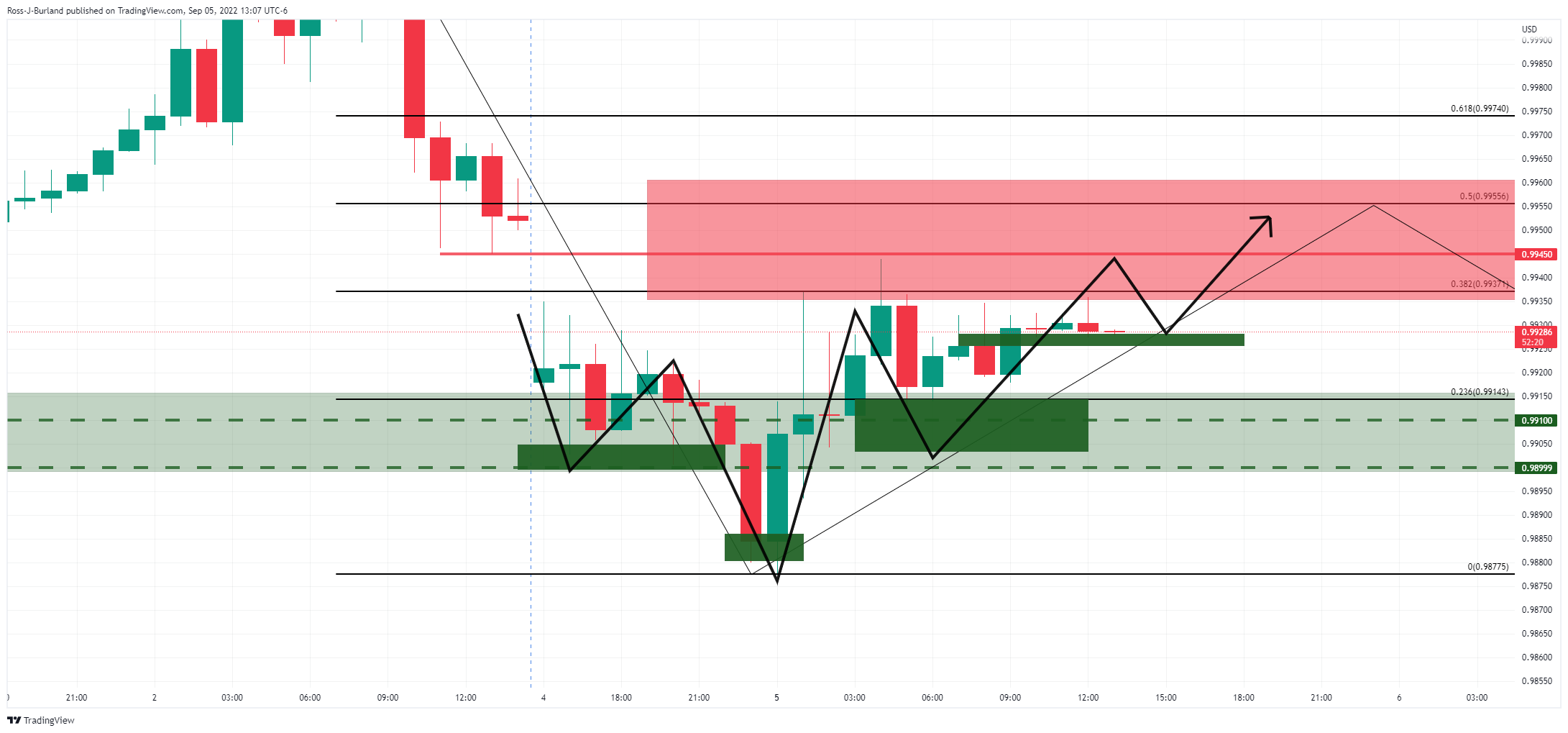

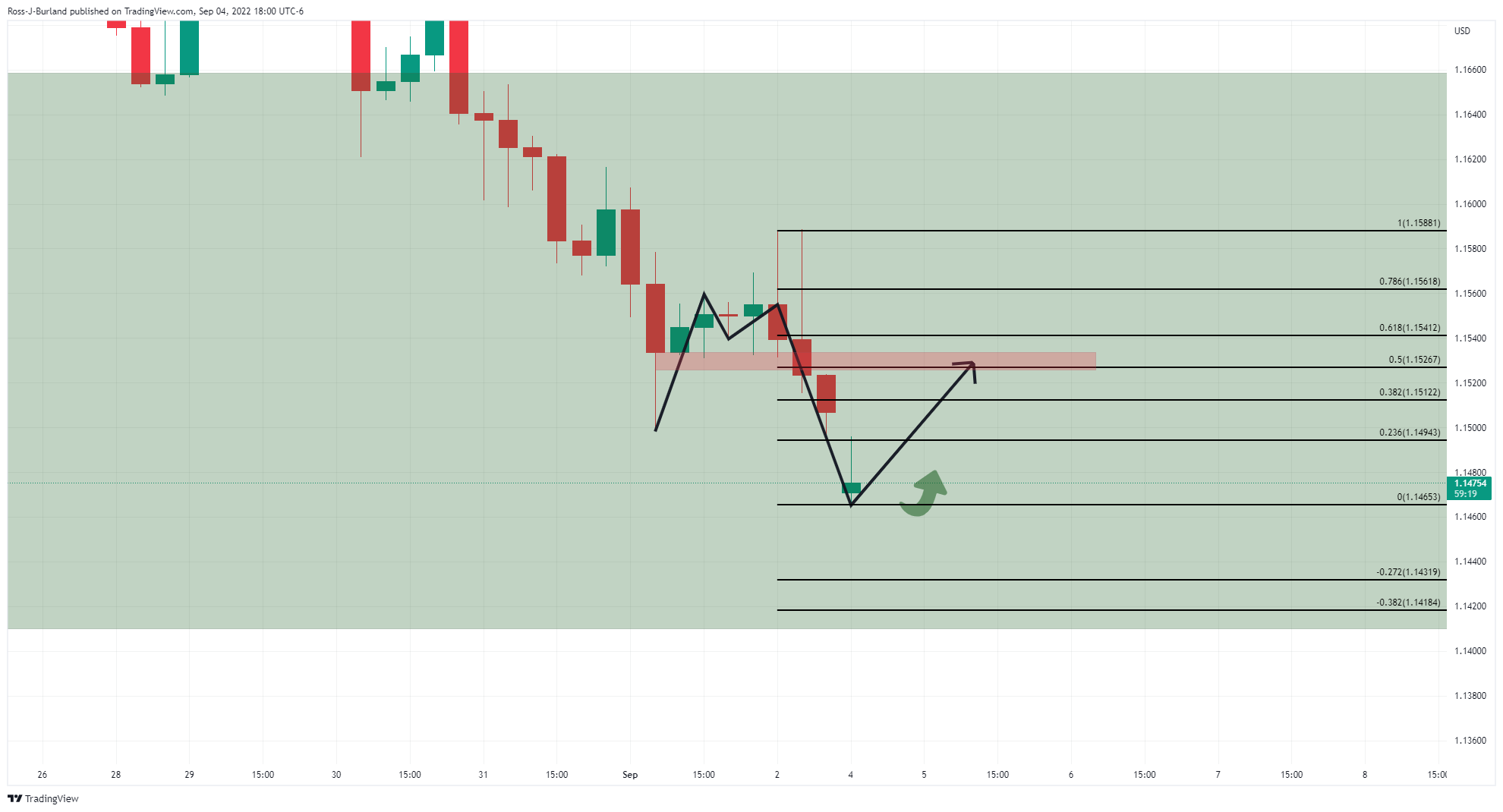

EUR/USD Price Analysis: Bulls eye a 50% mean reversion near 0.9950

- EUR/USD bulls are committing at 0.9925 support.

- If the right-hand shoulder of the H&S continues to build above 0.9900, then a 50% mean target 0.9950 will be eyed.

