Notícias do Mercado

-

20:01

U.S.: Consumer Credit , September 13.7 (forecast 12.8)

-

20:00

Dow -100.92 15,645.96 -0.64% Nasdaq -58.72 3,873.23 -1.49% S&P -16.66 1,753.83 -0.94%

-

19:00

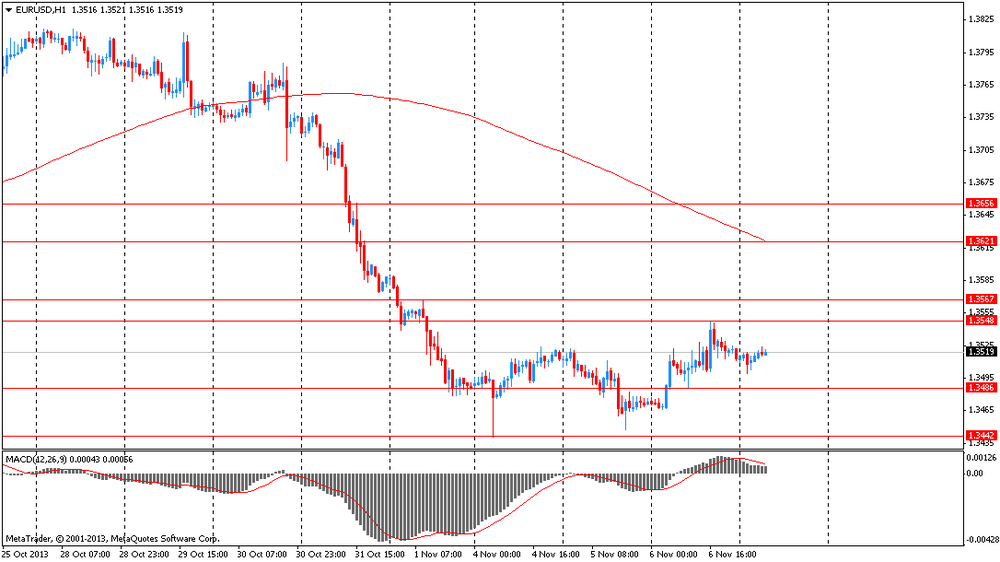

American focus : the dollar against the euro has increased markedly

The euro exchange rate against the dollar has declined markedly , although half of the previously recovered lost ground as market participants' attention shifted to tomorrow's employment report in the U.S.. Experts expect the number of people employed in non c / agricultural sector grew in October at 126 thousand , compared with an increase of 148 million in September .

It should be noted that today, the pressure on the European currency had the ECB's decision to lower its key policy rates to a new record low , and the lending rate , as some analysts predicted after last week's euro zone inflation data came out much worse than expected. The Governing Council of the ECB lowered its main refinancing rate by 25 basis points up to 0.25 %. The bank also lowered the rate of lending by 25 basis points to 0.75 %, while the deposit rate remained unchanged at 0.00%. ECB refrained from lowering rates in May .

Negative for the euro was also a report on the United States, which showed that the gross domestic product , the broadest measure of goods and services produced in all sectors of the economy, grew at an annual rate of 2.8 % in the third quarter. The result showed the highest growth rate for the year , which followed a 2.5 % rise in the second quarter. Economists had expected growth in the third quarter will be at 1.9 %. The report reflects a good picture of the state of the economy before the 16 -day partial government shutdown , which began Oct. 1. The higher growth housekeeper largely attributable to restocking by companies and the rise in the cost of state and local governments.

The report showed that inflation in general has increased , but the basic prices remain weak. The price index for personal consumption expenditures - an indicator that the Fed is used as a benchmark of inflation - rose by 1.9 %. The rate of core inflation , which excludes volatile food prices and energy prices, rose 1.4 %. This indicates that the core inflation rate remains below the annual forecast of the inflation the Fed at 2% .

