Notícias do Mercado

-

20:58

United Kingdom CFTC GBP NC Net Positions dipped from previous £-46.4K to £-49.5K

-

20:58

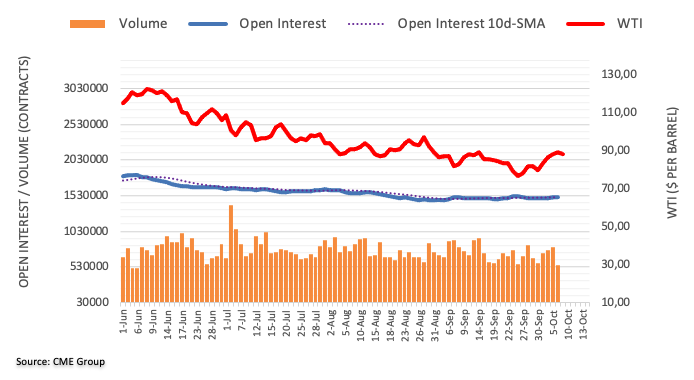

United States CFTC Oil NC Net Positions: 242K vs 226.1K

-

20:58

United States CFTC Gold NC Net Positions rose from previous $52.1K to $88.4K

-

20:58

European Monetary Union CFTC EUR NC Net Positions rose from previous €33.8K to €43.7K

-

20:58

Australia CFTC AUD NC Net Positions climbed from previous $-34.7K to $-27.8K

-

20:57

Japan CFTC JPY NC Net Positions up to ¥-81.6K from previous ¥-82.6K

-

20:56

United States CFTC S&P 500 NC Net Positions dipped from previous $-150.2K to $-209.3K

-

20:02

United States Consumer Credit Change above forecasts ($25B) in August: Actual ($32.24B)

-

18:04

United States Baker Hughes US Oil Rig Count dipped from previous 604 to 602

-

17:03

Russia Consumer Price Index (MoM) registered at 0.1% above expectations (-0.1%) in September

-

16:40

GBPUSD at a brink of collapsing, eyes on the 1.1000 threshold

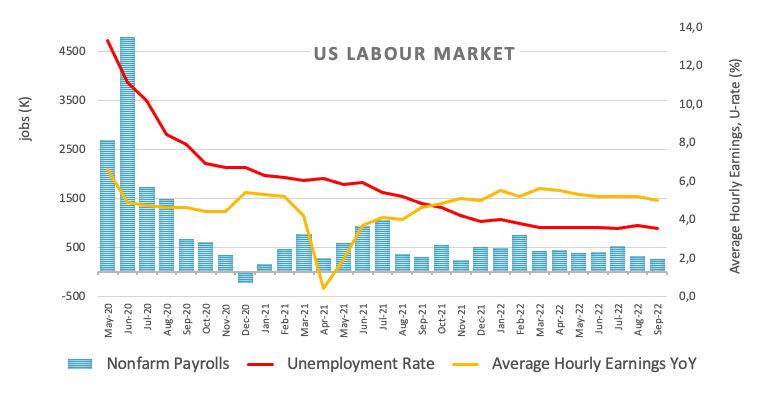

- The US Nonfarm Payroll report showed that the country added 265K jobs in September.

- Wall Street holds on to intraday losses but pared the bleeding.

- GBP/USD cannot bounce ahead of the weekly close, hinting at more pain ahead.

Following the US monthly employment report, the American dollar rallied, pushing GBP/USD down to an intraday low of 1.1089. According to the Bureau of Labor Statistics, the country added 265K new jobs in September, beating expectations, while the Unemployment Rate unexpectedly slid to 3.5%. The strength in the sector left the path clear for the US Federal Reserve to keep hiking rates at the whopping pace of 75 bps per meeting.

The greenback’s rally lost steam after Wall Street’s opening, as stocks hold on to pre-opening losses without extending their slumps. Some profit-taking ahead of the weekend has helped major pairs to bounce, but that’s not the case for GBP/USD, which currently battles to retain the 1.1100 threshold.

GBP/USD technical outlook

The GBP/USD pair is down for a third consecutive day and not far away from the weekly low posted on Monday at 1.1085. Technical readings in the near-term support a bearish continuation in the near term, particularly if the pair pierces the mentioned weekly low. The next relevant support level is 1.1024, September 30 daily low.

Chances of recovery are pretty much null, although a corrective advance may surge if the pair recovers beyond the 1.1130 price zone.

-

16:31

EUR/USD rebounds from weekly lows, stays below 0.9800

- EUR/USD fell sharply with the initial reaction to US jobs report.

- Nonfarm Payrolls in the US rose by 263K in September.

- The pair remains on track to end the week little changed.

EUR/USD managed to erase a large portion of its daily losses but lost its recovery momentum before reaching 0.9800. As of writing, the pair was down 0.1% on a daily basis at 0.9780. Following the latest price action, EUR/USD remains on track to end the week flat.

Dollar capitalizes on upbeat NFP

Earlier in the day, the data published by the US Bureau of Labor Statistics revealed that Nonfarm Payrolls rose by 263,000 in September. This print came in better than the market expectation for an increase of 250,000 and helped the dollar outperform its rivals. Additionally, the Unemployment Rate declined to 3.5% from 3.7%.

With the initial reaction, the US Dollar Index (DXY) jumped to a daily high of 112.82 and forced EUR/USD to drop to a weekly low of 0.9726. Week-end flows and profit-taking, however, seem to be limiting the dollar's gains with the DXY retreating below 112.50 toward the London fix.

Meanwhile, Wall Street's main indexes are trading deep in negative territory, making it difficult for EUR/USD to stretch higher. At the time of press, the Nasdaq Composite and the S&P 500 indexes were both losing more than 2% on the day.

Technical levels to watch for

-

15:52

USD/CAD could reach 1.40 before falling back to 1.32 next year – CIBC

The Canadian dollar is set to see modest weakening in the fourth quarter as the Federal reserve outguns the Bank of Canada (BoC). But the loonie is expected to gain ground in 2023 as the USD falls out of favour, economists at CIBC Capital Markets report.

CAD to weaken, before following the pack stronger in 2023

“The Fed’s hawkish announcement in late September and general risk aversion has sent the USD on a broadly stronger trajectory, and the loonie has depreciated as a result. There's likely more of the same to come, given a gap opening up in where policy rates will peak, and soft global growth favouring the USD and capping any upside for commodities.”

“A run to 1.40 is quite possible, and a rebound at year end should still see CAD in 1.38 territory.”

“In 2023, we see scope for a broad softening in the USD as the Fed pauses hiking below current market expectations, which will see CAD end the year stronger, with USD/CAD at 1.32.”

“The loonie could still end 2024 stronger, with USD/CAD at 1.28, helped by expectations for a pickup in global growth and commodity prices in 2025 that would benefit Canada's export sector.”

-

15:43

Turkey Treasury Cash Balance: -79.26B (September) vs previous 28.73B

-

15:30

NFP unlikely to sway the USD one way or the other – TDS

The September employment gain was not too far off relative to consensus. NFP should be broadly neutral for the USD at this time, in the opinion of economists at TD Securities.

USD/JPY above 145 risks yen-tervention

“We do not think today's report will do much to sway the USD one way or the other. At a minimum, markets will likely have to wait until the upcoming CPI report to stake a bigger claim in direction.”

“We continue to see USD resilience into year-end. The currency we think that is most vulnerable to the USD wrecking ball is the CAD given its very awful household debt servicing outlook.”

“We are wary that a move above 145 in USD/JPY will compel FX intervention, which could be more likely given upcoming CPI (especially if stronger). That could introduce temporary USD drag. Nonetheless, the USD remains best in class, and we look to accumulate on dips.”

-

15:17

USD/CAD set to extend its drop below 1.3690 support – Scotiabank

The loonie firms modestly ahead. Economists at Scotiabank expect the USD/CAD pair to slide below 1.3690 in the near-term.

Broader outlook is somewhat mixed

“USD/CAD cast a marginally negative look to the very short-term charts, with the USD testing the 1.3750 twice before edging lower. That trend rather implies modest downside prospects for the USD in early trade below 1.3690 support, from a purely technical perspective.”

“The broader outlook is somewhat mixed, with the USD holding above the 1.36 area that we think is pivotal for the trend in the short run but holding a net loss on the week so far, suggesting stiff-ish resistance in the low/mid 1.38s remains.”

-

15:02

US Dollar Index to see a final push stronger towards the 121.02 high of 2001 – Credit Suisse

Economists at Credit Suisse stay core bullish on the US dollar and see scope for a potentially final push higher later on in the fourth quarter.

USD rally is seen overdone near-term

“The latest move to a new cycle high for the DXY has not been confirmed by weekly momentum, suggesting a trend that is tiring. Whilst we maintain our core and long-held bullish outlook, we think early Q4 can see a consolidation phase unfold, before a potentially final push stronger in the USD for a move to 118.37 in the DXY, potentially the 121.02 high of 2001.”

“Good support is seen at 109.29 through to 107.68, which is a cluster of levels including the 55-day average, 23.6% retracement of the entire 2021/2022 uptrend and September low which we look to ideally prove a solid floor. Should weakness extend (not our base case), we would expect strong support next at 105.01/104.64.”

-

15:00

United States Wholesale Inventories above expectations (1.1%) in August: Actual (1.3%)

-

14:51

NZD/USD finds some support near 0.5600 mark, seems vulnerable amid bullish USD

- NZD/USD descends to a multi-day low amid the upbeat NFP-inspired modest USD strength.