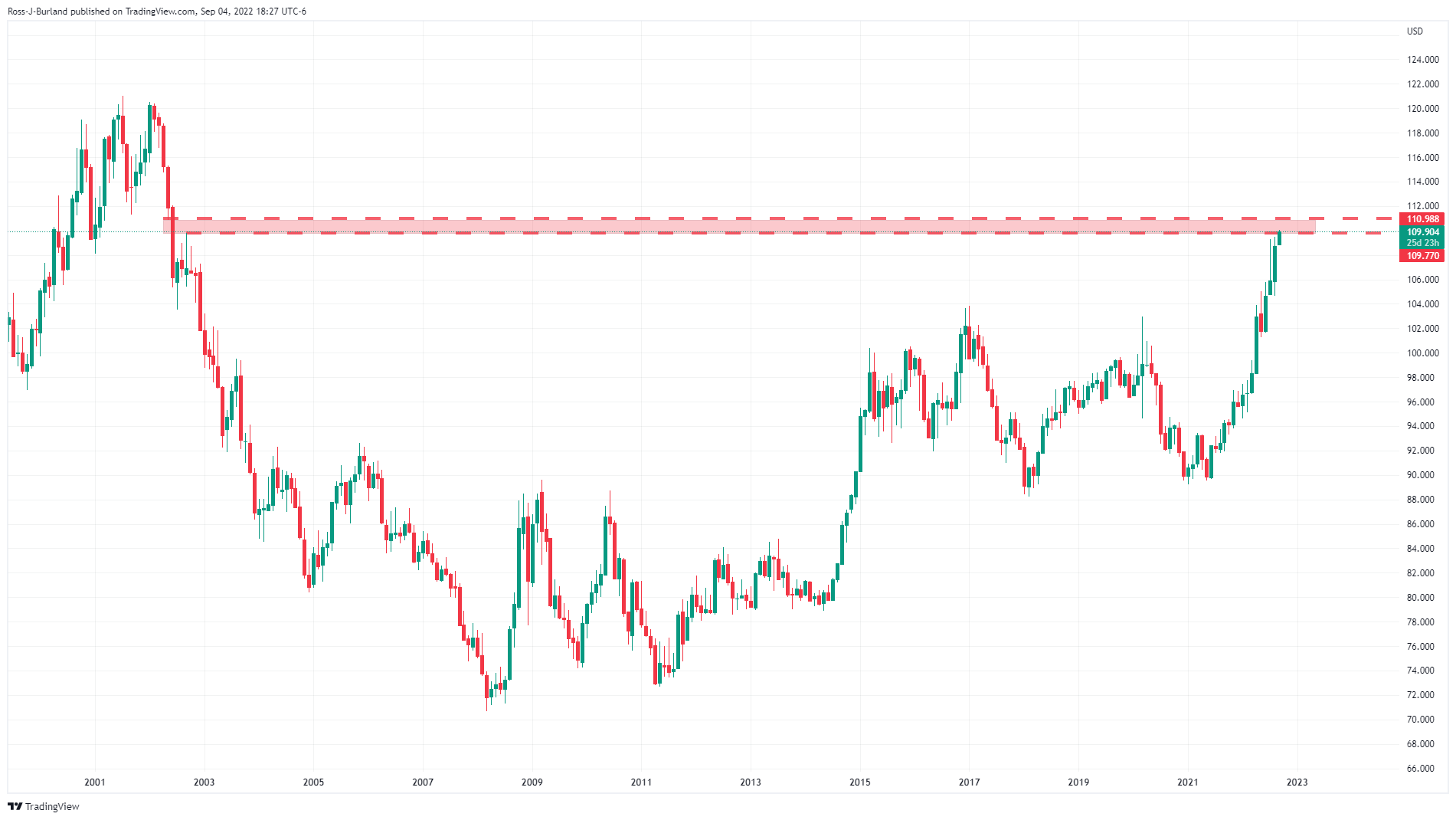

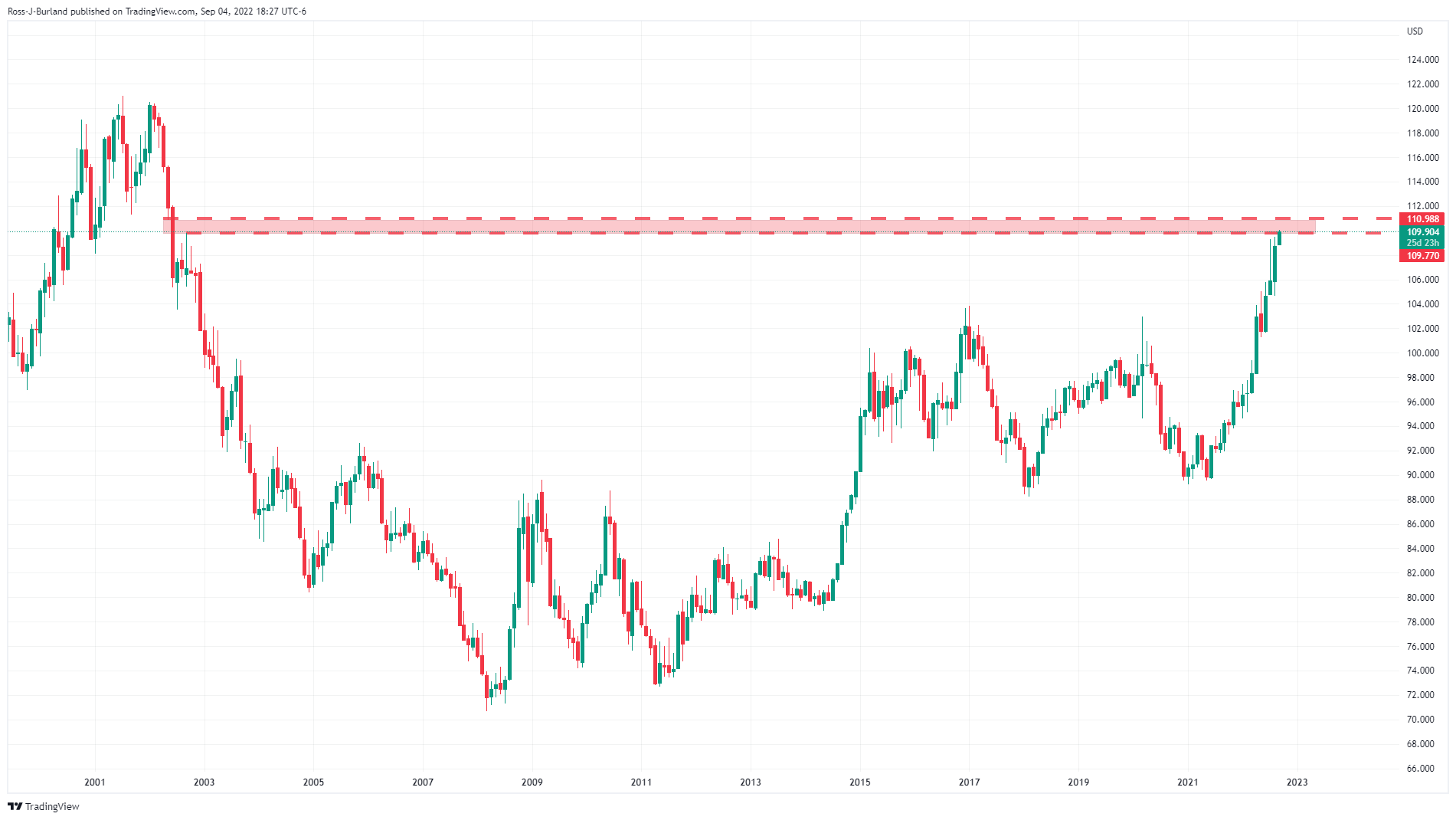

As per the prior analysis, EUR/USD Price Analysis: Bears eye a move into test 0.9900, the price indeed moved in to test the round number, reaching a low of 0.9877 on the day. This happened in a bearish gap and subsequent follow-through as the US dollar firmed to score fresh bull cycle highs around 110.20 as per the DXY index.

The dollar has since been faded which gave some relief to the forex space and the euro. At the time of writing, DXY is trading at 109.779 and recently plummeted to 109.534.

The euro's recovery has started to decelerate but the price is yet to close the opening gap or correct meaningfully to a significant retracement of the prior 4-hour bearish impulse. This leaves prospects of a deeper bullish correction for the day ahead as illustrated in the following analysis.

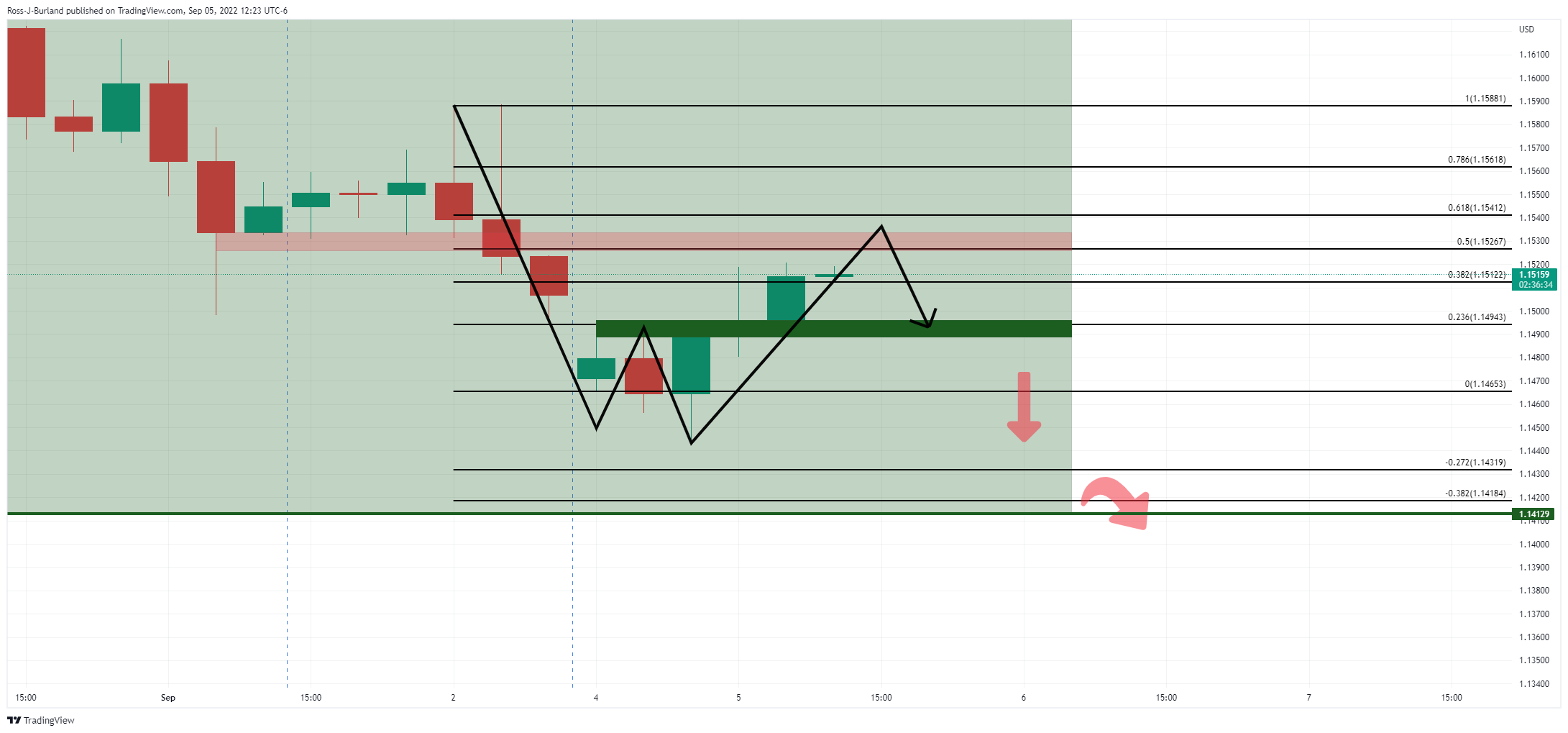

EUR/USD prior analysis, H4 chart

It was explained that the price had dropped heavily from the 78.6% Fibonacci retracement area that met with the resistance of the M-formation's neckline. The tweezer top was also a bearish feature and a move to test support was on the cards should 0.9940 give out:

EUR/USD live update

The price is creeping in on the gap and it has made a 38.2% Fibonacci retracement, but a fuller correction could be on the cards prior to the next bearish impulse to the downside:

EUR/USD H1 charts

On the chart above, the bullish inverse head and shoulders are a compelling feature on the hourly time frame. this is also accompanied by the W-formation below:

Should the support around 0.9925 hold, then an imminent bullish impulse could be on the cards. If the right-hand shoulder continues to build above 0.9900, then the bulls will be seen to be committing to the correction for the day ahead and a higher retracement on the breakout would be expected. The 50% mean reversion target is located around 0.9950.

-

19:29

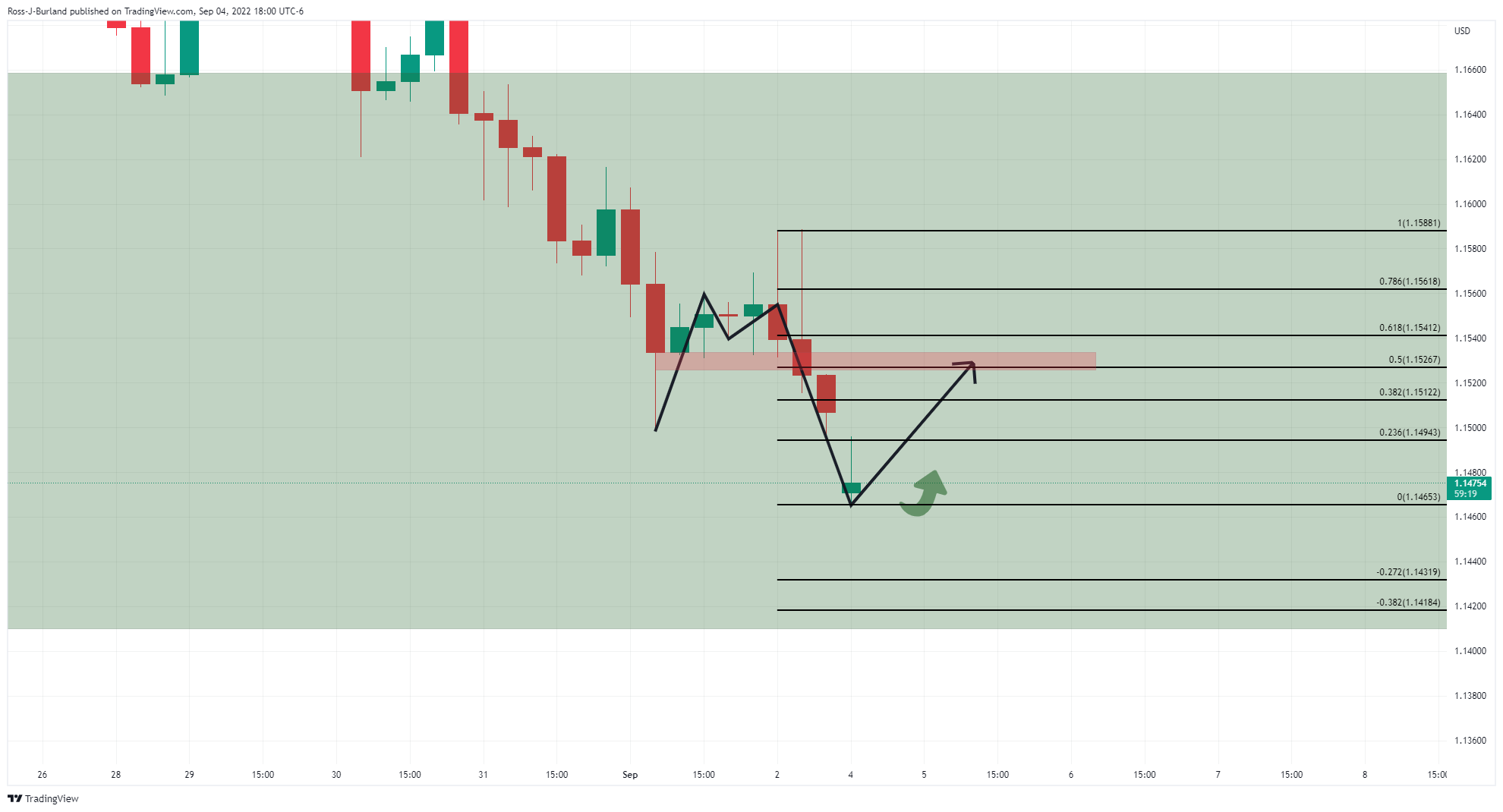

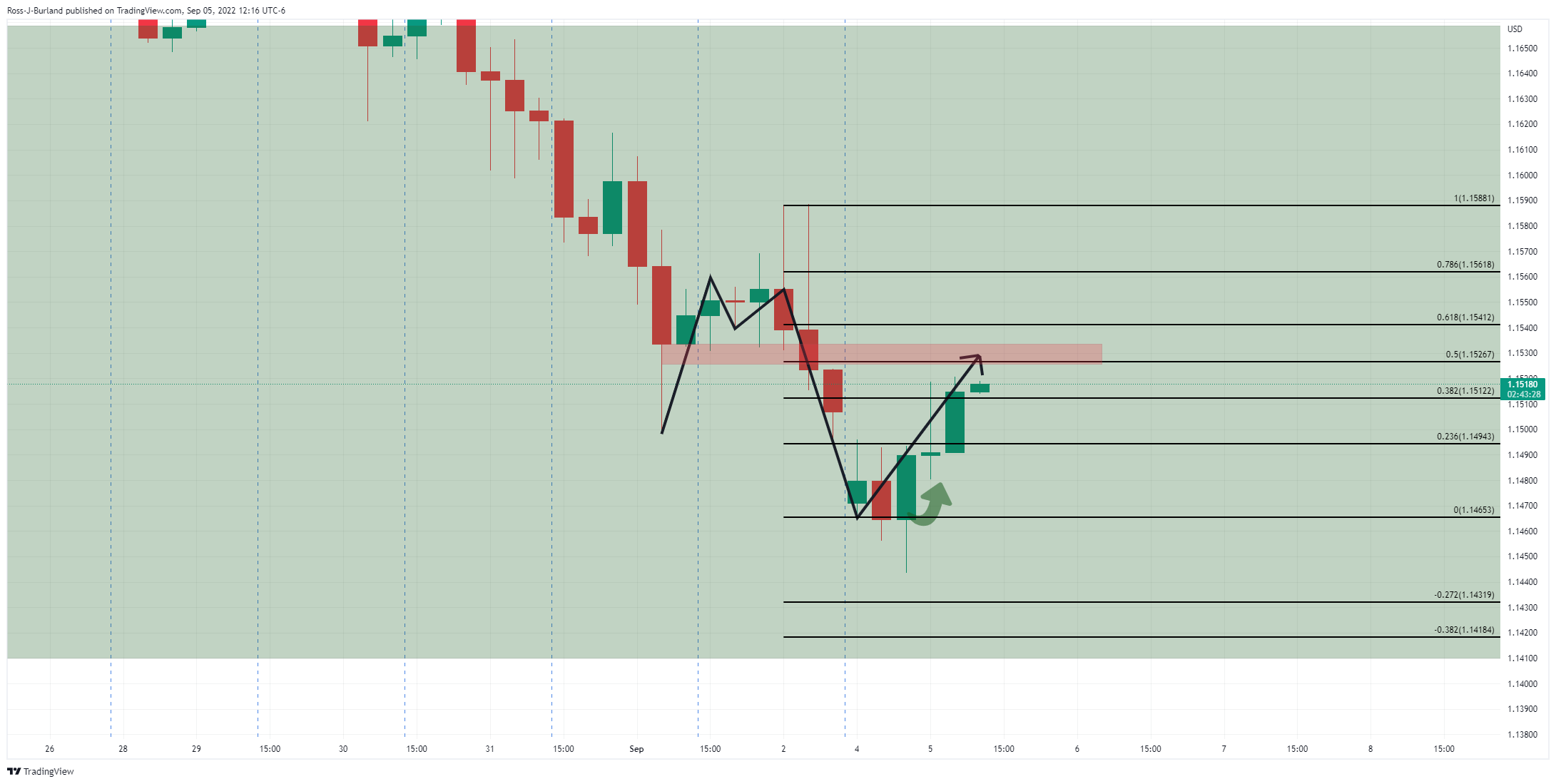

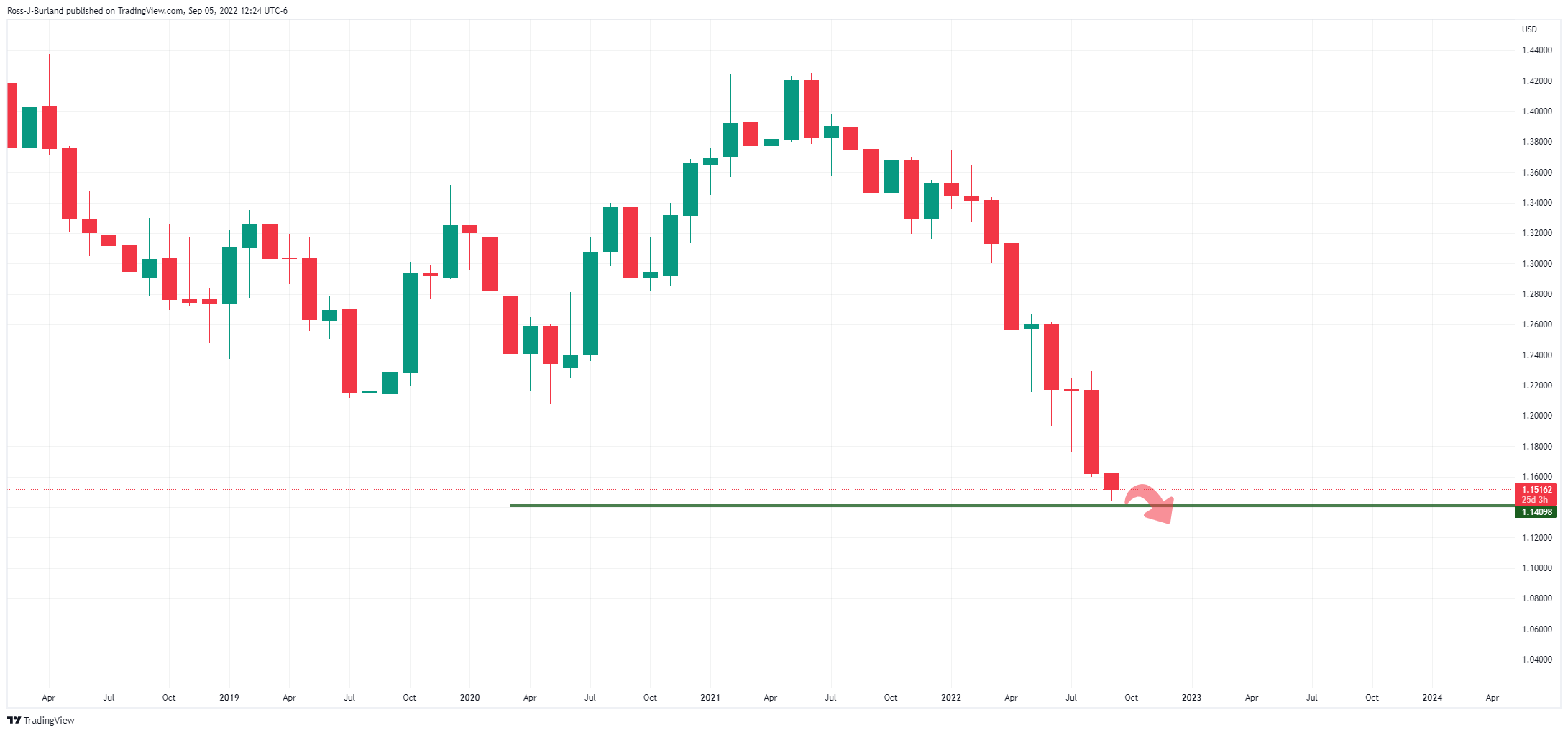

GBP/USD bulls hold the fort above critical levels at the edge of the abyss

- GBP/USD holds in bullish territories as the US dollar slides from fresh bull cycle highs.

- GBP/USD bulls step in at a key area of support on the near and longer-term charts.

GBP/USD remains in bullish territory above 1.1500 having recovered from the low of the day down at 1.1443, around a two-and-a-half-year low, making its way into test 1.1520 in recent trade. The US dollar is the driver in the forex space but, domestically, the main feature so far for the week has been Liz Truss becoming Britain's next prime minister after winning a leadership race for the governing Conservative Party.

Truss will take power and name her cabinet on Tuesday, and markets will be on the lookout for any leaks of her fiscal plans. She has already pledged not to raise taxes nor to ration energy and has specifically ruled out any windfall taxes on energy companies.

Reports suggest Truss is preparing an emergency mini-budget in her first month as Prime Minister and it is yet to be seen whether she will follow through on her promises to immediately cut taxes in an effort to jump-start the economy. British government bonds suffered their biggest monthly price losses in decades in August, due to inflation fears but also on Truss's planned tax cuts and proposals to stimulate the economy with fiscal spending.

Meanwhile, on Wednesday, the Bank do England Governor, Andrew Bailey & 3 members of the Monetary Policy Committee will face MPs for a grilling on the outlook for inflation and interest rates. This will be the last we will hear from them ahead of the September BoE meeting, so traders will be all ears to the ground for hints with regards to a bias leaning towards either a 50bps or 75bps hike for the MPC rate decision.

''Governor Bailey, Chief Economist Pill, and MPC members Mann and Tenreyro will testify. They will of course come under heavy criticism for allowing inflation to rise so much above target,'' analysts at Brown Brothers Harriman said. ''Tightening expectations continue to rise, as WIRP suggests nearly 70% odds of a 75 bp hike to 2.5% September 15. Looking ahead the swaps market is pricing in 275 bp of tightening over the next 12 months that would see the policy rate peak near 4.5%, up from 4.0% just two weeks ago.''

US dollar is faded through 110 psychological level

The US dollar, as measured by the DXY index, rallied to 110.271 on Monday, helped by a plunge in the euro due to the Russian gas halt and a drop in the Chinese yuan that struggles in the face of a resurgence of COVID-19 infections across the country. Besides the risk-off pulses, the greenback continued to be driven higher on the coattails of Fed Chair Jerome Powell's recent remarks made at the Jackson Hole symposium in Wyoming, explaining that rates would need to be high "for some time" to combat stubbornly high inflation. However, the dollar has since been faded from the highs which gave some relief to the forex space, including the pound. At the time of writing, DXY is trading at 109.779 and recently plummeted to 109.534.