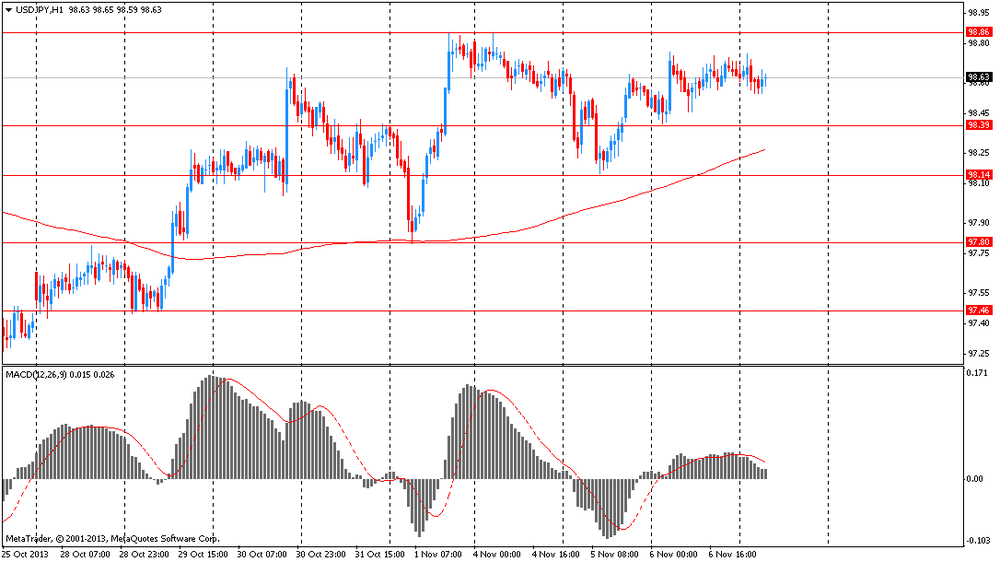

The yen declined significantly against the dollar, losing points scored in response to the publication of the U.S. GDP . We add that the pair slid to new lows against the fading of euphoria and reduction of U.S. stocks .

Experts also point out that when a couple has broken this morning , investors rushed to buy it , even though many have placed stop orders at Y99. These stop orders were triggered when the pair fell back to the level of Y99, causing large dollar sales and pitting the pair to Y98.50. There were "large dollar purchases at lower " and it means that the pair is likely to remain below Y99 not for long.

-

18:20

European stock close

Most stocks in Europe fell as an unexpected European Central Bank interest rate cut pointed to prolonged weak growth in the region and stronger U.S. economic data fueled speculation the Federal Reserve may reduce the pace of its bond buying in the coming meetings.

The Stoxx Europe 600 Index fell less than 0.1 percent to 323.2 at 4:30 p.m. in London, paring earlier gains of as much as 1.5 percent. About three stocks fell for every two that rose.

The ECB lowered its benchmark interest rate to 0.25 percent from 0.5 percent. The ECB expects key interest rates to remain at the current level or lower for an extended period of time, President Mario Draghi said at a press conference after the announcement.

“We may experience a prolonged period of low inflation,” Draghi told reporters in Frankfurt. “Accordingly, our monetary policy stance will remain accommodative for as long as necessary.”

The Bank of England held its key interest rate at 0.5 percent and its asset-purchase target at 375 billion pounds ($603 billion), matching the median forecast of economists.

National benchmark indexes dropped in 12 of the 18 western European markets.

FTSE 100 6,697.22 -44.47 -0.66% CAC 40 4,280.99 -5.94 -0.14% DAX 9,081.03 +40.16 +0.44%

In the U.S., a Commerce Department report today showed that the world’s biggest economy expanded in the third quarter at a faster pace than forecast. Gross domestic product rose at a 2.8 percent annualized rate after a 2.5 percent gain the prior three months, beating the median forecast of economists surveyed for a 2 percent advance.

HeidelbergCement slipped 4.1 percent to 56.71 euros. The world’s third-largest maker of cement said quarterly operating income before depreciation fell to 811 million euros from 872 million euros a year earlier because of weaker currencies in emerging markets.

Bureau Veritas (BVI) fell 3.5 percent to 21.73 euros. The world’s second-biggest goods-inspection company posted third-quarter sales of 969.7 million euros late yesterday, trailing the 992 million-euro average estimate of analysts.

Siemens advanced 3.5 percent to 95.80 euros after saying it will buy back 4 billion euros of shares over the next two years. Europe’s biggest engineering company reported fourth-quarter profit from continuing operations of 1.08 billion euros ($1.44 billion), surpassing the 997 million-euro average projection of analysts.

Swiss Re rose 1.8 percent to 81.35 Swiss francs after the world’s second-biggest reinsurer said third-quarter profit fell to $1.07 billion from $2.18 billion a year earlier. Analysts on average had predicted profit of $775 million. The sale of a U.S. unit had boosted earnings in the year-earlier period.