- The US economy added 263K jobs in September and the unemployment rate falls to 3.5%.

- The data reaffirms Fed rate hike bets and favours the USD bulls amid the risk-off mood.

The NZD/USD pair comes under some selling pressure during the early North American session and drops to a four-day low following the release of the US labour market data. The pair, however, recovers a few pips and is currently trading with modest intraday losses, just below mid-0.5600s.

The US dollar hits a fresh weekly high in reaction to the upbeat US NFP report, which, in turn, exerts some downward pressure on the NZD/USD pair. The closely-watched jobs data showed that the unemployment rate unexpectedly fell to 3.5% in September from 3.7%. Furthermore, the US economy added more-than-anticipated, 263K new jobs during the reported month.

The data lifted bets for another supersized 75 bps Fed rate hike move in November, which is evident from a fresh leg up in the US Treasury bond yields. This, along with the prevalent risk-off mood, is seen underpinning the safe-haven buck and driving flows away from the risk-sensitive kiwi. The NZD/USD pair, however, find some support near the 0.5600 mark.

The lack of follow-through selling warrants some caution for bearish traders and before positioning for any further decline. That said, any meaningful recovery still seems elusive amid the prospects for a more aggressive policy tightening by the Fed. This, along with recession fears, suggests that the path of least resistance for the NZD/USD pair is to the downside.

Technical levels to watch

-

14:49

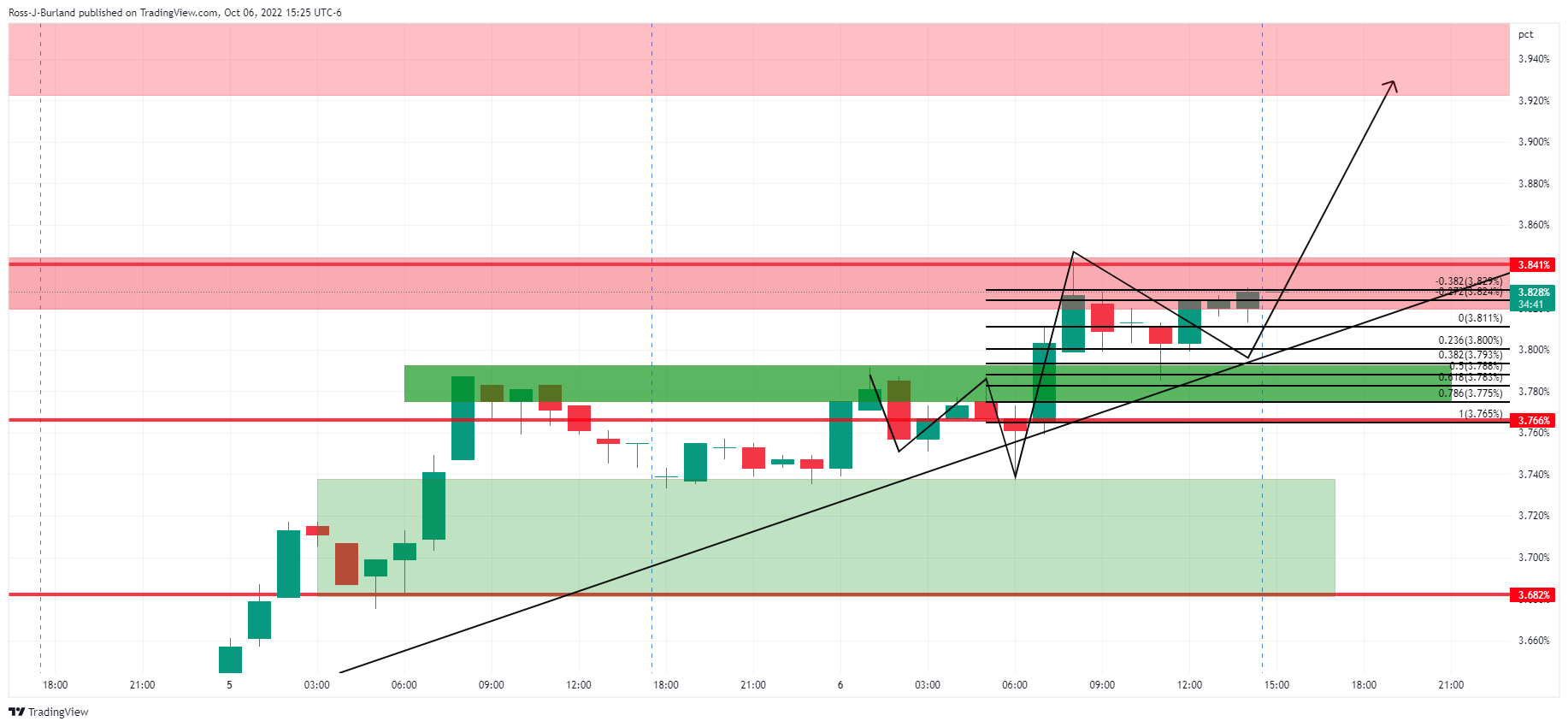

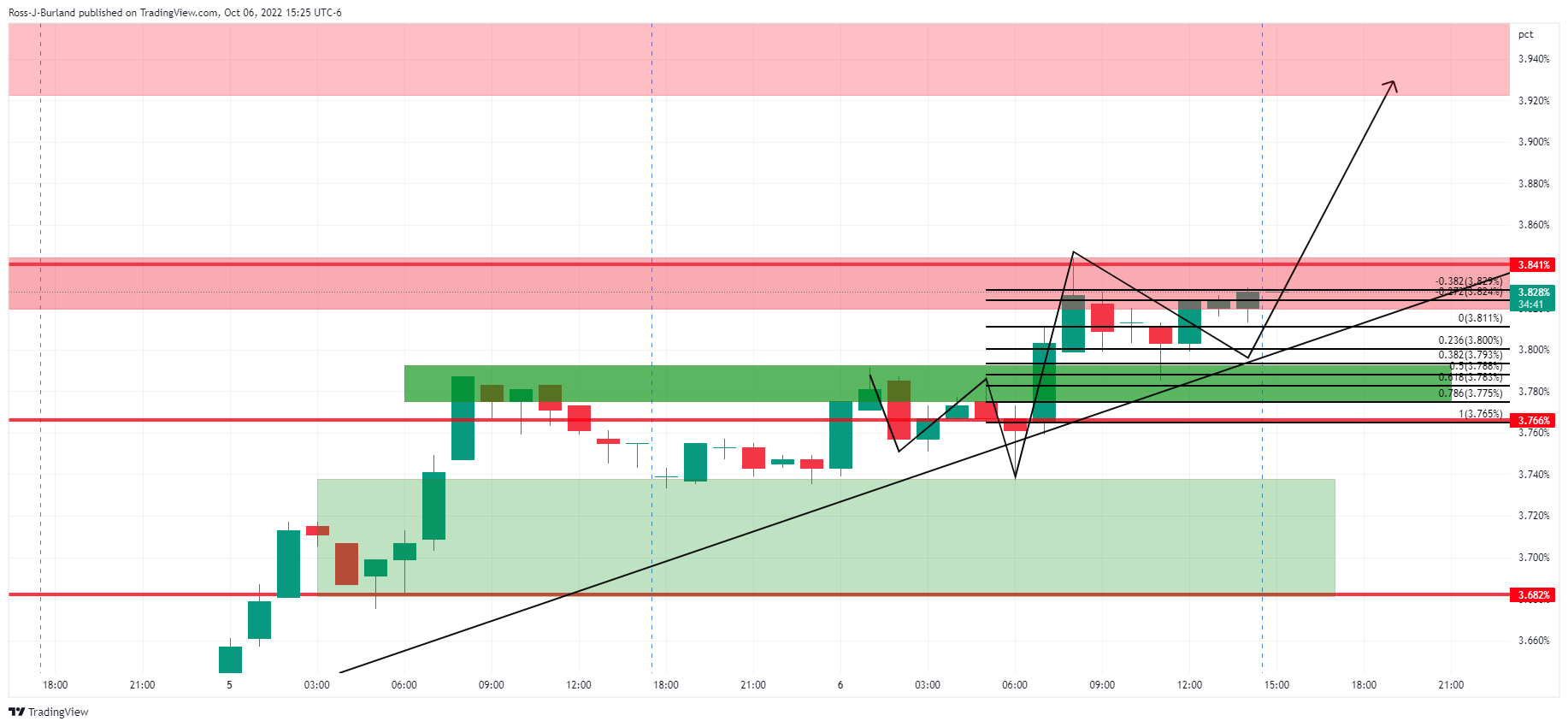

USD/CHF fails to break key resistance around 0.9960 after NFP

- Non-farm payroll rise by 263K in September, in line with expectations.

- US dollar rises across the board, as US yields soar.

- USD/CHF jumps to test recent highs around 0.9950 and retreats.

Boosted by a rally of the US dollar following the NFP, the USD/CHF pair rose to test the 0.9950/60 key resistance area and then pulled back. The pair hit a weekly high at 0.9953 and then retreat to 0.9915.

The zone around 0.9950/60 continues to be a critical support that capped the upside last week and also on Friday. A consolidation above could trigger more gains for the dollar. While as long as it remains below, the Swiss franc could recover ground. The immediate support is seen at 0.9915 followed by 0.9875 and then the weekly low at 0.9780.

After the report, US yields jumped with the 2-year approaching the top, near 4.35% and the 10-year hitting levels above 3.90%. The DXY jumped to 112.83, a fresh weekly high and then pulled back, trimming gains. It is up by just 0.25%, hovering around 112.50.