For the week ahead, the data highlight will be August ISM services PMI Tuesday. The headline is expected at 55.4 vs. 56.7 in July. Traders will be taking note of the employment and prices paid data, which stood at 49.1 and 72.3 in July, respectively. fed speakers will also be key. Chair Powell, Vice-Chair Brainard, and Governor Waller will make public appearances to talk about the economic outlook and markets will be looking for them to build on Powell's Jackson Hole remarks.

''They will stress that inflation is still too high and bringing it down is priority number 1, which requires further rate hikes as well as keeping the policy rate high for "some time" once the terminal is reached,'' analysts at TD Securities said.

GBP/USD technical analysis

As per the start of the day's analysis, GBP/USD Price Analysis: Bulls move in but there could be more from the US dollar, the bulls have moved in and we did see more from the US dollar.

GBP/USD H4 chart, prior analysis

GBP/USD, update

The price made fresh lows but the bulls stuck in there and have subsequently moved in on the 50% mean reversion target as the prior analysis had projected. At this juncture, bulls will need to keep above 1.1490 or face prospects of a move to the lowest levels since 1985, below 1.1413:

GBP/USD monthly charts

On the other hand, should the bulls stay the course, then the upside eyes prospects of a significant retracement:

-

19:28

AUD/USD solid, meandering around 0.6800 ahead of the RBA's decision

- AUD/USD is registering solid gains amidst a dismal market sentiment.

- Softer than estimated US employment figures pushed the Federal funds rate expectations lower than previously.

- Based on data, TDS Securities Analysts commented that the RBA might hike 50 bps.

The AUD/USD recovers some ground after recording fresh two-month lows during the last week, amid a negative market sentiment trading session, with US equities being closed in the observance of Labor day, while European stocks are trading in the red. Factors like Europe’s energy crisis, alongside high inflation, added to the risks of a global economy.

The AUD/USD opened the week near the session’s lows, around 0.6770s, but edged higher and exchanging hands around the 0.6800 figure at the time of writing.

Last Friday’s US employment report exceeded estimates, but downward revisions on the previous two months, easied expectations of a Federal Reserve 75 bps rate hike. Nonfarm Payrolls came at 315K vs. 298K estimated, while the unemployment rate was 3.7%. That said, Federal Funds futures lost 3.7 bps on Friday, to 63.9 bps to tightening, right in the middle of 50-75 bps.

Meanwhile, the US Dollar Index records decent gains of 0.16%, at 109.779, capped by a sour sentiment.

AUD/USD to edge higher on the RBA 50 bps hike expected

On Tuesday, the Reserve Bank of Australia is expected to hike rates by 50 bps as they continue to fight to tame inflation. Analysts at TD Securities forecast a 50 bps rate hike on the thesis that the labor market remains tight, a solid consumer spending, and price pressures spread wide.

“A 50bps hike is consistent with prior RBA hikes and in line with firm data outcomes. Of more importance is the language accompanying a 50bps hike. Does the RBA strengthen its language/resolve to get on top of inflation by removing ‘even keel’ or ‘path to achieve this balance is a narrow one and clouded in uncertainty’. Or does the RBA signal a more prolonged hiking cycle but highlights a step down in the pace of rate hikes? We favour the 2nd option.”

What to watch

Australia’s economic docket will feature the RBA’s monetary policy decision, alongside the Current Account Balance, Exports, and the Real GDP. The US calendar will feature Fed speakers with Cleveland President Loretta Mester on Wednesday and Jerome Powell’s speech on Thursday. Furthermore, unemployment claims for the week ending on September 2, alongside the S&P Global and ISM Services PMI, would be eyed by investors, looking for clues of how the US economy fares.