Commerzbank AG jumped 10 percent to 10.26 euros, the largest gain in almost three months, as Germany’s second-biggest lender said third-quarter net income rose to 77 million euros. That beat the average analyst estimate of 32 million euros as the bank paid fewer taxes and risky-loan provisions climbed less than expected.

-

17:00

European stock close: FTSE 100 6,697.22 -44.47 -0.66% CAC 40 4,280.99 -5.94 -0.14% DAX 9,081.03 +40.16 +0.44%

-

16:40

Oil: an overview of the market situation

The cost of oil futures fell today, reaching at the same level of $ 94 per barrel, which was due to unexpected decline in rates by the European Central Bank and the significant strengthening of the dollar.

Note that the ECB cut its refinancing rate to 0.25 % from 0.50 %, and also reduced the rate of emergency lending by 25 basis points to 0.75%. The Governing Council decided to leave the bank deposit rate unchanged at zero . Recall that the ECB did not change its key interest rate in May, preferring instead to rely on the landmark , published in July. He is expected to maintain interest rates at current or lower level for a "long time." Most economists expect the ECB to leave policy unchanged , but alarmingly low inflation in October , which became known last week, caught investors and the government by surprise, and could put pressure on the ECB in order to take action sooner rather than later. Lowering rates indicates that the Governing Council has decided that such a low inflation rate in the euro area is not acceptable and must act quickly to restore is of no effect .

Add that to the cost of oil also affected the data from the U.S. Department of Commerce , which showed that gross domestic product grew at an annual rate of 2.8 % in the third quarter. The result showed the highest growth rate for the year , which followed a 2.5 % rise in the second quarter. Economists had expected growth in the third quarter will be at 1.9 %. The report reflects a good picture of the state of the economy before the 16 -day partial government shutdown , which began Oct. 1. The higher growth housekeeper largely attributable to restocking by companies and the rise in the cost of state and local governments.

It should be noted that in the course of trade is also affected by a report from the Organization of Petroleum Exporting Countries , which showed that the demand for oil could fall to 29.2 million barrels a day in 2018 , compared with 30.3 million barrels per year this year. In OPEC also said that the growth of imports from other countries such as Canada and Latin America and the increased use of biofuels will contribute to a drop in demand for its own products.

In OPEC also predicted that world oil demand will increase from 81.2 million barrels per day in 2013 to 89.7 million bpd in 2020 and to 100.2 million barrels per day in 2035. At the same time, the share of renewable energy sources and other types of fuel down from 32.2 percent in 2010 to 26.3 percent in 2035.

The cost of the December futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 94.04 a barrel on the New York Mercantile Exchange.

December futures price for North Sea Brent crude oil mixture fell $1.12 to $ 103.75 a barrel on the London exchange ICE Futures Europe.

-

16:20

Oil: an overview of the market situation

Gold prices declined significantly today , down with up to three-week low , and losing all previously earned position achieved after the decision of the European Central reduce the interest rate to a record low , as the sharp rise in the dollar outweighed the impact of a softer monetary policy.

Note that the lower interest rates tend to play in favor of gold , because they reduce the costs of holdings, but at the same time, reinforce fears about inflation in the long run. However , gold was sensitive to the pressure from the recent strengthening of the dollar . We add that the U.S. currency hit a seven-week high against the euro after the ECB's decision , and continued to rise after the third-quarter U.S. economic growth exceeded forecasts.

The data showed that U.S. GDP in the third quarter rose 2.8 % year on year, after rising 2.5 % in the previous quarter. Initially, the data had to go out on Oct. 30 , but was delayed due to the termination of the period of the government. The median forecast of experts was at 1.9 %. Range of estimates ranged from 1.2 % to 3 %. Consumer spending rose 1.5 % - the increase was the weakest since 2011 . A significant contribution to GDP growth has brought an increase in inventories , which was the highest since the first quarter . The contribution of inventories to GDP growth was 0.8 %. They rose by 86 billion dollars a year on year, after rising by 56.6 billion dollars in the second quarter.

Gold prices have fallen 20 percent this year on expectations that the Federal Reserve will reduce the amount of its economic stimulus program . Investors are eagerly awaiting key U.S. data , which will be presented this week, as they may bring a clue as to when this will happen. Analysts said that Friday's employment report in the U.S. in October may provide the clearest understanding of the influence of " shutdown " of the government in the past month , which may also trigger an increase in terms of bond buying program the Fed, which has undermined the dollar .