NFP cooled in September, job market still strong

The US Labor Department reported on Friday that the jobs in the US economy (Non-farm payrolls) rose by 263K in September, above estimates of 250K. The Unemployment Rate dropped unexpectedly from 3.7% to % to 3.5%.

“The unemployment rate returned to a 50-year low of 3.5% through a combination of solid job growth and a roughly flat labor force. Wage growth moderated slightly but remains well above rates that are consistent with the Fed's 2% inflation target. We continue to look for the FOMC to hike its policy rate by 75 bps at its November meeting”, explained analysts at Wells Fargo.

Despite Monday’s US holiday (Columbus Day), next week’s calendar is busy with the FOMC minutes on Wednesday, CPI on Thursday and retail sales on Friday. Those numbers will likely weigh on expectations about Fed’s monetary policy.

Technical levels

-

14:40

USD/TRY pushes higher and flirts with 18.6000

- USD/TRY trades at shouting distance from 18.6000.

- The lira loses ground for the 10th month in a row so far.

- US Nonfarm Payrolls came in above estimates in September.

Further gains in the dollar keeps USD/TRY bid and closer to the 18.6000 level at the end of the week.

USD/TRY bid on USD-strength

USD/TRY keeps the upbeat note well in place in the second half of the week and appears further bid amidst the continuation of the weekly recovery in the greenback.

Indeed, another solid print of US Nonfarm Payrolls (+263K) coupled with a drop in the jobless rate and higher US yields lend extra wings to the buck and collaborates with the relentless upside in spot.

It is worth noting that the pair has so far entered the 10th consecutive month with gains. Furthermore, spot only printed monthly gains in only four months since 2021 (January, July, August and December 2021).

On another front, news cited South Korea transferred $780M to the Turkish central bank (CBRT) last week as part of a swap deal worth $2 billion and signed back in 2021. Furthermore around the central bank, net FX reserves rose to around $9.70B by September 30 vs. a 2-decade low of just above $6B recorded in July.

What to look for around TRY

USD/TRY keeps navigating the area of all-time tops near 18.60 amidst the combination of omnipresent lira weakness and the renewed bid bias in the dollar.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: CPI, Producer Prices, Manufacturing PMI (Monday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.7% at 18.5866 and faces the next hurdle at 18.5908 (all-time high October 4) followed by 19.00 (round level). On the downside, a break below 18.1451 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

14:35

USD/CAD will inevitably trade higher towards 1.40 – TDS

Dual US and CA employment reports largely delivered on consensus expectations – leaving a broadly neutral impact on the USD. But economists at TD Securities expect USD/CAD to edge higher towards 1.40.

Looking to 1.40 as the next major target

“The takeaway is that while both reports show signs of some moderation in the labour market, we think the impact on the USD is broadly neutral at this time.”

“USD/CAD is likely to make another lurch higher, but the market may need to wait for US and maybe CA CPI before securing a new YTD high.”

“We see strong support to buy into USDCAD dips around 1.3600/40. A push above 1.38 will re-open 1.40 risk. We think we will need a bit more time to get there but nonetheless, the destination remains up.”

-

14:23

USD/JPY slides below 145.00 following a positive US jobs report

- The US economy added 263K jobs to the economy while the unemployment rate ticked lower.

- The USD/JPY dived towards 144.66 following the US NFP release and recovered some ground.

- The US 10-year T-bond yield edges towards 3.90%, usually a tailwind for USD/JPY traders, which remain cautious after September’s BoJ intervention.

USD/JPY remains subdued after US employment data unexpectedly surprised market participants, with the US economy adding more jobs than economists estimated. At the time of writing, the USD/JPY is trading at around 144.90s, below its opening price.

Data revealed by the US Labor Department reported that Nonfarm Payrolls increased by 263K, above estimates of 250K, while the Unemployment Rate headed south from 3.7% to 3.5%, putting additional pressure on the Federal Reserve. Given Fed official’s expressions throughout the last week, speaking about the tightness of the Labor market, September’s jobs report would likely justify another three-quarter percent (0.75%) rate hike.

Before the US employment data hit traders’ screens, the Fed’s chances of a 75 bps rate hike were at 85.5%. After the report, it increased to 92%.

Elsewhere, the US Dollar Index, a gauge of the buck’s value against a basket of peers, extended its gains by 0.31%, at 112.636. Notably, the greenback made a U-turn and is positive in the week by 0.40%.

US Treasury bond yields jumped upwards, with the US 10-year Treasury bond yield advancing six bps, at 3.895%, a tailwind for the USD/JPY.

However, the USD/JPY uptrend was capped by the 145.00 line in the sand imposed on September 22 by the Bank of Japan (BoJ) intervention in the markets. Of note, the USD/JPY fluctuated in the 144.63-145.34 range after the US NFP release.

What to watch

Next week’s US economic docket will reveal inflation figures for September, namely the Consumer Price Index (CPI), alongside the University of Michigan Consumer Sentiment.

USD/JPY 1-hour Chart

USD/JPY Key Technical Levels

-

14:19

S&P 500 Index: Clear break below 3595 to open up further falls to 3235/3195 – Credit Suisse

S&P 500 is expected to see a recovery phase. But an eventual sustained break lower is expected in Q4, with 3235/3195 as the level targeted by the Credit Suisse analyst team.

S&P 500 could enjoy a temporary recovery phase

“Although our broader outlook stays bearish, we continue to look for a temporary recovery phase to emerge for the first part of Q4, especially given bullish momentum divergences. Post this anticipated strength though, we look for a sustained move below 3595 in due course, for a fall to our core target of a cluster of supports at 3235/3195.”

“A triple weekly RSI momentum divergence suggests early Q4 should see a temporary recovery phase.”

-

14:07

AUD/USD hangs near YTD low, below 0.6400 as upbeat US jobs data lifts USD

- AUD/USD slides back below the 0.6400 mark amid the emergence of some USD buying.

- The upbeat US NFP report reaffirms Fed rate hike bets and boosts demand for the buck.

- The prevalent risk-off mood is exerting additional pressure on the risk-sensitive aussie.

The AUD/USD pair struggles to capitalize on its modest intraday bounce and attracts fresh sellers near the 0.6430 region during the early North American session. Spot prices slide further below the 0.6400 mark in reaction to the upbeat US jobs data and move well within the striking distance of the lowest level since April 2020 touched last week.

The US dollar catches some bids and hits a fresh weekly high after the closely watched US NFP report showed that the unemployment rate unexpectedly to 3.5% in September from 3.7% previous. Additional details revealed that the US economy added 263K new jobs during the reported month, beating consensus estimates for a reading of 250K. The data all but reaffirmed expectations that the Fed will stick to its aggressive policy tightening and continues to underpin the USD, which, in turn, is seen exerting some pressure on the AUD/USD pair.

The prospects for faster interest rate hikes by the US central bank trigger a fresh leg up in the US Treasury bond yields. This, along with the risk-off mood, boosts demand for the safe-haven buck and contributes to driving flows away from the risk-sensitive aussie. The market sentiment remains fragile amid worries about the economic headwinds stemming from rapidly rising borrowing costs and geopolitical risk. Moreover, a less hawkish Reserve Bank of Australia supports prospects for a further depreciating move for the AUD/USD pair.

Furthermore, acceptance below the 0.6400 mark could be seen as a fresh trigger for bearish traders. Hence, a subsequent slide back towards challenging the YTD low, around the 0.6365 region, remains a distinct possibility. The downward trajectory could further get extended and make the AUD/USD pair vulnerable to test the next relevant support near the 0.6300 round figure.

Technical levels to watch

-

14:03

Near-term pressures on EM FX to persist, but scope for some recovery next year – TDS

EM FX is vulnerable to further pressure in the short term. Nonetheless, economists at TD Securities see scope for some recovery in 2023.

Deterioration in external positions to limit gains

“While near-term pressures on EM FX will likely persist, we see scope for some recovery next year. We see particularly strong recoveries in BRL, ZAR, PLN and HUF.”

“Our expectation that the USD will lose ground next year will bode well for EM FX, helping to reverse the downward pressure that has been in place over recent months. Higher real rates will also provide some support to many EM FX.”

“However, we are cognisant of a deterioration in external positions across EM suggesting that EM FX will find it difficult to recover significantly even against the background of a softer USD profile.”

-

14:00

USD/CAD rises toward daily highs boosted by the USD after employment reports

- US payrolls rise by 263K against expectations of 250K.

- Canada: Net change in employment during September 21K vs 20K.

- Loonie drops versus the dollar, although it hits fresh daily highs against most of its rivals.

- USD/CAD rises toward daily highs amid a stronger dollar.

The USD/CAD climbed from 1.3722 to 1.3760, matching the daily highs following the September employment reports from Canada and the US. Both showed better-than-expected numbers. The dollar rose across the board but also the loonie, although at a slower pace.

Positive reports in Canada and the US

The US official employment report showed non-farm payrolls rose by 263K in September, above the 250K expected. The unemployment rate dropped unexpectedly from 3.7% to 3.5%.

In Canada, net change in employment was positive by 21.1K during September, in line with market consensus. The unemployment rate fell from 5.4% to 5.2%, with the participation rate falling from 64.8% to 64.7%.

The greenback rose after the figures, boosted by higher US yields. The US 10-year yield is at 3.90%, while the 2-year reached 4.34%, a few points below the cycle highs.

Despite the dollar’s strength, so far USD/CAD remains in the range between 1.3760 and 1.3705, still undecided. The loonie printed fresh highs versus currencies like AUD, NZD, GBP and EUR after the report.