AUD/USD Key Technical Levels

-

17:59

Bank of Canada to deliver a 75 bps hike to 3.25% on Wednesday – Wells Fargo

The Bank of Canada (BoC) will have its monetary policy meeting on Wednesday. A rate hike of 75 basis points is expected. Analysts at Wells Fargo think the BoC will slow down the pace of its hikes beyond September, only taking the policy rate to 3.75% by the end of the fourth quarter.

Key Quotes:

“The Bank of Canada (BoC) will also have its September monetary policy meeting on Wednesday. The BoC has embarked on one of the more aggressive tightening cycles among the G10 countries, and there are some hints the effects of tighter monetary policy might be starting to cool inflation down. Headline inflation in Canada decelerated to a 7.6% year-over-year pace in July, driven by falling commodity prices. However, the average of three core inflation measures ticked up to 5.3%, indicating that underlying price pressures still remain elevated for now.”

“After a jumbo 100 bps rate hike in July, we expect the BoC to deliver a 75 bps hike to 3.25% at its September meeting. We think the BoC will slow down the pace of its hikes beyond September, only taking the policy rate to 3.75% by the end of Q4-2022, although we see the risks as remaining tilted to a higher peak. We will be particularly interested in guidance on future policy from the BoC, especially against a backdrop of slowing growth and still-elevated inflation.”

-

17:59

USD/JPY Price Analysis: Retraces from the YTD highs, stays around 140.50s

- USD/JPY marches firmly around 0.28% amidst a light trading session.

- The weekly chart shows the pair in overbought conditions, opening the door for a pullback.

- A doji in the USD/JPY daily chart depicts the balance between buyers/sellers, suggesting the major consolidating in a range.

The USD/JPY is recording solid gains during the North American session, amidst light liquidity trading conditions, due to Wall Street being closed in observance of the US Labor day. The USD/JPY is trading at 140.53, at the time of writing, after refreshing 24-year highs on Friday at 140.80.

USD/JPY Price Analysis: Technical outlook

From a weekly chart perspective, the USD/JPY is still upward biased, but overbought conditions begin to be present. After refreshing YTD highs during May, July, and September, peaking at 131.34, 139.38, and 140.80, respectively, the Relative Strength Index (RSI) reached 88, 84, and 72. Hence, buying pressure might be easing due to traders refraining from opening fresh longs, alongside profit taking.

The USD/JPY daily chart portrays the pair breaking above the rising-wedge trendline, invalidating the bearish bias of the pattern. However, USD/JPY Friday’s price action formed a doji, meaning buyers and sellers in balance, spurred by rumors of Japanese authorities intervening in the Forex Market due to the perceived yen weakness. Therefore, the major might consolidate in the 139.00-140.00 range.

The USD/JPY first resistance would be YTD high at 140.80. Break above will expose the 141.00 psychological level before testing 24-year highs at 147.67. On the flip side, the USD/JPY first support would be the 140.00 mark. Once cleared, the next support would be the September 1 daily low at 138.83, followed by the 138.00 mark.

USD/JPY Key Technical Levels

-

17:41

RBA: Data outcomes do not support the central bank pausing this year – TDS

On Tuesday, the Reserve Bank of Australia (RBA) will announce its decision on monetary policy. Market participants expect a 50 basis points rate hike. Analysts at TD Securities point out business confidence remains buoyant, capex plans are firm, labour market/capacity utilisation remains tight, the consumer continues to spend and price pressures are 'widespread'. They consider a rate hike from the RBA of less than 50bps would represent a loosening of financial conditions.

Key Quotes:

“The data outcomes do not support the RBA pausing this year. Of most interest is how the Bank will telegraph ongoing hikes but signal a step down in the pace of hikes from October to 25bps increments. Reiterating the Bank is not on a 'pre-set path' would meet this objective.”

“A 50bps hike is consistent with prior RBA hikes and in line with firm data outcomes. Of more importance is the language accompanying a 50bps hike. Does the RBA strengthen its language/resolve to get on top of inflation by removing 'even keel' or 'path to achieve this balance is a narrow one and clouded in uncertainty'. Or does the RBA signal a more prolonged hiking cycle but highlights a step down in the pace of rate hikes? We favour the 2nd option.”

-

17:33

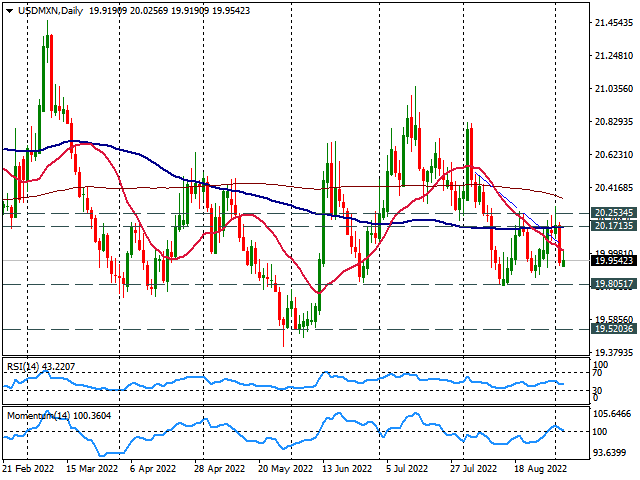

USD/MXN Price Analysis: Looking at 19.80 while under 20.00

- USD/MXN with bearish bias in the very short-term, in range.

- Next support below 19.90 at 19.80.

- Critical resistance around 20.20/25.

The USD/MXN is rising modestly on Monday as it remains trading near the weekly low it hit at the beginning of the week at 19.91. Momentum and technical indicators point to the downside in the very short-term. A break under 19.90 would expose the next support area at 19.80.

Since mid-August USD/MXN is moving sideways in a range between 19.80 and 20.25. The 19.80 should hold if tested in the near-term, offering a rebound. A firm break lower would weaken the dollar further, exposing 19.72.

On the upside, the immediate resistance stands 20.02 (20-day Simple Moving Average) followed by 20.17. A daily close above 20.25, would change the short-term bias to neutral/bullish and should open the doors to more gains, targeting initially the 20.45 zone.

USD/MXN daily chart

-

16:41

BoE's Mann: Gradual pace of rate hikes has not tempered expectations enough

Bank of England (BoE) policymaker Catherine Mann said on Monday that the gradual pace of increase in bank rate has not tempered expectations enough, as reported by Reuters.

Additional takeaways

"Fast and forceful tightening potentially by a hold or reversal is superior to a gradualist approach."

"Long-term expectation metrics apparently remain anchored and consistent with the 2% target."

"Credibility of monetary policy is intact."

"Drift in medium-term expectations is already apparent in the data."

"We cannot be complacent in the face of the short-term spikes and medium-term drift."

"Acting more forcefully now is designed to avoid depending on a deeper and longer contraction."

"If current wholesale energy prices are allowed to be passed on to households and firms, this will lead to enormous pain for millions."

"Monetary policy is a relatively blunt instrument and is ill-equipped and not intended to deal with large relative price movements like the one we’re seeing currently."

"Ratcheting-up from short-term to medium-term expectations has been apparent for a while, and could portend a persistent drift higher."

"This has the potential to cement expectations inconsistent with the 2% target which would necessitate a persistently tighter stance of monetary policy."

"We will not tolerate a persistent inflation overshoot and will stay vigilant even when headline rates start to come down."

"The more we control medium-term inflation expectations now, the less tight for long monetary policy will need to be."

Market reaction

GBP/USD showed no immediate reaction to these remarks and was last seen trading flat on the day at 1.1505.

-

16:38

GBP/JPY rises toward 162.00 from two-week lows, Truss to become UK PM

- Liz Truss wins Conservative Party leadership battle.

- UK data: S&P Global Service PMI for August revised lower.

- Yen remains under pressure, despite risk aversion.

The GBP/JPY cross turned positive for the day and erased losses, after recovering from the lowest level in almost three weeks. It bottomed at the beginning of the week at 160.63 and recently hit a fresh daily high at 161.91.

The recovery of the cross took place as GBP/USD moved off multi-year lows and as USD/JPP climbed back to the 140.50 area. The yen remains weak even as European stocks drop sharply.

The pound was unaffected following the result of the Tory race that offered no surprises. Liz Truss will become the next prime minister. “I will deliver a bold plan to cut taxes and grow our economy”, said Truss in brief acceptance speech. Regarding the energy crisis she said she will deal “with people’s energy bills but also dealing with the long-term issues we have on energy supply.”

Truss will become PM on Tuesday. On Wednesday, Bank of England’s official will testify to a Treasury Committee at the Parliament. Over the next days, market participants will keep an eye on Truss’s comments on BoE’s mandate.

On economic data, the UK S&P Global Service PMI came in at 50.9 in August, below the 52.5 of the flash estimate.

Technically, GBP/JPY is moving sideways around 161.50 since mid-August. A close below 161.00 should point to more losses while on the upside, a break above 162.50 would increase the odds of a more sustainable recovery targeting 164.00 initially.

Technical levels

-

16:33

Silver Price Forecast: XAG/USD steadily around $18.00 amid sour sentiment

- Silver price begins the week on the right foot, up by 0.30%.

- Europe’s energy crises worsen as G7 ministers put a lid on Russian oil prices while Russia halts gas exports.

- Real yields in the US remain above the 0.70% threshold but almost ten bps off the day’s highs.

Silver price regained some composture advancing more than 0.50% on Monday, despite thin liquidity conditions, with US markets closed for Labor Day. Meanwhile, the common bloc energy crisis worsens with Gazprom halting gas deliveries to Europe as retaliation after a G7 meeting put a cap on Russian oil. At the time of writing, the XAG/USD is trading at $18.08, above its opening price.