Meanwhile, today it was announced that the gold reserves in the holding SPDR Gold Trust rose yesterday by 2.1 tons to 868.42 million tons , showing the first increase since Oct. 22. Note that from the beginning of the year inventories fell by 450 tons, reaching at this lowest level since early 2009.

The cost of the December gold futures on COMEX today rose to $ 1309.90 per ounce.

-

15:15

Japan's leading index rises sharply in September

An indicator of the performance of the Japanese economy increased sharply in September, after falling in the previous month, preliminary data released by the Cabinet Office showed Thursday.

The leading economic index, which is designed to measure changes in the direction of the economy, moved up to 109.5 in September from 106.8 in August. The September score was slightly above 109.4 economists had forecast. In July, the index was at 107.9.

At the same time, the coincident economic index, which measures the current economic situation, advanced to 108.2 in September from 107.6 a month earlier.

The lagging index, which gauges the past performance of the economy, increased to 115.1 from 114.4 in August, data showed. -

14:42

-

14:29

Before the bell: S&P futures +0.35%, Nasdaq futures +0.16%

U.S. stock futures rose as data showed the economy expanded faster than estimated in the third quarter and the European Central Bank unexpectedly cut a key interest rate.

Global stocks:

Nikkei 14,228.44 -108.87 -0.76%

Hang Seng 22,881.03 -155.91 -0.68%

Shanghai Composite 2,129.4 -10.21 -0.48%

FTSE 6,750.66 +8.97 +0.13%

CAC 4,333.41 +46.48 +1.08%

DAX 9,160.09 +119.22 +1.32%

Crude oil $94.19 (-0.64%).

Gold $1303.00 (-1.12%).

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y97.75, Y98.00, Y98.50, Y98.60, Y99.00, Y100.00

EUR/USD $1.3400, $1.3425, $1.3450, $1.3500, $1.3550, $1.3650, $1.3700

GBP/USD $1.6100

EUR/GBP stg0.8400, stg0.8425, stg0.8450, stg0.8470, stg0.8485

USD/CHF Chf0.9060, Chf0.9100, Chf0.9150

AUD/USD $0.9450, $0.9470, $0.9475, $0.9500, $0.9550

AUD/NZD Y94.00

NZD/USD $0.8275, $0.8425

USD/CAD C$1.0425, C$1.0440

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter III +1.9% (forecast +1.5%)

-

13:30

U.S.: Initial Jobless Claims, October 336 (forecast 332)

-

13:30

U.S.: GDP, q/q, Quarter III +2.8% (forecast +1.9%)

-

13:16

European session: the euro fell

06:45 Switzerland SECO Consumer Climate Quarter III -9 -2 -5

08:00 Switzerland Foreign Currency Reserves October 432.4 434.7

11:00 Germany Industrial Production s.a. (MoM) September +1.6% Revised From +1.4% +0.2% -0.9%

11:00 Germany Industrial Production (YoY) September +0.9% Revised From +0.3% +0.8% +1.0%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.50% 0.50% 0.25%

The euro fell sharply against major currencies after the ECB decided to lower its key policy rates to a new record low , and the lending rate , as some analysts predicted after last week's euro zone inflation data came out much worse than expected. The Governing Council of the ECB lowered its main refinancing rate by 25 basis points up to 0.25 %. The bank also lowered the rate of lending by 25 basis points to 0.75 %, while the deposit rate remained unchanged at 0.00%. ECB refrained from lowering rates in May . Now all attention turned to the speech of the Central Bank , Mario Draghi , who will comment on the government's decision at a press conference scheduled for 13:30 GMT.

Previously, the pressure on the single currency had data on German industrial production . The volume of German industrial production fell more than expected to 0.9 percent in September , although the two-month average suggests that the situation in the industry in Europe's largest economy is on the path to growth. Industrial production declined in spite of the consensus forecast of economists, who had expected growth of 0.2 percent. The value in August was revised upwards by 0.2 percentage points , and recorded a growth of 1.6 percent. The two-month average showed a slight increase in production of 0.6 percent , according to the Ministry of Economy. " Production in the manufacturing sector as a whole is on the way up , despite a slight decrease in the current level," the ministry said .