Technical levels

-

13:52

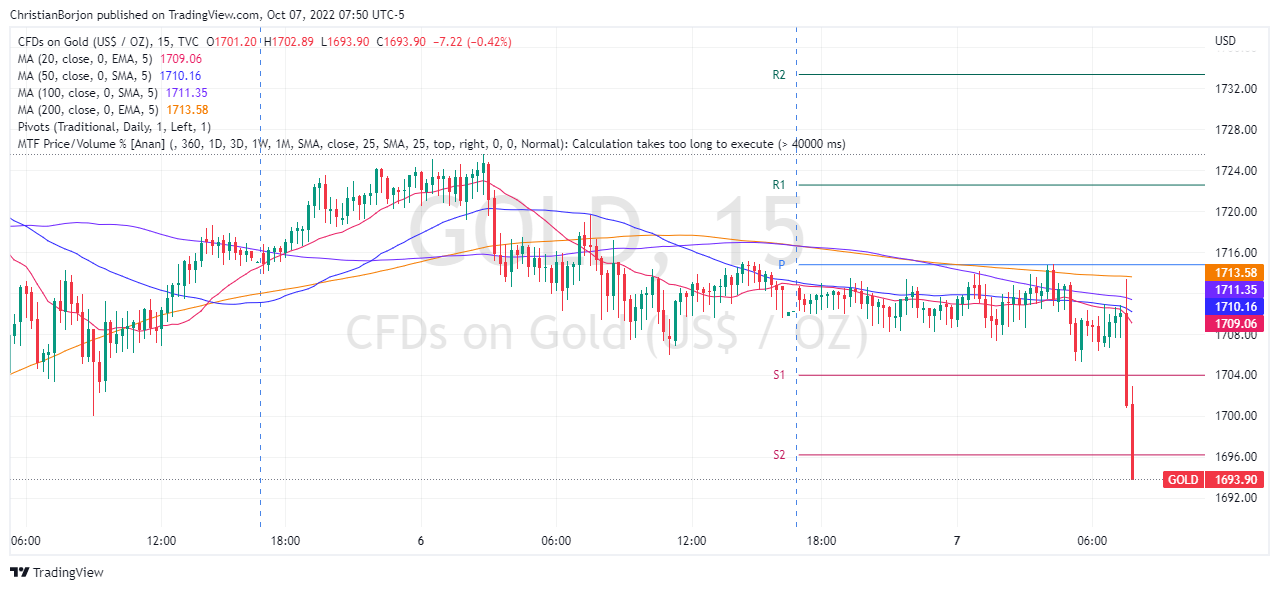

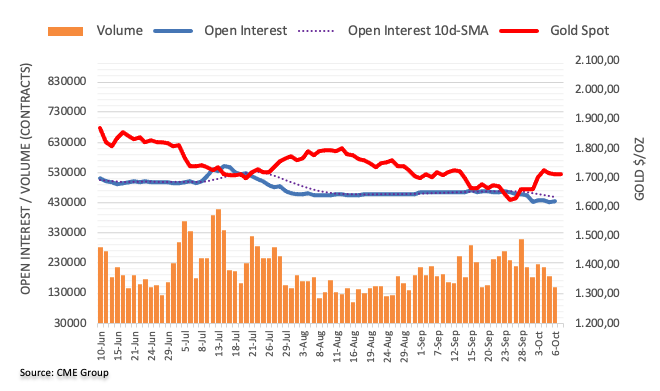

Gold Price Forecast: XAU/USD plunges below $1700 after upbeat US NFP, next CPI

- The gold price tumbled below the $1700 figure, in the aftermath of the US jobs report.

- US Nonfarm Payrolls exceeded estimates at 263K, further Fed hikes coming.

- US Treasury bond yields pushed to the upside, staying above 3.80%.

Gold price dropped after the US Labor Department reported employment figures, which exceeded estimations, justifying the Fed’s need for further tightening, bolstering the greenback. Therefore, XAU/USD is trading at around $1690, below its opening price.

Before the US Nonfarm Payrolls report was released, the yellow metal meandered around $1710. However, once the headline crossed newswires, gold’s initial reaction slid towards the $1700 region, but the initial move dissipated. Nevertheless, at the time of typing, it extended its losses below $1700 in a volatile reaction.

US Data reported by the US Bureau of Labor Statistics (BLS), showed that the US economy added 263K new jobs, smashing estimations of 250K, while the Unemployment Rate ticked lower to 3.5%, from 3.7% expectations. Even though it is a lower reading than August’s figures, it was above estimates, which would further cement the case for e Federal Reserve rate hike.

In the meantime, money market futures have priced in a 92% chance of a Fed 75 bps rate hake, up from 85.5%, before the US Nonfarm Payrolls report.

US Treasury bond yields pushed to the upside, with the US 10-year Treasury bond yield advancing three bps, at 3.865%, while the US Dollar Index, a gauge of the buck’s value vs. six currencies, is up 0.28%, at 112.565.

What to watch

Now that the US Nonfarm Payrolls report is on the rearview mirror, the next important events in the US calendar would be September CPI figures and the University of Michigan Consumer Sentiment in the next week.

Gold 5-minute Chart

Gold Key Technical Levels

-

13:49

Canada: Unemployment Rate declines to 5.2% in September vs. 5.4% expected

- Unemployment Rate in Canada declined unexpectedly in September.

- USD/CAD continues to trade in daily range above 1.3700.

The Unemployment Rate in Canada declined to 5.2% in September from 5.4% in August with the Net Change in Employment coming in at 21.1K, slightly better than the market expectation of 20K, the data published by Statistics Canada showed.

"Year-over-year wage growth remained above 5% for a fourth consecutive month, with the average hourly wages of employees rising 5.2% (+$1.57 to $31.67) compared with September 2021 (not seasonally adjusted)," the publication further read.

Market reaction

The Canadian dollar managed to stay resilient against the greenback, which has started to gather strength on the upbeat Nonfarm Payrolls report. As of writing, USD/CAD was flat on the day at 1.3745.

-

13:43

GBP/USD turns lower, flits with daily low amid the post-NFP modest USD strength

- GBP/USD drops back closer to the daily low amid the emergence of fresh USD buying.

- The upbeat US NFP data reaffirms Fed rate hike bets and acts as a tailwind for the buck.

- Concerns about the UK’s fiscal policy weigh on the GBP and contribute to the downtick.

The GBP/USD pair meets with a fresh supply during the early North American session and slides back closer to the daily low, below mid-1.1100s in reaction to the upbeat US employment details.

The US dollar reverses an intraday dip and climbs to a fresh weekly high after the headline NFP report showed that the US economy added 263K new jobs in September. The reading marks a notable slowdown from the 315K reported in the previous month, though surpasses consensus estimates for a reading of 250K.

Additional details revealed that the unemployment rate fell to 3.5% during the reported month from 3.7% in August, reaffirming hawkish Fed expectations. This, in turn, remains supportive of elevated US Treasury bond yields and underpins the greenback, which exerts some pressure on the GBP/USD pair.

Apart from rising bets for a more aggressive policy tightening by the Fed, the prevalent risk-off mood is seen as another factor benefitting the safe-haven buck. The British pound, on the other hand, is weighed down by concerns about the UK government's fiscal policy and looming recession risks.

The aforementioned fundamental factors suggest that the path of least resistance for the GBP/USD pair is to the downside. Hence, any attempted recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Technical levels to watch

-

13:42

USD Index clings to daily gains near 112.60 post-Payrolls

- The index remains bid around the 112.50 region on Friday.

- US Non-farm Payrolls rose by 263K jobs in September.

- The Unemployment Rate surprised markets and dropped to 3.5%.

The greenback, when tracked by the USD Index (DXY), sticks to the positive territory in the mid-112.00s in the wake of the publication of Nonfarm Payrolls for the month of September.

USD Index flirts with weekly highs

The index keeps the positive stance on Friday after the release of the Nonfarm Payrolls showed the US economy added 263K jobs during September, surpassing initial estimates for a gain of 250K jobs.

Further data saw the Unemployment Rate retreat to 3.5% (from 3.7%) and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 5.0% from a year earlier. Additionally, the Participation Rate, receded a tad to 62.3% (from 62.4).

Next on tap in the US docket comes the speech by NY Fed J.Williams, Wholesale Inventories and Consumer Credit Change.

What to look for around USD

The index gathers extra pace and revisits the 112.50 zone following another healthy print from the Nonfarm Payrolls.

The firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change, Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.27% at 112.56 and faces the next hurdle at 114.76 (2022 high September 28) seconded by 115.00 (round level) and then 115.32 (May 2002 high). On the flip side, a breach of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

13:37

EUR/USD drops to one-week lows near 0.9750 after NFP

- US Payrolls rise by 263K in September, slightly more than 250K of market consensus.

- US dollar gains momentum after NFP, hits daily highs across the board.

- EUR/USD breaks multi-hour range to the downside, flat for the week.

The EUR/USD fell from 0.9790 to 0.9750 reaching the lowest level in a week following the release of the US official employment report that showed numbers slightly above expectations. The greenback strengthened after the numbers.

Prior to the report, the pair was moving in the range between 0.9785 and 0.9815. It is moving away from the lows, back into the range as the initial reaction of the dollar fades.

On a weekly basis, EUR/USD is about to end the week hovering around the same level it had a week ago, a negative considering it traded as high at 0.9999 a few days ago. The move off lows reflects that the bearish pressure still persists. On the positive, it has been able to remain above 0.9660/70, a relevant short-term support.