Global equities are trading in the red, reflecting the market deterioration. Last week US employment data, with Nonfarm Payrolls exceeding expectations, downward reviews, and the unemployment rate increasing by 3.7%, diminished the odds of an aggressive Federal Reserve.

The US Dollar index refreshed 20-year highs at around $110.27, sending the EUR/USD tumbling below the 0.9900 figure, though the white metal edged lower but above its opening price. The US 10-year TIPS, a proxy for real yields, which measures the 10-year nominal yield minus inflation expectations, remains positive but off the highs of the day around 0.827%, at 0.729%, a tailwind for XAG/USD.

What to watch

The US docket will feature Fed speakers with Cleveland President Loretta Mester on Wednesday and Jerome Powell’s speech on Thursday. Also, unemployment claims for the week ending on September 2, alongside the S&P Global and ISM Services PMI, would be eyed by investors, looking for clues of how the US economy fares.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remains neutral to downward biased, despite the recent jump off YTD lows at $17.56. Nevertheless, a break above the July 14 low at $18.14 is needed to open the door to a re-test of the confluence of the 20-50-DMAs, at around $19.25-40. Otherwise, expect a resumption to the downside and another attempt to break below the YTD low on its way towards June 2020 lows at $16.95.

-

16:15

French President Marcon: France in favour of common gas buying at European level

Following his phone call with German Chancellor Olaf Scholz, French President Emmanuel Macron noted that are ahead of the gas storage targets, having 92-93% of the storage capacity already filled, as reported by Reuters.

Additional takeaways

"Germany needs our gas and we need power from the rest of Europe, notably Germany.",

"On energy prices, measures are at first-hand national but there must also be measures at a European level."

"France is in favour of common gas buying at a European level."

"We need to act against speculation on energy prices at an EU level."

Market reaction

Markets paid little to no attention to these comments and EUR/USD was last seen losing 0.3% on the day at 0.9920.

-

16:03

Germany to keep two nuclear power plants as emergency reserve – Spiegel

According to Der Spiegel, German Economy Minister Robert Habeck wants to keep two nuclear power stations as emergency reserves until mid-April, 2023, as reported by Reuters.

Earlier in the day, German gas importer Uniper's CEO Klaus-Dieter Maubach told Reuters that Germany might eventually be forced to consider gas rationing following Russia's latest decision to halt gas flows via Nord Stream.

Market reaction

This headline failed to help the shared currency find demand and EUR/USD was last seen losing 0.27% on a daily basis at 0.9924.

-

15:52

OPEC+ decision sends message to market that group will intervene to bring stability – Reuters

OPEC+ decision to lower the oil output target by 100,000 barrels per day in October sends a message to the market that the group will intervene to bring stability, Reuters reported on Monday, citing a Gulf OPEC source.

"Opec+ members have trusted the chairman - Saudi energy minister - to intervene whenever necessary to stabilize markets," the source told Reuters.

Market reaction

Crude oil prices continue to rise despite the Labor Day holiday in the US. As of writing, the barrel of West Texas Intermediate (WTI) was up 3.5% on a daily basis at $90.10.

-

15:23

Germany: Gas rationing will occur in the winter if supplies are not resumed soon – Commerzbank

Russia will not be supplying natural gas to Germany until further notice. Can Germany close the natural gas gap? Strategists at Commerzbank try to give an answer.

Rationing threatens in winter

“In the best-case scenario (the 80 TWh gas gap) and a mild winter, supply could just about be met through conservation and stock withdrawals, even without the resumption of Russian supplies.”

“A gas gap of 245 TWh would require savings of 195 TWh in the next 12 months. Although extremely high prices provide a significant incentive for savings, this does not appear achievable. Rationing is probably inevitable in this case. In that case, the recession we already expect would be much more severe.”

-

14:47

Gold Price Forecast: XAU/USD remains confined in a range, upside potential seems limited

- Gold struggles to gain any meaningful traction and oscillates in a range on Monday.

- A modest USD pullback from a two-decade high offers some support to the metal.

- Expectations for aggressive tightening by major central banks might continue to cap.

Gold lacks any firm directional bias and seesaws between tepid gains/minor losses through the early North American session on Monday. The XAU/USD, so far, has managed to hold above the $1,700 round-figure mark and remains below Friday's swing high touched in the aftermath of the mixed US monthly jobs report.

The US dollar trims a part of its intraday gains to a fresh two-decade high and offers some support to the dollar-denominated gold. A modest USD pullback could be solely attributed to some profit-taking amid slightly overbought conditions and relatively thin trading volumes on the back of the Labor Day holiday in the US. Apart from this, recession fears assist the safe-haven precious metal to attract some dip-buying near the $1,707 region.

That said, the prospects for a further policy tightening by major central banks to tame inflation act as a headwind for the non-yielding yellow metal. In fact, the Reserve Bank of Australia is anticipated to raise the cash rate at its meeting on Tuesday. Furthermore, the markets have been betting on a bumper rate hike by the European Central Bank on Thursday. The Bank of England is also expected to raise interest rates by at least 50 bps.

Adding to this, the markets have been pricing in a supersized 75 bps rate hike by the Federal Reserve at its upcoming policy meeting on September 20-21. This remains supportive of elevated US Treasury bond yields and favours the USD bulls. The fundamental backdrop should hold back traders from placing bullish bets around gold, warranting caution before positioning for an extension of last week's bounce from the vicinity of the YTD low.

Technical levels to watch

-

14:41

EUR/USD Price Analysis: Extra losses still favoured

- EUR/USD accelerates losses and drops to new cycle lows.

- Below the YTD low comes the December 2002 low at 0.9859.

EUR/USD resumes the leg lower and breaks below the 0.9900 level to reach new 2-decade lows in the 0.9880/75 band on Monday.

The continuation of the downtrend could not be ruled out just yet, as the daily RSI around 36 still allows for some weakness prior to reach the oversold territory.

Against that, the next support of note comes at 0.9859 (December 2002 low) seconded by 0.9685 (October 2002 low).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0787.

EUR/USD daily chart

-

14:24

US Dollar Index Price Analysis: Overbought levels could spark a corrective move

- DXY climbs to new highs near 110.30 on Monday.

- A technical correction should not be ruled out.

DXY extends the march north to the vicinity of 110.30, where it seems to have met some initial resistance.

The short-term bullish view in the dollar remains well in place for the time being and propped up by the 7-month support line, today around 105.70.

However, the current overbought conditions of the index could trigger some corrective downside, which should be seen as a buying opportunity.

Still on the upside, the surpass of the recent top could face the next barrier at the weekly highs at 111.90 (June 6 2002) and 113.35 (May 24 2002).

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 101.06.

DXY daily chart

-

14:06

USD/CNY: Forex RRR cut unlikely to stem the yuan's weakening trend – ING

The People's Bank of China cut the required reserve ratio of foreign currency deposits that banks need to keep at the central bank. Nonetheless, the yuan is set to keep weakening, economists at ING report.

Cutting FX RRR won't strengthen yuan

“The PBoC cut the forex RRR again this year – this time to 6% from 8% effective 15 September 2022. We believe that this RRR cut will not change the yuan weakening trend. This is because this round of yuan weakness comes from a strong US dollar and the expectation of more Federal Reserve hikes at the coming meetings.”

“Our USD/CNY forecast is 7.05 by the end of 3Q22.”

“Less aggressive rate hike talk in the market nearer the end of the year might help the yuan to strengthen slightly. As such, we expect USD/CNY to fall to 6.85 by the end of the year.”

-

13:55

EUR/JPY Price Analysis: The 142.30 region emerges as the next target

- EUR/JPY adds to Friday’s small gains below 140.00.

- The next hurdle of note turns up at the 142.30 zone.

EUR/JPY alternates gains with losses around 139.00 after bottoming out in earlier lows near 138.70 on Monday.

Extra gains in the cross are now favoured once it clears the recent high at 140.74 (September 2). Beyond this level, another visit of the weekly top at 142.32 (July 21) should re-emerge on the horizon prior to the 2022 peak at 144.27 (June 28).

While above the 200-day SMA at 134.54, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

13:42

GBP/USD struggles to register any meaningful recovery, hangs near two-and-half-year low

- GBP/USD attracts some intraday buying on Monday, though lacks follow-through.

- A modest USD pullback from a two-decade high offers some support to the major.

- The fundamental/technical backdrop still seems tilted in favour of bearish traders.

The GBP/USD pair stages a modest bounce from its lowest level since March 2020, around the 1.1445 area touched earlier this Monday. Spot prices hit a fresh daily high during the mid-European session, albeit seemed to struggle to capitalize on the move or find acceptance above the 1.1500 psychological mark.

The US dollar trims a part of its early gains to a fresh two-decade high and turns out to be a key factor offering some support to the GBP/USD pair. That said, expectations that the Fed will stick to its aggressive policy tightening path act as a tailwind for the greenback. Apart from this, a bleak outlook for the UK economy continue to undermine the British pound and kept a lid on any meaningful gains for the major.

It is worth recalling that the Bank of England had warned last month that the UK economy will enter a prolonged recession during the last quarter of the year. Adding to this, the British Chambers of Commerce (BCC) downgraded its forecast and now expects the UK economy to record three consecutive quarters of contraction. This, to a larger extent, overshadows the prospects for further interest rate hikes by the UK central bank.

On the UK political front, Liz Truss won the Conservative Party leadership race to become the next British Prime Minister. The news, however, did little to impress bullish traders, suggesting that the path of least resistance for the GBP/USD pair is to the downside. That said, relatively lighter trading volumes on the back of the Labor Day holiday in the US might hold back traders from placing aggressive bearish bets and limit losses.