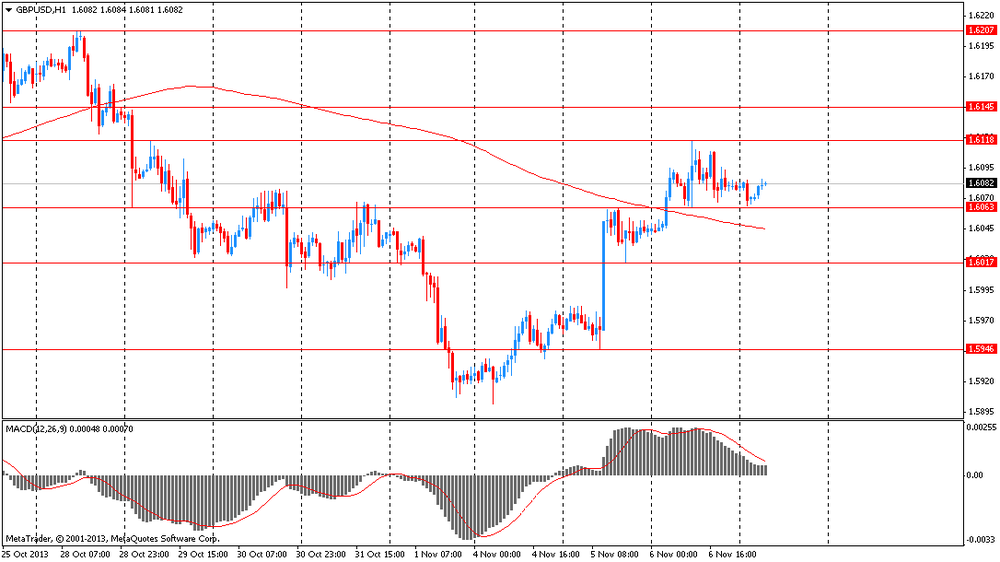

The pound fell against the dollar after the ECB decision , but previously ignored the decision of the Bank of England to keep monetary policy unchanged. At the last meeting of the Bank of England did not bring any surprises markets , leaving the key lending rate at a record low 0.5 %, where it has been since March 2009 , while the purchase of assets remained at £ 375 billion the central bank announced its intention to keep rates at a low level as long as the rate b / d in Britain will not fall below 7% , which is not expected before 2016. The latest economic forecasts willows within the inflation report will be published on 13 November. Minutes of this meeting will be made public on Wednesday, November 20.

EUR / USD: during the European session, the pair fell to $ 1.3353

GBP / USD: during the European session, the pair fell to $ 1.6015

USD / JPY: during the European session, the pair rose to Y98.81

At 13:30 GMT will be the monthly press conference of the ECB . At 13:30 GMT the United States will publish the change in GDP for the quarter , the GDP price index , an index of personal consumption expenditures , the main index of personal consumption expenditures in Q3 . At 19:00 GMT deliver a speech , ECB President Mario Draghi .

-

13:00

Orders

EUR/USD

Offers $1.3600, $1.3565/70, $1.3550

Bids $1.3500, $1.3450/40, $1.3420, $1.3350

GBP/USD

Offers $1.6250/60, $1.6200/10, $1.6180, $1.6140/50, $1.6120/25

Bids $1.6050/40, $1.6020, $1.6005/00, $1.5985/80, $1.5950

AUD/USD

Offers $0.9600, $0.9575/80, $0.9555/65, $0.9500

Bids $0.9450, $0.9420, $0.9400

EUR/GBP

Offers stg0.8520/30, stg0.8500, stg0.8480, stg0.8415/20

Bids stg0.8400, stg0.8380, stg0.8370/65, stg0.8320, stg0.8300

EUR/JPY

Offers Y134.20, Y134.00

Bids Y133.10/00, Y132.55/50, Y132.00

USD/JPY

Offers Y99.50, Y99.20, Y99.00

Bids Y98.00, Y97.80

-

12:46

Eurozone: ECB Interest Rate Decision, 0.25% (forecast 0.50%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:30

Stocks in Europe were little changed

Stocks in Europe were little changed from their highest level in more than five years as investors awaited the European Central Bank’s interest-rate decision. U.S. index futures and Asian shares slipped.