Calm ends with NFP

The US official employment report showed non-farm payrolls rose by 263K in September, above the 250K expected. The unemployment rate dropped unexpectedly from 3.7% to 3.5%.

The numbers triggered volatility across financial markets ending with hours of limited price action. The US dollar rose in line with US yields that hit fresh weekly highs after the report. Stocks turn lower.

Technical levels

-

13:32

United States Average Weekly Hours in line with forecasts (34.5) in September

-

13:32

United States Nonfarm Payrolls above expectations (250K) in September: Actual (263K)

-

13:31

Gold Price Forecast: XAU/USD to come under renewed pressure during Q4 – Credit Suisse

Gold is expected to re-confirm its “double top.” Thus, strategists at Credit Suisse expect further weakness during the fourth quarter.

Only a convincing weekly close above $1,724 would ease the pressure on gold

“Gold below $1,691/76 completed a large ‘double top’ but is now hovering slightly back above this level. However, we expect gold to come under renewed pressure during Q4, also due to the fact that it remains still clearly below the falling 200-day average, currently seen at $1,824. We note that the next support is seen at $1,620/14, then $1,560 and eventually $1,451/40.”

“Only a convincing weekly close above the 55-day average at $1,724 would ease the pressure on the precious metal, with next resistance then seen at the even more important 200-day average at $1,824, which we would expect to cap at the very latest.”

-

13:31

United States Average Hourly Earnings (YoY) below expectations (5.1%) in September: Actual (5%)

-

13:31

Canada Participation Rate dipped from previous 64.8% to 64.7% in September

-

13:31

Canada Net Change in Employment registered at 21.1K above expectations (20K) in September

-

13:31

United States Labor Force Participation Rate above forecasts (62.2%) in September: Actual (62.3%)

-

13:30

United States Average Hourly Earnings (MoM) in line with expectations (0.3%) in September

-

13:30

United States Unemployment Rate registered at 3.5%, below expectations (3.7%) in September

-

13:30

Canada Unemployment Rate below expectations (5.4%) in September: Actual (5.2%)

-

13:30

United States U6 Underemployment Rate registered at 6.7%, below expectations (6.8%) in September

-

13:30

Breaking: US Nonfarm Payrolls rise by 263,000 in September vs. 250,000 expected

Nonfarm Payrolls in the US rose by 263,000 in September, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed August's increase of 315,000 and came in better than the market expectation of 250,000.

Further details of the report revealed that the Unemployment Rate declined to 3.5% from 3.7% with the Labor Force Participation Rate edging lower to 62.3% from 62.4.

Finally, wage inflation, as measured by the Average Hourly Earnings, fell to 5% on a yearly basis from 5.2%.

Follow our live coverage of market reaction to the US jobs report.

Market reaction

The US Dollar Index gained traction with the initial reaction to the US jobs report and was last seen rising 0.15% on the day at 112.42.

-

13:25

Chile Trade Balance up to $-513M in September from previous $-990M

-

13:14

Chile Core Consumer Price Index (Inflation) (MoM) up to 13.7% in September from previous 0.9%

-

13:08

USD/TRY: New currency crisis to push the pair toward 27.00 by year-end – TDS

USD/TRY has broken multiple record highs for the past 24 months. In the view of economists at TD Securities, another currency crisis is in the making.

Turkey's macrofinancial conditions hang in a fragile and unsustainable balance

“The last currency crisis dates back to Dec 2021, but — we believe — a new one is in the making and can push the pair to 27.00 by December 2022.”

“Turkey's macrofinancial conditions hang in a fragile and, eventually, unsustainable balance.”

“The CBRT continues to provide indirect lira support through derivatives transactions that have swelled to USD65 bn in August, USD30 bn of which are maturing within one month. For these reasons, we think that another currency crisis is coming, though, obviously, its exact timing is difficult to call.”

-

13:01

Brazil Retail Sales (MoM) in line with expectations (-0.1%) in August

-

13:00

Chile Consumer Price Index (Inflation) (MoM) fell from previous 1.2% to 0.9% in September

-

12:48

EUR/USD Price Analysis: Key resistance lies at the parity zone

- EUR/USD wobbles around the 0.9800 zone ahead of NFP.

- Bullish attempts face a tough barrier at the parity level.

EUR/USD gyrates around the 0.9800 region ahead of the release of US Nonfarm Payrolls on Friday.

The resumption of the buying interest is expected to meet a solid hurdle at recent peaks around the parity zone. Ideally, EUR/USD should leave behind this key resistance zone in the near term to allow for the continuation of the rebound.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0616.

EUR/USD daily chart

-

12:43

USD Index Price Analysis: Another drop to 110.00 stays in the pipeline

- DXY recedes modestly to the 112.00 region on Friday.

- Losses could gather pace and attempt another test of 110.00.

DXY comes under some tepid selling pressure after two consecutive sessions with gains at the end of the week.

The index faces an immediate risk with the release of the Nonfarm Payrolls. A negative surprise could encourage sellers to return to the market and drag the dollar to the area of recent lows in the proximity of the 110.00 mark.

On the upside, there is still scope for a move to the 2022 high near 114.80 (September 28).The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 107.50.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.84.

DXY daily chart

-

12:42

EUR/CAD: Gains through 1.36 to clear the way towards 1.40 – Scotiabank

EUR/CAD neared 1.36 earlier this week. The recovery needs to extend through this level to reach 1.40, economists at Scotiabank report.

Initial retracement resistance at 1.3606 is reachable

“Long-term (monthly) price action is supportive of a broader reversal developing; monthly candle patterns suggest a bullish ‘morning star’ reversal developed around the Aug low in the EUR.”

“Initial retracement resistance is 1.3606 (23.6% retracement of the 2020/21 decline from 1.5975/1.2875) and is reachable, we believe. Gains through here on a sustained basis target additional EUR appreciation towards 1.40 (38.2% retracement at 1.4062) in the medium-term.”

-

12:36

EUR/JPY Price Analysis: Interim top looks likely at 144.00?

- EUR/JPY’s downside momentum picks up further pace on Friday.

- Extra decline could leave the 144.00 region as a short-term top.

EUR/JPY trades on the defensive for the third session in a row and breaks below the 142.00 mark at the end of the week.

The continuation of the decline would likely leave the recent peaks in the 144.00 neighbourhood as short-term tops. In case the downside accelerates, there is an interim support at the 139.50/75 band, where the 100- and 55-day SMAs coincide.

In the meantime, while above the key 200-day SMA at 136.15, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

12:17

GBP/USD to fall back toward the lows hit early last week – MUFG

The British pound was the second-worst-performing currency across G10 On Thursday. In the view of economists at MUFG Bank, GBP/USD could slide toward the last week’s lows.

Pound remains vulnerable

“Given our view of broader financial conditions tightening further from here, the pound remains vulnerable with the real test coming after the Bank of England’s support for the Gilt market ends next week.”

“We continue to expect GBP/USD to decline back toward the lows hit early last week.”

See – GBP/USD: A return to sub-1.10 levels is a question of when rather than if – ING

-

12:03

When is the US monthly jobs report (NFP) and how could it affect EUR/USD?

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data for September. The popularly known NFP report is scheduled for release at 12:30 GMT and is expected to show that the economy added 250K jobs during the reported month, down from the 315K in August. The unemployment rate, however, is expected to hold steady at 3.7% in September. Apart from this, investors will take cues from Average Hourly Earnings, which could offer fresh insight into the possibility of a further rise in inflationary pressures.

Analysts at Societe Generale are more optimistic and offer their expectations on the upcoming US jobs data: “We project a 280K gain. The unemployment rate for September is expected to decline to 3.6% from 3.7% in August. The monthly flows are volatile. If there are no returnees, or if there is a net exodus from the labor force rather than re-entrants, the unemployment rate could drop even more than the 3.6% we project. Wages are expected to rise 0.5% MoM in September. We view the shortfall seen in August, when wages rose 0.3%, as noise in the data rather than the beginning of a new trend.”

How could the data affect EUR/USD?

Ahead of the key release, growing acceptance for another supersized 75 bps Fed rate hike move in November continues to act as a tailwind for the US dollar. A stronger print should reaffirm hawkish Fed expectations and lift the US Treasury bond yields higher, along with the greenback. Conversely, a weaker reading will add to growing worried about a deeper economic downturn and underpin the safe-haven buck. This, in turn, suggest that the path of least resistance for the EUR/USD pair is to the downside.

Eren Sengezer, Editor at FXStreet, offers a brief technical overview and writes: “Following Thursday's decline, the Relative Strength Index (RSI) indicator on the four-hour chart dropped below 50. The indicator, however, has been moving sideways since then, suggesting that sellers remain on the sidelines for the time being.”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the downside, 0.9780 (Fibonacci 50% retracement of the latest uptrend) aligns as first support ahead of 0.9720 (Fibonacci 61.8% retracement) and 0.9650 (static level).”

“Resistances are located at 0.9830 (Fibonacci 38.2% retracement, 100-period SMA), 0.9900 (psychological level, Fibonacci 23.6% retracement) and 0.9920 (200-period SMA),” Eren adds further.

Key Notes

• Nonfarm Payrolls Preview: Five scenarios for trading King Dollar as markets plead for pain

• NFP Preview: Forecasts from nine major banks, employment trend slows down

• EUR/USD Forecast: US jobs report to determine next short-term direction

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

-

12:00

Mexico Headline Inflation above forecasts (0.58%) in September: Actual (0.62%)

-

12:00

Mexico 12-Month Inflation above forecasts (8.6%) in September: Actual (8.7%)

-

12:00

Mexico Core Inflation registered at 0.67%, below expectations (0.7%) in September

-

11:54

When is the Canadian monthly jobs report and how could it affect USD/CAD?