Nevertheless, the fundamental backdrop still supports prospects for an extension of a three-week-old downward trajectory. Even from a technical perspective, acceptance below the 1.1500 mark and the GBP/USD pair's inability to attract any buyers suggests that the near-term selling bias is still far from being over. Hence, any attempted recovery move could be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Technical levels to watch

-

13:35

OPEC+ agrees to lower oil output targets by 100K bpd in October – Reuters

Reuters reported on Monday that the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, have agreed to lower oil output targets by 100,000 barrels per day in October.

The group is scheduled to meet again on October 5 and the chairman is reportedly considering calling for an OPEC and non-OPEC ministerial meeting anytime to address market developments, if necessary.

Market reaction

Crude oil prices cling to strong daily gains with the barrel of West Texas Intermediate (WTI) rising more than 3% on the day at $89.90.

-

13:20

USD/MYR: Strong resistance at 4.4980 appears out of reach – UOB

The continuation of the uptrend in USD/MYR seems favoured for the time being, but a visit to the solid hurdle at 4.4980 seems not favoured, suggests FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We highlighted last Monday (29 Aug, spot at 4.4800) that ‘the bias for USD/MYR is on the upside but the major resistance at 4.4980 is likely out of reach’. USD/MYR subsequently rose to 4.4890 before trading sideways.”

“While upward momentum has not improved, there is room for USD/MYR to edge higher. However, 4.4980 is still likely out of reach. On the downside, support is at 4.4750 followed by the major level at 4.4650.”

-

13:16

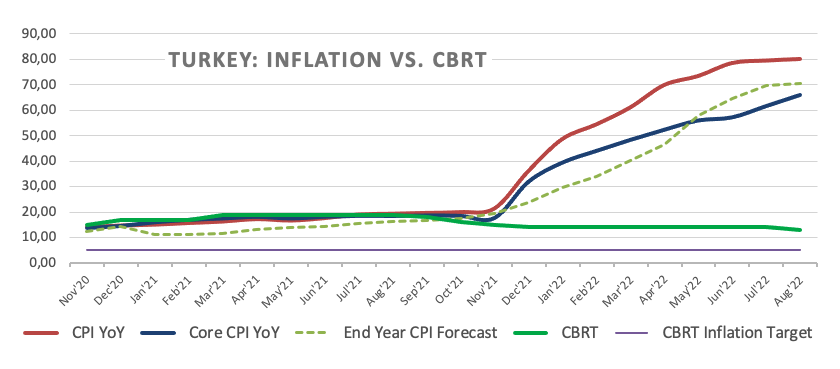

USD/TRY resumes the upside and approaches the all-time high

- USD/TRY fades Friday’s pullback and rises above 18.22.

- Türkiye’s Inflation Rate came at 80.21% YoY in August.

- Türkiye’s Producer Prices rose 143.75% YoY during last month.

The Turkish lira resumes its usual depreciation vs. the greenback and pushes USD/TRY back above the 18.22 level on Monday.

USD/TRY keeps targeting the 18.25 region and above

USD/TRY advances modestly above the 18.20 level at the beginning of the week, although keeping the prevailing multi-week consolidative phase well in place for yet another session.

The resumption of the bearish mood in the lira came after inflation figures in Türkiye rose 80.21% YoY in August, the highest pace since September 1998. On a monthly basis, consumer prices rose 1.46%.

In addition, Producer Prices rose 2.41% inter-month and 143.75% from a year earlier.

Over the weekend, the Medium Term Program updated the country’s economic targets for the 2023-2025 period and now sees inflation rising 65% in 2022, 24.9% next year, 13.8% in 2024 and 9.9% in 2025.

What to look for around TRY

USD/TRY flirted with all-time highs around 18.25 last Friday, keeping the uptrend well in place and entering the ninth consecutive month in the positive territory.

In the meantime, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate option to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Monday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.39% at 18.2233 and faces the immediate target at 18.2574 (2022 high September 2) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.6272 (55-day SMA) and finally 17.1903 (weekly low July 15).

-

13:05

OPEC+ JMMC recommends cutting oil output targets by 100K bpd in October – Reuters

Joint Ministerial Monitoring Committee (JMMC) of the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, has recommended cutting oil output targets by 100,000 barrels per day in October, Reuters reported on Monday, citing sources.

Market reaction

Crude oil prices edged higher on this headline. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $89.90, where it was up 3.3% on a daily basis. Similarly, the barrel of Brent was rising 3.4% on the day at $96.50.

-

12:55

EUR/USD is unlikely to stage a steady rebound

EUR/USD has steadied above 0.9900 following earlier decline. However, the pair remains vulnerable, FXStreet’s Eren Sengezer reports.

EUR/USD has more room on the downside

“Although the trading action is likely to remain muted in the second half of the day, the euro is unlikely to stage a steady rebound.”

“0.9900 (psychological level, static level) aligns as first support on the downside. With a drop below that level, EUR/USD could extend its slide toward 0.9875 (daily low) and 0.9800 (psychological level).”

“On the upside, first resistance is located at 0.9950 (static level) ahead of 0.9975 (20-period SMA, 50-period SMA) and 1.0000 (psychological level, Fibonacci 32.6% retracement of the latest downtrend).”

-

12:40

UK: Liz Truss wins contest to become the next UK Prime Minister

Liz Truss won the Conservative Party leadership race to become the next British Prime Minister.

"I will deal with long-term issues on energy supply," Liz Truss said in her acceptance speech and noted that she will deal with the crisis in households' energy bills.

Additional takeaways

"I will govern as a conservative."

"I intend to deliver what we promised voters in 2019."

"I will deliver a bold plan to cut taxes and grow our economy."

"We will deliver a great victory for the conservative party in 2024."

Market reaction

The UK's FTSE 100 Index showed no immediate reaction to these comments and was last seen losing 0.6% on a daily basis. Meanwhile, the GBP/USD pair continues to fluctuate at around 1.1500 during the European trading hours.

-

12:37

Further upside not ruled out in USD/IDR – UOB

USD/IDR looks poised to extend the uptrend although it faces a tough barrier around 14,990, according to FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We expected USD/IDR to break the declining trend-line resistance last week. Our view was not wrong as USD/IDR edged above the trendline last Friday (02 Sep) before rising sharply upon opening today. Rapid improvement in upward momentum suggests USD/IDR is likely to advance further.”

“For this week, USD/IDR is unlikely to challenge the resistance at 14,990. On the downside, support is at 14,840 followed by 14,790.”

-

12:12

EU Commission Spokesman: Russia is weaponizing its gas supplies to Europe

"If there was a technical problem which was impeding supplies via Nord Stream 1, there would be a possibility, if there was willingness, to deliver gas to Europe through other pipelines," a European Commission spokesperson said on Monday, as reported by Reuters.

"That's something we're not seeing happening," the spokesman added and noted that this was demonstrating the weaponization of energy by Russia.

Market reaction

These comments failed to trigger a noticeable market reaction. As of writing, the EUR/USD pair was down 0.25% on a daily basis at 0.9927.

-

12:01

Mexico Consumer Confidence s.a came in at 40.9, below expectations (42.5) in August

-

12:01

Mexico Consumer Confidence: 40.3 (August) vs previous 41.3

-

11:47

USD/CAD pares intraday gains, retreats to mid-1.3100s amid rising oil prices

- USD/CAD trims a part of its intraday gains, though the downside remains cushioned.

- Rising oil prices underpin the loonie and act as a headwind amid a modest USD pullback.

- Aggressive Fed rate hike bets favour the USD bulls and should lend support to the pair.

The USD/CAD pair builds on Friday's late rebound from the 1.3075 area and kicks off the new week on a positive note. The pair, however, struggles to capitalize on the move and trims a part of its strong intraday gains, retreating to mid-1.3100s during the first half of the European session.

Expectations that OPEC+ producers will cut production to support prices at a meeting later this Monday push crude oil prices higher. This, in turn, boosts the commodity-linked loonie and acts as a headwind for the USD/CAD pair. Apart from this, a modest US dollar pullback from a fresh two-decade high attracts some sellers near the 1.3175 region.

Signs of recovery in the risk sentiment - as depicted by a generally positive tone around the equity markets - prompt some profit-taking around the safe-haven greenback. That said, worries about a deeper global economic downturn should cap any optimism. This, along with hawkish Fed expectations, should help limit any meaningful USD corrective slide.

Despite Friday's mixed US monthly jobs report, investors seem convinced that the Fed will stick to its aggressive policy tightening path. In fact, the markets are currently pricing in a supersized 75 bps rate hike at the upcoming FOMC meeting on September 20-21. This remains supportive of elevated US Treasury bond yields and favours the USD bulls.

The fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the upside and any meaningful pullback might still be seen as a buying opportunity. Traders, however, might refrain from placing aggressive bets ahead of the OPEC meeting and amid relatively thin trading volumes on the back of the Labor Day holiday in the US.

Technical levels to watch

-

11:29

RBA could raise the OCR by 40 bps – UOB

Economist at UOB Group Lee Sue Ann suggest the RBA could hike the OCR by 40 bps at its meeting on Tuesday.

Key Quotes

“Following the 50bps hike in Aug, the RBA is expected to continue pushing interest rates higher. We believe the RBA can afford to raise the OCR by a further 40bps to 2.25% at the Sep meeting, given the extremely tight labour market and soaring inflation.”

“From there, we believe the RBA will remain data dependent, monitoring the impact of higher interest rates, particularly on household spending, inflation, and wages.”

-

10:46

AUD/USD hangs near its lowest level since mid-July, focus shifts to RBA decision on Tuesday

- AUD/USD is seen oscillating in a narrow trading range below the 0.6800 mark on Monday.

- Bets for aggressive Fed rate hikes lift the USD to a two-decade high and act as a headwind.

- Relatively thin trading volumes limit the downside ahead of the RBA meeting on Tuesday.