The ECB will announce its interest-rate decision at 1:45 p.m. in Frankfurt, with Draghi scheduled to hold a press conference 45 minutes later. Three of 70 economists’ estimates compiled by Bloomberg forecast the central bank will cut its benchmark interest rate to 0.25 percent from 0.5 percent. In a separate survey, eight of 38 economists predicted the ECB will lower rates in December.

In another decision at noon in London, the Bank of England will maintain its key interest rate at 0.5 percent and its asset-purchase target at 375 billion pounds ($603 billion), according to the median forecasts of economists surveyed by Bloomberg.

HeidelbergCement slipped 4.2 percent to 56.65 euros. The world’s third-largest maker of cement said quarterly operating income before depreciation fell to 811 million euros ($1.1 billion) from 872 million euros a year earlier because of weaker currencies in emerging markets.

Bureau Veritas fell 3 percent to 21.84 euros. The world’s second-biggest goods-inspection company posted third-quarter sales of 969.7 million euros late yesterday, trailing the 992 million-euro average estimate of analysts surveyed by Bloomberg.

Siemens advanced 3.6 percent to 95.89 euros after saying it will buy back 4 billion euros of shares over the next two years. Europe’s biggest engineering company reported fourth-quarter profit from continuing operations of 1.08 billion euros, surpassing the 997 million-euro average projection of analysts surveyed by Bloomberg.

FTSE 100 6,728.16 -13.53 -0.20%

CAC 40 4,280.29 -6.64 -0.15%

DAX 9,043.37 +2.50 +0.03%

-

11:00

Germany: Industrial Production s.a. (MoM), September -0.9% (forecast +0.2%)

-

10:45

Swiss consumer confidence improves in October

Sentiment among Swiss consumers improved in three months through October, a survey published by the State Secretariat for Economic Affairs, or SECO, revealed Thursday.

The confidence index rose to -5 in October from -9 in the July survey. Economists had forecast a better reading of -4.

This development largely reflected households' more optimistic expectations with regard to the economic prospects and the labor market over the next 12 months, SECO said in the survey report.

At the same time, the expectations for their personal financial situation and opportunities for savings over the coming months remained broadly at the same level as in July.

Between October and July, both the assessment of inflation over the last twelve months as well as the prospects for inflation for the coming twelve months remained virtually unchanged, SECO said.

-

10:20

Option expiries for today's 1400GMT cut

USD/JPY Y97.75, Y98.00, Y98.50, Y98.60, Y99.00, Y100.00

EUR/USD $1.3400, $1.3425, $1.3450, $1.3500, $1.3550, $1.3650, $1.3700

GBP/USD $1.6100

EUR/GBP stg0.8400, stg0.8425, stg0.8450, stg0.8470, stg0.8485

USD/CHF Chf0.9060, Chf0.9100, Chf0.9150

AUD/USD $0.9450, $0.9470, $0.9475, $0.9500, $0.9550

AUD/NZD Y94.00

NZD/USD $0.8275, $0.8425

USD/CAD C$1.0425

-

09:39

Asia Pacific stocks close

Asian stocks fell as investors await economic data from the U.S. and amid concern gains in equities over the past two months have outpaced prospects for earnings.

Nikkei 225 14,228.44 -108.87 -0.76%

S&P/ASX 200 5,422.04 -11.77 -0.22%

Shanghai Composite 2,129.4 -10.21 -0.48%

Toyota Motor Corp., the world’s biggest carmaker, lost 1.3 percent in Tokyo after its net-income forecast fell short of analyst estimates.

Ausdrill Ltd. slumped 29 percent in Sydney after the drilling contractor said its expects a lower profit.

GungHo Online Entertainment Inc. gained 2.5 percent as Japan Exchange Group Inc. and Nikkei Inc. said the Internet-game maker will be included in their new index.

-

08:43

FTSE 100 6,720.7 -20.99 -0.31%, CAC 40 4,282.98 -3.95 -0.09%, Xetra DAX 9,039.06 -1.81 -0.02%

-

08:00

Switzerland: Foreign Currency Reserves, October 434.7

-

07:30

European bourses are initially seen trading lower Thursday: the FTSE down 8, the DAX down 4 and the CAC down 18.