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment report for September later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 20K jobs during the reported month, up sharply from the 39.7K fall reported in August. The unemployment rate, meanwhile, is anticipated to hold steady at 5.4% in September.

Analysts at RBC Economics offer a brief preview of the report and explain: “Canadian employment likely edged higher in September after three straight monthly declines. But as monetary tightening continues, that bump isn’t likely to last. The 40K drop in employment in August was largely due to a sharp 50K pullback in education employment numbers. Those seasonal distortions are expected to fade in September, fueling a 15K increase in overall employment.”

How could the data affect USD/CAD?

The data is likely to be overshadowed by the simultaneous release of the closely-watched US jobs report - popularly known as NFP. That said, a significant divergence from the expected readings should influence the Canadian dollar and provide some meaningful impetus to the USD/CAD pair. Ahead of the key release, bullish crude oil prices, along with the overnight hawkish remarks by Bank of Canada Governor Tiff Macklem, underpins the commodity-linked loonie. This, along with a modest US dollar downtick, exerts some downward pressure on the major.

Strong domestic data should provide an additional lift to the Canadian dollar and pave the way for some meaningful downside for the USD/CAD pair. Spot prices might then accelerate the fall towards the 1.3600 mark, which coincides with a three-week-old ascending trend line. A convincing break below will be seen as a fresh trigger for bearish traders and pave the way for a slide back towards challenging the monthly low, around the 1.3500 psychological mark.

Conversely, any disappointment from the Canadian jobs data and (or) upbeat US NFP report should assist the USD/CAD pair to regain positive traction. The subsequent strength has the potential to lift spot prices to the 1.3800 mark en route to the double-top barrier, around the 1.3835-1.3840 region, or the highest level since May 2020. Some follow-through buying would allow bulls to reclaim the 1.3900 mark. The momentum could get extended to the 1.4000 psychological level, with some intermediate resistance near the 1.3955-1.3960 zone.

Key Notes

• Canadian Jobs Preview: Forecasts from six major banks, employment to rise but outlook is dimming

• USD/CAD Outlook: Bulls take a brief pause, await US/Canadian jobs data before placing fresh bets

• USD/CAD: Positive Canadian jobs unlikely to avoid a retest of 1.3830 highs – ING

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

-

11:44

USD/CAD to hit 1.39 by year-end as loonie has no chances to strengthen – NBF

USD/CAD broke through its 1.32 resistance in September. Economists at the National Bank of Canada expect the pair to reach 1.39 by year-end before easing back to 1.30 by the end of the second quarter in 2023.

FOMC pivot expected by mid-2023

“With inflation cooling faster in Canada than in the US and the Bank of Canada unlikely to overtake the Fed in the coming months, as we expected, we do not see opportunities for a significant strengthening of the CAD against the USD until an FOMC pivot, which we expect in H1 2023.”

“We see USD/CAD at 1.39 at the end of Q4 22 and at 1.30 at the end of Q2 23.”

-

11:43

BoE's Ramsden: Recent market movements to have significant effect on November forecasts

Bank of England (BOE) Deputy Governor Dave Ramsden said on Friday that they will assess the impact on demand and inflation of the government's growth plan during the forecast round leading up to the next policy meeting, per Reuters.

Key takeaways

"UKs energy support package represents a very significant fiscal intervention, which can be thought of as a shock."

"Impacts of UK's growth plan likely to be material for economic outlook over next three years, which is also the horizon relevant for monetary policy."

"Recent market movements could have a significant direct effect on the November forecasts and on the committee’s broader assessment of financial conditions."

"Overall, the adjustment in market prices has been consistent with tighter monetary policy globally."

"Part of market re-pricing continues to reflect broader global developments, but there is undoubtedly a UK-specific component."

"I think of BOE's gilt buying operation as an operation designed to buy time."

"One key consideration for the MPC at its upcoming meetings will be whether recent repricing of UK assets reflects a changed assessment by markets of the UK macroeconomic policy mix between fiscal and monetary policy."

Market reaction

GBP/USD edged slightly lower from session highs after these comments and was last seen rising 0.35% on the day at 1.1198.

-

11:21

USD/CHF to hit 0.96 by year-end and 0.92 by June-2023 – UBS

USD/CHF has hit the 0.99 level. Nonetheless, economists at UBS expect the pair to ease back lower towards 0.96 by the end of the year.

Swiss National Bank to remain on a tightening path

“While Swiss inflation moderated both on a YoY and MoM basis in September, we believe the SNB remains on a tightening path and wants a stronger CHF to continue to fight inflation.”

“Any rally toward USD/CHF 0.99 or higher is a good opportunity to sell the greenback in favor of the franc, in our view, forecasting the pair to hit 0.96 by year-end and 0.92 by June next year.”

-

11:02

Silver Price Analysis: XAG/USD to trade at $20.50 by year-end – Commerzbank

Silver (XAG/USD) is trading slightly above the $20.50 mark. This price is the year-end forecast of strategists at Commerzbank for the precious metal.

Silver to surge towards $25 by end-2023

“We have confirmed our price forecast for silver: the silver price is likely to be trading at $20.50 by year’s end, and to increase to $25 by the end of 2023.”

“Thanks to its latest upswing, silver has noticeably reduced its previous significant undervaluation as compared with gold. Silver has further catch-up potential, in our view. This is suggested not least by the important role that silver plays in decarbonisation, the buzzwords here being photovoltaics and electric vehicles.”

-

10:59

Gold Price Forecast: XAU/USD remains confined in a range above $1,700, NFP awaited

- Gold oscillates in a narrow band through the first half of the European session on Friday.

- Aggressive Fed rate hike bets, elevated US bond yields continue to act as a headwind.

- Recession fears and the risk-off mood offer some support amid a modest USD downtick.

- Investors keenly await the US monthly employment data for a fresh directional impetus.

Gold struggles to gain any meaningful traction on Friday and seesaws between tepid gains/minor losses through the first half of the European session. The XAU/USD, however, manages to hold above the $1,700 mark as traders keenly await the closely-watched US monthly employment details for a fresh impetus.

The popularly known NFP report is scheduled for release later during the early North American session and will play a key role in influencing Federal Reserve's rate hike plans. In fact, the markets seem convinced that the US central bank will tighten its monetary policy at a faster pace to curb inflation and have been pricing in another supersized 75 bps increase in November. Hence, the key labour market report will help to determine the next leg of a directional move for gold.

In the meantime, hawkish Fed expectations remain supportive of elevated US Treasury bond yields and continue to act as a headwind for the non-yielding yellow metal. That said, a modest USD pullback from the vicinity of the weekly high is seen offering support to the dollar-denominated gold. Apart from this, the prevalent risk-off mood - amid growing worries about a deeper global economic downturn - further contributes to limiting the downside for the safe-haven precious metal.

The market sentiment remains fragile amid concerns about economic headwinds stemming from rapidly rising borrowing costs. Furthermore, the risk of a further escalation in the Russia-Ukraine conflict has been fueling recession fears and tempering investors' appetite for perceived riskier assets. Heading into the key event risk, the mixed fundamental backdrop holds back traders from placing aggressive bets around gold and leads to subdued/range-bound price action on the last day of the week.

Technical levels to watch

-

10:56

USD/ZAR to remain elevated before moving back lower to 15.90 by end-2023 – TDS

The South African rand's resilience is likely to be tested in the coming months. Economists at TD Securities expect the USD/ZAR pair to hit 18.00 before easing back lower to 15.90 by the end of the next year.

SARB’s tightening to support the rand

“We think that USD/ZAR will trade as high as 18.00 in Q1 2023, but ultimately the SARB's tightening and steep SAGB curve are supporting factors that will help stem rand weakness.”

“We expect USD/ZAR to end 2023 at 15.90.”

-

10:40

US Dollar Index could rebound towards the 114.80 high – SocGen

The Dollar Index (DXY) has pulled back after forming interim high near 114.80 last month. Nevertheless, technicals suggest prevalence of upward momentum, with a bounce towards the 114.80 peak again on the cards, economists at Société Générale report.

Only a break under 110.00/109.30 would suggest a risk of deeper pullback

“Daily RSI is still within bullish territory denoting prevalence of upward momentum.”

“A rebound towards 113.60 and the peak near 114.80 is not ruled out.”

“Only if the support zone at 110.00/109.30 gets violated would there be a risk of a deeper pullback. In such a scenario, next objective could be at September low of 107.60.”

-

10:40

FX option expiries for Oct 7 NY cut

FX option expiries for Oct 7 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 0.9690-00 1.6b

- 0.9730-40 1.29b

- 0.9750-55 1.14b

- 0.9770-75 820m

- 0.9800-10 2.17b

- 0.9845-55 1.98b

- 0.9860 254m

- 0.9870-80 694m

- 0.9900 1.79b

- 0.9915-25 1.84b

- 0.9940-50 1.2b

- GBP/USD: GBP amounts

- 1.1050 255m

- 1.1150 230m

- 1.1220 255m

- 1.1300 585m

- 1.1400 572m

- USD/JPY: USD amounts

- 143.90-00 380m

- 144.55-57 417m

- 145.00 235m

- USD/CHF: USD amounts

- 0.9900 212m

- AUD/USD: AUD amounts

- 0.6370 371m

- 0.6545-50 309m

- 0.6535 395m

- USD/CAD: USD amounts

- 1.3715-20 535m

- 1.3885 900m

- EUR/GBP: EUR amounts

- 0.8700 1.1b

- 0.8900 536m

- EUR/CHF: EUR amounts

- 0.9625 260m

-

10:31

EUR/HUF to fall back below 420 and settle at 412 by end-Q4 – TDS

EUR/HUF has pushed above 420. Therefore, economists at TD Securities expect the Hungarian National Bank to tighten and drive the pair to 412 by the end of the fourth quarter.