The AUD/USD pair struggles to gain any meaningful traction on Monday and oscillates in a narrow trading band through the first half of the European session. The pair is currently placed around the 0.6780 region, just a few pips above its lowest level since mid-July touched on Friday.

The US dollar hits a fresh two-decade high on the first day of a new week and turns out to be a key factor acting as a headwind for the AUD/USD pair. Despite Friday's mixed US jobs report, expectations that the Fed will stick to its aggressive policy tightening path continue to underpin the greenback. In fact, the markets are pricing in a greater chance of a supersized 75 bps rate hike at the next FOMC meeting on September 20-21.

That said, the better-than-expected Chinese service sector activity report, along with signs of stability in the equity markets, offers some support to the risk-sensitive aussie. Apart from this, relatively thin liquidity conditions on the back of the Labor Day holiday in the US help limit the downside for the AUD/USD pair. Investors also seem reluctant ahead of the central bank event risk - the Reserve Bank of Australia (RBA) meeting.

The RBA is scheduled to announce its decision during the Asian session on Tuesday and is widely expected to continue to raise the cash rate gains. Investors, however, remain divided over the size of the rate hike. Hence, the focus will be on the accompanying monetary policy statement, which will be looked upon for clues if the Australian central bank will continue to normalise rates amid worries about a deeper global economic downturn.

This, in turn, will play a key role in influencing the Australian dollar and help determine the near-term trajectory for the AUD/USD pair. In the meantime, spot prices are more likely to prolong the range-bound price action. The fundamental backdrop, however, favours bearish traders, though a sustained break below the 0.6775-0.6770 support is needed to confirm the negative bias.

Technical levels to watch

-

10:39

USD/THB could revisit the 36.95 major hurdle – UOB

FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research suggested further upside lies ahead for USD/THB.

Key Quotes

“Last Monday (29 Aug, spot at 36.42), we highlighted that ‘the rapid improvement in momentum suggests USD/THB could strengthen further’. However, we were of the view ‘July’s high at 36.95 is unlikely to come into the picture’. Our view turned out to correct as USD/THB rose to a high of 35.85 last Friday (02 Sep). Shorter-term conditions are deeply overbought but upward momentum remains strong.”

“For this week, USD/THB could rise above 36.95 but in view of the overbought conditions, it is unlikely able to maintain a foothold above this major resistance level. The next resistance at 37.15 is unlikely to come into the picture. Support is at 36.60 followed by the rising trend-line support, currently at 36.31. The rising trend-line support is unlikely to come under threat, at least for this week.”

-

10:24

Kremlin on Nord Stream shutdown: Gas transportation problems arose due to sanctions by western countries

Speaking on the Nord Stream 1 pipeline shutdown, the Kremlin said on Monday that “the only turbine left is malfunctioning, that leads to stoppages.”

“Gas transportation problems arose because of sanctions introduced by western countries,” Kremlin added.

Market reaction

EUR/USD shrugs off the Kremlin statement, as it is trading at 0.9912, down 0.36% on the day, as of writing.

-

10:15

PBOC: Will cut FX reserve requirement ratio to help limit yuan weakness

The People's Bank of China (PBOC) said in an online statement on Monday that it would cut the foreign exchange reserve requirement ratio (RRR) by 200 basis points (bps) to 6% from 8% beginning September 15, per Reuters.

The central bank said that the move is aimed at slowing the pace of the yuan's recent depreciation and improving the forex capital capacity of financial institutions.

Market reaction

USD/CNY is largely unchanged on the above headlines, keeping its range around 6.9320, up 0.48% on the day.

-

10:01

Eurozone Retail Sales drop 0.9% YoY in July vs. -0.7% expected

- Eurozone Retail Sales stood at 0.3% MoM in July vs. 0.4% expected.

- Retail Sales in the bloc arrived at -0.9% YoY in July vs. -0.7% expected.

Eurozone’s Retail Sales rose by 0.3% MoM in July versus 0.4% expected and -1.0% last, the official figures released by Eurostat showed on Monday.

On an annualized basis, the bloc’s Retail Sales came in at -0.9% in July versus -3.2% recorded in June and -0.7% estimated.

FX implications

The euro is defending 0.9900 on the downbeat Eurozone data. At the time of writing, the major is trading at 0.9907, down 0.43% on the day.

About Eurozone Retail Sales

The Retail Sales released by Eurostat are a measure of changes in sales of the Eurozone retail sector. It shows the performance of the retail sector in the short term. Percent changes reflect the rate of changes of such sales. The changes are widely followed as an indicator of consumer spending. Usually, positive economic growth anticipates "Bullish" for the EUR, while a low reading is seen as negative, or bearish, for the EUR.

-

10:00

European Monetary Union Retail Sales (MoM) below forecasts (0.4%) in July: Actual (0.3%)

-

10:00

European Monetary Union Retail Sales (YoY) below expectations (-0.7%) in July: Actual (-0.9%)

-

09:56

USD/JPY sticks to gains near mid-140.00s, just below 24-year peak amid stronger USD

- USD/JPY catches fresh bids on Monday and inches back closer to a 24-year peak.

- A broad-based USD strength and the Fed-BoJ policy divergence remain supportive.

- Bulls seem reluctant amid thin trading volumes on the back of a holiday in the US.

The USD/JPY pair attracts fresh buying on the first day of a new week and maintains its bid tone through the first half of the European session. The pair is currently around the 140.50-140.55 region, just a few pips below a 24-year peak touched on Friday.

The US dollar hits a new two-decade high and turns out to be a key factor acting as a tailwind for the USD/JPY pair. Despite the mixed US jobs report released on Friday, firming expectations that the Fed will continue with its aggressive policy tightening remains supportive of the underlying strong bullish sentiment surrounding the USD.

In fact, the current market pricing suggests a greater chance of a supersized 75 bps Fed rate hike at the September meeting. In contrast, the Bank of Japan remains committed to its ultra-loose monetary policy stance. The resultant Fed-BoJ policy divergence continues to undermine the Japanese yen and offers additional support to the USD/JPY pair.

Furthermore, signs of stability in the equity markets could further dent demand for the safe-haven JPY and support prospects for an extension of over a three-week-old uptrend. Investors, however, seem reluctant amid relatively thin liquidity conditions on the back of the Labor Day holiday in the US and slightly overbought RSI on the daily chart.

Nevertheless, the fundamental backdrop remains tilted firmly in favour of bullish traders. This, in turn, suggests that any meaningful pullback could be seen as a buying opportunity and is more likely to remain limited.

Technical levels to watch

-

09:53

Eurozone Sentix Investor Confidence deteriorates to -31.8 in Sept vs. -27.5 expected

The Eurozone Sentix Investor Confidence index came in at -31.8 in September from -25.2 in August vs. -27.5 expected. The index snapped its recovery amid mounting recession fears.

The current situation in the eurozone dropped to -31.8 points in September from -25.2 in August.

An expectations index tumbled to -37.0, which was the lowest since December 2008.

Key takeaways

“Never before in more than 20 years of history, with the exception of the financial crisis in 2008, have investors' assessments of the eurozone economy been so weak - and at the same time expectations have been so low.”

"At the moment, there are no signs of monetary aid similar to the central bank response after the economic collapse caused by the coronavirus pandemic in 2020.”

EUR/USD reaction

The shared currency fails to show any reaction to the Eurozone Sentix data. EUR/USD is trading at 0.9911, down 0.39% on the day.

-

09:44

GBP/USD: Sellers to dominate the action unless 1.1550 turns into support

GBP/USD has managed to erase a large portion of its daily losses after having dropped to its weakest level since March 2020. But bearish bias stays intact below 1.1550, FXStreet’s Eren Sengezer reports.

Sellers are likely to retain control as long as 1.1550 resistance holds

“Liz Truss is widely expected to win the Conservative Party leadership race. The market action is likely to be muted because participants want to see what the new PM will do to help households amid surging energy costs. Moreover, Brexit remains an unresolved issue that is likely to make it difficult for the pound to stage a decisive rebound.”

“In case cable stages a technical correction, 1.1500 (psychological level, static level) forms interim support before 1.1550 (static level, the upper limit of the descending regression channel, 20-period SMA). If the latter turns into support, additional recovery gains toward 1.1600 (static level, psychological level) could be witnessed.”

“On the downside, 1.1450 (daily low) aligns as next support ahead of 1.1400 (psychological level, lower limit of the descending channel).”

-

09:30

United Kingdom S&P Global/CIPS Services PMI below expectations (52.5) in August: Actual (50.9)

-

09:30

European Monetary Union Sentix Investor Confidence below forecasts (-27.5) in September: Actual (-31.8)

-

09:30

United Kingdom S&P Global/CIPS Composite PMI registered at 49.6, below expectations (50.9) in August

-

09:25

GBP/USD remains on the defensive below 1.1500 mark ahead of UK PM results

- GBP/USD drops to its lowest level since March 2020 and is pressured by a combination of factors.

- The UK’s gloomy economic outlook undermines the British pound amid a broad-based USD strength.

- Traders await the announcement of the UK Prime Minister amid relatively thin liquidity conditions.

The GBP/USD pair kicks off the new week on a weaker note and hits a fresh low since March 2020 during the early European session. Spot prices, however, manage to rebound a few pips, though remain on the defensive below the 1.1500 psychological mark.

The British pound continues to be weighed down by a bleak outlook for the UK economy and uncertainty over the economic policies of the next British Prime Minister. The recent surge in energy prices has raised concerns over the UK cost of living crisis and intensified fears of a deeper economic downturn. The worries were further fueled by the latest forecast from the British Chambers of Commerce (BCC), which expects the UK economy to record three consecutive quarters of contraction this year.