-

07:01

Asian session: The euro held a gain from yesterday

00:30 Australia Unemployment rate October 5.6% 5.7% 5.7%

00:30 Australia Changing the number of employed October 9.1 10.3 1.1

05:00 Japan Leading Economic Index September 106.8 109.4 109.5

05:00 Japan Coincident Index September 107.6 108.3 108.2

The euro held a gain from yesterday versus most major peers before European Central Bank policy makers meet today amid speculation the region’s economy isn’t fragile enough to warrant an interest-rate cut. The ECB will leave its main refinancing rate at a record-low 0.5 percent today, according to 67 of 70 economists surveyed by Bloomberg News. Bank of America Corp., Royal Bank of Scotland Group Plc and UBS AG predict the central bank will reduce borrowing costs by 25 basis points.

A gauge of U.S dollar strength remained lower before data that may show an expansion in U.S. gross domestic product slowed last quarter. U.S. GDP grew at a 2 percent annualized rate in the third quarter, down from 2.5 percent in the previous three months, according to a Bloomberg survey before the data are released today. Nonfarm payrolls rose by 120,000 last month after a 148,000 gain in September, Labor Department figures may show tomorrow, a separate poll indicates.

Australia’s dollar slid after a government report showed employers added 1,100 jobs in October. Economists forecast a gain of 10,000 workers, according to the median response in a Bloomberg poll.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3500-20

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6065-85

USD / JPY: during the Asian session the pair traded in the range of Y98.55-75

The main focus for the day is undoubtedly the key policy decisions from both the ECB and the BOE, both due lunchtime. Across the Atlantic, the third quarter US GDP data will be the highlight. There is only a limited European data calendar expected ahead of the central bank decisions. At 0800GMT, Spain's September industrial output data is set for release. At 1100GMT, Germany's September industrial output data will be published. The ECB announces the latest policy decision at 1245GMT, with President Draghi's press conference expected at 1330GMT.

The first central bank decision of the day is expected at 1200GMT, when the Bank of England announces their outcome. With the economic recovery starting to gain traction, no change is seen either in Bank Rate or QE levels, with forward guidance firmly anchored.

-

06:46

Switzerland: SECO Consumer Climate, Quarter III -5 (forecast -2)

-

06:25

Commodities. Daily history for Nov 6’2013:

GOLD 1,317.80 9.70 0.74%

OIL (WTI) 94.90 1.53 1.64%

-

06:25

Stocks. Daily history for Nov 6’2013:

Nikkei 225 14,337.31 +111.94 +0.79%

S&P/ASX 200 5,433.8 +1.84 +0.03%

Shanghai Composite 2,140.89 -16.35 -0.76%

FTSE 100 6,741.69 -5.15 -0.08%

CAC 40 4,286.93 +33.59 +0.79%

DAX 9,040.87 +31.76 +0.35%

Dow +128.41 15,746.63 +0.82%

Nasdaq -7.91 3,931.95 -0.20%

S&P +7.5 1,770.47 +0.43%

-

06:24

Currencies. Daily history for Nov 6'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3513 +0,30%

GBP/USD $1,6078 +0,21%

USD/CHF Chf0,9119 -0,15%

USD/JPY Y98,64 +0,15%

EUR/JPY Y133,30 +0,46%

GBP/JPY Y158,61 +0,38%

AUD/USD $0,9526 +0,20%

NZD/USD $0,8375 +0,14%

USD/CAD C$1,0417 -0,35%

-

05:59

Schedule for today, Thursday, Nov 7’2013:

00:30 Australia Unemployment rate October 5.6% 5.7%

00:30 Australia Changing the number of employed October 9.1 10.3

05:00 Japan Leading Economic Index September 106.8 109.4

05:00 Japan Coincident Index September 107.6 108.3

06:45 Switzerland SECO Consumer Climate Quarter III -9 -2

08:00 Switzerland Foreign Currency Reserves October 432.4

11:00 Germany Industrial Production s.a. (MoM) September +1.4% +0.2%

11:00 Germany Industrial Production (YoY) September +0.3% +0.8%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.50% 0.50%

13:30 Eurozone ECB Press Conference

13:30 U.S. PCE price index, q/q Quarter III +1.8% +1.6%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +0.6% +1.5%

13:30 U.S. Initial Jobless Claims October 340 332

13:30 U.S. GDP, q/q (Preliminary) Quarter III +2.5% +1.9%

18:50 U.S. FOMC Member Jeremy Stein Speaks

19:00 Eurozone ECB President Mario Draghi Speaks

20:00 U.S. Consumer Credit September 13.6 12.8

-