NBH to continue running an FX-driven monetary policy

“We expect the NBH to continue running an FX-driven monetary policy, rather than an inflation-driven one. In essence, hike rates in response to forint weakness rather than upside inflation risks.”

“We think that EUR/HUF will trade in the 400-430 range in Q4 2022, but fall back below 420 and settle at 412 by the end of the quarter.”

-

10:29

ECB Study: European consumers see inflation in next 12 months at 5%.

In its latest study published on Friday, the European Central Bank (ECB) said, “surging consumer demand across the eurozone is playing an increasing role in excessive inflation.”

Additional takeaways

“Some policymakers have feared - price pressures are becoming more entrenched.”

"Over recent months, supply and demand factors have played broadly similar roles in (underlying) inflation.”

"More recently the contributions of predominantly demand-driven components to services inflation have outweighed those of predominantly supply-driven components.”

Market reaction

The shared currency is unfazed by the above findings, with EUR/USD trading at 0.9807, up 0.21% on the day.

-

10:18

SNB outpacing the ECB could support CHF ahead – CIBC

Against the backdrop of elevated price pressures, economists at CIBC Capital Markets expect the Swiss National Bank (SNB) to be increasingly prepared to tolerate a stronger franc.

Additional policy tightening

“In the context of elevated CPI, we can expect the SNB to remain wary of elevated price pressures feeding through into wage demands; this comes as the unemployment rate is at a 20-year low of 2.1%.”

“A central bank keen to bear down on wage growth and an overheated real estate market could prove to be more activist than the ECB, supporting a stronger CHF into 2023.”

“EUR/CHF: Q4 2022: 0.94 | Q1 2023: 0.97”

-

10:17

EU's von der Leyen: Willing to discuss price caps

European Commission President Ursula von der Leyen said on Friday, “the European Union (EU) members now willing to discuss price caps, to discuss how to limit peaks on the energy market.”

“We need to discuss how and where to install price caps,” she added.

Parallelly, Charles Michel, the President of the European Council said that “we need a decision on energy measures as soon as possible.”

Related reads

- EUR/USD regains the smile and flirts with 0.9800, focus on US NFP

- EUR/USD Forecast: US jobs report to determine next short-term direction

-

10:12

10-year UST bonds yields to reach 4.00% and even 4.15/20% – SocGen

10-year US Treasury bond yields experienced a brief down move. But while above 3.50%, the uptrend is set to persist towards 4.00% and even beyond, economists at Société Générale report.

Short-term support aligns at 3.50%

“Daily MACD has dipped below its trigger however signals of an extended pullback are not yet visible.”

“The peak of June near 3.50% remains a short-term support.”

“Holding above 3.50%, 10Y UST is expected to persist with its uptrend towards 4.00% and perhaps even towards the upper limit of a multi month channel near 4.15%/4.20%.”

-

10:08

USD/CAD remains depressed, holds above 1.3700 mark ahead of US/Canadian jobs report

- USD/CAD meets with some supply on Friday and snaps a two-day winning streak.

- The USD edges lower amid some repositioning trade ahead of the US NFP report.

- The recent bullish run in oil prices underpins the loonie and contributes to the fall.

- The downside seems limited ahead of the key jobs report from the US and Canada.

The USD/CAD pair struggles to capitalize on its gains recorded over the past two trading sessions and comes under some selling pressure on Friday. The pair remains depressed through the first half of the European session and is currently placed near the daily low, just above the 1.3700 round-figure mark.

The US dollar retreats from the vicinity of the weekly high amid some repositioning trade ahead of the closely-watched US monthly jobs data. The Canadian dollar, on the other hand, is underpinned by the overnight hawkish remarks by the Bank of Canada Governor Tiff Macklem and the recent bullish run-up in crude oil prices. This, in turn, is seen exerting downward pressure on the USD/CAD pair, though the downside seems cushioned, at least for the time being.

The OPEC+ decision to slash production by about 2 million bpd - the largest reduction since the 2020 COVID pandemic - continues to act as a tailwind for the black liquid. That said, concerns that a deeper global economic downturn will dent fuel demand keep a lid on any further gains. Adding to this, the prospects for a more aggressive policy tightening by the Fed should limit losses for the greenback and lend some support to the USD/CAD pair.

In fact, the markets seem convinced that the US central bank will continue to hike rates at a faster pace to curb inflation and have been pricing in another supersized 75 bps increase in November. The bets were reaffirmed by the recent hawkish remarks by several Fed officials, which remain supportive of elevated US Treasury bond yields. This, along with recession fears, supports prospects for the emergence of some dip-buying around the safe-haven buck.

Traders might also prefer to wait for the release of the crucial monthly employment details from the US and Canada, due later during the early North American session. Hence, it will be prudent to wait for strong follow-through selling before confirming that this week's solid rebound from the 1.3500 psychological mark has run out of steam and placing fresh bearish bets around the USD/CAD pair.

Technical levels to watch

-

10:01

Singapore Foreign Reserves (MoM) dipped from previous 289.4B to 286.1B in September

-

09:56

USD to remain supported by a hawkish Fed and a safe-haven bid in Q4 – CIBC

Economists at CIBC Capital Markets have been USD bulls for a few quarters now. They see little reason to deviate at this point.

USD dominance to fade next year

“We still see a sufficient degree of uncertainty with respect to where the Fed terminal is priced to keep the greenback supported on dips against other major developed market currencies.”

“A weaker backdrop for global demand should continue to buttress the USD via the safe-haven channel. That should show up against the commodity and select EM currency blocs that have been relatively sheltered against hitherto USD strength compared to the funders (like the EUR, and JPY).”

“Next year, we expect market narratives to shift towards an ex-US recovery. But that’s a story for another time.”

-

09:51

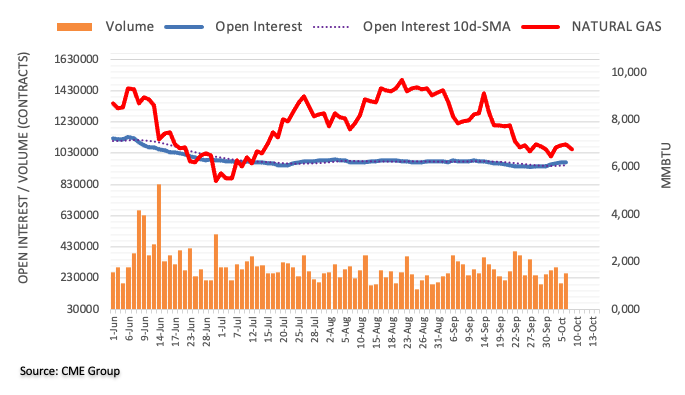

OPEC’s Al Ghais: OPEC+ output cuts allow countries to intervene in case of oil market crisis

Haitham Al Ghais, the new Secretary-General of the Organization of the Petroleum Exporting Countries (OPEC), said on Friday that “oil production capacity freed up by latest output cuts could allow countries to intervene in case of any crisis in oil markets.”

Additional quotes

“The world needs $12 trillion in investments in the oil sector globally.”

“The lack of investments significantly affects global energy supply.”

Market reaction

WTI is off the highs, currently trading at $88.29, modestly flat on the day.

-

09:48

Japan’s Top FX Diplomat Kanda: Has never felt a limit to ammunition for currency intervention

Japan’s top currency diplomat Masato Kanda said on Friday that he “has never felt a limit to ammunition for currency intervention.”

Kanda added, “making various steps so as not to face a limit to ammunition when it comes to FX intervention.”

Market reaction

USD/JPY is extending its retreat from above 145.00 on Japanese verbal intervention. The pair is trading -0.21% on the day at 144.81, as of writing.

-

09:44

GBP/USD: A return to sub-1.10 levels is a question of when rather than if – ING

GBP/USD dived under 1.12. Economists at ING expect the pair to move back below 1.10 sooner or later.

Cable looks unsustainable above 1.10

“We still deem the pound’s current levels as unsustainable given the fragility in the bond market and the UK’s deteriorated fiscal and current account position.”

“A return to sub-1.10 levels in cable is a question of when rather than if, in our view, and today’s US payrolls may favour a more rapid descent.”

“A potentially fast acceleration in the UK housing market correction has surely become a more relevant theme for the government, and likely another downside risk for the pound.”

-

09:26

Singapore: Retail Sales remain healthy – UOB

Senior Economist at UOB Group Alvin Liew reviews the latest Retail Sales release in Singapore.

Key Takeaways

“Even as Singapore’s retail sales declined by -1.3% m/m in Aug (from 0.7% in Jul), that still translated to a 13.0% y/y expansion for Aug (from 13.9% in Jul), the fifth consecutive month of double-digit growth. Excluding motor vehicle sales, the m/m decrease was more pronounced at -1.8%, (from 0.6% in Jul), translating to a +16.2% y/y increase (from 18.4% y/y in Jul).”

“While the growth fell short of forecast, Aug retail sales growth still added to a solid foundation for domestic demand in 3Q22. While we note that most of the main segments recorded m/m declines in Aug, that could likely be some element of normalisation after the strong post-reopening in Apr (2022) surge from pent-up demand. According to the Department of Statistics Singapore, the y/y increase was attributed to y/y increases recorded in most of the key segments of retail sales.”

“Year-to-date, retail sales grew by 11.2% y/y. We believe domestic retailers will likely see continued domestic and external support, complemented by the return of major events such as the F1 night race, various concerts and BTMICE activities (Business Travel and Meetings, Incentive Travel, Conventions and Exhibitions) attracting tourist arrivals, while the tightening domestic labour market will also contribute to domestic consumption demand. The low base effect is likely to continue to uplift retail sales growth prints in the coming months. Barring the re-emergence of fresh COVID-19 or other health-related risks in Singapore and around the region (leading to re-imposition of social and travel restrictions, which is not our base case), we project retail sales to expand by 8.5% in 2022 (implying a more conservative forecast of around 4% growth in the remaining months of 2022).”

-

09:25

EUR/USD: Further weakness ahead as ECB set to undershoot market expectations – CIBC

The European Central Bank (ECB) is set to undershoot median rate hike expectations. Furthermore, slower global demand will weigh on growth in the region, pressuring the euro in the fourth quarter, according to economists at CIBC Capital Markets.

Trade unlikely to benefit the eurozone until well into 2023

“The ECB appears intent on taking the deposit rate towards 2.00% into year-end. A cumulative tightening of 125 bps will leave rate spreads still substantially in the favour of the US.”

“Euro real economy headwinds underline that the ECB looks set to undershoot median rate hike expectations. Moreover, weakness in the global economy will mean that trade is unlikely to benefit the eurozone until well into 2023.”

“While eurozone energy headwinds remain a concern, we also expect markets to remain mindful of the risk of widening BTP-Bund spreads.”

-

09:24

GBP/USD retakes 1.1200 and beyond amid some repositioning trade ahead of NFP

- GBP/USD stages a modest intraday bounce from a multi-day low touched earlier this Friday.

- The USD edges lower amid some repositioning trade ahead of the NFP and offers support.

- Concerns about the UK government’s fiscal plans, recession fears should cap further gains.

The GBP/USD pair reverses an intraday dip to a multi-day low, around the 1.1115 region touched in the last hour and refreshes its daily high during the early European session. The intraday move up lifts spot prices back above the 1.1200 round-figure mark, though lacks bullish conviction.

The US dollar eases a bit from the vicinity of the weekly high and turns out to be a key factor lending some support to the GBP/USD pair. The modest USD downtick could be solely attributed to repositioning trade ahead of the closely-watched US monthly jobs data, due for release later during the early North American session. That said, the prospects for a more aggressive policy tightening by the Fed, along with the prevalent risk-off environment, should limit any meaningful USD pullback.

In fact, market participants seem convinced that the US central bank will continue to hike rates at a faster pace to curb inflation and have been pricing in another supersized 75 bps increase in November. This remains supportive of elevated US Treasury bond yields. Meanwhile, concerns that rapidly rising borrowing costs will lead to a deeper global economic downturn tempers investors' appetite for riskier assets. The anti-risk flow should lend some support to the safe-haven greenback.

Furthermore, concerns about the UK government's fiscal policy and looming recession risks could also contribute to capping the upside for the GBP/USD pair. UK Prime Minister Liz Truss defended the tax-cut plan on Wednesday and said that cutting taxes is the right thing to do morally and economically. The fiscal package is expected to derail the Bank of England's efforts to contain high inflation and force it to turn more hawkish, which, in turn, would create additional economic headwinds.

The aforementioned fundamental backdrop warrants caution for aggressive traders and before positioning for any further appreciating move for the GBP/USD pair. Investors might also prefer to move to the sidelines and wait for the release of the US NFP report. The US labour market data will play a key role in Influencing Fed rate hike expectations and driving the USD demand in the near term. This, in turn, should allow traders to grab short-term opportunities around the major.

Technical levels to watch

-

09:14

EUR/USD regains the smile and flirts with 0.9800, focus on US NFP

- EUR/USD bounces off earlier lows in the vicinity of 0.9760.

- Germany Retail Sales contracted 4.6% in the year to August.

- Markets’ attention will be on the release of US Payrolls.

Following an early drop to the 0.9765/60 region, EUR/USD manages to regain some upside traction and return to the 0.9800 neighbourhood on Friday.

EUR/USD now looks to the US calendar

EUR/USD attempts a mild recovery against the backdrop of a knee-jerk in the dollar, while market participants remain prudent in light of the upcoming release of the US Nonfarm Payrolls for the month of September (250K exp).

The small bounce in spot also comes along another positive move in the German 10-year bund yields, which already retake the 2.15% region amidst the third consecutive daily advance.

Earlier in the session, Germany’s Retail Sales contracted 4.6% YoY in August and Industrial Production dropped 0.8% vs. the previous month.

What to look for around EUR

EUR/USD appears to have met a decent contention in the 0.9760 zone so far on Friday and ahead of key data releases in the US docket.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The latter has been exacerbated further following the latest rate hike by the Fed and the persevering hawkish message from Powell and the rest of his rate-setters peers.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: Germany Retail Sales. Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian post-elections developments. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.11% at 0.9801 and the breakout of 0.9999 (weekly high October 4) would target 1.0013 (55-day SMA) en route to 1.0050 (weekly high September 20). On the flip side, the initial support comes at 0.9535 (2022 low September 28) ahead of 0.9411 (weekly low June 17 2002) and finally 0.9386 (weekly low June 10 2002).

-

09:07

USD/CAD: Positive Canadian jobs unlikely to avoid a retest of 1.3830 highs – ING

Jobs data will be published in Canada, but the implications for the Bank of Canada (BoC) policy should be limited, in the view of economists at ING. USD/CAD is set to react more substantially to US Nonfarm Payrolls, thus, the risks are skewed to the upside.

BoC to stay hawkish despite jobs jitter

“BoC’s governor Tiff Macklem delivered some quite hawkish remarks as he claimed the Bank is not ready for a more finely balanced policy, that there is still plenty to be done to curb inflation given lingering excess demand and largely accepting the prospect of a quite hard landing for the economy. In this sense, yesterday’s comments may have worked as a ‘hedge’ against another potential job data disappointment today.

“We expect the US payrolls impact on USD to be larger than Canada’s jobs data impact on CAD, and see USD/CAD upside risks today even if Canada’s figures come in positive.”

“A re-test of the 1.3830 highs in USD/CAD is a material risk over the coming weeks.”

See:

- NFP Preview: Forecasts from nine major banks, employment trend slows down

- Canadian Jobs Preview: Forecasts from six major banks, employment to rise but outlook is dimming

-

09:01

USD Index: Upside takes a breather ahead of Payrolls

- The index comes under some selling pressure near 112.50.

- US yields continue their march north to multi-session peaks.

- Nonfarm Payrolls and the Unemployment Rate will take centre stage later.

The greenback, in terms of the USD Index (DXY), meets a decent resistance region in the 112.50 at the end of the week.

USD index focuses on data

The index now slips back to the 112.00 neighbourhood and trades slightly on the defensive amidst some recovery in the risk complex and broad-based cautiousness ahead of the release of September’s Nonfarm Payrolls later in the NA session.

The results from the job creation during last month has grown in importance in past sessions, as it could determine the size of the next rate hike by the Fed and probably give a hint regarding the probable extension of the normalization process.

Other than Payrolls, the Unemployment Rate is due along with Wholesale Inventories, Consumer Credit Change and the speech by NY Fed J.Williams (permanent voter, centrist).

What to look for around USD

The index managed to advance to the 112.50 region, where it seems to have met some decent hurdle for the time being.

While the near-term outlook for the dollar looks somewhat dented, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change, Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is losing 0.08% at 112.16 and a breach of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13). On the other hand, the next up barrier emerges at 114.76 (2022 high September 28) seconded by 115.00 (round level) and then 115.32 (May 2002 high).

-

09:01

Italy Retail Sales n.s.a (YoY) below forecasts (5.2%) in August: Actual (4.3%)

-

09:01

Italy Retail Sales s.a. (MoM) came in at -0.4%, below expectations (-0.2%) in August

-

09:00

China Foreign Exchange Reserves (MoM) above expectations ($3.007T) in September: Actual ($3.029T)

-

08:49

South Korea: Higher inflation could spark a larger rate hike by the BoK – UOB

Economist at UOB Group Ho Woei Chen, CFA, comments on the latest inflation figures in South Korea and the upcoming BoK event.

Key Takeaways

“South Korea’s headline inflation edged lower to 5.6% y/y in Sep, signalling it has likely peaked at more than two-decade high in Jul (6.3% y/y) as oil prices eased. However, core inflation rebounded to 4.5% y/y which keeps concerns on the second-round effects from a potential wage-price spiral.”

“The trajectory remains for headline inflation to stay in the 5%-6% y/y range in the next few months until 1Q23, averaging around 5.2% and 3.5% for 2022 and 2023 respectively.”

“Market’s expectation is gravitating towards a larger move by the BOK next week (12 Oct) amidst high domestic inflation and a more hawkish posturing from the US Fed. While we see a 25bps hike in the 7-day repo rate to 2.75% on 12 Oct as the base case, the prospect of a more aggressive 50 bps hike to 3.00% has increased.”

“Thus, the odds are certainly tilted towards a higher terminal interest rate than our current forecast of 3.00% as BOK is likely to hike further in Nov (last meeting of 2022) and even into 1Q23 if inflation does not cool as fast as it hoped. We will get a better sense of that from BOK’s post-decision press conference next week.”